|

市場調查報告書

商品編碼

1445650

數位銀行平台 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Digital Banking Platform - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

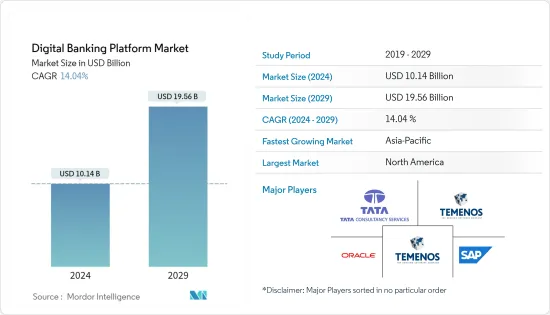

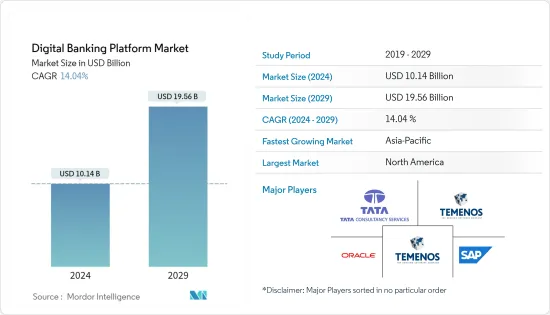

數位銀行平台市場規模預計到 2024 年為 101.4 億美元,預計到 2029 年將達到 195.6 億美元,在預測期內(2024-2029 年)CAGR為 14.04%。

銀行業正在快速經歷數位轉型,消費者需要智慧行動裝置和數位銀行服務。這些是推動市場成長的一些主要因素。

主要亮點

- 大多數銀行喜歡數位銀行平台,因為它具有各種優勢,例如降低 IT 成本、快速上市、開放銀行、開箱即用但可配置的功能、全通路客戶體驗和微服務架構等一些。例如,2022 年 12 月,德勤宣布與 AWS 合作,解決銀行業的長期難題:向涵蓋客戶端介面到後台營運的數位優先系統過渡。

- 儘管新銀行仍然是一個利基市場,但它們的市場佔有率成長率更高,並且服務客戶的成本約為傳統銀行的三分之一。金融科技公司瞄準了價值鏈中利潤豐厚的利基市場。擁有龐大客戶群的大型科技公司構成了真正的威脅,一些老牌企業正在大力投資創新,使落後者黯然失色。

- 然而,數位銀行平台與遺留系統的整合、網路中斷和安全問題等問題可能會對銀行造成嚴重損失,因此這些因素可能會阻礙市場的成長。

- 由於新冠肺炎 (COVID-19) 危機,網路銀行活動增加,例如數位交易增加,而前往實體分行的次數減少。這場大流行迫使曾經抵制網路銀行的個人消費者和企業採用數位銀行應用程式作為新的預設。疫情為消費者帶來了更多便利,長遠來看可能會增加需求。在供應商方面,大多數供應商一直專注於透過提供課題時期所需的服務來獲取客戶。

數位銀行平台市場趨勢

擴大採用基於雲端的平台來促進市場成長

- 2023 年 1 月,菲律賓數位銀行 GoTyme Bank 與全球雲端銀行平台 Mambu 合作,創建創新的數位銀行解決方案,旨在增加菲律賓人獲得高品質金融服務的機會。

- 許多銀行更喜歡利用基於雲端的服務來削減本地設置所需的IT 基礎設施成本,這使他們能夠快速部署新產品和擴展基礎設施,以更快的速度滿足更廣泛的客戶群的不同需求,並快速管理增加即時支付,同時確保合規性和安全標準。

- 由於向 SaaS 提供者支付訂閱費,系統維護成本和遺留技術問題都會減少。 SaaS 為銀行提供了重新分配預算的能力,使他們能夠專注於創新、客戶滿意度和業務成長,而不是在 IT 上花費大量資金。

- 雲端的使用還幫助行動銀行平台提供響應式使用者介面 (UI),並支援銀行客戶在行動裝置上的整個銀行業務流程,從入職到交易銀行請求。由於銀行對行動銀行的偏好不斷變化,它們正在迅速採用行動銀行平台。

- 此外,擴大採用第三方即時支付應用程式(例如 Whatsapp Pay 和 PhonePay),促使銀行對可靠基礎設施的需求增加,以順利進行 UPI 交易。例如,Visa 最近完成了對 Plaid 的 53 億美元收購,Plaid 是一家金融科技新創公司,允許應用程式輕鬆、即時地連接客戶的銀行帳戶。諸如此類的技術變革促使數位銀行業對雲端基礎設施的需求增加。

北美預計將佔據主要佔有率

- 許多最大的銀行都位於北美,這是數位銀行平台市場不斷成長的一個重要原因。該地區的數位銀行公司提供軟體即服務,以便將遺留系統轉變為數位系統。例如,Temenos 憑藉著功能最豐富、技術最先進的前端到後端 SaaS 數位銀行產品,幫助新的美國數位銀行在 90 天內上線。

- 隨著安全性更好的區塊鏈技術的使用越來越多,數位銀行平台變得越來越受歡迎,特別是在 BSFI 領域。這一因素正在推動該國市場的成長。許多公司正在開發基於區塊鏈的雲端數位銀行平台。

- 北美也是最具創新性和最早使用雲端的地方之一。雲端基礎設施供應商在該地區擁有強大的立足點,這有助於市場進一步成長。

- 數位銀行平台的使用量穩定上升,金融科技應用程式的使用量也出現了類似的成長,金融科技應用程式是美國成長最快的應用程式類型之一。由於全球冠狀病毒(COVID-19)大流行,美國人更多地留在家裡並更多地使用手機。這促使該地區出現了更多的數位銀行業務。

數位銀行平台產業概況

數位銀行平台市場正走向碎片化。這是因為公司和解決方案進入市場,在數位銀行生態系統中形成了碎片化的格局。然而,隨著技術進步和產品創新,中小型公司正在透過獲得新合約和合作夥伴關係來擴大其市場佔有率。

2023 年 1 月,Axis Bank 與 OPEN 合作,為其客戶(包括中小企業、自由工作者、家庭創業家、影響者等)提供完全原生的數位活期帳戶。此次合作使更大的企業界能夠獲得Axis Bank 全面的銀行業務經驗和OPEN 的端到端財務自動化功能,用於業務管理,例如支付、會計、工資單、合規性、支出管理和其他服務。

2022年11月,Capco與Savana宣布策略合作,加速銀行轉型,推動數位產品持續創新。此次合作將支持銀行克服在滿足不斷變化的客戶期望和無縫現代全通路體驗需求方面所面臨的技術課題。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭激烈程度

- 市場促進因素

- 擴大採用基於雲端的平台以獲得更高的可擴展性

- 消費者對智慧行動裝置和數位銀行服務的需求不斷成長

- 市場限制

- 日益增加的安全擔憂

- COVID-19 對產業影響的評估

第 5 章:市場區隔

- 依部署

- 雲

- 本地部署

- 依類型

- 企業銀行

- 零售銀行

- 地理

- 北美洲

- 亞太地區

- 歐洲

- 中東和非洲

第 6 章:競爭格局

- 公司簡介

- Appway AG

- CREALOGIX Holding AG

- EdgeVerve Systems Limited

- Fiserv, Inc.

- Oracle Corporation

- SAP SE

- Sopra Steria

- Tata Consultancy Services Limited

- Temenos Headquarters SA

- Worldline SA

第 7 章:投資分析

第 8 章:市場機會與未來趨勢

The Digital Banking Platform Market size is estimated at USD 10.14 billion in 2024, and is expected to reach USD 19.56 billion by 2029, growing at a CAGR of 14.04% during the forecast period (2024-2029).

The banking industry is going through a digital transformation quickly, and consumers want smart mobile devices and digital banking services. These are some of the main things that are driving the market's growth.

Key Highlights

- The majority of the banks prefer digital banking platforms due to the various benefits offered, such as reduced IT cost, fast time to market, open banking, out-of-the box yet configurable capabilities, omnichannel customer experience, and microservice architecture, to name a few. For example, in December 2022, Deloitte announced a collaboration with AWS to address a chronic difficulty in banking: the transition to digital-first systems that span the client interface to back office operations.

- Though neo-banks are still a niche market, they are witnessing a higher growth rate in terms of market share and serving customers at around one-third of the cost of traditional banks. Fintechs are targeting lucrative niches in the value chain. The big tech players, with their large customer bases, pose a real threat, and a few incumbents are investing heavily in innovation, putting laggards in the shade.

- However, issues such as integrating digital banking platforms with legacy systems, network outages, and security concerns can cause banks severe losses, and thus such factors might hamper the growth of the market.

- As a result of the COVID-19 crisis, there was a rise in online banking activity, such as increased digital transactions, and a decline in trips to brick-and-mortar branches. The pandemic forced individual consumers as well as corporations that once resisted online banking to adopt digital banking apps as their new default. The pandemic resulted in increased convenience among consumers, which might grow demand in the long run. On the vendors part, the majority of the vendors have been concentrating on customer acquisition by providing services demanded by the challenging times.

Digital Banking Platform Market Trends

Increasing Adoption of Cloud-Based Platforms to Boost the Market Growth

- In January 2023, the digital bank in the Philippines, GoTyme Bank, collaborated with the worldwide cloud banking platform Mambu to create an innovative digital banking solution that seeks to increase Filipinos' access to high-quality financial services.

- Many banks prefer cutting the IT infrastructure cost needed for on-premise setup by leveraging cloud-based services, which enable them to deploy new products and scale infrastructure quickly, cater to a broader customer base with varied needs at a faster speed, and manage rapidly increasing real-time payments while ensuring compliance and security standards.

- As a subscription fee is paid to a SaaS provider, system maintenance costs and legacy technology issues are reduced. Rather than spending a small fortune on IT, SaaS provides banks with the ability to reallocate budgets so they can focus on innovation, customer satisfaction, and business growth.

- The use of the cloud has also helped mobile banking platforms offer a responsive user interface (UI) and support the bank customers' entire banking journey, right from onboarding to transactional banking requests, on their mobile devices. Banks are rapidly adopting mobile banking platforms, owing to their changing preference toward mobile banking.

- Moreover, increased adoption of third-party applications for real-time payments, such as Whatsapp Pay and PhonePay, has led to increased demand for reliable infrastructure by the banks to carry out UPI transactions smoothly. For instance, Visa recently completed a USD 5.3 billion acquisition of Plaid, a fintech startup that allows applications to connect with customers' bank accounts easily and instantly. Technological shifts such as these have led to increased demand for cloud infrastructure in the digital banking industry.

North America is Expected to Hold Major Share

- Many of the biggest banks are in North America, which is a big reason why the market for digital banking platforms is growing. Digital banking companies in the region offer software as a service so that legacy systems can be turned into digital ones. For instance, Temenos helps new U.S. digital banks go live in 90 days with the most functionally rich and technologically advanced front-to-back SaaS digital banking offering.

- Digital banking platforms are becoming more popular as blockchain technology, which makes security better, is used more and more, especially in the BSFI sector. This factor is fueling the market's growth in the country. Many companies are developing blockchain-based cloud digital banking platforms.

- North America is also one of the most innovative and first places to use the cloud. Cloud infrastructure providers have a strong foothold in the region, which helps the market grow even more.

- The steady rise in the use of digital banking platforms follows a similar rise in the use of fintech apps, which are notable for being one of the fastest-growing types of apps in the US. Due to the global coronavirus (COVID-19) pandemic, people in the United States stayed at home more and used their phones more. This led to more digital banking across the region.

Digital Banking Platform Industry Overview

The market for digital banking platforms is moving toward fragmentation. This is because of the entry of companies and solutions into the market, creating a fragmented landscape within the digital banking ecosystem. However, with technological advancements and product innovation, midsize to smaller companies are increasing their market presence by securing new contracts and partnerships.

In January 2023, Axis Bank collaborated with OPEN to provide its clients, who include SMEs, freelancers, homepreneurs, influencers, and others, with a completely native digital current account. This collaboration gives the larger business community access to Axis Bank's comprehensive banking experience and OPEN's end-to-end financial automation capabilities for business administration, such as payments, accounting, payroll, compliance, expenditure management, and other services.

In November 2022, Capco and Savana announced that they would work together in a strategic way to speed up the transformation of banks and drive continuous innovation in digital products. This partnership will support banks in overcoming the technical challenges they face in meeting evolving customer expectations and needs for seamless modern omnichannel experiences.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Increasing Adoption of Cloud-Based Platforms to Obtain Higher Scalability

- 4.4.2 Rising demand for smart mobile devices and digital banking services among consumers

- 4.5 Market Restraints

- 4.5.1 Increasing Security Concerns

- 4.6 Assessment of Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Deployment

- 5.1.1 Cloud

- 5.1.2 On-Premises

- 5.2 By Type

- 5.2.1 Corporate Banking

- 5.2.2 Retail Banking

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Asia Pacific

- 5.3.3 Europe

- 5.3.4 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles*

- 6.1.1 Appway AG

- 6.1.2 CREALOGIX Holding AG

- 6.1.3 EdgeVerve Systems Limited

- 6.1.4 Fiserv, Inc.

- 6.1.5 Oracle Corporation

- 6.1.6 SAP SE

- 6.1.7 Sopra Steria

- 6.1.8 Tata Consultancy Services Limited

- 6.1.9 Temenos Headquarters SA

- 6.1.10 Worldline SA