|

市場調查報告書

商品編碼

1440084

自動化 3D 列印:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Automated 3D Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

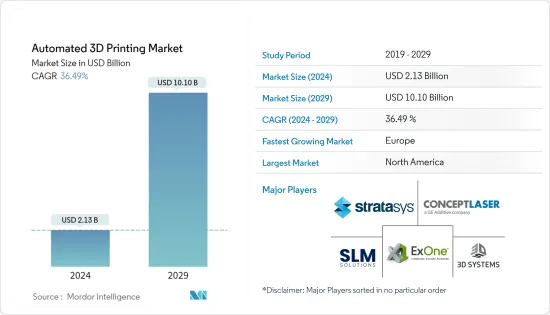

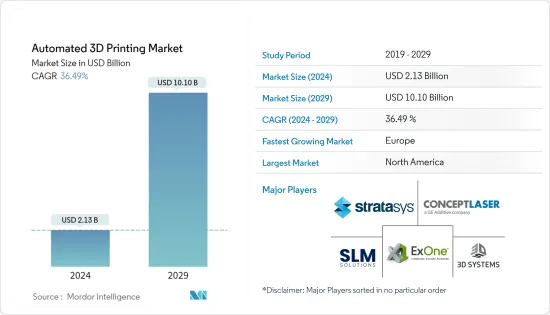

自動化3D列印市場規模預計到2024年為21.3億美元,預計到2029年將達到101億美元,在預測期內(2024-2029年)複合年成長率為36.49%。

研發投資的增加以及工業自動化機器人的日益採用預計將推動市場成長。

主要亮點

- 近年來,3D列印不斷經歷從原型製作和小批量階段到大規模生產技術的轉變,整個產業的採用率不斷提高,工業和非列印機供應商將重點轉向自動化。此外,隨著積層製造的發展趨勢,硬體正在超越用於原型製作、模具加工和單件生產的獨立系統,轉變為整合數位大規模生產線和新的熄燈工廠中的核心系統。

- 人工智慧和機器學習技術正在被用於積層製造業的各種應用。例如,麻省理工學院的研究人員應用機器學習的資料驅動性質來自動化發現新 3D 列印材料的流程。透過機器學習,韌性和抗壓強度等材料性能因素使用演算法進行了最佳化,這些演算法很快就超越了傳統的 3D 列印材料配方方法。研究人員開發了一個名為 AutoOED 的免費開放原始碼材料最佳化平台,使其他研究人員能夠執行材料最佳化。

- 同樣,2022 年 1 月,來自德國和加拿大的一組組織建立了新的合作夥伴關係,以利用 3D 列印和人工智慧來實現零件固定過程的自動化。自適應雷射積層製造過程感測的人工智慧增強 (AI-SLAM)計劃旨在創建強大的基於人工智慧的軟體,可自動運行定向能量沉澱(DED) 3D 列印機。為了更好地修復受損部件的凹凸表面,軟體透過演算法控制列印過程。弗勞恩霍夫雷射技術研究所 (ILT) 和軟體公司 BCT 是德國聯盟的一部分。在加拿大,這項研究將由加拿大國家研究委員會(NRC)監督。麥吉爾大學將協調這項研究,機器學習公司 Braintoy 將協助對 AI 模型進行程式設計。

- 此外,參與者還在市場上進行了各種開發,以增強他們在市場中的地位。例如,2021年4月,Mosaic推出了自動化3D列印平台Array。它將材料加載和卸載到四台 Element HT 印表機、開始列印、刪除列印並保存它們,以便您可以開始下一次列印。此陣列的設計具有最大的彈性,配有自動販賣機式的機械臂,可以檢索列印件,將其放在一邊,並為下一次列印裝載乾淨的床,從而最大限度地提高產量。

- 2021 年 10 月,總部位於溫哥華的 3D 列印產業自動化技術開發商 3DQue 宣布推出兩款適用於 Creality CR-10 和 CR-6 SE 的全新 Quinly 自動化套件。 Quinly 是 Raspberry Pi 提供的虛擬3D 列印機操作員,它是一個硬體和軟體套件,可讓您獨立運行桌上型 3D 列印機。該技術旨在透過消除體力勞動來提高 3D 列印的擴充性。它主要針對印刷實驗室、依需製造商、教育機構以及任何其他尋求自動化大批量零件生產的企業。

- 此外,由於供應鏈中斷以及對治療方法和材料的新需求,COVID-19 大流行顯著加速了製藥、醫療設備和製造領域的技術進步。供應鏈短缺導致醫護人員難以取得所需物資,導致醫院對抗病毒的個人防護設備(PPE)和醫療設備短缺。因此,積層製造 (AM)(自動 3D 列印)因其可近性和彈性而成為值得注意的製造流程之一,可快速生產複雜的整體零件和機械系統。

自動化3D列印市場趨勢

汽車領域預計將推動市場成長

- 汽車作為當今主要的交通途徑,已成為人類生活中不可或缺的一部分。目前全球道路上行駛的汽車數量超過 13 億輛,預計到 2035 年將增加至 18 億輛。小客車約佔這些統計數據的74%,而輕型商用車、大型卡車、巴士和遠距,其餘26%是小型客車。

- 3D 列印可用於創建模具和熱成型工具,以快速製造夾具、夾具和固定裝置。這使得汽車製造商能夠以較低的成本生產樣品和工具,從而消除投資高成本工具時的未來生產損失。 Local Motors 於 2014 年推出了第一輛 3D 列印電動車。 BMW集團等其他老字型大小企業也紛紛效仿,推出自動化 3D 列印技術。在美國一些最大的汽車製造商中,大約 80% 到 90% 的初始原型組件是 3D 列印的,自動化的趨勢正在增強。受歡迎的部件包括排氣、進氣和管道系統部件。這些部件在短時間內進行數位設計、3D列印並安裝在汽車上,並透過多次迭代進行測試。

- 自動化 3D 列印在汽車領域最常見的應用也許是生產夾具和固定裝置等製造輔助工具。使用傳統方法創建製造工具非常昂貴且耗時,並且幾何形狀限制降低了製造過程的效率並增加了對最終使用零件的幾何形狀的限制。 3D 列印製造工具重量輕且符合人體工學,使工廠工人更輕鬆、更安全地完成業務。

- 此外,汽車製造涉及的數量非常大,每個零件都要運行數十萬次。大多數 3D 列印技術(目前)很難趕上這一點。然而,許多豪華汽車製造商將汽車的產量限制在數千輛,這使得自動化 3D 列印成為可行的選擇。

- 根據世界經濟論壇預測,到2035年,全自動駕駛汽車的銷售量與前一年同期比較超過1,200萬輛,佔全球汽車市場的25%。此外,電動機製造商的多項舉措正在推動市場成長。 2020馬達3月,英國工程公司Equipmake開發出一款高功率永磁電動。馬達是與 3D 列印專家 Hieta 合作設計的。 Equipmake 的 Ampere馬達重近 10 公斤,但可輸出 295 匹馬力。

- 此外,支架是小型、常見的零件,在過去,當工程師受到傳統製造方法的限制時,很難對其進行最佳化。工程師現在可以設計最佳化的支架,並使用 3D 列印將這些設計變為現實。勞斯萊斯最近展示了其支架的 3D 列印能力。該公司展示了一大批經過 DfAM 最佳化和 3D 列印的汽車金屬零件,其中許多零件似乎都在支架中。儘管 3D 列印在汽車行業的主要用途仍然是原型製作,但該技術在工具中的應用正在迅速普及。大眾汽車就是這方面的主要例子之一,該公司多年來一直在內部使用 3D 列印。該公司的黏著劑噴塗成型技術也用於建造組件。同樣在 2021 年 7 月,大眾汽車宣布與西門子和惠普建立合作關係,以工業化 3D 列印結構部件,這些部件比鋼板製成的同類部件輕得多。

預計北美將佔據主要市場佔有率

- 北美是全球自動化3D列印的重要市場之一,其中美國在該地區佔有很大佔有率。該國不斷成長的需求可歸因於大大小小的供應商的大量存在。例如,位於加州卡爾斯巴德的 Forecast 3D 為醫療保健、汽車、航太、消費品和設計行業提供各種材料的 3D 列印服務。

- 由於強大的人工智慧應用的快速發展,閉環控制系統長期以來一直是增材製造工程師的基本目標。 例如,GE位於紐約的Niskayuna Additive Investigation的研究人員創建了一個獨特的機器學習平臺,該平臺使用高解析度相機逐層監控列印過程,並檢測條紋、空洞、孔洞和其他通常肉眼看不見的問題。 用肉眼。 此外,利用計算機斷層掃描 (CT) 成像將數據與預先記錄的缺陷資料庫進行實時比較。 人工智慧系統經過訓練,可以使用高解析度圖像和 CT 掃描數據在整個列印過程中預測問題並檢測缺陷。

- 此外,市場上也發布了多項與聚合物3D列印相關的技術專利。例如,工業3D列印自動化智慧後列印解決方案供應商之一PostProcess Technologies Inc.於2020年8月獲得了聚合物3D列印自動化後列印技術專利。 SVC 技術是 PostProcess 3D 列印聚合物支撐去除和樹脂去除解決方案積層製造系列的一部分。此取得專利的方法使用正在申請專利的清潔劑和專有演算法,以確保 3D 列印組件在列印後均勻一致地接觸清潔劑和空化。

- 各供應商也在該地區擴建其設施,主要是為了應對供應鏈課題和各個最終用戶領域不斷成長的需求。例如,2021年2月,Roboze宣布將在德克薩斯州休士頓開設美國總部,以促進國內生產回歸並解決供應鏈問題。 Roboze 計劃在未來兩年內僱用 100 多名員工,將加強其在美國的工程和製造能力,以滿足航太、石油天然氣和移動出行等行業對 3D 列印技術不斷成長的需求。能夠回應。

- 同樣,2021 年 4 月,Roboze 宣布推出 Roboze Automate,這是一種工業自動化系統,可將使用超聚合物和複合材料的客製化 3D 列印引入最終最終用戶應用的生產工作流程中。在美國,隨著從能源到運輸再到製造業的基礎設施發展開始,金屬短缺正在對每個工業部門產生影響。 Roboze 將其新型聚合物平台技術 PEEK(理想的金屬替代技術)與與貝加萊合作開發的 PLC 工業自動化系統結合。

自動化3D列印產業概述

儘管自動化3D列印市場競爭激烈,多家大公司都在爭奪更大的佔有率,主要企業已經佔領了大多數消費者,並正在研究進一步的開發和創新。同時也投資於硬體的開發和合作供應商。主要參與者包括 Stratasys Ltd、3D Systems Corporation、ExOne Company 等。

- 2022 年 2 月 - Viaccess-Orca、ShipParts.com 與 SLM Solutions 共同宣布推出一項新技術解決方案,可實現積層製造 (AM) 的直接雲端列印。這種完全自動化的軟體執行透過控制允許的列印數量、持續時間和參數來保護製造商與零件資料相關的智慧財產權 (IP)。此雲端列印解決方案基於 VO 的 SMP 軟體庫和 SLM 解決方案機器韌體的本機整合,使製造商能夠在獲取列印許可證時確信其 IP 受到保護。

- 2022 年 1 月 - 知名的增材製造 (AM) 軟體和服務提供者 Materialise NV、品質保證軟體供應商 Sigma Labs, Inc. 和 Materialise 共同開發了一種技術,可增強金屬增材製造應用的可擴充性。 新平臺將Sigma Labs的PrintRite 3D感測器技術與Materialize控制平台相結合,使用戶能夠實時識別和修復金屬構建中的問題。

- 2022 年 1 月 - PostProcess Technologies 宣佈在其產品組合中添加用於積層製造 (AM) 的自動化和智慧列印後解決方案的新解決方案系列。新型 VORSA 500 利用後處理技術,以免持方式持續移除 3D 列印 FDM 零件上的支撐結構。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 加大研發投入

- 機器人技術在工業自動化領域的應用不斷增加

- 市場課題

- 營運課題

第6章市場區隔

- 奉獻

- 硬體

- 軟體

- 服務

- 過程

- 自動化生產

- 物料輸送

- 零件處理

- 後處理

- 多重處理

- 依最終用戶產業

- 工業製造

- 車

- 航太和國防

- 消費性產品

- 衛生保健

- 能源

- 其他最終用戶產業

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭形勢

- 公司簡介

- Stratasys Ltd

- Concept Laser Inc.(GE Additive)

- The ExOne Company

- SLM Solutions Group AG

- 3D Systems Corporation

- Universal Robots AS

- Formlabs

- PostProcess Technologies Inc.

- Materialise NV

- Authentise Inc.

- DWS Systems

- Coobx AG

- ABB Group

第8章投資分析

第9章市場機會與未來趨勢

The Automated 3D Printing Market size is estimated at USD 2.13 billion in 2024, and is expected to reach USD 10.10 billion by 2029, growing at a CAGR of 36.49% during the forecast period (2024-2029).

The increasing investments in R&D and growth in the adoption of robotics for industrial automation are expected to propel market growth.

Key Highlights

- Over the last few years, 3D printing has constantly experienced a shift from the prototyping and small batches phase to mass production technology with a growing adoption rate across the industries, where the industrial and non-printer vendors have shifted their focus toward automation. Also, with the evolutionary trend for additive manufacturing, hardware growing beyond stand-alone systems that are used for prototyping, tooling, and single-part production to be used as core systems within integrated digital mass production lines is driving the number of opportunities in the emerging lights-out factories.

- Artificial Intelligence and machine learning technologies are finding their way through various applications in the additive manufacturing industry. For instance, researchers from MIT have applied the data-driven nature of machine learning to automate the process of discovering new 3D printing materials. With machine learning, material performance factors, such as toughness and compression strength, were optimized using an algorithm that quickly outperformed conventional methods of 3D printing material formulation. The researchers developed a free, open-source materials optimization platform called AutoOED, allowing other researchers to conduct their material optimization.

- Similarly, in January 2022, a group of organizations from Germany and Canada formed a new collaboration to use 3D printing and AI to automate the process of fixing parts. The Artificial Intelligence Enhancement of Process Sensing for Adaptive Laser Additive Manufacturing (AI-SLAM) project aims to create powerful AI-based software that can run directed energy deposition (DED) 3D printers automatically. To more successfully repair uneven surfaces on damaged components, the software will algorithmically regulate the printing process. The Fraunhofer Institute for Laser Technology (ILT) and a software company BCT are part of the German consortium. In Canada, the work will be overseen by the National Research Council of Canada (NRC). McGill University will coordinate the research, and machine learning firm Braintoy will help program the AI models.

- Furthermore, there have been various developments in the market by players to enhance their position in the market. For instance, in April 2021, Mosaic launched Array, an automated 3D printing platform, which loads and unloads materials for its four Element HT printers, starts prints, removes prints, and stores them so that the next prints can begin. The Array is designed for maximum flexibility with its vending machine-style robotic arm that removes prints, places them to the side, and loads a clean bed for the next print, ensuring maximum output.

- In October 2021, 3DQue, a Vancouver-based developer of automation technology for the 3D printing industry, announced the launch of two new Quinly automation kits for the Creality CR-10 and CR-6 SE. Quinly is a virtual 3D printer operator served by a Raspberry Pi, a hardware and software kit capable of running desktop 3D printers on its own. The technology is designed to make 3D printing more scalable by taking manual labor out of the equation. It is primarily aimed at print labs, on-demand manufacturers, educational institutions, and anyone else seeking automated mass part production.

- Additionally, due to the disruption of supply chains and new demands for treatments and materials, the COVID-19 pandemic has significantly accelerated technological advancements in the pharmaceutical, medical device, and manufacturing sectors. The supply chain shortages have made it hard for medical personnel to get the supplies they need, generating a shortage of personal protection equipment (PPE) and medical devices in hospitals for fighting off the virus. Owing to this, additive manufacturing (AM) (automated 3D printing) has emerged as one remarkable fabrication process because of its accessibility and flexibility to produce complex and monolithic parts or even mechanical systems quickly.

Automated 3D Printing Market Trends

The Automotive Segment is Expected to Drive the Market's Growth

- Automobiles are an essential part of human lives as the main mode of transportation today. Currently, there are over 1.3 billion motor vehicles on the road globally, with that number expected to rise to 1.8 billion by the year 2035. Passenger cars comprise roughly 74% of these statistics, while light commercial vehicles and heavy trucks, buses, coaches, and minibusses make up the remaining 26%.

- 3D printing can be used in making molds and thermoforming tools for the rapid manufacturing of grips, jigs, and fixtures. This allows automakers to produce samples and tools at low costs and eliminate future production losses when investing in high-cost tooling. The first-ever 3D-printed electric car was launched in 2014 by Local Motors. Subsequently, other established firms, like the BMW group, have also followed suit in terms of adopting automated 3D printing techniques. In several major US auto manufacturers, around 80%-90% of each initial prototype assembly has been 3D printed, with an increasing trend toward automation. Some of the popular components are parts of the exhaust, air intake, and ducting. These parts are designed digitally, 3D printed, and fitted on a car in short order, then tested through multiple iterations.

- Perhaps the most popular use of automated 3D printing in the automotive space is fabricating manufacturing aids like jigs and fixtures. Making manufacturing tools using traditional means is rather costly and time-consuming, and geometry limitations translate into less efficient manufacturing processes and more constraints on the geometry of end-use parts. Manufacturing tools that are 3D printed are lighter and more ergonomic, making it easier and safer for factory workers to perform their duties.

- Furthermore, the production volumes associated with automotive manufacturing are very high, tallying to hundreds of thousands of runs for every part. That would be difficult for most 3D printing technologies to keep up with (for now). But many high-end automobile manufacturers limit the production runs of their cars to only a few thousand units, which makes automated 3d printing a viable option.

- According to the World Economic Forum, more than 12 million fully autonomous cars are expected to be sold per year-on-year 2035, covering 25% of the global automotive market. Also, several initiatives taken by the electric motor manufacturers are leading to the growth of the market. In March 2020, UK-based engineering company Equipmake developed a power-dense permanent magnet electric motor. The motor was designed in collaboration with Hieta, a 3D printing specialist. Equipmake's Ampere motor will weigh near to 10kg but provide an output of 295bhp.

- Furthermore, Brackets are small and rather mundane parts, which were very difficult to optimize in the past time when engineers were constrained by the traditional manufacturing methods. Currently, engineers can design optimized brackets and bring these designs to life with the help of 3D printing. Rolls Royce recently showcased the capabilities of 3D printing for brackets. The company showed off a large batch of DfAM-optimized and 3D-printed automotive metal parts, many of which look to be bracketed. While prototyping remains the primary application of 3D printing within the automotive industry, using the technology for tooling is rapidly catching on. One major example of this is Volkswagen, which has been using 3D printing in-house for a number of years. Their binder jetting technology is also in use to construct the component. Also, in July 2021, Volkswagen stated that it is partnering with Siemens and HP to industrialize 3D printing of structural parts, which can be significantly lighter than equivalent components made of sheet steel.

North America is Expected to Hold a Major Market Share

- North America is one of the significant markets for Automated 3D printing globally, with the United States accounting for a significant share in the region. The country's rising demand can be attributed to the vast presence of small and big vendors. For instance, Forecast 3D in Carlsbad, CA, offers 3D printing services in a variety of materials to the healthcare, automotive, aerospace, consumer products, and design industries.

- Closed-loop control systems have long been a fundamental aim for additive manufacturing engineers due to the rapid development of powerful AI applications. For instance, Researchers at GE's Niskayuna Additive Research Lab, New York, created a proprietary machine-learning platform that uses high-resolution cameras to monitor the printing process layer by layer and detect streaks, pits, holes, and other problems that are typically invisible to the naked eye. Further, The data is compared in real-time to a pre-recorded flaws database utilizing computer tomography (CT) imaging. The AI system will be trained to forecast difficulties and detect flaws throughout the printing process using the high-resolution image and CT scan data.

- Furthermore, the market is witnessed with various technology patents for polymer 3D printing. For instance, in August 2020, PostProcess Technologies Inc., one of the providers of automated and intelligent post-printing solutions for industrial 3D printing, received a patent for automated post-printing technology for polymer 3D printing. The SVC technology is part of PostProcess's additive manufacturing family of 3D printed polymer support removal and resin removal solutions. This patented method uses patent-pending detergents and proprietary algorithms to ensure that 3D printed components are exposed to detergent and cavitation uniformly, consistently, and reliably during post-printing.

- Also, various vendors are expanding facilities into the region, primarily to address the supply chain challenges and growing demand in various end-user verticals. For instance, in February 2021, Roboze announced the opening of its US headquarters in Houston, Texas, to facilitate the reshoring of domestic production and address supply chain issues. Roboze will be able to increase its engineering and production capacity in the United States with plans to hire over 100 employees in the next two years and address a growing demand for 3D printing technology in industries such as aerospace, oil and gas, and mobility.

- Similarly, in April 2021, Roboze announced the launch of Roboze Automate, the industrial automation system to bring customized 3D printing with super polymers and composites into the production workflow for extreme end-user applications. The United States is experiencing a metals deficit that is affecting each of the industry areas as it begins an infrastructure push that spans from energy to transportation to manufacturing. Roboze combined its novel polymer platform technology, PEEK, an ideal metals replacement technology, with a PLC industrial automation system developed in partnership with B&R.

Automated 3D Printing Industry Overview

The automated 3D printing market is competitive and consists of several major players who are trying to gain a larger share, but top players have gained a major proportion of consumers and also investing in R&D and partnerships with hardware vendors for more developments and innovations. Some of the key players include Stratasys Ltd, 3D Systems Corporation, and The ExOne Company, among others.

- February 2022 - Viaccess-Orca, ShipParts.com, along with SLM Solutions, announced a new technology solution that enables direct Cloud-to-Print for additive manufacturing (AM). This fully automated software execution protects the manufacturer's intellectual property (IP) associated with part data by controlling the quantity, duration, and parameters of acceptable prints. Based on the native integration of VO's SMP software library and SLM Solutions machine firmware, this Cloud-to-Print solution allows manufacturers to be fully confident that their IP will be protected when printing is licensed.

- January 2022 - Materialise NV, a renowned provider of additive manufacturing (AM) software and services, Sigma Labs, Inc., a provider of quality assurance software, and Materialise, together have developed a technology to enhance the scalability of metal AM applications. The new platform combines Sigma Labs' PrintRite3D sensor technology to Materialise Control Platform to enable the users to identify and correct metal build issues in real-time.

- January 2022 - PostProcess Technologies announced the addition of a new solution lineup of automated, intelligent post-printing solutions for additive manufacturing (AM) to its portfolio. The new VORSA 500 leverages PostProcess technology for consistent, hands-free support structure removal on 3D printed FDM parts.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assestment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Investments in R&D

- 5.1.2 Growth in Adoption of Robotics for Industrial Automation

- 5.2 Market Challenges

- 5.2.1 Operational Challenges

6 MARKET SEGMENTATION

- 6.1 Offering

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 Process

- 6.2.1 Automated Production

- 6.2.2 Material Handling

- 6.2.3 Part Handling

- 6.2.4 Post-Processing

- 6.2.5 Multiprocessing

- 6.3 End-user Vertical

- 6.3.1 Industrial Manufacturing

- 6.3.2 Automotive

- 6.3.3 Aerospace and Defense

- 6.3.4 Consumer Products

- 6.3.5 Healthcare

- 6.3.6 Energy

- 6.3.7 Other End-user Verticals

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Stratasys Ltd

- 7.1.2 Concept Laser Inc. (GE Additive)

- 7.1.3 The ExOne Company

- 7.1.4 SLM Solutions Group AG

- 7.1.5 3D Systems Corporation

- 7.1.6 Universal Robots AS

- 7.1.7 Formlabs

- 7.1.8 PostProcess Technologies Inc.

- 7.1.9 Materialise NV

- 7.1.10 Authentise Inc.

- 7.1.11 DWS Systems

- 7.1.12 Coobx AG

- 7.1.13 ABB Group