|

市場調查報告書

商品編碼

1329866

建築粘合劑的市場規模和份額分析 - 增長趨勢和預測(2023-2028)Construction Adhesives Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

建築粘合劑市場規模預計將從2023年的89.4億美元增長到2028年的120.2億美元,預測期內(2023-2028年)複合年增長率為6.10%。

COVID-19 的爆發對建築行業產生了一些短期和長期影響,並可能影響對建築粘合劑和密封劑的需求。 美國總承包商協會(AGC)表示,將會出現工作中斷和項目取消的情況,辦公、娛樂和體育設施等“非必要”項目的需求可能會減少。 這些項目和其他建築活動的暫停往往會減少對建築粘合劑的需求。

主要亮點

- 短期來看,新興國家住房和建築項目的增加以及建築業投資的增加是推動市場的主要因素。

- 但是,嚴格的排放環境法規可能會抑制市場增長。

- 建築行業對生物基和混合粘合劑的需求不斷增加,以及粘合劑對綠色建築的貢獻,可能會在未來為市場創造機會。

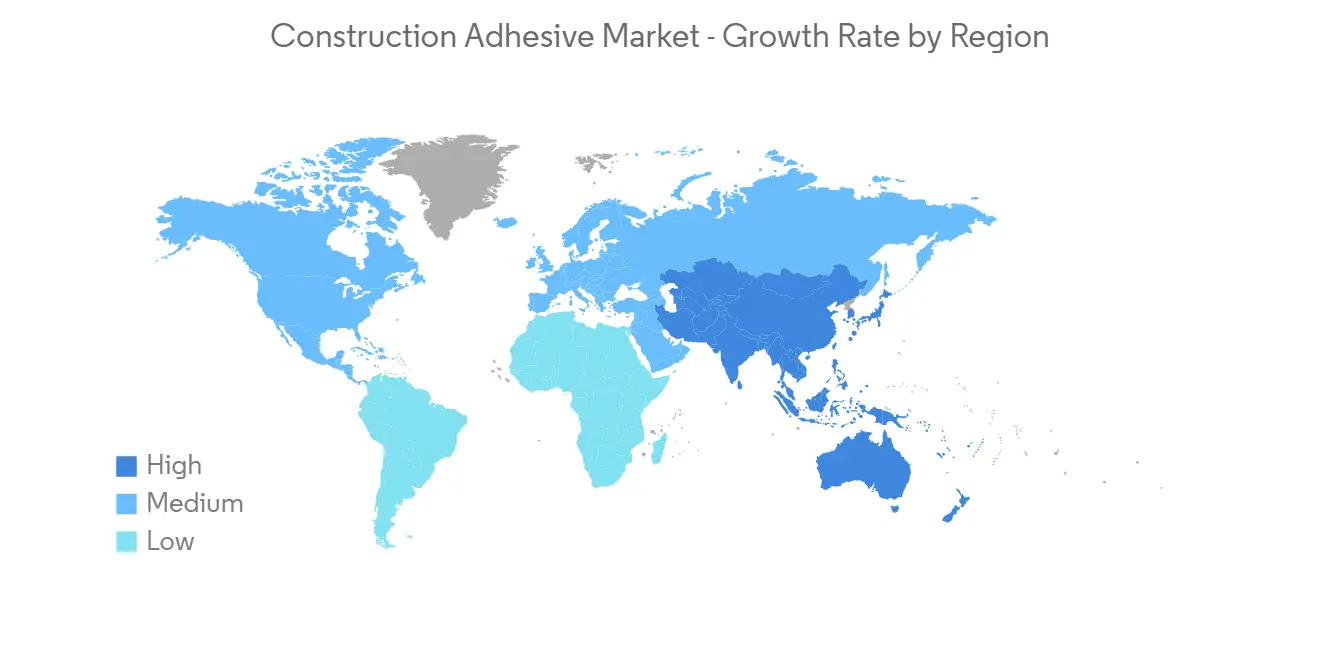

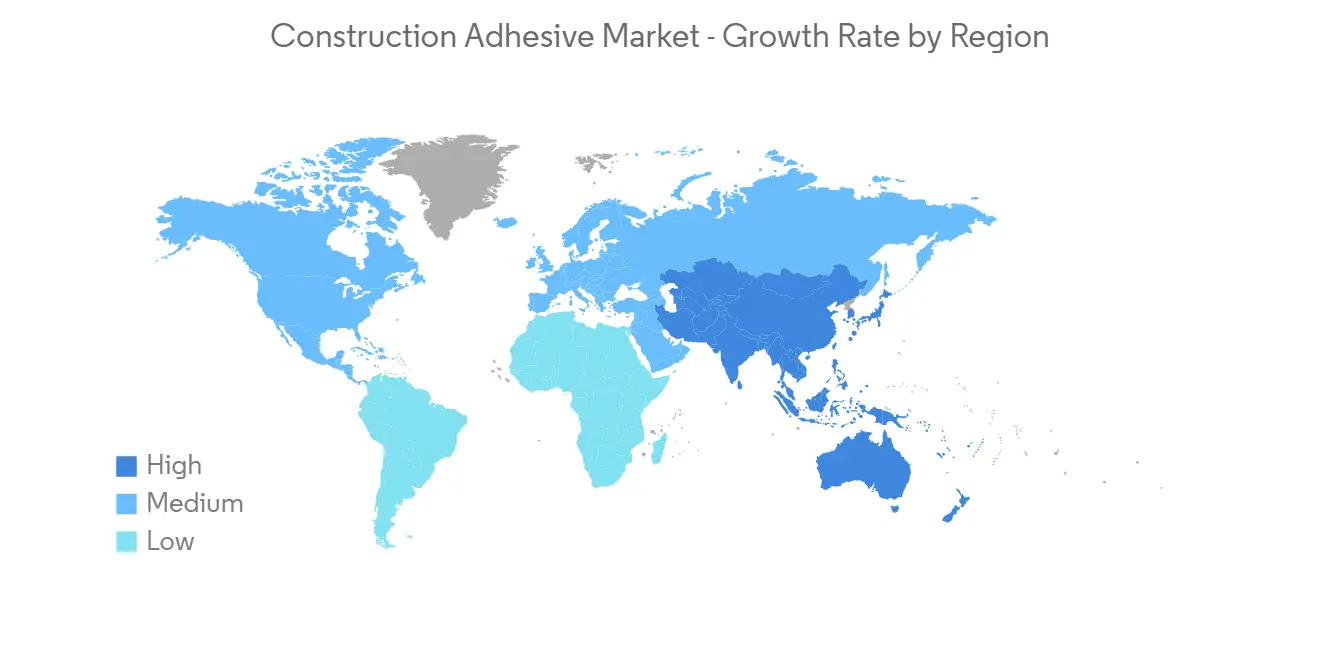

- 亞太地區在市場中佔據主導地位,並且由於中國和印度的建築活動不斷增加,預計在預測期內將繼續佔據主導地位。

建築膠粘劑市場趨勢

主要住宅區

- 在住宅建築中,粘合劑有多個應用領域,例如鋪設地毯、層壓檯面、安裝地板和粘貼壁紙。 通過使用粘合劑,您可以減少使用的螺釘數量並提高房屋的耐候性。

- 受人口增長、農村地區向服務業集群轉移以及核心家庭增多等因素影響,過去幾年全球住房建設呈現顯著增長。 此外,土地與人口比率的下降以及高層住宅和城鎮建設的增長趨勢正在促進粘合劑在全球住宅建築領域的應用。

- 在全球範圍內,滿足住房需求的供應嚴重短缺。 這為投資者和開發商提供了巨大的機會,可以採用替代的施工方法和新的合作夥伴關係來推動發展。

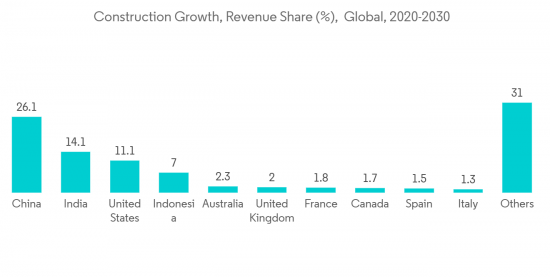

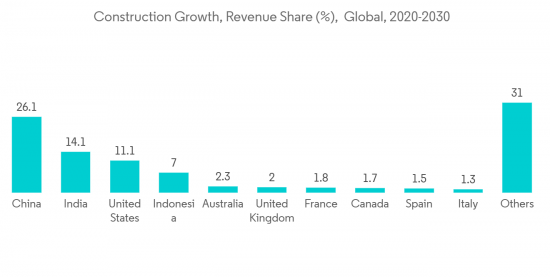

- 根據牛津經濟研究院的估計,2020 年全球建築業產值為 10.7 萬億美元,2020 年至 2030 年間將增長 42%,達到 4.5 萬億美元和 15.2 萬億美元。預計將達到 例如

- 在美國,《今日世界建築》報導稱,美國總承包商委員會 (AGC) 評估了聯邦數據,並確定對多種類型商業建築的需求將在一段時間內保持強勁。

- 據國際建設報導,中國政府計劃從2023年起同比增加重大建設和基礎設施項目支出1.8萬億美元,以支持地區經濟從疫情中復蘇。

- 在加拿大,各種政府項目正在支持該行業的擴張,包括經濟適用房計劃 (AHI)、加拿大新建計劃 (NBCP) 和加拿大製造。

- 根據歐盟統計局的數據,與 2023 年 1 月相比,2023 年 2 月歐元區 (EA20) 的建築產量增長了 2.3%,歐盟 27 國的建築產量增長了 2.1%。

- 由於上述因素,全球建築業預計將增長,建築粘合劑的需求預計也會增加。

亞太地區主導市場

- 由於印度、中國和東南亞國家建築市場的巨大需求,亞太地區是建築粘合劑的最大市場。

- 過去十年,由於主要經濟和商業中心的發展,以及建築商之間對有吸引力的外觀和可持續、經濟的建築的競爭,該地區的商業辦公樓和建築數量有所增加。

- 由於中央政府鼓勵對該行業的投資作為維持經濟增長的手段,中國建築業迅速發展。

- 根據中國國家統計局的數據,2022 年中國建築業增加值約為 8.3 萬億元人民幣(1.18 萬億美元)。

- 儘管中國政府努力實現經濟再平衡,轉向更加以服務為導向的模式,但我們仍制定了建設計劃。

- 根據印度品牌資產基金會 (IBEF) 的數據,到 2025 年,印度建築業將發展成為全球第三大市場,規模約為 1 萬億美元。

- 根據日本國土交通省的數據,2022 年日本將建造約 859,500 套住房。 根據經濟研究所的數據,截至2023年4月的日本月度建築材料價格指數為147.8。

- 這些因素預計將推動亞太地區建築粘合劑市場的發展。

建築膠粘劑行業概況

全球建築粘合劑市場本質上是整合的。 主要參與者包括漢高粘合劑技術印度私人有限公司、陶氏化學、H.B. Fuller、阿科瑪集團和 3M。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第一章簡介

- 調查的先決條件

- 調查範圍

第二章研究方法

第 3 章執行摘要

第 4 章市場動態

- 促進因素

- 增加建築業投資

- 新興國家的住房和建築項目增加

- 其他司機

- 抑制因素

- 嚴格的環境法規

- 其他抑制因素

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章市場細分(基於價值的市場規模)

- 類型

- 水性

- 溶劑型

- 熱熔膠

- 反應性

- 其他類型

- 應用

- 住宅用途

- 商業

- 基礎設施

- 工業/設施

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 意大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭態勢

- 併購、合資企業、聯盟、協議

- 市場份額(%)分析**/市場排名分析

- 各大公司的戰略

- 公司簡介

- 3M

- Adhesives Technology Corporation(ATC)

- Ashland

- Avery Dennison Corporation

- Bostik

- Don Construction Products Limited

- Dow

- Franklin International

- Gorilla Glue Inc.

- H.B. Fuller Company

- Henkel Adhesives Technologies India Private Limited

- Huntsman International LLC

- MAPEI S.p.A.

- RPM International Inc.

- Sika AG

- Wacker Chemie AG

第7章市場機會和未來趨勢

- 建築行業對生物基和混合粘合劑的需求增加

- 有助於綠色建築的粘合劑

The Construction Adhesives Market size is expected to grow from USD 8.94 billion in 2023 to USD 12.02 billion by 2028, at a CAGR of 6.10% during the forecast period (2023-2028).

The outbreak of COVID-19 brought several short-term and long-term consequences in the construction industry, which is likely to affect the demand for construction adhesives and sealants. According to the Associated General Contractors of America (AGC), there were disruptions to work or canceled projects, and the demand may be potentially less for "non-essential" projects, like offices, entertainment, and sports facilities. Due to the shutdown of such projects and other construction activities, the demand for construction adhesives tends to constrain.

Key Highlights

- In the short term, major factors driving the market studied are the increase in housing and construction projects in emerging countries and increasing investments in the construction industry.

- However, stringent environmental regulations related to emissions will likely restrain the market's growth.

- Increasing demand for bio-based and hybrid adhesives in the construction sector and adhesive contribution to green construction is likely to create opportunities for the market in the future.

- Asia-Pacific dominated the market and is projected to continue its dominance during the forecast period due to the rise in construction activities in China and India.

Construction Adhesives Market Trends

The Residential Segment to Dominate the Market

- In residential construction, adhesives have several application areas like carpet laying, laminating countertops, installing flooring, wallpapering, etc. The use of adhesives can reduce the usage of screws and help in weatherproofing the house.

- Residential construction across the globe has been witnessing significant growth over the past few years owing to factors like population growth, migration from rural areas to service sector clusters, and the growing trend of nuclear families. Besides, decreasing land-to-population ratio and the growing trend of constructing high-rise residential buildings and townships have been driving the application of adhesives in the residential construction segment across the globe.

- Globally, there has been a significant undersupply to meet the demand for housing. This presented a major opportunity for the investors and developers to embrace alternative construction methods and new partnerships to bring forward development.

- According to Oxford Economics Estimates, in 2020, the global construction output was USD 10.7 trillion and is expected to grow by 42% or USD 4.5 trillion between 2020 and 2030 to reach USD 15.2 trillion. For instance:

- In the United States, according to World Construction Today, the Associated General Contractors of America's- AGC evaluation of the federal data determined that the demand for numerous kinds of commercial construction will remain strong for the immediate future.

- According to International Construction, the Chinese government is set to increase its spending on large construction and infrastructure projects by USD 1.8 trillion year-on-year starting from 2023 to help regional economies recover from the pandemic.

- Various government projects in Canada, including the Affordable Housing Initiative (AHI), New Building Canada Plan (NBCP), and Made in Canada, have supported the sector's expansion.

- According to Eurostat, in February 2023, construction production increased by 2.3% in the euro area (EA20) and 2.1% in EU-27 compared to January 2023.

- Due to all the factors above, the global construction industry is expected to grow, so the demand for construction adhesives is also expected to increase.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific accounted for the largest market for construction adhesives, owing to huge demand from the construction market in India, China, and various countries in Southeast Asia.

- The number of commercial offices and buildings in the region has increased since the last decade, owing to major economic and business centers' growth and competition among the construction players for attractive looks and sustainable and economical construction.

- China's construction industry developed rapidly due to the central government's push for investment in the construction industry as a means to sustain economic growth.

- China's construction industry generated an added value of around 8.3 trillion yuan (USD 1.18 trillion) in 2022, according to the National Bureau of Statistics of China.

- The Chinese government rolled out massive construction plans, including making provision for the movement of 250 million people to its new megacities over the next ten years, despite efforts to rebalance its economy to a more service-oriented form.

- According to the India Brand Equity Foundation (IBEF), India's construction industry is set to emerge as the third-largest market in the world, with a size of almost USD 1 trillion by 2025.

- According to MLIT (Japan), around 859.5 thousand housing units were initiated in Japan in 2022. According to the Economic Research Association, as of April 2023, Japan's construction materials monthly price index stood at 147.8.

- These factors are expected to drive the construction adhesives market in the Asia-Pacific region.

Construction Adhesives Industry Overview

The global construction adhesive market is consolidated in nature. Some of the major players include Henkel Adhesives Technologies India Private Limited, Dow, H.B. Fuller, Arkema Group, and 3M.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Investments in the Construction Industry

- 4.1.2 Increase in Housing and Construction Projects in Emerging Countries

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Water-based

- 5.1.2 Solvent-based

- 5.1.3 Hot-melt

- 5.1.4 Reactive

- 5.1.5 Other Types

- 5.2 Application

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Infrastructure

- 5.2.4 Industrial and Institutional

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis**/Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Adhesives Technology Corporation (ATC)

- 6.4.3 Ashland

- 6.4.4 Avery Dennison Corporation

- 6.4.5 Bostik

- 6.4.6 Don Construction Products Limited

- 6.4.7 Dow

- 6.4.8 Franklin International

- 6.4.9 Gorilla Glue Inc.

- 6.4.10 H.B. Fuller Company

- 6.4.11 Henkel Adhesives Technologies India Private Limited

- 6.4.12 Huntsman International LLC

- 6.4.13 MAPEI S.p.A.

- 6.4.14 RPM International Inc.

- 6.4.15 Sika AG

- 6.4.16 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increase In Demand for Bio-based and Hybrid Adhesives in the Construction Industry

- 7.2 Adhesives Contribute to Green Construction