|

市場調查報告書

商品編碼

1440147

特種車輛:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Specialty Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

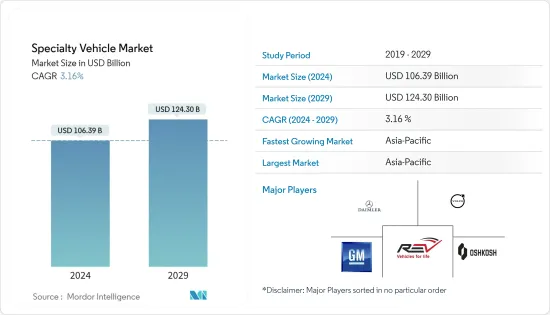

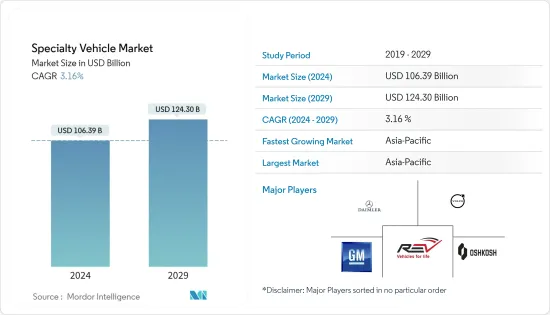

特種車輛市場規模預計到2024年為1,063.9億美元,預計2029年將達到1,243億美元,在預測期內(2024-2029年)複合年成長率為3.16%。

2020年專用車市場下降的主要原因是新型冠狀病毒感染疾病(COVID-19)大流行導致運輸活動暫停和供應鏈中斷。然而,在封鎖措施解除後,隨著世界各地的治理機構開始大力投資醫療設施、緊急服務和相關設備,市場開始顯著成長。

從長遠來看,私營部門的積極參與預計將擴大中國和印度等國家的建築業,從而推動特種車輛市場的發展。物流行業的擴張預計將增加對專業氣動散裝船和油輪拖車的需求,從而推動散裝貨船市場的發展。因此,玩家們也專注於開發創新產品。

主要亮點

由於成本降低、新服務模式要求、平台變化以及材料和生產價格上漲,製造商也開始關注有吸引力的服務產品。特種車輛產業的客戶購買習慣正在發生巨大變化,尤其是在產品客製化方面。隨著客製化需求的增加,OEM面臨更多的選擇和複雜性。

預計亞太地區在預測期內的複合年成長率最高,其次是歐洲和北美。在預測期內,美國中小型企業將這些車輛用於食品卡車營運、移動展示室以及廣告和促銷等目的的情況預計將會增加,同時對旅行、醫療和旅遊的需求也會增加。具備醫療保健功能的車輛。

專用車市場趨勢

執法和醫療保健設施支出增加

流行病和流行病、交通事故、家庭和工作相關事故以及政府資助的醫療保健計劃的增加正在增加對醫療和保健特種車輛的需求。在美國,三分之一的人患有血癌等疾病,增加了對血液的需求,推動了血液載體市場的成長。

最近的感染疾病和大流行,例如伊波拉出血熱和 COVID-19 的爆發,增加了對救護車、移動藥房和移動加護病房的需求。在許多國家,救護車需求的成長速度超過了人口成長速度。一些國家使用先進的醫療車輛來應對突發衛生事件。例如,在取消 COVID-19感染疾病限制後,紐西蘭的移動手術室服務已恢復。隨著自動駕駛汽車技術的興起和發展,預計在不久的將來緊急醫療車輛將配備半自動駕駛輔助技術。全球政府在執法和醫療保健設施上的支出增加正在推動對專用車輛的需求。

此外,日本使用的特種車輛數量從2012年的約164萬輛增加到去年的177萬輛。因此,SPV 的數量在過去十年中穩步成長。

亞太地區將在預測期內呈現最高成長率

預計亞太地區將引領特種車輛市場。技術發展的進步正在推動該地區特種車輛市場的成長。在 COVID-19感染疾病期間,多家公司向地方政府和其他國家交付了救護車。不過,疫情過後,救護車也有了新的發展,企業紛紛結成策略聯盟,推出先進的救護車。

例如,2022年10月,緊急醫療回應服務供應商Medulance Healthcare與該國最大的通訊業者Reliance Jio合作推出了5G智慧連網救護車。

2022 年 5 月:印度首個電動車緊急應變裝置將在 2022 年電動車博覽會上亮相。 AmbulanceMe 應用程式與印度製造的電動救護車相容。

醫療保健車輛行業也是佔據市場佔有率較大的行業。電力推進、獨立病人艙、負壓產生技術、紫外線消毒等創新變革等設計預計將在不久的將來推動醫療特種車輛市場的發展。

專用車產業概況

專用車市場高度分散,跨國公司如戴姆勒、通用汽車集團、沃爾沃AB等。市場上有許多針對電動和自動駕駛技術的收購、合資和投資。

例如,2022 年 2 月,Lightning e-Motors 宣布與通用汽車建立新的合作夥伴關係,使其成為第一家開發 100% 電動 3-6 級中型商用車的通用汽車特種車輛製造商 (SVM)。接駁車、貨車、救護車和校車均採用通用汽車底盤。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 市場限制因素

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 依類型

- 救護車

- 消防車

- 移動式燃油運輸罐車

- 其他

- 依使用類型

- 執法和公共安全

- 醫療保健

- 露營者

- 其他

- 依地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 北美洲

第6章 競爭形勢

- 供應商市場佔有率

- 公司簡介

- LDV Inc.

- Force Motors Limited

- Matthews Specialty Vehicles Inc.

- Specialty Vehicles Inc.

- Farber Specialty Vehicles

- REV Group

- Daimler AG

- Volvo Group

- General Motors Company

- Spartan Motors Inc.(Shyft Group)

- Emergency One Group

- Oshkosh Corporation

第7章市場機會與未來趨勢

The Specialty Vehicle Market size is estimated at USD 106.39 billion in 2024, and is expected to reach USD 124.30 billion by 2029, growing at a CAGR of 3.16% during the forecast period (2024-2029).

The market for specialty vehicle market experienced a decline in 2020, primarily owing to the COVID-19 pandemic, which caused a halt in transportation activities, disrupting the supply chain. However, after the lockdown measures were revoked, the market started witnessing significant growth as governing bodies across the world started investing heavily in healthcare facilities and emergency services, and associated equipment.

Over the long term, the expansion of the construction industry in countries such as China and India, with active participation from the private sector, is expected to drive the specialized vehicle market. The expansion of the logistics sector is expected to drive the demand for special pneumatically powered bulk carriers and tank truck trailers, which will drive the bulk carrier market. Therefore, players are also focusing on developing innovative products. For instance,

Key Highlights

- In October 2022, GAZ began manufacturing commercial vehicles GAZelle Next at the AvtoVAZ Argun plant in Chechenavto. The model can also be used for school buses, ambulances, housing, and community services.

Moreover, manufacturers are also focusing on lowering costs, new service model requirements, providing appealing services due to shifting platforms, and rising material and production prices. Customers' purchasing habits in the specialty vehicle industry are changing dramatically, particularly when it comes to product customization. As the demand for customization grows, OEMs face more options and complexity.

Asia-Pacific is anticipated to witness the highest CAGR over the forecast period, followed by Europe and North America. The usage of these vehicles by small businesses in the United States for purposes such as food truck businesses, mobile showrooms, and advertising and promotions, along with the demand for travel, medical, and healthcare response vehicles, is expected to rise during the forecast period.

Specialty Vehicles Market Trends

Increase in Spending on Law Enforcement and Healthcare Facilities

The rise in epidemics and pandemics, traffic accidents, household and industrial injuries, and government-sponsored healthcare programs is driving demand for medical and healthcare specialty vehicles. Diseases such as blood cancer, which affect one person every three minutes in the United States, have increased the demand for blood, propelling the market growth for bloodmobiles.

Recent epidemics and pandemics, such as the Ebola and COVID-19 outbreaks, have increased demand for ambulances, mobile pharmacies, and mobile intensive care units. In many countries, the increase in demand for ambulances has outpaced population growth. Several countries are using advanced healthcare vehicles to cater to health emergencies. For instance, after the COVID-19 lockdown restrictions were lifted, the mobile operation theatre service resumed in New Zealand. With the rise and development of autonomous vehicle technology, emergency medical vehicles are expected to be outfitted with semi-autonomous driving assistance technology in the near future. The increase in global government spending on law enforcement and healthcare facilities is driving the demand for specialty vehicles.

Moreover, the number of specialty vehicles in use in Japan reached 1.77 million last year, up from around 1.64 million in 2012. As a result, the number of SPVs increased steadily over the previous decade.

Asia-Pacific to Exhibit the Highest Growth Rate Over the Forecast Period

Asia-Pacific is anticipated to lead the specialty vehicle market. The advancements in technology developments are propelling the growth of the specialty vehicles market in the region. Various companies have delivered ambulances to local authorities and other countries during the COVID-19 pandemic. However, post-pandemic, there have also been new developments in ambulances as companies are getting into a strategic collaboration and launching advanced ambulances.

For instance, in October 2022, Medulance Healthcare, an emergency medical response service provider, launched a 5G-Smart connected ambulance in collaboration with Reliance Jio, the country's largest telecom operator.

In May 2022: At the EV Expo 2022, India's first EV emergency responder will be unveiled. The AmbulanceMe app is compatible with the Made in India Electric first responder vehicle.

The medical and healthcare response vehicles sector is another sector that holds a major share of the market. Design and other innovative changes such as electric propulsion, separate patient compartment, negative pressure creation technology, and UV disinfection are expected to propel the medical specialty vehicle market in the near future.

Specialty Vehicles Industry Overview

The specialty vehicle market is fairly fragmented, with multinational players including Daimler, GM Group, and Volvo AB. Many acquisitions, joint ventures, and investments in electric and autonomous driving technology are taking place in the market.

For instance, in February 2022, Lightning eMotors announced a new partnership with General Motors, making it the first GM Specialty Vehicle Manufacturer (SVM) to develop 100% electric Class 3 through 6 medium-duty commercial vehicles. Shuttles, delivery trucks, ambulances, and school buses are all supported by GM chassis.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Ambulances

- 5.1.2 Fire Extinguishing Trucks

- 5.1.3 Mobile Fuel Carrying Tankers

- 5.1.4 Other Types

- 5.2 By Application Type

- 5.2.1 Law Enforcement And Public Safety

- 5.2.2 Medical And Healthcare

- 5.2.3 Recreational Vehicles

- 5.2.4 Other Services

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 LDV Inc.

- 6.2.2 Force Motors Limited

- 6.2.3 Matthews Specialty Vehicles Inc.

- 6.2.4 Specialty Vehicles Inc.

- 6.2.5 Farber Specialty Vehicles

- 6.2.6 REV Group

- 6.2.7 Daimler AG

- 6.2.8 Volvo Group

- 6.2.9 General Motors Company

- 6.2.10 Spartan Motors Inc. (Shyft Group)

- 6.2.11 Emergency One Group

- 6.2.12 Oshkosh Corporation