|

市場調查報告書

商品編碼

1438376

超音波無損檢測 (NDT) 設備 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029 年)Ultrasonic Non-Destructive Testing (NDT) Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

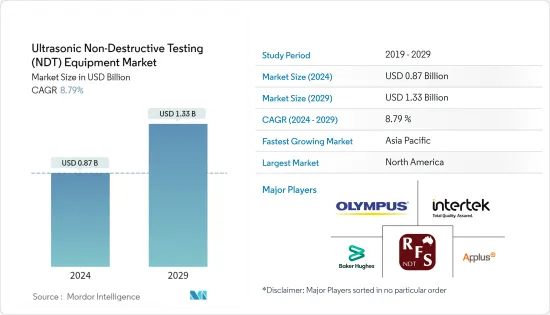

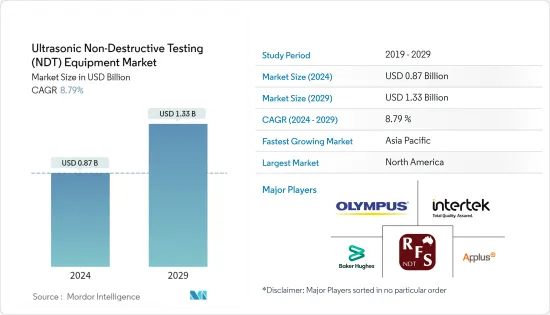

超音波無損檢測設備市場規模預計到2024年為8.7億美元,預計到2029年將達到13.3億美元,在預測期內(2024-2029年)CAGR為8.79%。

發展中國家持續消耗大量天然氣,而已開發國家的需求卻在增加。需求的增加促使管道和煉油廠的擴建,從而促使超音波無損檢測市場的激增。

主要亮點

- 根據許多國家的法律要求,定期無損檢測被廣泛用作主動安全措施。然而,與船舶檢查中經常使用的目視檢查相比,超音波檢測越來越受歡迎,因為它可以創建更好的船舶腐蝕圖,並且可以準確地確定船體厚度。透過超音波檢測產生的影像可以顯示肉眼檢查無法偵測到的船體內部缺陷。定期超音波測試可確保在發生代價高昂的故障之前發現船體問題。預計這些趨勢將為預測期內研究的市場創造顯著的成長前景。

- 超音波檢測設備是應用最廣泛的無損檢測設備,其結構簡單、重量輕、便於攜帶、能承受溫度、濕度、振動、灰塵,而且性價比高。超音波測試正在見證旨在填補現有市場產品組合空白的漸進式創新。在超音波測試中,相控陣超音波測試市場正在飽和,而導波超音波測試被稱為最重要的技術之一。此外,超音波測試正在成為最終用戶進行故障檢測的首選,因為它對操作員或附近人員無害,並且不會影響正在測試的材料。它還提供即時結果。超音波測試已在發電行業和石油天然氣行業中廣泛應用。然而,隨著行業技術的不斷進步,技術也在其他行業中得到了重要的應用。

- 例如,超音波測試正在應用於船舶和航空業,因為測試活動定期在鋼和鋁容器上進行,以檢測和量化腐蝕。它也可用於測量複合材料結構的厚度和完整性。 2021 年 4 月,Jet Aviation 獲得瑞士聯邦民航局批准,在其巴塞爾維修設施中使用紅外線熱成像技術進行無損檢測 (NDT),以補充巴塞爾使用的其他 NDT 技術,例如液體滲透劑、X-射線、磁粉、渦流和超音波檢測。

- 世界各地對超音波檢測活動熟練技術人員以及熟練無損檢測技術人員的需求不斷增加。由於多種原因,目前需求超過供應。非破壞性檢驗只能由經過認證的專業人員執行,他們在主題專家在場的情況下接受詳細培訓,以獲得分析資料所涉及的各種技術和技能的專業知識。

- 無損檢測行業的技術進步使工人更難跟上當今的實踐和技術。在加拿大、美國、中東和亞洲等一些地區,熟練勞動力嚴重短缺。加拿大和美國部分地區的頁岩油氣探勘促使對無損檢測工人的需求突然激增。缺乏優質教師是新興國家令人擔憂的另一個問題。這種趨勢加上市場上營運的公司由於缺乏現場訪問和供應鏈中斷而面臨臨時營運問題,可能會阻礙超音波無損檢測設備市場的發展。

超音波無損檢測 (NDT) 設備市場趨勢

用於即時數據的攜帶式和連接設備的可用性預計將推動市場的成長

- 移動性是各公司持續監控關鍵資產的關鍵要求。超音波無損檢測設備提供的攜帶性使無損檢測技術人員能夠處理多項現場任務。例如,技術人員可以在現場執行無損檢測的準備、採集、分析和報告。測試設備需要定期往返於不同的管道、鐵路和其他工作地點。攜帶式超音波無損檢測設備使技術人員無需回到辦公桌前即可執行所有此類活動,從而節省時間並加快流程。

- 此外,由於提供的靈活性,無線超音波檢測設備的興起和物聯網等先進技術的滲透正在推動所研究的市場。物聯網解決方案擴大被各行業採用,以最佳化營運、生產力和保護環境。製造業、石油和天然氣、食品和飲料以及公用事業等行業面臨激烈的競爭。因此,他們擴大投資於利用物聯網、雲端和巨量資料分析功能的新技術,以增強創新能力並最大限度地提高資產回報。

- 隨著工業4.0的到來,工業物聯網(IIoT)、智慧製造、智慧工廠、預測製造、工業機器人和感測器等趨勢使物聯網成為這些產業的核心支柱,實現設備上的遠端監控、連續掃描功能工廠車間、即時分析以及支援新功能,例如預測性和持續維護。

- 工業 4.0 一直在幫助產業從遺留系統過渡到智慧組件和機器,促進數位工廠,以及後來的互聯工廠和企業的生態系統。這種轉型趨勢預計將成為無損檢測產業採用攜帶式和連網設備的主要驅動力。攜帶性和連接性等功能提供了無與倫比的功能,可以在遠端位置定位不連續性和其他缺陷,而不會使攜帶設備成為限制因素。

- 隨著智慧工廠概念的生效,企業專注於預測性和持續性維護和製造,預計這將降低和最佳化營運和維護成本並提高生產能力。此外,Wollenhaupt 表示,低維護策略可使公司的產能降低多達 20%。為了及早發現問題並預防問題,超音波檢測是最有效的維護工具之一。

預計北美將佔據主要市場佔有率

- 由於預測性維護測試技術的使用不斷增加、石油和天然氣行業的採用不斷增加,以及該地區各行業安全法規的不斷改進(尤其是來自國家的需求。擴大使用超音波無損檢測設備來確定材料的厚度或管道中的任何裂縫,預計將推動其成長。因此,石油和煉油行業管道建設投資的不斷成長預計將推動該國的研究市場。

- 例如,佩科斯小徑管道項目、賓夕法尼亞東管道項目和大西洋海岸管道等管道建設項目預計將在未來幾年內完成。預計這些項目將在未來幾年內為該國創造對超音波無損檢測設備的巨大需求。

- 超音波脈衝速度(UPV)是一種有效的無損檢測方法,用於混凝土材料的品質控制和檢測結構部件的損壞,過去幾年美國建築業的成長正在增加設備的銷售。總統選舉後,預計將特別重視建設新的基礎設施和修復引起安全擔憂的現有資本資產。此外,預計公私合作夥伴關係(PPP)將會增加,以開展大型基礎設施項目。根據美國人口普查局的數據,新建商業建築的價值已恢復至經濟衰退前的水平,預計2020年將達799億美元。2022年,美國新開工建築價值預計將達到1350億美元。私人辦公室、倉庫和購物/零售設施預計將在未來幾年流行。建築業的不斷成長可能會推動美國無損檢測檢測設備市場的發展。

- 此外,加拿大經濟正在復甦,過去幾年持續成長。隨著美國經濟的走強和歐洲經濟在衰退後的復甦,預計加拿大製造業在未來幾年將表現得更好。

- 加拿大是全球重要的汽車生產國之一,該產業是該國製造業的最大貢獻者。一段時間以來,車輛重量不斷減輕,以提高燃油效率。使用更少或替代的複合材料來保持結構完整性和安全性,促使該地區需要更多和改進的超音波無損檢測設備。

超音波無損檢測(NDT)設備產業概況

由於初始投資增加,全球超音波無損檢測 (NDT) 設備市場已整合。該市場由貝克休斯(Baker Hughes)、Intertek Group PKC、奧林巴斯公司(Olympus Corporation) 和Russell Fraser Sales Pty Ltd 等幾家主要參與者主導。這些重要參與者在市場上佔有顯著佔有率,專注於擴大其在國外的客戶群。這些公司正在利用策略合作計劃來增加市場佔有率並提高盈利能力。然而,隨著技術進步和產品創新,中小型公司正在透過獲得新合約和開拓新市場來擴大其市場佔有率。

- 2021 年 10 月 - Intertek 位於英國德比的無損檢測 (NDT) 專家為該公司龐大的先進技術實驗室添加了一台 X光電腦斷層掃描 (CT) 掃描儀。此掃描器具有 240 kV 微焦點和 450 kV 迷你焦點功能。 CT 掃描結合了隨著被檢物體緩慢旋轉而從不同角度拍攝的多個 X 光影像。專用軟體將這些影像結合起來創建一個3D模型,透過分析該模型可以識別內部特徵和潛在缺陷,例如裂縫、孔隙和分層。

- 2021 年 9 月 - 必維國際檢驗集團 (Bureau Veritas) 收購了專門從事實驗室測試、產品開發和永續測試的 AET France。此次收購增強了 BV 在歐洲消費品零售業的地位。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭激烈程度

- 產業價值鏈分析

- 評估 COVID-19 對市場的影響

第 5 章:市場動態

- 市場促進因素

- 加強安全監管

- 更重視持續監控以防止突然故障

- 可攜式和連接設備的即時數據可用性

- 市場限制

- 缺乏實施和進行檢驗服務所需的熟練勞動力

第 6 章:市場區隔

- 依地理

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太地區其他地區

- 拉丁美洲

- 巴西

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 中東和非洲其他地區

- 北美洲

第 7 章:競爭格局

- 公司簡介

- Baker Hughes

- MISTRAS Group

- Intertek Group PKC

- Olympus Corporation

- Russell Fraser Sales Pty Ltd

- Advanced NDT Ltd

- Johnson and Allen Ltd

- ROSEN Group

- OkoNDT group

- Bureau Veritas SA

- Applus Services SA

第 8 章:投資分析

第 9 章:市場的未來

The Ultrasonic Non-Destructive Testing Equipment Market size is estimated at USD 0.87 billion in 2024, and is expected to reach USD 1.33 billion by 2029, growing at a CAGR of 8.79% during the forecast period (2024-2029).

Developing countries continue to consume vast amounts of natural gas while the demand increases in developed countries. The increased demand is causing the expansion of pipelines and refineries, due to which there is a surge in the ultrasonic NDT testing market.

Key Highlights

- Regular non-destructive testing is widely used as a proactive safety measure, as it is required by law in many countries. However, ultrasonic testing is gaining popularity as it creates a better map of ship corrosion and can accurately determine hull thickness, as compared to visual inspection, which is frequently used in ship inspections. Images produced through ultrasonic testing can visualize defects inside the hull that visual inspection cannot detect. Regular ultrasonic testing ensures that hull issues are identified before a costly failure. Such trends are expected to create significant growth prospects for the market studied over the forecast period.

- Ultrasonic testing equipment is the most extensively used NDT equipment that is simple, lightweight, portable, can withstand temperature, humidity, vibration, and dust, and are also cost-effective in nature. Ultrasonic testing is witnessing incremental innovations aimed at filling gaps in the existing market product portfolio. Within ultrasonic testing, the market for phased array ultrasonic testing is witnessing saturation, while guided wave ultrasonic testing is being dubbed as one of the most significant techniques. Moreover, Ultrasonic testing is becoming a preferred choice amongst the end-users for fault detection, as it is non-hazardous to operators or nearby personnel and does not affect the material being tested. It also provides instantaneous results. Ultrasonic testing has witnessed the majority of applications in the power generation industry and the oil & gas industry. However, with the increasing technological advancements in the industry, technology is witnessing significant instances of applications in other industries as well.

- For instance, ultrasonic testing is being used in the marine and aviation industry, as the testing activity is regularly performed on steel and aluminum vessels to detect and quantify corrosion. It can also be used to measure the thickness and integrity of composite structures. In April 2021, Jet Aviation was approved by the Swiss Federal Office of Civil Aviation to use infrared thermography for non-destructive testing (NDT) at its Basel maintenance facility to add to other NDT techniques used in Basel, such as liquid penetrant, X-ray, magnetic particle, eddy current, and ultrasonic testing.

- There has been an incremental rise in the demand for skilled technicians in ultrasonic testing activities, along with skilled NDT technicians across the world. The demand currently outweighs supply due to many reasons. Non-destructive testing can only be performed by certified professionals who undergo detailed training in the presence of subject-matter experts to gain expertise on the various techniques and skills involved in analyzing the data.

- Technological advancements in the NDT industry have made it even tougher for workers to stay abreast of present-day practices and techniques. Acute shortage of skilled workforce can be seen in some regions, like Canada, the United States, the Middle East, and Asia. Shale oil and gas explorations in Canada and certain parts of the United States have led to a sudden surge in demand for NDT workers. The lack of quality instructors is another source of concern in emerging countries. Such trends coupled with companies operating in the market facing temporary operative issues due to the absence of site access and disruption in the supply chain might hamper the progression of the ultrasonic NDT testing equipment market.

Ultrasonic Non-Destructive Testing (NDT) Equipment Market Trends

Availability of Portable and Connected Devices for Real-time Data is Expected to Drive the Market's Growth

- Mobility is a key requirement for various companies to monitor critical assets continuously. The portability offered by ultrasonic NDT equipment allows NDT technicians to handle several on-site tasks. For instance, technicians can perform preparation, acquisition, analysis, and reporting of NDT on the site. The testing equipment is required to be transported to and from varying stretches of pipelines, rail, and other job sites regularly. The portable ultrasonic NDT equipment enables the technicians to perform all such activities without the need to go back to the desk, saving time and fastening the process.

- Furthermore, the rise of cordless ultrasonic testing equipment and the penetration of advanced technologies, like the Internet of Things, is driving the studied market, owing to the flexibility offered. IoT solutions are being increasingly adopted across industries for optimizing operations, productivity, and safeguarding the environment. Industries such as manufacturing, oil and gas, food and beverage, and utilities face intense competition. Thus, they are increasingly investing in new technologies that leverage the capabilities of IoT, cloud, and Big Data analytics to enhance their ability to innovate and maximize return on their assets.

- With the advent of Industry 4.0, trends like Industrial IoT (IIoT), smart manufacturing, smart factories, predictive manufacturing, industrial robots, and sensors have made IoT the central backbone of these industries, enabling remote monitoring, continuously scanning capabilities from the equipment on the factory floor, real-time analysis, and supporting new capabilities, such as predictive and continuous maintenance.

- Industry 4.0 has been aiding the industries' transition from legacy systems to smart components and machines, facilitating digital factories and, later, to an ecosystem of connected plants and enterprises. Such transformational trends are expected to act as a major driver for adopting portable and connected devices in the NDT industry. The features such as portability and connectivity provide unmatched capabilities for locating discontinuities and other flaws at remote locations without making carrying the device a restraining factor.

- With the smart factory concept coming into force, companies focus on predictive and continuous maintenance and manufacturing, which is anticipated to reduce and optimize operations and maintenance costs and enhance production capacities. Moreover, according to Wollenhaupt, low maintenance strategies can reduce a company's production capacity by as much as 20%. To identify the problems and prevent them at an early stage, ultrasonic testing is one of the most effective maintenance tools.

North America is Expected to Hold a Major Market Share

- The United States is expected to command a prominent share of the market demand owing to the increasing use of testing technology for predictive maintenance, growing adoption in the oil and gas sector, and growing safety regulations in the various industries in the region especially driven by the demand from the country. The increasing use of ultrasonic non-destructive testing equipment to determine a material's thickness or any cracks in a pipeline is expected to drive its growth. Therefore, the growing investment in the construction of pipelines in the oil and refinery sector is expected to drive the studied market in the country.

- For instance, Pipeline construction projects, such as Pecos trail Pipeline Project, Penn East Pipeline Project, and Atlantic Coast Pipeline, are some of the projects that are destined to be completed in the next few years. These projects are expected to create considerable demand for Ultrasonic non-destructive testing equipment in the country over the next few years.

- Ultrasonic Pulse Velocity (UPV) is an effective non-destructive testing method for quality control of concrete materials and detecting damages in structural components, and the growing construction sector in the United States over the past few years is augmenting the sales of equipment. After the presidential election, a particular emphasis on building new infrastructure and repairing existing capital assets that are raising safety concerns is expected to take place. Additionally, public-private partnerships (PPPs) are expected to increase to carry out large-scale infrastructure projects. According to the United States Census Bureau, the value of new commercial buildings has recovered to pre-recession levels, with USD 79.9 billion expected in 2020. In 2022, the value of construction starts in the United States is expected to reach USD 135 billion. Private offices, warehouses, and shopping/retail facilities are expected to be popular in the coming years. The increasing growth in the construction sector may boost the market for NDT testing equipment in the United States.

- Moreover, Canada is experiencing a resurging economy, with continuous growth over the last few years. With the strengthening of the American economy and the resurfacing of the European economy post-recession, the Canadian manufacturing sector is expected to perform better in the coming years.

- Canada is one of the significant vehicle producers globally, and this sector is the biggest contributor to the country's manufacturing industry. Over a period of time, vehicle weight has been reduced to increase fuel efficiency. Maintaining structural integrity and safety with less or alternative composite materials has created the need for more and improved ultrasonic non-destructive testing equipment in the region.

Ultrasonic Non-Destructive Testing (NDT) Equipment Industry Overview

The Global Ultrasonic Non-Destructive Testing (NDT) Equipment Market is consolidated due to higher initial investments. It is dominated by a few major players like Baker Hughes, Intertek Group PKC, Olympus Corporation, and Russell Fraser Sales Pty Ltd. These significant players, with a prominent share in the market, are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and increase their profitability. However, with technological advancements and product innovations, mid-size to smaller companies are growing their market presence by securing new contracts and tapping new markets.

- October 2021 - Intertek's non-destructive testing (NDT) experts in Derby, United Kingdom, added an X-ray computed tomography (CT) scanner to the company's extensive laboratory of advanced technology. The scanner has 240 kV microfocus and 450 kV mini focus capability. CT scanning combines multiple X-ray images taken from different angles as the inspected object is slowly rotated. Specialized software combines these images to create a three-dimensional model that can be analyzed to identify internal features and potential defects such as cracking, porosity, and delamination.

- September 2021 - Bureau Veritas acquired AET France, which is specialized in laboratory testing, product development, and sustainable testing. This acquisition has strengthened BV's position in the European consumer goods retail industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTs

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Safety Regulation

- 5.1.2 More Emphasis Toward Continuous Monitoring to Prevent Sudden Failure

- 5.1.3 Availability of Portable and Connected Devices for Real-time Data

- 5.2 Market Restraints

- 5.2.1 Lack of Skilled Labor Required to Implement and Carry Out Inspection Service

6 MARKET SEGMENTATION

- 6.1 By Geography

- 6.1.1 North America

- 6.1.1.1 United States

- 6.1.1.2 Canada

- 6.1.2 Europe

- 6.1.2.1 Germany

- 6.1.2.2 United Kingdom

- 6.1.2.3 France

- 6.1.2.4 Spain

- 6.1.2.5 Rest of Europe

- 6.1.3 Asia Pacific

- 6.1.3.1 China

- 6.1.3.2 Japan

- 6.1.3.3 India

- 6.1.3.4 South Korea

- 6.1.3.5 Rest of Asia Pacific

- 6.1.4 Latin America

- 6.1.4.1 Brazil

- 6.1.4.2 Argentina

- 6.1.4.3 Rest of Latin America

- 6.1.5 Middle East and Africa

- 6.1.5.1 United Arab Emirates

- 6.1.5.2 Saudi Arabia

- 6.1.5.3 Rest of Middle East and Africa

- 6.1.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Baker Hughes

- 7.1.2 MISTRAS Group

- 7.1.3 Intertek Group PKC

- 7.1.4 Olympus Corporation

- 7.1.5 Russell Fraser Sales Pty Ltd

- 7.1.6 Advanced NDT Ltd

- 7.1.7 Johnson and Allen Ltd

- 7.1.8 ROSEN Group

- 7.1.9 OkoNDT group

- 7.1.10 Bureau Veritas SA

- 7.1.11 Applus Services SA