|

市場調查報告書

商品編碼

1624591

銅絞線:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Copper Stranded Wire - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

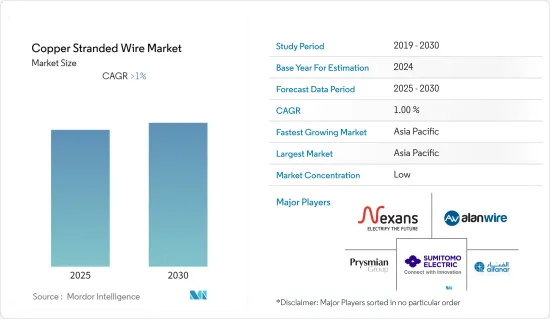

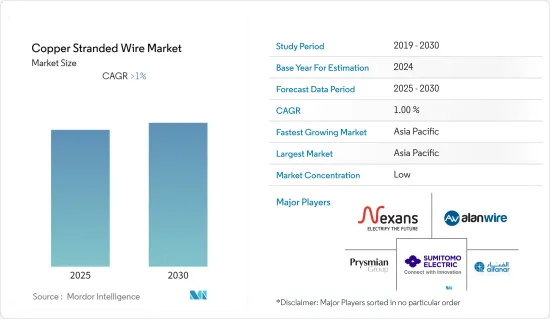

預計銅絞線市場在預測期內的年複合成長率將超過 1%。

主要亮點

- 由於全國封鎖和投資減少等多種因素,COVID-19大流行對2020年和2021年銅絞線市場的成長產生了重大影響。疫情對世界各地的經濟造成了嚴重影響,對住宅建設產生了負面影響。

- 疫情期間,各國失業、企業倒閉和購買力下降對住宅建築業產生了負面影響。此外,由於勞動力短缺、材料供應鏈中斷以及材料價格飆升而導致的計劃延誤,對世界各地的住宅建設產生了重大影響。然而,到了 2021 年,該產業開始復甦,所研究市場的需求也有所恢復。

- 從中期來看,推動市場的主要因素包括能源需求的增加以及針對更靈活和功能性應用的產品開發。另一方面,鄰近效應造成的能源損失預計將嚴重阻礙市場成長。

- 新興經濟體基礎設施、通訊、能源等領域和活動的使用增加可能會在未來帶來機會。預計亞太地區將在預測期內主導全球市場。

銅絞線市場趨勢

建設產業需求增加

- 銅絞線用於供電,可安裝在住宅和工業層面。銅絞線市場的主要最終用戶之一是建設產業。在建設產業,基礎設施對絞合銅線的市場需求貢獻巨大。

- 亞洲是世界上基礎設施發展最快的地區。在中國和印度等國家,政府投資和舉措正在推動該產業的成長。例如,根據國家統計局的數據,中國建築業產值佔GDP的比重從2020年的11.0%上升到2021年的25.7%。住宅和商業建築是中國銅絞線市場的重要終端用戶產業。由於全球建設產業的需求不斷增加,預計該行業對銅絞線的需求在預測期內將會成長。

- 根據土木工程師協會 (ICE) 的一項研究,到 2030 年,全球建築業預計將達到 8 兆美元,其中中國、印度和美國是主要推動力。根據工業和內貿促進部(DPIIT)統計,2000年4月印度建築業和基礎設施領域的外國直接投資為262.4億美元,2022年9月為289.6億美元。

- 中東和非洲基礎設施建設投資的增加預計將提振絞銅線的需求。例如,在沙烏地阿拉伯,多股銅線市場受到活躍的房地產開發、住宅需求增加以及政府改善社會經濟基礎設施的努力的推動。沙烏地阿拉伯住宅部長 Majid Al-Hogail 表示,該國計劃在未來五年內新增 30 萬住宅。住宅是沙烏地阿拉伯 2030 年願景的關鍵舉措之一。這可能會在未來幾年產生該國建設產業對銅絞線市場的需求。

- 因此,預計投資的增加將在預測期內推動所研究的市場。

亞太地區主導市場

- 在預測期內,亞太地區可能會主導銅絞線市場的需求。近年來,中國一直是世界基礎建設的主要投資國之一,並做出了重要貢獻。例如,根據國家統計局(NBS)的數據,2021年,中國建築業產值達到29.31兆元人民幣(4.542兆美元),比2020年增加11.10%。

- 全年成長率僅0.4%,2021年中國基礎建設投資與前一年同期比較去年同期幾乎持平。預計2022年基礎建設投資將成長5%。 2021年中國GDP成長8.1%(第一季18.3%,第二季7.9%),但2022年GDP成長率預估溫和約5.5%。基礎設施投資的擴張可能會在預測期內推動對絞合銅線的需求。

- 此外,2021年,中國電力銷售額突破1,620億美元,較上年(2020年)成長超過100億美元。印度是領先的電子設備製造商之一,2021年電子設備市場規模為749.9億美元,較2020年成長3.91%。該國市場預計將快速成長,並將進一步帶動銅絞線市場。

- 中國是最大的乘用車生產國之一,這是由於其他因素促進了該國乘用車市場產品的發展,例如物流和供應鏈的改善、商業活動的活性化以及該國的消費促進措施。因此,乘用車領域對銅絞線市場的需求正在增加。 2020年中國乘用車產量下降6.5%。然而,2021 年產量恢復了 7%,達到 21,407,962 輛。

- 此外,印度和日本等國家也為市場成長做出了貢獻。因此,預計預測期內銅絞線市場的需求將進一步增加。

銅絞線行業概況

銅絞線市場部分分散。該市場的主要參與者包括 Prysmian Group、Alan Wire Company、Nexans、Alfanar Group 和 Sumitomo Electric Industries, Ltd.。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 能源需求增加

- 開發更靈活、功能更豐富的應用產品

- 抑制因素

- 由於鄰近效應造成的能量損失

- 製造成本高

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(以金額為準的市場規模)

- 形狀

- 成束的

- 同心

- 最終用戶產業

- 建造

- 能源

- 運輸

- 電子和通訊

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)分析**/排名分析

- 主要企業策略

- 公司簡介

- Alan Wire Company

- alfanar Group

- NEXANS

- International Wire

- Pacific Electric Wire and Cable Co., Ltd.

- Polycab India Limited

- Prysmian SpA

- Sarkuysan

- Southwire Company, LLC.

- Sumitomo Electric Industries, Ltd.

- Superior Essex Inc.

- WL Gore & Associates, Inc.

第7章市場機會與未來趨勢

- 高頻變壓器用利茲線的開發

- 擴大在基礎設施、通訊、能源等領域的應用以及新興國家的活動

簡介目錄

Product Code: 46596

The Copper Stranded Wire Market is expected to register a CAGR of greater than 1% during the forecast period.

Key Highlights

- The COVID-19 pandemic significantly impacted the copper-stranded wire market's growth in 2020 and 2021 due to several factors, such as nationwide lockdowns and a decline in investments. The pandemic severely affected the economies of many countries around the globe, which adversely affected the construction of housing units.

- Unemployment, the shutting down of businesses, and the decreasing purchasing power of countries negatively impacted the housing unit sector during the pandemic. Additionally, delaying projects due to a shortage of labor, disruption in the supply chain of materials, and an upward surge in material prices, among others, significantly impacted the construction of housing units globally. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

- Over the medium term, the major factors driving the market include increasing energy requirements and developing products with more flexible and functional applications. On the flip side, loss of energy due to the proximity effect is expected to hinder the market's growth significantly.

- Increasing usage in infrastructure, telecommunications, energy, etc., and activities in emerging economies are likely to act as opportunities in the future. Asia-Pacific is expected to dominate the global market during the forecast period.

Copper Stranded Wire Market Trends

Growing Demand from the Construction Industry

- Copper-stranded wires are used for electric supply and can be installed at both the residential and industrial levels. One of the major end-users of the copper-stranded market is the construction industry. In the construction industry, infrastructure is the major contributor to the market demand for copper-stranded wires.

- Asia is the fastest-growing region in the infrastructure sector in the world. In countries such as China and India, government investments and initiatives are boosting this sector's growth in the region. For instance, according to the National Bureau of Statistics (NBS), the value of construction output accounted for 25.7% of China's GDP in 2021, up from 11.0% in 2020. Residential and commercial buildings are prominent end-user industries for the copper-stranded wire market in China. With the growing global demand from the construction industry, the demand for copper-stranded wire from this sector is projected to grow during the forecast period.

- According to a study by the Institution of Civil Engineers (ICE), the global construction industry is expected to reach USD 8 trillion by 2030, primarily driven by China, India, and the United States. According to the Department for Promotion of Industry and Internal Trade (DPIIT), FDIs in the Indian construction sector and infrastructure stood at USD 26.24 billion and USD 28.96 billion in April 2000 and September 2022, respectively.

- Increasing investment in infrastructure construction in the Middle East and Africa is expected to boost the demand for copper-stranded wires. For instance, in Saudi Arabia, the growing number of real estate developments, increasing demand for residential property, and governmental initiatives to develop socio-economic infrastructure drive the market for copper-stranded wires in the country. According to Majid Al-Hogail, the Saudi Housing Minister, the Kingdom of Saudi Arabia plans to construct 300,000 extra housing units over the next five years. One of Saudi Arabia's significant initiatives under Vision 2030 is housing. This will likely create demand for the copper-stranded wire market from the country's construction industry in the upcoming years.

- Therefore, the growing investments are expected to drive the market studied during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the demand in the copper-stranded wire market during the forecast period. China is a huge contributor, as it has been one of the leading investors in infrastructure worldwide over the past few years. For instance, according to the National Bureau of Statistics (NBS) of China, in 2021, the output value of construction works in China amounted to 29.31 trillion yuan (USD 4542.07 billion), an increase of 11.10% compared with 2020.

- At a mere 0.4 percent annual growth rate, China's infrastructure investment in 2021 was almost flat compared to the previous year. The infrastructure investment is estimated to grow by 5 percent in 2022. While China's GDP expanded by 8.1 percent in 2021 (boosted by 18.3 percent growth in the first and 7.9 percent in the second quarter), the country's GDP growth is projected to moderate at around 5.5 percent in 2022. While China's GDP expanded by 8.1 percent in 2021 (boosted by 18.3 percent growth in the first and 7.9 percent in the second quarter), the country's GDP growth is projected to moderate at around 5.5 percent in 2022. This growing investment in infrastructure will likely boost the demand for copper-stranded wire during the forecast period.

- Moreover, in 2021, the consumer electronics revenue in China amounted to over USD 162 billion, an increase of more than USD 10 billion since the previous year(2020). India is one of the major electronics manufacturers, and the electronics market stood at USD 74.99 billion in 2021, an increase of 3.91% compared with 2020. The market is anticipated to witness fast growth in the country, further driving the copper-stranded wire market.

- China is one of the largest producers of passenger cars, due to the improving logistics and supply chains, increased business activity, and the country's raft of pro-consumption measures, among other factors contributing to the passenger car market products in the country. Therefore, this has increased demand for the copper-stranded wire market from the passenger car segment. Passenger car production in China declined by 6.5% in 2020. However, the production recovered by 7% and reached 2,14,07,962 units in 2021.

- Furthermore, countries such as India and Japan have also contributed to the market's growth. This is expected to drive further the demand in the copper-stranded wire market over the forecast period.

Copper Stranded Wire Industry Overview

The copper-stranded wire market is partially fragmented in nature. The major players in this market include Prysmian Group, Alan Wire Company, Nexans, Alfanar Group, and Sumitomo Electric Industries, Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Energy Requirement

- 4.1.2 Developments of Products with More Flexible and Functional Application

- 4.2 Restraints

- 4.2.1 Loss of Energy Due to Proximity Effect

- 4.2.2 Expensive to Manufacture

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Geometry

- 5.1.1 Bunched

- 5.1.2 Concentric

- 5.2 End-user Industry

- 5.2.1 Construction

- 5.2.2 Energy

- 5.2.3 Transportation

- 5.2.4 Electronics and Telecommunication

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alan Wire Company

- 6.4.2 alfanar Group

- 6.4.3 NEXANS

- 6.4.4 International Wire

- 6.4.5 Pacific Electric Wire and Cable Co., Ltd.

- 6.4.6 Polycab India Limited

- 6.4.7 Prysmian S.p.A

- 6.4.8 Sarkuysan

- 6.4.9 Southwire Company, LLC.

- 6.4.10 Sumitomo Electric Industries, Ltd.

- 6.4.11 Superior Essex Inc.

- 6.4.12 W. L. Gore & Associates, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Litz Wire for High-frequency Transformers

- 7.2 Increasing Usage in Infrastructure, Telecommunications, Energy, etc., and Activities in Emerging Economies

02-2729-4219

+886-2-2729-4219