|

市場調查報告書

商品編碼

1519949

金屬黏劑:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Metal Bonding Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

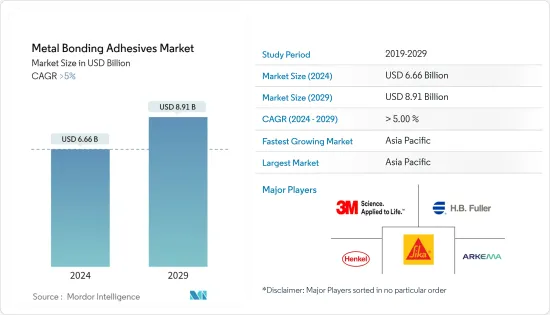

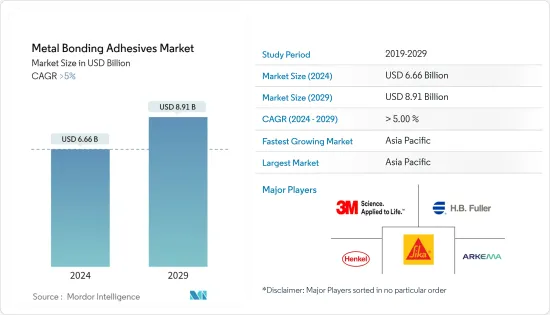

金屬黏劑市場規模預計到2024年為66.6億美元,預計到2029年將達到89.1億美元,在預測期內(2024-2029年)複合年成長率將超過5%,預計將會如此。

COVID-19 大流行擾亂了供應鏈,導致生產放緩和停工以及景氣衰退,對金屬黏劑市場產生了重大影響。儘管 COVID-19 的最初影響是負面的,但市場預計將在預測期內復甦。

主要亮點

- 推動市場的主要因素是汽車和運輸業需求的增加。

- 另一方面,由於國家之間地緣政治緊張局勢加劇導致原物料價格波動正在阻礙市場成長。

- 生物基黏劑的創新發展為市場帶來了新的機會。

- 亞太地區是最大的市場,由於中國、印度和日本等國家的消費量不斷增加,預計亞太地區將成為預測期內成長最快的市場。

金屬黏劑市場趨勢

汽車和運輸業的需求不斷增加

- 它被汽車和運輸行業的OEM廣泛用於底盤結構、汽車外觀、面板粘合劑、框架以及乘用車和重型車輛的加固。外飾板和麵板黏合劑是汽車領域的主要應用之一。

- 另外,在航太工業中,金屬黏劑經過專門設計,具有根據使用環境設計的最大耐用性、高強度、韌性和耐溫性。

- 根據OICA(國際汽車構造組織)的數據,2022年全球汽車產量約8,501萬輛,較2021年的8,020.5萬輛成長5.99%。 2022年,全球乘用車產量約6,000萬輛,較2021年成長近7.35%。

- 亞太地區是世界上一些最有價值的汽車製造商的所在地。中國、印度、日本和韓國等新興國家正在努力加強其製造基礎並創建高效的供應鏈以提高盈利。

- 根據波音《2023-2042年商業展望》,到2042年,新型商用噴射機的需求預計將達到42,595架飛機,金額8兆美元。到 2042 年,全球噴射機持有幾乎翻倍,達到 48,600 架,每年成長 3.5%。航空公司將用燃油效率更高的新機型替換全球約一半的機隊。

- 北美地區將以 9,250 架飛機佔據最大佔有率,其次是歐亞大陸和中國,預計到 2042 年交付9,645 架新飛機,這表明航空業的需求不斷成長。

- 在中國,空中巴士公司於 2023 年 3 月宣布計劃擴大其最暢銷的 A320 單通道噴射機的生產並加強銷售。這種擴張將顯著成長金屬黏劑市場,因為中國是歐洲航空公司製造商的最大市場之一,預計這些黏劑用於減輕飛機結構的重量並提高強度和抗疲勞性。

- 汽車和飛機的需求和產量的成長預計將在預測期內推動市場。

亞太地區主導市場

- 由於佔據主要市場佔有率的中國對技術先進的家用電器和汽車生產的需求不斷增加,預計亞太地區的金屬黏劑市場將出現顯著而快速的成長。

- 此外,由於印度、泰國、印尼和中國擁有具有成本效益的原料和勞動力,製造地進行了搬遷,同時跨國公司在工業和電子行業以及亞太地區的投資也不斷增加。保留該地區製造地競爭日益激烈,是刺激該地區金屬黏劑需求增加的核心方面。

- 中國的汽車製造業是全世界最大的。 2022年產業呈現小幅成長,產銷量不斷成長。 2021 年仍延續類似趨勢,2022 年產量成長 3%。根據中國工業協會統計,比亞迪、上汽等企業在燃油車和電動車領域的汽車產量不斷增加,汽車產量預計將持續成長。

- 根據中國工業協會的數據,中國汽車製造商預計到 2022 年將銷售約 940 萬輛電動和混合動力汽車汽車,高於一年前的 690 萬輛。該協會也預測銷售量將持續成長,到2024年將達到1,150萬台。

- 例如,中國汽車巨頭比亞迪2023年銷售了超過300萬輛電池動力汽車。其中,160萬輛是純電動車,140萬輛是汽油電池混合動力汽車。合計而言,與 2022 年相比成長了 62%。此外,比亞迪報告稱,去年上半年其利潤成長了兩倍,達到15億美元。

- 根據《今日印度》報道,2023 年印度國內市場銷量為 4,108,000 輛。這是歷年銷量首度突破400萬台。 2022 年銷量為 3,792,000 輛。在印度,馬魯蒂、現代、塔塔、本田和馬恆達等主要汽車製造商因庫存未售出而停止生產。預計這將在不久的將來對印度汽車生產產生重大負面影響。

- 中國擁有世界上最大的醫療保健產業之一。在「十三五」規劃中,中國政府將健康和創新放在優先地位,預計預測期內對醫療設備製造業的投資將增加。此外,由於COVID-19的爆發,該國對醫療保健產業的投資逐漸增加。

- 金屬黏劑在現代建築中發揮重要作用,與焊接、鉚接和螺栓連接等傳統連接方法相比,具有許多優勢。

- 中國的成長也得益於住宅和商業建築業的快速擴張以及國家經濟的擴張。中國正鼓勵並持續推動都市化進程,預計2030年都市化率將達到70%。因此,中國等國家建築活動的活性化預計將刺激該地區的黏劑產業。所有這些因素都會增加全部區域對黏劑的需求。

- 根據中國國家統計局的數據,到 2022 年,建築業產值將達到 31.2 兆元(4.5 兆美元),高於 2021 年的 29.31 兆元(4.2 兆美元)。此外,根據住宅部預測,2025年後中國建築業預計將維持GDP的6%。

- 據印度投資局稱,到2025年,印度建設產業預計將達到1.4兆美元,印度建設產業跨越250子部門,並與其他行業合作,正在引進超過54項全球創新建築技術。時代。

- 此外,在亞洲、北美和太平洋地區強勁需求的推動下,2022年韓國建築公司的海外建築訂單連續第三年超過300億美國。

- 因此,受上述因素影響,該地區國內金屬黏劑的需求量激增。

金屬黏劑產業概況

金屬黏劑市場得到部分完整。主要企業(排名不分先後)包括 Henkel AG &Co.KGaA、3M、HB Fuller Company、Arkema 和 Sika AG。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 汽車和運輸業的需求不斷增加

- 建築和基礎設施部門的消費增加

- 其他司機

- 抑制因素

- 嚴格的監理政策

- 永續性問題

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 樹脂型

- 丙烯酸纖維

- 環氧樹脂

- 聚氨酯

- 矽膠

- 其他樹脂類型(生物基樹脂、混合樹脂等)

- 目的

- 汽車和交通

- 航太/國防

- 電力/電子

- 工業組裝

- 建築/基礎設施

- 其他用途(海洋、醫療等)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東和非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- 3M

- Arkema

- Ashland

- Avery Dennison Corporation

- Beardow Adams

- DELO Industrie Klebstoffe GmbH & Co. KGaA5

- Dow

- DuPont

- HB Fuller Company

- Henkel AG & Co. KgaA

- Huntsman International LLC

- Hexion

- ITW Performance Polymers(Illinois Tool Works Inc.)

- Parker Hannifin Corp(Lord Corporation)

- Parson Adhesives Inc.

- Sika AG

- Solvay

第7章 市場機會及未來趨勢

- 生物基黏劑的創新與發展

- 轉向複合黏合

The Metal Bonding Adhesives Market size is estimated at USD 6.66 billion in 2024, and is expected to reach USD 8.91 billion by 2029, growing at a CAGR of greater than 5% during the forecast period (2024-2029).

The COVID-19 pandemic significantly impacted the metal bonding adhesive market by disrupting the supply chain, causing production to slow down and shut down and an economic downturn. While the initial impact of COVID-19 was negative, the market appears to be on a recovery path during the forecast period.

Key Highlights

- Major factors driving the market studied are growing demand from the automotive and transportation industry.

- On the flip side, volatility in raw material prices, due to the rising geopolitical tensions between various nations is hindering the growth of the market.

- Innovation and development of bio-based adhesives to open new opportunities for the market.

- The Asia-Pacific region represents the largest market, and it is also expected to be the fastest-growing market over the forecast period, owing to the increasing consumption from countries, such as China, India, and Japan.

Metal Bonding Adhesives Market Trends

Growing Demand from the Automotive and Transportation Industry

- Metal bonding adhesives are widely used in the automotive and transportation industry by OEMs for fabricating chassis, automotive exteriors, panel bonding, frames, and reinforcement of the passenger, as well as heavy vehicles segment. Exterior panels and panel bonding are among the top applications in the automotive segment.

- Furthermore, in the aerospace industry, metal bonding adhesives are specifically designed for maximum durability, high strength, and toughness with temperature resistance designed for their operating environment.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), in 2022, around 85.01 million vehicles were produced across the globe, witnessing a growth rate of 5.99% compared to 80.205 million vehicles in 2021, thereby indicating an increased demand for metal hoses from the automotive industry. In 2022, around 60 million passenger cars were manufactured worldwide, up nearly 7.35% compared to 2021.

- The Asia-Pacific is home to some of the world's most valuable vehicle manufacturers. Developing countries such as China, India, Japan, and South Korea have been working hard to strengthen the manufacturing base and develop efficient supply chains for greater profitability.

- According to the Boeing Commercial Outlook 2023-2042, the demand for new commercial jets by 2042 is expected to reach 42,595 units, valued at USD 8 trillion. The global fleet will nearly double to 48,600 jets by 2042, expanding by 3.5% annually. Airlines will replace about half of the global fleet with new, more fuel-efficient models.

- North America accounts for the largest share with 9,250 deliveries, followed byEurasia and China, with the total deliveries of new airplanes estimated to be 9,645 units by 2042, indicating rising demand from the industry.

- In China, Airbus announced plans in March 2023 to expand production of its best-selling A320 single-aisle jet and boost sales. China is one of the largest markets for European airline manufacturers, and this expansion is expected to significantly grow the metal bonding adhesives market as these adhesives are used in weight reduction and improving strength and fatigue resistance experienced by the aircraft structures.

- Over the forecast period, increasing demand and production of automotive vehicles and aircrafts are likely to drive the market.

The Asia-Pacific Region to Dominate the Market

- The Asia-Pacific metal bonding adhesives market is anticipated to witness significant and fastest growth, owing to the growing demand for technologically advanced consumer electronics and automobile production in China, which holds a significant market share.

- In addition, the relocation of manufacturing hubs due to the accessibility of cost-effective raw materials and labor in India, Thailand, Indonesia, and China, coupled with increasing investments by multinationals in the industrial and electronics sectors and growing competition among market players to hold a manufacturing base in the Asia-Pacific, is the central aspect stimulating the increasing demand for metal bonding adhesives in the region.

- The Chinese automotive manufacturing industry is the largest in the world. The industry witnessed a slight growth in 2022, wherein production and sales increased. A similar trend continued in 2021, with production witnessing a 3% incline in 2022. According to the China Association of Automobile Manufacturers (CAAM), automotive production is expected to grow in the future, with companies like BYD, SAIC Motors, and more increasing their automotive production sales in the fuel-run and electric vehicles segment.

- According to the China Association of Automobile Manufacturers, Chinese automakers are anticipated to report sales of approximately 9.4 million electric vehicles and hybrids in the previous year, up from 6.9 million in 2022. The association further projects a continued increase in sales for 2024, reaching 11.5 million units.

- For Example, China's automotive giant BYD sold over 3 million battery-powered cars in 2023, of which both batteries and gasoline power 1.6 million fully electric vehicles and another 1.4 million hybrids. Together, that is a 62 percent increase over 2022. BYD is also making money, tripling its profit to USD 1.5 billion in the first half of last year, according to BYD.

- According to India Today, 4,108,000 cars were sold in the domestic market in 2023. This was the first time during a calendar year that over 4 million units were sold in the country. In 2022, the industry witnessed sales of 3,792,000 units. In India, major automotive manufacturers, like Maruti, Hyundai, Tata, Honda, and Mahindra, have shut down their production owing to the unsold stock. This is expected to have a substantial negative impact on India's automotive production in the near future.

- China has one of the largest healthcare sectors in the world. Under the 13th Five-Year Plan, the Government of China prioritized health and innovation, which is expected to increase investments in the medical device manufacturing sector during the forecast period. Additionally, due to the COVID-19 outbreak, investment in the healthcare sector has been gradually growing in the country.

- Metal bonding adhesives play a crucial role in modern construction, offering numerous advantages over traditional joining methods like welding, riveting, or bolting.

- China's growth is also fueled by rapid expansion in the residential and commercial building sectors and the country's expanding economy. China is encouraging and enduring a continuous urbanization process, with a projected rate of 70% by 2030. As a result, increased building activity in nations like China is projected to fuel the region's adhesive industry. All such factors tend to increase the demand for adhesives across the region.

- According to the National Bureau of Statistics of China, the value of construction output accounted for CNY 31.2 trillion (USD 4.5 trillion) in 2022, up from CNY 29.31 trillion (USD 4.2 trillion) in 2021. Moreover, as per the forecast given by the Ministry of Housing and Urban-Rural Development, China's construction sector is expected to maintain a 6% share of the country's GDP going into 2025.

- As per Invest India, the construction industry in India is expected to reach USD 1.4 Trillion by 2025, and the construction industry in India works across 250 sub-sectors with linkages across sectors and over 54 global innovative construction technologies identified under a Technology Sub-Mission of PMAY-U to start a new era in Indian Construction Sectors.

- Furthermore, South Korean builders' overseas building orders have surpassed 30 billion US dollars for the third consecutive year in 2022, owing to strong demand from Asia, North America, and the Pacific Ocean regions.

- Hence, owing to the factors mentioned above, the demand for metal bonding adhesives in the country has been on the rapid rise in the region.

Metal Bonding Adhesives Industry Overview

The Metal Bonding Adhesives market is partially consolidated in nature. The major players (not in any particular order) include Henkel AG & Co. KGaA, 3M, H.B. Fuller Company., Arkema and Sika AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Automotive and Transportation Industry

- 4.1.2 Increased Consumption from Construction and Infrastructure Sector

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Regulatory Policies

- 4.2.2 Sustainability Concerns

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size In Value)

- 5.1 Resin Type

- 5.1.1 Acrylic

- 5.1.2 Epoxy

- 5.1.3 Polyurethane

- 5.1.4 Silicone

- 5.1.5 Other Resin Types (Bio-Based Resins, Hybrid, etc.)

- 5.2 Application

- 5.2.1 Automotive and Transportation

- 5.2.2 Aerospace and Defense

- 5.2.3 Electrical and Electronics

- 5.2.4 Industrial Assembly

- 5.2.5 Construction and Infrastructure

- 5.2.6 Other Applications (Marine, Medical, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 UAE

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Arkema

- 6.4.3 Ashland

- 6.4.4 Avery Dennison Corporation

- 6.4.5 Beardow Adams

- 6.4.6 DELO Industrie Klebstoffe GmbH & Co. KGaA5

- 6.4.7 Dow

- 6.4.8 DuPont

- 6.4.9 H.B. Fuller Company

- 6.4.10 Henkel AG & Co. KgaA

- 6.4.11 Huntsman International LLC

- 6.4.12 Hexion

- 6.4.13 ITW Performance Polymers (Illinois Tool Works Inc.)

- 6.4.14 Parker Hannifin Corp (Lord Corporation)

- 6.4.15 Parson Adhesives Inc.

- 6.4.16 Sika AG

- 6.4.17 Solvay

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation and Development of Bio-based Adhesives

- 7.2 Shifting Focus Towards Adhesive Bonding for Composite Materials