|

市場調查報告書

商品編碼

1435772

工作流程自動化:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Workflow Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

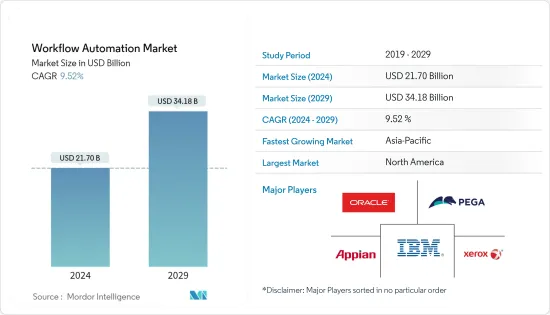

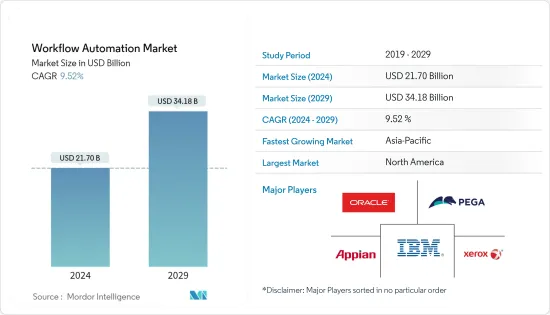

工作流程自動化市場規模預計到 2024 年為 217 億美元,預計到 2029 年將達到 341.8 億美元,在預測期內(2024-2029 年)複合年成長率為 9.52%。

工作流程的概念是從製造和辦公室的流程概念演變而來的。這些流程自工業化時代以來就已經存在,是透過關注工作活動的平凡方面來顯著提高效率的結果。他們通常將工作活動分類為明確定義的任務、規則、角色和程序,並規範大多數製造和管理任務。最初,過程完全由人類操縱物理物件來執行。

主要亮點

- 從資訊科技簡介開始,職場流程由資訊系統部分或完全自動化,其中電腦程式執行任務並執行先前由人類執行的規則。工作流程自動化的開發是為了透過將最佳實踐涵蓋製造和控制工作流程來提高生產力和品質。這樣可以輕鬆定義工作流程,並根據從執行特定階段的各個階段的資料來源和網路位置檢索的資料產生作業單。系統可以自動移動作業單,無需外部因素的干涉,還可以隨時直覺地顯示作業單的狀態。這個系統還可以適應某些階段的變化。

- 組織對工作流程軟體的需求不斷成長,導致快速投資開發更複雜、更有效率的軟體。 Signavio 表示,62% 的組織對其多達 25% 的業務進行建模,但只有 2% 的組織對所有流程進行建模。此外,13% 的受訪組織表示他們正在大規模實施智慧自動化解決方案。 23% 已實施自動化,37% 正在試行自動化。

- 組織對工作流程軟體的需求不斷成長,導致快速投資開發更複雜、更有效率的軟體。從電腦視覺、認知自動化、機器學習到機器人流程自動化,人工智慧和相關新技術的採用正在增加。這種技術的融合創造了自動化功能,可以顯著提高客戶業務。

- 與實施新技術不同,工作流程自動化可能會對人類和非人類帳戶造成網路攻擊的風險。因此,流程自動化的安全性變得極為重要。 RPA 機器人通常處理敏感資料並將其從一個系統傳輸到另一個系統。如果資料無法受到保護,資料可能會被利用,並使企業損失數百萬美元。

- 新型冠狀病毒肺炎(COVID-19)的爆發暴露了供應鏈的脆弱性。對大多數 IT 組織而言,脆弱的生態系統包括關鍵 IT 服務的提供者。此外,在家工作的要求使服務供應商能夠確保關鍵任務企業客戶擁有所需的工具和技術,以實現所提供服務的速度、安全性、品質和整體有效性。這樣做是必要的。

工作流程自動化市場趨勢

軟體產業預計將大幅成長

- 由於新興應用和經營模式以及設備成本的降低,物聯網在各行業的採用正在迅速增加。隨著物聯網連接的激增,我們看到對用於自動化工作流程的工具的巨大需求,例如工作流程自動化軟體、工作流程管理軟體、工作流程系統和業務流程自動化 (BPA)。工作流程自動化軟體具有多種優勢,包括付加功能和整合功能,可擴展可實施的自動化範圍。這種採用將進一步增加整個工作流程自動化市場對軟體產業的需求。

- 一些功能包括減少實施和維護軟體所需的 IT 支援量的能力。業務用戶可以透過直覺的視覺化介面輕鬆存取某些功能,從而加快自動化速度,並使業務團隊能夠在最佳化工作流程中發揮共同創造性的作用。低程式碼還可以減輕 IT 積壓的壓力。例如,Integrify 是一個低程式碼工作流程自動化平台,提供易於使用的建構器、靈活的客製化、多種定價選項和專用的客戶支援。

- 此外,擷取和整合傳入資料對於任何團隊來說都是困難的,工作流程自動化軟體提供了可定製表單等功能,可透過標準化流程、避免錯誤和消除重複資料輸入來簡化請求管理。推廣功能性解決方案。此入口網站可讓您輕鬆組織表單並與內部或外部合作夥伴安全地共用它們。在工作流程自動化中發揮重要作用的其他功能包括整合、範本和規則的存在以及條件邏輯。

- 例如,2023 年 10 月,商業軟體低程式碼開發平台 Retool Inc. 宣布全面推出 Retool Workflows。這種高度創新的自動化工具旨在透過允許開發人員優先考慮編碼並與監控和維護工具一起無縫地自動化任務來顯著幫助開發人員。 Retool Workflows 允許開發人員提供使用者友好且具有視覺吸引力的介面,該介面提供了廣泛的編碼原型製作和建構。此外,該工具還有助於基於觸發器的資料提取、轉換和載入。

預計亞太地區在預測期內成長最快

- 隨著中國市場競爭的加劇,國內各產業都在透過數位轉型改善工作流程。例如,東風日產啟動了數位轉型計劃,以簡化和加快一系列新車的行銷流程。該公司啟動了數位轉型策略,以推動更好地利用資料,旨在改善現有工作流程、簡化內部業務並提高整體效率。作為該計劃的一部分,該公司部署了 UiPath,一種機器人流程自動化 (RPA) 軟體,以自動執行重複的數位任務。

- 中國聯通智慧網路研發中心於2021年與華為合作,基於華為AUTIN系統開發並部署了人工智慧驅動的網路管理和營運平台。該公司推出了基於人工智慧的網路管理和營運平台,利用資料來簡化和自動化全國網路營運、規劃和管理,同時隨著5G網路和服務的推出提高成本效率和客戶體驗,提高永續性。

- 自動化是與未來工作方式相關的最重要部分之一,日本正在透過人工智慧進行創新。野村研究認為,到 2035 年,日本人工智慧領域將取得重大進展。 Abeja 和 NEC 等自動化公司正在透過創新來提高生產效率,從而推動日本的 GDP 成長。

- 自動化在印度的經濟發展中發揮了重要作用。該國目前正在透過引進技術和創新在大多數行業進行轉型。國家人工智慧戰略(NSAI)強調,人工智慧預計到 2035 年將使印度年成長率加快 1.3%。

- 東南亞和澳洲是亞太地區的其他重要地區。東南亞的公司正在讓員工為以人工智慧為中心的未來做好準備,並擁抱新技術。為此,公司需要透過適當的技能提升策略來縮小技能差距。數位化不僅將幫助該地區為當地企業建立具有全球競爭力的合作夥伴關係,還將增加全球擴張的潛力並支持成功的技術和知識轉移。

工作流程自動化產業概述

工作流程自動化市場分散且競爭激烈。該市場由IBM公司、甲骨文公司、Pegasystems公司、全錄公司和Appian公司等幾家主要企業組成。這些公司正在利用策略合作舉措來提高市場佔有率和盈利。

- 2023 年 11 月:全球雲端平台和人工智慧主導的財務、採購和客戶服務功能流程自動化解決方案的產業領導者 Esker 宣布 Teknion 將使用 Esker 的應付帳款自動化解決方案來提高業務效率,並宣布已被選中。 Teknion 旨在利用 Esker 的創新技術簡化其全球站點的系統和 ERP 工作流程。 Teknion 特別尋求一種結合自動化和人工智慧的解決方案,以有效地結合來自多個 ERP 的訊息,從而實現財務系統的持續轉型。

- 2023 年 9 月:Salesforce 為 Slack 平台引進了一些令人印象深刻的進步。這包括整合 Slack 的原生生成人工智慧功能、幫助結構化工作流程的清單功能以及對我們的自動化平台的各種增強功能。同時,Slack 也取得了重大進展,推出了自己的 Slack AI,該人工智慧利用了自己的本地法學碩士技術。此外,Slack 還為工作流程自動化添加了有價值的功能,包括列出有組織的任務、核准和資訊的能力。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 市場促進因素

- 各產業的物聯網採用率不斷提高

- 在業務流程管理中更多地採用 RPA

- 市場限制因素

- 資料安全問題

第5章市場區隔

- 按配置

- 本地

- 雲

- 按解決方案

- 軟體

- 服務

- 按最終用戶產業

- 銀行

- 電信

- 零售

- 製造/物流

- 醫療保健/製藥

- 能源/公共產業

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 世界其他地區(拉丁美洲、中東和非洲)

- 北美洲

第6章 競爭形勢

- 公司簡介

- IBM Corporation

- Oracle Corporation

- Xerox Corporation

- Pegasystems Inc.

- Appian Corporation

- Bizagi

- Software AG

- IPsoft Inc.

- Newgen Software Technologies Limited

- Nintex Global Limited

第7章 投資分析

第8章市場趨勢與未來機遇

The Workflow Automation Market size is estimated at USD 21.70 billion in 2024, and is expected to reach USD 34.18 billion by 2029, growing at a CAGR of 9.52% during the forecast period (2024-2029).

The workflow concept has evolved from the notion of process in manufacturing and the office, and such processes have existed since the time of industrialization and are the outcome of a search to surge efficiency by concentrating on the routine aspects of work activities. They typically separate work activities into well-defined tasks, rules, roles, and procedures that regulate most of the manufacturing and office work. Initially, processes were carried out entirely by humans who manipulated physical objects.

Key Highlights

- With the introduction of information technology, processes in the workplace are partially or totally automated by information systems through computer programs performing tasks and enforcing rules that humans previously implemented. Workflow automation is developed to enhance productivity and quality by incorporating best practices in workflow processes involved in manufacturing as well as management. It facilitates defining workflow processes from the data fetched from the data sources and the network location of the various stages at which the execution of that particular stage is performed, along with the generation of job ticket. The system is able to move the job ticket automatically without any intervention of any external factor along with providing the user, a visual display of status of any job ticket at any point of time. The system is also adaptable to changes at a particular stage.

- The growing demand for workflow software from organizations is leading to rapid investment in the development of more sophisticated and efficient software. According to Signavio, 62% of the organizations have modeled up to 25% of their businesses, but a meager 2% have all their processes modeled. Moreover, 13% of the surveyed organizations say that they are implementing intelligent automation solutions at scale; 23% are implementing, and 37% are piloting automation.

- The increasing demand for workflow software by organizations is leading to rapid investment in the development of more sophisticated and efficient software. There is increasing adoption of artificial intelligence and related new technologies ranging from computer vision, cognitive automation, and machine learning to robotic process automation. This convergence of technologies produces automation capabilities that dramatically elevate business value and competitive advantages for customers.

- Unlike any new technology implementation, workflow automation can create risks for cyberattacks directed at both human and non-human accounts. As a result, process automation security is of critical importance. RPA bots often work on confidential data, transferring it from one system to another. If data is not protected, it can be leveraged, costing businesses millions.

- With the onset of COVID-19, the vulnerability of supply chains has been exposed. For most IT organizations, a fragile ecosystem includes providers of critical IT services. In addition, work-from-home mandates led the service providers to ensure that mission-critical enterprise customers have the necessary tools and technologies to enable the speed, security, quality, and overall efficacy of services provided.

Workflow Automation Market Trends

Software Segment is Expected to Register Significant Growth

- The adoption of IoT is surging among industries owing to the emergence of applications and business models and reduced device costs. With surging IoT connective, the tools used to automate workflows, including workflow automation software, workflow management software, workflow systems, or business process automation (BPA) are observing significant demand. The workflow automation software has various advantages, including value-adding features, and provides integration capabilities to increase the range of automation one can implement. Such adoption will bring more demand for the software segment across the workflow automation market.

- Some features include the capability of reducing the amount of IT support required to implement and maintain the software. Business users can conveniently access some features through an intuitive visual interface, making the automation faster and putting business teams in a co-creative role for optimizing workflows. Low code also relieves pressure on the IT backlog. For instance, Integrify is a low-code workflow automation platform that offers an easy-to-use builder, flexible customization, multiple pricing options, and dedicated customer support.

- Moreover, capturing and consolidating incoming data can be challenging for any team, and workflow automation software facilitates a solution with features such as customizable forms to simplify request management by standardizing processes, avoiding errors, and eliminating duplicate data entry. Portals make organizing and securely sharing forms with internal or external partners easy. Other features that play a crucial role in the workflow automation includes integrations, presence of templates and rules as well as conditional logic.

- For instance, In October 2023, Retool Inc., a low-code development platform for business software, announced the general availability of Retool Workflows. This highly innovative automation tool has been designed with the aim of greatly assisting developers by enabling them to prioritize coding and then seamlessly automate tasks alongside monitoring and maintenance tools. With Retool Workflows, developers are offered a user-friendly and visually appealing interface that provides an extensive array of coding tools, allowing for efficient prototyping and construction of periodic jobs, customized alerts, and information management tasks. Furthermore, this tool facilitates data extraction, transformation, and loading based on triggers.

Asia-Pacific Expected to Register the Fastest Growth During the Forecast Period

- With the increasing competition in the Chinese market, various industries in the country have been improving workflow through digital transformation. For instance, Dongfeng Nissan initiated its digital transformation program to improve efficiency and speed up the process of marketing a line of new vehicles. The company launched its digital transformation strategy for promoting the better use of data aimed to improve existing workflows, streamline internal business operations, and promote overall efficiency. As part of the program, the company implemented robotic process automation (RPA) software, UiPath, to automate repetitive digital tasks.

- China Unicom's Intelligent Network Innovation Center worked with Huawei in 2021 to develop and deploy an AI-powered network management and operations platform based on Huawei's AUTIN system. The company deployed an AI-based network management and operations platform to use data to simplify and automate national network operation, planning, and management while improving cost-effectiveness, customer experience, and sustainability as it rolled out 5G networks and services.

- Automation is one of the most crucial parts related to the future of work approach, and Japan is innovating through AI. According to the Nomura Research Institute, the AI sector in the country will see a massive stride by 2035. Automation companies such as Abeja, NEC, and others innovate to bring more production efficiency to push Japan's GDP.

- Automation has been playing a major role in India's economic development. The country is currently witnessing a transition in most sectors through the implementation of technology and innovation. The National Strategy for Artificial Intelligence (NSAI) highlighted that AI is predicted to accelerate India's annual growth rate by 1.3% by 2035.

- Southeast Asia and Australia are prominent regions in the Rest of Asia-Pacific. Southeast Asian companies are preparing employees for an AI-centered future and embracing new technologies. This would require enterprises to plug the skills gap through a proper upskilling strategy. Digitization would help the region to create globally competitive partnerships for local companies as well as improve the potential for global expansion and support a successful technology and knowledge transfer.

Workflow Automation Industry Overview

The Workflow Automation Market is fragemented and highly competitive. This market consists of several major players, such as IBM Corporation, Oracle Corporation, Pegasystems Inc., Xerox Corporation, and Appian Corporation. These companies leverage strategic collaborative initiatives to increase their market share and profitability.

- November 2023: Esker, a global cloud platform and industry leader in AI-driven process automation solutions for Finance, Procurement, and Customer Service functions, announced Teknion has selected Esker's Accounts Payable automation solution to enhance its operational efficiencies. By leveraging Esker's innovative technology, Teknion aims to streamline its systems and ERP workflow across its global sites. Teknion specifically sought a solution incorporating automation and artificial intelligence to effectively combine information from multiple ERPs for their ongoing transformation of financial systems.

- September 2023: Salesforce has introduced some impressive advancements to its Slack platform. These include integrating Slack-native generative AI capabilities, a helpful lists function for structured workflow, and various enhancements to its automation platform. On the other hand, Slack has also made significant strides by launching its own Slack AI, which is powered by its own native LLM technology. Additionally, Slack has made valuable additions to its workflow automation, such as a lists feature for organized tasks, approvals, and information.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Market Drivers

- 4.3.1 Increasing Adoption of IoT across industries

- 4.3.2 Rise in Implementation of RPA in Business Process Management

- 4.4 Market Restraints

- 4.4.1 Data Security Concerns

5 MARKET SEGMENTATION

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By Solution

- 5.2.1 Software

- 5.2.2 Service

- 5.3 By End-user Industry

- 5.3.1 Banking

- 5.3.2 Telecom

- 5.3.3 Retail

- 5.3.4 Manufacturing and Logistics

- 5.3.5 Healthcare and Pharmaceuticals

- 5.3.6 Energy and Utilities

- 5.3.7 Other End-user Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Rest of the World (Latin America, Middle East and Africa)

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IBM Corporation

- 6.1.2 Oracle Corporation

- 6.1.3 Xerox Corporation

- 6.1.4 Pegasystems Inc.

- 6.1.5 Appian Corporation

- 6.1.6 Bizagi

- 6.1.7 Software AG

- 6.1.8 IPsoft Inc.

- 6.1.9 Newgen Software Technologies Limited

- 6.1.10 Nintex Global Limited