|

市場調查報告書

商品編碼

1248150

高速切削工具市場—增長、趨勢、COVID-19影響和預測2023-2028High Speed Cutting Tools Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

今年高速切削刀具的市場規模預計為 68.1 億美元,預測期內復合年增長率超過 3%。

主要亮點

- 市場的增長主要是由於汽車、航空航天等全球多個最終用戶行業的需求不斷增加。 工具是製造過程中的重要組成部分,因為機床用於加工,如鑽、銑、磨、攻絲和鑽孔,這些加工決定了製造產品的質量。 經過幾年的平靜,全球機床產量呈現爆發式增長。 由於切削被納入機床的最終過程,因此隨著機床市場的增長,將需要更多的工具。 一般高速鋼刀具固定在數控機床上,用於開發複雜的產品和形狀。

- 中國在機床市場處於世界領先地位。 即使從全球範圍來看,與成型技術相比,機床加工領域在生產量中佔有很大份額。

- 由於高速鋼 (HSS) 具有高工作硬度、耐用性、高耐磨性和良好的硬度保持性等特性,因此在切削工具製造中的需求不斷增加。 與傳統使用的碳鋼相比,高速鋼的使用將切削速度提高了 4 倍。 製造商對高效可靠加工的需求日益增長。 由於以上特點,黃銅刀具正走在大批量生產和高溫工作的道路上。 此外,對客戶滿意度和產品質量的日益關注也推動了高性能切削工具市場的發展。

- 此外,通過新的塗層技術和成分調整,高速鋼工具已成為機加工和金屬加工不可或缺的材料。

高速鋼刀具市場趨勢

汽車行業前景樂觀

推動高速鋼刀具增長的主要因素是汽車行業不斷增長的需求。 高速鋼刀具是汽車行業的主流,用於汽車零件的銑削、磨削、拉削。 HSS 切削工具在製造過程中提供高精度、耐用性和可重複性,為提高整體生產率提供了一種高效且經濟的選擇。

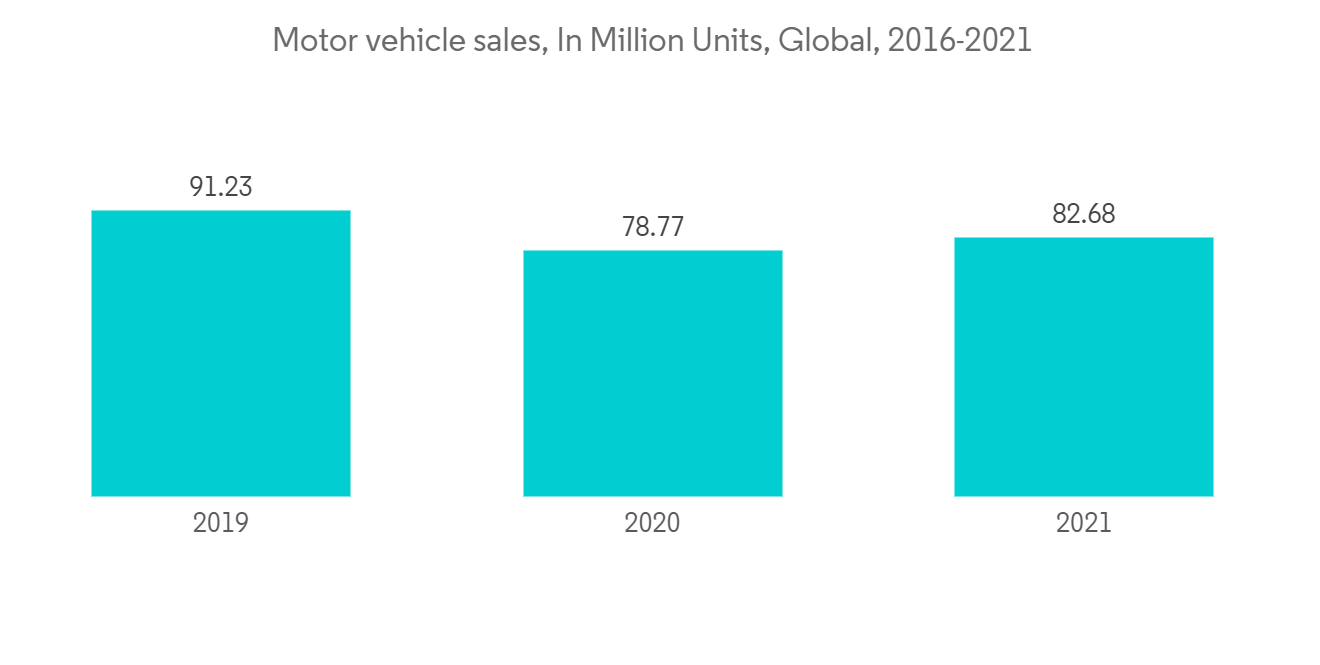

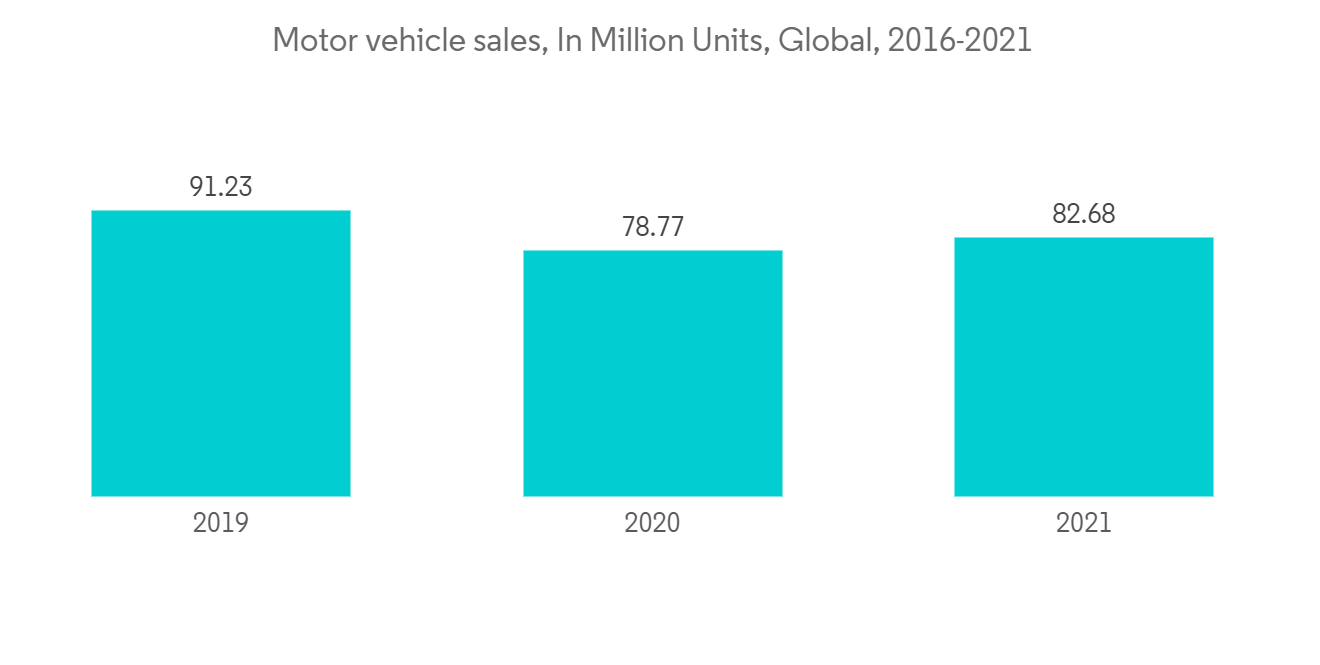

儘管存在一些不利因素,但全球汽車行業的前景依然樂觀。 美國微型車零售量將在 2021 年達到 1490 萬輛的峰值。 業內人士表示,全球微型車產量增長顯著,未來有望延續這一趨勢。

預計亞太地區的產量增長最快,其次是北美。 預計這種情況將創造對切削工具和其他與製造過程相關的設備的需求。

亞太地區鋼材需求的增長推動了鋼材刀具市場的發展

世界鋼鐵協會預測,2022 年鋼鐵需求將增長 0.4% 至 18.4 億噸,2023 年將再增長 2.2% 至 18.8 億噸。 全球發達國家鋼鐵需求2021年增長16.5%,預計2022年下降1.1%,2023年增長2.4%。 世界各地的鋼鐵製造商都在通過大規模的資本投資來提高產能以滿足高需求。

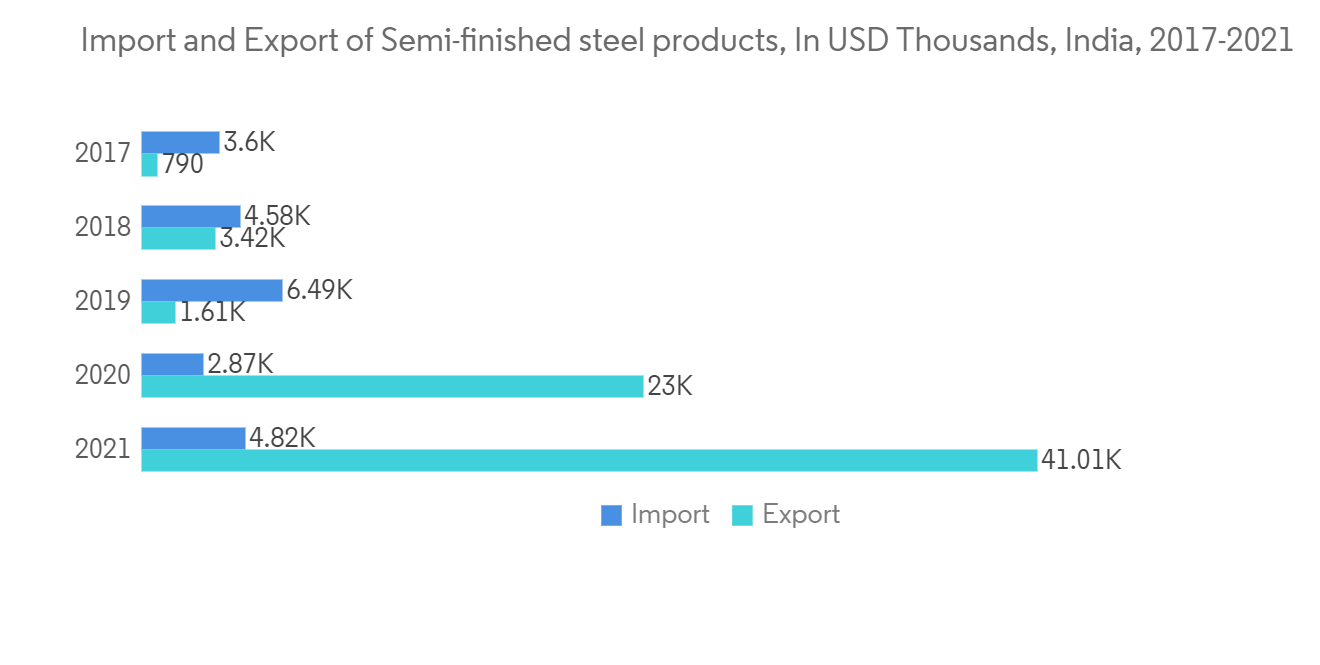

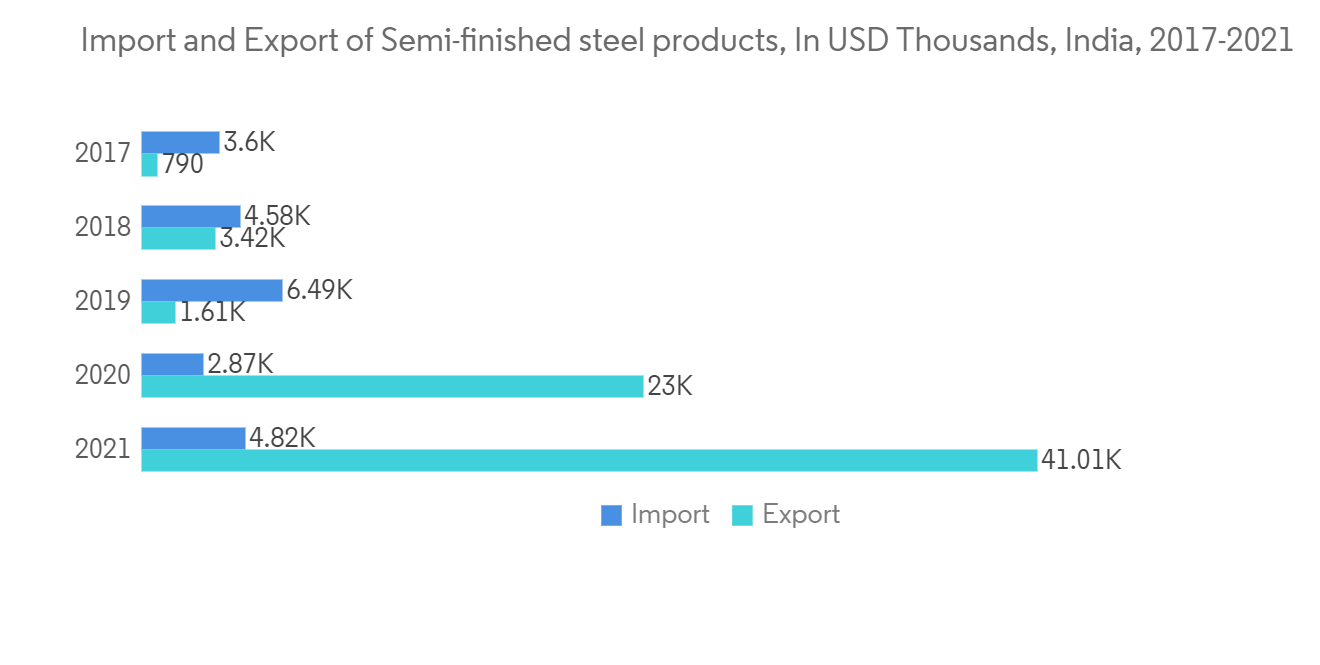

工業專家預計印度的鋼鐵需求將從 2020 年的 100MTPA 增長到 2030-31 年的 230MTPA。 例如,在印度,JSW Steel 投資 2800 億印度盧比(37 億美元),將其鋼鐵產能從 2021 年 3 月的 24.5 MTPA 增加到 2024 年 3 月的 36.5 MTPA。 塔塔鋼鐵宣布投資 800 億印度盧比(11 億美元),以完成其 Kalinganagar 工廠的擴建,將其產能從 3 MTPA 提高到 8 MTPA,並擴大其採礦和回收業務。 SAIL 還將完成一項 7000 億盧比(93 億美元)的現代化和擴建計劃,以將其產能擴大至 21.4 MTPA。

中國已建成龐大的鋼鐵產能,已連續兩年成為世界第一大鋼鐵生產國,粗鋼年產量連續兩年超過10億噸。 儘管生產的大部分鋼鐵在中國消費,但出口對中國鋼鐵製造商也很重要。

日本也是世界領先的鋼鐵生產國之一,建築和汽車製造等國內行業消耗了大部分產量。 在日本,鋼鐵依然不可或缺。 它是世界第二大鋼鐵出口國,儘管它依賴進口鐵礦石和煉焦煤。

高速鋼刀具市場競爭者分析

高速鋼刀具市場是一個相當分散的市場,既有全球大型企業,也有本土中小型企業,其中相當數量的企業佔據了市場份額。 市場參與者包括 BIG Kaiser Precision Tooling、Erasteel、Kennametal, Inc.、OSG Korea Corporation 和 Niagara Cutter, Inc.。

我們還知道,許多跨國公司都位於主要國家/地區。 在 HSS 工具市場上運營的主要參與者正在專注於加強他們的銷售網點,以滿足不斷增長的需求,並在有利的地點獲得覆蓋。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查結果

- 調查先決條件

- 調查範圍

第二章研究方法論

- 分析方法

- 研究階段

第 3 章執行摘要

第 4 章市場概述

- 當前市場情況

- 市場動態

- 司機

- 約束因素

- 機會

- 波特的五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 工業價值鏈分析

- 世界製造業(概況、趨勢、研發、關鍵統計數據等)

- 與製造業相關的主要政府法規和舉措

- 鋼鐵行業概況(概述、關鍵指標、發展等)

- 技術快照

- 粉末冶金聚光燈

- 對刀架和刀架的見解

- 關於 COVID-19 對市場的影響

第 5 章市場細分

- 按類型

- 銑削

- 鑽探

- 點擊

- 其他

- 最終用戶

- 製造/汽車

- 石油和天然氣行業

- 採礦和採石

- 農業、漁業、林業

- 建築

- 分銷貿易

- 醫療保健/醫藥

- 其他最終用戶

- 地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太地區的其他國家/地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 南非

- 沙特阿拉伯

- 其他中東和非洲地區

- 亞太地區

第六章競爭格局

- 公司簡介

- Erasteel

- Kennametal, Inc.

- Nachi America, Inc.

- OSG Korea Corporation

- Niagara Cutter, Inc.

- Addison & Co., Ltd

- Sumitomo Electric Industries

- Tiangong International

- Walter AG

- NACHI-FUJIKOSHI CORP

- DeWALT

- Somta Tools(Pty)Ltd

- Morse Cutting Tools

- Sandvik Group

- Arch Cutting Tools

第七章市場機會與未來趨勢

第8章附錄

- GDP 分佈(按活動)- 主要國家

- 對資本流動的見解 - 主要國家

- 經濟統計製造業,對經濟的貢獻(主要國家)

- 世界製造業統計數據

The size of the High-Speed Cutting Tools market is USD 6.81 billion in the current year and is anticipated to register a CAGR of over 3% during the forecast period

Key Highlights

- The growth of the market is majorly driven by the increasing demand from several end-user industries, such as automotive, aerospace, and others, across the world. Tooling is an important part of the manufacturing process since machine tools are used to bore, mill, grind, tap, drill, etc., and determine the quality of the manufactured product. Following a few years of quiet moderation, the worldwide production of machine tools underwent explosive growth. Since cutting is an integrated part of the machine tools in the final operation, the growth of the machine tool market demands more tools. Generally, HSS cutting tools are fixed on CNC machine tools to develop complex products and shapes.

- China is the global leader in the machine tool market. Worldwide, the machine tool-cutting sector represents a major share in terms of production volume compared to forming technology.

- The demand for high-speed steel (HSS) is growing for manufacturing cutting tools due to its properties such as high working hardness, durability, high wear hardness, and good retention of hardness. The use of HSS has increased the cutting speed by four times compared to previously-used carbon steels. The need for efficient and reliable machining is increasing for manufacturers. Due to the above-mentioned properties, HSS cutting tools are making their way for mass production and high-temperature operations. The growing focus on customer satisfaction and product quality is also helping to boost the market for high-performance cutting tools.

- Adapting new coating technologies and adjusting their composition accordingly, HSS tools continue to gain ground, thereby retaining their position as vital materials in the machining and metal-cutting industries.

High Speed Steel Cutting Tools Market Trends

Positive Outlook for the Automotive Industry

The major factor boosting the growth of HSS cutting tools is the increasing demand from the automotive industry. HSS cutting tools dominate the automotive industry and are used for milling, grinding, and broaching automotive car parts. HSS cutting tools provide an efficient and economical option to increase overall productivity, owing to their high precision, durability, and repeatability during manufacturing operations.

Despite some headwinds, the automotive industry is looking bright globally. U.S. light-vehicle retail sales peaked in 2021 at 14.9 million units. According to industry sources, global light vehicle production units have seen remarkable growth and continue to do so.

APAC is expected to register the highest growth rates in production volumes, followed by North America. This scenario is expected to create demand for cutting tools and other equipment associated with the manufacturing process.

Higher Demand for Steel from the APAC Region is Driving the Steel Cutting Tools Market

The World Steel Association forecasts steel demand to edge up 0.4% in 2022 to 1.84 billion mt and grow a further 2.2% in 2023 to 1.88 billion mt. In the developed nations of the world, steel demand is expected to increase by a lower 1.1% in 2022 and 2.4% in 2023, after rising 16.5% in 2021. Steelmakers around the world are increasing capacity through large capital investments to meet the high demand.

Steel demand in India is expected to rise from 100 MTPA in 2020 to 230 MTPA in 2030-31, according to industry experts. For example, In India, JSW Steel spent Rs. 280 billion (USD 3.7 billion) to increase its steelmaking capacity from 24.5 MTPA in March 2021 to 36.5 MTPA in March 2024. Tata Steel announced an investment of Rs. 80 billion (USD 1.1 billion) toward the completion of the Kalinganagar plant expansion, which will increase capacity to 8 MTPA from 3 MTPA, as well as the expansion of the mining operations and recycling business. SAIL, too, is nearing the end of an Rs. 700 billion (USD 9.3 billion) modernization and expansion program that will increase its capacity to 21.4 MTPA.

China has built up massive iron and steel production capacity and is now the world's largest steel producer, with annual crude steel production volume exceeding one billion metric tons for the past two years in a row. Although China consumes the majority of the steel produced, exports are also important for Chinese steelmakers.

Japan is also one of the world's largest steel producers, with domestic industries such as construction and automotive manufacturing consuming a large portion of the output. Steel remains indispensable in Japan. It is the world's second-largest steel exporter, despite relying on price-driving iron ore and coking coal imports.

High Speed Steel Cutting Tools Market Competitor Analysis

The high-speed steel-cutting tools market is fairly fragmented in nature, with the presence of large global players and small and medium-sized local players, with quite a few players who occupy the market share. Some of the major players in the market are BIG Kaiser Precision Tooling, Erasteel, Kennametal, Inc., OSG Korea Corporation, and Niagara Cutter, Inc.

It has also been found that many global companies have a footprint in major countries. Key players operating in the HSS tools market focus on strengthening their distribution footprint to keep pace with growing demand and gain coverage in lucrative locations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.2 Restraints

- 4.2.3 Opportunities

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Value Chain Analysis

- 4.5 Global Manufacturing Sector (Overview, Trends, R&D, Key Statistics, etc.)

- 4.6 Key Government Regulations and Initiatives for Manufacturing Sector

- 4.7 Steel Industry Snapshot (Overview, Key Metrics, Developments, etc.)

- 4.8 Technology Snapshot

- 4.9 Spotlight on Powder Metallurgy

- 4.10 Insights on Tool Posts and Tool Holders

- 4.11 Impact of COVID - 19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Milling

- 5.1.2 Drilling

- 5.1.3 Tapping

- 5.1.4 Others

- 5.2 By End-user

- 5.2.1 Manufacturing and Automotive

- 5.2.2 Oil and Gas

- 5.2.3 Mining, and Quarrying

- 5.2.4 Agriculture, Fishing, and Forestry

- 5.2.5 Construction

- 5.2.6 Distributive Trade

- 5.2.7 Healthcare and Pharmaceutical

- 5.2.8 Other End Users

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of APAC

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 United Kingdom

- 5.3.3.2 Germany

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Erasteel

- 6.1.2 Kennametal, Inc.

- 6.1.3 Nachi America, Inc.

- 6.1.4 OSG Korea Corporation

- 6.1.5 Niagara Cutter, Inc.

- 6.1.6 Addison & Co., Ltd

- 6.1.7 Sumitomo Electric Industries

- 6.1.8 Tiangong International

- 6.1.9 Walter AG

- 6.1.10 NACHI-FUJIKOSHI CORP

- 6.1.11 DeWALT

- 6.1.12 Somta Tools (Pty) Ltd

- 6.1.13 Morse Cutting Tools

- 6.1.14 Sandvik Group

- 6.1.15 Arch Cutting Tools*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 APPENDIX

- 8.1 GDP Distribution, by Activity-Key Countries

- 8.2 Insights on Capital Flows-Key Countries

- 8.3 Economic Statistics Manufacturing Sector, Contribution to Economy (Key Countries)

- 8.4 Global Manufacturing Industry Statistics