|

市場調查報告書

商品編碼

1441559

輕型電動商用車:全球市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Global Electric Light Commercial Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

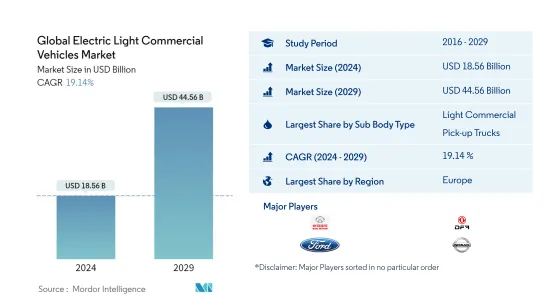

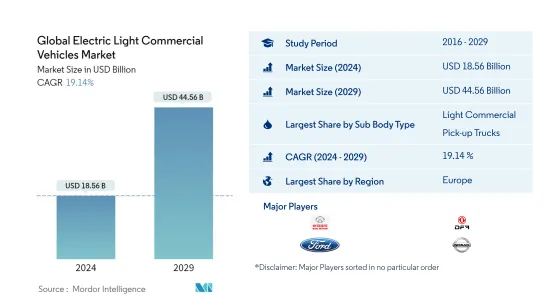

預計2024年全球輕型電動商用車市場規模為185.6億美元,預計2029年將達到445.6億美元,在預測期間(2024-2029年)年複合成長率為19.14%。

主要亮點

- 按燃料類型分類的最大細分市場:純電動車的日益普及和充電基礎設施的發展是推動全球輕型電動商用車市場成長的關鍵因素。

- 按車輛類型分類最大的細分市場:貨車是輕型商用車類別中最受歡迎的車輛細分市場,因為其安全性高、停機時間短、營運成本低且適用於各種應用。

- 按地區分類最大的細分市場:歐洲電子商務的成長使輕型商用車市場受益匪淺。這也可能是未來的一個促進因素。

- 主流充電站類型:許多充電系統製造商正在與物流和電子商務產業合作,在全球增加插電式充電系統的使用。

小型電動商用車市場趨勢

按車身類型分類,輕型商用皮卡車是最大的細分市場。

- 電子商務和物流領域本質上是輕型商用車市場的驅動力。隨著越來越多的人使用網路和智慧型手機,線上零售和電子商務正在不斷成長。因此,輕型商用車的購買量預計將增加,有助於更快地向客戶交付貨物。 2021年全球輕型商用車產量為17,217,990輛,增至18,593,850輛。

- 由於 COVID-19感染疾病期間的線上銷售,全球電子商務市場的收益和用戶群顯著增加。然而,由於網路購物日益普及,預計成長將加速。 2020年,全球電子商務市場快速擴張,2021年收益達26.7兆美元。過去幾年,全球線上消費者的數量和比例持續成長。 COVID-19 的疫情推動人們線上上購物,並促成 2020 年線上消費者的最大增幅。

- 包括歐洲、美國和中國在內的所有主要經濟體的電子商務和物流業的快速擴張增加了對更現代化的分銷網路的需求。戴姆勒、日產、福特和雷諾等主要輕型商用車製造商的電子商務銷售額大幅成長,推動了物流業的發展。此外,皮卡和貨車傳統上滿足電子商務運輸對物流和消費者配送服務的要求,預計將對全球輕型商用車市場產生重大正面影響。

按地區分類,歐洲是最大的部分。

- 世界各國政府一直在積極制定政策鼓勵採用電動車。中國、印度、法國和英國已宣布計劃在 2040 年完全淘汰汽油和柴油汽車產業。

- 汽車產業對清潔能源的需求不斷成長是推動市場成長的主要因素之一。OEM正在重新定義電動車藍圖。例如,Kia於2022年3月宣布計畫進軍電動皮卡市場,並於2027年推出兩款車型。一種是全電動皮卡,它將與汽車等競爭對手競爭。特斯拉 Cybertruck、福特 F-150 Lightning、Rivian R1T、GMC 悍馬 EV。 2022年3月,福特宣佈2024年將推出四款新一代商用電動車。福特標誌性的 Transit 系列將於 2023 年包括四款新電動車型:全新 Transit 自訂一噸貨車和 Tourneo 自訂車。 ,並在 2024 年推出下一代緊湊型 Transit Courier 貨車和 Tourneo Courier 多功能車。

- 由於北美地區網路和智慧型手機普及較高,電商企業擁有龐大的開拓零售電商市場的機會。也幫助電商企業在更廣泛的範圍內拓展業務。這是全球電動卡車市場成長的關鍵因素。上述趨勢促使汽車製造商增加卡車研發支出,最終推動電動卡車市場成長。

輕型電動商用車產業概況

全球輕型電動商用車市場較為集中,前五名佔725.99%。該市場的主要企業包括北汽集團、東風汽車公司、福特馬達公司、日產汽車有限公司和大眾汽車公司(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章執行摘要和主要發現

第2章 檢舉要約

第3章簡介

- 研究假設和市場定義

- 調查範圍

- 調查方法

第4章 產業主要趨勢

- 人口

- GDP

- CVP

- 通貨膨脹率

- 汽車貸款利率

- 電池價格(每度電)

- 物流績效指數

- 電動的影響

- 新XEV車型發布

- 充電站的部署

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 體型

- 輕型商用車

- 輕型商用皮卡車

- 小型商用車

- 輕型商用車

- 汽油種類

- BEV

- FCEV

- HEV

- PHEV

- 地區

- 非洲

- 南非

- 亞太地區

- 澳洲

- 中國

- 印度

- 印尼

- 馬來西亞

- 韓國

- 泰國

- 亞太地區其他地區

- 歐洲

- 奧地利

- 比利時

- 捷克共和國

- 丹麥

- 愛沙尼亞

- 法國

- 德國

- 愛爾蘭

- 義大利

- 拉脫維亞

- 立陶宛

- 挪威

- 波蘭

- 俄羅斯

- 西班牙

- 瑞典

- 英國

- 歐洲其他地區

- 中東

- 阿拉伯聯合大公國

- 其他多邊環境協定

- 中東

- 北美洲

- 加拿大

- 墨西哥

- 美國

- 北美其他地區

- 南美洲

- 拉丁美洲其他地區

- 非洲

第6章 競爭形勢

- 重大策略舉措

- 市場佔有率分析

- 公司形勢

- 公司簡介

- BAIC Group

- BYD Motors Inc.

- Dongfeng Motor Corporation

- Ford Motor Company

- General Motors Company

- Groupe Renault

- Nissan Motor Company Ltd

- Rivian Automotive LLC

- Tesla Inc.

- Volkswagen AG

第7章 CEO 面臨的關鍵策略問題

第8章附錄

- 世界概況

- 概述

- 波特的五力框架

- 全球價值鏈分析

- 市場動態(DRO)

- 來源和參考文獻

- 表格和圖形列表

- 重要見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 93053

The Global Electric Light Commercial Vehicles Market size is estimated at USD 18.56 billion in 2024, and is expected to reach USD 44.56 billion by 2029, growing at a CAGR of 19.14% during the forecast period (2024-2029).

Key Highlights

- Largest Segment by Fuel Type - BEV : The rising popularity of BEVs, and the development of charging infrastructure are the primary factors driving the growth of the electric light commercial vehicles market globally.

- Largest Segment by Vehicle Type - Light Commercial Pick-up Trucks : Vans are the most popular vehicle type segment in the light commercial vehicle category due to safety, reduced downtime, cheaper operating costs, and applicability for various uses.

- Largest Segment by Region - Europe : The growth of e-commerce in Europe was highly beneficial to the market for light commercial vehicles. This could be a driving factor in future too.

- Dominant Charging station Type - BEV : Many charging system manufacturers are collaborating with the logistics and e-commerce industries to increase the use of plugin charging systems across the globe.

Electric Light Commercial Vehicles Market Trends

Light Commercial Pick-up Trucks is the largest segment by Sub Body Type.

- The e-commerce and logistics sectors are what essentially fuel the light commercial vehicle market. Online retail sales and e-commerce have been increasing as a result of more people having access to the internet and smartphones. Light commercial vehicle purchases are projected to rise as a result, assisting in the prompt delivery of goods to clients. The light commercial vehicle production was 17,217.99 thousand units, and it increased to 18,593.85 thousand units globally in 2021.

- The revenue and user base of the worldwide e-commerce market has significantly increased as a result of online sales during the Covid-19 pandemic. However, a surge in the popularity of internet shopping is anticipated to spur growth. In 2020, the global e-commerce market saw rapid expansion, and in 2021, it earned USD 26.7 trillion in revenue. Over the past few years, the number and share of online shoppers have increased consistently over the world. The Covid-19 epidemic, which compelled people to shop online, contributed to the largest growth in the number of online shoppers in 2020.

- The rapid expansion of the e-commerce and logistics industries across all of the major economies, including those of Europe, the United States, and China, is fueling the desire for a more contemporary distribution network. Significant light commercial vehicle manufacturers, like Daimler, Nissan, Ford, and Renault, have seen a dramatic increase in e-commerce sales, which has bolstered the logistics industry. Additionally, pick-up trucks and vans have traditionally filled the requirement for e-commerce transportation for logistics and consumer delivery services, which is expected to have a substantial positive impact on the global light commercial vehicle market.

Europe is the largest segment by Region.

- Governments around the world have been proactive in enacting policies to encourage the adoption of electric vehicles. China, India, France, and the United Kingdom have announced plans to completely phase out the petrol and diesel vehicles industry before 2040.

- An increase in the demand for clean energy in the automotive industry is one of the major factors contributing to the growth of the market. OEM is redefining its roadmap for electric vehicles. For instance, in March 2022, Kia Motors announced its plans to enter the electric pick-up truck market, announcing that two models would be available by 2027. One will be an all-electric pick-up truck and compete with rivals such as the Tesla Cybertruck, Ford F-150 Lightning, Rivian R1T, and GMC Hummer EV. In March 2022, Ford announced it would offer a new generation of four commercial electric vehicles by 2024. Ford's iconic Transit range will include four new electric models, the all-new Transit Custom one-tonne van and Tourneo Custom multi-purpose vehicle in 2023, and the smaller, next-generation Transit Courier van and Tourneo Courier multi-purpose vehicle in 2024.

- The e-commerce companies have significant opportunities to explore the retail e-commerce market due to high internet and smartphone penetration in the North American region. It also helps e-commerce companies in expanding their business through a wider reach. This is an important factor in the growth of the electric truck market in the world. The above trend has propelled the automakers to increase their expenditure on the R&D of trucks, which eventually pushed the market growth of electric trucks.

Electric Light Commercial Vehicles Industry Overview

The Global Electric Light Commercial Vehicles Market is fairly consolidated, with the top five companies occupying 725.99%. The major players in this market are BAIC Group, Dongfeng Motor Corporation, Ford Motor Company, Nissan Motor Company Ltd and Volkswagen AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP

- 4.3 CVP

- 4.4 Inflation Rate

- 4.5 Interest Rate For Auto Loans

- 4.6 Battery Price (per Kwh)

- 4.7 Logistics Performance Index

- 4.8 Electrification Impact

- 4.9 New XEV Models Announced

- 4.10 Charging Stations Deployment

- 4.11 Regulatory Framework

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION

- 5.1 Body Type

- 5.1.1 Light Commercial Vehicles

- 5.1.1.1 Light Commercial Pick-up Trucks

- 5.1.1.2 Light Commercial Vans

- 5.1.1 Light Commercial Vehicles

- 5.2 Fuel Type

- 5.2.1 BEV

- 5.2.2 FCEV

- 5.2.3 HEV

- 5.2.4 PHEV

- 5.3 Region

- 5.3.1 Africa

- 5.3.1.1 South Africa

- 5.3.2 Asia-Pacific

- 5.3.2.1 Australia

- 5.3.2.2 China

- 5.3.2.3 India

- 5.3.2.4 Indonesia

- 5.3.2.5 Malaysia

- 5.3.2.6 South Korea

- 5.3.2.7 Thailand

- 5.3.2.8 Rest-of-APAC

- 5.3.3 Europe

- 5.3.3.1 Austria

- 5.3.3.2 Belgium

- 5.3.3.3 Czech Republic

- 5.3.3.4 Denmark

- 5.3.3.5 Estonia

- 5.3.3.6 France

- 5.3.3.7 Germany

- 5.3.3.8 Ireland

- 5.3.3.9 Italy

- 5.3.3.10 Latvia

- 5.3.3.11 Lithuania

- 5.3.3.12 Norway

- 5.3.3.13 Poland

- 5.3.3.14 Russia

- 5.3.3.15 Spain

- 5.3.3.16 Sweden

- 5.3.3.17 UK

- 5.3.3.18 Rest-of-Europe

- 5.3.4 Middle East

- 5.3.4.1 UAE

- 5.3.4.2 Rest-of-MEA

- 5.3.5 Miidle East

- 5.3.6 North America

- 5.3.6.1 Canada

- 5.3.6.2 Mexico

- 5.3.6.3 US

- 5.3.6.4 Rest-of-North America

- 5.3.7 South America

- 5.3.7.1 Rest-of-Latin America

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BAIC Group

- 6.4.2 BYD Motors Inc.

- 6.4.3 Dongfeng Motor Corporation

- 6.4.4 Ford Motor Company

- 6.4.5 General Motors Company

- 6.4.6 Groupe Renault

- 6.4.7 Nissan Motor Company Ltd

- 6.4.8 Rivian Automotive LLC

- 6.4.9 Tesla Inc.

- 6.4.10 Volkswagen AG

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219