|

市場調查報告書

商品編碼

1651046

電信計費和收益管理:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Telecom Billing Revenue Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

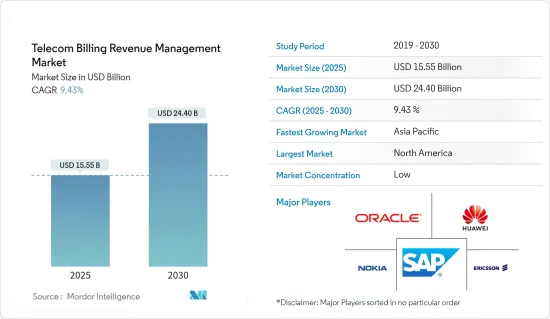

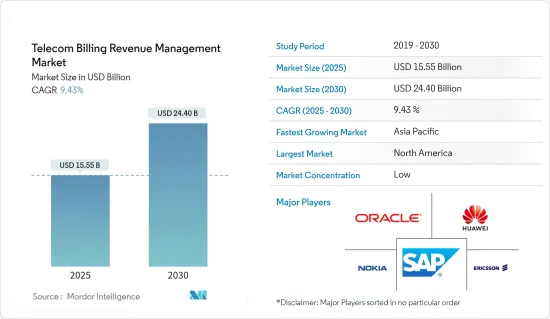

電信計費和收益管理市場規模預計在 2025 年為 155.5 億美元,預計到 2030 年將達到 244 億美元,預測期內(2025-2030 年)的複合年成長率為 9.43%。

全球各地的通訊服務供應商 (CSP) 都面臨著用戶數量不斷增加的問題,導致網路擁塞和通話斷線等嚴重問題。為了緩解這些問題,使用者開始要求 CSP 實施高效率、有效的計費和收益管理系統。

主要亮點

- 電信計費和收益流程包括管理通訊服務以及應收帳款的收取。這包括計算帳單資訊、管理客戶付款和發票、以及提供有關資料使用情況的資訊。透過最佳化通訊網路,這些解決方案經常被通訊業者和數位服務供應商採用來提高業務效率。

- 過去十幾年來,全球通訊市場發生了巨大變化。從透過網路與客戶互動的雲端原生業務的興起,到內容、應用程式和服務向雲端的快速遷移。為了滿足這項需求,CSP 供應商已花費數十億美元升級其網路。然而,許多 CSP 仍在使用需要更多現代收益管理功能的傳統業務支援系統。因此,世界各地的許多 CSP 都使用當前的計費和收益管理系統。

- 電信計費和收益管理平台解決方案使通訊服務供應商能夠在市場上推出最新的服務並幫助利用客戶關係。此外,軟體即服務(SaaS)平台的出現將進一步推動市場成長。

- 電訊業供應商使用這些軟體解決方案來檢測和管理頻譜異常,最終有助於降低營運成本。此外,這些技術支援的計劃將透過部署新措施來解決問題並最佳化網路服務和可見性,幫助 CSP 進一步增加收益。

- 此外,在當前的市場情況下,CSP 需要即時計費和策略控制功能來捕獲和收益所有 IP 5G 機會,包括新的用例、設備、經營模式和夥伴關係。隨著管理各種合作夥伴變得越來越複雜,挑戰包括有效管理互連、批發、OTT/內容播放器、經銷商、互連、MVNO 和代理商等合作夥伴。

- 而且隨著數位經濟加速消費,傳統計費系統只能按需設計,缺乏客製化。新一代計費系統透過靈活的業務規則引擎,圍繞著服務和產品建立敏捷原則。業務腳本可協助 CSP 將產品上市時間 (TTM) 從數月縮短至數小時。

- 最近,由於COVID-19疫情,公司政策已轉為在家工作。這種在家工作的趨勢導致通訊塔的資料消費量增加。例如,儘管持續至5月底的68天全國封鎖導致經濟放緩,但兩家印度通訊業者報告稱,由於資費上漲和資料使用折舊免稅額增加,截至6月的三個月(2021會計年度第一季)收入和EBITDA(息稅折舊攤銷前利潤)實現強勁成長。家庭中透過行動電話存取網路的設備數量不斷增加,從而導致資料使用量增加。這增加了通訊計費和收益管理的需求。

電信計費和收益管理市場趨勢

行動電話營運商佔據大部分市場佔有率

- 智慧型手機用戶的快速成長,加上行動應用程式的大量出現,帶來了前所未有的用戶成長。例如,根據Cisco,截至 2022 年,全球智慧型手機用戶約為 57 億。這導致對行動網路提供者的容量需求龐大。

- 行動通訊業者正在透過引入 5G、Volte 和 Vowifi 等新技術並增加網路容量來滿足這一需求。顯然,OSS 和 BSS 營運商級計費解決方案必須跟上步伐,支援數百萬個並發交易。

- 在歐洲,通訊計費收益管理系統市場預計將成長。政府加強推動 5G 連接,以及主要企業不斷滲透到該領域,這些都是推動市場發展的因素。此外,隨著行動用戶的增加和通訊服務供應商增加新服務,對高效計費和收益管理系統和服務的需求也日益成長。

- 此外,受網路能力、服務和其他增強客戶體驗管理領域的創新推動,全球通訊業競爭日益激烈,使得行動電話電信商能夠專注於加速推出新產品和服務的策略,並以強大的收益分享模式為後盾。電信計費和收益管理等解決方案使營運商能夠實現業務流程自動化,例如確保計費準確性以及透過端到端爭議管理改善客戶體驗。

- 此外,該解決方案還能幫助行動電話營運商消除管理相關人員收入分成中的詐欺,從而降低成本。例如,根據通訊詐欺控制協會(CFCA)的數據,全球行動電話營運商每年因詐欺和未收收入損失約 380 億美元。

北美佔很大佔有率

- 由於通訊業相當成熟,預計北美將佔據主要市場佔有率。例如,美國5G覆蓋範圍日益凸顯,該地區主要行動通訊業者均已多次推出5G商用服務。事實上,GSMA 的一項研究估計,到 2025 年,北美 5G 普及率將上升到 46%,即 2 億個 5G 連線。

- 研究進一步顯示,北美約有 3.21 億獨立行動用戶,佔其總人口的 83%。此外,預計到 2025 年,這一數字將達到 3.45 億,佔總人口的 85%。

- 美國也是世界上科技最先進的國家之一。這個國家因其開創性的新興企業而聞名。這一高佔有率很大程度上得益於最尖端科技的採用和通訊業需求的不斷成長。物聯網、5G、分析和雲端等最尖端科技的採用正在幫助美國在收益方面佔據電信計費和收益管理市場的主導地位。

- 市場成長的動力包括用戶數量的增加、消費者對各種行動服務的高支出以及該地區一些知名企業(如 Amdocs、Oracle、CSG International 和 HPE)的存在。此外,該地區擁有成熟的通訊業和較高的通訊產品和服務普及率。該地區的通訊業產生大量資料,從而推動了通訊計費和收益管理的需求。

- 此外,在新冠肺炎疫情之後,由於該地區擺脫孤立狀態、新的工作方式的出現以及該地區占主導地位的全球化電訊模式的潛在轉變,服務自動化的步伐加快了。這些服務包括計費和收益管理。預計案例將進一步加速未來市場的成長。

電信計費和收益管理行業概況

目前電信計費和收益管理市場由眾多參與者組成,競爭激烈且日益分散。全球電信計費和收益管理市場的幾家主要企業正在不斷努力實現產品進步。一些知名公司已經結盟,透過擴大在邊境地區的影響力來擴大其市場影響力。主要公司包括愛立信、華為技術、SAP SE和Oracle。

- 2023 年 1 月-愛立信和 Ooredoo 科威特合作在兩個網路上推出愛立信計費。計費系統的更新有助於制定5G產品的有競爭力的行銷計劃,同時推動5G在Ooredoo科威特網路上的演進。

- 2023 年 1 月-NEC 公司將向 NTT DOCOMO 提供計費閘道功能 (CGF),以高效能處理計費資訊。 CGF 將簡化 5GC 傳輸的各種計費資訊並將其連接到 BSS,以協助快速推出、交付和收益新服務。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 行動電話用戶數量增加

- 電信生態系統的收益分配變得更加複雜

- 市場限制

- 嚴格的通訊法規

- 波特五力分析

- 購買者/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 產業影響評估

第5章 市場區隔

- 按部署

- 本地

- 雲

- 按類型

- 軟體

- 服務

- 按經營者

- 行動通訊業者

- 網際網路服務供應商

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第6章 競爭格局

- 公司簡介

- NetCracker Technology Corporation

- CSG Systems International Inc.

- Oracle Corporation

- Ericsson

- Huawei Technologies

- SAP Se

- Nokia

- Comarch SA

- Optiva, Inc.

- Enghouse Networks

- Sterlite Technologies Limited

- Intracom Telecom SA

第7章投資分析

第8章 市場機會與未來趨勢

The Telecom Billing Revenue Management Market size is estimated at USD 15.55 billion in 2025, and is expected to reach USD 24.40 billion by 2030, at a CAGR of 9.43% during the forecast period (2025-2030).

Communication Service Providers (CSP) worldwide are experiencing increased subscribers, causing significant issues, including network congestion and call drops. To curb these issues, users have started to demand that CSPs deploy efficient and effective billing and revenue management systems.

Key Highlights

- The process of managing telecom billing and revenue includes the management of debt collection as well as communication services. The procedure involves calculating billing and charging information, managing the customer's payments and invoices, and providing information on data utilization. By optimizing the telecom networks, these solutions are frequently employed by telecommunication and digital service providers to increase operational efficiency.

- In the last decade, the global telecom market has changed dramatically, from the rise of cloud-native businesses that interact with customers via the Internet to the rapid migration of content, applications, and services to the cloud. CSP providers have spent billions upgrading their networks to meet the demand. However, many CSPs continue to operate with traditional business support systems that need more modern revenue management capabilities. Therefore, many CSPs worldwide are adopting current billing and revenue management systems.

- Telecom billing and revenue management platform solutions enable telecom service providers to launch the latest services in the market and help leverage their customer relationships. and develop a sense of harmony between the service providers and end-users. Also, the emergence of software-as-a-service (SaaS) platforms further leverages market growth.

- Vendors in the telecom industry use these software solutions to help detect and manage anomalies in the spectrum and eventually decrease operational costs. Also, these tech-enabled programs further assist the CSPs in increasing their revenue by rectifying problems and deploying new measures to optimize network service and visibility.

- Further, in the current market scenario, CSPs require real-time billing and policy control capabilities to help seize and monetize all IP 5G opportunities, including new use cases, devices, business models, and partnerships. With the growing complexity of managing diverse partners, challenges such as efficiently managing partners, including interconnect, wholesale, OTT/content players, distributors, interconnect, MVNOs, and agents, among others.

- Additionally, with the digital economy accelerating consumption, traditional billing systems can only keep up with a lack of on-demand design or customization. With the new generation of billing systems, build on agile principles in terms of services and products through a flexible business rule engine. The business script helps CSP reduce the time-to-market (TTM) from months to hours. thereby driving demand among the end-users.

- The recent outbreak of the COVID-19 pandemic resulted in a shift in company policies towards work-from-home policies. This remote work from home increased the data consumption of the telecom towers. For instance, two Indian telecom operators reported substantial revenue and earnings before interest, taxes, depreciation, and amortization (EBITDA) growth in the three months ending June (Q1 FY2021) due to tariff growth and higher data usage, defying the economic slowdown from the countrywide lockdown of 68 days up to May-end. The increasing number of devices using the Internet for work from home through mobile phones resulted in an increase in data usage. This increased the demand for telecom billing and revenue management.

Telecom Billing and Revenue Management Market Trends

Mobile Operators to Account Major Market Share

- The proliferation of smartphone users, coupled with numerous mobile applications, has enabled unprecedented growth in subscribers. For instance, According to Cisco Systems, as of 2022, there were around 5.7 billion smartphone users worldwide. This has resulted in significant demand for the capacity of mobile network providers.

- The mobile operators leverage the demand by deploying new technologies such as 5G, Volte, and Vowifi and adding networking capacities. Evidently, the OSS and BSS carrier-class billing solutions also need to keep up the pace and are required to support millions of simultaneous transactions.

- The market for revenue management systems for telecom invoicing in Europe will increase. Government efforts to promote 5G connectivity are expanding, and key market players are becoming more prevalent in the area, which can be attributed to the market's development. Additionally, the demand for efficient invoicing and revenue management systems and services is growing as mobile users grow and telecom service companies continuously add new services to their portfolios.

- Also, owing to the increase in the competitive landscape of the telecom industry worldwide, led by innovations in network capabilities, service, and other customer experience management enhancements, mobile operators are able to focus on strategies to help accelerate new product and service launches backed by a robust revenue-sharing model. By leveraging solutions such as telecom billing revenue management, operators can automate the business process, such as maintaining billing accuracy and improving customer experience by managing end-to-end disputes.

- Additionally, the solution would also enable mobile operators to save costs by eliminating the fraud associated with managing the stakeholders' revenue shares. For instance, according to the Communications Fraud Control Association (CFCA), mobile operators worldwide lose around USD 38 billion annually due to fraud and uncollected revenues.

North America to Hold Major Share

- North America is expected to hold a significant market share due to its significantly mature telecom industry. For instance, following several commercial 5G launches by major US mobile operators, the region now has prominent 5G coverage. In fact, a GSMA study estimates that 5G adoption in North America will rise to 46% by 2025, i.e., 200 5G connections.

- The study further reveals that around 321 million unique mobile subscribers in North America represent 83% of the population. Additionally, by 2025, the number is forecast to reach 345 million, i.e., 85% of the population.

- Additionally, the United States is among the nations with the highest levels of technological adoption worldwide. The nation is renowned for its ground-breaking startups. This high share is mostly due to the market's adoption of cutting-edge technology and the increased demand from the telecom industry. Due to the adoption of cutting-edge technologies like IoT, 5G, analytics, and cloud, the U.S. also dominated the telecom billing and revenue management market in terms of revenue.

- The increasing number of subscribers, coupled with high consumer spending on various mobile services and the presence of a few of the prominent players in the region, including Amdocs, Oracle, CSG International, and HPE, among others, is set to leverage market growth. Additionally, the region's communication industry is well-established and has a high penetration of telecom products and services. The region's telecom sector produces a vast amount of data, which in turn is increasing demand for telecom billing and revenue management.

- Additionally, the post-COVID-19 situation as the region emerged from lockdown, the backdrop of new ways of working, and potential shifts in the dominant globalization telecom model in the region enabled an acceleration in the rate of automation of services. These services include billing and revenue management. This instance is expected to further leverage the market's growth going forward.

Telecom Billing and Revenue Management Industry Overview

The telecom billing revenue management market is very competitive and moving towards fragmentation as it currently consists of many players. Several key players in the global telecom billing revenue management market are making constant efforts to bring product advancements. A few prominent companies are entering into collaborations and are also expanding their footprints in developing regions to consolidate their positions in the market. The major players are Ericsson, Huawei Technologies, SAP SE, and Oracle Corp., among others.

- January 2023 - Ericsson and Ooredoo Kuwait teamed up to roll out Ericsson billing across their networks. The billing system update helped create competitive marketing plans for 5G products while also enabling 5G evolution across Ooredoo Kuwait's network.

- January 2023 - NEC Corporation gave NTT DOCOMO a charging gateway function (CGF) for the high-performance processing of billing information. The CGF supports new services' quick start, provision, and monetization by organizing the diverse range of billing information sent from 5GC and connecting to the BSS.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Number of Cellular or Mobile Subscribers

- 4.2.2 Growing Complexities in Revenue Sharing Across the Telecom Ecosystem

- 4.3 Market Restraints

- 4.3.1 Presence of Stringent Telecom Regulations

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of COVID-19 Impact on the Industry

5 MARKET SEGMENTATION

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By Type

- 5.2.1 Software

- 5.2.2 Service

- 5.3 By Operator

- 5.3.1 Mobile Operator

- 5.3.2 Internet Service Provider

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 US

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 UK

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 NetCracker Technology Corporation

- 6.1.2 CSG Systems International Inc.

- 6.1.3 Oracle Corporation

- 6.1.4 Ericsson

- 6.1.5 Huawei Technologies

- 6.1.6 SAP Se

- 6.1.7 Nokia

- 6.1.8 Comarch SA

- 6.1.9 Optiva, Inc.

- 6.1.10 Enghouse Networks

- 6.1.11 Sterlite Technologies Limited

- 6.1.12 Intracom Telecom SA