|

市場調查報告書

商品編碼

1640481

生物分解性包裝解決方案:市場佔有率分析、產業趨勢和成長預測(2025-2030 年)Biodegradable Packaging Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

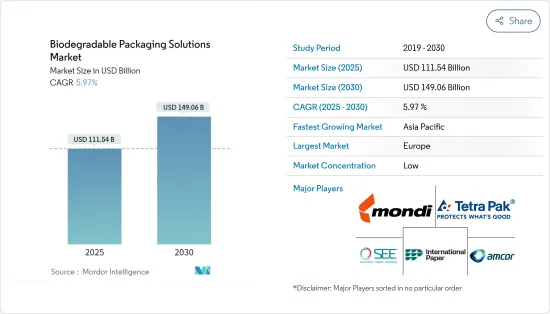

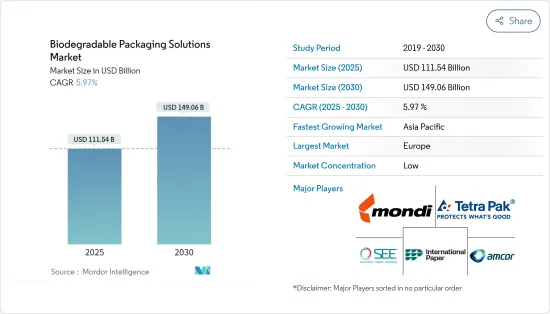

生物分解性包裝解決方案市場規模預計在 2025 年為 1,115.4 億美元,預計到 2030 年將達到 1,490.6 億美元,預測期內(2025-2030 年)的複合年成長率為 5.97%。

由於人們對環境保護意識的不斷增強,尤其是在後疫情時代,生物分解性包裝解決方案的市場在過去幾年中不斷擴大。市場成長的動力在於消費者對永續包裝材料的偏好日益成長,以及各個終端用戶產業對可回收和生物分解性產品的需求不斷增加。

關鍵亮點

- 生物分解性的包裝解決方案是從製造過程中回收的材料中再加工並包含在最終產品或零件中的材料。再生材料是已經達到原始用途並用於包裝的材料。提倡使用回收材料,因為它可以顯著減少組織的廢棄物足跡,同時最佳化製造流程。對於回收產品而言,回收的內容物可以提高公司的永續性,流程的效率還可以提高成本效益。

- 技術進步推動了創新可回收包裝解決方案的發展。製造商專注於開發環保的包裝材料並為包裝產品提供必要的保護和功能。因此,再生包裝市場正在採用新材料、新設計和新製造流程來滿足多樣化的需求。

- 隨著各國和組織逐漸不再使用一次性塑膠包裝,預計將為生物分解性包裝創造有利的市場前景。在印度等包裝廢棄物問題嚴重的國家,各邦政府和中央政府已採取措施禁止使用一次性塑膠。

- 生物分解性塑膠在環境中由細菌和真菌等微生物自然分解。這意味著,與不會分解的傳統塑膠不同,生物分解性塑膠可以堆肥並返回到環境中。

- 原料不一定在自然環境中分解。例如,可生物分解性塑膠只能在工業堆肥廠分解,在那裡它們被加熱到足夠高的溫度,以使微生物以明顯的速度分解它們。

- 根據Thermogard介紹,生物分解性塑膠需要特殊的環境才能完全分解。當留在垃圾掩埋場或海洋中時,生物分解性塑膠會分解成微小的微塑膠,對環境造成影響。然而,生物分解性塑膠比傳統塑膠更環保,因為它們在垃圾掩埋場中分解得更快。

生物分解性包裝解決方案的市場趨勢

塑膠有望佔據主要市場佔有率

- 過去十年來,生質塑膠的需求激增。這種快速成長的推動力是全球對環境保護的日益重視,製造業向生物基和自然資源的轉變,以及世界各地實施各種法規以促進永續資源利用和廢棄物管理。由於消費者對環保材料的偏好日益增加以及環保意識的增強,市場有望經歷顯著成長。

- 包裝產業對生物友善塑膠的需求龐大,預計未來五年仍將保持不變。生物分解性塑膠包裝解決方案因其對環境的影響較小、人們越來越關注可回收性和永續性,以及政府對高效包裝管理的興趣日益濃厚,正在見證行業的崛起。

- 生物基材料在其生命週期內就溫室氣體預算和其他環境影響而言具有多種潛在優勢。生物分解性材料的使用有望促進永續性,並顯著減少石油基聚合物處置對環境的影響。

- 生物分解性塑膠包裝與基於石化燃料的包裝不同,由於可在環境中被微生物自然分解,因此風險較小。從食品飲料到醫療保健,越來越多的產業開始轉向生物分解性的包裝。這些塑膠不僅具有環境效益,而且還有望降低生產成本。它也為專為堆肥設計的產品開闢了新的市場。

- 根據歐洲生物塑膠新研究所的數據,2023年全球生物分解性塑膠的產能為1,136噸。預計到2028年這數字將上升至4,605噸。預計生產能力不斷增加的趨勢將推動生物分解性塑膠的需求。

亞太地區可望大幅成長

- 政府措施和環保包裝產品的發展是市場需求不斷成長的主要原因。消費者對塑膠廢棄物帶來的環境風險的認知正在不斷提高,隨著先進技術的發展,印度許多製造商正在致力於開發生物分解性的包裝解決方案。

- 在印度,食品和飲料業率先採用生物分解性包裝,其次是個人保健產品和化妝品。食品包裝行業在包裝和標籤方面正在經歷重大創新。環保食品包裝市場分為材料選擇、應用、類型和技術。

- 印度產生的塑膠廢棄物量每十年都在增加。預計將從 2021 年的 1,750 萬噸增加到 2031 年的 3,140 萬噸,再到 2041 年的 5,500 萬噸。隨著印度塑膠廢棄物的增加,該地區為製造商提供了將廢棄塑膠轉化並回收為生質塑膠包裝的機會。

- 近年來,日本的包裝趨勢發生了重大變化。其中一個主要原因是人們對環境問題的認知不斷增強。因此,人們將重點放在減輕容器重量和精簡包裝材料上。這種環保意識的方法導致了由可回收材料製成的產品的出現。此外,我們非常注重創造高性能產品,並強調安全性和便利性。

生物分解性包裝解決方案產業概況

生物分解性包裝解決方案市場是細分的。主要市場參與企業包括 Amcor Limited、Sealed Air Corporation、Mondi Group PLC 和 Tetra Pak International SA。印度等新興國家的區域性公司也正在尋求搶佔市場佔有率。進入門檻低導致規模較小的參與企業的出現,進一步加劇了競爭對手之間的敵意。

- 2024年6月,拉丁美洲永續包裝公司Bioelements Group宣布策略擴張至美國市場。該公司在休士頓設立了美國總部,並宣布了建立BIOLab研究機構的計畫。 Bioelements 專門從事利用科學、生物分解性和可堆肥材料的先進包裝。透過此次擴張,該公司旨在更緊密地滿足美國零售、電子商務、食品、家居用品、個人護理和專業行業品牌不斷變化的包裝需求。

- 2024 年 2 月,全球包裝解決方案供應商SEE 推出了蛋白質包裝的開創性生物基工業可堆肥托盤,凸顯了其對永續包裝的承諾。這些托盤是針對現代食品加工設施而設計並經過嚴格測試的。 SEE 的最新產品 CRYOVAC Overwrap 採用美國認證的生物基樹脂製成,其中 54% 的生物基含量源自可再生木質纖維素。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 技術簡介

第5章 市場動態

- 市場促進因素

- 消費者和品牌對永續產品的需求不斷增加

- 嚴格的政府法規

- 市場限制

- 生質塑膠及相關材料供不應求

第6章 市場細分

- 依材料類型

- 塑膠

- 澱粉基塑膠

- 纖維素基塑膠

- 聚乳酸(PLA)

- 聚-3-羥基丁酸酯 (PHB)

- 聚羥基烷酯(PHA)

- 紙

- 牛皮紙

- 軟紙

- 紙板

- 箱板

- 塑膠

- 按應用

- 食品包裝

- 飲料包裝

- 醫藥包裝

- 個人/居家醫療

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 北美洲

- 其他

第7章 競爭格局

- 公司簡介

- Tetra Pak International SA

- Amcor Group Gmbh

- Mondi Group

- Sealed Air Corporation

- Elevate Packaging Inc.

- Kruger Inc.

- Biopak PTY Ltd(Duni Group)

- Smurfit Kappa Group PLC

- Berkley International Packaging Limited

- Greenpack Limited

- International Paper Company

- Ranpak Holding Corporation

第8章投資分析

第9章:未來市場展望

The Biodegradable Packaging Solutions Market size is estimated at USD 111.54 billion in 2025, and is expected to reach USD 149.06 billion by 2030, at a CAGR of 5.97% during the forecast period (2025-2030).

The market for biodegradable packaging solutions has grown over the past few years due to the growing awareness about environmental conservation, especially in the post-pandemic scenario. The market's growth is driven by the increase in consumer preference for sustainable packaging materials and the growing demand for recyclable and biodegradable products across various end-user industries.

Key Highlights

- Biodegradable packaging solutions are the materials reprocessed from a recovered material using a manufacturing process and then included in a final product or component. Recycled material is any material that has already served the use that it was initially intended for and is being used for packaging. Recycled content is promoted as it significantly reduces organizational waste footprints while optimizing the manufacturing process. With recycled products, recycled content will improve a company's sustainability, and due to the efficiency of the process, it is also associated with increased cost benefits.

- Technological advancements are leading to the development of innovative recyclable packaging solutions. Manufacturers are focused on creating packaging materials that are environmentally friendly and offer the required protection and functionality for the products being packaged. As a result, the recycled packaging market is witnessing the introduction of new materials, designs, and manufacturing processes that cater to diverse needs.

- Various countries and organizations are avoiding the utilization of single-use plastic packaging, which is expected to create a favorable market scenario for biodegradable packaging. In countries like India, where packaging waste has become a major issue, state and central governments are taking steps to prohibit the use of single-use plastic.

- Biodegradable plastics break down naturally in the environment through microorganisms such as bacteria and fungi. This means that biodegradable plastics can be composted and returned to the environment, unlike conventional plastics, which do not decompose.

- The source material does not necessarily imply it can be broken down into the natural environment. For instance, biodegradable plastics might only break down in industrial composting plants, where they can be heated to a high enough temperature to allow microbes to break them down at a noticeable rate.

- According to Thermogard, biodegradable plastics require a particular environment to break down entirely. If left to do so in landfills or seas, biodegradable plastics break into tiny microplastics, impacting the environment. However, biodegradable plastics are more environmentally friendly than traditional plastics as they decompose faster in landfills.

Biodegradable Packaging Solutions Market Trends

Plastic is Expected to Hold a Significant Market Share

- Over the past decade, the demand for bioplastics has surged. This surge can be attributed to a heightened global emphasis on environmental conservation, a shift toward bio-based and natural resources in manufacturing, and the implementation of diverse regulations worldwide to promote sustainable resource utilization and waste management. With consumers increasingly favoring eco-friendly materials and a rising environmental consciousness, the market is poised for significant growth.

- The demand for bio-friendly plastics in the packaging industry is enormous and is expected to remain the same in the next five years. Biodegradable plastic packaging solutions are witnessing a rise in the industry owing to their low environmental impact, growing focus on recyclability and sustainability, and government focus on efficient packaging management.

- Bio-based materials have several potential benefits for greenhouse gas balances and other environmental impacts over life cycles. The use of biodegradable materials is expected to contribute to sustainability and a high reduction in the environmental effects associated with the disposal of oil-based polymers.

- Unlike its fossil fuel-based counterpart, biodegradable plastic packaging naturally decomposes in the environment through microorganisms, posing lesser risks. Industries, spanning from food & beverages to healthcare, are increasingly pivoting toward biodegradable packaging. Beyond environmental benefits, these plastics also promise cost reductions in production. Moreover, they open avenues for new markets, especially in products designed for composting.

- As per the European Bioplastics Nova-Institute, global production capacity for biodegradable plastics stood at 1,136 metric tons in 2023. This figure is expected to increase to 4,605 metric tons by 2028. This uptrend in production capacity is poised to fuel the demand for biodegradable plastics.

Asia-Pacific is Expected to Record Significant Growth

- Government initiatives and the development of environment-friendly packaging products are the main reasons for the growing demand in the market. Consumers are increasingly aware of the environmental risks caused by plastic waste, and the development of advanced technology has prompted many Indian manufacturers to create biodegradation packaging solutions.

- The food & beverage industry was the first adopter of biodegradable packaging, followed by personal care products and cosmetics in India. Significant innovation in packaging and labeling has occurred within the food packaging industry. The market for eco-friendly food packaging is divided into material choices, applications, types, and techniques.

- Plastic waste generation in India has grown every ten years. In 2021, it was 17.5 million metric tons, which is expected to increase to 31.40 million metric tons by 2031 and 55 million metric tons by 2041. With increasing plastic waste generation in India, this region provides opportunities for manufacturers to convert and recycle the waste plastic into bioplastic packaging.

- Japan's packaging trends have changed a lot in recent years. One of the main reasons for this is the increased awareness about environmental issues. This has led to a focus on reducing container weight and streamlining packaging materials. This eco-friendly approach has resulted in products using recyclable materials. In addition, there is a strong focus on creating high-performing products that focus on safety and convenience.

Biodegradable Packaging Solutions Industry Overview

The biodegradable packaging solutions market is fragmented. Major market players include Amcor Limited, Sealed Air Corporation, Mondi Group PLC, and Tetra Pak International SA. Several regional firms in developing countries like India are also trying to gain market share. Barriers to entry are low, resulting in the advent of smaller players and further increasing competitive rivalry.

- June 2024: Bioelements Group, a sustainable packaging firm in Latin America, unveiled its strategic move into the US market. The company established its US headquarters in Houston and announced plans for a BIOLab research facility. Bioelements specializes in an advanced packaging range, leveraging biobased, biodegradable, and compostable materials crafted through science and technology. With this expansion, the company aims to align closely with the evolving packaging demands of US brands across retail, e-commerce, food, home, personal care, and specialty industries.

- February 2024: SEE, a global packaging solutions provider, underscored its commitment to sustainable packaging by unveiling a pioneering biobased industrial compostable tray for protein packaging. This tray, designed for modern food processing facilities, underwent rigorous testing. SEE's latest offering, the CRYOVAC overwrap, is crafted from a USDA-certified biobased resin, boasting a 54% biobased content derived from renewable wood cellulose.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand For Sustainable Products By Consumers And Brands

- 5.1.2 Stringent Government Regulations

- 5.2 Market Restraints

- 5.2.1 Lack of Supply of Bio-plastics and Related Materials

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.1.1 Starch-Based Plastics

- 6.1.1.2 Cellulose-Based Plastics

- 6.1.1.3 Polylactic Acid (PLA)

- 6.1.1.4 Poly-3-Hydroxybutyrate (PHB)

- 6.1.1.5 Polyhydroxyalkanoates (PHA)

- 6.1.2 Paper

- 6.1.2.1 Kraft Paper

- 6.1.2.2 Flexible Paper

- 6.1.2.3 Corrugated Fiberboard

- 6.1.2.4 Boxboard

- 6.1.1 Plastic

- 6.2 By Application

- 6.2.1 Food Packaging

- 6.2.2 Beverage Packaging

- 6.2.3 Pharmaceutical Packaging

- 6.2.4 Personal/Homecare Packaging

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia Pacific

- 6.3.1 North America

- 6.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Tetra Pak International SA

- 7.1.2 Amcor Group Gmbh

- 7.1.3 Mondi Group

- 7.1.4 Sealed Air Corporation

- 7.1.5 Elevate Packaging Inc.

- 7.1.6 Kruger Inc.

- 7.1.7 Biopak PTY Ltd (Duni Group)

- 7.1.8 Smurfit Kappa Group PLC

- 7.1.9 Berkley International Packaging Limited

- 7.1.10 Greenpack Limited

- 7.1.11 International Paper Company

- 7.1.12 Ranpak Holding Corporation