|

市場調查報告書

商品編碼

1444772

商業智慧(BI):市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Business Intelligence (BI) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

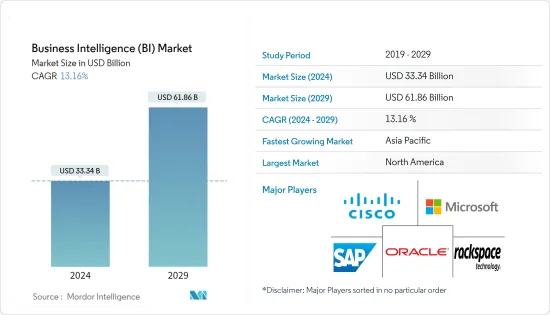

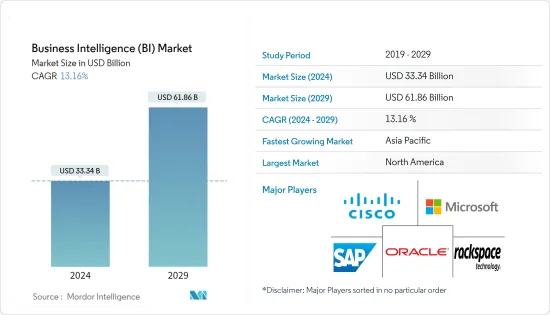

商業智慧(BI)市場規模預計到 2024 年為 333.4 億美元,在預測期內(2024-2029 年)預計到 2029 年將達到 618.6 億美元,年複合成長率為 13.16%。

主要亮點

- 由於巨量資料的興起以及在短時間內做出關鍵業務決策的需求不斷成長,商業智慧和分析工具在過去十年中顯著擴大了市場佔有率。在整個預測期內,隨著技術的發展和投資水準的上升,這種趨勢預計將繼續增強。

- BI 是一個依賴科技來分析資料並提供資訊供管理者、企業最終使用者和主管人員用來制定業務決策的過程。 BI 包括使管理員能夠從外部來源和內部系統收集資料、分析資料、豐富和監控查詢,以及建立報告、儀表板和資料視覺化以供操作人員和企業使用。包括廣泛的技術、工具和軟體程式。

- 此外,越來越多的組織正在使用資料視覺化工具進行分析。它們用於建立 BI 儀表板、績效記分卡、資訊圖表和圖表。 BI中也使用了文字探勘、預測分析、統計分析和巨量資料分析等先進的分析技術。這些工具的使用增加將推動許多行業對 BI 的需求,因為它提高了得出富有洞察力的結論的能力。此外,BI 系統還可以幫助公司識別緊迫的業務問題和行業趨勢。

- 小型企業部門對雲端基礎的業務解決方案日益成長的需求正在推動 BI 行業的發展。公司越來越認知到 BI 軟體的優勢,包括資料可擴展性和追蹤關鍵績效指標 (KPI) 的能力。這些好處使組織能夠改善使用者體驗並根據資料驅動的見解做出明智的決策。

- 中小企業最關心的是實施BI基礎設施的成本,這抑制了市場的擴張。 BI 產業的成長也可能因缺乏合格的資料科學家、諮詢分析師和 IT 專家等資源而受到限制。然而,自助服務的進步有望解決昂貴的基礎設施問題。

- 消費者行為和所有市場都受到了 COVID-19感染疾病的影響。由於全球封鎖,提供 BI 產品和服務的公司的成長陷入停滯。醫療保健、生命科學和 BFSI 行業仍然擁有 BI 系統。因此,COVID-19對這些地區影響不大。疫情也影響了供應鏈。借助 BI 工具,即使在行銷和銷售漏斗結束後,公司也能夠繼續以相同的勢頭運作。由於鎖定機會,BI 解決方案市場這些系統的銷售量增加。

商業智慧(BI) 市場趨勢

BFSI 產業預計將推動市場成長

- 近年來,由於數位化和各種技術進步的快速引入,銀行業迅速擴張。商業智慧和資料分析等技術和工具的進步使銀行能夠遵守所有必要的法規,保持競爭力並滿足當今現代客戶的數位需求。金融公司可以利用這些技術做出更明智的財務和營運決策。

- 區塊鏈、人工智慧(AI)、生物識別和機器學習(ML)等新興技術正在銀行業得到應用。金融機構正在試驗預測性和自適應分析、業務自動化和物聯網 (IoT),以提高決策能力。因此,銀行、金融服務和保險(BFSI)行業預計很快就會為市場參與企業提供利潤豐厚的機會。

- 該行業的擴張是由於金融資料的高度敏感性,並與稅務機關、證券監管機構、央行、證券交易所、稅務部門等許多其他行業以及新的投資策略的製定相聯繫,需要進行調整。

- 許多變數都促成了這一成長,包括資料分析的使用不斷增加、資料產生的增加、雲端 BI 在中小企業 (SME) 中的日益普及,以及 BI 工具的有效性不斷提高。這是有可能的。 BFSI產業引進BI。人工智慧、機器學習和物聯網等技術增加了我們對資料的依賴,增加了對 BI 工具的需求。透過即時發現、分析、處理和解決問題,幫助銀行和金融部門改善業務。

北美保持最大市場佔有率

- 北美大陸主導 BI 市場。 Tableau Software, LLC、Oracle Corporation、IBM Corporation 和 Microsoft Corporation 等主要產業參與者預計將加速該領域的市場成長。技術研發力度的加強、競爭的加劇以及資料擴散趨勢的不斷變化,進一步推動了北美市場的擴張。

- 中小企業對雲端基礎的業務解決方案不斷成長的需求正在推動區域商業智慧產業的發展。組織越來越意識到 BI 軟體提供的眾多優勢,包括資料可擴展性和關鍵績效指標 (KPI) 追蹤,這些可以改善用戶體驗。

- 此外,廣泛的資料系統擴大使用 BI 平台作為前端介面。創新的 BI 軟體可讓企業連接到各種資料來源。它還提供了易於理解的用戶介面(UI),使其適合建立大量資料。為了創建多樣化資料的全面觀點,該地區的最終用戶正在連接到各種資料基礎,包括 NoSQL資料庫、Hadoop 系統、傳統資料倉儲和雲端平台。

- 醫療保健和零售業預計將在北美地區發揮重要作用,因為近年來這些行業一直專注於自動化。由於大量投資和有利條件使這些行業全面數位化,醫療保健和零售業發生了根本性變化。隨著分析成為這些業務的基本要素,對 BI 解決方案的需求預計在未來幾年將顯著增加。

商業智慧(BI) 產業概覽

BI 市場競爭激烈,有許多健康且成熟的參與者。市場參與者採取收購、聯盟、合併和合作等策略性舉措來獲得相對於其他市場參與者的競爭優勢。

2023 年 5 月,Rackspace US Inc. 宣布與 CCS Presentation Systems 合作,成功完成複雜的雲端遷移。這項轉變透過採用雲端原生環境提供了增強的安全性、擴充性和生產力。 Rackspace Technology 與 Rackspace Elastic Engineering for Microsoft Azure 一起提供諮詢和諮詢服務,以實現遠端勞動力最佳化並降低總擁有成本 (TCO)。

2022 年 11 月,GoodData 宣佈在 Amazon Web Services (AWS) 上全面推出 GoodData Cloud。下一代雲端分析平台優先考慮易於部署、應用程式介面 (API) 優先的設計以及與現代資料堆疊的整合。 GoodData Cloud on AWS 可在全球範圍內訪問,使 GoodData 能夠在符合當地法律和合法令遵循的任何地方提供可擴展的分析服務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 評估 COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 企業越來越多採用資料分析

- 物聯網技術的出現

- 市場限制因素

- 本地解決方案投資成本高

- 缺乏熟練的專業人員

- 分析商業智慧(BI) 能力

- 報告

- 資料探勘

- 資料分析

- OLAP

- 流程挖掘和文字探勘

- 複雜事件處理

- 其他特性

- 商業智慧(BI)趨勢分析

- 行動商業智慧

- 雲端商業智慧

- 社交商業智慧

- 傳統商業智慧

第6章市場區隔

- 按成分

- 軟體和平台

- 服務

- 按配置

- 本地

- 雲

- 按最終用戶產業

- BFSI

- 資訊科技/通訊

- 零售

- 衛生保健

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭形勢

- 公司簡介

- Rackspace US Inc.

- SAP SE

- Oracle Corporation

- Microsoft Corporation

- Cisco Systems Inc.

- SAS Institute Inc.

- GoodData Corporation

- Targit AS

- International Business Machines Corporation

- VMware Inc.

- Tableau Software Inc.(Salesforce)

第8章投資分析

第9章市場機會與未來趨勢

The Business Intelligence Market size is estimated at USD 33.34 billion in 2024, and is expected to reach USD 61.86 billion by 2029, growing at a CAGR of 13.16% during the forecast period (2024-2029).

Key Highlights

- BI and analytics tools have significantly increased in market share over the past ten years due to the increase in big data and the growing requirement to make important business decisions in a condensed amount of time. Throughout the projected period, this tendency is anticipated to rise continuously along with the development of technology and rising investment levels.

- BI is a process that relies on technology for analyzing data and providing information that may be used to make business decisions by managers, corporate end users, and executives. BI includes a wide range of techniques, instruments, and software programs that enable administrations to collect data from external sources and internal systems, analyze it, enhance and monitor queries, and produce reports, dashboards, and data visualizations for use by operational staff and corporate decision-makers.

- Additionally, an increasing number of organizations are using data visualization tools for analytics. They are employed in the creation of BI dashboards, performance scorecards, infographics, and charts. Advanced analytics techniques, including text mining, predictive analytics, statistical analysis, and big data analytics, are also used in BI. The rising use of these tools promotes the demand for BI across many industries because of the improved capacity to derive insightful conclusions. Additionally, BI systems assist businesses in spotting pressing business issues and industry trends.

- The SME sector's rising desire for cloud-based business solutions is propelling the BI industry. The advantages of BI software, such as data scalability and the ability to track key performance indicators (KPIs), are becoming increasingly recognized. These advantages enable organizations to enhance user experience and make informed decisions based on data-driven insights.

- Small and medium-sized organizations are most concerned about the expense of adopting BI infrastructure, which inhibits market expansion. The growth of the BI industry may also be constrained by a shortage of resources, such as qualified data scientists, consulting analysts, and IT specialists. But it is envisaged that the advancement of self-service would address the problem of pricy infrastructure.

- Consumer behavior and all marketplaces were impacted by the COVID-19 pandemic. Businesses offering BI products and services experienced a pause in growth as a result of the global lockdowns put in place. Healthcare, life sciences, and BFSI sectors are still implementing BI systems. Hence COVID-19 had little impact on these sectors. The pandemic also influenced supply chains; BI tools enabled companies to continue operating with the same vigor even after they had reached the end of their marketing and sales funnels. The lockdown's opportunity helped the market for BI solutions increase sales of those systems.

Business Intelligence (BI) Market Trends

BFSI Industry is Expected to Drive the Market Growth

- Due to digitization and the fast adoption of different technical breakthroughs in recent years, the banking sector is expanding quickly. The development of technologies and tools, such as BI and data analytics, has assisted banks in adhering to all necessary regulations, being competitive, and serving the digital needs of today's modern clients. Financial firms can make wise financial and operational decisions with the help of these technologies.

- Modern technologies like blockchain, artificial intelligence (AI), biometrics, and machine learning (ML) are used in the banking industry. Financial institutions are experimenting with predictive and adaptive analytics, business automation, and the Internet of Things (IoT) to improve their decision-making capacity. Consequently, it is anticipated that the banking, financial services, and insurance (BFSI) sectors will soon provide market participants with lucrative opportunities.

- The segment's expansion is attributed to the sensitive nature of financial data, which calls for coordination with many other industries, including tax authorities, securities controlling authorities, central banks, stock exchanges, revenue departments, and the creation of new investment strategies.

- Numerous variables, including the expanding use of data analytics, an increase in data generation, the growing popularity of cloud BI among small- and medium-sized enterprises (SMEs), and the greater effectiveness of BI tools, can be blamed for the rise in BI adoption in the BFSI industry. The dependence on data is growing due to technologies like AI, ML, and IoT, which are driving up demand for BI tools. By discovering, analyzing, addressing, and resolving issues in real-time, they contribute to improving the operations of the banking and financial sectors.

North America to Hold Maximum Market Share

- The North American continent dominates the BI market. It is anticipated that key industry players like Tableau Software, LLC, Oracle Corporation, IBM Corporation, and Microsoft Corporation will accelerate market growth in the area. Intensified technological R&D efforts, rising competition, and an evolving trend of data proliferation are further drivers supporting the market expansion in North America.

- The SME sector's increasing desire for cloud-based business solutions is propelling the regional BI industry. Organizations are able to improve user experience thanks to growing awareness of numerous benefits, like data scalability and tracking key performance indicators (KPIs) provided by BI software.

- Furthermore, extensive data systems are increasingly using BI platforms as front-end interfaces. Businesses may connect to various data sources thanks to innovative BI software. It also provides straightforward user interfaces (UI), making the tackles well-suited for giant data constructions. To create a comprehensive perspective of their diverse data, end users throughout the region connect to various data foundations, such as NoSQL databases, Hadoop systems, traditional data warehouses, and cloud platforms.

- With an emphasis on automation in these sectors in recent years, the healthcare and retail sectors are anticipated to be crucial in the North American area. Healthcare and retail have undergone radical change due to significant investments and enabling conditions, enabling these industries to attain complete digitalization. In the upcoming years, the demand for BI solutions is anticipated to increase significantly as analytics become a fundamental component of these businesses.

Business Intelligence (BI) Industry Overview

The BI market is competitive with many healthy well-established players. The market players adopt strategic initiatives such as acquisitions, collaborations, mergers, and partnerships to get a competitive edge over other market players.

In May 2023, Rackspace US Inc. announced its collaboration with CCS Presentation Systems to successfully complete a complex cloud transition. This transition resulted in enhanced security, scalability, and productivity by adopting a cloud-native environment. Rackspace Technology provided consulting and advisory services, along with Rackspace Elastic Engineering for Microsoft Azure, enabling optimizing their remote workforce and reducing the total cost of ownership (TCO).

In November 2022, GoodData announced the general availability of GoodData Cloud on Amazon Web Services (AWS). The next-generation cloud analytics platform prioritizes ease of adoption, application programming interface (API)-first design, and integration with the modern data stack. With the worldwide accessibility of GoodData Cloud on AWS, GoodData can deliver scalable analytics services that adhere to local laws and compliance regulations everywhere.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Data Analytics by Enterprises

- 5.1.2 Emergence of IoT-Enabled Technologies

- 5.2 Market Restraints

- 5.2.1 High Investment Costs for On-Premise Solutions

- 5.2.2 Lack of Skilled Professionals

- 5.3 Analysis on Business Intelligence (BI) Functions

- 5.3.1 Reporting

- 5.3.2 Data Mining

- 5.3.3 Data Analytics

- 5.3.4 OLAP

- 5.3.5 Process and Text Mining

- 5.3.6 Complex Event Processing

- 5.3.7 Other Functions

- 5.4 Analysis on Business Intelligence (BI) Trends

- 5.4.1 Mobile BI

- 5.4.2 Cloud BI

- 5.4.3 Social BI

- 5.4.4 Traditional BI

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Software and Platform

- 6.1.2 Services

- 6.2 By Deployment

- 6.2.1 On-Premise

- 6.2.2 Cloud

- 6.3 By End-User Industry

- 6.3.1 BFSI

- 6.3.2 IT and Telecommunication

- 6.3.3 Retail

- 6.3.4 Healthcare

- 6.3.5 Other End-User Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Rackspace US Inc.

- 7.1.2 SAP SE

- 7.1.3 Oracle Corporation

- 7.1.4 Microsoft Corporation

- 7.1.5 Cisco Systems Inc.

- 7.1.6 SAS Institute Inc.

- 7.1.7 GoodData Corporation

- 7.1.8 Targit AS

- 7.1.9 International Business Machines Corporation

- 7.1.10 VMware Inc.

- 7.1.11 Tableau Software Inc. (Salesforce)