|

市場調查報告書

商品編碼

1697452

物聯網資產追蹤與可視性:採用報告(2025 年)IoT Asset Tracking & Visibility Adoption Report 2025 |

|||||||

本報告是 IoT Analytics 正在進行的系列研究報告的一部分,基於對製造、零售和建築領域採用資產追蹤解決方案的 100 家公司的廣泛調查。

本報告是 IoT Analytics 發佈的一份以數據為中心的市場研究報告。我們調查基於物聯網的資產追蹤和視覺化解決方案的實際採用情況。基於對 100 名決策者的調查,該研究探討了企業如何使用 GPS、RFID 和物聯網感測器等技術來追蹤實體資產。它揭示了各行業的採用水準、追蹤的資產類型、供應商參與度和支出模式,為高階主管和策略家提供全面的基準參考點。

範例視圖

範例視圖

問題解答:

- 最常被追蹤的資產有哪些?每項資產的追蹤內容是什麼?

- 資產追蹤解決方案支援哪些用例?

- 最常用的追蹤技術有哪些?追蹤解決方案與哪些企業系統整合?

- 實施的解決方案具有哪些可擴充性/整合功能?資料是如何傳輸/分析的?

- 最受歡迎的供應商有哪些?他們的客戶滿意度如何?

- 市場上各供應商的優勢和劣勢是什麼?

- 公司如何選擇資產追蹤解決方案?

- 在實施過程中您遇到了哪些課題?成功實施的關鍵是什麼?

- 公司從實施中獲得了哪些投資報酬?其投資回報是否達到了預期?

- 預計 2025 年會出現哪些發展?

特色公司

|

|

|

|

目錄

第 1 章執行摘要

第 2 章簡介

第3章:資產追蹤的現況

- 1. 概述與要點

- 2.資產追蹤概述

- 3.製藥和食品飲料產業資產追蹤的推動因素:冷鏈

- 4.追蹤的資產類型

- 5.追蹤範例:正在進行的工作

- 6.追蹤範例:員工/工作者

- 7.追蹤範例:包裹

- 8.追蹤的資產數量

- 9. 追蹤資產屬性

- 10. 溫度跟蹤

- 11. 使用情形追蹤

- 12.資產追蹤用例:總體

- 13.資產追蹤用例:按資產類型

- 14.按地區和公司規模劃分的資產追蹤用例

- 15.資產追蹤用例:按行業

第4章 技術洞察

- 1. 概述與要點

- 2.連接技術:概述

- 3.按資產類型劃分的連結技術

- 4.追蹤貨櫃:赫伯羅特結合使用衛星和行動電話技術

- 5. 支援資產追蹤的軟體和平台:概述

- 6. 支援以資產類型追蹤資產的軟體和平台

- 7. 平台範例:與 SAP ERP 集成

- 8. 平台範例:Oracle 的 EAM 資產管理解決方案

- 9. 平台範例:Verizon 的車隊管理解決方案 Connect Reveal

- 10.技術亮點:概述

- 11.技術深入分析:資產追蹤解決方案的可擴展性

- 12.技術深度探究:與企業系統集成

- 13.整合影響追蹤專案的成功

- 14.技術細節:資料傳輸頻率

- 15.資料傳輸頻率影響追蹤項目的成功

- 16.技術深度探討:資產追蹤資料的迫切性分析

第5章 供應商洞察

- 1. 概述與要點

- 2.十大最常提及的資產追蹤供應商:概述

- 3.十大最常被提及的資產追蹤供應商:滿意度與期望

- 4. Asset Tracked 提及次數最多的 10 大資產追蹤供應商

- 5.與受訪者有業務往來的所有供應商的詳細清單。

- 6. 主要供應商提供的連接技術和硬體產品

- 7. 概述:供應商的優點和缺點

- 8.深入挖掘:供應商優勢

- 9.深入挖掘:供應商弱點

- 10. 意見挖掘:供應商:SAP、內部、Oracle

- 11. 意見摘要:供應商:IBM、Microsoft、Honeywell、Zebra、Samsara

- 12. 意見摘要:供應商:Verizon、Project44、Asset Panda

第6章 推動因素、成功因素與課題

- 1. 概述與要點

- 2. 概述:資產追蹤實施的推動因素與決策標準

- 3.資產追蹤解決方案的關鍵決策標準:按地區、產業和公司規模

- 4.資產追蹤解決方案的關鍵決策標準:按產業垂直細分

- 5.決策標準詳情:概述

- 6.範例:資產追蹤解決方案的成本

- 7.範例:將資料合併到現有系統中

- 8.決策標準詳情:依地區、產業及規模

- 9.深入了解決策標準:詳細的行業特定

- 10.實施資產追蹤解決方案的目標:概述

- 11. 實施資產追蹤解決方案的目的:依產業詳細說明

- 12.範例:某公司如何達成其資產追蹤目標

- 13.實施資產追蹤的課題:概述

- 14.實施資產追蹤的課題:XX

- 15.2025 年的費用、投資報酬率和業務展望:概述和要點

- 16.資產追蹤費用:概述

- 17.資產追蹤費用:依資產類型

- 18.資產追蹤支出:詳細產業垂直

- 19. 資產追蹤解決方案的投資報酬率:概述

- 20. 資產追蹤解決方案的投資報酬率(按細分市場和追蹤資產)

- 21.為什麼資產追蹤解決方案具有高投資報酬率

第 7 章 支出、投資報酬率與 2025 年業務展望

- 1. 資產追蹤實施結果:概述

- 2. 資產追蹤實施結果:按細分市場與資產類型

- 3. 資產追蹤實施結果:按資產類型細分的詳細信息

- 4. 2025年支出展望:概述

- 5.2025 年支出展望:詳細的行業細分信息

- 6. 2025 年按資產類型劃分的支出展望

- 7.支出成長的五大推動因素(基於受訪者的評論)

- 8.支出增加的原因

第 8 章 研究方法

第 9 章附錄

第 10 章 關於物聯網分析

A 142-page report on enterprise asset-tracking projects in manufacturing, mfg. supply chains, construction, retail, energy, incl. insights on implementation, vendors in use, spending patterns, ROI, challenges, and success factors.

The "IoT Asset Tracking & Visibility Adoption Report 2025" is part of IoT Analytics' ongoing coverage of the IoT in general. The information presented in this report is based on an extensive survey of 100 adopters of asset-tracking solutions in the manufacturing, retail, and construction industries. The purpose is to inform other market participants about the current state of asset tracking across companies. Survey participants were selected randomly, and their knowledge was verified independently. To ensure complete objectivity, IoT Analytics did not alter or supplement any survey results and did not accept participants who were suggested by third parties (e.g., customers from specific vendors)-and where it's heading.

SAMPLE VIEW

Understand the current state of IoT asset tracking adoption

The "IoT Asset Tracking & Visibility Adoption Report 2025" is a data-centric market research publication by IoT Analytics. It explores the real-world adoption of IoT-based asset tracking and visibility solutions. Based on a global survey of 100 qualified decision-makers, the report investigates how companies track physical assets using technologies like GPS, RFID, and IoT sensors. It highlights adoption levels, tracked asset types, vendor involvement, and spending patterns across industries, offering C-level executives and strategists a comprehensive reference point for benchmarking.

SAMPLE VIEW

Structured analysis across key areas of asset tracking

The report is organized into clearly defined chapters, each covering a specific aspect of IoT-based asset tracking and visibility adoption:

- Executive summary. Highlights of the key findings and conclusions from the survey analysis.

- Introduction. Context and definitions, including the scope of asset types, environments, and visibility goals.

- State of asset tracking. Examines which assets are tracked, how many, which attributes are monitored, and the implementation footprint across use cases.

- Technology insights. Reviews tagging technologies, connectivity protocols, software platforms, integration levels, and data transmission frequency.

- Vendor insights. Details which solution providers are used, customer satisfaction levels, and vendor strengths/weaknesses.

- Drivers, success factors & challenges. Covers project goals, implementation bottlenecks, and best practices.

- Spending, ROI & business outlook 2025. Discusses current and planned investment levels, ROI findings, and future expectations.

- Methodology and appendix. Outlines survey methodology, respondent demographics, and additional charts.

Insights into what companies are doing in the field

The report provides a detailed snapshot of how companies are applying IoT-based asset tracking today. Based on end-user input, it allows market participants to understand what is being tracked, how it is being tracked, and why:

- Asset types and tracked data. Understand which assets are being monitored and what attributes-like location, temperature, or vibration-are tracked by end-users.

- Scale of deployment. See how many assets are currently tracked per type and what share of total assets companies aim to monitor in full rollouts.

- Technology and integration. Learn which connectivity technologies and sensor types are used in practice, how often data is transmitted, and how tracking systems are integrated into enterprise platforms like ERP or inventory management.

- Software and use cases. Discover which software platforms support tracking and what use cases-such as theft prevention, predictive maintenance, or inventory optimization-are actively enabled by users.

- Vendor landscape. Identify which solution providers are being used, what parts of the solution they deliver, and how satisfied users are with their performance.

- Spending and ROI. Benchmark how much companies are spending annually, how budgets are expected to change in 2025, and what levels of ROI are achieved across asset types.

- Implementation realities. Gain insight into how end-users select solutions, handle time-sensitive data, overcome deployment challenges, and what they cite as key success factors.

A downloadable sample of the report is available to preview the structure, explore example insights, and assess the data depth. It provides a grounded foundation for organizations looking to benchmark or plan their IoT asset tracking initiatives.

Questions answered:

- Which are the most tracked assets and what is being tracked for each asset?

- Which use cases are enabled from asset-tracking solutions?

- Which are the most used tracking technologies, and which company systems are integrated with the tracking solution?

- How scalable/integrated are the implemented solutions, and how is the data transmitted/analyzed?

- Which are the most used vendors, and how satisfied are their customers?

- What are the strengths and weaknesses of individual vendors in the market?

- How are adopters selecting asset-tracking solutions?

- What challenges did they face when implementing, and what tips do they have for a successful implementation?

- What ROI have companies seen from their implementations, and how did this meet their expectations?

- How much are companies spending on asset tracking and how is that spending expected to develop in 2025?

Companies mentioned:

A selection of companies mentioned in the report.

|

|

|

|

Table of Contents

1. Executive Summary

2. Introduction

- 1. What is Asset Tracking in the context of this report

- 2. Asset tracking plays a crucial role in companies' supply chains

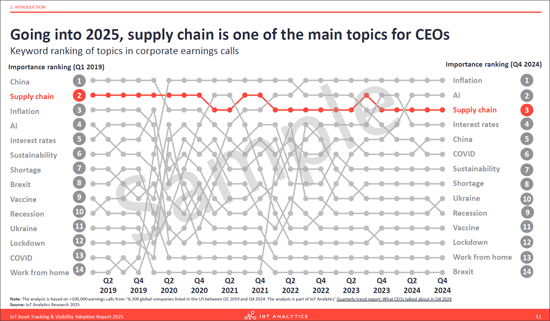

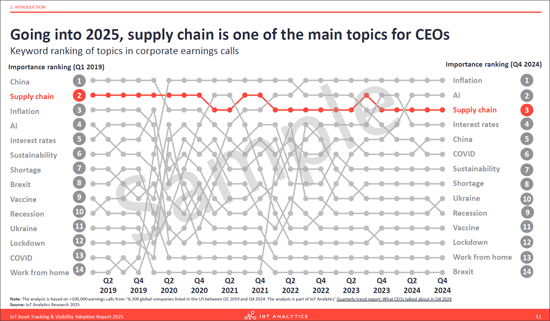

- 3. Going into 2025, supply chain is one of the main topics for CEOs

- 4. The interest in search terms related to asset tracking and supply chain is slowly growing

- 5. Companies with a focus on asset tracking are seeing the results of that interest

- 6. There are many reasons why companies adopt IoT asset-tracking solutions

- 7. The report is segmented into 5 chapters

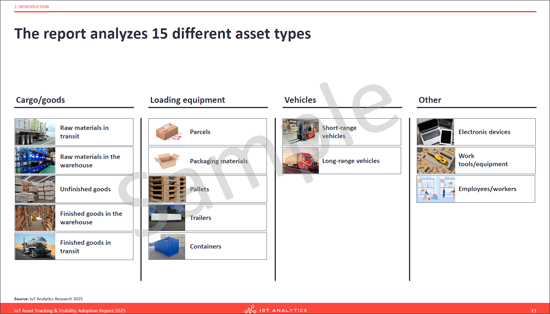

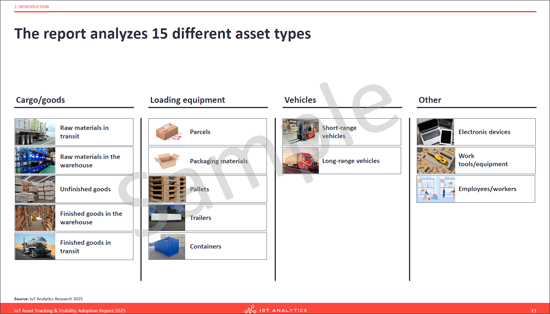

- 8. The report analyzes 15 different asset types

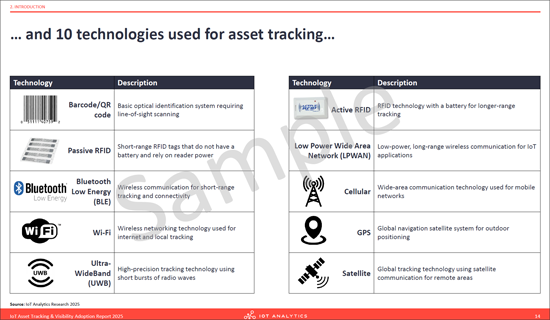

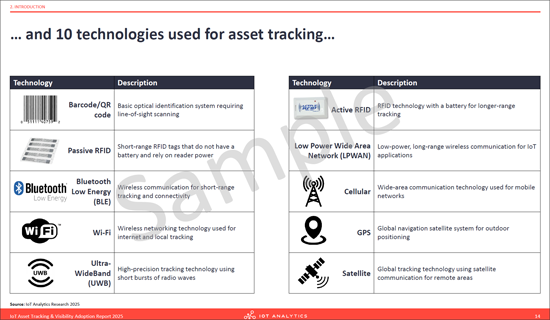

- 9. ... and 10 technologies used for asset tracking...

- 10. ... based on a survey of 100 end-users of asset-tracking solutions

- 11. Examples of companies who participated in the research

3. State of asset tracking

- 1. Chapter 3: State of asset tracking - Overview and key takeaways

- 2. Asset tracking overview

- 3. What is driving asset tracking in the Pharma and F&B industries: Cold chains

- 4. Types of assets tracked

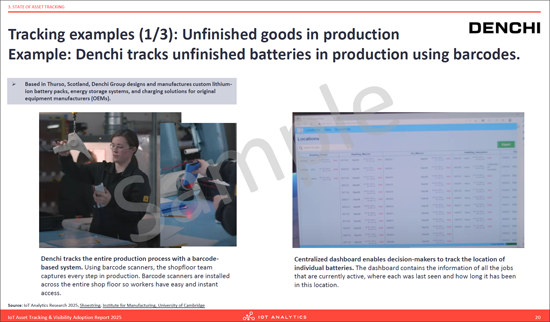

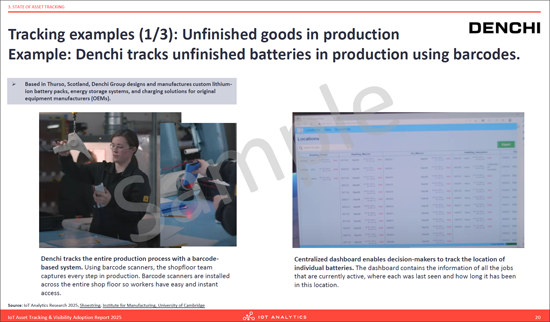

- 5. Tracking examples: Unfinished goods in production - Example: Denchi tracks unfinished batteries in production using barcodes.

- 6. Tracking examples: Employees/workers - Example: Salco tracks workers using a UWB solution.

- 7. Tracking examples: Parcels - Example: Altru tracks parcels using Bluetooth-enabled sensors.

- 8. Number of assets tracked

- 9. Asset attributes tracked

- 10. Tracking temperature: Sensitech provides a platform to see asset temperature over time and accepted ranges

- 11. Tracking Utilization: Samsara provides special "Utilization Reports" that show how often assets are used

- 12. Asset tracking use cases: Overall

- 13. Asset tracking use cases: By asset type

- 14. Asset tracking use cases: By region, and company size

- 15. Asset tracking use cases: By industry

4. Technology insights

- 1. Chapter 4: Technology insights - Overview and key takeaways

- 2. Connectivity technologies: Overview

- 3. Connectivity technologies: By asset type

- 4. Tracking shipping containers: Hapag Lloyd uses a mix of satellite and cellular technologies

- 5. Software and platforms that support asset tracking: Overview

- 6. Software and platforms that support asset tracking: By asset type

- 7. Platform example: Integrating into SAP ERP

- 8. Platform example: Oracle's EAM Asset Management solution

- 9. Platform example: Verizon's Fleet Management solution "Verizon Connect Reveal"

- 10. Technology highlights: Overview

- 11. Technology deep-dive: Scalability of asset-tracking solutions

- 12. Technology deep-dive: Integration with company systems

- 13. Integration affecting success of tracking projects

- 14. Technology deep-dive: Data transmission frequency

- 15. Data transmission frequency affecting success of tracking projects

- 16. Technology deep-dive: Analysis urgency of asset tracking data

5. Vendor insights

- 1. Chapter 5: Vendor insights - Overview and key takeaways

- 2. 10 most mentioned asset-tracking vendors: Overview

- 3. 10 most mentioned asset-tracking vendors: Satisfaction & expectations

- 4. 10 most mentioned asset-tracking vendors: By asset tracked

- 5. Extensive list with all vendors that respondents have worked with

- 6. Connectivity technologies and hardware offerings of select vendors

- 7. Overview: Vendor strengths and weaknesses

- 8. Opinion deep dives: Vendor strengths

- 9. Opinion deep dives: Vendor weaknesses

- 10. Opinion deep dives: By vendor: SAP, in-house, and Oracle

- 11. Opinion deep dives: By vendor: IBM, Microsoft, Honeywell, Zebra, Samsara

- 12. Opinion deep dives: By vendor: Verizon, Project44, Asset Panda

6. Drivers, success factors & challenges

- 1. Chapter 6: Drivers, success factors & challenges - Overview and key takeaways

- 2. Overview: Asset-tracking implementation drivers & decision-making criteria

- 3. Top decision-making criteria for asset-tracking solutions: By region, industry, and company size

- 4. Top decision-making criteria for asset-tracking solutions: By detailed industry

- 5. Decision-making criteria deep-dive: Overview

- 6. Example: Cost of asset-tracking solutions

- 7. Example: Incorporating data in existing systems

- 8. Decision-making criteria deep-dive: By region, industry, size

- 9. Decision-making criteria deep-dive: By detailed industry

- 10. Goals when implementing an asset-tracking solution: Overview

- 11. Goals when implementing an asset-tracking solution: By detailed industry

- 12. Examples: How specific companies achieved their asset tracking goals

- 13. Challenges when implementing asset tracking: Overview

- 14. Challenges when implementing asset tracking: XX

- 15. Chapter 7: Spending, ROI & business outlook 2025 - Overview and key takeaways

- 16. Asset-tracking spending: Overview

- 17. Asset-tracking spending: By asset type

- 18. Asset-tracking spending: By detailed industry

- 19. ROI of asset-tracking solutions: Overview

- 20. ROI of asset-tracking solutions: By segment and asset tracked

- 21. Reasons for a high ROI of an asset-tracking solution

7. Spending, ROI & business outlook 2025

- 1. Results of asset-tracking implementations: Overview

- 2. Results of asset-tracking implementations: By segment and asset type

- 3. Results of asset-tracking implementations: By asset type detailed

- 4. Spending outlook for 2025: Overview

- 5. Spending outlook for 2025: By detailed industry

- 6. Spending outlook for 2025: By asset type

- 7. 5 key drivers of higher spending (based on respondent comments)

- 8. Reasons for increased spending