|

市場調查報告書

商品編碼

1641882

數據即服務 (DaaS) -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Data as a Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

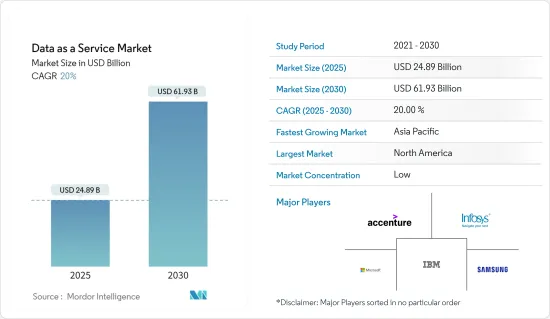

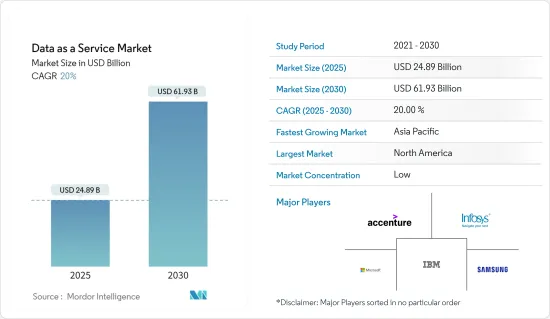

數據即服務 (DaaS) 市場規模預計在 2025 年達到 248.9 億美元,預計在 2030 年將達到 619.3 億美元,2025 年至 2030 年的複合年成長率為 1.4%。

企業越來越希望利用資料來獲得競爭優勢,而管理日益複雜和異質的資料環境的挑戰也隨之而來,這推動了數據即服務 (DaaS) 的興起,從而創造了為市場創造了有利條件。

關鍵亮點

- DaaS(資料即服務)基於雲端部署模型。它可以部署在混合、公有或私有雲平台上。由於雲端運算提供的優勢,其應用正在迅速成長。此外,資料的使用方式多種多樣,以前僅限於核心商務策略。在當前市場情況下,採用 DaaS 是最佳解決方案,因為它打破了資料孤島、提高了靈活性並可以輕鬆操作資料。

- 此外,越來越多的企業正在採用即時資料分析和巨量資料來從這些資料庫中獲取有價值的見解。巨量資料對於企業來說正變得越來越重要,支援巨量資料所需的儲存量也不斷成長。許多公司正在利用巨量資料來制定商務策略,推動市場的成長。據希捷稱,全球資料的創建、捕獲、複製和消費量預計都將大幅成長。預計到 2025 年,全球資料產生量將成長到 180 Zetta位元組以上。

- 世界各地的公司,尤其是零售和通訊業的公司,擴大使用資料來提高品牌吸引力和廣告影響力。這就是為什麼社群媒體 DaaS 提供者數量不斷增加的原因。此外,整個組織內為了獲得早期洞察而進行的即時分析正在推動對 DaaS 解決方案的需求。 DaaS 解決方案也正在成為中小型企業和新興企業的有利選擇,因為它們可以完全外包,可以作為整合解決方案(如 Oracle)或獨立解決方案,而無需投資整個技術。

- 然而,DaaS 部署涉及的雲端平台隱私和安全挑戰可能會影響市場成長。

- 新冠肺炎疫情正在對市場產生正面影響。自 COVID-19 疫情爆發以來,由於雲端運算帶來的好處,其採用率迅速成長。這場疫情也推動了數位化進程。根據 Sisense 的一項調查,50% 的企業現在使用資料分析的次數比新冠疫情之前要多,其中包括超過 68% 的中小型企業。

DaaS(數據即服務)市場趨勢

BFSI 產業實現高成長

- 資產服務業正在從服務主導轉向資料和技術主導。銀行也使用 DaaS 為尋求商業智慧洞察的客戶提供報告即服務和分析即服務。銀行業和金融業正面臨一個關鍵的十字路口:要麼利用存取、分析和處理即時產生的資料所帶來的機遇,要麼在市場上無法競爭。

- 然而,我們觀察到只有大型國家和地區銀行才優先考慮資料和分析需求。規模較小的銀行和金融機構尚未起步,尚未看到顯著的效益。此外,隨著彭博終端機等產品的存在,參與金融分析和股票市場的公司預計將成為數據即服務(DaaS)的主要受益者。

- 資料即服務解決方案可協助銀行和金融資料簡化資料輸出、產生連貫的資料集、識別當前趨勢並減少資料處理時間。

- 此外,銀行和金融機構正在廣泛採用數據即服務解決方案,以使相關人員能夠利用資料來開闢新的收益來源。例如,總部位於法蘭克福的德國大型銀行、全能銀行德國商業銀行開發了 200 多個 API,以實現流程轉型並為其合作夥伴提供近乎即時的 DaaS,從而增加價值。

- PitchBook 的數據顯示,去年全球對金融科技公司的投資總額為 2,265 億美元,而前年僅 1,277 億美元。全球對金融科技公司的總投資大幅增加,為市場提供了廣泛的成長機會,這將在整個預測期內顯著促進市場的成長。

北美佔有最大市場佔有率

- 北美一直是數據即服務解決方案採用領域的領先創新者和先驅。由於擁有強大的資料分析供應商支撐,該地區對能源領域的資料分析需求龐大,為市場成長提供了豐厚的機會。

- 此外,該地區的主要企業正在廣泛採用 DaaS 作為其產品的一部分。採用 DaaS 的主要原因遠遠超過其缺點:您需要一個適應性強且可擴展的交付、處理和儲存平台,尤其是在涉及物聯網資料時。因此,與儲存在企業儲存庫或資料湖中的靜態資料相比,企業採用 DaaS 來處理機器產生的物聯網資料的可能性高出五倍。此外,企業資料聯合使得各種規模的企業能夠企業聯合組織(共用和收益)資料,這也是 DaaS 的關鍵機遇,也是市場最大的前景之一。

- 與加拿大相比,美國在該地區的需求成長中發揮關鍵作用。 BFSI、IT 和通訊以及石油和天然氣領域的需求尤其增加。此外,該地區的許多國際品牌正在採用基於社群媒體的促銷策略來進入市場,利用市場中各個參與企業提供的資料。

- 例如今年3月,專注於金融科技的創業投資基金First Rate Ventures投資了全面、可自訂的跨細分監理預警服務供應商RegAlytics。 RegAlytics 為全球最大的金融機構和交易所提供資訊服務。 RegAlytics 每天提供來自 5,000 多個監管機構的一致、可自訂且經過徹底審查的監管資料。

- 此外,今年 6 月,專注於金融科技的創業投資基金 First Rate Ventures 從其新推出的2,500 萬美元創業投資基金中向 OWL ESG 進行了投資。 OWL ESG 提供資料、指數、指標和其他工具,幫助投資者在產生影響的同時做出明智的選擇。該公司使用機器學習和自然語言處理 (NLP) 從數百萬個來源收集和匯總 ESG資料。

DaaS(數據即服務)產業概覽

DaaS 市場競爭激烈,許多大大小小的參與企業都在國內和國際市場開展業務。市場細分化,主要企業正在採用產品和服務創新策略和併購。市場的主要企業包括 IBM 公司、Oracle 公司、SAP SE 和彭博金融有限合夥公司。

- 2022年10月:供應鏈協作解決方案供應商Nulogy在多企業供應鏈業務網路平台(MESCBN)上正式推出Nulogy DaaS解決方案。 Nulogy 使用者可以透過 Nulogy DaaS 服務存取新的自助分析選項。客戶可以利用透過DaaS獲得的資料來建立分析能力,以大規模探索複雜資料,並完全控制最終的分析輸出,從而進行資料主導的決策。

- 2022年6月:阿里巴巴成立新的資料智慧服務公司凌陽,進一步推動這家電子商務巨頭轉型為企業市場。凌陽智慧服務公司提供的「數據智慧即服務」支持企業決策和業務效率。新子公司將利用阿里巴巴在資料智慧應用於製造、行銷和其他服務方面的專業知識。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 技術展望

- COVID-19 工業影響評估

第5章 市場動態

- 市場促進因素

- 基於資料庫的決策在企業中日益流行

- 企業轉型帶來即時分析需求

- 市場限制

- 隱私和安全問題

第6章 市場細分

- 按最終用戶

- BFSI

- 資訊科技/通訊

- 政府

- 零售

- 教育

- 石油和天然氣

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Bloomberg Finance LP

- Dow Jones & Company Inc.

- Environmental Systems Research Institute

- Equifax Inc.

- FactSet Research Systems Inc.

- IBM Corporation

- Oracle Corporation

- SAP SE

- Thomson Reuters Corporation

- Morningstar Inc.

- Moody's Investors Service Inc.

- MasterCard Advisors LLC

第8章投資分析

第9章 市場機會與未來趨勢

The Data as a Service Market size is estimated at USD 24.89 billion in 2025, and is expected to reach USD 61.93 billion by 2030, at a CAGR of 20% during the forecast period (2025-2030).

The rapidly increasing appetite of businesses to gain a competitive advantage over the competition from the use of data, coupled with the challenges of managing an increasingly complex and heterogeneous data landscape, has created the right conditions for the data-as-a-service (DaaS) market.

Key Highlights

- Data as a Service is based on the cloud deployment model. It can be deployed on hybrid, public, and private cloud platforms. Owing to the benefits cloud computing offers, it is witnessing a rapid increase in its adoption. Moreover, the number of applications where data is being used is increasing, which was previously confined only to core business strategies. The adoption of DaaS can break down data silos, help in improving agility, and enable effortless manipulation of data, thus, making it the best solution in the current market scenario.

- Also, organizations are increasingly adopting real-time data analytics and big data to gain valuable insights from these databases. Big data is becoming imperative to businesses, and the amount of storage required to support circulation is also increasing. Many companies use big data to establish their business strategies, driving the market's growth. As per Seagate, global data production, capture, copying, and consumption are all expected to rise sharply. Global data generation is anticipated to increase to more than 180 zettabytes over the following years, up until 2025.

- Companies worldwide heavily utilize data to increase their brand appeal and advertisement reach, specifically in the retail and telecommunications industries. Therefore, growth in the number of social media-related DaaS providers can be observed. Also, real-time analytics across organizations to gain insights at the earliest is driving the demand for DaaS solutions. Also, as DaaS solutions can be outsourced entirely as a unified solution (like in Oracle) or as stand-alone ones without investing in the whole technology, they are increasingly becoming a lucrative choice for smaller companies and emerging businesses.

- However, concerns regarding the privacy and security of cloud platforms involved in DaaS deployment can challenge the market's growth.

- The COVID-19 pandemic has positively impacted the market. Owing to the benefits cloud computing offers, it has witnessed a rapid increase in its adoption since the COVID-19 pandemic. The pandemic also led to the rise in digitization. According to a survey from Sisense, 50% of companies are utilizing data analytics more or much more than before the COVID-19 pandemic, including over 68% of small businesses.

Data as a Service (DaaS) Market Trends

BFSI Sector to Witness High Growth

- The asset-servicing industry is shifting from one based on service-led offerings to one based on data and technology-led services. Moreover, banks are adapting DaaS to offer reports-as-a-service or analytics-as-a-service to customers looking for business intelligence insights. The banking and financial industry is facing a critical juncture to capitalize on the opportunity created by accessing, analyzing, and acting on the data generated in real-time or risk becoming non-competitive in the market.

- However, it has been observed that only big national and regional banks prioritize the need for data and analytics. Smaller banks and financial institutions are yet to get started or see significant benefits. Also, the presence of firms involved in financial analysis or stock markets is expected to primarily benefit from Data-as-a-Service, owing to the presence of products such as Bloomberg Terminal.

- Data-as-a-Service solutions provide solutions such as simplification of data outputs, generating coherent datasets, identification of present trends, reducing the time taken to process data, and many more, which can be utilized by banking and finance institutions to unite datasets in an easily understandable way and also ensures compatibility of data between systems.

- Moreover, banking and financial institutes are widely implementing Data-as-a-Service solutions to enable their stakeholders to leverage their data to create new revenue streams for the institute. For instance, Commerzbank, a major German bank operating as a universal bank headquartered in Frankfurt, has developed more than 200 APIs that enable the transformation of processes and adds value to the company's partners by offering near-real-time DaaS.

- As per PitchBook, the total value of investments into fintech companies worldwide last year was USD 226.5 billion, whereas it was only USD 127.7 billion in the previous year. This significant rise in the total value of investments into fintech companies worldwide will offer the market a wide range of lucrative growth opportunities, driving the market's growth considerably throughout the forecasted period.

North America to Witness the Largest Market Share

- North America is among the leading innovators and pioneers, in terms of the adoption, of Data-as-a-Service solutions. The region offers lucrative opportunities for market growth, exhibiting a massive demand for data analytics in the energy sector owing to the strong foothold of data analytics vendors.

- Moreover, major regional firms are widely implementing DaaS as their product offerings. The prime reasons for implementing DaaS far outweigh the drawbacks, particularly regarding IoT data, which requires adaptable and scalable distribution, processing, and storage platforms. Hence, compared to static data stored in corporate repositories or data lakes, enterprise firms are five times more likely to deploy DaaS for machine-generated IoT data. In addition, enterprise data syndication, which allows businesses of all sizes to syndicate (i.e., share and monetize) their data, is another significant opportunity for DaaS, representing one of the biggest prospects for the market.

- The United States plays a crucial role in increasing the demand from the region when compared to Canada. The country has increased demand, especially from BFSI, IT and telecommunications, and oil and gas segments. Further, in the region, a wide range of international brands are incorporating social media-based promotion strategies by using data provided by various players in the market to tap into the market.

- For instance, in March this year, First Rate Ventures, a FinTech-focused venture capital fund, invested in RegAlytics, a comprehensive and customizable cross-sector regulatory alert service provider. RegAlytics delivers data services to some of the world's largest financial institutions and exchanges. RegAlytics provides coherent, customizable, and thoroughly vetted regulatory data from over 5,000 regulators every day.

- Further, in June this year, First Rate Ventures, a FinTech-focused venture capital fund, invested in OWL ESG from its recently launched $25 million venture capital fund. OWL ESG provides data, indexes, evaluation metrics, and other tools that allow investors to make informed choices while making an impact. The company leverages machine learning and natural language processing (NLP) to gather and aggregate ESG data from millions of sources.

Data as a Service (DaaS) Industry Overview

The DaaS market is highly competitive owing to the presence of many small and large players in the market running their business in domestic and international markets. The market appears fragmented, with significant players adopting product and service innovation strategies and mergers and acquisitions. Some major players in the market are IBM Corporation, Oracle Corporation, SAP SE, and Bloomberg Finance LP, among others.

- October 2022: The Nulogy Data as a Service (DaaS) Solution was officially launched by Nulogy, a provider of supply chain collaboration solutions, on the Multi-Enterprise Supply Chain Business Network Platform (MESCBN). Users of Nulogy can access new self-serve analytics options due to the Nulogy DaaS service. Clients can construct analytics capabilities to examine complex data at scale and have total control over the final analytics output for data-driven decision-making with the help of data obtained via DaaS.

- June 2022: Alibaba set up a new data intelligence services company, Lingyang, to further the e-commerce giant's shift into the enterprise market. The "data-intelligence-as-a-service" offered by Lingyang Intelligent Service Co. will aid businesses in decision-making and operational efficiency. The new subsidiary will tap into Alibaba's expertise in using data intelligence for manufacturing, marketing, and other services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Outlook

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Penetration of Data-based Decisions Among Enterprises

- 5.1.2 Transformation of Enterprises Leading to Real-time Analytics Demand

- 5.2 Market Restraints

- 5.2.1 Concerns Regarding Privacy and Security

6 MARKET SEGMENTATION

- 6.1 By End User

- 6.1.1 BFSI

- 6.1.2 IT and Telecommunications

- 6.1.3 Government

- 6.1.4 Retail

- 6.1.5 Education

- 6.1.6 Oil and Gas

- 6.1.7 Other End Users

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Bloomberg Finance LP

- 7.1.2 Dow Jones & Company Inc.

- 7.1.3 Environmental Systems Research Institute

- 7.1.4 Equifax Inc.

- 7.1.5 FactSet Research Systems Inc.

- 7.1.6 IBM Corporation

- 7.1.7 Oracle Corporation

- 7.1.8 SAP SE

- 7.1.9 Thomson Reuters Corporation

- 7.1.10 Morningstar Inc.

- 7.1.11 Moody's Investors Service Inc.

- 7.1.12 MasterCard Advisors LLC