|

市場調查報告書

商品編碼

1434285

LED農業:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)LED Farming - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

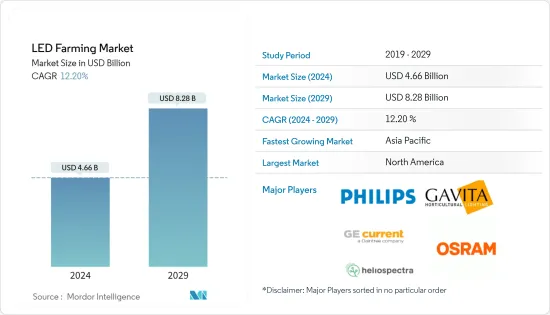

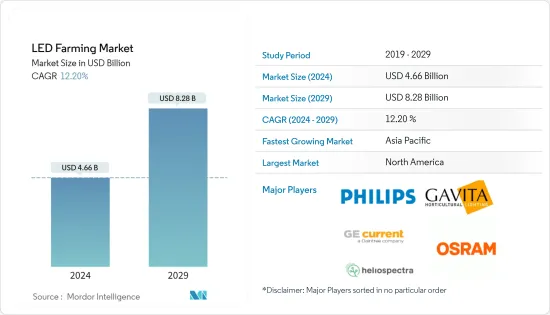

LED農業市場規模預計2024年為46.6億美元,預計到2029年將達到82.8億美元,在預測期內(2024-2029年)複合年成長率為12.20%成長。

主要亮點

- 垂直農業方面的受控環境農業(CEA)的出現在LED農業市場中發揮了重要作用。提高可靠性、能源效率、產品多樣化和降低長期成本是推動垂直農場廣泛普及LED 照明的關鍵特徵。

- 2019年北美在全球LED農業市場中佔據最大市場規模,其次是室內農場和商業溫室。紐約、芝加哥、密爾瓦基、多倫多和溫哥華等城市的城市人口集中正在推動貨櫃式室內農場和建築式農場的建立,以滿足對生鮮食品的新需求。

- LED農業市場高度分散,老牌企業和新興企業都在爭奪市場上的立足點。市場主要企業包括 Koninklijke Philips NV、Gavita International BV、通用電氣公司、歐司朗光電半導體有限公司、Heliospectra AB、Hortilux Schreder BV、Illumitex 等。

LED農業市場趨勢

垂直農業引領LED農業市場

垂直農業的興起開啟了發光二極體(LED)技術的革命性趨勢。隨著經濟實惠且高效的 LED 燈推動農業技術市場的發展,受控環境農業 (CEA) 正在迅速從大麻等高價值作物轉向微型菜苗和蔬菜等更廣泛的品種。根據美國能源局,2010 年至 2014 年間,LED 價格下降了 90%,效率加倍。經驗觀察表明,LED 比高壓鈉 (HPS) 和金屬鹵化物 (MH) 燈節能 40% 至 70%,非常適合垂直農場。根據歐洲研究理事會統計,2016年,照明在全球垂直農業總收入中所佔佔有率最大,為35.8%(折合2.68億美元)。這意味著LED照明在垂直農業中發揮著至關重要的作用,並且未來有望發揮更多作用。該細分市場的快速成長可以在預測期內反映出來。

北美—LED農業最大市場

2019年北美佔據全球LED農業市場最大佔有率。美國佔該地區總收益的最大部分。在美國,農業用地的短缺以及由此產生的提高作物生產力的需求已經變得顯而易見。根據美國農業部(USDA)估算,2015年阿拉巴馬州和喬治亞農業用地面積減少了10萬英畝,農業用地佔總土地面積的比例為44.58%。2015 年。此後一直穩定下降。 2017年為44.36%。截至2016年,美國商業規模垂直農場總數已接近20個,由於農業技術領域投資加大,預計將進一步增加,提振LED農業市場。農業研究服務處也正在進行計劃,利用 LED 燈來增加美國的番茄產量,並提高其他受保護環境中的生產品質。此外,「從農場到餐桌的新鮮」消費導向促使多家加拿大公司,包括Modular Farms、Goodleaf Farms、新斯科細亞省的True Leaf 和Ecoburn Gardens,致力於解決國家的糧食危機。為了做到這一點,他轉向都市農業。有時。

LED農業產業概況

該市場競爭非常激烈,一些國際知名企業和一些區域企業都在新興農業LED照明市場爭奪更高的市場佔有率。市場主要企業包括 Koninklijke Philips NV、Gavita International BV、通用電氣公司、歐司朗光電半導體有限公司、Heliospectra AB、Hortilux Schreder BV、Illumitex 等。併購、創新、產品系列多元化和投資是這些公司透過全面的研發方法進入不斷發展的市場時最常採用的一些策略。例如,Heliospectra於2019年5月推出了全新模組化LED照明系列MITRA。它為商業溫室、室內和垂直農場提供高亮度光輸出和高達2.7mol/J的電力效率。 2018年,歐司朗收購了Fluence。 Bioengineering 是一家總部位於德克薩斯的領先商業作物生產 LED 照明供應商,目前正在尋求擴大其在歐洲、中東和非洲地區的業務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素與市場約束因素介紹

- 市場促進因素

- 市場限制因素

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 目的

- 垂直農業

- 室內農業

- 商業溫室

- 草坪和景觀美化

- 波長

- 藍色波長

- 紅色波長

- 遠紅光波長

- 作物類型

- 水果和蔬菜

- 花朵

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲等

- 中東/非洲

- 阿拉伯聯合大公國

- 南非

- 埃及

- 其他中東和非洲

- 北美洲

第 6 章:競爭形勢

- 最採用的策略

- 市場佔有率分析

- 公司簡介

- Koninklijke Philips NV

- Gavita International BV

- General Electric Company

- OSRAM Opto Semiconductors GmbH

- Heliospectra AB

- Hortilux Schreder BV

- Illumitex

- LumiGrow

- Smart Grow Systems, Inc.

- Hubbell

第7章 市場機會及未來趨勢

The LED Farming Market size is estimated at USD 4.66 billion in 2024, and is expected to reach USD 8.28 billion by 2029, growing at a CAGR of 12.20% during the forecast period (2024-2029).

Key Highlights

- The advent of Controlled Environment Agriculture (CEA) in terms of vertical farming has had a significant role to play in the LED farming market. Increased reliability, energy-efficiency, diversified products, and reduced long-term costs are the key features driving the penetration of LED lighting in vertical farms.

- North America held the largest market size in the global LED farming market in 2019, followed by indoor farms and commercial greenhouses. The onset of the urban populationdwelling across cities, such as New York, Chicago, and Milwaukee, Toronto, and Vancouver, has propelled the establishment of indoor farms in shipping containerized form or building-based farms to cater to the emerging need for fresh grown foods.

- The market for LED farming is fairly fragmented with the well-established players and emerging companies equally vying for a stronger foothold in the market. Some of the key players in the market includeKoninklijke Philips N.V., Gavita International B.V., General Electric Company, OSRAM Opto Semiconductors GmbH, Heliospectra AB, Hortilux Schreder B.V., and Illumitex, among others.

LED Farming Market Trends

Vertical Farming to Lead the LED Farming Market

The onset of vertical farming has embarked on a revolutionary trend for the light-emitting diode (LED) technology. A rapid transition has been witnessed in Controlled Environment Agriculture (CEA) from only high-value crops such as cannabis to a wide-ranging variety such as microgreens and vegetables owing to the affordable and efficient LED lights thrusting the agricultural technology market. According to the US Department of Energy, the price of LEDs dropped by 90% whole their efficiency increased double-fold between the period 2010-2014. Empirical observations have revealed that LEDs are 40% to 70% more energy-efficient and suitable for vertical farms than high-pressure sodium (HPS) lights or metal halide (MH) lamps. According to the European Research Council, lighting contributed the largest share of 35.8% valued at USD 268.0 million to the total revenue of vertical farming, globally, in 2016. This signifies that LED lights have played a pivotal role in vertical farming and is further expected to witness a rapid growth in this segment during the forecast period.

North America - The Largest Market in LED Farming

North America accounted for the largest share in the global LED farming market in 2019. The United States contributed the largest portion of the total revenue generated in the region. The US has been surfaced with farmland scarcity and the subsequent need for higher productivity of crops. According to the United States Department of Agriculture (USDA) estimates, the amount of land used for agricultural purposes fell by 100,000 acres in Alabama and Georgia in 2015 while the percentage of agricultural land in the total land area fell steadily from 44.58% in 2015 to 44.36% in 2017. As of 2016, the total number of commercial-scale vertical farms in the US approached 20 and is further expected to rise with increased investment in the agricultural technology sector, thus, giving a boost to the LED farming market. The Agricultural Research Service has also undertaken a project to increase tomato production in the US and the quality of production in other protected environments using LED lights. Moreover, a "fresh-from-farm-to-table" consumption preference has encouraged several Canadian players such as Modular Farms, Goodleaf Farms, Nova Scotia's TruLeaf, and Ecobain Gardens, to turn to urban agriculture to answer food shocks in the country from time to time.

LED Farming Industry Overview

The market is highlycompetitive witha few internationally established players as well as several regional players vying for a higher market share in the emerging market for LED lights in farming. The key players in the market include Koninklijke Philips N.V., Gavita International B.V., General Electric Company, OSRAM Opto Semiconductors GmbH, Heliospectra AB, Hortilux Schreder B.V., and Illumitex, among others. Mergers and acquisitions, innovation, diversification of product portfolios, and investments are some of the most adopted strategies of these players for penetrating the evolving market with an all-encompassing Research & Development approach. For instance, Heliospectra launched thenew modular LED lighting series, MITRA,in May 2019, which provides high-intensity light output and electrical efficacy of up to 2.7 µmol/J forcommercial greenhouses, indoor, and vertical farms.In 2018, OSRAM acquired Fluence Bioengineering, a Texas-based leading provider of LED lighting for commercial crop production, in a bid to enhance its outreach in Europe, the Middle East, and Africa regions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.4 Market Restraints

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Vertical farming

- 5.1.2 Indoor Farming

- 5.1.3 Commercial Greenhouse

- 5.1.4 Turf and Landscaping

- 5.2 Wavelength

- 5.2.1 Blue Wavelength

- 5.2.2 Red Wavelength

- 5.2.3 Far Red Wavelength

- 5.3 Crop Type

- 5.3.1 Fruits & Vegetables

- 5.3.2 Herbs & Microgreens

- 5.3.3 Flowers & Ornamentals

- 5.3.4 Other Crop Types

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 US

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 UK

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 UAE

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Egypt

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Koninklijke Philips N.V.

- 6.3.2 Gavita International B.V.

- 6.3.3 General Electric Company

- 6.3.4 OSRAM Opto Semiconductors GmbH

- 6.3.5 Heliospectra AB

- 6.3.6 Hortilux Schreder B.V.

- 6.3.7 Illumitex

- 6.3.8 LumiGrow

- 6.3.9 Smart Grow Systems, Inc.

- 6.3.10 Hubbell