|

市場調查報告書

商品編碼

1687941

資產追蹤:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Asset Tracking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

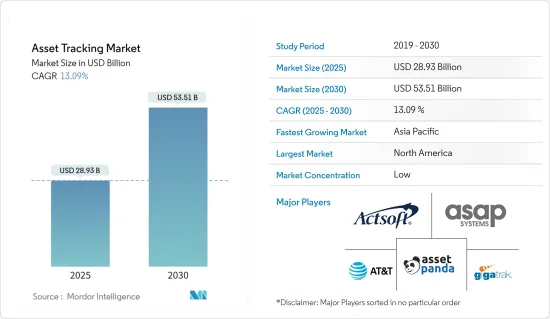

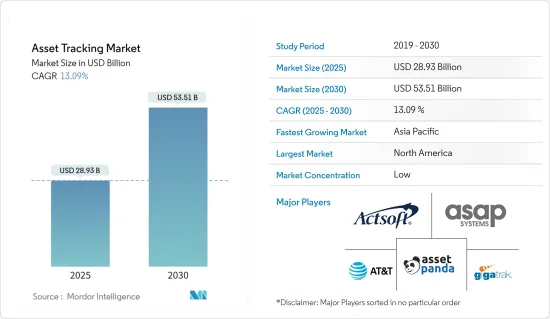

資產追蹤市場規模預計在 2025 年為 289.3 億美元,預計到 2030 年將達到 535.1 億美元,預測期內(2025-2030 年)的複合年成長率為 13.09%。

關鍵亮點

- 在當前製造環境和辦公空間快速數位化的市場形勢下,資產管理和追蹤解決方案對於實現更高的業務效率至關重要。資產追蹤技術以硬體形式部署,例如 GPS、RFID、BLE、QR 碼和/或用於內部部署和雲端部署的軟體。

- 物聯網技術的最新進展使得運輸和物流、製造、食品和飲料以及其他領域的最終用戶能夠使用經濟高效的資產追蹤硬體。例如,在醫療保健領域,醫院和其他醫療機構需要密切監視高價值醫療設備的狀況,以防止盜竊並確保持續使用。醫院追蹤系統可以即時監控物資和設備。它為患者提供所需的護理,並有可能顯著提高患者照護的標準。

- 工業 4.0 幫助工業領域數位化的早期採用者節省了新計畫的時間和資源。資產追蹤是數位化中最有益和最必要的方面。行動應用工具和雲端基礎的資產追蹤和監控大大減少了定位和追蹤資產所需的時間和精力。透過持續的即時定位和狀況追蹤以及物品評估,這些系統正在提高施工現場的效率。企業領導者需要具有適合大規模現場和業務的物聯網技術功能的強大資產監控解決方案,因此他們青睞提供雲端解決方案的解決方案供應商。

- 疫情過後,由於物聯網在各個終端用戶產業的滲透率不斷提高,以及對有效追蹤和管理資產的需求不斷成長,市場正在經歷顯著成長。此外,資產追蹤技術的硬體和軟體都取得了重大技術進步,對疫情後資產追蹤市場的成長產生了積極影響。

- 儘管高昂的初始成本限制了市場的成長,但第三方物流參與企業透過增值追蹤服務不斷成長的需求以及物聯網設備在資產追蹤中的日益普及,刺激了市場的成長。基於物聯網的資產追蹤正在獲得發展動力,因為它利用感測器和連接的設備來遠端監控和追蹤資產的地理位置和移動。物聯網技術也為企業(尤其是工業、運輸和物流服務領域的企業)提供了巨大的成長機會,以監控資產、提高效率並實施新的經營模式。

資產追蹤市場趨勢

製造業成為最大的終端用戶產業

- 隨著工業4.0和智慧工廠的普及,製造業需要採用先進的數位技術來改善生產流程。資產追蹤在各行各業被廣泛採用,以追蹤和監控資產的位置和狀態。

- 資產監控技術廣泛應用於製造工廠,以監控原料、在製品和成品的移動和儲存。即時追蹤資料簡化了供應鏈操作並最大限度地減少了缺貨。

- 物聯網和低功耗藍牙 (BLE) 等先進的資產追蹤技術在製造業中正在迅速普及。 BLE 標籤具有多種尺寸、形式和功能,使製造商可以輕鬆開始他們的第一個使用案例。無論是零件還是設備,資產追蹤都融合了物聯網 (IoT) 的進步,使用薄標籤可以在整個工廠或院子裡自動追蹤。這種利用物聯網的先進資產追蹤解決方案有望豐富製造業的資產追蹤解決方案並促進市場成長。

- 同時監控多個工廠位置並獲取有關流程、操作和庫存的即時資訊的需求預計將推動製造業資產追蹤的成長。利用物聯網和工業IoT的創新資產追蹤解決方案有望豐富資產追蹤解決方案。物聯網連接性的不斷增強導致對物聯網資產追蹤設備的需求增加。

- 例如,根據Telenor IoT的數據,目前已部署約140億台連網物聯網設備,數量超過智慧型手機、平板電腦、個人電腦和固定電話等非物聯網連接設備。預計到 2025 年,這一數字將成長到 300 億台。這些設備在遠端監控、定位和管理資產方面發揮著至關重要的作用,能夠提高各行業的效率、增強安全性並最佳化利用率。不斷擴大的物聯網生態系統正在促進此類追蹤設備的採用,以便更好地即時管理和監控資產。

- 預計在預測期內,向智慧工廠、工業 4.0 和製造業數位化的日益轉變將為市場成長帶來光明的未來。

北美佔最大市場佔有率

- 由於美國和加拿大等國家先進技術的採用率很高,預計北美將在資產追蹤市場佔據主要市場佔有率。

- 加拿大和美國面臨類似的供應鏈物流挑戰,包括邊境和主要港口附近的公路和鐵路瓶頸。因嚴重天氣災害、勞動力短缺、安全中斷和材料短缺而導致的工作停工凸顯了裁員和規劃的必要性。

- 美國和加拿大食品和飲料行業的顯著成長以及先進技術的採用促進了市場成長率。食品和飲料產業對美國經濟至關重要。該行業包括農業、製造業、零售業和食品服務業,約佔該國 GDP 的 5% 和就業機會的 10%。根據美國經濟發展委員會的報告,食品和飲料業約有 27,000 家企業,僱用了約 150 萬人。

- 加拿大也將推出一個獨立的供應鏈工作小組,與企業領導者、員工和產業專家進行磋商,為物流供應鏈問題提案短期和長期解決方案。通用致力於解決供應鏈物流挑戰是加拿大和美國在運輸物流長期合作的基礎。此次合作的範圍包括共同管理五大湖聖勞倫斯航道系統,以及實施智慧交通系統,使商用車輛能夠獲取即時邊境延誤資訊。

- 隨著主要企業致力於創新資產追蹤解決方案,該地區的醫療保健領域也持續成長。例如,2024 年 2 月,Geotab Inc. 推出了 Geotab GO Anywhere 資產追蹤器。此硬體解決方案旨在改善企業管理和監控各行各業資產的方式,包括運輸、航運、供應鏈、採礦、建築和政府。

- 此類策略合作夥伴關係和產品發布旨在為物流、製造、食品和飲料等各個行業提供滿足當前需求和技術的解決方案,提高採用率,並最終提高該地區的成長率。

資產追蹤市場概覽

資產追蹤市場競爭激烈,湧現許多大型供應商和新的市場供應商。解決方案供應商正在大力投資多項研發活動,以改善現有的資產追蹤解決方案並推出整合最新技術發展的新解決方案。公司將全球擴張視為佔領最大市場佔有率的途徑。市場的主要企業包括 Asset Panda LLC、ActSoft Inc.、Touma Incorporated(ASAP Systems)、AT&T Inc. 和 GigaTrak(P&T Solutions Inc.)。

- 2024 年 3 月:匯豐資產管理公司推出印度科技 Ucits ETF。該 ETF 旨在為投資者提供投資技術主導印度公司的廣泛全球管道。該報告涵蓋了廣泛的行業,並介紹了深入參與數位技術、通訊和軟體的公司。

- 2024 年 1 月:BioConnect 收購了領先的 RFID 庫存和資產管理軟體供應商 Silent Partner Technologies Inc.。透過此次收購,BioConnect 擴展了其尖端的可信任安全平台,以建造尖端的雲端基礎的智慧保險箱、儲物櫃、櫥櫃、房間和車輛,實現智慧「保管鏈」和任何關鍵資產的安全保障。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 價值鏈分析

- 評估宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 透過增值追蹤服務增加第三方物流營運商的需求

- 物聯網設備在資產追蹤中的應用日益增多

- 市場限制

- 資產追蹤軟體的初始成本高

第6章市場區隔

- 按組件

- 硬體

- 軟體

- 依實施類型

- 在雲端

- 本地

- 按最終用戶產業

- 運輸和物流

- 航空

- 醫療保健

- 製造業

- 飲食

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

7. 消費者資產追蹤市場

- 消費者資產追蹤市場概覽

- 按類型追蹤消費者資產

- 家庭和兒童追蹤

- 寵物追蹤

- 消費者車輛追蹤

- 其他消費者資產追蹤類型

第8章競爭格局

- 公司簡介

- Actsoft Inc.

- Touma Incorporated(ASAP Systems)

- Asset Panda

- AT & T Inc.

- GigaTrak(P& T Solutions Inc.)

- OnAsset Intelligence Inc.

- Fleet Complete

- Oracle Corporation

- Spireon Inc.

- Trimble Inc.

- Zebra Technologies Corporation

- Verizon Communications Inc.

- Ubisense Limited

- TIVE

第9章投資分析

第10章 市場機會與未來趨勢

The Asset Tracking Market size is estimated at USD 28.93 billion in 2025, and is expected to reach USD 53.51 billion by 2030, at a CAGR of 13.09% during the forecast period (2025-2030).

Key Highlights

- Asset management and tracking solutions are essential to achieve greater operational efficiencies in the current market scenario of rapid digitalization in manufacturing environments and office spaces. The asset tracking technology is deployed as hardware, including GPS, RFID, BLE, QR codes, and software for on-premises and cloud deployment.

- Recent advancements in IoT technology have enabled several end users, such as transportation and logistics, manufacturing, and food and beverage, to acquire economical and efficient asset-tracking hardware. For instance, in the healthcare segment, hospitals and other healthcare facilities must closely monitor the status of medical equipment due to its high cost to deter theft and ensure ongoing accessibility. The hospital tracking system enables real-time monitoring of supplies and equipment. It may give patients the care they need and significantly raise the standard of patient care.

- Industry 4.0 has aided early digitalization adopters in the industrial segment by saving time and resources on new projects. Asset tracking is the most beneficial and necessary aspect of this digitization. Mobile application tools and cloud-based asset tracking and monitoring significantly reduce the time and effort required to find and track assets. With continuous, real-time location and condition tracking and commodity evaluation, these systems improve efficiency at building sites. Corporate leaders prefer solution providers that offer cloud solutions as they require a robust asset monitoring solution with the proper IoT technology ability for large sites and operations.

- Post-pandemic, the market is witnessing considerable growth driven by the proliferation of IoT in various end-user industries, coupled with the growing demand to track and manage assets effectively. In addition, the market has witnessed substantial technological advancements in hardware and software in asset-tracking technology, positively impacting the growth of the asset-tracking market post-pandemic.

- Although the high initial costs are restraining the market growth, it is stimulated by the rising demand from third-party logistics players through value-added tracking services and the growing adoption of IoT devices for asset tracking. IoT-based asset tracking is gaining substantial traction as it leverages sensors and connected devices to remotely monitor and track an asset's geo position and movements. Also, IoT technology offers significant growth opportunities for monitoring assets, achieving efficiency gains, and implementing new business models for companies, notably in the industrial, transport, and logistics services.

Asset Tracking Market Trends

Manufacturing to be the Largest End-user Industry

- With the growing popularity of Industry 4.0 and smart factories, it has become necessary for manufacturing sectors to adopt advanced digital technologies to improve manufacturing processes. Industries widely adopt asset tracking to track and monitor asset location and status.

- Asset monitoring technologies are widely used in manufacturing facilities to monitor the movement and storage of raw materials, work-in-progress, and finished goods. Due to real-time tracking data, the supply chain's operations are streamlined, and stockouts are minimized.

- Advanced asset tracking technology, such as IoT and Bluetooth Low Energy (BLE), is rapidly gaining traction in the manufacturing industry. BLE tags come in many sizes, shapes, and capabilities, making it easy for manufacturers to tackle that first use case. Whether parts or equipment, asset tracking incorporates internet of things (IoT) advancements with thin tags that may be automatically tracked throughout the factory or yard. These advanced asset-tracking solutions with IoT are expected to enrich the asset-tracking solutions in the manufacturing sector, thus increasing the market's growth.

- The need to monitor multiple plant locations simultaneously to get real-time information about the process, operations, and inventory is expected to boost the growth of asset tracking in the manufacturing sector. Innovative asset-tracking solutions with IoT and Industrial IoT are anticipated to enrich the asset-tracking solutions. The growing IoT connectivity is leading to increasing demand for IoT asset-tracking devices.

- For instance, according to Telenor IoT, there are approximately 14 billion connected IoT devices in deployment, which exceeds the number of non-IoT connected devices, such as smartphones, tablets, PCs, and fixed-line telephones. This number is expected to grow to 30 billion in 2025. These devices play a crucial role in monitoring, locating, and managing assets remotely, which can enhance efficiency, improve security, and optimize utilization across various industries. The expanding IoT ecosystem is driving the adoption of such tracking devices to better manage and monitor assets in real-time.

- The growing shift toward smart factories, Industry 4.0, and digitization of the manufacturing sector is expected to provide a promising future for the market's growth during the forecast period.

North America Holds Largest Market Share

- North America is expected to account for a significant market share of the asset tracking market, owing to the high adoption rate of advanced technologies in countries across the United States and Canada.

- Canada and the United States have suffered similar supply chain logistics challenges, such as road and rail bottlenecks near borders and key ports. Significant weather disasters, worker shortages, security interruptions, and work stoppages due to material scarcity have underscored the necessity of redundancy and planning.

- The significant growth in the food and beverage segment in the United States and Canada and the adoption of advanced technologies contribute to the market's growth rate. The food and beverage segment is vital to the US economy. The industry accounts for around 5% of the nation's GDP and 10% of employment, including agriculture, manufacturing, retail, and foodservice. The US Committee for Economic Development reports that the food and beverage segment includes nearly 27,000 businesses and employs around 1.5 million people.

- Canada is also setting up its independent Supply Chain Task Force to confer with business leaders, employees, and industry experts to develop recommendations for both immediate and long-term solutions to logistical supply chain issues. Their shared determination to address supply chain logistics issues supports long-standing cooperation in transport logistics between Canada and the United States. This partnership ranges from joint management of the Great Lakes St. Lawrence Seaway System to implementing intelligent transportation systems, which allow commercial vehicles access to real-time border delay information.

- As the healthcare segment in the region is also witnessing incremental growth, the key players are innovating asset-tacking solutions. For instance, in February 2024, Geotab Inc. launched the Geotab GO Anywhere asset tracker. This hardware solution is designed to improve how companies manage and monitor their assets across various industries, such as transportation, shipping and supply chain, mining, construction, and government.

- These strategic collaborations and product launches aim to provide various industries, such as logistics, manufacturing, and food and beverages, with solutions that meet the current demand and technologies, boost the adoption rate, and consequently result in a growth rate in the region.

Asset Tracking Market Overview

The asset tracking market is highly competitive, with many significant vendors and the emergence of new market vendors. Solution providers are heavily investing in multiple R&D activities to improve existing asset-tracking solutions and launch new solutions by integrating the latest technological developments. Companies view global expansion as a path to attracting maximum market share. Some of the key players in the market are Asset Panda LLC, ActSoft Inc., Touma Incorporated (ASAP Systems), AT&T Inc., and GigaTrak (P&T Solutions Inc.).

- March 2024: HSBC Asset Management launched the India Tech Ucits ETF. This ETF aims to give investors global access to a broad spectrum of technology-driven Indian enterprises. It encompasses a variety of sectors, showcasing companies deeply entrenched in digital technology, communication, and software-related activities.

- January 2024: BioConnect acquired Silent Partner Technologies Inc., a leading RFID Inventory and asset management software provider. This acquisition will help BioConnect expand its leading Trusted Security Platform to create the most advanced cloud-based smart safes, lockers, cabinets, rooms, and vehicles for the intelligent "chain of custody" and security assurance for any critical asset.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of Impact of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand from Third-party Logistics Players through Value-add Tracking Services

- 5.1.2 Increasing Adoption of IoT Devices for Asset Tracking

- 5.2 Market Restraints

- 5.2.1 High Initial Cost of Asset Tracking Software

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.2 By Deployment Type

- 6.2.1 On-cloud

- 6.2.2 On-premise

- 6.3 By End-user Industry

- 6.3.1 Transportation and Logistics

- 6.3.2 Aviation

- 6.3.3 Healthcare

- 6.3.4 Manufacturing

- 6.3.5 Food and Beverages

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 CONSUMER ASSET TRACKING MARKET

- 7.1 Consumer Asset Tracking Market Overview

- 7.2 By Consumer Asset Tracking Type

- 7.2.1 Family and Child Tracking

- 7.2.2 Pet Tracking

- 7.2.3 Consumer Vehicle Tracking

- 7.2.4 Other Consumer Asset Tracking Types

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Actsoft Inc.

- 8.1.2 Touma Incorporated (ASAP Systems)

- 8.1.3 Asset Panda

- 8.1.4 AT & T Inc.

- 8.1.5 GigaTrak (P&T Solutions Inc.)

- 8.1.6 OnAsset Intelligence Inc.

- 8.1.7 Fleet Complete

- 8.1.8 Oracle Corporation

- 8.1.9 Spireon Inc.

- 8.1.10 Trimble Inc.

- 8.1.11 Zebra Technologies Corporation

- 8.1.12 Verizon Communications Inc.

- 8.1.13 Ubisense Limited

- 8.1.14 TIVE