|

市場調查報告書

商品編碼

1771254

自動駕駛車輛的4D影像雷達市場 - 產業,市場,競爭分析(2025年版)4D Imaging Radar in Autonomous Vehicles - Industry, Market, and Competition Analysis, Edition 2025 |

||||||

用於 ADAS 和自動駕駛汽車內外感知的 4D 成像雷達,60GHz、76-81GHz、140GHz 頻段,SAE 2+ 級及以上應用,新興 4D 成像公司競爭力評估

重點

- 預計從 2025 年到 2035 年,ADAS 和 AV 雷達模組市場將成長 2.7 倍,複合年增長率為 11.7%,從 2025 年的 90 億美元增至 2035 年的 250 億美元。

- 預計到 2035 年,4D 成像雷達模組的滲透率將達到 56% 以上,較目前的市場滲透率激增 45%。

- 到 2035 年,隨著自動駕駛汽車的興起和成本降低,4D 雷達可能在短距離和中距離領域佔據主導地位,並在許多 ADAS 和 AV 系統中取代傳統的 3D 雷達。

- 由於歐洲新車安全評估協會 (EURO NCAP) 等監管要求,用於乘員監控和兒童遺留檢測的車載應用正在成為利基市場增長。

- 台積電、格芯和 imec 開發的 140GHz 雷達技術專注於室內和室外應用的高解析度感測。

- 大陸集團、博世、Vayyar、Arbe、Uhnder、恩智浦和特斯拉等主要參與者正在推動創新,最近在 CES 2025 和 IAA Mobility 2025 上展示了其在分辨率、效率和監管準備方面的進步。

- RFISee、RadSee、Smart Radar System、Zadar Labs、InnoSenT、英飛凌和 Ainstein 是 4D 成像雷達行業值得關注的新創公司。同時,德州儀器 (TI)、恩智浦半導體 (NXP Semiconductors)、意法半導體 (STMicroelectronics)、賽靈思 (Xilinx) 和亞德諾半導體 (ADI) 是領先的片上系統 (SoC) 供應商,正在積極開發 4D 半導體 (ADI) 是領先的片上系統 (SoC) 供應商,正在積極開發 4D 輔助系統解決方案,以支援 ADAS(高階車輛)和更高的車輛控制系統。

- 一些新創公司,例如 Zendar Inc.,專注於利用 AI 實現動態分辨率的軟體定義雷達;Sensrad AB,從 Qamcom 集團分拆出來;Waveye,專注於快速進入市場;Altos Radar,旨在在機器人出租車和城市自動駕駛汽車中率先採用;Altos Radar 正在與中國原始設備製造商(利基、吉利等)進行防電

樣品view

全面覆蓋

M14 Intelligence 憑藉其在自動駕駛、網聯、電動和共享出行領域關鍵趨勢識別方面的核心競爭力,發布了關於 4D 成像雷達技術的研究成果。

- ADAS、自動駕駛汽車、機器人汽車 - 市場展望

- ADAS 和 AV 產業中雷達感測器的現狀

- 從自動化等級(ADAS、L2/L2+、L3、L4/L5)、工作範圍(短程、中長程)、工作頻段(60GHz、76-81GHz、140GHz)等多個角度了解雷達需求和市場規模的潛在變化

- 調變技術 - FMCW 與數位編碼調變 (DCM)

- 片上雷達與 MIMO 天線設計

- 基於 AI 的處理

- 用於車載和外部感測的 4D 成像片上雷達感測器的全球市場滲透趨勢

- 各地區頻率監管與分配的影響

- 4D 成像雷達和感測器套件動態硬體晶片軟體解決方案面臨的挑戰

- 顛覆性趨勢正在重塑人工智慧整合、片上雷達和感測器融合等市場挑戰

- 高成本和整合複雜性等挑戰,以及半導體和軟體定義雷達的進步如何應對這些挑戰

- 對新興領導者和新創企業的競爭評估,以及晶片供應商和汽車雷達市場第一線解決方案供應商的策略和市場發展。

市場概覽

自動駕駛汽車的 4D成像雷達市場處於汽車技術創新的前沿,推動著高級駕駛輔助系統 (ADAS) 和自動駕駛汽車 (AV) 的發展。預計該市場規模將在 2024 年達到約 20 億美元,到 2030 年將達到 100 億美元,複合年增長率為 38%。這得益於對更高安全性、法規要求以及更高級別自動駕駛(SAE 4/5 級)的不斷增長的需求。

本報告摘要探討了雷達感測器在ADAS和AV中的應用、4D雷達取代3D雷達的普及情況、當前和未來的雷達技術及頻段、主要參與者和新興參與者、競爭策略、近期趨勢、4D雷達在AV中的關鍵作用以及機器人出租車和穿梭巴士的市場發展潛力,重點關注亞太地區等前景廣闊的地區。

雷達感測器在ADAS和自動駕駛汽車中的應用

雷達感知器在ADAS和AV中至關重要,可實現自適應巡航控制 (ACC)、自動緊急煞車 (AEB)、盲點偵測 (BSD)、車道變換輔助 (LCA) 和兒童存在偵測 (CPD) 等關鍵功能。與攝影機和雷射雷達不同,雷達在惡劣天氣條件(霧、雨、雪等)和低光源條件下表現更佳,可提供可靠的物體偵測和測距。預計到2024年,全球雷達感測器出貨量將超過1.69億個,平均每輛車配備0.8個遠端雷達,到2030年將接近1個。自動駕駛計程車,例如Cruise(每輛車配備21個雷達)和Waymo(配備6個高性能4D雷達),已證明其在4/5級自動駕駛中高度依賴雷達,以確保強大的環境感知能力。在消費者對安全性的需求和監管要求(例如,2024年7月歐盟 "車輛通用安全法規" )的推動下,ADAS的普及正在加速雷達在乘用車、商用卡車和自動駕駛班車中的部署。

4D雷達技術取代3D雷達

4D成像雷達在3D雷達的距離、方向和多普勒數據的基礎上增加了速度和高度數據,憑藉其卓越的分辨率和精度,正在迅速取代傳統雷達。到2025年,4D雷達預計將佔據汽車雷達市場的11.4%,並在2-3年內從小眾技術發展成為主流技術。與難以實現高程解析度和複雜物體分離(例如區分行人和車輛)的3D雷達不同,4D雷達利用大規模多輸入多輸出 (MIMO)、數位碼調變 (DCM) 和人工智慧驅動的處理技術,產生高解析度點雲,在某些應用領域可與雷射雷達相媲美。例如,搭載Drive Pilot系統的賓士EQS和搭載大陸集團ARS540 4D雷達的現代IONIQ 5在低能見度下均表現出色。這種轉變源自於3-5級自動駕駛對精準感知的需求,以及對路口行人AEB等高階安全功能的監管要求。

競爭策略與區域市場機會

現有企業充分利用專注於高解析度雷達和光達/攝影機感測器融合的研發、全球佈局以及與原始設備製造商 (OEM) 的合作夥伴關係(例如,博世與大眾的合作)。同時,新興企業則在成本效益設計(RadSee 的 COTS、Uhnder 的 RoC)、AI 整合(Waveye、Zendar)和利基應用(Sensrad 的工業重點)方面脫穎而出。與一級供應商和原始設備製造商 (OEM)(例如,Arbe-BAIC)的合作方式正在加速新進入者的市場准入。

亞太地區是成長最快的地區,其複合年增長率最高,這得益於中國電動車的蓬勃發展和政府對智慧城市的支持。上汽集團和蔚來汽車等公司正在整合 4D 雷達(例如,採埃孚 (ZF) 和上汽集團的合作(2022 年 12 月))。北美市場以美國為主導,佔據了最大的銷售佔有率,福特、通用和特斯拉等汽車製造商在其 BlueCruise、Super Cruise 和 Autopilot 系統中都採用了 4D 雷達。由於嚴格的安全法規(例如,歐盟 2024 年強制規定),歐洲市場成長強勁。例如,梅賽德斯-奔馳和寶馬在 2+/3 級系統方面處於領先地位,而高階汽車和合規驅動型市場也蘊藏著巨大的機會。

市場機會

包括自動駕駛計程車和接駁車在內的 SAE 4/5 級自動駕駛汽車市場是 4D 雷達的主要成長動力。 Cruise和Waymo 已廣泛部署 4D 雷達,預計到 2024 年,其車隊規模將超過 1,000 輛,這標誌著商業化自動駕駛計程車服務的興起。預計到 2035 年,僅 Level 4/5 自動駕駛汽車的全球 4D 雷達市場規模將達到 9.11 億美元,其中,自動駕駛計程車和接駁車在城市和高速公路上的自動駕駛過程中將消耗大量雷達單元。

機會包括:

- 城市出行:在密集環境中導航對雷達的需求很高(例如,Waveye 的城市專用雷達)。

- 最後一哩配送:自動駕駛接駁車和配送車輛將採用 4D 雷達來確保安全。

- 監管支援:強制性 AEB 和 CPD 將推動雷達整合到 4/5 級自動駕駛系統中。

主要的問題

- SAE 1-5 級自動駕駛汽車中 4D 成像雷達的採用率和趨勢如何?

- 到 2035 年,汽車 4D 成像雷達市場的當前市場規模和成長潛力如何?

- 哪些 ADAS 功能(例如 AEB、ACC、BSM)最依賴 4D 雷達?它們如何提升安全性和性能?

- 4D 雷達的成本如何演變(例如 77GHz、60GHz、140GHz)?

- 將 4D 雷達與其他感測器(例如 LiDAR、攝影機)整合以實現穩健的感測器融合面臨哪些挑戰?

- 全球的頻率法規(例如 77GHz、60GHz、140GHz)有何差異?它們將如何影響 4D 雷達的部署?

- 4D 雷達在座艙監控(例如乘員監控和兒童遺留檢測)中的作用如何創造市場機會?

- 哪些新興公司(例如 Arbe、Uhnder、Zendar)正在顛覆 4D 雷達市場?它們有哪些獨特的戰略?

- 在 4D 雷達市場中,現有企業(大陸集團、博世、恩智浦等)與新興企業相比,有哪些競爭優勢?

- 合作、併購如何塑造 4D 雷達市場?它們將為利害關係人帶來哪些機會?

- 哪些投資和融資趨勢正在支撐 4D 雷達市場的成長?利害關係人如何利用這些趨勢?

取得 4D 成像雷達產業最有趣問題的答案!

企業清單

|

|

目錄

乘用車銷售量 - 市場展望

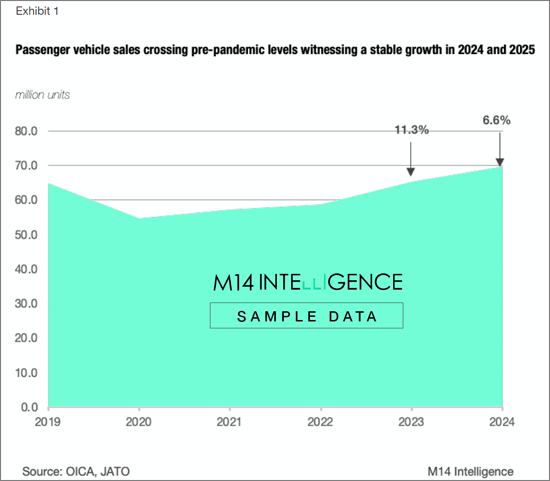

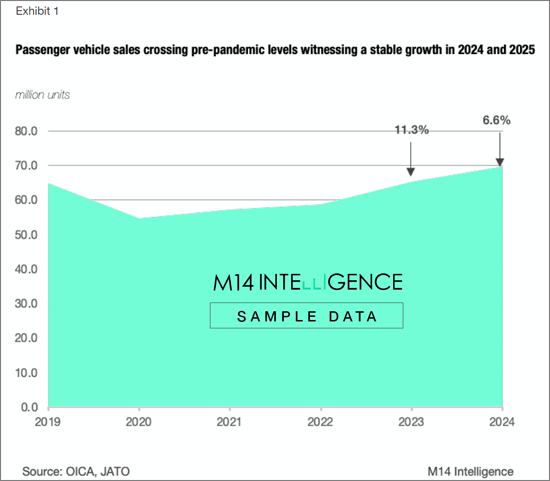

- 全球乘用車銷量 (2019-2024)

- 以自動化等級 (L1-L5) 劃分的乘用車銷量

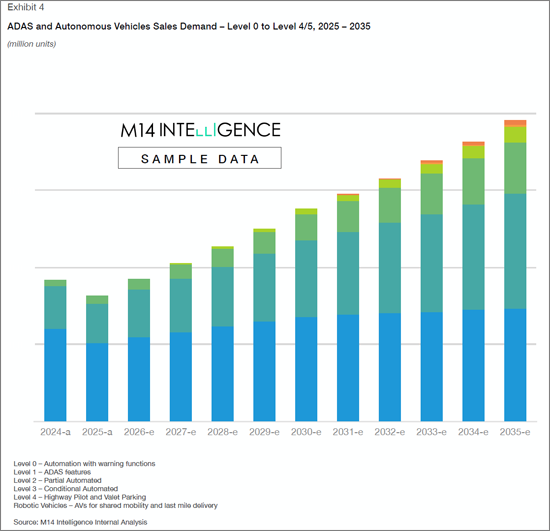

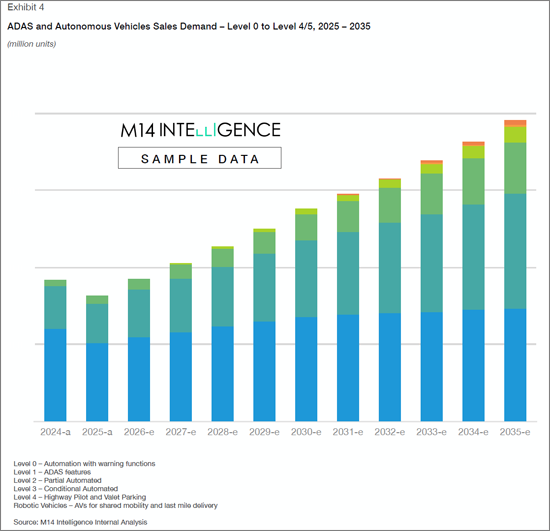

- 2025-2035 年 ADAS 與自動駕駛汽車市場銷售及預測

- 中國佔據市場主導地位,歐洲具有高成長潛力

- 城市交通、最後一哩配送和監管支援將成為新的收入來源

汽車雷達產業現況 - 2025-2035 年市場展望、產量與價值

- 每輛車的雷達感測器需求

- 雷達平均售價及預期降幅

- 依自動化等級劃分的雷達需求

- 依操作範圍 (LRR、 MRR/SRR,車內)

- 按頻率劃分的雷達需求

- 按頻率劃分的雷達市場滲透率

- 4D 成像雷達快速擴張趨勢

汽車 4D 雷達產業 - 市場展望、數量與價值,2025-2035

- 4D 雷達市場 - 按自動化水平劃分

- 4D 雷達市場 - 按 ADAS 和 AV 應用劃分

- 用於外部感測應用的 4D 成像雷達

- 用於車載應用的 4D 成像雷達

汽車 4D 雷達產業 - 競爭評估

- 汽車 4D 雷達應用領域的新興公司概況

- 產品比較與基準分析

- 合作夥伴圖譜與供應商分析

- 汽車產業的 OEM、一級供應商和感測器供應商4D雷達業務

- 重點公司研發投入

- 4D雷達業務新創企業的融資及投資分析

In-cabin and Exterior Sensing Applications of 4D imaging radar in ADAS and Autonomous Vehicles; 60 GHz, 76-81 GHz, and 140 GHz Band, SAE Level 2+ and above applications, Emerging 4D imaging players competition assessment.

Key Highlights

- ADAS and AV radar module market size anticipated to grow 2.7x times between 2025 to 2035, accounting $25 billion in 2035 from $9 billion by 2025 at a CAGR of 11.7 percent

- 4D imaging radar modules expected to penetrate over 56 percent by 2035, a jump of 45% from the current market penetration

- By 2035, with the rise of autonomous vehicles and cost reductions, 4D radar could dominate short- and medium-range applications, potentially replacing conventional 3D radar in many ADAS and AV systems

- The in-cabin applications of occupant monitoring and left-child detection is a growing niche due to regulatory mandates like those from EURO NCAP

- Development of 140 GHz radar technology by TSMC, GlobalFoundries, and imec focuses on high-resolution sensing for both interior and exterior applications, though not yet commercialized, the technology is expected to strongly compete with 77GHz system by 2035

- Leading companies like Continental, Bosch, Vayyar, Arbe, Uhnder, NXP, and Tesla are driving innovation, with recent showcases at CES 2025 and IAA Mobility 2025 highlighting advancements in resolution, efficiency, and regulatory compliance.

- RFISee, RadSee, Smart Radar System, Zadar Labs, InnoSenT, Infineon, and Ainstein are prominent emerging players in the 4D imaging radar industry. Meanwhile, Texas Instruments, NXP Semiconductors, STMicroelectronics, Xilinx, and Analog Devices are leading System-on-Chip (SoC) providers actively developing 4D imaging radar solutions to support Advanced Driver Assistance Systems (ADAS) and higher levels of vehicle automation.

- Emerging start-ups such as Zendar Inc. focusing on software-defined radar with AI for dynamic resolution, Sensrad AB is a spin-out from Qamcom Group, focusing on rapid market entry, Waveye is targeting early adoption in robotaxis and urban AVs, Altos Radar partnering with Chinese OEMs (e.g., SAIC, Geely) for regional expansion, Xavveo is targeting niche markets like autonomous shuttles and industrial applications

SAMPLE VIEW

Countries Covered: Global (China, India, Japan, South Korea, US, Canada, South America, Germany, France, Italy, UK, Israel, others).

Exhaustive Coverage

M14 Intelligence with its core capabilities in understanding the key trends of autonomous, connected, electric, and shared mobility published the research on 4D imaging radar technology which talks about following important factors of the market.

- ADAS, Autonomous and Robotic Vehicles - Market Outlook

- Status of radar sensors in the ADAS and AV industry

- Understanding the potential change in the radar demand and its market size from different perspectives including - automation levels (ADAS, Level 2/2+, Level 3 and Level 4/5), range of operations (short, medium-long), and frequency band of operation (60 GHz, 76-81 GHz , and 140GHz)

- Modulation Techniques- FMCW and Digital Code Modulation (DCM)

- Radar-on-Chip and MIMO antenna design

- AI-based processing

- Market penetration trend of 4D imaging radar-on-chip sensors for in-cabin and world-facing exterior sensing applications

- Impact of frequency regulations and allocations across different geographies

- 4D imaging radar hardware chip and software solutions and how it is expected to challenge the sensor suite dynamics

- Disruptive trends like AI integration, radar-on-chip, and sensor fusion that will reshape the market

- Challenges like high costs and integration complexities, and how advancements in semiconductors and software-defined radar are addressing these hurdles

- Competition assessment of emerging leaders and start-ups, along with the strategies and developments of chip providers and tier-1s offering solutions in automotive radar market.

Market Overview

The 4D imaging radar market for autonomous vehicles is at the forefront of automotive innovation, driving the evolution of Advanced Driver Assistance Systems (ADAS) and autonomous vehicles (AVs) . Valued at approximately USD 2 billion in 2024, the market is projected to reach USD 10 billion by 2030, with a CAGR of 38%, fueled by the increasing demand for enhanced safety, regulatory mandates, and the push for higher autonomy levels (SAE Level 4/5).

This report summary explores the adoption of radar sensors in ADAS and AVs, the penetration of 4D radar replacing 3D radar, current and future radar technologies and frequency bands, leading and emerging players, competitive strategies, recent developments, the critical role of 4D radar in AVs, and market potential for robotaxis and shuttles, with a focus on high-potential regions like Asia-Pacific.

Adoption of Radar Sensors in ADAS and Autonomous Vehicles

Radar sensors are integral to ADAS and AVs, enabling critical features like Adaptive Cruise Control (ACC), Automatic Emergency Braking (AEB), Blind Spot Detection (BSD), Lane Change Assist (LCA), and Child Presence Detection (CPD) . Unlike cameras and LiDAR, radar excels in adverse weather conditions (e.g., fog, rain, snow) and low-light scenarios, providing reliable object detection and ranging. In 2024, over 169 million radar sensors were shipped globally, with an average of 0.8 long-range radars per vehicle in 2024, expected to approach 1 per vehicle by 2030. Robotaxis, such as Cruise (21 radars per vehicle) and Waymo (six high-performance 4D radars), demonstrate heavy reliance on radar for Level 4/5 autonomy, ensuring robust environmental perception. The rising adoption of ADAS, driven by consumer demand for safety and regulatory mandates (e.g., EU's Vehicle General Safety Regulations, July 2024), is accelerating radar deployment across passenger vehicles, commercial trucks, and autonomous shuttles.

Penetration of 4D Radar Technology Replacing 3D Radars

4D imaging radar, which adds velocity and elevation to the range, azimuth, and Doppler data of 3D radar, is rapidly replacing its predecessor due to superior resolution and accuracy. By 2025, 4D radar is expected to penetrate 11.4% of the automotive radar market, transitioning from a niche to a mainstream technology within 2-3 years. Unlike 3D radar, which struggles with elevation resolution and complex object separation (e.g., distinguishing a pedestrian from a vehicle), 4D radar leverages Massive MIMO, Digital Code Modulation (DCM) , and AI-driven processing to create high-resolution point clouds, rivaling LiDAR in some applications. For instance, Mercedes-Benz EQS with Drive Pilot and Hyundai IONIQ 5 with Continental's ARS540 4D radar showcase enhanced performance in poor visibility. The shift is driven by the need for precise perception in Level 3-5 autonomy and regulatory requirements for advanced safety features like Junction Pedestrian AEB.

Competitive Strategies and regional market opportunities

Established players leverage R&D, global presence, and OEM partnerships (e.g., Bosch's collaboration with Volkswagen) focusing on high-resolution radar and sensor fusion with LiDAR/cameras. On the other hand, start-ups differentiate through cost-effective designs (RadSee's COTS, Uhnder's RoC), AI integration (Waveye, Zendar), and niche applications (Sensrad's industrial focus). A collaborative approach is wherein partnership with Tier 1s and OEMs (e.g., Arbe-BAIC) is accelerating market entry for new players.

Asia-Pacific is the fastest-growing region with the highest CAGR, driven by China's EV boom and government support for smart cities. Companies like SAIC and NIO integrate 4D radar (e.g., ZF's partnership with SAIC, Dec 2022). Opportunities lie in mass-market EVs and robotaxi fleets in urban centers like Shanghai. North America holds largest revenue share, led by the US with OEMs like Ford, GM, and Tesla adopting 4D radar for BlueCruise, Super Cruise, and Autopilot. Europe shows strong growth due to stringent safety regulations (e.g., EU's 2024 mandates). For instance, Mercedes-Benz and BMW lead with Level 2+/3 systems and opportunities are evidently reflected in premium vehicles and compliance-driven markets.

Market Potential

The market for SAE Level 4/5 AVs, including robotaxis and shuttles, is a key growth driver for 4D radar. By 2035, the AV segment is expected to exhibit the highest CAGR (127%) from 2025 to 2035 within the 4D radar market, driven by the need for multiple high-performance radars (6-21 per vehicle). Cruise and Waymo deploy 4D radar extensively, with fleets exceeding 1,000 vehicles in 2024, signaling commercial robotaxi services' rise. The global 4D radar market is projected to reach USD 911 million by 2035 for Level 4/5 AVs alone, with robotaxis and shuttles consuming significant radar units for urban and highway autonomy.

Opportunities include:

- Urban Mobility: High radar demand for navigating dense environments (e.g., Waveye's urban-focused radar).

- Last-Mile Delivery: Autonomous shuttles and delivery vehicles adopting 4D radar for safety.

- Regulatory Support: Mandates for AEB and CPD boost radar integration in Level 4/5 systems.

Key Questions Answered:

- How rapidly is 4D imaging radar penetrating autonomous vehicles across SAE Levels 1-5, and what are the adoption trends?

- What is the current market size and growth potential of the 4D imaging radar market for automotive applications through 2035?

- Which ADAS features (e.g., AEB, ACC, BSM) are most reliant on 4D radar, and how do they enhance safety and performance?

- How are 4D radar costs (e.g., 77 GHz, 60 GHz, 140 GHz) evolving, and what factors drive cost erosion for mass production?

- What are the challenges of integrating 4D radar with other sensors (e.g., LiDAR, cameras) for robust sensor fusion?

- How do frequency regulations (e.g., 77 GHz, 60 GHz, 140 GHz) vary globally, and what impact do they have on 4D radar deployment?

- How 4D radar's role in in-cabin monitoring applications of occupant monitoring and left-child detection is creating market opportunity?

- Which emerging startups (e.g., Arbe, Uhnder, Zendar) are disrupting the 4D radar market, and what are their unique strategies?

- What are the competitive advantages of established players (e.g., Continental, Bosch, NXP) versus emerging startups in the 4D radar market?

- How are partnerships, mergers, and acquisitions shaping the 4D radar market, and what opportunities do they create for stakeholders?

- What investment and funding trends are supporting the growth of the 4D radar market, and how can stakeholders capitalize on them?

Get answers to the most intriguing questions in the 4D imaging radar industry!

List of Companies

|

|

Table of Contents

Passenger Vehicle Sales - Market Outlook

- Global Passenger Vehicle Sales, 2019-2024

- Passenger Vehicle Sales Breakdown, by Level of Automation, L1 to L5

- ADAS and Autonomous Vehicle Market sales and forecast, 2025-2035

- China dominating the market while Europe holds strong growth potential

- Urban mobility, last-mile delivery and regulatory support will be the new revenue pockets

Status of Automotive Radar Industry - Market Outlook Volume & Value, 2025-2035

- Radar Sensor requirement per vehicle

- ASP of Radar and Expected Price Erosion

- Radar Demand by Levels of Automation

- Radar Demand by Range of Operation (LRR, MRR/SRR, In-cabin)

- Radar Demand by Frequency

- Radar Market Penetration by Frequency

- Trend towards 4D Imaging Radar is Growing Rapidly

Automotive 4D Radar Industry - Market Outlook Volume & Value, 2025-2035

- 4D Radar Market - Split by Levels of Automation

- 4D Radar Market - Split by ADAS and AV Applications

- 4D Imaging Radar for Exterior Sensing Application

- 4D Imaging Radar for In-cabin Application

Automotive 4D Radar Industry - Competition Assessment

- Profiles of Emerging Companies in Automotive 4D Radar Application

- Product Comparison and Benchmarking

- Partnership Mapping and Supplier Analysis

- OEMs, Tier-1s, and Sensor Suppliers in 4D Radar Business

- Investment in R&D by leading players

- Funding and Investment Analysis of Start-ups in 4D Radar Business