|

市場調查報告書

商品編碼

1436139

OHV(越野車)遠端資訊處理:全球市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Global Off-Highway Vehicle Telematics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

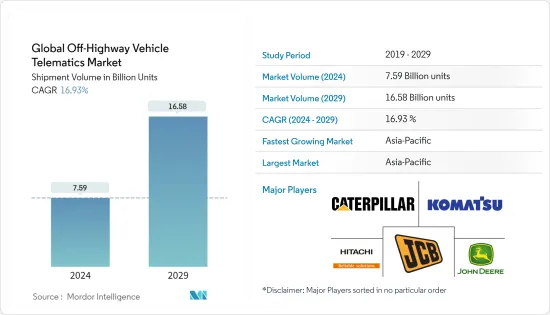

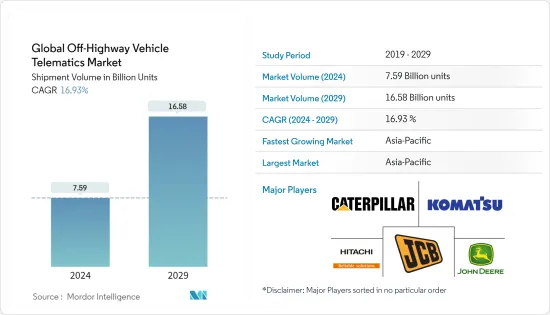

以出貨量計算的全球 OHV(越野車)遠程資訊處理市場規模預計將從2024 年的75.9 億輛成長到2029 年的1.65 億輛,預測期(2024-2029 年)複合年成長率為16.93%。預計將成長至8000萬台。

OHV 遠端資訊處理市場涵蓋建築、採礦、農業和林業中使用的各種設備,包括專用重型設備、輕型裝備和其他車輛。 OHV 遠端資訊處理設備可透過 GPS、蜂窩或衛星連接存取即時設備資料,OHV 遠端資訊處理解決方案可永續監控設備位置、狀態、運作狀況和使用情況。

主要亮點

- OHV 市場由各種工具組成,包括專用重型設備、輕型設備以及用於建築、採礦、農業和林業的其他車輛。 OHV 遠端資訊處理是指為遠端監控和管理這些領域使用的機器和設備而部署的遠端資訊處理硬體和相關軟體解決方案。

- 該行業的主要驅動力是對 OHV資料分析需求的增加、生產力和利用率的提高以及與維護和維修相關的營運成本的降低。由於技術的進步,遠端資訊處理行業得到了快速發展。升級到4G和5G網路在頻寬、更快的資料上傳和反饋下載方面提供了全新的體驗,從而實現更多的即時資料集、即時駕駛員安全、車隊維護以及提高車隊效率。市場領導提供強大的基於位置的服務 (LBS) 和遠端資訊處理功能,作為直覺且全面的 OHV 遠端資訊處理解決方案的一部分。

- OHV 遠端資訊處理市場受到先進的地區法規的推動,為非越野車配備遠端資訊處理,以改善對車輛排放、燃油排放、駕駛時間法規和事故偵測的追蹤。遠端資訊處理解決方案在重型設備、公路設備和非公路設備產業中越來越受歡迎。目前,各大汽車製造商都將遠端資訊處理系統作為標準配置,而這種趨勢正在蔓延到其他車型和設備類別。

- 遠端資訊處理設備可以即時監控 OHV 及其駕駛員。大多數車隊經理和越野車駕駛員對於在車輛中部署遠端資訊處理設備猶豫不決,認為這是對隱私的侵犯。遠端資訊處理系統收集和傳輸有關速度變化、不良駕駛習慣、即時追蹤、車輛診斷等的資料。此外,由於車輛營運商對安裝追蹤器相關法律影響的不確定性不斷增加,預計全球非高度車輛(OHV)遠端資訊處理市場的成長將很快受到限制。

- COVID-19的不確定性影響了所有車輛領域,導致區域封鎖、路線關閉和運輸組織崩壞。此外,由於封鎖和病毒的傳播迫使人們待在室內,OHV遠端資訊處理市場因疫情而面臨的財務脆弱性比之前的疫情爆發期間要高得多。隨著企業車隊擁有的車輛數量增加,在苛刻的商業環境中有效管理車隊的課題和壓力也越來越大,這可能會推動 OHV 遠端資訊處理市場的發展。

OHV 遠距資訊處理市場趨勢

建築業仍然是最大的行業

- 公共和私營部門建設活動的擴大預計將很快推動市場成長。印度、菲律賓、阿拉伯聯合大公國、沙烏地阿拉伯、埃及、奈及利亞和美國等國家正在或計劃建造多個基礎設施相關計劃,例如印度政府正計劃建造100個智慧城市。投資6,500億美元用於該國的各種城市和基礎設施計劃。基礎設施計劃的快速發展預計將增加對施工機械的需求並支持 OHV 遠端資訊處理市場的成長。

- 建設產業正在進行的數位轉型正在推動技術的採用,並為遠端資訊處理市場創造新的機會。根據 NBS Enterprises Ltd 的《2021 年數位化建設報告》,46% 的受訪者已經致力於數位轉型計畫一段時間,17% 的受訪者預計將完成該計畫。

- 在重型設備製造商提供的OEM遠端資訊處理系統的推動下,建築業佔據了最大的佔有率。施工機械遠端資訊處理允許建設公司追蹤施工機械的位置和性能,並監控施工機械的使用情況,以確保資產有效利用。儘管印度等新興國家爆發了第二波COVID-19大流行,但根據統計和規劃部的數據,印度建築業在2021年第三季仍錄得68.3%與前一年同期比較成長。實施(MoSPI)對市場成長做出了重大貢獻。

- 資產管理和駕駛員管理問題使得車隊管理解決方案在建築工地上變得至關重要。根據中小型企業車隊管理軟體公司 Vimcar 進行的一項調查(2021 年 8 月),三分之一的施工經理的車隊車輛被盜,87% 的施工經理失去了車隊營運的整體情況。在員工不知道自己在做什麼的情況下限制他們使用車輛。

- 根據 Verizon Connect 車隊技術趨勢報告 2021,51% 的建築終端用戶使用 GPS 車隊追蹤,57% 使用車載影片來降低事故成本並提高駕駛員安全,43% 使用保險實現了成本降低。

- 建設產業事故數量的增加增加了對車隊管理行業的需求。根據健康與安全執行局 2021 年的研究,英國建設產業死亡人數為 39 人(是英國所有行業中死亡人數最多的)。

亞太地區成長率最高

- 中國和印度等亞洲國家人口不斷成長,但遠端資訊普及較低,因此對更好的公共基礎設施的需求日益增加。人們越來越認知到遠端資訊處理系統在 OHV 中的重要性以及這些國家的快速發展,預計將在不久的將來提供重大的成長機會。此外,許多製造商正在推出配備遠端資訊處理系統的 OHV,以利用該地區利潤豐厚的市場。

- 這些經濟體的政府正積極投資基礎設施發展計劃。例如,「Bharatmalayojana」包括改善全國公路網的規定。同樣,印尼政府正在實施 20 多個計劃,透過建造更好的道路、住宅、醫院和其他必要的基礎設施來發展 52,000 多個農村地區。這些正在進行的和提案的基礎設施開發計劃投資預計將推動越野車的需求,並推動 OHV 遠端資訊處理解決方案市場的成長。

- 預計在預測期內,中國的挖土機和其他施工機械市場將會成長。 2021年施工機械銷售強勁的主要原因是政府在地方政府基礎設施計劃上的支出。例如,全國各地的城市都在擴大地鐵和其他城市交通系統。

- 此外,根據國家發展和改革委員會的數據,2021年前10個月重卡銷量成長40%至137萬輛。聯合卡車年銷量預計將增至 160 萬輛。在供應商方面,威伯科控股公司 (WABCO Holdings Inc.) 和 G7 宣布,雙方已同意在中國成立一家合資企業,開發和銷售先進的卡車和拖車車隊管理系統。

- MFTBC 多年來一直提供卡車“Truck Connect”。此協作平台可讓操作員查看車輛位置、安全評分、車輛使用情況和消費量等即時資訊。此外,它的開發目的是透過即時遠端診斷來檢測技術故障。根據與 Wise Systems 達成協議,MFTBC 將添加路線和調度解決方案,以最佳化最後一哩的交付。靈活使用任何品牌或類型的車輛,包括越野車輛。

OHV 遠端資訊處理產業概述

競爭公司之間的競爭強度非常高,多個參與者在一個相當競爭的領域中爭奪市場佔有率。隨著新參與企業尋求提供專業服務和創新經營模式,競爭預計將進一步加劇。OEM正在進入遠端資訊處理領域,向車隊所有者提供本土遠端資訊處理硬體和軟體作為捆綁解決方案。這給售後市場供應商造成了艱難的處境。

- 2022 年 1 月,喜利得和 TrackUnit 宣佈建立策略合作夥伴關係,以有效消除停機時間。喜利得和 TrackUnit 已建立合作夥伴關係,推動建設產業的數位轉型,重點是為工具和設備連接領域帶來全球規模。 Trackunit 還可以擴展遠端資訊處理連接設備。

- 2021 年 11 月 - 日立建機英國提供 Hitachi ZX135US-7,協助建設公司實現零碳建築工地的目標。 ZX135US-7 配備了最新的 Stage V 引擎和 TRIAS III 泵浦技術,這是機器的標準配備。它還配備了半自動 Leica Geosystems 機器控制裝置、Xwatch 5 高度和迴轉限制器以及 Hitachi 即時 CT Fleet Link 遠端資訊處理系統,並由加氫處理植物油 (HVO) 燃料提供動力。 HCMUK 正在證明它可以幫助為永續性鋪平道路。

- 2021年10月-日本小松公司公司及其完全子公司日本小松公司 Europe International NV宣布,自動運輸系統(AHS)日本小松公司Front Runner是歐洲AITIC的930E-5超級運輸卡車之一,並宣布將於2021年10月推出。該平台。最大的露天銅礦位於瑞典北部,由瑞典公司 Boliden Komatsu 擁有。 Boliden Komatsu 的 Front Runner AHS 方法將頂級自動卸貨卡車與 ModulaMining 業界領先的 DISPATCH 車隊管理系統相結合。該系統100%符合經過驗證的最佳化調查方法。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 監管和OEM擴散

- 加大技術開發力度

- 市場限制因素

- 最終用戶越來越不願意改變業務實踐

- 缺乏使用重型設備的培訓

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭公司之間的敵意強度

- 替代品的威脅

- 法規和義務

- 評估 COVID-19 對市場的影響

第5章 OHV車聯網技術及解決方案

第6章市場區隔

- 依最終用戶產業

- 建造

- 農業

- 礦業

- 林業

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭形勢

- 公司簡介

- Caterpillar

- Komatsu

- JCB

- Hitachi Construction Machinery

- Deere &Company

- SANY Group

- Volvo Construction Equipment

- Doosan Corporation

- Liebherr

- CNH Industrial

- CLAAS Group

- Hyundai Motor Group

- Tadano Ltd

- AGCO

- Geotab Inc.

- MiXTelematics International

- Verizon Connect

- Trimble Inc.

- Omnitracs LLC

- ACTIA group

- Airbiquity Inc.

- UK Telematics

- Bridgestone Europe NV/SA(TomTom)

- Webfleet Solutions BV(Bridgestone Corp.)

- Teletrac Navman

- KeepTruckin Inc.

- Skylo Technologies

- Geoforce Inc.

- Orbcomm Inc.

- Samsara Networks Inc.

第8章投資分析

第9章市場機會與未來趨勢

The Global Off-Highway Vehicle Telematics Market size in terms of shipment volume is expected to grow from 7.59 Billion units in 2024 to 16.58 Billion units by 2029, at a CAGR of 16.93% during the forecast period (2024-2029).

The off-highway vehicle telematics market covers a wide range of equipment utilized in the construction, mining, agriculture, and forestry industries, including specialist heavy machinery, lighter gear, and other vehicles. By using off-highway vehicle (OHV) telematics devices that allow GPS, cellular, or satellite connectivity for access to real-time equipment data, off-highway vehicle telematics solutions offer continuous monitoring of the position, condition, health, and utilization of equipment.

Key Highlights

- The market for off-highway vehicles consists of various tools, including specialized heavy machinery, lighter equipment, and other vehicles used in the construction, mining, agriculture, and forestry industries. Off-highway vehicle telematics refers to telematics hardware and associated software solutions deployed for remote monitoring and managing fleets of machinery and equipment used in these sectors.

- The main drivers of this industry are the increasing demand for OHV data analysis, increased productivity and utilization, and decreased operational costs related to maintenance and repairs. The telematics industry has been developing quickly as a result of technological improvements. An entirely new experience in terms of bandwidth, faster data uploads, and feedback downloads are provided by upgrading to 4G and 5G networks, leading to more real-time data sets, real-time driver safety, fleet maintenance, and fleet efficiency. Market leaders provide robust location-based services (LBS) and telematics capabilities as part of an intuitive, all-inclusive OHV telematics solution.

- The off-highway vehicle telematics market is driven by regulations in developed regions to equip off-highway vehicles with telematics for improved tracking of vehicle emissions, fuel emissions, driver hour regulation, and accident detection. Telematics solutions are becoming more popular in the heavy-duty, on-highway, and off-highway equipment industries. Major automakers are now including telematics systems as standard equipment on their vehicles, and this trend is spreading to additional models and equipment categories.

- Real-time monitoring of off-highway vehicles and their drivers is made possible by telematics devices. Most fleet managers and off-road vehicle drivers view this as an invasion of privacy and are hesitant to deploy telematics devices in their fleets. Telematics systems gather and send data about, among other things, changes in speed and difficult driving habits, real-time tracking, and vehicle diagnostics. Furthermore, the worldwide off-high vehicle (OHV) telematics market growth is anticipated to be constrained shortly because of growing uncertainty among fleet operators regarding the legal implications associated with the installation of trackers.

- The uncertainty of COVID-19 impacted all vehicle segments and has resulted in regional lockdowns, line closures, and the disintegration of transportation organizations. Furthermore, the financial vulnerability of the off-highway vehicle telematics market due to the pandemic is much higher than it was in previous outbreaks as the lockdown and the virus spread are forcing people to stay indoors. With the increasing number of vehicles owned by corporate fleets, the challenges and pressures to effectively manage the fleet in a challenging business environment are increasing, which could drive the OHV Telematics Market.

Off-Highway Vehicle Telematics Market Trends

Construction Segment remains the biggest sector

- Growing construction activities in private as well as public sectors are expected to boost market growth soon. There are several infrastructure-related projects underway or planned across the globe in countries such as India, the Philippines, UAE, Saudi Arabia, Egypt, Nigeria, and the U.S. For Instance, the government of India is expected to invest US$ 650 billion in various urban and infrastructure projects in the country to build one hundred smart cities. This rampant development in infrastructure projects is expected to boost the demand for construction equipment, which in turn, is expected to support the growth of the Off-Highway vehicle telematics market.

- The ongoing digital transformation in the construction industry is driving the adoption of technologies and creating new opportunities for the telematics market. According to the Digital Construction Report 2021 by NBS Enterprises Ltd, 46% of the respondents have been on a digital transformation journey for some time, with 17% well on the way to completion.

- The construction sector accounts for the largest share, driven by OEM telematics systems offered by heavy equipment manufacturers. Construction equipment telematics allows construction firms to track the equipment's location and performance and monitor construction equipment utilization and ensure that assets are being used efficiently. In developing countries, such as India, despite the outbreak of the second wave of the COVID-19 pandemic, the construction industry in India registered a year-on-year growth of 68.3% in Q3 2021, according to the Ministry of Statistics and Programme Implementation (MoSPI), which significantly added to the market growth.

- Fleet management solutions have become essential in construction due to the issues of asset management and driver management. According to a survey conducted by Vimcar (August 2021), a fleet management software company for SMEs, one in three construction managers stole fleet vehicles, while 87% restrict employee vehicle usage without a full picture of how the fleet operates.

- According to Verizon Connect Fleet Technology Trends Report 2021, 51% of the construction end-users utilize GPS fleet tracking, 57% credit in-cab video for reduced accident costs and improved driver safety, and 43% saw reduced insurance costs.

- The increasing number of accidents in the construction industry is driving the demand for the fleet management industry. According to a 2021 survey by Health and Safety Executive, in Great Britain, there were 39 fatalities in the construction industry (the most of any sector in the United Kingdom).

Asia Pacific To Exhibit The Highest Growth Rate

- The growing population in Asian countries, such as China and India, drives the need for better public infrastructure as the penetration of telematics is low. Increasing awareness regarding the significance of telematics systems in OHV and rapid development in these countries is expected to provide major growth opportunities in the near future. Moreover, numerous manufacturers are launching OHV equipped with telematics systems, in order to capitalize on the lucrative market in the region.

- Governments of these economies are aggressively investing in infrastructure development projects. For example, the "Bharatmala Yojana" includes provisions for improving road networks throughout the country. Similarly, The Indonesian government has more than 20 projects for developing more than 52,000 rural villages by building better roads, houses, hospitals, and other necessary infrastructure. These ongoing and proposed investments in infrastructure development projects are expected to drive the demand for off-highway vehicles, which is expected to boost the growth of the market for off-highway vehicle telematics solutions.

- The market for excavators and other construction machinery is expected to grow in China during the forecast period. Government expenditure on municipal infrastructure projects is the key reason for healthy construction machinery sales in 2021. For instance, the cities around the country are expanding subways and other urban transportation systems.

- Further, according to the National Development and Reform Commission, heavy-duty truck sales grew by 40% to 1.37 million in the first ten months of 2021. Allied sales are expected to grow to 1.6 million for the year. On the vendor front, WABCO Holdings Inc. and G7 announced an agreement to form a joint venture in China to develop and sell advanced fleet management systems for trucks and trailers.

- MFTBC has, since long, been offering its trucks Truckonnect. The allied platform allows the operators to check real-time information, such as vehicle location, safety scores, vehicle utilization, and fuel consumption. Additionally, it was developed to detect technical failures through real-time remote diagnosis. After an agreement with Wise Systems, MFTBC plans to add routing and dispatching solutions that optimize the last mile of deliveries. It offers flexibility to use vehicles of all brands and types, including off-highway vehicles.

Off-Highway Vehicle Telematics Industry Overview

The intensity of competitive rivalry is high, with multiple players vying for market share in a fairly contested space. The competition is expected to increase further with newer players looking to offer specialized offerings and innovative business models. The OEMs are venturing into the telematics space by offering in-house development of telematics hardware and software as a bundled solution to the fleet owners. This is creating a tough spot for aftermarket vendors.

- In Jan 2022, Hilti and Trackunit announced a strategic partnership to eliminate downtime effectively. Hilti and Trackunit have formed a partnership to advance digital transformation in the construction industry focused on bringing global scale to the tool and equipment connectivity domain. It will also enable Trackunit to expansion in their telematics connectivity devices.

- November 2021 - Hitachi Construction Machinery UK is providing a Hitachi ZX135US-7, which will help the construction company move towards its goal of a zero-carbon construction site. The ZX135US-7 has the latest Stage V engine and TRIAS III pump technology that is standard on the machine; it was also equipped with semi-automated Leica Geosystems machine control, Xwatch 5 height, and slew limiter Hitachi's real-time CT fleet link telematics system and fueled with Hydrotreated Vegetable Oil (HVO) fuel; demonstrating that HCMUK can help to pave the way for sustainability.

- October 2021 - Komatsu Ltd and its wholly-owned subsidiary, Komatsu Europe International NV, announced that Komatsu FrontRunner, an autonomous haulage system (AHS), will be deployed on 11 930E-5 ultra-class haul trucks at Aitik, one oEurope's'soEurope's's largest open-pit copper mines, located in northern Sweden and owned by the Swedish company BolidenKomatsu's'sBolidenKomatsu's's approach for FrontRunner AHS brings together ultra-class dump trucks with ModulaMining's'sModulaMining's's industry-leading DISPATCH Fleet Management System, the preferred management system. The system enables 100% compliance with its proven optimization methodology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Regulations and OEM Proliferation

- 4.2.2 Increase in Technological Developments

- 4.3 Market Restraints

- 4.3.1 Growing Reluctance of End Users to Change Business Practices

- 4.3.2 Lack of Training for the Use in Heavy Equipment

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Intensity of Competitive Rivalry

- 4.4.5 Threat of Substitutes

- 4.5 Regulations and Mandates

- 4.6 Assessment of Impact of COVID-19 on the Market

5 OFF-HIGHWAY VEHICLE TELEMATICS TECHNOLOGIES AND SOLUTIONS

6 MARKET SEGMENTATION

- 6.1 By End-User Industry

- 6.1.1 Construction

- 6.1.2 Agriculture

- 6.1.3 Mining

- 6.1.4 Forestry

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Caterpillar

- 7.1.2 Komatsu

- 7.1.3 JCB

- 7.1.4 Hitachi Construction Machinery

- 7.1.5 Deere & Company

- 7.1.6 SANY Group

- 7.1.7 Volvo Construction Equipment

- 7.1.8 Doosan Corporation

- 7.1.9 Liebherr

- 7.1.10 CNH Industrial

- 7.1.11 CLAAS Group

- 7.1.12 Hyundai Motor Group

- 7.1.13 Tadano Ltd

- 7.1.14 AGCO

- 7.1.15 Geotab Inc.

- 7.1.16 MiXTelematics International

- 7.1.17 Verizon Connect

- 7.1.18 Trimble Inc.

- 7.1.19 Omnitracs LLC

- 7.1.20 ACTIA group

- 7.1.21 Airbiquity Inc.

- 7.1.22 UK Telematics

- 7.1.23 Bridgestone Europe NV/SA (TomTom)

- 7.1.24 Webfleet Solutions BV (Bridgestone Corp.)

- 7.1.25 Teletrac Navman

- 7.1.26 KeepTruckin Inc.

- 7.1.27 Skylo Technologies

- 7.1.28 Geoforce Inc.

- 7.1.29 Orbcomm Inc.

- 7.1.30 Samsara Networks Inc.