|

市場調查報告書

商品編碼

1642022

企業網路設備:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Enterprise Network Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

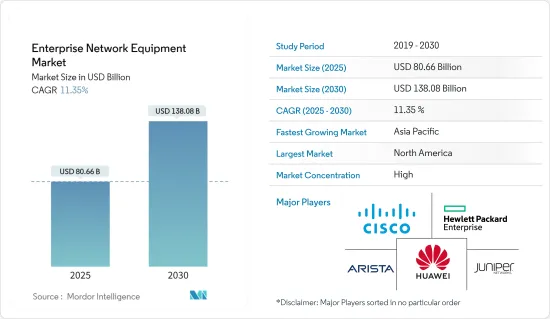

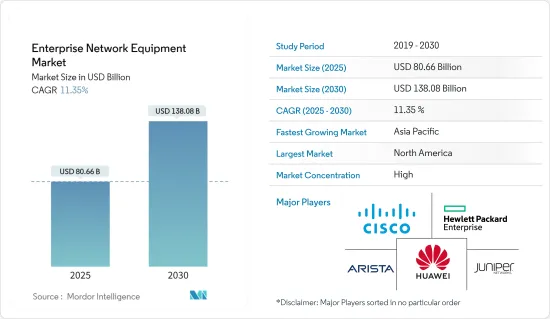

2025 年企業網路設備市場規模預估為 806.6 億美元,預計到 2030 年將達到 1,380.8 億美元,2025 年至 2030 年的複合年成長率為 11.35%。

企業網路是公司的通訊主幹,連接部門和工作小組網路中的電腦和相關設備,方便取得見解和資料。它減少了通訊協定,促進了系統和設備的互通性,並改善了企業內部和跨企業的資料管理。

主要亮點

- 在企業網路中,所有系統都必須能夠通訊並提供和檢索資訊。因此,實體系統和設備必須能夠維持並提供令人滿意的性能、可靠性和安全性。因此,交換器、路由器、無線網路、網路基地台、網路安全和管理以及廣域網路最佳化等元件和技術有助於以低成本建立安全、可靠且擴充性的網路。

- 隨著數位化的推進,網路基礎設施的重要性不斷增加。因此,對網路基礎設施的需求日益增加。此外,為了滿足無線網路日益成長的頻寬需求,企業正在擴展其網路。企業網路基礎設施市場受到行動裝置使用日益增多、頻寬需求不斷增加以及向無線技術的轉變等因素的推動。此外,企業正在增加對網路升級的投資,以提高網路速度,提供可靠、節能且經濟高效的解決方案。

- 此外,越來越多的企業青睞先進的技術和功能,例如100G乙太網路切換器和802.11ac標準的採用。例如,802.11ac 標準帶來了透過無線網路為終端設備提供更高效能和容量的機會。這使得企業網路能夠支援越來越多的無線終端設備,包括智慧型手機、平板電腦、新一代機器對機器 (M2M) 設備和物聯網 (IoT)。

- 企業網路設備市場預計將隨著「BYOD(自帶設備)」趨勢而成長,BYOD 代表了在任何地方使用任何設備的想法,並將推動侵入式無線網路和關鍵任務移動性的採用解決方案。應用需求。

- 根據消費科技協會預測,2020年全球智慧城市建設支出將達343.5億美元。這是市場的主要驅動力。此外,中國中產階級的崛起,作為一種獨特的城市現象,在不到30年的時間內已經幫助約5億人擺脫了貧困。這證明了城市提高生活水準的力量。中國有約500個智慧城市試點計劃,覆蓋各種規模的城市,比世界上任何其他國家都多。這潛在地要求未來網路設備的崛起。

- 網路基礎設施市場可能會受到 COVID-19 之後的經濟波動的影響。隨著疫情影響的持續,其影響可能會因市場不同部門、地區和垂直產業而異。

- 華為、三星、愛立信、諾基亞和中興等通訊網路供應商在新冠肺炎疫情爆發後面臨供應鏈問題。然而,儘管存在與新冠肺炎相關的挑戰,例如在疫情期間派人員到現場安裝新設備,但對設備安裝服務的需求仍然很高。電訊需要主要在現有站點(主要是城市市場和公共場所)部署利用高頻段頻譜和額外宏基地台的小型基地台。

企業網路設備市場趨勢

資料安全問題導致網路安全成長

- 市場的成長歸因於銀行和國防組織網路竊盜事件的增加。隨著網路攻擊變得越來越複雜和多樣化,組織越來越需要實施網路安全設備以減少大規模資料竊取的可能性。

- 許多組織正在超越傳統的防火牆實施和使用者存取控制,採用更強大的網路安全策略。這為開發人員帶來新的防禦方法提供了絕佳的機會。透過採用人工智慧來開發直覺且有效率的系統,企業可以利用智慧機器的力量儘早發現威脅,並採用主動策略來防禦資訊。

- 隨著數位化組織的快速發展,IT 專業人士認為缺乏視覺性是應對網路威脅面臨的最大挑戰之一。大多數組織都知道持續監控所有使用者、應用程式和裝置的網路是多麼重要。各組織正在努力使網路和安全團隊更加緊密地聯繫在一起,並利用其網路基礎設施來擴大各處的可見性並防止資料外洩和網路安全威脅。

- 此外,物聯網和自帶設備的廣泛採用也導致網路犯罪的增加,迫使企業轉向網路安全解決方案。該地區連網設備的增加使得企業網路變得更加複雜。不斷發展的網路環境迫使企業重新評估其網路安全基礎架構並部署強大的網路解決方案。

- 此外,據思科稱,未來幾年預計 46% 的連網設備將是 M2M 或 IoT,這使它們容易受到攻擊。為了充分發揮這些連網型設備的潛力,業界需要足夠靈活的廣域網路來滿足未來的網路需求。

預計北美將佔據較大的市場佔有率

- 預計北美將佔據企業網路設備市場的大部分佔有率。此外,網路設備供應商在該地區擁有強大的立足點。其中包括思科系統公司 (Cisco Systems, Inc.)、戴爾 EMC、瞻博網路公司 (Juniper Networks, Inc.)、Extreme Networks, Inc. 和 Arista Networks, Inc.,它們為市場的成長做出了貢獻。

- 在該地區營運的供應商正在致力於開發企業網路設備技術,以增強其產品能力。有效的長期在家工作解決方案必須提供安全的、類似企業的體驗,以提高效率、創造力和生產力。與重複使用消費級網路設備的解決方案不同,Aruba 提供企業級在家工作辦公硬體,結合即插即用安裝、基於身份的安全性和雲端原生管理,使您的部署快速、簡單且安全。擴充性的部署。

- 雲端網路、基於 SaaS 的應用程式、網路分析、DevOps 和虛擬等技術趨勢的出現正在推動北美用戶和企業採用企業網路設備產品。此外,對雲端運算、數位內容和新的資料主權法的不斷成長的需求可能會在不久的將來進一步推動北美網路設備市場的發展。

- 自動化技術的進步也透過智慧網路和快速補救措施滿足了 IT 部門當前的業務需求,可以持續檢查網路並提供解決方案,而無需第三方應用程式。

- 美國過去在基礎設施現代化方面投入了巨額資金。美國國防資訊局宣布計劃將其每秒 10Gigabit(Gbps) 的國防資訊系統網路 (DISN) 升級為 100Gbps分組光纖傳輸系統。預計這些投資將促進市場發展。

企業網路設備產業概況

企業網路設備市場競爭適中,少數參與者佔相當大的佔有率。目前,少數幾家大公司佔據著市場佔有率的主導地位。這些擁有較大市場佔有率的市場領導正致力於擴大海外消費群。網路設備也必須符合歐盟《限制有害物質指令》(RoHS)規定,只有有限數量的供應商能夠滿足企業的這些標準。這些公司正在利用戰略合作計劃來增加市場佔有率和盈利。此外,在這個市場營運的公司正在透過收購從事企業網路設備技術的新興企業來增強其產品供應。

2022 年 3 月,Avaya 的 OneCloud CCaaS 可組合解決方案(提供改善和簡化通訊和協作的解決方案)將與全球通訊、網路和雲端解決方案供應商阿爾卡特朗訊企業 (ALE) 合作開發和部署下一代企業雲端解決方案。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況(包括 COVID-19 影響評估)

- 市場促進因素

- 隨著物聯網的普及,頻寬需求激增

- 新興經濟體政府智慧城市發展舉措

- 市場限制

- 由於安全問題導致維修成本高昂

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

第5章 市場區隔

- 按類型

- 轉變

- 路由器

- 無線區域網路

- 網路安全

- 其他類型

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 世界其他地區

- 北美洲

第6章 競爭格局

- 公司簡介

- Cisco Systems Inc.

- Aruba(Hewlett Packard Enterprise Development LP)

- Juniper Networks, Inc.

- Huawei Technologies Co. Ltd

- Dell EMC

- Extreme Networks, Inc.

- Arista Networks, Inc.

- Fortinet, Inc.

- Vmware, Inc.

- NetScout Systems, Inc.

- Palo Alto Networks, Inc.

- Check Point Software Technologies Ltd

- F5 Networks, Inc.

- New H3C Technologies Co. Ltd

第7章投資分析

第8章 市場機會與未來趨勢

The Enterprise Network Equipment Market size is estimated at USD 80.66 billion in 2025, and is expected to reach USD 138.08 billion by 2030, at a CAGR of 11.35% during the forecast period (2025-2030).

An enterprise network is an enterprise's communication backbone that helps connect computers and related devices across departments and workgroup networks, facilitating insight and data accessibility. It reduces communication protocols, promotes system and device interoperability, and improves internal and external enterprise data management.

Key Highlights

- In an enterprise network, all systems should be able to communicate and provide and retrieve information. Therefore, physical systems and devices should be able to maintain and provide satisfactory performance, reliability, and security. Thus, components and technologies such as switches, routers, wireless networks, access points, network security and management, and WAN optimization assist in creating a secure, reliable, and scalable network at a lower cost.

- The significance of network infrastructure is rising along with digitalization. Consequently, there is a rising need for network infrastructure. Additionally, businesses are expanding their networks to accommodate the expanding bandwidth requirements of wireless networks. The market for enterprise network infrastructure is being driven by factors such as the expanding use of mobile devices, the rising need for bandwidth, and the transition to wireless technologies. Additionally, businesses are increasing their investments in network upgrades to increase speed, which would offer a reliable, energy-saving, and cost-effective solution.

- Moreover, enterprises are increasingly favoring advanced technologies and features such as 100G Ethernet switches and the adoption of 802.11 ac standards. For instance, the 802.11ac standard brings opportunities to deliver high-performance and end-device capacity over wireless networks. This enables the enterprise network to support the increasing range of wireless end devices such as smartphones, tablets, new generations of machine-to-machine (M2M) devices, and the Internet of Things (IoT).

- The market for corporate network devices is anticipated to grow in line with the trend of "bring your own device" (BYOD), which epitomizes the idea of any device used anywhere and is driving the demand for invasive wireless networks and mission-critical mobility applications.

- According to the Consumer Technology Association, worldwide spending on smart city developments is anticipated to reach USD 34.35 billion by 2020. This significantly drives the market. Further, the rise of China's middle class, a distinctly urban phenomenon, lifted around 500 million people out of poverty in less than 30 years. It is a testament to cities' power to elevate living standards. China has approximately 500 smart city pilot projects, the highest in the world, covering big and small cities. This potentially demands the rise of network equipment in the coming period.

- The network infrastructure market will be affected by the economic turbulence that has followed in the wake of Covid-19. The impact may be uneven across various sectors, geographies, and vertical industries across the market as the effects of the pandemic continues to play out.

- Telecom network vendors such as Huawei, Samsung, Ericsson, Nokia, and ZTE are facing supply chain issues in the wake of the COVID-19 pandemic. However, equipment installation services will remain in demand despite COVID-19-related challenges, such as rolling out personnel to sites to install new equipment amid the pandemic. Telecom operators still need to deploy small cells, predominantly in urban markets and public venues, that leverage high-band spectrum and additional macros in the field, primarily on existing sites.

Enterprise Network Equipment Market Trends

Network Security is Growing Due to Data Security Concerns

- The market's growth is attributed to the increasing cases of cyber thefts in banking and defense institutions. The growing complexity and diversity of cyber-attacks have driven the need among organizations to implement network security equipment to reduce the likelihood of large-scale data thefts.

- Many organizations are reaching for more robust cybersecurity strategies apart from implementing traditional firewalls and controlling user access. This creates an excellent opportunity for developers to bring new defense approaches to the table. Incorporating AI to develop intuitive, efficient systems will allow businesses to use smart machine capabilities to detect threats early and use proactive strategies in defending their information.

- Due to the rapidly increasing growth of digital organizations, IT professionals consider the lack of visibility as one of the biggest challenges being faced in addressing network threats. Most organizations recognize how critical it is to constantly monitor their network across all users, applications, and devices. Organizations are implementing networking and security teams to work more closely and leverage network infrastructure to extend visibility everywhere and avoid data breaches or cybersecurity threats.

- Additionally, the growing popularity of IoT and BYOD trends has also resulted in the growth of cyber-crimes, forcing organizations to use network security solutions. The rise in connected devices in the region has made enterprise networks more complex. The evolving network landscape has generated the need among enterprises to reassess their network security infrastructure and adopt robust network solutions.

- Moreover, according to Cisco, 46% of network devices will be M2M or IoT in the upcoming years, which are vulnerable to attacks. To fully realize the potential of these connected devices, industries need to be equipped with WANs that are flexible to meet the network demands anticipated over the future.

North America is Expected to Have Significant Market Share

- North America is expected to hold a prominent share of the enterprise network equipment market. Moreover, the region has a strong foothold of network equipment vendors. Some of them include Cisco Systems, Inc., Dell EMC, Juniper Networks, Inc., Extreme Networks, Inc., and Arista Networks, Inc., among others, which contribute to the growth of the market.

- The vendors operating in the region are working on enterprise network equipment technologies to strengthen their product capabilities. An effective long-term work-from-home solution has to deliver a secure, enterprise-like experience that enhances efficiency, creativity, and productivity. Unlike solutions that use repurposed consumer network equipment, Aruba provides enterprise-class telework hardware coupled with plug-and-play installation, identity-based security, and cloud-native management for rapid, simple, and scalable deployment.

- The emergence of trending technologies, such as cloud networking, SaaS-based application, network analytics, DevOps, and virtualization, has encouraged users and businesses in North America to undertake enterprise network equipment products. Also, the rising demand for cloud adoption, digital content, and new data sovereignty laws will further drive the North American region's network equipment market in the near future.

- Also, the advances in automation technology cater to the IT sector's current business needs through smart networks and quick remediation, which continuously check the network and offer a resolution without involving any third-party application.

- United States Department of Defense has invested a massive amount in modernizing its infrastructure in the past. Defense Systems Information Agency announced its plan to upgrade the Defense Information Systems Network (DISN) with 10 gigabits per second (Gbps) transport speeds to a 100 Gbps packet-optical transport system. Such investments are expected to boost the market.

Enterprise Network Equipment Industry Overview

The enterprise network equipment market is moderately competitive and consists of a few market players enjoying a significant market share. A few major players currently dominate the market in terms of market share. These market leaders with significant market shares are focusing on expanding their consumer base overseas. Network equipment should also meet the Restriction of Hazardous Substances (RoHS) directive from the European Union (EU), which makes limited numbers of suppliers meet such standards for enterprise use. These companies leverage strategic collaborative initiatives to increase their market share and profitability. The companies operating in the market are also acquiring start-ups working on enterprise network equipment technologies to strengthen their product capabilities

In March 2022, OneCloud CCaaS composable solutions from Avaya, a provider of solutions to improve and streamline communications and collaboration, and Alcatel-Lucent Enterprise (ALE), a global provider of communications, networking, and cloud solutions, announced a strategic partnership that expands the availability of ALE's digital networking solutions to Avaya customers globally.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview (Includes Assessment of Impact of COVID-19)

- 4.2 Market Drivers

- 4.2.1 Surging Bandwidth Requirements with IoT Prevalance

- 4.2.2 Government Initiations in Emerging Economies to Develop Smart Cities

- 4.3 Market Restraints

- 4.3.1 High Maintenance Cost Due to Security Concerns

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Industry Value Chain Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Switches

- 5.1.2 Routers

- 5.1.3 WLAN

- 5.1.4 Network Security

- 5.1.5 Other Types

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 Rest of Asia Pacific

- 5.2.4 Rest of the World

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cisco Systems Inc.

- 6.1.2 Aruba (Hewlett Packard Enterprise Development LP)

- 6.1.3 Juniper Networks, Inc.

- 6.1.4 Huawei Technologies Co. Ltd

- 6.1.5 Dell EMC

- 6.1.6 Extreme Networks, Inc.

- 6.1.7 Arista Networks, Inc.

- 6.1.8 Fortinet, Inc.

- 6.1.9 Vmware, Inc.

- 6.1.10 NetScout Systems, Inc.

- 6.1.11 Palo Alto Networks, Inc.

- 6.1.12 Check Point Software Technologies Ltd

- 6.1.13 F5 Networks, Inc.

- 6.1.14 New H3C Technologies Co. Ltd