|

市場調查報告書

商品編碼

1437983

施工機械租賃:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Construction Equipment Rental - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

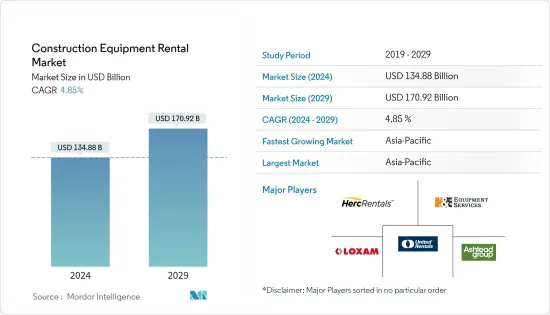

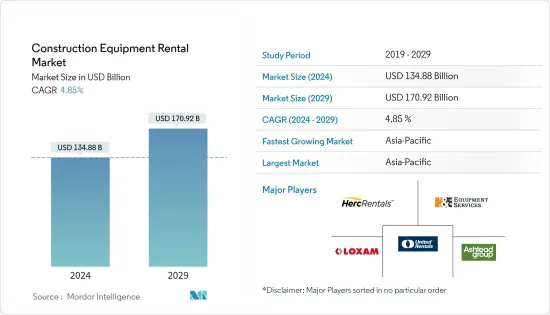

2024年施工機械租賃市場規模估計為1348.8億美元,預計到2029年將達到1709.2億美元,在預測期間(2024-2029年)以4.85%的複合年增長率增長。

2020 年市場受到不利影響,因為封鎖期間建設活動暫停,以遏制冠狀病毒感染疾病(COVID-19) 的傳播並維持社交距離規範。然而,隨著經濟穩定開放,需求正在恢復動力,使GDP成長重回正軌。各國政府正在增加建設活動支出,這可能會增加對施工機械租賃服務的需求。

美國政府通過了《基礎建設投資和就業法案》。該法案將耗資1.2兆美元,其中5,500億美元用於交通、寬頻和公共,1,100億美元用於道路、橋樑和其他重大基礎設施計劃,400億美元用於橋樑維修和更換。該法案還包括超過650億美元的電力基礎設施資金,其中290億美元用於電網。該法案授權聯邦政府對各種基礎設施計劃,預計這些項目將增加對建築服務、設備和材料的需求。因此,預計 2022 年建築支出將成長 5%,2023 年將成長 5.5%。

同樣,中國政府投資88.7億美元建造上海一家晶片製造工廠。作為計劃的一部分,正在中國上海建造一座 12 吋晶圓製造廠。預計2022年第一季開工,2024年第三季完工。該計劃旨在提高12吋晶圓產能,以滿足不斷成長的需求。

從中期來看,推動市場增長的主要因素是建築業的擴張,尤其是在發展中國家,因為住宅、非住宅和基礎設施領域存在多種增長機會。 例如,多戶住宅建設的增加(隨著核心家庭的增加趨勢),以及由於人口增長和城市化而對高速公路、橋樑、地鐵、智慧城市、主幹道和道路建設的投資增加。

此外,自動化趨勢的上升預計將推動市場成長。然而,施工機械嚴格的排放法規等因素預計將阻礙預測期內的市場成長。

對基礎設施的日益關注,以及建築和製造過程自動化的進步,對亞太施工機械租賃市場的成長產生了重大影響。每家公司都在向亞太市場推出自己的產品,並有望重振該市場。例如,

主要亮點

- 2022 年 5 月:總部位於杜拜的起重機和施工機械數位顛覆者 MYCRANE 宣布計劃在新加坡、泰國和印尼等主要亞太 (APAC) 市場推出全球首個線上起重機租賃平台。

施工機械租賃市場趨勢

施工機械的高成本推動市場成長

設備採購成本高、經濟不確定性增加、資本短缺、技術進步、不可預測的建築和基礎設施成長、折舊免稅額問題、昂貴的故障以及可用空間的缺乏都是推動租賃建築設備需求的因素。

由於馬達平土機的購買成本較高,許多小型企業更喜歡租賃馬達平土機。挖土機用途廣泛,並配有各種附件,這提高了生產力,是該行業成長的主要原因。第三方電子商務網站以低價提供低品質的機器,並鼓勵顧客購買其產品。這種低品質的設備可能會在短時間內面臨困難,增加了建築設備租賃市場的需求。

市場上有許多公司提供施工機械購買、銷售和租賃服務。例如,

- 2022 年 12 月:德國科技公司 UMT(United Mobility Technology AG)推出Smart Rental,這是一個基於行動電話應用程式的線上租賃市場。該公司表示,其「Car-2-Go」概念將允許客戶隨時在現場附近非接觸式地租用挖土機、隔膜、裝載機和其他施工機械。

主要已開發國家重點關注港口擴建、鐵路隧道、海底隧道,起重機需求不斷增加,帶動了施工機械租賃市場。

此外,建設產業的成長以及全球經濟狀況、預算和整體經濟等因素正在推動市場成長。這些方面的不可預測性影響了施工機械OEM和建築租賃設備業務。這導致租賃設備、二手設備和新設備的價格波動。

亞太地區預計將獲得顯著的市場佔有率

亞太地區是最大的市場之一,隨著各國政府越來越關注永續經濟的基礎設施發展,基礎設施和建築業的發展被認為正在蓬勃發展。該地區的經濟特區 (SEZ)、水力發電發電工程、水壩、高速公路建設、地鐵建設、機場等數量不斷增加,以維持高水準的工業活動、不斷成長的能源需求和改善的連結性。因此,一些國際公司開始在該地區投資和建立分銷中心和製造設施,以滿足不斷成長的需求並佔領當地市場。住友商事、日立、Caterpillar和利勃海爾等施工機械製造商提供租賃服務,具有競爭力的價格和技術先進設備的可用性使其成為多家地區和國家公司的熱門選擇,面臨著激烈的競爭。

然而,在COVID-19感染疾病期間,主要公共設施、醫院建設和基礎設施等關鍵政府建設計劃仍在繼續施工,但現場勞動力受到限制,以避免COVID-19的傳播。減少,進度放緩。因此,2020年,由於全球經濟成長放緩,施工機械租賃市場價值下降,施工進度也隨之延後。

目前,中國、英國、印度、美國等多國政府已開始核准跨城市的商業建設計劃,建築承包和施工機械租賃公司也逐漸開始繼續施工。為了提高工作效率並降低機器維護成本,設備租賃軟體解決方案為施工機械租賃公司提供了基礎。大多數國際公司已經開始使用這些軟體解決方案來追蹤業務效率、零件更換週期和準確的工時。

施工機械租賃業概況

施工機械租賃市場的特點是存在大量國家和地區參與者,導致市場環境高度分散。市場上的五家主要企業是 United Rentals Inc.、Ashtead Group PLC、Herc Rentals、H&E Equipment Services、Loxaman 和 Kanmoto。該市場主要受到併購和合資活動的推動。

- 2022 年 8 月:主要服務於風電產業的全方位服務起重機租賃公司 Atlas Crane Service, LLC 宣布,Ares Management 基礎設施機會策略管理的基金已購買該公司的控股權。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 市場限制因素

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔(市場金額)

- 依車型

- 土木工程設備

- 後鏟

- 裝載機

- 挖土機

- 其他土木工程設備

- 物料輸送

- 起重機

- 自動卸貨卡車

- 土木工程設備

- 依下驅動器類型

- 內燃機

- 混合型

- 依地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 供應商市場佔有率

- 公司簡介

- Herc Rentals Inc.

- H&E Equipment Services Inc.

- Loxam

- United Rentals Inc.

- Ashtead Group PLC

- Caterpillar

- Sumitomo Corp.

- Hitachi Construction Machinery(Hitachi Group)

- Liebherr International AG

- Kanamoto Co. Ltd

- CNH Industrial

- HSS Hire Group PLC

- Cramo Oyj

- Nishio Rent All Co.

第7章市場機會與未來趨勢

The Construction Equipment Rental Market size is estimated at USD 134.88 billion in 2024, and is expected to reach USD 170.92 billion by 2029, growing at a CAGR of 4.85% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in 2020, as construction activities were stopped during the lockdown period to contain the spread of the virus and maintain social distancing norms. Though, with the steady opening of economies, the demand is gaining back momentum in order to get the growth in GDP back on track. The governments are increasing their spending on construction activities which in turn is likely to drive the demand for construction equipment rental services.

The U.S. government passed the Infrastructure Investment and Jobs Act. This bill costs USD 1.2 trillion, including USD 550 billion for transportation, broadband, and utilities, USD 110 billion for roads, bridges, and other major infrastructure projects, and USD 40 billion for bridge repair and replacement. The bill also includes more than USD 65 billion in funding for power infrastructure, including USD 29 billion for the electricity grid. The bill authorizes federal investments in a variety of infrastructure projects, which are expected to increase demand for construction services, equipment, and materials. As a result, construction spending will rise by 5% in 2022 and 5.5% in 2023.

Similarly, the Chinese government invested USD 8,870 million in the Shanghai Chip Manufacturing Plant. In Shanghai, China, a 12-inch wafer manufacturing plant is being built as part of the project. Construction began in the first quarter of 2022 and is expected to be completed in the third quarter of 2024. The project aims to increase the 12-inch wafer production capacity to meet rising demand.

Over the medium term, the key factor propelling the growth of the market is the expanding construction industry, particularly in developing nations, due to several growth opportunities in residential, non-residential, and infrastructure sectors. For instance, the increase in construction of multi-family houses (with the growing trend of nuclear families), and increasing investments in the construction of expressways, bridges, metros, smart cities, highways, and roads, owing to increasing population and urbanization.

Furthermore, the rising trend toward automation is anticipated to fuel the growth of the market. However, factors such as stringent emission regulations for construction machinery are anticipated to hamper the growth of the market during the forecast period.

The growing emphasis on infrastructure, as well as the advancement of automation in construction and manufacturing processes, has had a significant impact on construction equipment rental market growth imn Asia Pacific. Players are launching thier products in the Asia-Pacific market which is also expectted to give boost to the market. For instance,

Key Highlights

- May, 2022: MYCRANE, a digital disruptor for cranes and construction equipment based in Dubai, has announced plans to launch the world's first online crane rental platform in key Asia-Pacific (APAC) markets such as Singapore, Thailand, and Indonesia.

Construction Equipment Rental Market Trends

High Cost of Construction Equipment is Driving the Growth of the Market

The high cost of purchasing equipment, increasing economic uncertainty, a lack of capital, technology advancement, unpredictable construction and infrastructure growth, depreciation woes, costly breakdowns, and a lack of available space are all factors driving the demand for rental construction equipment.

Owing to the high cost of purchasing motor graders, many smaller businesses prefer to rent them. Excavators are highly versatile and come with a variety of attachments, resulting in increased productivity, which is the primary reason for the industry's growth. Third-party e-commerce websites offer low-quality machines at low prices, enticing customers to purchase the products. This low-quality equipment may encounter difficulties in a short period, increasing the demand for the construction equipment rental market.

Many companies in the market are providing buying and selling services for construction equipment and also renting them. For instance,

- December, 2022: UMT (United Mobility Technology AG), a German technology company, has launched Smart Rental, an online rental marketplace based on a mobile phone App. Customers will be able to rent excavators, vibratory plates, loaders, and other construction equipment using the 'Car-2-Go' concept, which means close to their sites, at any time, and without contact, according to the company.

Major developed countries are focusing on port extension, railway tunnels, and underwater tunnels and are seeing more significant demand for cranes, thus driving the construction equipment rental market.

Moreover, the growing construction industry and several factors, like the global economic scenario, budgets, and overall economy, are promoting the market's growth. Unpredictability in these aspects affects the businesses of construction equipment OEMs, as well as construction rental equipment. This, in turn, is leading to price fluctuations of rental, used, and new equipment.

Asia-Pacific is Anticipated to Gain a Significant Market Share

Asia-Pacific is one of the largest markets that has perceived a boom in infrastructural and construction development because of the increasing emphasis by the governments on developing infrastructure for a sustainable economy. This region experienced growth in the number of Special Economic Zones (SEZs), hydroelectric projects, dams, highway constructions, metro construction, airports, etc., to sustain high-level industrial activities, growing energy demand, and better connectivity. As a result, several international players have started commencement to invest and are setting up distribution centers and manufacturing facilities in the region to meet the mounting demand and capture the regional market. Construction machinery manufacturers, such as Sumitomo Corporation, Hitachi, Caterpillar, and Liebherr, are offering rental services that face powerful competition from several regional and domestic players due to the competitive pricing and technologically advanced equipment availability.

However, during the COVID-19 pandemic, critical government construction projects, such as key utilities, hospital builds, and infrastructure, sustained work but at a slower pace with less labor force at the job site to avoid the spread of COVID-19. Therefore, in 2020, the value of the construction equipment rental market fell owing to a fall in global economic growth, which, in turn, is ensuing in a slowdown of construction work timelines.

Presently, construction contractors and construction equipment rental companies have gradually started to continue their construction works, as governments have begun giving approvals for commercial construction projects across the cities in many countries, like China, the United Kingdom, India, and the United States. To ramp up the efficiency of work and decrease the maintenance cost of the machinery, equipment rental software solutions provide a base for construction machinery rental companies. Most international companies have already begun using these software solutions to track operation efficiency, parts replacement cycle, and precise working hours.

Construction Equipment Rental Industry Overview

The construction equipment rental market is characterized by the presence of numerous domestic and regional players, resulting in a highly fragmented market environment. The five key players in the market are United Rentals Inc., Ashtead Group PLC, Herc Rentals, H&E Equipment Services, Loxaman, and Kanamoto Co. Ltd. The market is highly driven by mergers and acquisitions and joint venture activities.

- August, 2022: Atlas Crane Service, LLC, a full-service crane rental company primarily serving the wind industry, announced that a fund managed by Ares Management's Infrastructure Opportunities strategy has purchased a controlling interest in the Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Values in USD Million/Billion)

- 5.1 By Vehicle Type

- 5.1.1 Earth Moving Equipment

- 5.1.1.1 Backhoe

- 5.1.1.2 Loaders

- 5.1.1.3 Excavators

- 5.1.1.4 Other Earthmoving Equipment

- 5.1.2 Material Handling

- 5.1.2.1 Cranes

- 5.1.2.2 Dump Trucks

- 5.1.1 Earth Moving Equipment

- 5.2 By Drive Type

- 5.2.1 IC Engine

- 5.2.2 Hybrid Type

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Herc Rentals Inc.

- 6.2.2 H&E Equipment Services Inc.

- 6.2.3 Loxam

- 6.2.4 United Rentals Inc.

- 6.2.5 Ashtead Group PLC

- 6.2.6 Caterpillar

- 6.2.7 Sumitomo Corp.

- 6.2.8 Hitachi Construction Machinery (Hitachi Group)

- 6.2.9 Liebherr International AG

- 6.2.10 Kanamoto Co. Ltd

- 6.2.11 CNH Industrial

- 6.2.12 HSS Hire Group PLC

- 6.2.13 Cramo Oyj

- 6.2.14 Nishio Rent All Co.