|

市場調查報告書

商品編碼

1445487

鏈鋸:市場佔有率分析、產業趨勢與統計、成長預測(2024:2029)Chain Saw - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

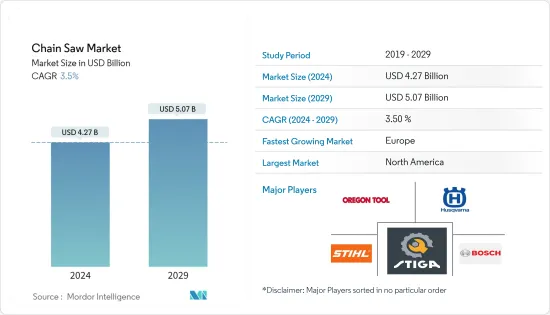

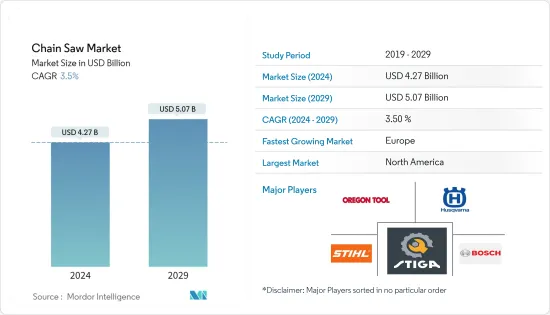

電鋸市場規模預計到 2024 年為 42.7 億美元,預計到 2029 年將達到 50.7 億美元,在預測期內(2024-2029 年)年複合成長率為 3.5%。

主要亮點

- 電鋸或電鋸是一種強大的切割工具,具有光滑的鏈條,其作用就像鋸片一樣,可以快速切割木材等材料。由於鏈鋸的效用,已在已開發國家和開發中國家建立了市場。近年來,由於快速都市化和新興經濟體對商品的需求不斷成長,森林砍伐加劇,推動了電鋸市場的發展。

- 家具製造、紙漿生產和住宅建設活動中木材的使用預計將推動需求。此外,由於建築等行業的需求增加,市場在預測期內可能會大幅成長。

- 新產品的推出可以幫助銷售商增加農業和農業機械的銷售量,擴大市場佔有率。供應商正試圖透過推出具有改進功能的新型機器或提供具有取得專利的功能的農業機械和農具來吸引更多消費者。專業和半專業工人更重視實施安全準則,以防止受傷和事故,可能會在預測期內推動市場發展。

電鋸市場趨勢

森林砍伐和對日常生活必需品和住所的需求增加

世界人口日益增加,而這種人口成長導致森林砍伐加劇。此外,對大豆、棕櫚油和木製品的需求增加導致森林砍伐。需求是由世界各地人口成長所驅動的。要獲得這些農產品,您必須砍伐森林以開墾耕地。巴西、哥倫比亞和印尼這些產品產量的增加正在導致森林砍伐。人們也對肉類和牛奶等產品有需求,並且透過砍伐森林面積擴大了牧場。由於砍伐森林活動的增加,預計全球對鏈鋸作為砍伐、砍伐和砍伐樹木的工具的需求將會增加。

在過去的十年中,世界各地對日常用品和住房的需求不斷增加,導致森林砍伐大幅增加。巴西在森林砍伐方面處於世界領先地位。家具製造、紙漿生產和住宅建築中木材使用量的增加刺激了對鏈鋸的需求。森林砍伐的增加是由於世界人口不斷成長,最終增加了對住宅和庇護所的需求。

2020年,巴西森林面積為496萬平方公里,10年來首次減少。因此,由於建築等行業的需求增加,市場在預測期內可能會顯著成長。

北美主導電鋸市場

北美在 2021 年佔據最大市場佔有率,預計未來幾年將大幅成長。由於需求不斷成長,鏈鋸市場的公司擴大在北美擴張並推出新產品。例如,Husqvarna 推出了一條新產品線,其中包括兩台新的 70cc 鋸、兩台重新設計的 50cc 鋸、一台氣動樹木護理鋸和幾種新的必需設備。該公司擴大了在北美的 X-Cut 鏈鋸鏈產品線。根據全國住宅建築商協會的數據,北美 90% 的住宅是用木材建造的。北美人選擇木製庇護所,因為木材被認為相對較輕。這是市場上最堅固的材料之一,甚至比鋼還要堅固。木材是支撐此重量的最佳材料之一,某些建築設計所需的支撐較少。

根據 NAHB 2021 年人口普查局的分析,92% 的新住宅是用木材建造的,另外 7% 是用混凝土建造的,只有不到 0.5% 是鋼骨建造的。在美國,在住宅建築中使用木材比混凝土或石材便宜得多。眾所周知,木框架在極端風暴中表現良好,特別是如果它們結構良好的話。美國人選擇住宅的原因之一是稅收低。用木材建造的房屋的稅收可能比用其他材料建造的房屋低得多。木材也是極佳的隔熱材料。眾所周知,木製產品具有較低的體積能量,同時隔熱又防寒。因此,即使在最冷的月份,木造建築通常也能保持非常溫暖。北美地區的大雪增加了柴火的使用,最終增加了住宅對電鋸的需求。預計這些因素將提高木材在住宅和庇護所製造中的利用率,並在預測期內推動鏈鋸市場。

鏈鋸產業概況

鏈鋸市場分為多家全球和本地公司。為了提供流暢的使用者體驗,市場上的大多數公司都提供各種林業、建築和園藝設備。供應商也提高了對環保工具的認知,並增加了世界各地的銷售量。這五家主要企業包括 Husqvarna AB、Robert Bosch GmbH、STIGA SpA、Andreas Stihl Limited 和 Oregon Tool Inc。每家公司都在創新和研發部門的幫助下不斷努力為客戶提供更好的解決方案。產品的推出和公司創新策略的各種發展正在推動全球市場的發展。不同公司推出的產品構成了市場的特徵。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 市場限制因素

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 產品類別

- 氣體類型

- 電動

- 電池供電

- 其他產品類型

- 目的

- 住宅

- 工業的

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 非洲

- 南非

- 其他非洲

- 北美洲

第6章 競爭形勢

- 最採用的策略

- 市場佔有率分析

- 公司簡介

- Robert Bosch GmbH

- Blount International Inc.

- Husqvarna AB

- ANDREAS STIHL Limited

- STIGA SpA

- AL-KO Kober

- Einhell Germany

- Emak SPA

- Hitachi Ltd

- Rochford Garden Machinery

- Stanley Black &Decker Inc.

- SUMEC Group Corporation

- Talon Tough Tools

- The Toro Co.

- Yamabiko Corp.

第7章市場機會與未來趨勢

The Chain Saw Market size is estimated at USD 4.27 billion in 2024, and is expected to reach USD 5.07 billion by 2029, growing at a CAGR of 3.5% during the forecast period (2024-2029).

Key Highlights

- Chainsaws, or chain saws, are powerful cutting tools containing soothed chains that function like a saw blade to cut through material such as wood quickly. The market is well-established across developed and developing nations due to the chainsaws' utility. Increasing deforestation due to rapid urbanization and rising demand for commodities in emerging economies has driven the chainsaw market in recent years.

- The use of wood in furniture manufacturing, pulp production, and for house construction activities is expected to propel the demand. Further, the market is likely to grow considerably during the forecast period due to the increased demand from sectors such as construction.

- The new product launches help the vendors increase the sales of agricultural and farm machinery, thus increasing their market share. The vendors are trying to attract more consumers by introducing new variants of machinery with improved features and offering agricultural and farm machinery with patented features. The increased emphasis of professional and semi-professional workers toward adopting safety guidelines to prevent injuries and mishaps may drive the market during the forecast period.

Chain Saw Market Trends

Increasing Deforestation and Demand for Commodities and Shelter

The world's population is increasing daily, and this increase in population is leading to increases in deforestation. Also, increased demand for soybeans, palm oil, and wood products leads to deforestation. The demand is driven by the growing population worldwide. Obtaining these agricultural commodities require the clearing of forests to create arable land. Increased production of these commodities in Brazil, Colombia, and Indonesia has resulted in deforestation. Demand for products such as meat and milk has also expanded the grazing land by clearing forest areas. The demand for chainsaws as a tool for bucking, cutting, and felling trees is expected to increase globally due to increased deforestation activities.

The past decade has seen a massive increase in deforestation due to the increasing demand for commodities and shelter worldwide. Brazil has been leading the world in terms of deforestation. The increased use of wood in the manufacture of furniture, the production of pulp, and the construction of houses stimulate the demand for chainsaws. This increase in deforestation is because of the increasing population growth of the world, which has ultimately increased the demand for homes and shelter.

In 2020, the forest area in Brazil was 4.96 million sq. km, which has decreased since a decade. Thus, the market will likely witness considerable growth during the forecast period due to the increased demand from sectors such as construction.

North America Dominates the Chainsaw Market

North America witnessed the largest market share in 2021, which is expected to grow at a significant rate in the coming years. Companies in the chainsaw market are increasingly expanding and launching new products in the North American region owing to the rising demand. For instance, Husqvarna launched its new product line, including two new 70cc saws, two redesigned 50cc saws, gas-powered tree care saws, and some new equipment essentials. It expanded its line of X-Cut chainsaw chains in North America. According to the National Association of home builders, 90% of North American homes are made up of wood. North Americans' choice of wood shelter is due to the reason that wood is considered to be relatively lightweight. It is one of the strongest materials in the market and even outperforms steel. Wood is one of the best materials to support its weight, which means that lesser support is necessary for certain building designs.

According to NAHB analysis of 2021 Census Bureau 2021, 92% of new homes were wood-framed, another 7% were concrete-framed, and less than half a percent were steel-framed. In America, wood is quite cheaper than concrete or masonry for the construction of homes. Wooden frames are known to perform well during extreme storms, especially when they are well constructed. One of the reasons Americans choices for houses made up of wood is due to the low taxes. Taxes on homes built with wood can be considerably lower than on houses built with other materials. Wood is also a good thermal insulator. Wooden products are known to have lower embodied energy while also isolating heat from cold. Due to this reason, buildings that are made from wood usually remain quite warm even during the coldest periods. Heavy snowfall in the North American region has increased the use of firewood, ultimately increasing the demand for chain saws in residential areas. Such factors have improved the use of wood for making homes and shelters and, thus, are expected to drive the chainsaw market during the forecast period.

Chain Saw Industry Overview

The chainsaw market is fragmented due to several global and local players. To provide a smooth user experience, most players in the market offer a wide range of forest, construction, and garden equipment. Vendors are also developing awareness about eco-friendly tools, driving their sales worldwide. Five major players are companies like Husqvarna AB, Robert Bosch GmbH, STIGA SpA, Andreas Stihl Limited, and Oregon Tool Inc. Companies are continuously trying to provide better solutions to their customers with the help of innovations and their R&D sectors. Various developments in product launches and the company's innovation strategies are driving the market globally. Product launches by various companies characterize the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Gas-powered

- 5.1.2 Electric-powered

- 5.1.3 Battery-powered

- 5.1.4 Other Product Types

- 5.2 Application

- 5.2.1 Residential

- 5.2.2 Industrial

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Russia

- 5.3.2.6 Spain

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Robert Bosch GmbH

- 6.3.2 Blount International Inc.

- 6.3.3 Husqvarna AB

- 6.3.4 ANDREAS STIHL Limited

- 6.3.5 STIGA SpA

- 6.3.6 AL-KO Kober

- 6.3.7 Einhell Germany

- 6.3.8 Emak SPA

- 6.3.9 Hitachi Ltd

- 6.3.10 Rochford Garden Machinery

- 6.3.11 Stanley Black & Decker Inc.

- 6.3.12 SUMEC Group Corporation

- 6.3.13 Talon Tough Tools

- 6.3.14 The Toro Co.

- 6.3.15 Yamabiko Corp.