|

市場調查報告書

商品編碼

1444518

精準灌溉 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Precision Irrigation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

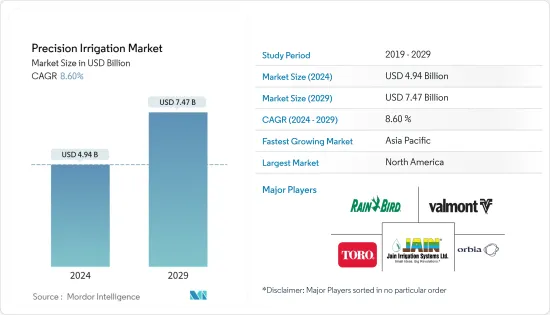

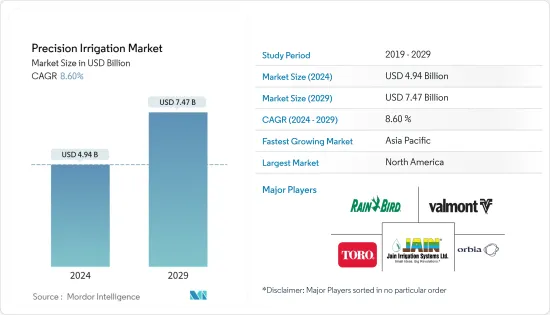

2024年精準灌溉市場規模預計為49.4億美元,預計到2029年將達到74.7億美元,在預測期內(2024-2029年)CAGR為8.60%。

主要亮點

- 水資源短缺是一項重大課題,從長遠來看,這又成為灌溉系統使用的關鍵促進因素。因此,對人工灌溉的需求增加,以確保作物高產,以滿足消費者不斷成長的需求。世界各地農田的整合使農民有可能投資昂貴的灌溉系統,例如精密灌溉系統,推動了市場。

- 噴灌系統是最大的區隔市場,因為公司投資研發提供創新的噴灌系統,能夠在不同的氣候條件下工作,並減少約50%的人工費用。

- 由於政府為實施現代先進的精準灌溉系統提供低利率貸款和補貼等優惠政策,未來幾年南美洲和亞太等發展中市場的精準灌溉市場可能會迅速成長。亞太地區對新技術的認知不斷提高和高度適應性正在推動該地區市場的成長。因此,市場正在高速成長。

精準灌溉市場趨勢

溫室蔬菜產量快速成長

自動滴灌對於控制土壤濕度至關重要,特別是在專業溫室蔬菜的情況下。滴灌系統的完全自動化為控制土壤濕度和施水提供了一個簡單而細緻的方法。此外,這些系統預計將增加單位產量所產生的利潤。

水是歐洲各國的稀缺資源,這是許多菜農面臨的首要問題。因此,精準灌溉系統在該地區越來越受歡迎。此外,根據比利時園藝拍賣協會的數據,2021年比利時溫室蔬菜產量為40.54萬噸,其中番茄產量為30.41萬噸。此外,由於氣候條件和高投資報酬率(ROI)提高作物產量的需求,瑞典溫室番茄產量在 2020 年至 2021 年間增加了 17.9%。

在美國、加拿大、日本、中東和歐洲國家,無土栽培主要用於溫室蔬菜的生產。由於溫室蔬菜需要大量的水,農民正在改用噴灌和滴灌系統,以實現更高的作物生產力。因此,增加溫室蔬菜的產量預計將促進所研究市場的成長。為了維持快速成長的全球人口,迫切需要提高農業生產。溫室蔬菜生產是實現這一目標的主要手段。考慮到上述所有因素,滴灌和噴灌系統的需求預計在不久的將來將大幅增加。

北美主導市場

北美是精準灌溉系統的重點地區。美國以超過一半的市佔率主導北美市場。聯邦、州和地方各級的水開發計劃以及地下水抽水技術的改進促進了美國灌溉面積的擴大。該國農民能夠以靈活的利率和還款時間表以農業設備貸款的形式及時獲得補貼。這甚至幫助小規模農民投資農業灌溉設備,擴大了精準灌溉系統市場。

勞動成本的增加增加了對精準灌溉系統的需求,因為這種灌溉不需要大量的勞動力。僱用勞動力進行灌溉可能會使灌溉費用增加 50%。因此,墨西哥的種植者依賴精密灌溉系統,促使市場擴大。由於無組織、隔離的耕作方法,農民面臨無數課題,因此墨西哥需要精確的灌溉系統實踐。

加拿大的農民技術精湛,願意接受新技術。因此,預計該地區將出現高成長率。因此,加拿大的農業實踐以其高生產力和現代化而聞名。推動加拿大市場的關鍵因素是透過最佳化水和勞動力的利用來節省成本。據估計,採用精準灌溉可節省約10%-50%的成本。因此,政府不斷採取的措施和增加灌溉系統的使用以提高生產力將在預測期內推動市場成長。

精準灌溉產業概況

全球精準灌溉系統市場已整合,主要公司包括 Orbia (Netafim Limited)、Jain Irrigation Systems Limited、The Toro Company、Valmont 等。 Orbia (Netafim Limited) 擁有最高的市場佔有率,其次是 Jain Irrigation Systems Limited。建立強大的分銷網路是成熟市場參與者的首要策略。此外,一些公司還與廣泛的經銷商簽署了最終的經銷協議,以提高可及性。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場概況

- 市場促進因素

- 市場限制

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章:市場區隔

- 類型

- 噴灌

- 傳統噴頭

- 中心樞軸噴頭

- 橫向移動/線性噴頭

- 滴灌

- 地表滴灌

- 地下滴灌

- 精準移動滴灌

- 其他類型

- 噴灌

- 作物類型

- 大田作物

- 種植園作物

- 果園和葡萄園

- 草坪和觀賞植物

- 地理

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 非洲

- 南非

- 非洲其他地區

- 北美洲

第 6 章:競爭格局

- 最常用的策略

- 市佔率分析

- 公司簡介

- Jain Irrigation Systems Ltd

- Lindsay Corporation

- Nelson Irrigation Corporation

- Netafim Ltd

- Rain Bird Corporation

- Rivulis Irrigation Ltd

- The Toro Company

- Valmont Industries Inc.

- Mahindra EPC Industries Limited

- Tl Irrigation Co.

- Deere & Company

第 7 章:市場機會與未來趨勢

The Precision Irrigation Market size is estimated at USD 4.94 billion in 2024, and is expected to reach USD 7.47 billion by 2029, growing at a CAGR of 8.60% during the forecast period (2024-2029).

Key Highlights

- Water scarcity is a major challenge and this, in turn, becomes the key driver for the use of irrigation systems in the long run. Hence, the need for artificial irrigation has increased to ensure a high crop yield to satiate the growing demand from consumers. The consolidation of farmlands in various parts of the world makes it possible for farmers to invest in expensive irrigation systems such as precision, which drives the market.

- The sprinkler irrigation system is the largest segment due to companies investing in R&D to provide innovative sprinkler systems, able to work in different climatic conditions and reduce labor expenses by about 50%.

- Due to favorable government policies regarding low-interest loans and subsidies for implementing modern and advanced precision irrigation systems, the precision irrigation market is likely to increase quickly in developing markets such as South America and Asia-Pacific in the coming years. Increasing awareness and high adaptability of new technologies in Asia-pacific are driving the growth of the market in that region. Hence, the market is growing at a high rate.

Precision Irrigation Market Trends

Rapid Growth of Greenhouse Vegetable Production

Automatic drip irrigation is essential for controlling soil moisture, especially in the case of specialized greenhouse vegetables. Total automation of drip irrigation systems provides a simple, meticulous method for controlling soil moisture and applying water. Furthermore, these systems are expected to increase profits generated per yield.

Water is a scarce resource in various European countries which is a primary issue faced by several vegetable farmers. Thus, precision irrigation systems are gaining immense popularity in this region. Furthermore, in 2021, as per the Association of Belgian Horticultural Auctions, the greenhouse vegetable production in Belgium stood at 405.4 thousand metric ton of which tomato production was 304.1 thousand metric ton. Also, Sweden witnessed a growth in the production of greenhouse tomatoes by 17.9% between 2020 and 2021 due to climatic conditions and demand for increasing crop yield with high Return on Investment (ROI).

In the United States, Canada, Japan, the Middle East, and European countries, soilless culture is primarily used for the production of greenhouse vegetables. As greenhouse vegetables require ample amounts of water, farmers are switching to both sprinkler and drip irrigation systems, in order to achieve higher crop productivity. Thus, increasing the production of greenhouse vegetables is expected to augment the growth of the market studied. There is a significant need to enhance agriculture production, in order to sustain the rapidly increasing global population. Production of greenhouse vegetables is the primary means of achieving it. Considering all the aforementioned factors, the demand for drip irrigation and sprinkler irrigation systems is expected to increase significantly in the near future.

North America Dominates the Market

North America is the key region for precision irrigation systems. The United States dominates the North American market with more than half of the market share. Water development programs at the federal, state, and local levels and improvements in groundwater pumping technologies contributed to the expansion of the irrigated area in the United States. Farmers in the country have been able to avail timely subsidies in the form of agriculture equipment loans at flexible interest rates and repayment schedules. This has helped even small-scale farmers to invest in agricultural irrigation equipment, thereby expanding the precision irrigation systems market.

The increase in the cost of labor charges increased the demand for precision irrigation systems as this irrigation does not require plenty of labor. Hiring labor for irrigation purposes potentially increases the irrigation overheads by 50%. Hence, growers in Mexico depend on precision irrigation systems, leading to the expansion of the market. As farmers face innumerable challenges due to the unorganized, segregating farming methodology, there is a need for precision irrigation system practices in Mexico.

Farmers in Canada are highly skilled and are willing to embrace new technologies. Thus, high growth rates are expected to be seen in the region. Therefore, the agricultural practices in Canada are known for their high productivity and for being modern. The key factors driving the market in Canada are cost savings achieved through optimum usage of water and labor. It is estimated that around 10%-50% of the costs can be saved by the use of precision irrigation. Therefore, the rising government initiatives and increasing use of irrigation systems for enhanced productivity will drive market growth during the forecast period.

Precision Irrigation Industry Overview

The global precision irrigation systems market is consolidated, with major companies such as Orbia (Netafim Limited), Jain Irrigation Systems Limited, The Toro Company, Valmont, to name a few. Orbia (Netafim Limited) held the highest market share followed by Jain Irrigation Systems Limited. Establishment of a strong distribution network is a prime strategy followed by well-established market players. Moreover, some of the companies signed definitive dealership agreements with a wide range of dealers, in order to enhance accessibility.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Force Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Sprinkler Irrigation

- 5.1.1.1 Traditional Sprinklers

- 5.1.1.2 Center Pivot Sprinklers

- 5.1.1.3 Lateral Move/ Linear Sprinklers

- 5.1.2 Drip Irrigation

- 5.1.2.1 Surface Drip Irrigation

- 5.1.2.2 Sub-Surface Drip Irrigation

- 5.1.2.3 Precision Mobile Drip Irrigation

- 5.1.3 Other Types

- 5.1.1 Sprinkler Irrigation

- 5.2 Crop Type

- 5.2.1 Field Crops

- 5.2.2 Plantation Crops

- 5.2.3 Orchards and Vineyards

- 5.2.4 Turf And Ornamentals

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Jain Irrigation Systems Ltd

- 6.3.2 Lindsay Corporation

- 6.3.3 Nelson Irrigation Corporation

- 6.3.4 Netafim Ltd

- 6.3.5 Rain Bird Corporation

- 6.3.6 Rivulis Irrigation Ltd

- 6.3.7 The Toro Company

- 6.3.8 Valmont Industries Inc.

- 6.3.9 Mahindra EPC Industries Limited

- 6.3.10 T-l Irrigation Co.

- 6.3.11 Deere & Company