|

市場調查報告書

商品編碼

1441584

汽車增壓器:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Automotive Supercharger - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

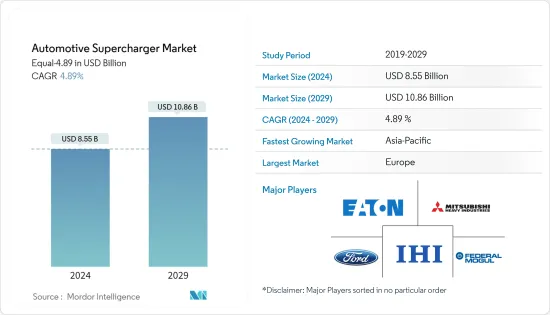

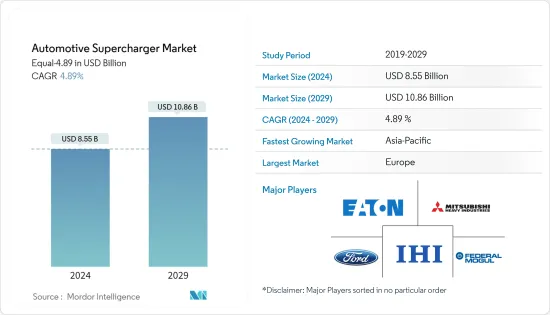

汽車增壓器市場規模預計將從2024年的85.5億美元成長到2029年的108.6億美元,預測期間(2024-2029年)年複合成長率為4.89%。

從長遠來看,汽車增壓器技術的增強,為引擎提供高功率並提高效率,以及對燃油效率和輕量化部件不斷成長的需求,預計將推動全球整體汽車增壓器市場的成長。 。世界。此外,政府積極推動新能源汽車的引進,導致各種液化石油氣(LPG)、壓縮天然氣(CNG)和氫基汽車進入市場,從而帶動了對先進汽車的需求。將產生積極影響隨著製造商越來越傾向於在這些車型中配備高功率引擎,增壓器系統也越來越受歡迎。

根據歐洲汽車工業協會(ACEA)的數據,2022年在歐盟註冊的新車中有36.4%是汽油車,而柴油車則佔16.4%。

然而,由於消費者對碳中和汽車的偏好日益增強,電動車的採用日益增多,這是汽車增壓器市場成長的主要阻礙因素,因為電動車沒有常規的內燃機。此外,政府禁止汽油和柴油車輛的嚴格法規可能會對未來幾年的增壓器需求產生負面影響。

例如,歐盟於 2023 年 3 月核准了新立法,要求到 2035 年在歐洲銷售的所有新車和貨車必須實現零排放。

此外,隨著汽車電動的進展,汽車製造商正在關閉其生產基地。例如,2022年11月,Stellantis宣布關閉位於巴西坎波拉戈的飛雅特動力傳動系統技術公司(FPT)引擎工廠,符合該公司在2038年實現零排放的目標。

各汽車製造商正在廣泛制定策略,開發可廣泛用於公共汽車、皮卡車和貨車等柴油動力商用車的柴油增壓器。由於印度和中國等國家柴油車銷量的預期成長,預計亞太地區將成為預測期內汽車增壓器成長最快的市場。北美、歐洲和亞太地區是世界汽車行業的領先地區,因為主要汽車製造商不斷制定策略,為客戶提供輕量化、高功率、高效率的引擎,以及隨之而來的需求適用於豪華車,在增壓器市場佔據主導地位。在這些領域。

汽車增壓器市場趨勢

小客車領域將在預測期內主導市場

許多新興國家對內燃機(ICE)小客車的熟悉以及電動車充電基礎設施的缺乏阻礙了電動車的普及。因此,消費者仍然更喜歡使用配備內燃機的汽車,這導致這些汽車的引擎系統不斷創新,以便為客戶提供高功率、更有效率的汽車。因此,對高功率小客車的需求不斷成長,導致全球汽車增壓器的需求激增。例如,

2022年,汽油車佔印度小客車總銷量的68%,而柴油車佔整個市場的19%。同樣,在希臘,2022年汽油車佔所有汽車銷量的71.3%,而同期柴油車佔17.42%。

增壓器製造商正試圖透過開發更輕、更強大、更省油的最緊湊產品來保持競爭優勢。此外,這些製造商不斷致力於縮小其增壓器產品的尺寸,以減輕車輛總重量並減少排放氣體。

此外,由於豪華汽車的普及,高功率引擎的產量顯著增加,這推動了對增壓器的需求。例如,BMW、賓士、奧迪等豪華品牌2022年銷售量分別達到240萬輛、207萬輛、161萬輛。引擎製造商正在擴大其業務可能性,以滿足不斷成長的需求。銷售汽油和柴油汽車全部區域。例如:

2022年11月,法國汽車巨頭雷諾集團討論了在其長期願景中重點關注內燃機生產的計劃。該公司與吉利控股有限公司簽署了一份不具約束力的框架協議,旨在建立生產部門並為未來的輕度混合動力車和內燃機汽車供應動力系統和內燃機。

豐田在2022年4月宣布,將投資3.83億美元在美國建立四個製造工廠,以支持包括混合電動車在內的四缸引擎的生產。此外,豐田阿拉巴馬州亨茨維爾工廠獲得2.22億美元擴建114,000平方英尺,並安裝一條新的四缸生產線,生產內燃機和混合電動動力傳動系統引擎。

由於引擎技術的快速進步和售後市場需求的不斷成長,預計在預測期內對汽車增壓器的需求將會巨大。

亞太地區將成為預測期內成長最快的市場

亞太地區預計將成為成長最快的市場,由於中國、印度和日本等主要汽車中心的存在,全球銷售的汽車近 50% 是在該地區生產的,預計亞太地區將進一步成長地區。未來幾年。對高功率引擎的需求逐年增加。在亞洲,引擎小型化的趨勢正在發生變化,配備增壓器的 V6 引擎比配備 V8 引擎的車輛更有效率。

此外,亞太地區的汽車銷售強勁,對整套引擎以及隨後的增壓器的需求呈現正面趨勢。例如:

根據中國工業協會統計,2023年10月小客車總銷量達24.88萬輛,與前一年同期比較11.4%。隨後,2023年1月至10月小客車總銷量達206.64萬輛,較2022年與前一年同期比較增7.5%。

同樣,2023年10月印度小客車銷量達到341,377輛,而2022年10月為291,113輛,與前一年同期比較去年同期成長17.2%。同時,根據日本汽車流通協會聯合會和全國輕型汽車摩托車協會的數據,2023年10月排氣量660cc以上的汽車銷售量與前一年同期比較243,144輛,660cc以下排氣量汽車銷量將成長4.7%,增至154,528輛。前一個月。

OEM專注於開發技術先進的高扭矩和高性能引擎,並透過將先進的增壓器整合到這些車輛中來做出回應。預計多燃料引擎技術的出現將為預測期內亞太全部區域汽車增壓器市場的活躍參與者提供利潤豐厚的機會。

汽車增壓器產業概況

由於生態系統中存在各種國際和地區參與者,汽車增壓器市場分散且競爭激烈。各公司積極投入大量研發活動,以實現增壓器領域的持續產品創新。例如,2023 年 12 月,德克薩斯的超級跑車製造商和高性能汽車開發商 Hennessy 宣布對通用汽車的 V8 動力皮卡車進行全面升級。此次升級將包括一個整合式增壓器,可提供高達 650 匹馬力和 658 磅英尺的扭力。扭矩。此外,該公司表示,該增壓器是現有 Sierra 和 Silverado 6.2 升 V8 (L87 EcoTec3) 系列的升級版,可將馬力比庫存增加 55%。

2023 年 7 月,Whipple Superchargers 宣布推出適用於 6.6 升 (L8T) V8 引擎的 3.0 升增壓器系統。這款 V8燃氣引擎可產生 401 匹馬力和 464 磅英尺的扭矩,是通用汽車重型皮卡(例如 GMC Sierra 2500 HD 和 3500 HD)的標準配備。此外,該公司表示,新開發的增壓器能夠將扭力額外增加 236 磅英尺,總合增加 700 磅。

隨著這些參與者尋求在該行業中獲得競爭優勢,預計市場將見證先進柴油增壓器技術的快速增強和推出。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 豪華車需求增加推動市場成長

- 市場限制因素

- 電動車普及阻礙市場成長

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔(以金額為準的市場規模)

- 依技術

- 離心式增壓器

- 羅茨增壓器

- 雙螺桿增壓器

- 按燃料類型

- 汽油

- 柴油引擎

- 透過電源

- 引擎驅動

- 電動馬達

- 按銷售管道

- 目標商標產品製造商 (OEM)

- 售後市場

- 按車型

- 小客車

- 商用車

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 供應商市場佔有率

- 公司簡介

- Ferarri NV

- Eaton Corporation PLC

- Mitsubishi Heavy Industries Ltd.

- Koenigsegg Automotive AB

- Honeywell Inc.

- IHI Corporation

- Vortech Engineering

- Federal-Mogul Corporation

- A&A Corvette

- Rotrex A/S

- Aeristech

- Daimler AG

- Ford Motor Company

第7章市場機會與未來趨勢

- 柴油增壓器技術快速進步,市場需求不斷擴大

The Automotive Supercharger Market size in terms of Equal-4.89 is expected to grow from USD 8.55 billion in 2024 to USD 10.86 billion by 2029, at a CAGR of 4.89% during the forecast period (2024-2029).

Over the long term, the enhancement in the automotive supercharger technology to provide higher-power output to engines, better efficiency, and the growing demand for fuel-efficient and lightweight components will serve as major determinants for the growth of the automotive supercharger market across the world. Further, the government's aggressive push towards the adoption of new-energy vehicles will witness the integration of various liquefied petroleum (LPG), compressed natural gas (CNG), and hydrogen-based vehicles in the market, which will positively impact the demand for advanced supercharger systems, as manufacturers will increasingly prefer to integrate high powered engines in these vehicle models.

According to the European Automobile Manufacturers' Association (ACEA), 36.4% of all new cars registered in the European Union were petrol-based, while diesel accounted for 16.4% of registrations in 2022.

However, the rising adoption of electric vehicles, owing to the increasing consumers' preference towards availing carbon-neutral vehicles, is serving as a major deterrent to the growth of the automotive supercharger market, as electric vehicles do not possess regular internal combustion engines. Coupled with that, strict government regulations to ban petrol and diesel-based cars will negatively impact the demand for superchargers in the coming years.

For instance, in March 2023, the European Union approved a new law requiring that all new cars and vans sold in Europe must be zero-emission by 2035.

Moreover, with the rising electrification of vehicle fleets, automakers are shutting down their respective production bases. For instance, In November 2022, Stellantis announced the closure of its Fiat Powertrain Technologies (FPT) engine plant in Campo Largo, Brazil, which was announced due to the company's aim to achieve zero emissions by 2038.

Various automakers are extensively strategizing to pivot towards the development of diesel-based superchargers as they can be extensively used in diesel-operated commercial vehicles such as buses, pickup trucks, and vans, among others. The Asia-Pacific region is anticipated to become the fastest-growing market for automotive superchargers during the forecast period, owing to the increasing diesel vehicle sales expected in countries such as India and China. North America, Europe, and Asia-Pacific regions dominate the global automotive supercharger market due to the presence of leading automakers in these regions which are constantly strategizing to offer lightweight, high-power, and efficient engines to customers and the subsequent demand for luxury vehicles in these regions.

Automotive Supercharger Market Trends

Passengers Cars Segment to Dominate the Market during the Forecast Period

The familiarity with internal combustion engine (ICE) passenger cars and the lack of electric vehicle charging infrastructure in many emerging countries hampers the penetration of EVs. Hence, consumers still prefer availing of ICE-powered cars, which in turn leads to constant innovations in the engine systems of these vehicles to offer higher-powered and more efficient vehicles to customers. Therefore, the increasing demand for higher-powered passenger cars contributes to the surging demand for automotive superchargers across the world. For instance,

In 2022, the share of petrol cars in the overall passenger car sales in India touched 68%, while diesel cars accounted for 19% of the overall sales in the market. Similarly, in Greece, sales of petrol cars accounted for 71.3% of the overall car sales in 2022, while diesel-operated cars accounted for 17.42% during the same period.

Supercharger manufacturers try to stay ahead of the competition by building the most compact products that are lightweight, have greater power output, and have a higher fuel economy. Moreover, these manufacturers are constantly working towards downsizing their supercharger offerings to assist in decreasing the overall curb weight of the vehicle and reducing emissions.

Furthermore, the production of high-powered engines is witnessing a massive surge due to the increasing adoption of luxury vehicles, which, in turn, assists the demand for superchargers. For instance, sales of luxury brands, such as BMW, Mercedes-Benz, and Audi, touched 2.4 million units, 2.07 million units, and 1.61 million units, respectively, in 2022. Engine manufacturers are expanding their business potential to meet the rising demand for gasoline and diesel vehicle sales across the geography. For instance:

In November 2022, French automotive giant Renault Groupe discussed its plans to focus on producing IC engines during its longer-term vision. The company has signed a non-binding framework agreement with GeelyHoldings for establishing production units, supply power trains, and IC engines for upcoming mild hybrid and IC engine vehicles.

In April 2022, Toyota announced an investment of USD 383 million in four of its US manufacturing plants to support the production of its four-cylinder engines, including hybrid electric vehicles. In addition, Toyota Alabama in Huntsville plant received USD 222 million to expand 114,000 sq ft and install a new four-cylinder production line to produce engines for both combustion and hybrid electric powertrains.

With the rapid enhancement in engine technology and the rising demand in the aftermarket, there will exist a massive demand for automotive superchargers during the forecast period.

Asia-Pacific Region to become the Fastest Growing Market during the Forecast Period

Asia-Pacific is expected to become the fastest-growing market, as almost 50% of the vehicles sold globally are from this region due to the presence of major automotive hubs like China, India, and Japan, which is further anticipated to grow in the coming years. The need for higher-powered engines has been increasing year-on-year. Asia has witnessed a change in the trend toward downsizing engines, wherein equipping a V6 with a supercharger is found to be more efficient than equipping a vehicle with a V8 engine.

Further, the Asia-Pacific region is witnessing impressive vehicle sales, which have taken the overall engine and, subsequently, supercharger demand on the positive side. For instance:

According to the China Association of Automobile Manufacturers (CAAM), total passenger car sales in October 2023 touched 248.8 thousand units, showcasing a Y-o-Y growth of 11.4% compared to the same period in 2022. Subsequently, total passenger car sales between January and October 2023 touched 2,066.4 thousand units, witnessing a Y-o-Y growth of 7.5% compared to the same period in 2022.

Similarly, passenger car sales in India touched 341,377 units in October 2023, compared to 291,113 units in October 2022, representing a Y-o-Y growth of 17.2%. Simultaneously, according to the Japan Automotive Dealers Association and Japan Light Motor Vehicle and Motorcycle Association, in October 2023, sales with engine displacements above 660cc increased 14.9% to 243,144 units, while vehicles with engine displacements below 660cc increased 4.7% to 154,528 units compared to the previous month.

OEMs have been focusing on developing technologically advanced powered engines to gain high torque and performance, which is being catered to by integrating advanced superchargers in these vehicles. The emergence of multi-fuel engine technology is expected to provide lucrative opportunities to the active players in the automotive supercharger market across the Asia-Pacific region during the forecast period.

Automotive Supercharger Industry Overview

The automotive supercharger market is fragmented and highly competitive due to the presence of various international and regional players operating in the ecosystem. Some of the major players include Eaton Corporation PLC, Mitsubishi Heavy Industries Ltd., IHI Corporation, Federal-Mogul Corporation, Ford Motor Company, Honeywell Inc., Vortech Engineering, Aeristech, and Daimler AG, among others. These players are actively engaged in investing hefty sums in their R&D activity for constant product innovation in the realm of superchargers. For instance, in December 2023, Hennessey, the Texas-based hypercar manufacturer and high-performance vehicle creator announced comprehensive upgrades for General Motor's V8-powered pickup trucks, which will be integrated with a supercharger to deliver 650 bhp and 658 lb-ft of torque. Further, the company stated that its supercharger is upgraded from its existing Sierra and Silverado's 6.2-liter V8 (L87 EcoTec3) lineup, which can increase horsepower over stock by 55%.

In July 2023, Whipple Superchargers announced that the launch of its 3.0-liter supercharger system for the 6.6-liter (L8T) V8 engine. This V8 gas engine produces 401 horsepower and 464 lb-ft of torque in stock form and is standard fitment on General Motors' Heavy Duty pickups like the GMC Sierra 2500 HD and 3500 HD. Further, the company stated that the newly developed supercharger has the capability of boosting the torque by an additional 236 lb-ft for a total of 700.

The market is anticipated to witness a rapid enhancement and launch of advanced diesel supercharger technology as these players try to gain a competitive edge in the industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand for Luxury Vehicles to Foster the Growth of the Market

- 4.2 Market Restraints

- 4.2.1 Rising Adoption of Electric Vehicles Deter Market Growth

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Technology

- 5.1.1 Centrifugal Supercharger

- 5.1.2 Roots Supercharger

- 5.1.3 Twin-Screw Supercharger

- 5.2 By Fuel Type

- 5.2.1 Gasoline

- 5.2.2 Diesel

- 5.3 By Power Source

- 5.3.1 Engine Driven

- 5.3.2 Electric Motor Driven

- 5.4 By Sales Channel

- 5.4.1 Original Equipment Manufacturer (OEM)

- 5.4.2 Aftermarket

- 5.5 By Vehicle Type

- 5.5.1 Passenger Cars

- 5.5.2 Commercial Vehicles

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Ferarri N.V.

- 6.2.2 Eaton Corporation PLC

- 6.2.3 Mitsubishi Heavy Industries Ltd.

- 6.2.4 Koenigsegg Automotive AB

- 6.2.5 Honeywell Inc.

- 6.2.6 IHI Corporation

- 6.2.7 Vortech Engineering

- 6.2.8 Federal-Mogul Corporation

- 6.2.9 A&A Corvette

- 6.2.10 Rotrex A/S

- 6.2.11 Aeristech

- 6.2.12 Daimler AG

- 6.2.13 Ford Motor Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rapid Enhancement in Diesel Supercharger Technology Fuels the Market Demand