|

市場調查報告書

商品編碼

1833424

資料中心即服務市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Data Center-as-a-Service Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

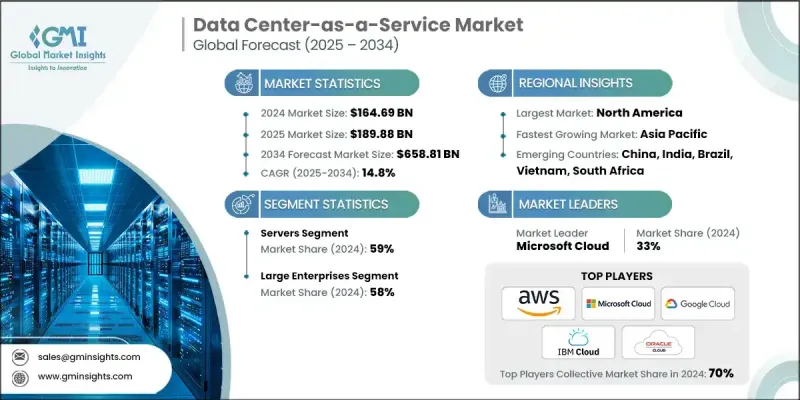

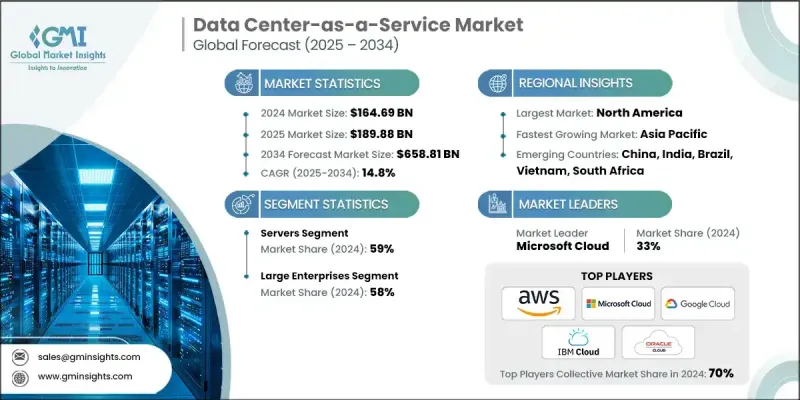

2024 年全球資料中心即服務市場價值為 1,646.9 億美元,預計到 2034 年將以 14.8% 的複合年成長率成長,達到 6,588.1 億美元。

這一激增源於對可擴展基礎設施解決方案日益成長的需求,尤其是在人工智慧、物聯網、機器學習和資料分析工作負載不斷成長的情況下。 DCaaS 模式使企業能夠避免資本密集基礎架構的負擔,同時獲得靈活性、可擴展性和營運敏捷性。各行各業的組織越來越傾向於使用基於服務的資料中心,以便在無需投資本地硬體的情況下處理日益成長的數位工作負載。此外,對合規性、資料本地化和區域主權日益成長的擔憂,正在影響企業採用特定區域的服務。 GDPR 等監管框架以及新興經濟體的本地化授權也推動了對按地理位置分類的託管資料中心服務的需求。另一個關鍵的成長因素是推動永續發展;隨著減少碳足跡的壓力越來越大,企業正在轉向更環保、更節能的資料中心解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1646.9億美元 |

| 預測值 | 6588.1億美元 |

| 複合年成長率 | 14.8% |

伺服器市場在2024年佔據了59%的市場佔有率,預計到2034年將以15%的複合年成長率成長,這得益於企業廣泛採用專為高效能運算和即時資料處理而設計的先進伺服器。企業正在投資具有更高處理密度和現代冷卻技術(尤其是液體冷卻系統)的下一代基礎設施,以滿足人工智慧和生成性工作負載等現代應用的繁重運算需求。企業基礎設施的持續更新周期也推動了伺服器升級的巨大需求。

大型企業在2024年佔了58%的市場佔有率,預計2025年至2034年的複合年成長率將達到14.7%。這些組織通常擁有複雜的營運需求、大量資料流量和更高的合規性要求。對於這類公司,DCaaS提供了安全且可擴展的解決方案,同時允許他們控制關鍵方面,例如法規合規性、資料隱私和應用程式效能。由於大型企業的業務分佈在地理上分散,他們需要在其營運中心附近提供強大的服務交付,這進一步推動了對DCaaS模式的依賴。

2024年,北美資料中心即服務市場佔據38%的市場佔有率,市場規模達622.2億美元。美國和加拿大憑藉著成熟的基礎設施、強大的企業數位化以及人工智慧和雲端平台的快速普及,引領著這一趨勢。這些國家對彈性資料中心容量的需求龐大,這些容量與高吞吐量數位服務和應用相契合。從金融服務到醫療保健等各個垂直行業的組織都在轉向基於服務的模式,以實現營運現代化,同時降低長期資本支出。

資料中心即服務 (DCaaS) 市場的主要活躍參與者包括Google雲端平台、亞馬遜網路服務 (AWS)、CoreSite Realty、IBM Cloud、微軟 Azure、騰訊雲端、阿里雲、甲骨文雲、CyrusOne 和 Salesforce。領先的 DCaaS 供應商正在擴展其全球資料中心覆蓋範圍,以降低延遲並滿足資料本地化需求。他們大力投資永續基礎設施,包括再生能源和低排放冷卻系統,以實現環保目標。提供者還在嵌入人工智慧和自動化技術,以實現預測性維護、自動擴展和智慧工作負載管理。與電信營運商在 5G 整合和邊緣運算支援方面的合作正在日益深入。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 雲端服務需求增加

- 成本效益和可擴展性

- 採用混合雲和多雲策略

- 對資料儲存和處理的需求日益成長

- 更加重視安全性和合規性

- 邊緣運算的興起

- 產業陷阱與挑戰

- 資料中心基礎建設初期投資高

- 遠端位置的延遲問題

- 市場機會

- 5G網路的擴展

- 人工智慧和機器學習整合

- 透過併購擴大國際影響力

- 邊緣運算解決方案的需求不斷成長

- 成長動力

- 成長潛力分析

- 投資與融資趨勢分析

- 網路安全威脅情勢

- 技術趨勢與創新生態系統

- 邊緣運算和分散式基礎設施的演進

- 5G整合與行動邊緣運算開發

- AI/ML 工作負載最佳化與專業服務

- 永續性和綠色資料中心技術

- 軟體定義基礎設施和自動化

- 沉浸式科技與元宇宙基礎設施

- 服務等級協定(SLA)和效能分析

- SLA 標準和行業基準

- SLA 監控和管理系統

- SLA 懲罰和補償分析

- 效能最佳化與改進

- 定價模型和成本分析

- 主機託管定價模型

- 雲端服務定價模型

- 託管服務定價模型

- 總擁有成本(TCO)分析

- 監管格局

- 網路安全標準和框架

- 資料保護和隱私法規

- 實體安全和存取控制

- 網路安全和基礎設施保護

- 供應商選擇和管理框架

- 供應商評估和選擇流程

- 多供應商策略與管理

- 合約管理與治理

- 供應商風險管理

- 永續性和 ESG 影響分析

- 社會影響力和社區關係

- 治理與企業責任

- Finops 和即時成本最佳化

- 雲端財務管理與財務營運框架

- 資料傳輸和出口成本最佳化

- API 經濟與整合服務

- API 管理和貨幣化平台

- API 閘道和流量管理服務

- API 分析和效能監控

- 專利分析

- 部署模型和創新格局

- 波特的分析

- PESTEL分析

- 用例

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 部署模式創新與研發投資分析

- 市場進入策略

- 客戶滿意度基準測試

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:依基礎設施分類,2021 - 2034 年

- 主要趨勢

- 伺服器

- 貯存

- 聯網

第6章:市場估計與預測:依組織規模,2021 - 2034 年

- 主要趨勢

- 中小型企業

- 大型企業

第7章:市場估計與預測:依部署模型,2021 - 2034 年

- 主要趨勢

- 公共雲端

- 私有雲端

- 混合雲端

第 8 章:市場估計與預測:按最終用途產業,2021 年至 2034 年

- 主要趨勢

- 金融服務業協會

- IT和電信

- 醫療保健和生命科學

- 政府和公共部門

- 製造業和工業

- 零售與電子商務

- 其他

第9章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐人

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 印尼

- 菲律賓

- 泰國

- 韓國

- 新加坡

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- 全球參與者

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform

- IBM Cloud

- Oracle Cloud

- Alibaba Cloud

- Salesforce

- Tencent Cloud

- 區域參與者

- Equinix

- Digital Realty Trust

- CyrusOne

- CoreSite Realty

- Iron Mountain

- QTS Realty Trust

- Switch

- Cyxtera Technologies

- Flexential

- 新興參與者/顛覆者

- Rackspace Technology

- Lumen Technologies

- Verizon Business

- AT&T Business

- NTT Communications

- OVHcloud

- Liquid Web

- InterServer

The Global Data Center-as-a-Service Market was valued at USD 164.69 billion in 2024 and is estimated to grow at a CAGR of 14.8% to reach USD 658.81 billion by 2034.

This surge is driven by the growing need for scalable infrastructure solutions, especially in the face of rising AI, IoT, machine learning, and data analytics workloads. The DCaaS model enables businesses to avoid the burden of capital-intensive infrastructure while gaining flexibility, scalability, and operational agility. Organizations across industries are increasingly leaning toward service-based data center consumption to handle their growing digital workloads without investing in on-premises hardware. Additionally, rising concerns around compliance, data localization, and regional sovereignty are influencing enterprises to adopt region-specific services. Regulatory frameworks such as GDPR and localized mandates in emerging economies are also prompting demand for geographically segmented managed data center services. Another critical growth factor is the push for sustainability; as pressure builds to reduce carbon footprints, companies are moving toward greener, energy-efficient data center solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $164.69 Billion |

| Forecast Value | $658.81 Billion |

| CAGR | 14.8% |

The servers segment held a 59% share in 2024 and is anticipated to grow at a CAGR of 15% through 2034, fueled by widespread enterprise adoption of advanced servers designed for high-performance computing and real-time data processing. Enterprises are investing in next-generation infrastructure with higher processing densities and modern cooling technologies, especially liquid-based systems, to meet the heavy compute requirements of modern applications such as AI and generative workloads. The ongoing refresh cycle in enterprise infrastructure is also driving substantial demand for server upgrades.

The large enterprises segment accounted for a 58% share in 2024 and is expected to grow at a CAGR of 14.7% from 2025 to 2034. These organizations typically have complex operational demands, large-scale data traffic, and heightened compliance needs. For such companies, DCaaS offers a secure and scalable solution while allowing them to retain control over critical aspects such as regulatory compliance, data privacy, and application performance. With geographically distributed operations, large enterprises require robust service delivery near their operational hubs, which further drives reliance on DCaaS models.

North America Data Center-as-a-Service Market held a 38% share in 2024, generating USD 62.22 billion. The United States and Canada are leading the charge due to mature infrastructure, strong enterprise digitization, and rapid adoption of AI and cloud platforms. These nations are home to significant demand for elastic data center capacity that aligns with high-throughput digital services and applications. Organizations across various verticals from financial services to healthcare are turning to service-based models to modernize operations while reducing long-term capital expenditures.

Key players active in the Data Center-as-a-Service Market include Google Cloud Platform, Amazon Web Services (AWS), CoreSite Realty, IBM Cloud, Microsoft Azure, Tencent Cloud, Alibaba Cloud, Oracle Cloud, CyrusOne, and Salesforce. Leading DCaaS providers are expanding their global data center footprint to reduce latency and address data localization demands. They are heavily investing in sustainable infrastructure, including renewable energy and low-emission cooling systems, to meet environmental goals. Providers are also embedding AI and automation to enable predictive maintenance, auto-scaling, and intelligent workload management. Collaborations with telecom carriers for 5G integration and edge computing support are gaining traction.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Infrastructure

- 2.2.3 Organization size

- 2.2.4 Deployment model

- 2.2.5 End use industry

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future-outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increased demand for cloud services

- 3.2.1.2 Cost efficiency and scalability

- 3.2.1.3 Adoption of hybrid and multi-cloud strategies

- 3.2.1.4 Growing need for data storage and processing

- 3.2.1.5 Enhanced focus on security and compliance

- 3.2.1.6 Rise in edge computing

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment for data center infrastructure

- 3.2.2.2 Latency issues in remote locations

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of 5G networks

- 3.2.3.2 Ai and machine learning integration

- 3.2.3.3 Mergers and acquisitions to expand international footprint

- 3.2.3.4 Rising demand for edge computing solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Investment & funding trends analysis

- 3.5 Cybersecurity threat landscape

- 3.6 Technology trends & innovation ecosystem

- 3.6.1 Edge computing & distributed infrastructure evolution

- 3.6.2 5G integration & mobile edge computing development

- 3.6.3 AI/ML workload optimization & specialized services

- 3.6.4 Sustainability & green data center technology

- 3.6.5 Software-defined infrastructure & automation

- 3.6.6 Immersive technology & metaverse infrastructure

- 3.7 Service level agreement (SLA) & performance analysis

- 3.7.1 SLA standards & industry benchmarks

- 3.7.2 SLA monitoring & management systems

- 3.7.3 SLA penalty & compensation analysis

- 3.7.4 Performance optimization & improvement

- 3.8 Pricing models & cost analysis

- 3.8.1 Colocation pricing models

- 3.8.2 Cloud services pricing models

- 3.8.3 Managed services pricing models

- 3.8.4 Total cost of ownership (TCO) analysis

- 3.9 Regulatory landscape

- 3.9.1 Cybersecurity standards & frameworks

- 3.9.2 Data protection & privacy regulations

- 3.9.3 Physical security & access control

- 3.9.4 Network security & infrastructure protection

- 3.10 Vendor selection & management framework

- 3.10.1 Vendor evaluation & selection process

- 3.10.2 Multi-vendor strategy & management

- 3.10.3 Contract management & governance

- 3.10.4 Vendor risk management

- 3.11 Sustainability & ESG impact analysis

- 3.11.1 Social impact & community relations

- 3.11.2 Governance & corporate responsibility

- 3.12 Finops & real-time cost optimization

- 3.12.1 Cloud financial management & finops framework

- 3.12.2 Data transfer & egress cost optimization

- 3.13 API economy & integration services

- 3.13.1 API management & monetization platforms

- 3.13.2 API gateway & traffic management services

- 3.13.3 API analytics & performance monitoring

- 3.14 Patent analysis

- 3.15 Deployment model and innovation landscape

- 3.16 Porter’s analysis

- 3.17 PESTEL analysis

- 3.18 Use Cases

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Deployment Model innovation & R&D investment analysis

- 4.7 Go-to-market strategies

- 4.8 Customer satisfaction benchmarking

- 4.9 Key developments

- 4.9.1 Mergers & acquisitions

- 4.9.2 Partnerships & collaborations

- 4.9.3 New product launches

- 4.9.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Infrastructure, 2021 - 2034 (USD Bn)

- 5.1 Key trends

- 5.2 Servers

- 5.3 Storage

- 5.4 Networking

Chapter 6 Market Estimates & Forecast, By Organization Size, 2021 - 2034 (USD Bn)

- 6.1 Key trends

- 6.2 Small/medium enterprises

- 6.3 Large enterprises

Chapter 7 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 (USD Bn)

- 7.1 Key trends

- 7.2 Public cloud

- 7.3 Private cloud

- 7.4 Hybrid cloud

Chapter 8 Market Estimates & Forecast, By End use Industry, 2021 - 2034 (USD Bn)

- 8.1 Key trends

- 8.2 BFSI

- 8.3 IT and telecom

- 8.4 Healthcare and life sciences

- 8.5 Government and public sector

- 8.6 Manufacturing and industrial

- 8.7 Retail and e-commerce

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Indonesia

- 9.4.6 Philippines

- 9.4.7 Thailand

- 9.4.8 South Korea

- 9.4.9 Singapore

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Amazon Web Services (AWS)

- 10.1.2 Microsoft Azure

- 10.1.3 Google Cloud Platform

- 10.1.4 IBM Cloud

- 10.1.5 Oracle Cloud

- 10.1.6 Alibaba Cloud

- 10.1.7 Salesforce

- 10.1.8 Tencent Cloud

- 10.2 Regional Players

- 10.2.1 Equinix

- 10.2.2 Digital Realty Trust

- 10.2.3 CyrusOne

- 10.2.4 CoreSite Realty

- 10.2.5 Iron Mountain

- 10.2.6 QTS Realty Trust

- 10.2.7 Switch

- 10.2.8 Cyxtera Technologies

- 10.2.9 Flexential

- 10.3 Emerging Players / Disruptors

- 10.3.1 Rackspace Technology

- 10.3.2 Lumen Technologies

- 10.3.3 Verizon Business

- 10.3.4 AT&T Business

- 10.3.5 NTT Communications

- 10.3.6 OVHcloud

- 10.3.7 Liquid Web

- 10.3.8 InterServer