|

市場調查報告書

商品編碼

1444699

醫療保健BI - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Healthcare BI - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

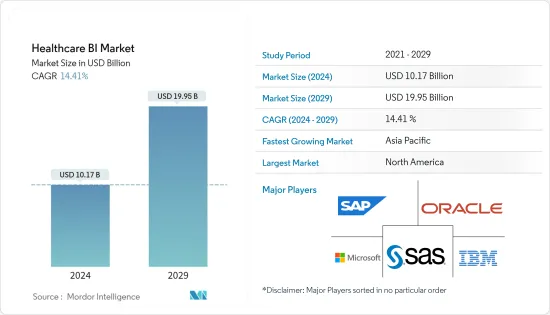

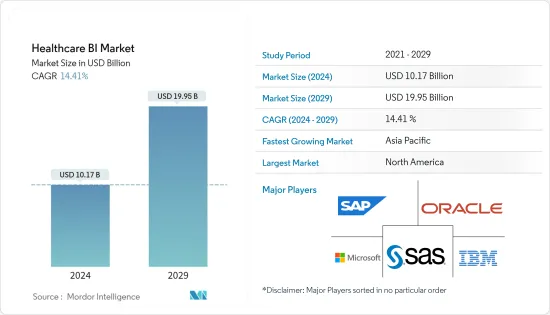

醫療保健BI市場規模2024年估計為101.7億美元,預計到2029年將達到199.5億美元,在預測期內(2024-2029年)CAGR為14.41%。

COVID-19 的爆發證明了公共衛生危機對急診和醫院系統的影響。近年來,第一線醫療機構已經展示瞭如何使用資料分析和應用程式有效管理有限的資產。 COVID-19資料由疫情爆發地點的工作人員收集,包括傳播性、危險因子、潛伏期和死亡率。這些資訊創建視覺化、數學模型和神經網路訓練。例如,Elsevier2022年 2月發布的一項研究顯示,疫情期間歐洲數位技術採用率從 81%躍升至 95%。事實證明,應用於緊急醫療服務(EMS)的商業智慧對於改善流行病管理和加速疫情應對決策過程極為有益。因此,所研究的市場受到了 COVID-19 大流行的顯著影響。然而,隨著疫情的消退,預計市場將失去一些吸引力,但預計在預測期內將實現健康成長。

在軟體即服務市場中,商業智慧的資金越來越充足。 BI 承諾透過處理大量資料來分析和基準化業務線,幫助識別、開發和創造新的收入機會。病患登記數量的增加是推動市場成長的主要因素。例如,根據 Frontiers2022年 8月發表的一篇文章 ,病患登記被認為是醫療保健實踐、藥物利用和臨床結果的重要資料來源。這些登記處透過提供罕見疾病的流行病學、護理標準和治療模式等資訊來幫助應對各種挑戰。因此,病患登記的優勢預計將增加病患登記的使用,增加健康商業智慧的採用。

由於政府提高 EHR 採用率和病患登記數量的舉措,以及醫療保健產業巨量資料的出現,醫療保健 BI 市場將呈現快速成長。根據《生物醫學科學與技術研究雜誌》於2021年 1月發表的文章 ,印度政府重點關注其醫療保健數位化,包括電子健康記錄(EHR),以提供更好的患者資料管理、醫療保健提供者之間的無縫協調以及改善醫療保健研究。製定多項國家級政策,例如國家數位健康藍圖,以創建泛印度數位健康記錄系統。據同一消息來源表示,在提供者層面,Tata紀念醫院和 Max Hospitals Private Limited 等大型醫療系統已經實施了電子病歷(EMR)系統,並轉向 EHR。因此,與 BI 相關的好處及其在整個醫療保健行業日益成長的採用率推動市場成長。然而,系統的複雜性可能會阻礙預測期內的市場成長。

醫療保健 BI 市場趨勢

預計在預測期內,基於雲端的模型將在醫療保健 BI 市場中顯著成長

基於雲端的交付模式是成長最快的區隔,因為公司擴大採用基於雲端的商業智慧工具,例如銷售人員的客戶關係管理(CRM)應用程式、患者參與 CRM 等。這是由於基於雲端的工具的敏捷性和可存取性。此外,與本地或混合模型相比,基於雲端的模型具有成本效益、方便用戶使用且接受率更高;因此,所有這些因素都促成了該細分市場的重要佔有率。

擴大採用基於雲端的模型,加上醫療保健對數位技術的高度依賴來操作複雜的醫療保健系統的功能,進一步推動了市場的成長。此外,創新產品的推出也有助於市場成長。例如,2022年 3月,Snowflake 為醫療保健產業推出了一個基於雲端的資料共享平台,該平台將公司的核心資料倉儲、分析和商業智慧產品與資料市場和按需諮詢服務整合在一起。

此外,2022年 3月,微軟宣布全面推出 Azure 健康資料服務,這是一個基於雲端的平台,用於管理和分析各種形式的患者資料。 Azure 健康資料服務平台即服務(PaaS)可協助組織在多個資料儲存中管理不同形式的受保護健康資訊(PHI),讓他們能夠使用更少的時間和精力來處理並理解患者資料。資源。因此,技術先進產品的推出推動市場成長。

北美預計將在市場中佔據重要佔有率,並在預測期內保持相同的勢頭

由於提供者擴大實施醫療保健 BI 解決方案和服務以提供更好的患者護理以及人們對商業智慧的認知不斷增強,北美地區在全球市場佔據主導地位。此外,不斷升級的醫療保健和 IT 基礎設施以及雲端運算採用的增加大幅促進了市場成長。例如,根據 PubMed Central2022年 3月發表的一篇文章 ,在美國進行的一項研究表明,商業智慧(BI)流程有助於識別碘造影劑(ICA)被浪費的情況在對患者進行CT 掃描期間。因此,BI 在各個醫療保健領域的日益採用預計將推動該地區市場的成長。

北美的科技業有效地利用資料服務來應對流行病。例如,2021年 4月,美國能源部橡樹嶺國家實驗室(ORNL)部署了由 IBM 製造的世界上最強大、最智慧的超級電腦之一,名為「Summit」。這個新系統將有助於緊急計算,並且還可以用於以非常高的速度執行模擬。

此外,根據國家衛生資訊科技協調員辦公室2021年發布的資料,大約五分之四的基層開業醫師(78%)和幾乎所有非聯邦急診醫院(96%)採用了經過認證的 EHR預計2021年將在美國實現這一目標。因此,美國EHR 的高採用率預計也將推動市場成長。此外,新產品的推出也有助於整體市場的成長。例如,2021年 9月,Med Tech Solutions(MTS)推出了 MTS Practice Data Analytics 視覺化商業智慧(BI)工具。實踐資料分析根據電子健康記錄(EHR)資料產生 40 多個標準商業智慧(BI)報告,可以在輕鬆自訂的儀表板中查看。因此,由於上述因素,預計北美市場將顯著成長。

醫療保健 BI 行業概覽

該市場競爭適中,有多家大型和新興參與者。產品創新和持續開發先進技術的研發活動預計將推動市場的成長。市場上一些主要的參與者包括 Oracle 公司、微軟公司、IBM 公司、SAP SE 和 SAS Institute Inc。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 政府不斷加強醫療保健數位化舉措,例如採用電子病歷

- 病患登記數量不斷增加

- 巨量資料在醫療保健產業的出現

- 市場限制

- 實施成本高

- 缺乏熟練的專業人員

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

第5章 市場細分

- 依組件

- 軟體

- 服務

- 按交付方式

- 內部部署模型

- 混合模型

- 基於雲端的模型

- 依應用

- 財務分析

- 臨床資料分析

- 病人護理分析

- 其他應用

- 依最終用戶

- 付款人

- 醫療保健機構

- 其他最終用戶

- 地理

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 亞太其他地區

- 中東和非洲

- 海灣合作理事會

- 南非

- 中東和非洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章 競爭格局

- 公司簡介

- Microsoft Corporation

- IBM Corporation

- Oracle Corporation

- SAP SE

- SAS Institute Inc.

- Salesforce

- MicroStrategy Incorporated

- QlikTech International AB

- Information Builders

- Sisense Inc.

- EPIC SYSTEMS

- Infor Inc.

- CareCloud Inc.

- Domo Inc.

第7章 市場機會與未來趨勢

The Healthcare BI Market size is estimated at USD 10.17 billion in 2024, and is expected to reach USD 19.95 billion by 2029, growing at a CAGR of 14.41% during the forecast period (2024-2029).

The COVID-19 outbreak demonstrated the effects of public health crises on emergency departments and hospital systems. In recent years, frontline healthcare facilities have demonstrated how to effectively manage limited assets using data analytics and applications. COVID-19 data was collected by workers at outbreak sites, including transmissibility, risk factors, incubation period, and mortality rate. This information creates visualizations, mathematical models, and neural network training. For example, according to a study published by Elsevier in February 2022, a study was conducted which showed that digital technology adoption in Europe jumped from 81% to 95% during the pandemic. BI applied to emergency medical services (EMS) has proven extremely beneficial in improving pandemic management and speeding up the outbreak response decision-making process. Hence, the studied market was significantly impacted by the COVID-19 pandemic. However, as the pandemic has subsided, the market is expected to lose some tractions, but it is expected to have healthy growth during the forecast period.

In the software-as-a-service market, business intelligence is becoming increasingly well-funded. BI promises to help identify, develop, and otherwise create new revenue opportunities by handling large amounts of data to analyze and benchmark lines of business. The increasing number of patient registries is a major factor driving the growth of the market. For instance, according to an article published by Frontiers in August 2022, patient registries are considered an important source of data for healthcare practices, drug utilization, and clinical outcomes. These registries help in addressing various challenges by providing information on epidemiology, standards of care, and treatment patterns of rare diseases, among others. Hence, the advantages of patient registries are expected to increase the usage of patient registries, thereby increasing the adoption of health business intelligence.

The healthcare BI market will show rapid growth due to government initiatives to increase EHR adoption and the number of patient registries, and the emergence of big data in the healthcare industry. As per the article published by the Biomedical Journal of Scientific & Technical Research in January 2021, the Government of India focused on digitizing its healthcare, including Electronic Health Records (EHR), to provide better patient data management, seamless coordination between healthcare providers, and improved healthcare research. Several national-level policies, such as National Digital Health Blueprint, are being formulated to create a pan-India digital health record system. As per the same source, at the provider level, large health systems like Tata Memorial Hospital and Max Hospitals Private Limited have implemented electronic medical record (EMR) systems and are moving toward EHR. Hence, the benefits associated with the BI and its increasing adoption rate across the healthcare industry are driving the market growth. However, the complexity of systems may hinder market growth over the forecast period.

Healthcare BI Market Trends

Cloud-based Model is Expected to Grow Significantly in the Healthcare BI Market Over the Forecast Period

The cloud-based delivery model is the fastest-growing segment as companies are increasingly adopting cloud-based business intelligence tools, such as Customer Relationship Management (CRM) applications by salesforce, patient engagement CRM, and others. This is due to the agility and accessibility of cloud-based tools. In addition, cloud-based models are cost-effective, user-friendly, and have a higher acceptance rate in comparison to on-premise or hybrid models; therefore, all these factors contribute to the segment's significant share.

Increasing adoption of cloud-based models coupled with the high dependency of healthcare on digital technology to operate functions of a complex healthcare system is further boosting the market growth. Furthermore, the launch of innovative products is also contributing to market growth. For instance, in March 2022, Snowflake launched a cloud-based data-sharing platform for the healthcare industry that integrates the company's core data warehousing, analytics, and business intelligence offerings with a data marketplace and on-demand consulting services.

Also, in March 2022, Microsoft announced the general availability of Azure Health Data Services, a cloud-based platform for managing and analyzing various forms of patient data. The Azure Health Data Services platform-as-a-service (PaaS) helps organizations manage disparate forms of protected health information (PHI) across multiple data stores, letting them work with -- and make sense of -- patient data using less time and resources. Hence, the launch of technologically advanced products is driving market growth.

North America is Expected to Hold a Significant Share in the Market and Expected to do Same in the Forecast Period

North America is found to dominate the global market due to the providers' increasing implementation of healthcare BI solutions and services to offer enhanced patient care and the increasing awareness about business intelligence. Moreover, constantly upgrading healthcare and IT infrastructure along with increased adoption of cloud computing contributes significantly to the market growth. For instance, according to an article published by PubMed Central in March 2022, a study was conducted in the United States which showed that the business intelligence (BI) process helped in the identification of situations in which iodinated contrast agents (ICA) were being wasted during the CT scan in the patient. Hence, the increasing adoption of BI in various healthcare fields is expected to drive the growth of the market in the region.

The tech sector of North America is using data services efficiently to survive pandemics. For instance, in April 2021, the United States Department of Energy's Oak Ridge National Laboratory (ORNL) deployed one of the world's most powerful and smartest supercomputers, named 'Summit,' built by IBM. This new system will help in emergency computation, and it can also be used to perform simulations at a very high speed.

Moreover, according to the data published by the Office of the National Coordinator for Health Information Technology in 2021, approximately 4 in 5 office-based physicians (78%) and nearly all non-federal acute care hospitals (96%) adopted a certified EHR in the United States in 2021. Hence, the high adoption rate of EHR in the United States is also expected to boost market growth. In addition, the introduction of new products contributes to overall market growth. For instance, in September 2021, Med Tech Solutions (MTS) launched MTS Practice Data Analytics visual business intelligence (BI) tools. Practice Data Analytics generates over 40 standard business intelligence (BI) reports from electronic health record (EHR) data, which can be viewed in easily customizable dashboards. Hence, the market is projected to grow significantly in North America due to the above-mentioned factors.

Healthcare BI Industry Overview

The market is moderately competitive, with several big and emerging players. Product innovation and ongoing R&D activities to develop advanced technologies are expected to boost the market's growth. Some of the major players operating in the market include Oracle Corporation, Microsoft Corporation, IBM Corporation, SAP SE, and SAS Institute Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Government Initiatives for Healthcare Digitalization, Like Adoption of EHR

- 4.2.2 Increasing Number of Patient Registries

- 4.2.3 The Emergence of Big Data in the Healthcare Industry

- 4.3 Market Restraints

- 4.3.1 High Cost of Implementation

- 4.3.2 Lack of Skilled Professionals

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Component

- 5.1.1 Software

- 5.1.2 Services

- 5.2 By Mode of Delivery

- 5.2.1 On-premise Model

- 5.2.2 Hybrid Model

- 5.2.3 Cloud-based Model

- 5.3 By Application

- 5.3.1 Financial Analysis

- 5.3.2 Clinical Data Analysis

- 5.3.3 Patient Care Analysis

- 5.3.4 Other Applications

- 5.4 By End User

- 5.4.1 Payers

- 5.4.2 Healthcare Providers

- 5.4.3 Other End Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle-East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle-East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Microsoft Corporation

- 6.1.2 IBM Corporation

- 6.1.3 Oracle Corporation

- 6.1.4 SAP SE

- 6.1.5 SAS Institute Inc.

- 6.1.6 Salesforce

- 6.1.7 MicroStrategy Incorporated

- 6.1.8 QlikTech International AB

- 6.1.9 Information Builders

- 6.1.10 Sisense Inc.

- 6.1.11 EPIC SYSTEMS

- 6.1.12 Infor Inc.

- 6.1.13 CareCloud Inc.

- 6.1.14 Domo Inc.