|

市場調查報告書

商品編碼

1445569

智慧溫室:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Smart Greenhouse - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

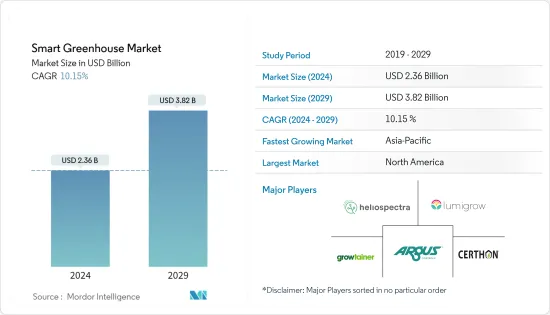

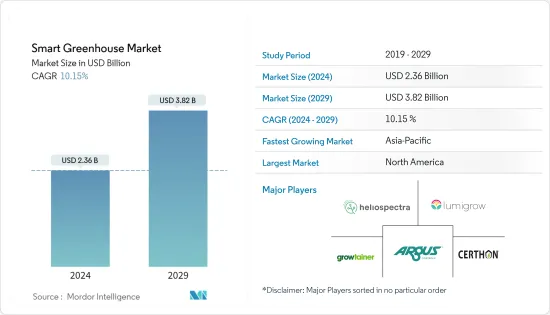

智慧溫室市場規模預計到 2024 年為 23.6 億美元,預計到 2029 年將達到 38.2 億美元,預測期內(2024-2029 年)年複合成長率為 10.15%。

主要亮點

- 在當今時代,農業成長是直接影響一國經濟成長的核心因素之一,因為它透過生產糧食和原料提供收入,是進出口的主要來源。有一個。它還創造了更大的就業機會。這有助於各國利用從條約經濟體向已開發經濟體的經濟轉型,並促進市場成長。

- 智慧溫室配備了最新的感測器和通訊技術,24/7 自動記錄和傳播有關環境和作物的資訊。資料被收集並輸入物聯網平台,其中分析演算法將其轉化為可操作的見解,以識別瓶頸和異常情況。因此,暖通空調和照明操作、灌溉和噴灑操作都可以按需控制。持續資料監測有助於建立預測模型來估計作物病害和感染風險。

- 農民可以使用物聯網感測器以前所未有的詳細程度收集各種資料點。這些提供了關鍵氣候因素的即時資料,例如整個溫室的溫度、濕度、光照和二氧化碳。這些資訊會導致暖通空調和照明設定發生適當的變化,以維持工廠發育的理想條件,同時提高能源經濟性。同時,運動/加速感應器可偵測無意打開的門,確保嚴格控制的環境。

- HVAC、物料物流、感測器和 LED 生長燈都是智慧溫室技術的一部分。不同的公司為受監管的環境提供不同的功能,因此很難將所有技術整合到溫室中。因此,建造智慧溫室需要企業共同努力,提供受監管的環境,以產生最佳產量。這是擴大智慧溫室市場的關鍵挑戰。

- 由於 COVID-19感染疾病,智慧溫室市場受到生產、分銷和需求不確定性的打擊。由於與 COVID-19 相關的進出口限制擾亂了供應鏈,供應商旨在促進智慧農場出口。例如,2021 年 12 月,韓國正在中東建造智慧農場,其技術可以在使用最少水的情況下種植各種作物。政府旨在以技術和價格競爭力為基礎,促進智慧農場向該地區的出口。

智慧溫室市場趨勢

農民和農業工人更常採用物聯網和人工智慧

- 智慧溫室配備了最新的感測器和通訊技術,24/7 自動記錄和傳播環境和作物資訊。資料被收集並輸入物聯網平台,其中分析演算法將其轉化為可操作的見解,以識別瓶頸和異常情況。

- 因此,暖通空調和照明操作、灌溉和噴灑操作都可以按需控制。持續資料監測有助於建立預測模型來估計作物病害和感染風險。

- 此外,物聯網和人工智慧等先進技術的日益採用正在增加市場成長潛力。例如,根據 IDATE DigiWorld 和 ETNO資料,據報導,歐盟 (EU) 農業領域的物聯網 (IoT) 活躍連線數量已從 2016 年的 51 萬個增加到 2025 年的 7,026 萬個。

- 農民可以使用物聯網感測器以前所未有的詳細程度收集各種資料點。這些提供了關鍵氣候因素的即時資料,例如整個溫室的溫度、濕度、光照和二氧化碳。這些資訊會導致暖通空調和照明設定發生適當的變化,以保持理想的植物生長條件,同時提高能源經濟性。同時,動作感測器和加速感應器可以偵測無意打開的門,確保嚴格控制的環境。

- 種植高價值作物的溫室很容易成為駭客的目標。建立具有CCTV的標準監控網路成本高昂,因此許多農民需要高效的安全系統。智慧溫室物聯網感測器提供了一種經濟高效的基礎設施,用於監控門狀況並檢測這種情況下的可疑活動。連接到自動警報系統可以在出現安全風險時立即向農民發出警報。

亞太地區市場顯著成長

- 農業部門長期以來一直是印度經濟的支柱,僱用了該國約60%的勞動力。印度意識到這個農業國家的龐大市場,在向世界各地出口大量食品的同時也賺取了巨額利潤。根據政府資料,2021-22年4月至11月期間,印度農產品和加工食品出口以美元計算與去年同期相比成長了13%以上。

- 然而,印度農業部門仍主要依賴氣候,技術滲透率有限。人口成長和飲食習慣的變化給印度的土地帶來了巨大的壓力。隨著土壤持續劣化、作物產量趨於平穩、水資源短缺加劇、自然災害更加頻繁發生以及生物多樣性下降,農民正在努力維持生產。

- 這些綜合因素正在推動對現代農業技術的需求,以滿足不斷成長的農產品需求。溫室已成為一種非常有益的園藝解決方案,特別是在極端天氣條件下,因為它們提供了一個可保證持續產量的受控環境。

- 同樣,印度、日本和澳洲等其他亞太國家也支持該地區智慧溫室市場的成長。例如,在中國,智慧溫室象徵智慧農業的發展。將此技術與最新技術結合,中國農民可以利用巨量資料支援的智慧系統,即時監測土壤狀況,進行預警控制,高效進行病蟲害監測,你一定能做到。

- 此外,據新南威爾斯州政府稱,到 2030 年,農業技術或農業科技預計將成為澳洲下一個價值 1,000 億美元的產業。由於全球暖化、自然資源減少、人事費用上升、能源、化肥和除草劑等因素,種子促進了農業科技的發展。

- 這些趨勢以及該國對智慧溫室的需求不斷增加,導致人們更加重視研發創新解決方案。例如,2022 年初,澳洲農業技術新興企業公司 Farm 4.0 宣布將與韓國公司 Green Plus 合作,在澳洲圖文巴 (Toowoomba) 佔地超過 4 公頃的土地上開發草莓溫室。

智慧溫室產業概況

智慧溫室市場分散,各公司在區域範圍內競爭以獲得市場佔有率。市場上的供應商預計將在大型計劃上展開激烈競爭,而規模較小的供應商預計將保持其在當地市場的主導地位。擁有整合產品的大型供應商預計其解決方案的採用率會更高,因為它們在整個價值鏈中擁有更廣泛的影響力,並且可以降低風險。

2022 年 8 月,Signify 韓國公司在韓國忠清南道論山市佔地 2.8 公頃的棕櫚農場溫室中安裝了飛利浦園藝 LED 生長燈解決方案,用於番茄生產。棕櫚農場安裝了飛利浦 GreenPower 頂光緊湊型產品,以提高產量、促進植物生長並生產出更高品質的作物。

2022 年 1 月,BFG Supply 超越了商業和業餘溫室結構及相關產品經銷商 International Greenhouse Co. Greenhouse Megastore。收購GMS擴大了BFG的溫室能力和產品選擇,並進一步提高了園藝市場的客戶服務水準。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對的強度

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 農民和農業工人更常採用物聯網和人工智慧

- 由於世界人口的持續成長,糧食需求不斷增加

- 市場挑戰

- 智慧溫室安裝昂貴的系統,投資成本高

第6章市場區隔

- 按類型

- 水耕

- 水耕栽培

- 依技術

- LED植物生長燈

- 空調設備

- 物料輸送

- 控制系統

- 感光元件和相機

- 閥門和泵

- 灌溉系統

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Heliospectra AB

- Rough Brothers Inc.(Gibraltar Industries INC.)

- Lumigrow Inc.

- Certhon

- GreenTech Agro LLC

- Argus Control System Ltd

- Logigs

- Greenhouse Megastore(BFG Supply)

- Netafim

- Desert Growing

- Sensaphone

- CarbonBook(Motorleaf)

第8章市場機會及未來趨勢

The Smart Greenhouse Market size is estimated at USD 2.36 billion in 2024, and is expected to reach USD 3.82 billion by 2029, growing at a CAGR of 10.15% during the forecast period (2024-2029).

Key Highlights

- In the current era, agriculture growth is considered one of the core components that can directly influence a country's economic growth as it provides revenue through the production of food and raw materials, which thereby counts as a primary source for imports and exports. It additionally generates employment opportunities on a larger scale. It helps countries leverage their economic transformation from a convention to an advanced economy, hence fostering the market's growth.

- Smart greenhouses, equipped with current sensors and communications technology, automatically record and disseminate information on the environment and crop 24/7. Data is collected and supplied into an IoT platform, where analytical algorithms turn it into actionable insight to identify bottlenecks and irregularities. As a result, HVAC and lighting operations and irrigation and spraying operations may all be controlled on demand. The creation of predictive models to estimate crop disease and infection risks is aided by continuous data monitoring.

- Farmers can collect various data points in unprecedented detail using IoT sensors. They provide real-time data on critical climate factors such as temperature, humidity, light exposure, and carbon dioxide throughout the greenhouse. This information leads to appropriate changes to HVAC and lighting settings to maintain the ideal conditions for plant development while also increasing the energy economy. Simultaneously, motion/acceleration sensors help detect doors left open unintentionally, ensuring a tightly controlled environment.

- HVAC, material logistics, sensors, and LED grow lights are all part of a smart greenhouse's technology. Because different companies supply distinct features for a regulated environment, integrating all technology in greenhouses is difficult. As a result, to create a smart greenhouse, companies must collaborate and provide a regulated environment to produce optimal yields. This is a significant challenge for the smart greenhouse market's expansion.

- The smart greenhouse market has suffered in terms of production, distribution, and uncertainty in demand due to the global COVID-19 pandemic. COVID-19-related restrictions on exports and imports have resulted in supply chain disruptions and vendors aiming to promote smart farm exports. For instance, in December 2021, in the Middle East, South Korea was building a smart farm with technology that allows it to grow various crops while using the least amount of water possible. The government aims to promote smart farm exports to the region based on technology and price competitiveness.

Smart Greenhouse Market Trends

Increasing Adoption of IoT and AI by Farmers and Agriculturists

- Smart greenhouses, equipped with current sensors and communications technology, automatically record and disseminate environmental and crop information 24/7. Data is collected and supplied to an IoT platform, where analytical algorithms turn it into actionable insight to identify bottlenecks and irregularities.

- As a result, HVAC and lighting operations, irrigation, and spraying operations may all be controlled on demand. The creation of predictive models to estimate crop disease and infection risks is aided by continuous data monitoring.

- Moreover, the increasing adoption of advanced technologies such as IoT and AI is fostering market growth potential. For instance, according to the data from IDATE DigiWorld and ETNO, the number of Internet of Things (IoT) active connections in agriculture in the European Union (EU) is reported to have increased from 0.51 million in 2016 to 70.26 million by 2025.

- Farmers can collect various data points in unprecedented detail using IoT sensors. They provide real-time data on critical climate factors such as temperature, humidity, light exposure, and carbon dioxide throughout the greenhouse. This information leads to appropriate changes to HVAC and lighting settings to maintain ideal plant development conditions while increasing the energy economy. Simultaneously, motion and acceleration sensors help detect doors left open unintentionally, ensuring a tightly controlled environment.

- Greenhouses with high-value crops are a viable target for hackers. Many farmers need an efficient security system since standard surveillance networks with CCTVs are costly to establish. IoT sensors in smart greenhouses provide a cost-effective infrastructure for monitoring door status and detecting suspicious activity in this context. They can immediately alert farmers if a security risk emerges when linked to an automatic alarm system.

Asia-Pacific to Witness Significant Growth in the Market

- The agriculture sector has remained the backbone of the Indian economy for a long time, as it employs about 60% of the country's workforce. Sensing the big market of the farming-based country, India also gains huge profits while exporting large amounts of food products across the globe. According to government data, India's exports of agricultural and processed food products increased by more than 13% in USD from April to November for the fiscal year 2021-22, compared to the previous year's period.

- However, the agriculture sector in India is still primarily climate-based, with limited technology penetration. The rising population and changing diets have created huge pressure on land in India. Farmers struggle to keep up as soil degradation rises, crop yields level off, water shortages increase, natural calamities become more frequent, and biodiversity declines.

- These combined factors drive the demand for modern farming techniques to cater to the ever-increasing demand for agricultural products. Greenhouses have emerged as highly beneficial gardening solutions, especially in extreme weather conditions, as they offer a controlled environment that guarantees higher yields sustainably.

- Similarly, other APAC countries such as India, Japan, and Australia also support smart greenhouse market growth in the region. For instance, in China, smart greenhouses epitomize the development of smart agriculture. This technique, combined with the latest technology, enables Chinese farmers to monitor the conditions of the soil in real-time and achieve warning and control, as well as efficient pest monitoring, using smart systems backed up by big data.

- Further, according to the New South Wales government, agricultural technology, or Agtech, is predicted to become Australia's next USD 100 billion industry by 2030. Factors such as global warming, diminishing natural resources, rising labor costs, energy, fertilizer, herbicides, and seeds have allowed Agtech to grow.

- Such trends drive the demand for smart greenhouses in the country, leading to a growing emphasis on R&D to develop innovative solutions. For instance, in early 2022, Australian agri-tech start-up Farm 4.0 announced a collaboration with Korea-based company Green Plus to develop a strawberry greenhouse on more than 4 hectares in Toowoomba, Australia.

Smart Greenhouse Industry Overview

The smart greenhouse market is fragmented, and various companies compete on a regional scale to gain market share. Vendors in the market are expected to compete intensely for large-scale projects, but smaller vendors are expected to hold prominence over the market in the local space. Major vendors that offer integrated products are expected to command a higher share of the adoption of their solutions due to the spread of their presence over the value chain and the ability to mitigate the risk.

In August 2022, Signify Korea installed a Philips horticulture LED grow light solution at the 2.8 ha Parm Farm Greenhouse for tomato production in Nonsan, Chungcheongnam-do, Korea. Parm Farm installed Philips GreenPower toplighting compact to produce higher yields, accelerate plant growth, and enable higher-quality crop production.

In January 2022, BFG Supply overtook International Greenhouse Co. Greenhouse Megastore, a distributor of commercial and hobby greenhouse structures and related products. The acquisition of GMS will expand BFG's greenhouse capabilities and product selection, further improving customer service levels in the horticulture market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of IoT and AI by Farmers and Agriculturists

- 5.1.2 Growing Demand for Food due to Continuously Increasing Global Population

- 5.2 Market Challenges

- 5.2.1 High Investment Costs due to the Deployment of Expensive Systems in Smart Greenhouses

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hydroponic

- 6.1.2 Non-hydroponic

- 6.2 By Technology

- 6.2.1 LED Grow Light

- 6.2.2 HVAC

- 6.2.3 Material Handling

- 6.2.4 Control Systems

- 6.2.5 Sensors and Cameras

- 6.2.6 Valves and Pumps

- 6.2.7 Irrigation Systems

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 India

- 6.3.3.2 China

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Heliospectra AB

- 7.1.2 Rough Brothers Inc. (Gibraltar Industries INC.)

- 7.1.3 Lumigrow Inc.

- 7.1.4 Certhon

- 7.1.5 GreenTech Agro LLC

- 7.1.6 Argus Control System Ltd

- 7.1.7 Logigs

- 7.1.8 Greenhouse Megastore (BFG Supply)

- 7.1.9 Netafim

- 7.1.10 Desert Growing

- 7.1.11 Sensaphone

- 7.1.12 CarbonBook (Motorleaf)