|

市場調查報告書

商品編碼

1443930

電子貨架標籤:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Electronic Shelf Label - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

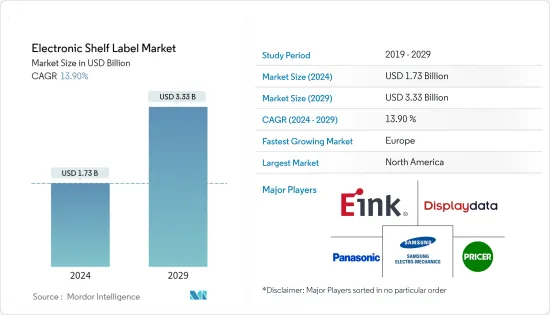

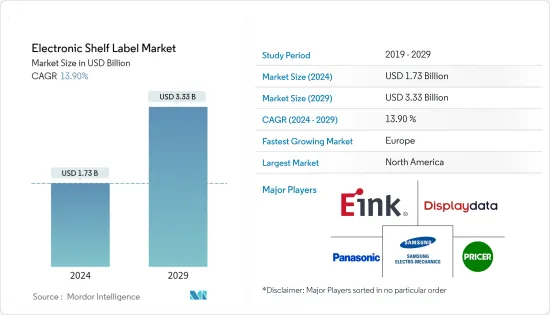

電子貨架標籤市場規模預計到2024年為17.3億美元,預計到2029年將達到33.3億美元,在預測期內(2024-2029年)成長13.90%,以年複合成長率成長。

包括超級市場和大賣場在內的眾多零售店的興起對零售業務產生了重大影響,增加了對零售技術和數位貨架標籤等小工具的需求。

主要亮點

- 零售業的成長趨勢預計將有助於零售自動化的採用,包括電子貨架標籤。例如,根據美國人口普查局2022年3月的數據,2021年零售總收益約6.6兆美元,與前一年同期比較增加約10億美元。

- 由於印度和中國強勁的宏觀經濟變數和網路普及,新興國家有組織零售業的興起是推動該產業成長的關鍵驅動力之一。零售商正在實施 ESL 等自動化技術,以更好地服務不斷成長的中階客戶群。零售自動化與成本節約相結合,縮短了結帳隊伍,提高了客戶滿意度,並減少了浪費。此外,它還有助於改善客戶體驗並增加銷售。電子貨架標籤產業的主要前景之一是零售機器人產業即將在開發中國家興起。

- 隨著新興電子商務領域的領導者在其配送中心實施尖端技術,該行業預計將在預測期內擴張。由於 COVID-19 爆發,多家公司採用自動化技術來升級商店。透過僱用 ESL,商店能夠降低營運成本、人事費用和工時。此外,由於自動化技術的顯著發展和電子產品成本的持續下降,ESL的需求在COVID-19之後有所增加,並預計在預測期內將推升。

- 然而,新興經濟體大量失業人口降低了人事費用,減少了投資有效自動化方法以減少工作量的必要性。此外,實施該技術所需的高昂初始成本預計將限制未來幾年的市場成長。

電子貨架標籤 (ESL) 市場趨勢

NFC行動付款可望推動市場成長

- 在零售業,近場通訊(NFC) 技術是標準 ESL 的重要補充,能夠隨時顯示價格和更新價格,讓庫存管理變得更加輕鬆。只需在支援 NFC 的智慧型手機上輕按一下即可簡化客戶互動。

- 客戶可以透過電子標籤輕鬆存取產品訊息,並使用 NFC 或行動裝置輕鬆付款。使用內建 NFC 讀取標籤後,客戶的行動電話將被引導至產品主頁,在那裡他們可以查看詳細資訊。此外,消費者現在可以立即付款,不再需要在收銀台排隊等候。隨著零售商專注於採用數位技術來實現利潤最大化,電子標籤將得到更廣泛的接受。

- 與 QR 碼和藍牙等其他數位創新技術相比,大多數客戶更喜歡 NFC 技術,因為它速度快且對資訊的控制能力更強。這些支援 NFC 的設備有助於收集客戶詳細資訊、購物興趣和經常購買的商品。這有利於個人化行銷並鼓勵客戶重複訪問。這一因素有助於推動市場成長。

- NFC 技術預計將變得更加普及,因為它可以實現裝置之間快速、即時的資料傳輸,企業也可以將 NFC 融入其產品中。許多智慧型手機和銷售點 (POS) 系統現在都使用 NFC 技術作為附加功能。對支援 NFC 的 ELS 的需求主要是由於智慧型手機等行動裝置中擴大使用 NFC 來加快 POS 支付速度並改善零售業務。

北美佔有很大佔有率

- 北美是全球最大的電子貨架標籤市場。人們相信,遍布這一地區的大大小小的零售店數量眾多,形成了一個巨大的市場。沃爾瑪等零售商正在推動該地區的活性化,並顯著促進市場開拓。

- 北美地區,尤其是美國,有許多公司和多家零售商。例如,2021 年,CVS Health 在美國擁有 9,939 個營業點,而 Dollar General 在 46 個州擁有超過 17,000 個營業點。此外,全國約有9,000家7-11便利商店。

- 該地區零售業的成長預計將為產品採用創造機會。例如,根據美國零售聯合會的數據,到 2022 年,美國所有零售商店的收益預計將超過 4.86 兆美元。

- 此外,美國政府對各行業尤其是零售自動化領域技術創新和自動化產品整合的積極舉措正在增加市場需求。

- 美國的工業革命創造了重要的資料進化能力,用於整合生產流程和供應鏈管理。該技術將有助於增強商店營運並進一步發展產業,從而ESL將提高商店營運的執行效率。

電子貨架標籤 (ESL) 產業概覽

電子貨架標籤市場高度分散,少數廠商佔較大佔有率。主要企業包括E Ink Holdings Inc.、Displaydata Ltd、三星馬達、Pricer AB 和松下公司。除其他事項外。這些公司採用產品發布、合作和夥伴關係等策略措施來獲得全球市場的競爭優勢。

2022 年 10 月,JRTech Solutions 向 10 家 Jean Coutu 藥局推出了最新版本的 Pricer 全視覺化 SmartTAG Power+ 電子貨架標籤 (ESL)。

2022年9月,SOLUM在越南開始進軍東南亞電子貨架標籤(ESL)產業。 SOLUM宣布將向越南「WinMart」提供ESL商品。 Masan 集團是越南三大私人公司之一,旗下擁有 WinMart。

2022 年 9 月,Instacart 推出了 Connected Stores,這是一系列新的尖端技術,可協助零售商創建客製化的線上和店內體驗。該公司正在與多家零售商一起測試最新技術,並將其在北美各地的商店中銷售。該公司還發布了胡蘿蔔標籤,旨在幫助消費者在商店中找到他們想要的東西。標籤照亮電子貨架標籤,讓您更容易找到特定產品。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- NFC在POS和智慧型手機的普及

- 市場限制因素

- 初始投資高

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

第 5 章技術概覽

- 通訊技術(RF、NFC、IR等)

- 配置(電池、顯示器等)

第6章市場區隔

- 依產品

- LCD ESL

- 電子紙ESL

- 按店家類型

- 大賣場

- 超級市場

- 專賣店及非食品零售店

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭形勢

- 公司簡介

- E ink Holdings Inc.

- Displaydata Ltd

- Samsung Electro-Mechanics Co. Ltd

- Pricer AB

- Panasonic Corporation

- Altierre Corporation

- Diebold Nixdorf

- LG Corporation

- M2 Communication Inc.

- SES-imagotag

- Wincor Nixdorf AG

- AdvanTech Inc.

第8章投資分析

第9章市場機會與未來趨勢

The Electronic Shelf Label Market size is estimated at USD 1.73 billion in 2024, and is expected to reach USD 3.33 billion by 2029, growing at a CAGR of 13.90% during the forecast period (2024-2029).

The rise of numerous retail locations, including supermarkets and hypermarkets, has significantly impacted the retail business, driving demand for retail technology and gadgets such as digital shelf labels.

Key Highlights

- The growing trends in the retail sector are expected to contribute to the adoption of retail automation, including electronic shelf labels. For instance, according to US Census Bureau March 2022, total retail revenues in 2021 were roughly USD 6.6 trillion, an increase of around USD 1 billion from the previous year.

- The rise of the organized retail sector in developing countries is one of the important drivers driving industry growth due to powerful macroeconomic variables and the spread of the internet in India and China. Retailers are implementing automated technologies like ESLs, which can successfully serve the growing middle-class customer base. Combined with cost savings, retail automation increases shorter checkout lines and customer satisfaction and lessens waste. Additionally, it aids in improving client experience, which raises sales. One of the key prospects for the industry for electronic shelf labels is the prospective rise of the retail robotics sector in developing nations.

- With emerging e-commerce sector leaders implementing cutting-edge technology at distribution centers, the industry will expand over the forecast period. Due to the COVID-19 outbreak, several companies upgraded their storefronts by employing automated technology. Due to the employment of ESLs, merchants were allowed to reduce their operational expenses, labor costs, and labor time. Additionally, because of significant developments in automation technologies and the ongoing decline in the cost of electronic goods, the demand for ESLs has increased post COVID-19 and is expected to receive a boost over the forecast period.

- However, emerging countries have a large pool of unemployed people, which lowers labor costs and lessens the need to invest in effective automation methods to decrease workloads. Additionally, the expensive initial expenditure needed to implement the technologies is expected to restrain market growth over the coming years.

Electronic Shelf Label (ESL) Market Trends

NFC Mobile Payment is expected to boost market growth

- In retail, near-field communication (NFC) technology significantly adds up to standard ESLs, which display the price and facilitate stock management by enabling price updates at any time. This simplifies customer interactions via a simple tap on an NFC-enabled smartphone.

- Customers may easily access product information via electronic labels and make simple payments using NFC or mobile devices. Using built-in NFC, reading the label directs the customer's phone to the goods homepage for further details. Additionally, the consumer may pay instantaneously, doing away with the requirement to wait in line at cash registers. Electronic labeling will become more widely accepted as merchants emphasize employing digital technology to maximize profits.

- A majority of customers prefer NFC technology over other digital innovations, such as QR codes, and Bluetooth, due to its high speed and improved control of information. These NFC-enabled devices help collect customer details, shopping interests, and frequently purchased items. This facilitates personalized marketing and, thus, attracts customers to visit again. This factor helps in boosting the growth of the market.

- NFC technology is expected to increase because it enables quick and instantaneous data transmission among devices, which drives companies to include it in goods. Numerous smartphones and point-of-sale (POS) systems now use NFC tech as an added function. The need for NFC-enabled ELSs is primarily driven by the growing use of NFC in mobile devices like smartphones, making POS payments faster and improving retail operations.

North America to Account for a Major Share

- North America is the largest market for electronic shelf labels globally. A large number of retail establishments, both small and large, that are spread out over the region may be credited for the enormous market there. Retails, such as Walmart, have been driving the uptick in activity and significantly boosting market development in the area.

- There are numerous businesses in the North American region, particularly in the United States, and multiple retailers exist. For instance, although CVS Health had 9,939 locations across the US in 2021, Dollar General has more than 17,000 locations across 46 states. Additionally, there are nearly 9,000 7-Eleven locations nationwide.

- Growth in the region's retail industry is expected to create opportunities for product adoption. For instance, according to the National Retail Federation, revenues from all retail outlets in the United States will exceed USD 4.86 trillion in 2022.

- Moreover, favorable government initiatives in the United States towards technological innovation and integration of automated products across all industry verticals, specifically in retail automation, are boosting the market demand.

- The industrial revolution in the United States has created significant data evolution capabilities to be used in the production processes and integration in supply chain management. The technology aids in enhancing store operations, further developing the industry, by which ESL will improve the performance efficiency of store operations.

Electronic Shelf Label (ESL) Industry Overview

The electronic shelf label market is fairly fragmented, with a few vendors occupying a large share. The key players are E Ink Holdings Inc., Displaydata Ltd, Samsung Electro-Mechanics Co. Ltd, Pricer AB, and Panasonic Corporation. among others. Product launches, collaboration, and partnerships, among other strategic initiatives, are being adopted by these players to gain a competitive edge in the global market.

In October 2022, JRTech Solutions implemented Pricer's latest edition of completely visual SmartTAG Power+ electronic shelf labels (ESL) in ten Jean Coutu pharmacies.

In September 2022, SOLUM began its entry into the Southeast Asian Electronic Shelf Label (ESL) industry in Vietnam. SOLUM announced that it will provide ESL items to Vietnam's "WinMart." Masan Group, among the three biggest private companies in Vietnam, owns WinMart as a subsidiary.

In September 2022, Instacart launched Connected Stores, a collection of new and current technologies to assist merchants in creating tailored online and in-store encounters. The business has been testing the latest technology with a few merchants and making them available to shops across North America. Carrot Tags, which the firm is also releasing, will aid consumers in finding what they're searching for at a store. The tags illuminate electronic shelf labels to make it easier to discover certain goods.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 NFC penetration in POS and Smartphones

- 4.3 Market Restraints

- 4.3.1 High Initial Investments

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 TECHNOLOGY SNAPSHOT

- 5.1 Communication Technology (RF, NFC, IR etc.)

- 5.2 Components (Batteries, Display etc.)

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 LCD ESLs

- 6.1.2 E-paper ESLs

- 6.2 By Store Type

- 6.2.1 Hyper Markets

- 6.2.2 Super Markets

- 6.2.3 Specialty Stores and Non-food Retail Stores

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 E ink Holdings Inc.

- 7.1.2 Displaydata Ltd

- 7.1.3 Samsung Electro-Mechanics Co. Ltd

- 7.1.4 Pricer AB

- 7.1.5 Panasonic Corporation

- 7.1.6 Altierre Corporation

- 7.1.7 Diebold Nixdorf

- 7.1.8 LG Corporation

- 7.1.9 M2 Communication Inc.

- 7.1.10 SES-imagotag

- 7.1.11 Wincor Nixdorf AG

- 7.1.12 AdvanTech Inc.

![智慧貨架市場:趨勢、機會與競爭分析 [2023-2028]](/sample/img/cover/42/1342030.png)