|

市場調查報告書

商品編碼

1437933

船用燃料:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Bunker Fuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

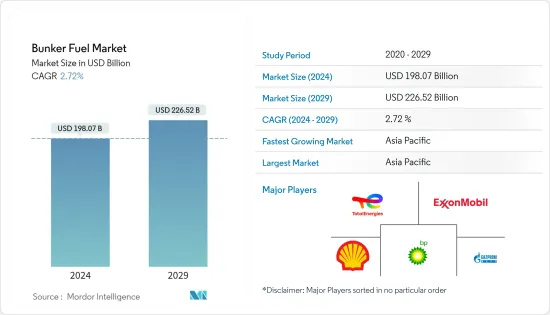

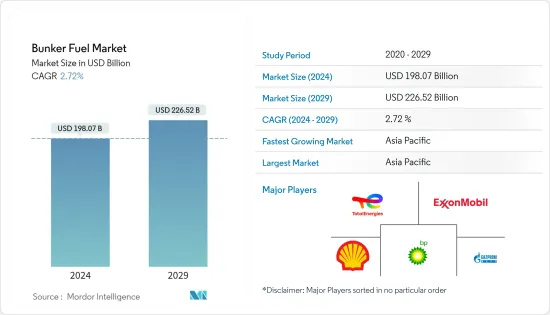

2024年船用燃料市場規模估計為1980.7億美元,預計到2029年將達到2265.2億美元,在預測期間(2024-2029年)以2.72%的複合年增長率增長。

2020 年,市場受到 COVID-19 的負面影響。目前市場處於大流行前的水平。

主要亮點

- 從中期來看,由於液化天然氣貿易的增加,船用燃料的需求預計將增加。液化天然氣主要用於工業、商業和住宅領域的電力部門。中國和印度等高度依賴煤炭的國家正在通過增加從中東國家以及俄羅斯聯邦、澳大利亞和奈及利亞等其他一些國家進口天然氣的方式逐步向清潔能源轉型。

- 同時,環境問題和與海運業排放相關的嚴格法規預計將在預測期內限制重質船用燃料,特別是高硫燃料油的使用。

- 儘管如此,隨著亞太、中東、非洲等地區新興國家經濟狀況改善,海上運輸需求和營運船舶數量預計將增加,為日本創造重大成長機會。未來幾年船用燃料市場的參與者。

- 預計亞太地區將在預測期內主導市場,大部分需求來自中國、印度等國家。

船用燃料油市場趨勢

液化天然氣作為船用燃料可能會顯著成長

- 由於全球液化天然氣使用量的增加、清潔能源需求以及減少溫室氣體排放的能力,全球液化天然氣燃料庫市場在過去十年中得到了發展。液化天然氣燃料船舶的訂單和交付不斷增加,2014年天然氣價格的下降標誌著液化天然氣燃料船舶開始擴大機會。

- 將目前營運的船舶改裝為液化天然氣船舶成本高昂。因此,它在經濟上不可行。然而,一旦新的排放法規訂定,液化天然氣船舶預計將成為所有替代燃料中營運成本最低的船舶。此外,與傳統使用重油、船用輕柴油、船用柴油等為船舶提供燃料的方法相比,逐步過渡到液化天然氣作為推進力更具優勢。基於液化天然氣的推進裝置可大幅減少碳排放並提高船舶運轉率。效率。

- 液化天然氣燃料庫產業也在大力投資基礎建設,截至2022年1月,已有33艘液化天然氣燃料庫船和141個液化天然氣港口運作,預計到年終還將有170個液化天然氣港口依計劃投入運作。因此,船東,尤其是在歐洲和美洲海域營運的船東,現在比傳統船舶更喜歡液化天然氣船舶。此外,液化天然氣燃料船舶尚未滲透到散裝貨船市場,因為它們被設計用於承載重載,而液化天然氣技術相對較新應用於此類船舶。是的。散裝貨船佔所有營運船舶的最大佔有率。

- 此外,由於自 2020 年 1 月以來低硫限制刺激了需求,低硫燃油的需求正朝著正面的方向發展。此外,使用液化天然氣作為燃料是一種經過驗證的商業性解決方案。液化天然氣為船舶帶來了顯著的好處,特別是考慮到日益嚴格的排放法規。從中期來看,傳統的石油燃料預計仍將是大多數船舶的主要燃料選擇,而液化天然氣可能會成為長期的流行選擇。 2022 年 6 月極低硫燃料油 (VLSFO) 燃油價格為每噸 1,043.84 美元(每月平均)。

- 例如,2022年5月,Titan LNG和Brittany Ferries簽署了一項長期燃料庫協議,為Brittany Ferries計畫營運的兩艘新型LNG燃料混合Ro-Pax船舶供應LNG和液化生物甲烷(LBM)。 2025 年起英國和法國。這些船隻預計將服務於朴茨茅斯和聖馬洛以及朴茨茅斯和烏伊斯特勒昂之間的既定航線。泰坦還計劃在正常貨運作業期間與 SIMOPS(同時作業)同時為兩艘船提供燃料。

- 隨著液化天然氣運輸船的訂單不斷增加,液化天然氣需求在預測期內可能會大幅增加,而且與傳統燃料相比相對便宜,與油基船用燃料相比具有溫室效應,有效氣體排放減少23% ,為全球脫碳做出貢獻。目標是成為未來最受歡迎的船用燃料。

預計亞太地區將主導市場

- 預計亞太地區將主導船用燃料市場。

- 截至2022年,以金額為準,中國的出口排名第一,進口排名第二。中國主要出口產品包括機電電子機械及設備、汽車零件等汽車產品、化學品及塑膠、鋼材、家具等。

- 此外,國內船舶也出現了嚴重的供應過剩情況。根據中華人民共和國交通部統計,2021年,上海港貨櫃吞吐量位居第一,較2020年成長8.1%,達到4,703萬個標箱以上。

- 澳洲是世界上最大的液化天然氣出口國之一。液化天然氣出口的增加支持了澳洲的國際貿易。隨著全球液化天然氣需求大幅增加,未來幾年出口量預計將增加。

- 為了提高海事部門在國際和國內貿易中的佔有率,印度政府宣佈在2035年投資220億美元,對現有港口進行現代化改造並建造新港口。預計在預測期內,港口基礎設施的發展將增加亞太地區海運業和船用燃料供應商的需求。

- 2022 年 3 月,TotalEnergies Marine Fuels 在新加坡港口水域交付了第一個海洋生物 VLSFO(極低硫燃油)燃油。此次交付是日本郵船公司和英美資源集團最近完成的生質燃料試驗的一部分。交付透過船對船轉運供應給 MT Friendship,由 B10生質燃料混合物組成,與 VLSFO 和 ISCC 認證的第二代廢棄物基 UCOME(廢食用油甲酯) 10% 混合。該生質燃料在新加坡和南非薩爾達尼亞灣之間的往返旅程中使用。

- 因此,基於上述因素,預計亞太地區將在預測期內主導船用燃料市場。

船用燃料油產業概況

船用燃料市場本質上是分散的。市場主要企業包括(排名不分先後)Gazpromneft Marine Bunker LLC、埃克森美孚公司、殼牌公司、TotalEnergies SE、BP PLC等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 調查先決條件

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2028年之前的市場規模與需求預測

- 政府政策法規

- 市場動態

- 促進因素

- 全球液化天然氣貿易不斷增加

- 發電對天然氣的依賴日益增加

- 抑制因素

- 關於環境問題和海運業排放的嚴格規定

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭公司之間敵對的強度

第5章市場區隔

- 汽油種類

- 高硫燃料油(HSFO)

- 極低硫燃油(VLSFO)

- 船用輕柴油 (MGO)

- 液化天然氣(LNG)

- 其他燃料類型

- 貨櫃類型

- 容器

- 油船

- 普通貨物

- 散貨船

- 其他貨櫃類型

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 併購、合資、合作與協議

- 主要企業採取的策略

- 公司簡介

- Fuel Suppliers

- ExxonMobil Corporation

- Shell PLC

- Gazpromneft Marine Bunker LLC

- BP PLC

- PJSC Lukoil Oil Company

- TotalEnergies SE

- Chevron Corporation

- Clipper Oil

- Gulf Agency Company Ltd

- Bomin Bunker Holding GmbH &Co. KG

- Ship Owners

- AP Moeller Maersk AS

- Mediterranean Shipping Company SA

- China COSCO Shipping Corporation Limited

- CMA CGM Group

- Hapag-Lloyd AG

- Ocean Network Express

- Evergreen Marine Corp Taiwan Ltd

- Yang Ming Marine Transport Corporation

- HMM Co. Ltd

- Pacific International Lines Pte Ltd

- Fuel Suppliers

第7章市場機會與未來趨勢

- 海上運輸需求增加,營運船舶數量增加

The Bunker Fuel Market size is estimated at USD 198.07 billion in 2024, and is expected to reach USD 226.52 billion by 2029, growing at a CAGR of 2.72% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the medium term, Increasing LNG trade is expected to increase the demand for bunker fuel. LNG is majorly traded for the power sector in industrial, commercial and residential segments. The countries with high coal dependencies, such as China and India, are gradually moving toward cleaner energy by increasing the import volume of natural gas from the Middle-east nations and few other nations, like the Russian Federation, Australia, Nigeria.

- On the other hand, the environmental concerns and the strict regulations related to emissions from maritime industry are anticipated to limit the usage of the heavy bunker fuels, especially the high Sulfur fuel oil, during the forecast period.

- Nevertheless, with the improved economic performance of developing countries in regions, such as the Asia-Pacific and the Middle-East and Africa, the demand for marine transportation and the number of ships in operation are expected to increase, offering significant growth opportunity for the bunker fuel market players in the coming years.

- Asia-Pacific is expected to dominate the market during the forecast period, with the majority of the demand coming from countries like China, India, etc.

Bunker Fuel Market Trends

LNG as a Bunker Fuel is Likely to Witness Significant Growth

- The global LNG bunkering market evolved over the past decade, driven by the growth in global LNG usage, clean energy demand, and its ability to reduce greenhouse gas emissions. The order and delivery of LNG-powered vessels are increasing, and the reduced natural gas prices in 2014 marked the beginning of expanding opportunities for such vessels.

- The conversion of the current operating vessels into LNG-based vessels is highly expensive. Hence, it is not economically viable. However, the operational cost of LNG-based vessels is expected to be least among all the fuel alternatives, once the new emission regulations become applicable. Further, a gradual shift to LNG for propulsion is more advantageous, as compared to the traditional methods of fueling ships with heavy fuel oil, marine gas oil, marine diesel oil, etc. LNG-based propulsion reduces carbon footprint significantly and increases the ship's operational efficiency.

- The LNG bunkering industry also registered significant investments in infrastructure construction, and as of January 2022, there are 33 LNG bunkering vessels and 141 LNG ports operational, and further 170 LNG ports to be expected to be operational by the end of 2022. As a result, the ship owners, particularly the ones that are operating in the European or American Sea, now prefer LNG-based vessels over conventional vessels. Furthermore, the LNG fueled ships have not penetrated the market for bulk carriers to a significant extent, as these ships are designed to carry heavy loads, and LNG technology is relatively new to apply for this type of vessels. The bulk carriers amount to the largest share of the in-operation ships.

- Furthermore, the demand for LSFO has been on the positive side due to the low sulfur restriction that has spurred demand since January 2020. Moreover, the use of LNG as a fuel is both a proven and commercially available solution. LNG offers enormous advantages, especially for ships in the light of ever-tightening emission regulations. Conventional oil-based fuels are expected to remain the primary fuel option for most ships in the mid-term, while LNG is likely to become a popular choice in the long-term scenario. In June 2022, the bunker prices for very low sulphur fuel oil (VLSFO) USD 1,043.84 per tonne (monthly average).

- For instance, in May 2022, Titan LNG and Brittany Ferries have signed a long-term bunkering agreement for the supply of LNG and Liquefied Bio Methane (LBM) to two new LNG fueled hybrid Ro-Pax vessels that Brittany Ferries is likely to operate between England and France from 2025. These vessels are expected to serve established routes connecting Portsmouth with Saint-Malo, and Portsmouth with Ouistreham. Also, Titans aims to supply fuel to both vessels during usual cargo operations alongside SIMOPS (simultaneous operations).

- The LNG demand is likely to increase significantly in the forecast period as the orderbook for LNG vessels continues to increase, relatively cheaper than conventional fuels, offers 23% cut in greenhouse gas emissions over oil-based marine fuel which will aid to meet the global decarbonization goals making it the most popular marine fuel in the future.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is expected to dominate the bunker fuel market due to the immense maritime trade potential of countries like India, China, Singapore, Japan, and other countries.

- As of 2022, China ranks first for exporter goods and second for imported goods by value. China's major exports are mechanical and electric machinery and equipment, automotive products, including vehicle parts, chemicals and plastics, iron and steel articles, furniture, etc.

- Further, the fleet in the country is registering a situation of drastic oversupply. According to the Ministry of Transport of the People's Republic of China, in 2021, Shanghai port topped in the container throughput, reaching over 47.03 million TEU witnessing an increase of 8.1% compared to 2020 levels.

- Australia is among the biggest exporter of LNG globally. The rising LNG exports supported the international trade of Australia.The export volume is likely to go up in the coming years as the demand for LNG is increasing significantly across the globe.

- To increase the share of the marine sector in international and domestic trade, the Indian government announced an investment of USD 22 billion by 2035 to modernize the existing ports and build new ports. The port infrastructure development is expected to increase the demand from the maritime industry and marine fuel suppliers in Asia-Pacific during the forecast period.

- In March 2022, the first marine bio-VLSFO (very low sulfur fuel oil) bunker delivery was carried out by TotalEnergies Marine Fuels at Singapore port's waters. The delivery was part of NYK Line and Anglo American's recently completed biofuel trial. The delivery was supplied to the MT Friendship via a ship-to-ship transfer and consisted of a B10 biofuel blend made up of VLSFO blended with 10% second-generation, waste-based and ISCC-certified UCOME (used cooking oil methyl ester). The biofuel was used during the vessel's two-way trip between Singapore and Saldanha Bay in South Africa.

- Therefore, based on the aforementioned factors, Asia-Pacific is expected to dominate the bunker fuel market during the forecast period.

Bunker Fuel Industry Overview

The bunker fuel Market is fragmented in nature. Some of the major players in the market (in no particular order) include Gazpromneft Marine Bunker LLC, ExxonMobil Corporation, Shell PLC, TotalEnergies SE, and BP PLC among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increased LNG Trade Worldwide

- 4.5.1.2 Increasing Dependecies over Natural Gas for Power Generation

- 4.5.2 Restraints

- 4.5.2.1 Environmental Concerns and the Strict Regulations Related to Emissions from Maritime Industry

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Fuel Type

- 5.1.1 High Sulfur Fuel Oil (HSFO)

- 5.1.2 Very Low Sulfur Fuel Oil (VLSFO)

- 5.1.3 Marine Gas Oil (MGO)

- 5.1.4 Liquefied Natural Gas (LNG)

- 5.1.5 Other Fuel Types

- 5.2 Vessel Type

- 5.2.1 Containers

- 5.2.2 Tankers

- 5.2.3 General Cargo

- 5.2.4 Bulk Carriers

- 5.2.5 Other Vessel Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Fuel Suppliers

- 6.3.1.1 ExxonMobil Corporation

- 6.3.1.2 Shell PLC

- 6.3.1.3 Gazpromneft Marine Bunker LLC

- 6.3.1.4 BP PLC

- 6.3.1.5 PJSC Lukoil Oil Company

- 6.3.1.6 TotalEnergies SE

- 6.3.1.7 Chevron Corporation

- 6.3.1.8 Clipper Oil

- 6.3.1.9 Gulf Agency Company Ltd

- 6.3.1.10 Bomin Bunker Holding GmbH & Co. KG

- 6.3.2 Ship Owners

- 6.3.2.1 AP Moeller Maersk AS

- 6.3.2.2 Mediterranean Shipping Company SA

- 6.3.2.3 China COSCO Shipping Corporation Limited

- 6.3.2.4 CMA CGM Group

- 6.3.2.5 Hapag-Lloyd AG

- 6.3.2.6 Ocean Network Express

- 6.3.2.7 Evergreen Marine Corp Taiwan Ltd

- 6.3.2.8 Yang Ming Marine Transport Corporation

- 6.3.2.9 HMM Co. Ltd

- 6.3.2.10 Pacific International Lines Pte Ltd

- 6.3.1 Fuel Suppliers

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Risisng Demand for Marine Transportation and Increasing Number of Ships in Operation