|

市場調查報告書

商品編碼

1640694

潮汐能 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Tidal Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

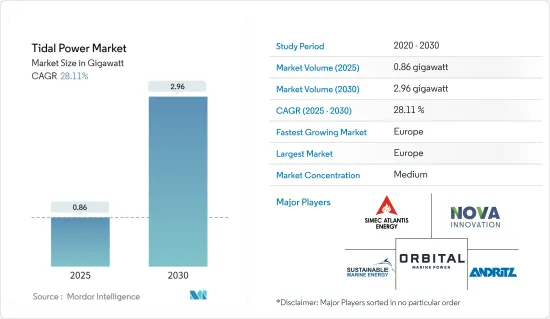

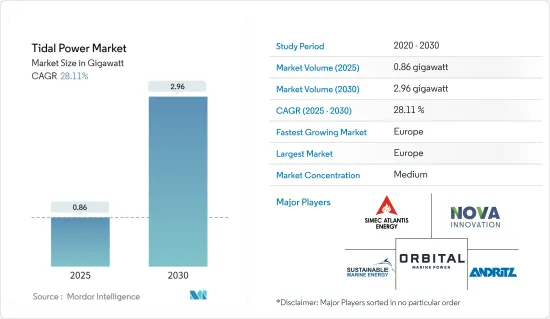

預計 2025 年潮汐能市場規模為 0.86 吉瓦,到 2030 年將達到 2.96 吉瓦,預測期內(2025-2030 年)的複合年成長率為 28.11%。

關鍵亮點

- 從中期來看,全球能源向可再生能源轉型以及許多新興國家部署新技術等因素預計將成為預測期內潮汐能市場最重要的驅動力。

- 同時,高昂的成本和環境影響也對市場造成了重大障礙。這對預測期內的潮汐能市場構成了威脅。

- 行業巨頭的研究和創新努力為市場成長帶來了巨大的機會。突破性的潮汐能加速器(TiPA)計劃就是對此的完美證明。作為最近舉措的一部分,TiPA 為潮汐渦輪機開發了可靠、高效且經濟實惠的水上發射系統。預計這些因素將在未來幾年為市場創造許多機會。

- 由於全部區域規劃了大量潮汐發電工程,預計在預測期內歐洲將佔據市場主導地位。

潮汐能市場趨勢

浮體式潮汐能平台預計將大幅成長

- 潮汐能是一種高效能、高功率的再生能源來源,因為潮汐全年都有恆定的流動和方向。

- 近年來,潮汐能市場對浮體式發電系統的採用有所增加。在該系統中,渦輪機以特定方式排列並安裝在標準遊動樑上。它們比固定結構產生更多的能量。

- 根據國際可再生能源機構的數據,2022年的預計海洋能容量為524MW,其中包括來自海洋波浪動能、潮汐能、鹽度和海洋溫差的能量。其中大部分是由於浮體式潮汐發電廠和波浪能發電能力的增加。隨著許多國家實現淨零排放目標,預計未來幾年該產業將進一步成長。因此,多個利用潮汐能技術的發電工程正在規劃中。

- 美國能源局實施水力發電計劃,致力於開發海洋能源和技術。 2022年10月,美國能源局同意提供3,500萬美元的資金,用於推進潮汐和河流能源系統。

- 由於浮體式/河流潮汐能平台的安裝增加,這些新興市場的發展可能會顯著促進市場的發展。

預計歐洲將主導市場

- 近年來歐洲已有多座潮汐電站計劃運作併網發電。英國和丹麥等國家是該地區最突出的國家。

- 英國愛丁堡大學專家在2021年的研究發現,光是潮汐能一項就能滿足英國目前每年電力需求的11%,是上年度太陽能光電和生質總合貢獻的2.2倍。

- 英國水力發電協會補充說,目前發展緩慢的潮汐發電工程如果獲得許可和足夠的資金,到 2030 年將能夠提供額外的 10GW 容量。這些計劃遍布英國各地,包括斯旺西灣、默西塞德郡、北薩默塞特海岸和北威爾斯海岸。

- 2023年3月,利物浦市政府希望將默西河改造成大型潮汐發電廠的所在地。一旦建成,它的發電量將至少達到 10 億噸,並可利用默西河的潮汐能。

- 此外,2022 年 5 月,Minesto 完成了位於丹麥法羅群島韋斯特曼納的 Dragon 4 潮汐電站的第一周試運行。 Minest 的 Deep Green Kite 技術即使在低潮和低流區域也具有成本效益。

- 這些新興市場的發展有望提升該地區在潮汐能市場成長中的地位。

潮汐能產業概況

潮能市場是半靜態的。市場的主要企業(不分先後順序)包括 Andritz AG、Nova Innovation Ltd、Orbital Marine Power Ltd、SIMEC Atlantis Energy Ltd 和 Sustainable Marine Energy Ltd。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 潮汐能裝置容量及2028年預測

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 全球能源向可再生能源轉型

- 許多新興國家推出新技術

- 限制因素

- 技術的成本過高,對環境的影響

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 發電方式

- 防波堤

- 浮體式潮汐能平台

- 潮汐發電

- 動態潮汐發電

- 潮汐能轉換

- 水平軸渦輪機

- 垂直軸渦輪機

- 其他

- 2028 年市場規模與需求預測(按地區)

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 英國

- 丹麥

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Andritz AG

- Nova Innovation Ltd

- Orbital Marine Power Ltd

- MAKO Turbines Pty Ltd

- SIMEC Atlantis Energy Ltd

- Hydroquest SAS

- Sustainable Marine Energy Ltd

- Lockheed Martin Corporation

第7章 市場機會與未來趨勢

- 致力於研究和創新的產業領袖

簡介目錄

Product Code: 57135

The Tidal Power Market size is estimated at 0.86 gigawatt in 2025, and is expected to reach 2.96 gigawatt by 2030, at a CAGR of 28.11% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the global energy transition toward renewables and the rollout of new technologies in many developed countries are expected to be one of the most significant drivers for the tidal power market during the forecast period.

- On the other hand, the market is highly obstructed due to the exorbitant costs and environmental impacts of the technology. This poses a threat to the tidal power market during the forecast period.

- Nevertheless, the research and innovation endeavors by the industry leaders present an enormous opportunity for the market's growth. The ground-breaking Tidal Turbine Power Take-off Accelerator (TiPA) project is a perfect demonstration of the statement. It recently developed a highly reliable, efficient, and cost-effective power-take-off system for a tidal turbine. This factor is expected to create several opportunities for the market in the future.

- The European region is expected to dominate the market during the forecast period due to many planned tidal energy projects across the region.

Tidal Power Market Trends

Floating Tidal Power Platform Expected to Witness Significant Growth

- Tidal energy uses tidal currents consistent in volume and direction throughout the year, making it an incredibly efficient renewable energy source with a high power output.

- The tidal power market recently witnessed increased floating power production system deployments. In the system, the turbines are aligned in a particular way and attached to a standard moving beam. They produce more energy as compared to fixed structures.

- According to the International Renewable Energy Agency, the estimated global marine energy capacity accounted for 524 MW in 2022, which includes the ocean energy derived from the kinetic energy of ocean waves, tides, salinity, and differences in ocean temperatures. Most of this was due to the added capacity from floating tidal power stations and wave energy. The industry is expected to grow even more in the coming years, parallel with the net-zero emission goals in many countries. Thus, several upcoming projects are lined up to harness the technology for power production.

- The US Department of Energy has a Water Power Program to develop marine energy and technologies. In October 2022, the US Department of Energy agreed to fund USD 35 million to advance tidal and river current energy systems as part of measures to boost a sector whose current impact is negligible.

- Such developments will likely significantly boost the market due to the expansion of floating/instream tidal energy platform installations.

Europe Expected to Dominate the Market

- Europe planned a series of tidal power plants coming into operation or getting grid-connected recently. Countries like the United Kingdom and Denmark are the most highlighted parts of the region.

- According to a 2021 study conducted by experts at Edinburgh University, tidal stream alone has the potential to produce 11% of the United Kingdom's current annual electricity demand, which is the same as the combined contribution of solar and biomass over the previous year.

- The British Hydropower Association adds that tidal range projects under development, which are now delayed, would provide 10 GW of extra capacity by 2030 if permission and enough funding were granted. These projects throughout the United Kingdom include Swansea Bay, Merseyside, the North Somerset Coast, and the North Wales Coast.

- In March 2023, authorities in Liverpool wanted the River Mersey to be the site of a massive tidal power plant that could power up to 1 million homes while creating thousands of employment in the region. If constructed, the plant would have a capacity of at least one gigatonne and use Mersey's tidal range.

- Moreover, in May 2022, Minesto completed the first week of commissioning the Dragon 4 tidal power plant in Vestmanna, Faroe Islands, Denmark, including energy production and verification of all critical operations. Minesto's Deep Green Kite technology is cost-effective in places with low-flow tidal streams and ocean currents.

- Such developments will likely boost the region's position in the tidal power market's growth.

Tidal Power Industry Overview

The tidal power market is semi consolidated. Some of the key players in the market (in no particular order) include Andritz AG, Nova Innovation Ltd, Orbital Marine Power Ltd, SIMEC Atlantis Energy Ltd, and Sustainable Marine Energy Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Tidal Power Installed Capacity and Forecast, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Global Energy Transition Toward Renewables

- 4.5.1.2 The Rollout of New Technologies in Many Developed Countries

- 4.5.2 Restraints

- 4.5.2.1 The Technology's Exorbitant Costs and Environmental Impacts

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Power Generation Method

- 5.1.1 Tidal Barrage

- 5.1.2 Floating Tidal Power Platform

- 5.1.3 Tidal Stream Generation

- 5.1.4 Dynamic Tidal Power

- 5.2 Tidal Energy Converters

- 5.2.1 Horizontal Axis Turbine

- 5.2.2 Vertical Axis Turbine

- 5.2.3 Other Tidal Energy Converters

- 5.3 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Denmark

- 5.3.2.3 France

- 5.3.2.4 Rest of the Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Rest of the Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 South Africa

- 5.3.5.3 Saudi Arabia

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Andritz AG

- 6.3.2 Nova Innovation Ltd

- 6.3.3 Orbital Marine Power Ltd

- 6.3.4 MAKO Turbines Pty Ltd

- 6.3.5 SIMEC Atlantis Energy Ltd

- 6.3.6 Hydroquest SAS

- 6.3.7 Sustainable Marine Energy Ltd

- 6.3.8 Lockheed Martin Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Research and Innovation Endeavors by Industry Leaders

02-2729-4219

+886-2-2729-4219