|

市場調查報告書

商品編碼

1885869

矽奈米線電池技術市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Silicon Nanowire Battery Technology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

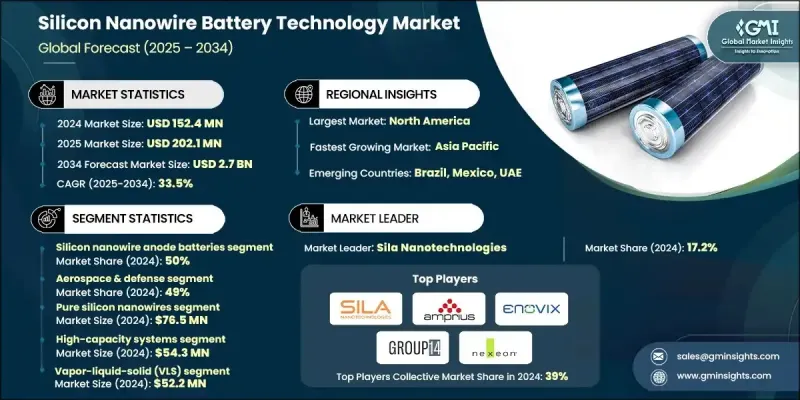

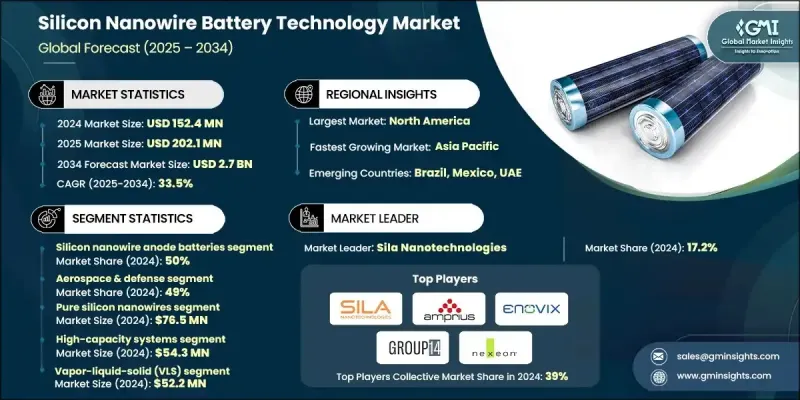

2024 年全球矽奈米線電池技術市場價值為 1.524 億美元,預計到 2034 年將以 33.5% 的複合年成長率成長至 27 億美元。

強勁的發展勢頭源於高能量密度儲能系統的普及、電動汽車的蓬勃發展以及先進電池化學技術在消費電子、汽車和固定式儲能等主要領域的廣泛應用。隨著儲能需求不斷演變,對耐久性、充電速度和循環壽命的要求也日益提高,製造商正日益專注於材料科學的突破、可擴展的製造技術以及數位化增強的開發路徑。這些努力旨在確保電池的安全性、實際性能以及商業化部署的準備就緒。此外,先進工程工具的更廣泛應用也進一步推動了市場的發展,這些工具簡化了開發流程,縮短了原型製作週期,使企業能夠更快地將下一代電池推向主流市場。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1.524億美元 |

| 預測值 | 27億美元 |

| 複合年成長率 | 33.5% |

對人工智慧驅動的材料研究、物聯網連接的監測平台和基於雲端的電池管理系統的日益依賴,正在改變奈米材料電池技術的發展方式。這些解決方案使開發人員能夠持續洞察電化學活性,及早預測衰減趨勢,並支援研究部門、試點設施和整合合作夥伴之間的同步工作流程管理。數位孿生、機器學習模擬和自動化測試平台的應用有助於加快驗證週期、提高能量保持率並降低研發成本,從而支援智慧電池生態系統的轉型。

預計到2024年,矽奈米線負極電池市佔率將達到50%,並在2025年至2034年間以32.9%的複合年成長率成長。這些負極系統經過精心設計,可顯著提升能量密度、導電性和耐久性。其獨特的結構能夠更好地吸收鋰離子,同時克服了傳統石墨負極的限制。隨著交通運輸、電子和航太等產業對更長電池壽命的需求不斷成長,純矽奈米線負極的應用也日益普及,各行業都在尋求更可靠、更高輸出功率的儲能技術。

2024年,航太與國防領域佔據49%的市場佔有率,預計到2034年將以33.1%的複合年成長率成長。其主導地位源自於對輕量化、高容量、高效能且能在嚴苛環境下運作的電源解決方案的需求。矽奈米線陽極系統具有高功率重量比、快速充電和超強的運作耐久性,能夠滿足該領域對先進設備的需求。隨著對高可靠性能源系統需求的成長,對奈米結構材料、先進熱控制系統和基於人工智慧的建模工具的持續投資進一步鞏固了該領域的領先地位。

預計到2024年,美國矽奈米線電池技術市場將佔88%的佔有率,市場規模約4,960萬美元。這一領先地位得益於美國成熟的電動車和電池生產體系、強大的研發基礎設施以及領先的奈米材料創新企業的積極參與。高容量矽奈米線電池在電動交通、消費性電子產品和電網級儲能領域的應用正在加速成長。美國各地的企業正在部署人工智慧診斷技術、物聯網連接的監控解決方案和雲端管理軟體,以提高電池安全性、提升效率並增強營運智慧。

矽奈米線電池技術市場的主要參與者包括Amprius Technologies、BTR New Material、Enevate、ENOVIX、Group14 Technologies、Nexeon、OneD Battery Sciences、信越化學、Sila Nanotechnologies和XG Sciences。這些公司正致力於透過多種策略措施來增強自身的競爭力。許多公司正在擴大產能,以支持商業化並確保穩定的供應。研發專案是提升能量密度、改善循環穩定性、最佳化奈米線結構的關鍵。與電動車製造商、電子產品品牌和國防承包商的合作有助於加速技術的實際應用。此外,企業也正在整合以人工智慧為基礎的分析、數位孿生和自動化測試系統,以縮短開發週期並降低成本。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 對高能量密度電池的需求不斷成長

- 奈米材料工程和基於人工智慧的材料最佳化方面的進展

- 快速充電基礎設施和高功率應用的發展

- 汽車原始設備製造商和電池製造商的投資不斷增加

- 產業陷阱與挑戰

- 生產成本高且可擴展性挑戰

- 機械不穩定性及退化風險

- 市場機遇

- 電動車普及率高和車隊電氣化

- 固定式儲能設施的擴建

- 拓展至電網級及再生能源儲存系統

- 開發符合循環經濟原則的回收技術

- 成長促進因素

- 成長潛力分析

- 監管環境

- 奈米材料法規及TSCA合規性

- 職業安全要求和 NIOSH 指南

- 環境影響法規與美國環保署標準

- 國際標準與協調努力

- 產品安全與測試要求

- 認證流程和品質保證

- 監管時間表及未來政策變化

- 合規成本分析及實施策略

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 技術演進時程及里程碑

- 技術性能提升預測

- 成本削減路線圖和經濟目標

- 生產規模擴大時程和產能規劃

- 新興科技整合與融合

- 市場滲透情景及採納曲線

- 顛覆性技術威脅及市場影響

- 長期市場機會與策略遠見

- 技術轉移與商業化途徑

- 創新生態系與合作網路

- 價格趨勢

- 按地區

- 依產品

- 生產統計

- 生產中心

- 消費中心

- 進出口

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 最佳情況

- 製造規模化和商業化路線圖

- 效能比較矩陣與替代技術

- 資本支出與融資環境

- 性能衰減與循環壽命分析

- 電解質和分離器創新趨勢

- 電池組整合與系統級設計

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依類型分類,2021-2034年

- 主要趨勢

- 矽奈米線陽極電池

- 矽奈米線複合電池

- 混合奈米結構電池

第6章:市場估算與預測:依製造方法分類,2021-2034年

- 主要趨勢

- 氣液固(VLS)生長

- 金屬輔助化學蝕刻(MACE)

- 化學氣相沉積(CVD)

- 基於解決方案的成長方法

- 電化學沉積

第7章:市場估算與預測:依績效類別分類,2021-2034年

- 主要趨勢

- 高容量系統

- 快速充電系統

- 長循環壽命系統

- 成本最佳化系統

第8章:市場估算與預測:依材料成分分類,2021-2034年

- 主要趨勢

- 純矽奈米線

- 矽碳複合材料

- 二氧化矽複合材料

- 矽合金奈米線

第9章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 航太與國防

- 汽車

- 消費性電子產品

- 固定式儲能

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 比利時

- 荷蘭

- 瑞典

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 新加坡

- 韓國

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第11章:公司簡介

- Global Player

- Amprius Technologies

- BTR New Material

- Group14 Technologies

- LG Energy Solution

- Nexeon

- OneD Material

- Panasonic Energy

- Samsung SDI

- Shanshan Technology

- Sila Nanotechnologies

- Regional Player

- DAEJOO Electronic Materials

- Enevate

- Gotion High-tech

- GUIBAO Science & Technology

- IOPSILION

- KINGi New Materials

- LeydenJar Technologies

- NanoGraf

- NEO Battery Materials

- StoreDot

- 新興參與者

11.3.1. 電池

- 阿德瓦諾

- 香港能源

- 奈米陶瓷實驗室

- 固態動力

The Global Silicon Nanowire Battery Technology Market was valued at USD 152.4 million in 2024 and is estimated to grow at a CAGR of 33.5% to reach USD 2.7 billion by 2034.

Strong momentum comes from the shift toward high-energy-density storage systems, surging electric mobility, and broader use of advanced battery chemistries across major sectors such as consumer electronics, automotive, and stationary energy storage. As energy storage requirements evolve to demand higher durability, faster charging, and longer life cycles, manufacturers are increasingly focusing on breakthroughs in material science, scalable fabrication techniques, and digitally enhanced development pathways. These efforts are aimed at ensuring safety, real-world performance, and readiness for commercial deployment. The market's progress is also reinforced by greater integration of sophisticated engineering tools that streamline development and reduce prototyping timelines, enabling companies to push next-generation batteries toward mainstream adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $152.4 Million |

| Forecast Value | $2.7 Billion |

| CAGR | 33.5% |

Growing reliance on AI-driven material research, IoT-linked monitoring platforms, and cloud-based battery management systems is transforming how nanomaterial battery technologies evolve. These solutions give developers continuous insight into electrochemical activity, allow early prediction of degradation trends, and support synchronized workflow management across research units, pilot facilities, and integration partners. The use of digital twins, machine-learning simulations, and automated testing platforms helps accelerate validation cycles, enhance energy retention, and cut down development expenditures, supporting the transition toward intelligent battery ecosystems.

The silicon nanowire anode batteries segment captured a 50% share in 2024 and is estimated to grow at a CAGR of 32.9% between 2025 and 2034. These anode systems are engineered to deliver substantial improvements in energy density, conductivity, and durability. Their structure enables greater lithium-ion intake while addressing limitations found in conventional graphite. Rising demand for extended battery life in transportation, electronics, and aerospace applications continues to strengthen the adoption of pure silicon nanowire anodes as industries pursue more reliable and high-output storage technologies.

The aerospace and defense segment held a 49% share in 2024 and is expected to grow at a CAGR of 33.1% through 2034. Its dominance is driven by the need for lightweight, high-capacity, and high-performance power solutions capable of functioning in harsh operating environments. Silicon nanowire anode systems offer high power-to-weight ratios, rapid charging, and strong operational endurance, which support the sector's advanced equipment needs. Continuous investments in nanostructured materials, advanced thermal-control systems, and AI-based modeling tools strengthen the segment's leadership as demand for resilient energy systems grows.

United States Silicon Nanowire Battery Technology Market held an 88% share in 2024, generating approximately USD 49.6 million. This position is supported by a well-established EV and battery production landscape, strong R&D infrastructure, and significant involvement from leading nanomaterials innovators. Adoption of high-capacity silicon nanowire batteries has accelerated across electric transportation, consumer devices, and grid-level storage. Companies across the U.S. are deploying AI-enabled diagnostics, IoT-connected monitoring solutions, and cloud-supported management software to increase battery safety, improve efficiency, and enhance operational intelligence.

Key companies active in the Silicon Nanowire Battery Technology Market include Amprius Technologies, BTR New Material, Enevate, ENOVIX, Group14 Technologies, Nexeon, OneD Battery Sciences, ShinEtsu Chemical, Sila Nanotechnologies, and XG Sciences. Companies involved in the Silicon Nanowire Battery Technology Market are focusing on several strategic approaches to strengthen their competitive standing. Many firms are expanding their manufacturing capacities to support commercialization and ensure a consistent supply. Heavy emphasis is placed on R&D programs that enhance energy density, improve cycle stability, and optimize nanowire structures. Collaborations with EV makers, electronics brands, and defense contractors help accelerate real-world adoption. Businesses are also integrating AI-based analytics, digital twins, and automated testing systems to shorten development cycles and reduce costs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Fabrication Method

- 2.2.4 Performance Category

- 2.2.5 Material Composition

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for high-energy-density batteries

- 3.2.1.2 Advancements in nanomaterial engineering and ai-based material optimization

- 3.2.1.3 Growth of fast-charging infrastructure and high-power applications

- 3.2.1.4 Increasing investments from automotive OEMs and battery manufacturers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs and scalability challenges

- 3.2.2.2 Mechanical instability and degradation risks

- 3.2.3 Market opportunities

- 3.2.3.1 High EV adoption and fleet electrification

- 3.2.3.2 Expansion of stationary energy storage

- 3.2.3.3 Expansion into grid-scale and renewable energy storage systems

- 3.2.3.4 Development of circular-economy-aligned recycling technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Nanomaterial regulations & TSCA compliance

- 3.4.2 Occupational safety requirements & NIOSH guidelines

- 3.4.3 Environmental impact regulations & EPA standards

- 3.4.4 International standards & harmonization efforts

- 3.4.5 Product safety & testing requirements

- 3.4.6 Certification processes & quality assurance

- 3.4.7 Regulatory timeline & future policy changes

- 3.4.8 Compliance cost analysis & implementation strategies

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Technology evolution timeline & milestones

- 3.7.2 Performance improvement projections by technology

- 3.7.3 Cost reduction roadmap & economic targets

- 3.7.4 Manufacturing scale-up timeline & capacity planning

- 3.7.5 Emerging technology integration & convergence

- 3.7.6 Market penetration scenarios & adoption curves

- 3.7.7 Disruptive technology threats & market impact

- 3.7.8 Long-term market opportunities & strategic vision

- 3.7.9 Technology transfer & commercialization pathways

- 3.7.10 Innovation ecosystem & collaboration networks

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Best case scenarios

- 3.14 Manufacturing Scalability & Commercialization Roadmap

- 3.15 Performance Comparison Matrix vs. Alternative Technologies

- 3.16 Capital Expenditure & Funding Landscape

- 3.17 Performance Degradation & Cycle Life Analysis

- 3.18 Electrolyte & Separator Innovation Trends

- 3.19 Battery Pack Integration & System-Level Design

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($ Mn, Units)

- 5.1 Key trends

- 5.2 Silicon nanowire anode batteries

- 5.3 Silicon nanowire composite batteries

- 5.4 Hybrid nanostructure batteries

Chapter 6 Market Estimates & Forecast, By Fabrication Method, 2021 - 2034 ($ Mn, Units)

- 6.1 Key trends

- 6.2 Vapor-liquid-solid (VLS) growth

- 6.3 Metal-assisted chemical etching (MACE)

- 6.4 Chemical vapor deposition (CVD)

- 6.5 Solution-based growth methods

- 6.6 Electrochemical deposition

Chapter 7 Market Estimates & Forecast, By Performance Category, 2021 - 2034 ($ Mn, Units)

- 7.1 Key trends

- 7.2 High-capacity systems

- 7.3 Fast charging systems

- 7.4 Long-cycle life systems

- 7.5 Cost-optimized systems

Chapter 8 Market Estimates & Forecast, By Material Composition, 2021 - 2034 ($ Mn, Units)

- 8.1 Key trends

- 8.2 Pure silicon nanowires

- 8.3 Silicon-carbon composites

- 8.4 Silicon-oxide composites

- 8.5 Silicon alloy nanowires

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($ Mn, Units)

- 9.1 Key trends

- 9.2 Aerospace & defense

- 9.3 Automotive

- 9.4 Consumer electronics

- 9.5 Stationary energy storage

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($ Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Belgium

- 10.3.7 Netherlands

- 10.3.8 Sweden

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 Singapore

- 10.4.6 South Korea

- 10.4.7 Vietnam

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Global Player

- 11.1.1 Amprius Technologies

- 11.1.2 BTR New Material

- 11.1.3 Group14 Technologies

- 11.1.4 LG Energy Solution

- 11.1.5 Nexeon

- 11.1.6 OneD Material

- 11.1.7 Panasonic Energy

- 11.1.8 Samsung SDI

- 11.1.9 Shanshan Technology

- 11.1.10 Sila Nanotechnologies

- 11.2 Regional Player

- 11.2.1 DAEJOO Electronic Materials

- 11.2.2 Enevate

- 11.2.3 Gotion High-tech

- 11.2.4 GUIBAO Science & Technology

- 11.2.5 IOPSILION

- 11.2.6 KINGi New Materials

- 11.2.7 LeydenJar Technologies

- 11.2.8 NanoGraf

- 11.2.9 NEO Battery Materials

- 11.2.10 StoreDot

- 11.3 Emerging Players

11.3.1. DBattery

- 11.3.2 Advano

- 11.3.3 HKG Energy

- 11.3.4 Nanoramic Laboratories

- 11.3.5 Solid Power