|

市場調查報告書

商品編碼

1437962

越野車:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Off-road Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

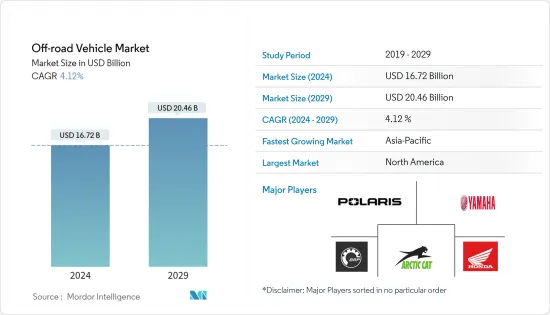

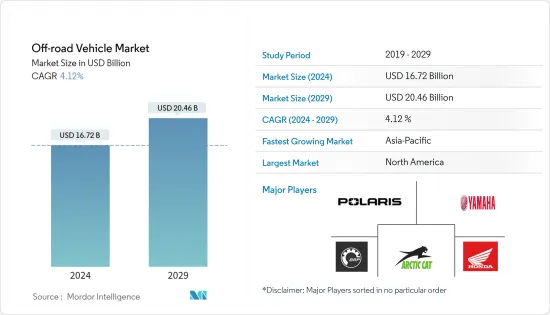

越野車市場規模預計到 2024 年為 167.2 億美元,預計到 2029 年將達到 204.6 億美元,預測期內(2024-2029 年)複合年成長率為 4.12%。

COVID-19 大流行打擊了市場,因為封鎖和旅行限制導致需求放緩。 然而,在大流行之後,隨著限制的放鬆,娛樂和體育活動開始出現積極的趨勢。 因此,預計在預測期內對越野車的需求將增加。

越野運動的日益普及以及對堅固、緊湊設備的需求增加了對越野車輛的需求。此外,越野車在農業、採礦、建築等領域擁有廣泛的用戶,預計未來將出現樂觀成長。此外,最低的維護成本、減少的燃料消費量和較低的保險成本推動了建設產業對這些車輛的需求。

由於全地形車和UTV不允許在高速公路和其他高速公路上行駛,政府官員正在分配更多資金來建造新的越野步道。這有利於休閒愛好者,並有潛力促進世界各地的冒險運動活動。預計這將推動市場。此外,公司也致力於推出功能改進的新產品,以吸引更多客戶並獲得市場競爭優勢。

電力傳動系統等新技術的發展為越野車市場創造了新的成長機會。由於對排放氣體的日益擔憂,電動越野車的日益普及將推動越野車產業的發展。

由於該地區消費者需求不斷成長,預計北美仍將是越野車的最大市場,其次是歐洲。在亞太地區,由於高普及和蓬勃發展的汽車產業,越野車市場預計將成長最快,特別是中國和印度預計將增加越野車的產量。

越野車市場趨勢

全地形車區隔市場可能會顯著成長

隨著汽車製造商開發適用於多種最終用途的全地形車,全地形車市場正在快速成長。人們對體育和休閒日益成長的興趣是該行業的重要驅動力。此外,製造商對各種環保版本開發不斷進步的興趣可能會提振市場。

2022年8月,北極星在印度推出了全新旗艦RZR(R) Pro R Sport ATV車型。新款 ATV 由強大的 1997 cc 4 衝程 DOHC 直列 4 缸引擎提供動力,可提供 225 bhp 的最大功率。 2022 年,Arctic Cat 推出了四種不同裝飾等級的全新 Alterra 600 ATV。 2021 年 4 月,北極貓於 7 月向經銷商宣布推出一款新型 ATV,作為其 2022 年車型陣容的一部分。新款 Alterra 600 EPS 採用全新引擎、傳動系統和底盤,可提高動力、更好的操控性和更輕鬆的維護。 ATV 的推出恰逢 Arctic Cat 為強力運動提供創新產品 60 週年。 2020 年 9 月,Yamaha推出了最新的 ATV 車型:Grizzly 2021 年車型以及 Kodiak 700 和 450 車型。該公司提供 Armor Grey Grizzly 90(建議零售價 3,099 美元)、Team Yamaha藍白 Raptor 90(建議零售價 3,099 美元)和 Team Yamaha藍白YFZ50(建議零售價2,199 美元)等產品,並宣布了2021 年青少年ATV 產品陣容。 2020年9月,北極星宣布與零馬達成立合資公司,開發電動全地形車和雪上摩托車。

ATV市場佔有率預計將穩定成長。這是由於管理和定義全地形車使用標準的規則和法規發生了變化。總部位於加州的非營利組織和監管機構,例如全地形車安全研究所 (ASI),制定了正確使用全地形車的法規,並要求使用核准的產品和配件,例如安全帶、腳踏板、頭盔和緊急開關。 。

預計北美將在市場上佔據顯著佔有率

預計在預測期內,北美地區將在越野車市場中佔據重要佔有率。儘管受到疫情影響,2020年北美市場的銷售依然非常強勁,由於年輕人對運動和休閒的偏好增加,全地形車的強勁成長。

休閒支出的增加和越野活動數量的增加是推動該地區全地形車市場的因素。此外,以不同價格提供多種產品預計將推動其在預測期內的成長。

2022年3月,北極星推出了首款由零馬達動力傳動系統總成驅動的全尺寸電動Ranger UTV,預計將於年終上市。 2022年2月,美國Landmaster進入電動UTV競爭。提供牽引力為 1,200 磅的電動UTV,有 2 門和 4 門版本,具有 4X2 駕駛模式。 2022 年 2 月,Segway 強力運動將 Fugleman Side-by-Side 的供貨範圍擴大到美國40 多家經銷商。 2020年6月,川崎公佈了2020年MULE和ATV系列產品陣容。包括 Brute Force ATV 系列、MULE PRO 和 SX 系列。為了減少損害的影響,休閒越野車協會 (ROHVA)、美國消費品安全委員會 (CPSC) 和美國環保署 (EPA) 等監管機構頒布了多項法規。關於 ATV 使用和乘員安全。因此,政府舉措和年輕人對休閒濃厚的興趣預計將在預測期內推動該地區越野車市場的成長。

越野車產業概況

越野車市場由眾多參與者主導。該行業的主要市場相關人員正在強調推出新產品和技術以吸引全球客戶。 Arctic Cat、Polaris Industries 和 Bombardier Recreational Products (BRP) 等大公司已經佔據了相當大的市場佔有率。電動全地形車和UTV預計將在未來幾年為產業參與者提供利潤豐厚的機會。

- 2022 年 3 月,Polaris 擴大了其在俄亥俄州威爾明頓的分銷設施。透過此次擴張,該公司加強了在北美的分銷能力,擴大了產品種類,改善了交付、客戶服務,並最佳化了業務。

- 2022 年 2 月,Polaris Inc. 與全球領先的電動車 (EV) 充電和能源管理解決方案提供商 Wallbox NV 合作。透過此次合作,Wallbox 將為美國和加拿大的 Polaris 電動車提供充電解決方案。

- 2021 年 3 月,北極貓宣布推出 2022 年雪上摩托車系列。全新 Thundercat 是首款提供電子動力方向盤(EPS) 的高性能渦輪增壓雪橇。 BLAST 系列迎來了兩款新的雪橇產品,其中包括第一款中型旅行雪橇 BLAST XR 4000 和 BLAST XR Touring 4000。

- 2021年3月,BRP在未來五年內投資3億美元,計畫在年終前實現現有產品線的電動。 BRP 內部開發了 Rotax 模組化電動組技術。這可能會在所有產品線中得到利用。

- 2020年11月,美國Landmaster宣布了2021年全新的並排陣容,名為Landmaster。 2021 年 Landmaster UTV 配備了 30 多項受客戶和經銷商啟發的新功能、一流的懸吊系統、汽車級組件和耐候電氣系統。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 市場限制因素

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 依車型

- 全地形車(ATV)

- 多用途作業車(UTV)

- 依用途

- 運動的

- 農業

- 其他用途

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭形勢

- 供應商市場佔有率

- 公司簡介

- Polaris Inc.

- Bombardier Recreational Products Inc.

- Yamaha Motor Corporation

- Arctic Cat Inc.

- Kawasaki Motors Corp.

- Suzuki Motor Corporation

- American LandMaster

- Kwang Yang Motor Co. Ltd

- Honda Company Motor Ltd

第7章市場機會與未來趨勢

The Off-road Vehicle Market size is estimated at USD 16.72 billion in 2024, and is expected to reach USD 20.46 billion by 2029, growing at a CAGR of 4.12% during the forecast period (2024-2029).

The COVID-19 pandemic hurt the market as lockdowns and travel restrictions resulted in a slowdown in demand. However, post-pandemic, as restrictions eased, recreational and sports activities started seeing positive trends. Due to this, the demand for off-road vehicles is expected to increase during the forecast period.

The growing popularity of off-road sports and the need for robust, compact equipment are elevating the demand for off-road vehicles. Moreover, as off-road vehicles have a wide range of users across the agriculture, mining, construction, and other sectors, they are expected to witness optimistic growth. Additionally, minimal maintenance costs, reduced fuel consumption, and low insurance costs will aid the demand for these vehicles in the construction industry.

ATVs and UTVs are not allowed to operate on highways and other main roads, so government authorities have allocated more funds to build new off-road trails, which may be useful for recreational enthusiasts and boost adventure sports activities worldwide. This is expected to drive the market. In addition, companies are also focusing on introducing new products with improved features to attract more customers and gain a competitive position in the market.

New technological developments, such as electric drive trains, will create new growth opportunities for the off-road vehicles market. The growing popularity of electric off-road vehicles owing to rising emission concerns will spur the off-road vehicles industry.

North America is expected to remain the largest market for off-road vehicles, followed by Europe, owing to growing consumer demand in the region. Asia-Pacific is expected to witness the fastest growth in the off-road vehicle market, owing to the high adoption rate and the booming automotive sector, leading to increased production of off-road vehicles, especially in China and India.

Off-Road Vehicle Market Trends

The All-Terrain Vehicle Segment is Likely to Witness Significant Growth

The ATV market is growing rapidly as vehicle manufacturers are developing ATVs for many end-use applications. The increasing interest of people in sports and recreational activities has emerged as a significant driving factor for the segment. Moreover, manufacturers' interest in frequent advancements in the development of various eco-friendly vehicle versions is likely to boost the market.

In August 2022, Polaris launched a new flagship RZR (R) Pro R Sport ATV model in India. The new ATV has a powerful 1997 cc 4-stroke DOHC inline four-cylinder engine responsible for delivering 225 bhp of maximum power. In 2022, Arctic Cat introduced the new Alterra 600 ATV in four different trim levels. In April 2021, Arctic Cat announced a new ATV as part of its model year 2022 line-up for dealerships in July. The new Alterra 600 EPS features an all-new engine, drivetrain, and chassis offering, with increased power, better handling, and easier servicing. The launch of the ATV coincides with Arctic Cat's 60th anniversary of bringing new and innovative products to power sports. In September 2020, Yamaha unveiled its latest ATV models, the Grizzly 2021 and Kodiak 700 and 450 models. The company unveiled its 2021 Youth ATV lineup, including the Grizzly 90 in Armor Gray (USD 3,099 MSRP), Raptor 90 in Team Yamaha Blue and White (USD 3,099 MSRP), and YFZ50 in Team Yamaha Blue and White (USD 2,199 MSRP). In September 2020, Polaris announced entering a joint venture with Zero Motorcycles to develop electric ATVs and snowmobiles.

ATVs' market share is projected to witness steady growth. This is owing to the change in the rules and regulations that govern and define the standards in the way ATVs are used. Regulatory authorities, such as the California-based non-profit organization and the All-terrain Vehicle Safety Institute (ASI), determine proper ATV usage regulations and promote approved products and accessories, such as seatbelts, footrests, helmets, and kill switches.

North America is Expected to Hold a Prominent Share in the Market

The North American region is anticipated to hold a significant share of the off-road vehicle market during the forecast period. Despite the pandemic, in 2020, the North American market had a very successful year in sales, with significant growth seen in all-terrain vehicles as the preference for sports and recreational activities rose among youth.

The increasing recreational expenditure and the increasing number of off-roading events are the factors driving the ATV market in the region. Furthermore, the availability of a wide range of products at varied prices is anticipated to enhance growth during the forecast period.

In March 2022, Polaris Inc. showed the testing of the first full-size off-road electric RANGER UTV with a Zero Motorcycles powertrain, which will be launched by the end of 2022. In February 2022, American Landmaster joined the electric UTV fray to provide electric-powered UTVs with a towing capacity of 1,200 LBS in 2-door and 4-door versions in 4X2 driving mode. In February 2022, Segway Powersports expanded the availability of Fugleman side-by-side to over 40 dealerships across the United States. In June 2020, Kawasaki unveiled the 2020 line-up for its MULE and ATV range of vehicles. It consists of the Brute Force ATV line-up, MULE PRO, and SX series. In order to reduce the impact of the hindrances, regulatory authorities, such as the Recreational Off-Highway Vehicle Association (ROHVA), the United States Consumer Product Safety Commission (CPSC), and the US Environmental Protection Agency (EPA), established numerous regulations regarding the use of ATVs and occupant safety. Thus, government initiatives and the growing interest of the youth in recreational events are the factors expected to drive the growth of the off-road vehicles market in the region during the forecast period.

Off-Road Vehicle Industry Overview

The off-road vehicle market is dominated by numerous players. The key market players in the industry emphasize introducing new products and technologies to attract customers worldwide. Some of the major players, like Arctic Cat, Polaris Industries, and Bombardier Recreational Products (BRP), captured significant shares of the market. Electric ATVs and UTVs are expected to offer lucrative opportunities for players in the industry over the coming years.

- In March 2022, Polaris Inc. expanded its distribution facility in Wilmington, Ohio. Through this expansion, the company enhanced distribution capacity, expanded product assortment, improved delivery, customer service, and optimized operations across North America.

- In February 2022, Polaris Inc. collaborated with Wallbox N.V., a leading provider of electric vehicle (EV) charging and energy management solutions worldwide. Through this collaboration, Wallbox provides charging solutions for Polaris electric vehicles in the United States and Canada.

- In March 2021, Arctic Cat announced the launch of the 2022 snowmobile line-up. The new Thundercat offers electronic power steering (EPS) for the first time on a high-performance, turbocharged sled. The BLAST line-up welcomes two new sleds to the family with the addition of the BLAST XR 4000 and BLAST XR Touring 4000, the first mid-sized touring sled.

- In March 2021, BRP invested USD 300 million over the next five years to electrify its existing product lines by the end of 2026. BRP developed its Rotax modular electric powerpack technology in-house, which may be leveraged across all product lines.

- In November 2020, American Landmaster revealed its all-new line-up of 2021 side-by-sides called the Landmaster. The 2021 Landmaster UTVs are equipped with over 30 new customer and dealer-inspired features, a best-in-class suspension system, automotive-grade components, and a weather-sealed electrical system.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Billion)

- 5.1 By Vehicle Type

- 5.1.1 All-terrain Vehicle (ATV)

- 5.1.2 Utility Task Vehicle (UTV)

- 5.2 By Application

- 5.2.1 Sports

- 5.2.2 Agricultural

- 5.2.3 Other Applications

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Polaris Inc.

- 6.2.2 Bombardier Recreational Products Inc.

- 6.2.3 Yamaha Motor Corporation

- 6.2.4 Arctic Cat Inc.

- 6.2.5 Kawasaki Motors Corp.

- 6.2.6 Suzuki Motor Corporation

- 6.2.7 American LandMaster

- 6.2.8 Kwang Yang Motor Co. Ltd

- 6.2.8.1 Honda Company Motor Ltd