|

市場調查報告書

商品編碼

1694052

電動車(EV)電池技術的全球市場:供應鏈分析(2025年~2035年)Global Electric Vehicle (EV) Battery Technology Market and Supply Chain Analysis, 2025-2035 |

||||||

電動車 (EV) 正在引領世界走向更綠色的未來,而電池是這場革命的核心。隨著需求的飆升,預計未來十年技術、市場和競爭將發生巨大變化。

電動車產業預計在未來五到十年內實現重大飛躍。預計電動車銷量將大幅成長,到 2030 年,電動車可能佔全球新車銷量的 20-30%,高於 2020 年的 4%。電動車的繁榮取決於電池成本的下降、龐大的充電網路以及政府對化石燃料汽車的限制政策。電池的能量密度可以翻倍,續航里程可超過 500 英里。歐盟國家和其他國家計劃在2035年逐步淘汰內燃機,以促進電動車的普及。

如今,鋰離子電池佔據主導地位,鎳錳鈷 (NMC) 可提供更長的續航里程,而磷酸鐵鋰 (LFP) 可降低成本並提高安全性。

鋰離子變體:使用鋰鎳錳鈷氧化物的 NMC 電池很常見且具有高能量密度,而 LFP 電池(按容量計算,到 2023 年將佔全球市場佔有率的 41%)更便宜且更具可持續性。 <>採用LFP是因為其能量密度較低且成本較低。

新興技術: 鈉離子電池適用於城市電動車和固定式蓄電池,預計將成本降低 20%,比亞迪、寧德時代等公司已宣布 2023 年量產。 <>豐田和 QuantumScape 率先推出的固態電池有望提供更高的能量密度和安全性,但尚未投入實際使用。

創新雙離子電池 (DIB) 和雙極 LFP 電池已經出現,可以實現快速充電和高電壓,但循環壽命仍然是一個問題。固態電池有可能將電動車的續航里程延長至 600 英里以上,但其高昂的成本意味著鋰離子電池很可能會繼續佔據主導地位十年。

中國:受 CATL(2024 年全球市佔率為 37.9%)和比亞迪(17.2%)等生產成本較低的公司所推動。生產成本更低的 LFP 電池將成為主流,到 2023 年,售出的電動車中三分之二將使用這種電池。

北美:在特斯拉和福特-SK On 等合作關係的推動下,美國預計將從 2021 年起吸引 2,100 億美元的投資。但生產成本比中國高出20%。

歐洲:面對高昂的成本(比中國高出 50%)和薄弱的供應鏈,Northvolt 的倒閉凸顯了困難。目標是到 2030 年建造 35 至 40 座超級工廠。

亞太地區:印度和韓國等新興市場正在成長,在 FAME II 等計畫的支持下,印度預計到 2023 年電動車註冊量將比去年增加 70%。

電動車電池市場是一塊地緣政治棋盤。中國佔全球產量的70%以上,寧德時代、比亞迪等巨頭透過規模和補貼發揮影響力。日本和韓國也紛紛效仿,松下和 LG 化學為特斯拉和現代等品牌提供動力。歐洲正在努力追趕,向歐洲電池聯盟投入大量資金來建立自己的供應鏈。在特斯拉內華達超級工廠的帶動下,北美正在加強國內生產力度,以減少對亞洲的依賴。

各地區的生產能力的概述

| 類型 | 優點 | 缺點 | 採用 |

|---|---|---|---|

| NMC | 高能量密度(~250Wh/kg) | 高價(鈷依存) | 減少傾向(Tesla,GM階段性地廢止) |

| LFP | 安價值,長壽生命,鈷自由 | 能量密度低(~180Wh/kg) | 優勢(Tesla,BYD,福特) |

| 固態 | 超高能量密度(~500Wh/kg) | 還沒被實用化 | 豐田,QuantumScape 2026-2030年目標 |

| 地區 | 目前容量(GWh) | 2030年預測(GWh) | 2035年預測(GWh) |

|---|---|---|---|

| 亞洲 | 500 | 1500 | 3000 |

| 歐洲 | 50 | 400 | 800 |

| 北美 | 100 | 300 | 600 |

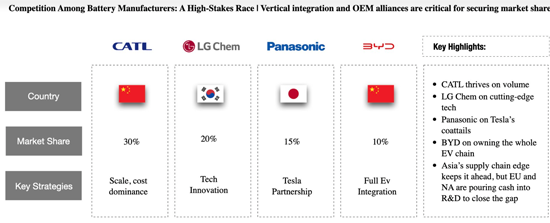

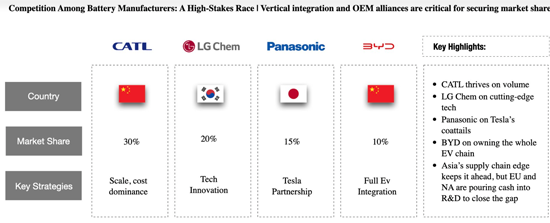

電池製造商競爭激烈。

CATL以數量,LG Chem是最尖端科技,PanasonicTesla的尾巴,並且BYD由於所有EV連鎖全體的事取得著成功。亞洲供應鏈處於優勢,不過,北美和歐洲應該縮短那個差研究開發投入著資金。

中國領導,CATL和BYD壟斷,受到著被整合的供應鏈和低成本的恩惠。2024年的CATL的339.3GWh的安裝,強調那個領導。

LG Energy 象Solution一樣的北美企業和象Northvolt一樣的歐洲企業,歐洲的成本量(比起中國高(貴)和50%)面臨著供應鏈的弱點這個課題。2024年的Northvolt的破產,把這樣的困難做為浮雕。

Tesla,BYD,象傳統的OEM(GM,Volkswagen)一樣的企業,由於價格,創新性,供應鏈·控制競爭著。Tesla的市場佔有率根據競爭從2019年的17%2022年13%降低了。象Tesla的Gigafactory一樣的行業,帶來成本優勢。

亞洲企業,尤其是中國企業,通過利基市場(合理的價格的小型車等等)政府補助金確保空間,破壞歐洲市場。他們,活用著線上銷售和地方自治團體形成策略。

電動車(EV)市場上,現有的汽車廠商和新興參與企業展開著激烈競爭。Tesla,Volkswagen,General 所說的Motors (GM的)產業大廠,為了強化自己的地位推進著積極的策略。Tesla垂直合併電池生產提高自給率,Volkswagen確保與Northvolt配合可靠性的高(貴)的電池供給,GM為大眾針對市場的EV的開發著重做擴大著客戶層。

同時,把電力卡車專門的Rivian,及高級EV市場區隔作為目標的Lucid 所說的Motors的新加入企業,活用創新的設計和先進技術獲得市場佔有率,也進入著到市場。這個競爭情形的成功重要的決策要素,是不是能確保電池的穩定的且充分的供給。

象Rivian一樣的新加入企業,有讓現有的汽車廠商混亂的可能性,不過,那個被限定如果為在供不應求的世界確保了電池。

EV用電池市場,隨著電動化紮根需求劇增,打算完成指數函數性的成長。現在是亞洲領導著,不過,歐洲和北美正在根據投資和技術創新縮短那個差。價格變動和競爭成為課題,不過,專心致力為創新和適應的企業機會溢出。對第一級供應商和電池廠商來說,要努力的目標明確。為了明天的EV供給電力,技術投資,確保供應鏈,是接受永續性。

本報告提供全球電動車(EV)電池技術市場相關調查,彙整市場概要技術趨勢,市場預測與預測,課題,競爭情形,及加入此市場的主要企業簡介等資訊。

目錄

調查範圍

調查手法

電池技術趨勢與動態

- 到 2030 年,原料短缺和回收將彌補這一缺口

- 中國主導地位將使LFP電池湧入全球市場

- 美國和歐盟可能對中國製造的電池徵收新關稅,重振國內製造業

- 超級工廠建設正在興起-特斯拉、通用汽車、福特領銜 人工智慧驅動的電池管理系統(BMS)

- 電池交換網路普及

- 電池即服務 (BAAS) 模式

市場預測與預測

- 全球EV車銷售預測- 各車種·各地區明細

- 各地區EV電池生產統計

- Gigafactory的容量- 計劃和運用

- EV電池市場規模與預測,2025年~2035年

- EV電池的裝置容量,2024年的GWH,2025年,2035年為止的預測

- EV電池市場規模- 各技術類型明細,2025年~2035年

- 鋰離子-LFP和NMC

- 新興技術- 固體及鈉離子

- EV電池市場規模- 各地區明細,2025年~2035年

- 北美市場,2025年~2035年

- 歐洲市場,2025年~2035年

- 中國市場,2025年~2035年

- 亞太地區(中國以外)市場,2025年~2035年

主要的市場課題

- 地緣政治緊張局勢(中國與西方的分離)

- 原物料價格波動

- 固態延遲

- 補貼政策的變化

競爭評估

- 競爭基準

- 市佔率分析

- 頂級電池製造商

- OEM 內部製造電池與外包電池

- 超級工廠合資企業

- 新創公司和 OEM 合作夥伴關係

- 跨產業合作

企業簡介

- esla

- Byd

- CaTL

- LG Energy Solution

- Panasonic

- SK On

- Northvolt

- Samsung SDI

- QuantumScape

- Solid Power

- Nio

- ChargePoint

- ABB

- StoreDot

- Freyr Battery

- ACC (Automotive Cells Co.)

- Farasis Energy

- Envision AESC

- Microvast

- Romeo Power

- ProLogium

- Nexeon

- Ample

- SparkCharge

- Electrify America

- Ionity

- Our Next Energy (ONE)

對利害關係人(OEM、供應商、投資者)的建議

附錄

次要來源清單

關於研究公司

Lithium-ion (LFP and NMC) and Emerging Battery Technology (Solid-state and Sodium-ion) Market Sizing, Regional breakdown, Regulatory Policies, Battery-as-a-Service Model (BaaS), Gigafactories, Trends & Dynamic, Supply Chain Analysis, Competition.

Key Highlights:

This comprehensive study examines the -

- Strategic Implications and Actionable Insights on EV Battery Technology for Automotive Players

- Battery technology trends, supply chain risks, and future outlook.

- Raw material price spikes and supply chain distribution

- China's market dominance and potential new tariffs impacting the growth of EV Battery industry

- Gigafactory constructions, battery swapping networks, and Batter-as0a Service model (BaaS)

- EV Battery Market Sizing and forecasting, 2025-2035

- Market breakdown by Technology- LPF, NMC, Solid-state, and Sodium-Ion

- Research & Development Analysis

- Partnership between OEMs and Start-ups, Cross-Industry Partnerships

- Market Analysis from perspective of OEMs, Battery Manufacturers, and Investors

Exhaustive Coverage:

- Global EV Car Sales Forecast - Breakdown by Vehicle Type and Region

- EV Battery Production Statistics, by Region

- Gigafactory Capacity- Planned Vs Operational

- EV Battery Market Sizing and Forecast, 2025-2035

- EV Batteries Installed Capacity, GWh in 2024, Estimated in 0225, Forecasted to 2035

- EV Batteries Market Breakdown- By Technology Type , 2025-2035

- Lithium-ion including LFP AND NMC

- Emerging Tech including Solid-State and Sodium-ion

- EV Batteries Market Size- Regional Breakdown, 2025-2035

- North America Market, 2025-2035

- Europe Market, 2025-2035

- China Market, 2025-2035

- Asia-Pacific (except China) Market, 2025-2035

- Key Market Challenges

- Geopolitical Tensions (China-West Decoupling)

- Raw Material Price Volatility

- Solid-Sate Delays

- Changing Subsidy policies

- Competition Assessment

- Competitor Benchmarking

- Market Share Analysis

- Top Battery Makers

- OEM In-housed Vs Outsourced

- Joint Ventures for Gigafactories

- Start-up and OEM partnerships

- Cross-industry collaborations

- Company Profiles

WHAT SHOULD YOU LOOK AT ?

THE SHIFTING DYNAMICS OF EV BATTERY INDUSTRY

- RAW MATERIAL SHORTAGE AND RECYCLING BRIDGING THE GAP BY 2023

- CHINA'S DOMINANCE FLOODING GLOBAL MARKET WITH LFP BATTERIES

- POTENTIAL NEW TARIFFS BY US AND EU ON CHINESE BATTERIES BOOMING THE DOMESTIC

- GIGAFACTORY CONSTRUCTIONS ON RISE - TELSA, GM FORD ON LEAD

- AI DRIVEN BATTERY MANAGEMENT SYSTEM (BMS)

- BATTERY SWAPPING NETWORKS GAINING TRACTION

- BATTERY AS A SERVICE (BAAS) MODEL

Market Overview

Charging the Future: The Explosive Rise of EV Batteries

Electric vehicles (EVs) are steering the world toward a greener tomorrow, and their batteries are the beating heart of this revolution. With demand skyrocketing, the next decade promises seismic shifts in technology, markets, and competition.

This report unpacks the electrifying future of EV batteries-where we're headed, who's leading the charge, and how manufacturers can stay ahead in this high-voltage race.

The Electric Horizon: Where EVs Are Headed in 10 Years

The EV industry is gearing up for a massive leap over the next 5 to 10 years. Sales are expected to surge, with EVs potentially claiming 20-30% of global new car sales by 2030, a steep climb from 4% in 2020. This boom hinges on shrinking battery costs, sprawling charging networks, and government policies slamming the brakes on fossil-fuel vehicles. Battery energy density could double, pushing ranges beyond 500 miles, while ultra-fast charging slashes wait times to mere minutes. Countries like those in the EU are eyeing 2035 to phase out internal combustion engines, turbocharging EV adoption.

"The EV tipping point is near-by 2030, one in three new cars could be electric, driven by cheaper batteries and a global push to ditch gas guzzlers."

Battery Breakthroughs: Powering Tomorrow's Drives

Today, lithium-ion batteries reign supreme, with Nickel-Manganese-Cobalt (NMC) delivering long ranges and Lithium Iron Phosphate (LFP) slashing costs and boosting safety.

Lithium-Ion Variants: NMC batteries, using lithium nickel manganese cobalt oxides, are common for high energy density, while LFP batteries, with 41% global market share by capacity in 2023, are cheaper and more sustainable. <>LFP's adoption is driven by its lower cost, despite lower energy density

Emerging Technologies: Sodium-ion batteries, announced for mass production by companies like BYD and CATL in 2023, could cost 20% less, suitable for urban EVs and stationary storage. Solid-state batteries, pioneered by <>Toyota and QuantumScape, promise higher energy density and safety but are not yet commercial.

Innovations: Dual-ion batteries (DIB) and bipolar LFP batteries are emerging, offering quick charging and higher voltage, though cycle life remains a challenge.

"Solid-state batteries could zap EV ranges past 600 miles, but their high costs mean lithium-ion will hold the wheel for another decade."

The Global Battery Battle: Who's Winning?

Regional leadership in the EV battery market is evident, with distinct roles:

- China: Dominates with over 51% market share in 2022, driven by low production costs and firms like CATL (37.9% global share in 2024) and BYD (17.2%). LFP batteries, cheaper to produce, are prevalent, with two-thirds of EV sales using this chemistry in 2023.

- North America: Growing, with the US attracting $210 billion in investments since 2021, led by Tesla and partnerships like Ford with SK On. However, production costs are 20% higher than in China.

- Europe: Faces challenges with higher costs (50% more than China) and supply chain weaknesses, with Northvolt's bankruptcy highlighting difficulties. Efforts to build local capacity include gigafactory projects, aiming for 35-40 by 2030.

- Asia Pacific: Emerging markets like India and South Korea are growing, with India seeing 70% year-on-year EV registration growth in 2023, supported by schemes like FAME II .

The EV battery market is a geopolitical chessboard. China commands over 70% of global production, with giants like CATL and BYD flexing muscle through scale and subsidies. Japan and South Korea follow, with Panasonic and LG Chem powering brands like Tesla and Hyundai. Europe's scrambling to catch up, pumping funds into the European Battery Alliance to build its own supply chain. North America, led by Tesla's Nevada Gigafactory, is revving up domestic production to cut reliance on Asia.

Here's a snapshot of regional capacities:

| Type | Advantages | Disadvantages | Adoption |

|---|---|---|---|

| NMC | High energy density (~250 Wh/kg) | Expensive (cobalt reliance) | Declining (Tesla, GM phasing out) |

| LFP | Cheap, long lifespan, cobalt-free | Lower energy density (~180 Wh/kg) | Dominating (Tesla, BYD, Ford) |

| Solid-State | Ultra-high energy density (~500 Wh/kg) | Not yet commercialized | Toyota, QuantumScape targeting 2026–2030 |

| Region | Current capacity(GWh) | Projected 2030(GWh) | Projected 2035(GWh) |

|---|---|---|---|

| Asia | 500 | 1500 | 3000 |

| Europe | 50 | 400 | 800 |

| North America | 100 | 300 | 600 |

Battery Giants Face Off: The Heavyweight Showdown

Competition among battery makers is fierce. Here's how the big players stack up:

CATL thrives on volume, LG Chem on cutting-edge tech, Panasonic on Tesla's coattails, and BYD on owning the whole EV chain. Asia's supply chain edge keeps it ahead, but Europe and North America are pouring cash into R&D to close the gap.

Highlights:

- Leaders: China leads, with CATL and BYD dominating, benefiting from integrated supply chains and lower costs. CATL's 339.3 GWh installations in 2024 underscore its lead.

- Followers: North American firms like LG Energy Solution and European players like Northvolt face challenges, with Europe's higher costs (50% more than China) and supply chain weaknesses. Northvolt's bankruptcy in 2024 highlights these difficulties.

OEM Competition and New Entrants

- OEM Strategies: Companies like Tesla, BYD, and traditional OEMs (GM, Volkswagen) compete on pricing, innovation, and supply chain control. Tesla's market share fell from 17% in 2019 to 13% in 2022 due to competition. Vertical integration, like Tesla's gigafactories, provides cost advantages.

- New Entrants: Asian firms, especially Chinese, find space through niche markets (e.g., affordable small cars) and government subsidies, disrupting Europe's market. They leverage online sales and community-building strategies.

Established automotive manufacturers and emerging players are engaged in intense competition within the electric vehicle (EV) market. Industry leaders such as Tesla, Volkswagen, and General Motors (GM) are pursuing aggressive strategies to strengthen their positions. Tesla is vertically integrating its battery production to enhance self-sufficiency, Volkswagen is collaborating with Northvolt to ensure a reliable battery supply, and GM is focusing on the development of mass-market EVs to broaden its customer base.

Concurrently, new entrants such as Rivian, which specializes in electric trucks, and Lucid Motors, which targets the luxury EV segment, are entering the market by leveraging innovative designs and advanced technology to capture market share. A critical determinant of success in this competitive landscape is the ability to secure a stable and sufficient supply of batteries.

New entrants like Rivian could disrupt the established automakers, but only if they lock down batteries in a supply-starved world.

Final conclusion:

What's Next for EV Batteries?

The EV battery market is set for exponential growth, with demand soaring as electrification takes hold. Asia leads today, but Europe and North America are closing the gap through investment and innovation. Price volatility and competition pose challenges, yet opportunities abound for those who innovate and adapt. For tier-1 suppliers and battery manufacturers, the path forward is clear: invest in technology, secure supply chains, and embrace sustainability to power the EVs of tomorrow.

Key Questions Answered:

- What battery technology shifts (solid-state, sodium-ion) will disrupt the market by 2035, and how should companies prepare?

- Which regulatory changes (EU Battery Regulation, IRA sourcing rules) will impact market access and profitability?

- Where should OEMs source critical materials to reduce China dependence while maintaining cost competitiveness?

- How can Tier 1 suppliers maintain relevance as OEMs like Tesla vertically integrate battery production?

- What R&D investments (solid-state, silicon anodes) offer the highest ROI for battery component suppliers?

- Which emerging markets (India's PLI scheme, Poland's recycling hub) present the best growth opportunities?

- How can Tier 2 suppliers protect margins against volatile lithium (300% price spikes) and cobalt prices?

- Which alternative chemistries (sodium-ion, LFP) will reshape raw material demand in next 5-10 years?

- How will recycling innovations (second-life batteries, 30% cost reductions) transform the supply chain?

- What strategic timelines (short/mid/long-term) should different players follow to maintain competitiveness?

Companies Mentioned:

|

|

|

TABLE OF CONTENTS

RESEARCH SCOPE

RESEARCH METHODOLOGY

BATTERY TECHNOLOGY TRENDS AND DYNAMIC

- RAW MATERIAL SHORTAGE AND RECYCLING BRIDGING THE GAP BY 2030

- CHINA'S DOMINANCE FLOODING GLOBAL MARKET WITH LFP BATTERIES

- POTENTIAL NEW TARIFFS BY US AND EU ON CHINESE BATTERIES BOOMING THE DOMESTIC MANUFACTURING

- GIGAFACTORY CONSTRUCTIONS ON RISE- TESLA, GM, FORD ON LEAD

- AI DRIVEN BATTERY MANAGEMENT SYSTEM (BMS)

- BATTERY SWAPPING NETWORKS GAINING TRACTION

- BATTERY AS A SERVICE (BAAS) MODEL

MARKET OUTLOOK AND FORECAST

- GLOBAL EV CAR SALES FORECAST - BREAKDOWN BY VEHICLE TYPE AND REGION

- EV BATTERY PRODUCTION STATISTICS BY REGION

- GIGAFACTORY CAPACITY- PLANNED VS OPERATIONAL

- EV BATTERY MARKET SIZING AND FORECAST, 2025-2035

- EV BATTERIES INSTALLED CAPACITY, GWH IN 2024, ESTIMATED IN 2025, FORCASTED TO 2035

- EV BATTERIES MARKET SIZE- BREAKDOWN BY TECHNOLOGY TYPE , 2025-2035

- LITHIUM-ION- LFP AND NMC

- EMERGING TECH- SOLID-STATE AND SODIUM-ION

- EV BATTERIES MARKET SIZE- REGIONAL BREAKDOWN, 2025-2035

- NORTH AMERICA MARKET, 2025-2035

- EUROPE MARKET, 2025-2035

- CHINA MARKET, 2025-2035

- ASIA-PACIFIC (EXCEPT CHINA) MARKET, 2025-2035

KEY MARKET CHALLENGES

- GEOPOLITICAL TENSIONS (CHINA-WEST DECOUPLING)

- RAW MATERIAL PRICE VOLATILITY

- SOLID-STATE DELAYS

- CHANGING SUBSIDY POLICIES

COMPETITION ASSESSMENT

- COMPETITOR BENCHMARKING

- MARKET SHARE ANALYSIS

- TOP BATTERY MAKERS

- OEM IN-HOUSED VS OUTSOURCED BATTERIES

- JOINT VENTURES FOR GIGAFACTORIES

- START-UPS AND OEM PARTENRSHIPS

- CROSS INDUSTRY COLLABORATIONS

COMPANY PROFILES

- Tesla

- Byd

- CaTL

- LG Energy Solution

- Panasonic

- SK On

- Northvolt

- Samsung SDI

- QuantumScape

- Solid Power

- Nio

- ChargePoint

- ABB

- StoreDot

- Freyr Battery

- ACC (Automotive Cells Co.)

- Farasis Energy

- Envision AESC

- Microvast

- Romeo Power

- ProLogium

- Nexeon

- Ample

- SparkCharge

- Electrify America

- Ionity

- Our Next Energy (ONE)