|

市場調查報告書

商品編碼

1435965

XR(延展實境)顯示器:市場佔有率分析、行業趨勢和統計、成長預測(2024-2029)Extended Reality Display - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

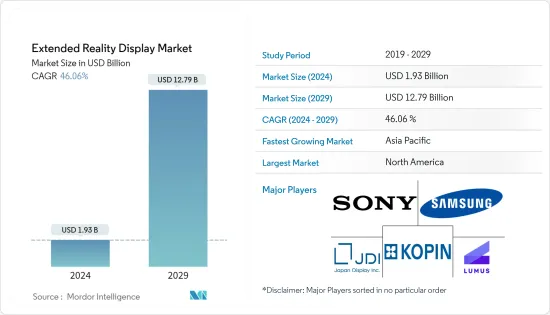

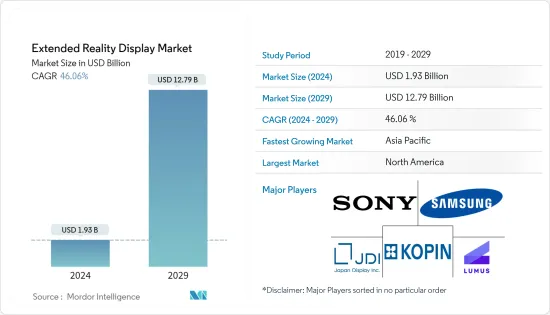

2024 年 XR 顯示器市場規模估計為 19.3 億美元,預計到 2029 年將達到 127.9 億美元,在預測期間(2024-2029 年)以 46.06% 的複合年增長率增長。

疫情的爆發引發了擴增實境技術在零售、教育和醫療保健領域的發展。然而,儘管COVID-19的影響加速了XR技術在其他終端用戶產業的採用,但XR技術的使用始終是遊戲和娛樂產業的主流。因此,促進了擴增實境市場顯示器的成長。

主要亮點

- 本研究中提到的市場數據顯示了供應商在遊戲和娛樂、零售、醫療保健、教育、軍事和國防以及汽車和製造等應用領域銷售的顯示器的價值。市面上使用的顯示器被設計為直視面板或微型顯示面板。 AR顯示面板被設計為透明的,讓使用者可以查看數位資料,同時充分了解周圍的物理世界。

- COVID-19 大流行促使 XR 技術的採用激增,推動了市場對顯示器的需求。例如,Sephora 和 Ulta 等美容零售商必須禁止顧客在自己的皮膚上實際測試美容產品。美容零售商轉而求助於 AR 來幫助消費者以數位方式測試產品並做出購買決定。

- 因此,由於疫情造成的短期需求增加,預計未來幾年身臨其境型技術在最終用戶環境中的使用將進一步增加。

- 此外,混合實境的採用正在各個領域獲得動力,查看和獲取資訊的能力是一個額外的優勢和優勢。微軟越來越注重產品創新以拓展其應用領域。例如,2021年3月,微軟贏得了美國價值219億美元的契約,生產基於HoloLens 2的耳機。預計此類發展將進一步影響該技術的採用,並推動市場對 XR 顯示器的需求。

- XR 技術面臨的最困難的課題之一與教育更廣泛的受眾 - 更廣泛的市場有關。目前的應用程式(適用於智慧型手機、平板電腦和穿戴式裝置)僅限於一名使用者。為了讓 XR 更容易使用,開發多用戶、統一和簡化的體驗至關重要。在當前的市場情況下,此類產品的供應有限,這對市場成長構成了重大課題。

- 未來幾年,即時渲染和互動式人工智慧、身臨其境型體驗的日益普及以及 5G 的普及預計將改變影院體驗並推動 XR 顯示市場的成長。例如,如果端到端延遲(使用者頭部運動和VR頭戴裝置顯示變化之間的延遲)很長,使用者可能會出現暈動症。為了避免這種情況,VR系統需要有低於20毫秒的延遲,而5G使這成為可能。因此,5G可望支撐XR市場需求。

XR顯示市場趨勢

AR 和 VR 應用在多個最終用戶產業的採用率不斷提高

- AR 和 VR 的快速採用正在改變遊戲產業,並為 XR 顯示器市場創造更多機會。公司正在快速開發產品,以最大限度地提高市場吸引力。例如,Oculus Quest VR頭戴裝置可以透過添加手部偵測功能來改善 VR 系統,讓 VR 使用者可以用手指來操縱 VR 世界。

- 基於手勢的計算現已成為遊戲、電視、設備、資訊亭、醫學、3D 雕塑、工程、醫療專業人員、設計師、廣告商甚至身體殘疾人士的一部分。基於手勢的遊戲已經超越了傳統的遊戲機,擴大被應用在兒童教育遊戲中。例如,Magic Touch Math 是第一款專注於使用自訂手勢繪圖學習數學的遊戲。因此,基於手勢的辨識可以用於傳統遊戲應用以外的應用。

- 2021 年 9 月,奧迪推出了 Holoride,一款虛擬實境路上娛樂產品。這使您可以從奧迪車內前往虛擬世界。Start-UpsHololide 致力於讓汽車出行成為多模態體驗。這項新技術將 VR 內容和駕駛動作即時融合在一起,使奧迪後座乘客能夠透過使用 VR 眼鏡即時適應汽車的駕駛動作,沉浸在遊戲、電影、簡報等內容中。您體驗虛擬內容。

- 此外,2021 年 9 月,酵母倫敦大學 (UEL) 宣布與 EON Reality 合作推出EON-XR 中心。英國的 EON-XR 中心讓學生和教師透過智慧型手機、網站和VR頭戴裝置等各種設備存取基於 AR 和 VR 的培訓,從而推動所研究市場的成長和需求。因此,此類發展預計將進一步推動市場上對 XR 顯示器研究的需求。

北美預計將佔據很大佔有率

- 隨著美國政府探索直接和間接方式使用擴增實境技術來促進創新和促進繁榮,北美地區預計將佔據重要的市場佔有率。

- 例如,外交部在某些培訓中引入了VR作為體驗式學習工具。該地區正在實施多個 AR 和 VR 培訓項目,以培養當地勞動力並管理污水。

- 由於接觸先進技術等因素,該地區在市場上佔據主導地位。此外,資源的便利獲取也創造了對擴增實境設備的強烈需求。多家地區公司正在為其 AR/VR 穿戴式裝置引入創新顯示器。

- 從蘋果到谷歌,許多美國科技巨頭都在大力投資打造 VR 和 AR 設備。由於顯示器是此類設備的關鍵要素,此類投資將推動市場成長。

- 例如,2022 年 6 月,Facebook 母公司 Meta 推出了四款用於研究目的的虛擬實境 (VR) 原型顯示器,旨在釋放元宇宙技術的全部潛力。該模型有望減輕耳機的重量,同時提供更真實的視覺體驗,並解決低解析度、視覺扭曲和眼睛疲勞等問題。

- 該地區也是許多大公司的所在地,例如eMagin公司,這是用於AR / VR和其他近視成像產品的高解析度OLED微型顯示器的領先製造商。 該公司於 2022 年 5 月在加利福尼亞州聖約瑟舉行的 2022 年顯示周(Display Week 2022)上舉辦了其當前產品線的展覽,該會議是業內最大的顯示市場會議之一。

XR顯示行業概況

XR顯示市場主要由多家國內外公司組成。公司之間的公司間競爭非常激烈,預計在預測期內將保持不變。市場主要參與者包括Sony Corporation、三星電子、Kopin公司、 JAPAN DISPLAY公司等。市場上的技術進步也為企業帶來了巨大的競爭優勢,市場上也出現了多種合作關係。

- 2022 年 6 月 - Kopin 獲得一份合同,為美國一家前國防承包商開發一種新的車載顯示成像系統。 新系統將 Kopin 的高亮度、高解析度、低功耗鐵電矽基液晶 (FLCOS) 微型顯示器和定製光學器件集成到極其堅固的定製外殼中,可在最惡劣的環境中運行。

- 2022 年 6 月 LG Display 計畫為可能向蘋果供應第二代混合實境(MR) 裝置的顯示器奠定基礎。 LG 已從 Sunic System 訂購沉澱設備,這將使該公司能夠生產微型 OLED 面板。

- 2022 年 5 月 - 三星電子在歐洲整合系統 (ISE) 上推出了其 micro-LED 技術,並推出了三款採用其尖端顯示技術 The Wall 的新型號。 The Wall 的下一代技術帶來的好處將改變任何業務並創造新的機會。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭公司之間的敵意強度

- 替代品的威脅

- 技術簡介

- 虛擬實境

- 擴增實境

- 混合實境

- 評估 COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- AR 和 VR 應用在多個最終用戶產業的採用率不斷提高

- MicroLED等整體微顯示器技術的重大進步

- 市場限制因素

- 顯示器製造過程複雜

- 擴增實境穿戴裝置的可用內容有限

第6章市場區隔

- 依顯示類型

- 液晶顯示器(LCD)

- 有機發光二極體二極體(OLED)

- 其他顯示類型

- 依最終用戶產業

- 遊戲和娛樂

- 衛生保健

- 教育

- 軍事和國防

- 汽車和製造

- 零售

- 其他用途

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭形勢

- 公司簡介

- Sony Corporation

- Samsung Electronics Co., Ltd.

- Kopin Corporation

- Japan Display Inc.

- Plessey Company plc

- eMagin Corporation

- LG Display Co., Ltd.

- Lumus, Ltd.

- Seiko Epson Corporation

- BOE Technology Group Co., Ltd.

- Realfiction Holding AB

- SA Photonics, Inc.

第8章投資分析

第9章市場機會與未來趨勢

The Extended Reality Display Market size is estimated at USD 1.93 billion in 2024, and is expected to reach USD 12.79 billion by 2029, growing at a CAGR of 46.06% during the forecast period (2024-2029).

The onset of the pandemic has triggered the development of extended reality technologies in retail, education, and healthcare. However, the use of XR Technologies has always been dominant in the gaming and entertainment industry despite the impact of COVID-19 that accelerated the adoption of XR technologies in other end-user industries. Thus, driving the growth for displays in the extended reality market.

Key Highlights

- The market numbers stated in the study indicate the value of displays sold by the vendors across applications such as gaming, entertainment, retail, healthcare, education, military and defense, automotive and manufacturing, and others. The displays used in the market are designed as either direct view panels or microdisplay panels. The AR display panels are designed as see-through and allow users to view the digital data while fully being aware of the physical world around them.

- The COVID-19 pandemic resulted in an upsurge in adopting XR technologies that drive the demand for displays studied in the market. For example, beauty retailers such as Sephora and Ulta have to forbid customers from physically testing the beauty products on their skin. Beauty retailers are instead turning to AR to help consumers digitally test products to assist in buying decisions.

- Therefore, the use of immersive technology in end-user settings is expected to increase further over the coming years due to the short-term growth in demand augmented by the effects of the pandemic.

- Moreover, Mixed reality adoption is gaining momentum in various sectors where information availability at the eyesight becomes an added advantage and gives an edge. Microsoft is increasingly focusing on innovating its offering to expand its application field. For instance, in March 2021, Microsoft won a contract from the US Army to produce headsets based on the HoloLens 2 worth USD 21.9 billion. Such developments are further expected to impact the adoption of the technology and drive the need for XR displays studied in the market.

- One of the most difficult challenges faced by the XR technology pertains to educating the wider audience - the broader market. The current applications (for smartphones, tablets, and wearables) are limited to a single user alone. For XR to be more accessible, developing multi-user, uniform, and streamlined experiences is a must. In the current market scenario, the availability of such products is limited, thus acting as a significant challenge to the market's growth.

- In the coming years, real-time rendering and interactive AI, the increasing popularity of immersive experiences, and the proliferation of 5G are expected to transform the theatrical experience and boost the growth of the XR display market. For instance, if the end-to-end latency (delay between the user's head movement and the change of the display in a VR headset) is very high, users can experience motion sickness. To avoid it, VR systems need less than 20ms latency, which a 5G can deliver. Thus, 5G is expected to support the demand for the XR market.

Extended Reality Display Market Trends

Rising Adoption of AR and VR Applications Across Multiple End-User Industries

- The rapid adoption of AR and VR is transforming the gaming industry, significantly creating more opportunities for the XR display market. Companies are making rapid developments in their products to gain maximum market traction. For instance, the Oculus Quest VR headset improvised its VR system by adding a hand tracking feature, which may enable VR users to use their fingers to manipulate the VR worlds.

- Gesture-based computing is now becoming a part of gaming, TVs, devices, kiosks, medical, 3D sculpting, engineering, medical professionals, designers, advertisers, and even people with physical disabilities. Gesture-based gaming has moved beyond traditional gaming consoles and is witnessing increasing adoption in educational games for children. For instance, Magic Touch Math is the first game that focuses on learning mathematics using custom gesture drawings. Thus, gesture-based recognition can also be used in applications apart from traditional gaming applications.

- In September 2021, Audi announced the virtual reality entertainment holoride on the road. This makes travel to virtual worlds from within an Audi possible. The startup holoride is working to make car rise a multi-modal experience. This new technology will merge VR content with driving movements in real-time to enable back seat passengers in Audi to dive into games, movies, and presentations and experience virtual content by adapting to the driving movements of the car in real-time using VR glasses.

- Further, in September 2021, the University of East London (UEL) announced the launch of an EON-XR Center in partnership with EON Reality. The EON-XR Center in the United Kingdom lets students and lecturers access AR and VR-based training through various devices, including smartphones, websites, and VR headsets.Thus, driving the growth and demand for the market studied. Thus, such developments are expected to further drive the demand for the XR displays studied in the market.

North America is Expected to Hold Significant Share

- The North American region is expected to hold a significant market share as the United States Government is finding both direct and indirect ways to use extended reality technology to facilitate innovation and promote prosperity.

- For instance, the Foreign Service Institute at the State Department has introduced VR as an experiential learning tool in specific training. Several AR and VR training programs have been implemented in the region to develop local workforces and manage wastewater.

- The region is dominating the market due to factors such as high technology exposure. Besides, the easy availability of resources has created a robust demand for extended reality devices. Several regional companies are deploying innovative displays into their AR/VR wearables.

- Many large American technology giants, from Apple to Google, are significantly investing in building VR and AR equipment. As the display forms a critical element in such devices, such investments will aid the market's growth.

- For instance, in June 2022, Facebook's parent company Meta unveiled four virtual reality (VR) prototype displays for research purposes as the company seeks to achieve the full potential of metaverse technology. The models are expected to deliver visual experiences that closely resemble reality and solve problems such as poor resolution, distorted views, and eye fatigue while making headsets lighter.

- The region is also home to many major players, such as eMagin Corporation, a major manufacturer of high-resolution OLED microdisplays for AR/VR and other near-eye imaging products. The company hosted an exhibit of its current product line, including its dPd Direct Patterning OLED Microdisplay Technology, at Display Week 2022, one of the industry's largest conferences devoted to the display market, in San Jose, California, in May 2022.

Extended Reality Display Industry Overview

The Extended Reality Display Market primarily comprises multiple domestic and international players. The competitive rivalry is expected to be high and remain the same during the forecast period among the players. Significant players in the market include Sony Corporation, Samsung Electronics Co., Ltd., Kopin Corporation, Japan Display, Inc., etc. Technological advancements in the market are also bringing considerable competitive advantage to the companies, and the market is also witnessing multiple partnerships.

- June 2022 - Kopin was awarded a contract to develop a new in-vehicle display imaging system for a US prime defense contractor. The new system would integrate Kopin's high-brightness, high-resolution, low-power ferroelectric liquid crystal on silicon (FLCOS) microdisplay and custom optic into a heavily ruggedized custom housing to enable operational use in extremely harsh environments.

- June 2022 - LG Display is planning the groundwork to potentially supply Apple with displays for its second-generation mixed reality (MR) device. LG will order deposition equipment from Sunic System, allowing the company to produce micro OLED panels.

- May 2022 - Samsung Electronics launched Micro LED technology at Integrated Systems Europe (ISE) with three new models of its state-of-the-art display technology, The Wall. The next-generation technology of The Wall would deliver benefits for transforming any business and unlocking new opportunities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Technology Snapshot

- 4.3.1 Virtual Reality

- 4.3.2 Augmented Reality

- 4.3.3 Mixed Reality

- 4.4 Assessment on the impact due to COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Adoption of AR and VR Applications Across Multiple End-user Industries

- 5.1.2 Significant Technological Advancement Across Micros Displays Such as MicroLEDs

- 5.2 Market Restraints

- 5.2.1 Complex Manufacturing Process Involved for the Production of Displays

- 5.2.2 Limited Content Available for the Extended Reality Wearables

6 MARKET SEGMENTATION

- 6.1 By Display Type

- 6.1.1 Liquid Crystal Displays (LCD)

- 6.1.2 Organic Light-Emitting Diode (OLED)

- 6.1.3 Other Display Type

- 6.2 By End-User Industry

- 6.2.1 Gaming and Entertainment

- 6.2.2 Healthcare

- 6.2.3 Education

- 6.2.4 Military and Defense

- 6.2.5 Automotive and Manufacturing

- 6.2.6 Retail

- 6.2.7 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Sony Corporation

- 7.1.2 Samsung Electronics Co., Ltd.

- 7.1.3 Kopin Corporation

- 7.1.4 Japan Display Inc.

- 7.1.5 Plessey Company plc

- 7.1.6 eMagin Corporation

- 7.1.7 LG Display Co., Ltd.

- 7.1.8 Lumus, Ltd.

- 7.1.9 Seiko Epson Corporation

- 7.1.10 BOE Technology Group Co., Ltd.

- 7.1.11 Realfiction Holding AB

- 7.1.12 SA Photonics, Inc.