|

市場調查報告書

商品編碼

1404396

密碼管理 -市場佔有率分析、產業趨勢/統計、2024 年至 2029 年成長預測Password Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

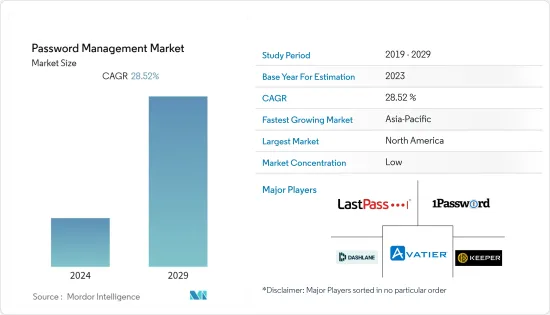

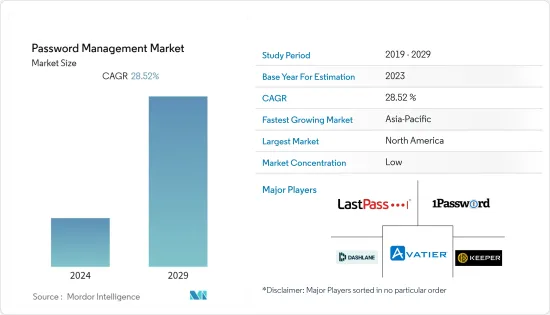

密碼管理市場上年度價值17.4億美元,預估未來五年將達73.2億美元,複合年增率為28.52%。

推動市場成長的關鍵因素之一是中小型企業擴大使用密碼管理解決方案。

主要亮點

- 密碼管理是根據一套道德標準在密碼的整個生命週期(從創建到終止)中保護和管理密碼的過程。這是在密碼管理器的幫助下完成的,密碼管理器使用內部加密保管庫來保存特權憑證。安全密碼管理解決方案變得越來越必要,特別是隨著小型企業、跨國公司和政府機構使用的數位裝置和應用程式數量不斷增加。

- 密碼管理解決方案專注於提供安全維護、搜尋和儲存數位密碼的服務。這些解決方案使用強大的安全標準和加密方法來降低駭客攻擊和資料外洩等網路攻擊的風險。隨著數位設備和應用程式的普及,對密碼管理解決方案的需求呈指數級成長。

- 密碼管理的使用不僅限於企業;個人使用者也可以從其設備和帳戶的安全解決方案中受益。此外,最終用戶經常依靠它來審核、保護、監督和管理與特權帳戶相關的業務。隨著網路攻擊似乎變得越來越普遍且更具破壞性,個人和企業必須保護資料。

- 根據《2022 年駭客驅動的安全報告》,與 2021 年相比,2022 年全球網路攻擊增加了 38%。隨著企業擴大採用雲端基礎的解決方案和服務來營運其營運,網路犯罪分子正在利用擴大的攻擊面,預計道德駭客將在2022 年發現超過65,000 個漏洞,比2021 年增加21% 。市場預計將從醫療保健、公共部門和 BFSI 等關鍵行業不斷上升的資料竊取風險中受益。

- 根據 Verizon 2022 年資料外洩調查報告,82% 的安全外洩涉及社交攻擊、錯誤和濫用等人為因素。為了抵禦這些攻擊,企業應專注於開發儲存、保護、管理和監控特權密碼的智慧策略。

- 密碼管理軟體的缺點阻礙了此類解決方案的採用和市場成長。由於應用程式處理許多 ID 和密碼,並且資料變得更加機密,因此從密碼管理員的角度來看,安全漏洞預計比單一洩漏更具破壞性。此外,密碼管理解決方案中的安全缺陷可能會損害該行業的市場成長和聲譽。

- 自 COVID-19 爆發以來,網路攻擊顯著增加,對個人、企業和組織產生了負面影響。遠距工作實踐、對流行病缺乏了解以及社會動盪加劇導致駭客採用多種網路攻擊技術來賺錢。一些受影響的公司正在花錢升級過時的資料和密碼管理系統。預計網路攻擊的威脅將持續到新冠肺炎 (COVID-19) 疫情爆發之後。

密碼管理器市場趨勢

近年來網路安全風險的增加推動了市場的成長

網路犯罪已成為現代商業中不可避免的一部分。根據德國IT安全獨立研究機構 AV-TEST Institute 的統計,每天都會註冊超過 450,000 個新惡意程式和潛在有害應用程式 (PUA)。由於網路攻擊的增加,隨著維護嚴格的密碼法規改善網路衛生並保護重要的企業資料,該市場預計將成長。

網路安全密碼管理提供整合且安全的資料存取。有了密碼管理器,整個公司的重要帳戶和資訊就會被系統性地發現並集中到一個屋簷下。因此,您可以一鍵存取目標電腦和應用程式,而無需手動輸入密碼。這為個人資料的集中管理鋪平了道路。

此外,分析認為政府對網路安全投資的增加將顯著增加對密碼管理的需求。 2022年3月,白宮公佈了美國總統拜登的上年度年預算提案(5.8兆美元),似乎引起了許多關注。

然而,總統的預算要求從 2022 年開始為私人網路安全相關業務增加約 109 億美元。其中,25 億美元獎勵給國土安全部的網路安全和基礎設施安全局。上年度增加了約5億美元。此類重要的政府舉措可能會產生對應對網路攻擊解決方案的需求。

此外,Snyk 2022 年雲端安全狀況報告發現,80% 的企業在過去 12 個月內至少經歷過一次嚴重的雲端安全事件。根據 IBM 的 2022 年資料外洩成本報告,83% 的受訪公司經歷過一次或多次資料外洩。這些因素可能會推動對多因素身份驗證類型解決方案的需求。多重身份驗證是密碼管理軟體的重要組成部分,由於其高安全性而越來越受歡迎。

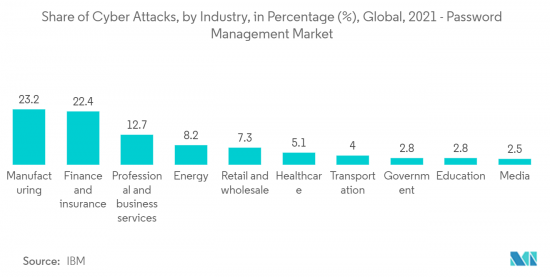

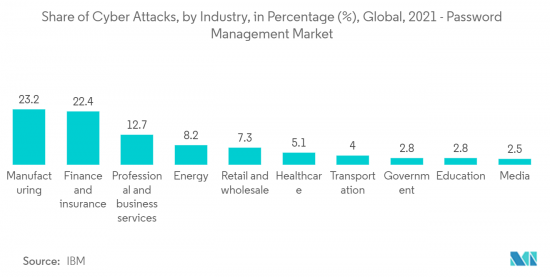

因此,網路安全風險的增加和政府為減輕風險而進行的投資,增強了預測期內對密碼管理解決方案的需求。 IBM 表示,在全球主要產業中,製造業遭受網路攻擊的比例最高。 2021 年,針對工業組織的攻擊佔所有網路攻擊的 23% 以上。金融和保險業位居第二,約佔 22% 的攻擊。專業和商業服務仍位居第三,約佔13%。

亞太地區將成長最快

由於中小企業基礎不斷擴大,亞太地區預計將在預測期內快速成長。印度、中國和日本等經濟體正快速擴張。該市場也受到技術和用戶的擴展以及基礎設施的快速發展的推動。

隨著該地區安全風險、資料外洩和詐騙事件的升級,以及機構受到越來越嚴格的監管和公眾審查,密碼管理解決方案變得越來越重要。例如,根據 IBM X-Force 威脅情報指數,亞太地區在 2022 年遭受的網路攻擊最多,佔全球已解決事件的 31%。

此外,根據IBM的X-Force威脅情報指數2023,工業部門將成為2022年24.8%網路攻擊的目標,其次是金融和保險部門(18.9%)。製造業連續第二年成為最常受到攻擊的行業。製造業約 61% 的安全事件發生在亞太地區。這些因素可能會推動對限制駭客存取的密碼管理工具的需求。

此外,隨著物聯網 (IoT)、雲端處理和其他數位框架引入流程,預計未來幾年對這些解決方案的需求將大幅增加。歐盟委員會估計,亞洲佔所有物聯網支出的三分之一以上。此外,各行業的雲端採用率正在不斷增加,包括銀行、金融服務和保險 (BFSI)、公共部門和公共產業、教育、製造、醫療保健、零售和批發分銷,這使得它們容易受到網路攻擊。以帶動市場需求。

網路和行動裝置使用的成長正在對各個行業產生重大影響。隨著網路使用量的增加,通訊方式的改進,許多公司正在引入用戶帳戶等安全措施,以確保問責制。根據 GSMA 的數據,2022 年行動網路用戶達到 13.6 億。預計到 2030 年,這一數字將增至 18.4 億用戶,普及將從 2022 年的 49% 增加到 61%。網際網路普及的提高可能會產生對安全解決方案的巨大需求,為供應商提供巨大的機會來增強其密碼管理解決方案服務。

例如,FastPassCorps 於 2022 年 11 月發布了其身分驗證用戶端 (IVC) 第 4 版。 IVC 提供了一種巧妙的方法來補充和取代 FPR,該方法詳細說明如何在為每位員工提供新密碼之前驗證其身分。這些供應商推出的創新解決方案預計將推動市場發展。

密碼管理器產業概述

密碼管理市場由 Lastpass US LP (Goto Group Inc.)、1Password (AgileBits Inc.) 和 Dashlane Inc. 主導。市場參與企業加強其產品陣容並獲得永續的競爭優勢。創新、投資和收購。

- 2023 年 1 月 - 企業瀏覽器市場的市場領導者之一 Island 推出了首款內建於企業瀏覽器中的密碼管理器,使 IT 團隊和員工能夠消除密碼詐欺,並提供強大的新功能,幫助您有組織地儲存企業密碼並採用無密碼使用者身份驗證流程。

- 2022 年 8 月 - 1Password 發布 Android 和 iOS 應用程式更新。 1Password 8 是一款全新外觀的行動密碼管理應用程式。可自訂的主頁標籤採用了新的行動佈局,可以更輕鬆地搜尋、保存收藏夾和組織使用者密碼。

- 2022 年 3 月 - 領先的密碼管理公司 LastPass 宣布與 Ping Identity(包括 PingOne 和 PingFederate)建立合作夥伴關係,以更好地支援企業客戶。使用 PingOne 和 PingFederate 作為身分識別提供者 (IdP) 的客戶可以與 LastPass 整合,以簡化存取管理並在整個組織中擴展有效的密碼衛生。這些新的改進使 LastPass Business 可供各種規模的企業使用,並允許與主要 IdP 整合。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 對密碼管理市場的影響

第5章市場動態

- 市場促進因素

- 近年來網路安全風險增加

- 市場抑制因素

- 與密碼管理員駭客攻擊相關的安全漏洞

第6章市場區隔

- 按解決方案類型

- 自助密碼管理

- 特權使用者密碼管理

- 依技術類型

- 桌面

- 行動裝置

- 語音密碼重設

- 按行業分類

- BFSI

- 醫療保健

- 資訊科技/通訊

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章競爭形勢

- 公司簡介

- Lastpass US LP(Goto Group Inc.)

- 1Password(AgileBits Inc.)

- Dashlane Inc.

- Keeper Security Inc.

- Avatier Corporation

- Core Security Technologies(Helpsystems LLC)

- Fastpasscorp A/s

- Hitachi ID Systems Inc.

- Microsoft Corporation

- IBM Corporation

- Cyberark Software Ltd

- Trend Micro Inc.

- EmpowerID Inc.

- Ivanti

- Intuitive Security Systems Pty Ltd

- Steganos Software GmbH

- AceBIT GmbH

- Siber Systems Inc(Roboform)

- Delinea Inc(Centrify Corp)

- Zoho Corporation Pvt. Ltd

第8章投資分析

第9章 市場機會及未來趨勢

Password Management Market was valued at USD 1.74 billion in the previous year and is expected to register a CAGR of 28.52%, reaching USD 7.32 billion by the next five years. One of the main factors driving market growth is the growing usage of password management solutions by small and medium-sized businesses.

Key Highlights

- Password management is the process of protecting and controlling passwords during their entire life cycle, from creation to termination, by following a set of ethical standards. This is accomplished with the aid of password managers, which use internal encrypted vaults to hold privileged credentials. Secure password management solutions are becoming more and more necessary as there are more and more digital devices and applications being used, especially by SMEs, MNCs, and government agencies.

- Password Management Solutions focuses on offering services for safely maintaining, retrieving, and saving digital passwords. These solutions use strong security standards and encryption approaches to reduce the danger of cyberattacks like hacking and data breaches. The demand for password management solutions has increased dramatically with the proliferation of digital devices and applications.

- The usage of password management is not just limited to businesses; individual users can also benefit from it as a security solution for their devices and accounts. Additionally, end users frequently utilize it to audit, safeguard, oversee, and manage the operations related to privileged accounts. As cyberattacks appear to become more common and damaging, individuals and companies must protect their data.

- The 2022 Hacker-Powered Security Report states that worldwide, cyberattacks increased by 38% in 2022 over 2021. Due to the rising adoption of cloud-based solutions and services to run corporate operations, cybercriminals have taken advantage of an enlarged attack surface, and ethical hackers discovered over 65,000 vulnerabilities in 2022, a 21% increase from 2021. The market is anticipated to benefit from the rising danger of data theft in crucial industries like healthcare, the public sector, and BFSI.

- Additionally, 82% of security breaches involve human aspects, such as social attacks, mistakes, and misuse, according to the Verizon 2022 Data Breach Investigation Report. To combat these assaults, businesses should concentrate on coming up with a sensible strategy for privileged password storage, protection, management, and monitoring.

- The adoption of such solutions and the market's growth are being hampered by the shortcomings in password management software. Due to the existence of many IDs and passwords handled by applications, which further increases the sensitivity of the data, a security breach from the standpoint of the password manager is anticipated to be catastrophic compared to a single entity leak. Moreover, Password management solution security flaws can harm the market's growth and the reputation of the sector.

- Since the COVID-19 outbreak, there have been a significant increase in cyberattacks that have had a negative impact on people, companies, and organizations. Due to remote working practices, a lack of knowledge about the outbreak's spread, and increased public anxiety, hackers used numerous cyberattack techniques in an effort to make money. Some impacted businesses are spending money to upgrade their outdated data and password management systems. It is anticipated that the threat of cyberattacks would continue longer than the COVID-19 epidemic.

Password Manager Market Trends

Increased Cybersecurity Risks in the Recent Times Drives the Market Growth

Cybercrime has become an unavoidable feature of modern business. Over 450,000 new harmful programs and potentially unwanted applications (PUA) are registered daily, according to the AV-TEST Institute, an independent German research organization for IT security. Due to the increase in cyberattacks, the market is anticipated to grow since maintaining strict password regulations improves cyber hygiene and protects vital company data.

Cybersecurity password management offers consolidated, secure data access. By implementing a password manager, essential accounts and credentials across the company are systematically found and gathered under one roof. As a result, target computers and apps can be accessed with only one click without manually inputting a password. This opens the door for centralized management of private data.

Further, the growing government investments in cybersecurity are analysed to bolster the demand for password management significantly. In March 2022, the President of the United States, Joe Biden's USD 5.8 trillion budget proposal for the fiscal year 2023 was published by the White House, and cybersecurity appears to be a full focus, as seen by a significant increase in spending from the previous year.

However, about a USD 10.9 billion increase from 2022 is requested in the President's budget for civilian cybersecurity-related operations. USD2.5 billion of that sum has been given to the DHS's Cybersecurity and Infrastructure Security Agency. That is a rise of about USD 500 million from the prior year. Such significant government initiatives will create the demand for solutions in combating cyber-attacks.

In addition, the Snyk 2022 State of Cloud Security Report discovered that 80% of enterprises had at least one serious cloud security event in the previous 12 months. 83% of the firms surveyed, according to IBM's Cost of a Data Breach Report 2022, experienced more than one data breach. Such elements will increase demand for multi-factor authentication-type solutions, which are a vital component of password management software and are growing in popularity due to their greater security.

Therefore, the growing cybersecurity risks and government investments to mitigate these bolstered the demand for password management solutions during the forecast period. According to IBM, Manufacturing has the most significant proportion of cyber-attacks among the global major industries. Attacks against industrial organizations accounted for over 23% of all cyber-attacks in 2021. Finance and insurance stood in second with approximately 22% of the attacks. Professional and commercial services remained in third place, accounting for about 13%.

Asia-Pacific to Witness the Fastest Growth

Asia Pacific is expected to proliferate throughout the projection period, owing to the region's growing base of small and medium-sized businesses. The economies of nations like India, China, and Japan have been expanding rapidly. The market is also driven by an expanding pool of technology users and an infrastructure developing quickly.

Passcode management solutions have grown crucial due to the region's escalating security risks, data breaches, and fraud events, putting institutions under increased regulatory and public scrutiny. For instance, according to IBM X-Force Threat Intelligence Index, the Asia-Pacific area experienced the most cyberattacks in 2022, accounting for 31% of all incidents resolved globally.

Additionally, according to IBM's X-Force Threat Intelligence Index 2023, the industrial sector was the target of 24.8% of cyberattacks in 2022, followed by the finance and insurance sectors (18.9%). The manufacturing sector continues to be the most frequently attacked sector for the second year in a row. The Asia-Pacific region had about 61% of security incidents in the manufacturing industry. These elements will increase the demand for password management tools that restrict hackers' access.

Moreover, Due to the introduction of the Internet of Things (IoT), cloud computing, and other digital frameworks within the processes, the demand for these solutions is expected to increase in the region in the coming years significantly. The European Commission estimates that Asia is responsible for over one-third of all IoT spending. Furthermore, adopting the Cloud across various industries such as banking, financial services and insurance (BFSI), public sector & and utilities, education, manufacturing, healthcare, retail, and wholesale distribution is likely to drive market demand as they are vulnerable to cyber assaults.

The rise in internet and mobile usage has had a significant impact on a variety of industries. As internet usage grows, communication methods improve, and many businesses are increasingly putting security measures like user accounts in place to ensure responsibility. In accordance with the GSMA, 1.36 billion mobile internet users were recorded in 2022. That number is projected to rise to 1.84 billion users by 2030, with a penetration rate of 61% compared to 49% in 2022. The increased Internet penetration rate will create a massive demand for security solutions by providing significant opportunities for the vendor to enhance their Password management solution services.

For example, in November 2022, FastPassCorps launched version 4 of its Identity Verification Client (IVC). IVC offers a clever approach that details how each employee's identification can be checked before giving a new password as a supplement to and replacement for FPR. Such vendors' activities in launching innovative solutions are expected to drive the market.

Password Manager Industry Overview

The password management market is highly fragmented with the presence of major players like Lastpass US LP (Goto Group Inc.), 1Password (AgileBits Inc.), Dashlane Inc., Keeper Security Inc., and Avatier Corporation among others. Players in the market are adopting strategies such as partnerships, mergers, innovations, investments and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- January 2023 - Island, one of the market leaders in the Enterprise Browser market, announced the first password manager natively built into an enterprise browser, giving IT teams and employees powerful new capabilities to eliminate password abuse, help ensure organizational custody of corporate passwords, and embrace passwordless user authentication flows.

- August 2022 - 1Password released an update for its Android and iOS apps. 1Password 8 completely overhauls the appearance of mobile password management apps. The customizable home tab includes a feature of the new mobile layout that should make it simpler to locate logins, save favorites, and arrange users' passwords.

- March 2022 - LastPass, the prominent player in password management, announced a partnership with Ping Identity, including PingOneand PingFederate, to better support enterprise customers. Customers who use PingOneand PingFederate as their identity provider (IdP) can now integrate with LastPass to streamline access management and scale effective password hygiene throughout entire organizations, saving time for IT departments while maintaining the security of the data without introducing another step - or password - to the end users' workflow. With these new improvements, LastPass Business can now be used by enterprises of all sizes and has integrations with all major IdPs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Password Management Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Cybersecurity Risk in the Recent Times

- 5.2 Market Restraints

- 5.2.1 Security Flaw Related to Hacking of Password Managers

6 MARKET SEGMENTATION

- 6.1 By Solution Type

- 6.1.1 Self-service Password Management

- 6.1.2 Privileged User Password Management

- 6.2 By Technology Type

- 6.2.1 Desktop

- 6.2.2 Mobile Devices

- 6.2.3 Voice-enabled Password Reset

- 6.3 By End-user Vertical

- 6.3.1 BFSI

- 6.3.2 Healthcare

- 6.3.3 IT and Telecommunication

- 6.3.4 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Lastpass US LP (Goto Group Inc.)

- 7.1.2 1Password (AgileBits Inc.)

- 7.1.3 Dashlane Inc.

- 7.1.4 Keeper Security Inc.

- 7.1.5 Avatier Corporation

- 7.1.6 Core Security Technologies (Helpsystems LLC)

- 7.1.7 Fastpasscorp A/s

- 7.1.8 Hitachi ID Systems Inc.

- 7.1.9 Microsoft Corporation

- 7.1.10 IBM Corporation

- 7.1.11 Cyberark Software Ltd

- 7.1.12 Trend Micro Inc.

- 7.1.13 EmpowerID Inc.

- 7.1.14 Ivanti

- 7.1.15 Intuitive Security Systems Pty Ltd

- 7.1.16 Steganos Software GmbH

- 7.1.17 AceBIT GmbH

- 7.1.18 Siber Systems Inc (Roboform)

- 7.1.19 Delinea Inc (Centrify Corp)

- 7.1.20 Zoho Corporation Pvt. Ltd