|

市場調查報告書

商品編碼

1915211

全球ADAS模擬市場按模擬類型、車輛類型、產品/服務、方法論、自動駕駛等級、應用、最終用戶和地區分類-預測至2032年ADAS Simulation Market by Method (On-Premises, Cloud-Based), Offering (Software, Services), Simulation Type (MIL, DIL, SIL, HIL), Vehicle Type (Passenger Cars, Commercial Vehicles), LoA, Application, End-users & Region - Global Forecast to 2032 |

||||||

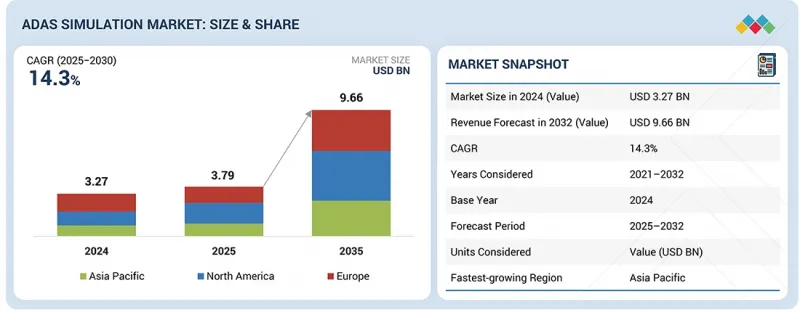

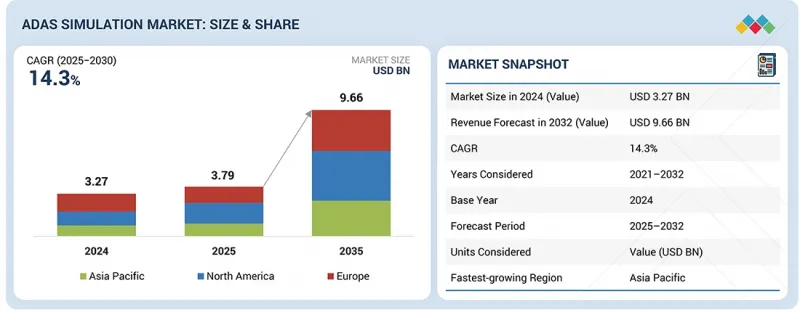

ADAS模擬市場預計將從2025年的37.9億美元成長到2032年的約96.6億美元,複合年成長率(CAGR)為14.3%。這一成長主要由汽車產業的快速變化所驅動。汽車製造商依賴模擬技術,因為它比在道路上測試每個系統更安全、更快捷、更經濟。工程師可以在車輛離開實驗室之前,研究感測器、攝影機和車載電腦在各種道路和天氣條件下的反應。

| 調查範圍 | |

|---|---|

| 調查期 | 2021-2032 |

| 基準年 | 2024 |

| 預測期 | 2025-2032 |

| 目標單元 | 價值(百萬美元/十億美元) |

| 部分 | 按模擬類型、車輛類型、產品/服務、方法論、自主等級、應用、最終用戶和區域分類 |

| 目標區域 | 亞太地區、歐洲、北美 |

領先的供應商正在將這些系統與硬體在環(HIL)、軟體在環(SIL)和雲端工具連接起來,從而能夠儘早改進自我調整巡航、煞車和車道維持系統。 3D模型和人工智慧生成的駕駛場景的使用顯著提高了虛擬測試的真實性。隨著安全法規的日益嚴格、生產週期的縮短以及電動車的快速普及,模擬正在悄悄成為車輛設計日常工作的一部分,這是實現完全自動駕駛的關鍵一步。

按模擬類型分類,預計在預測期內,模型在環 (MiL) 模擬將成為高階駕駛輔助系統 (ADAS) 模擬市場的主要驅動力。這主要是由於在開發週期早期評估控制演算法以降低後續整合風險的需求日益成長。隨著汽車製造商尋求在硬體準備就緒之前儘早測試控制演算法,這項技術的價值也日益凸顯。這有助於避免後期代價高成本的設計變更。工程師可以在建立實體組件之前測試感知、規劃和控制模型之間的交互方式。豐田、現代、寶馬和福特等汽車製造商目前正在利用 MIL 環境在初始設計階段微調感測器融合和決策邏輯。在虛擬環境中執行這些測試,使工程師能夠在無需完整原型的情況下,了解系統在各種道路、天氣和交通條件下的運作情況。隨著汽車越來越主導軟體,並頻繁進行空中下載 (OTA) 更新,早期測試已成為必不可少的步驟。西門子、Ansys 和 dSPACE 等模擬公司正在透過更好的模型庫和與軟體在環 (SIL) 和硬體在環 (HIL) 的無縫整合來增強其工具,以幫助製造商更快地檢驗並降低開發風險。

按自動駕駛等級分類,預計在預測期內,L4 和 L5 等級自動駕駛系統將在高階駕駛輔助系統 (ADAS) 模擬市場中實現最高成長。這一成長主要由高度複雜、完全自動化的系統驅動,這些系統必須在無人干預的情況下安全運作。汽車製造商和技術開發商正在利用先進的模擬技術測試數百萬種在真實道路上無法或難以複製的駕駛場景。 Waymo、Cruise、百度 Apollo 和現代摩比斯等公司,以及西門子、ANSYS、dSPACE 和 AVL 等模擬領導企業,正在建立大規模虛擬環境,以檢驗感測器融合、路徑規劃和基於人工智慧的感知系統。這些平台使工程師能夠在受控的數位環境中研究車輛如何應對極端天氣條件、感測器故障和不可預測的交通狀況。隨著監管機構收緊安全標準,以及產業向軟體定義出行 (SDR) 轉型,模擬技術對於檢驗全自動駕駛車輛的可靠性以及加速其在現實世界中的應用變得日益重要。

按車輛類型分類,預計在預測期內,商用車市場成長速度將超過乘用車市場。這項轉變主要源自於物流和運輸公司對更安全、更有效率車隊的需求。由於卡車和巴士的行駛里程更長、載重更大,且安全要求比乘用車更為嚴格,因此模擬已成為一種無需承擔實際測試成本和風險即可測試系統的實用方法。沃爾沃卡車、戴姆勒、斯堪尼亞、塔塔汽車和比亞迪等製造商已開始利用這些工具開發自動駕駛、防碰撞以及停車和對接輔助系統。虛擬測試使工程師能夠在車輛上路前,了解其在堵塞路況、急轉彎和多變天氣條件下的運作情況。隨著電子商務的蓬勃發展和交通安全法規的日益嚴格,許多公司正在轉向數位化測試平台。此外,西門子、Ansys 和 dSPACE 等模擬領域的領導企業正在更新其系統,以支援更大的車輛和基於人工智慧的駕駛邏輯,從而加速車隊的自動化進程。

ADAS 模擬市場由西門子(德國)、Ansys 公司(美國)、NVIDIA 公司(美國)、dSPACE(德國)和 AVL(奧地利)等主要企業主導,這些廠商正在擴展其產品組合,以鞏固其在 ADAS 模擬市場的地位。

該研究包括對主要市場參與企業的詳細競爭分析、公司簡介、對產品和業務供應的關鍵觀察、近期發展以及關鍵市場策略。

購買本報告的主要優勢:

- 本報告為市場領導和新參與企業提供了ADAS模擬市場及其細分市場收入規模的最準確估計值。

- 該報告將幫助相關人員了解競爭格局,並獲得進一步的見解,從而更好地定位其業務並制定適當的打入市場策略。

- 它還提供了對市場趨勢的洞察,並提供了關鍵市場促進因素、限制、挑戰和機會的資訊。

- 本報告根據方法論、最終用戶、應用、模擬類型、自主級別、車輛類型、產品和地區,為市場領導和新參與企業提供有關 ADAS 模擬市場各種趨勢的資訊。

目錄

第1章 引言

第2章執行摘要

第3章重要考察

第4章 市場概覽

- 市場動態

- 促進要素

- 抑制因素

- 機會

- 任務

- 市場動態影響分析

- 未滿足的需求和差距

- 相互關聯的市場與跨產業機遇

- 互聯市場

- 跨產業機遇

- 1/2/3級參與企業的策略舉措

第5章 產業趨勢

- 總體經濟指標

- 生態系分析

- 供應鏈分析

- 影響客戶業務的趨勢與干擾因素

- 投資和資金籌措方案

- 大型會議和活動

- 案例研究分析

- 領先的ADAS仿真市場中心

- 主要汽車製造商的ADAS

- 即將推出的車款和ADAS功能

- 未來ADAS軟體與模擬開發

- ADAS 測試,實現安全且可擴展的自動化

- 押注未來成長

- 仿真平台的成本效益與投資報酬率模型

第6章:技術進步、人工智慧影響、專利、創新與未來應用

- 主要技術

- 互補技術

- 鄰近技術

- 技術藍圖

- 專利分析

- 人工智慧/生成式人工智慧的影響

第7章:顧客狀況與購買行為

- 決策流程

- 買方相關人員和採購評估標準

- 招募障礙和內部挑戰

第8章永續性和監管環境

- 地方法規和合規性

- 監管機構、政府機構和其他組織

- 業界標準

- 對永續性的承諾

- 碳影響與生態應用

- 永續性影響和監管政策舉措

- 認證、標籤和環境標準

第9章:ADAS模擬市場(依模擬類型分類)

- 模型在環

- 軟體在環

- 硬體在環

- 驅動在環

- 關鍵見解

第10章:ADAS模擬市場(依車輛類型分類)

- 搭乘用車

- 商用車輛

- 關鍵見解

第11章:ADAS模擬市場(依產品/服務分類)

- 軟體

- 服務

- 關鍵見解

第12章:ADAS模擬市場(依方法論分類)

- 本地部署

- 基於雲端的

- 關鍵見解

第13章:ADAS模擬市場(依自動駕駛等級分類)

- 一級

- 2/2級或以上

- 3級

- 等級 4/5

- 關鍵見解

第14章 ADAS 模擬市場(依應用領域分類)

- 自動緊急制動

- 主動車距控制巡航系統

- 車道偏離預警與車道維持輔助

- 交通標誌識別

- 盲點偵測

- 停車協助

- 自動停車輔助

- 其他

- 關鍵見解

第15章 ADAS 模擬市場(依最終用戶分類)

- OEM

- 一級/二級零件製造商

- 技術提供者/軟體開發商

- 關鍵見解

第16章:ADAS仿真市場區域分類

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 歐洲

- 法國

- 義大利

- 德國

- 西班牙

- 英國

- 北美洲

- 美國

- 加拿大

第17章 競爭格局

- 概述

- 主要參與企業的策略/優勢,2022-2025年

- 2025年市佔率分析

- 2020-2024年收入分析

- 估值和財務指標

- 品牌/產品對比

- 公司估值矩陣:主要參與企業,2025 年

- 公司估值矩陣:Start-Ups/中小企業,2025 年

- 競爭場景

第18章:公司簡介

- 主要參與企業

- SIEMENS

- ANSYS, INC.

- NVIDIA CORPORATION

- DSPACE

- AVL

- APPLIED INTUITION, INC.

- IPG AUTOMOTIVE GMBH

- MATHWORKS, INC.

- HEXAGON AB

- VECTOR INFORMATIK GMBH

- KEYSIGHT TECHNOLOGIES

- DASSAULT SYSTEMES

- COGNATA

- 其他公司

- RFPRO

- FORETELLIX

- ELEKTROBIT

- ETAS

- VI-GRADE GMBH

- AVSIMULATION

- ANTEMOTION

- PARALLEL DOMAIN

- REAL-TIME TECHNOLOGIES

- AIMOTIVE

- ANYVERSE SL

- DORLECO

第19章調查方法

第20章附錄

The ADAS simulation market is projected to reach around USD 9.66 billion by 2032, growing from USD 3.79 billion in 2025 at a CAGR of 14.3%. Much of this growth stems from the rapid pace of change in the auto industry. Carmakers are relying on simulation because it's safer, faster, and cheaper than testing every system on real roads. Engineers can study how sensors, cameras, and onboard computers react to different road and weather conditions before a car ever leaves the lab.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/Billion) |

| Segments | By Method, Simulation Type, Level of Autonomy, Vehicle Type, Offering, Application, and End User |

| Regions covered | Asia Pacific, Europe, North America |

Major suppliers are linking these setups with HIL, SIL, and cloud tools, enabling the refinement of adaptive cruise, braking, and lane-keeping systems early on. The use of 3D models and AI-generated driving scenes is making virtual testing feel far more realistic. With stricter safety rules, shorter production cycles, and the rapid rise of electric cars, simulation has quietly become a daily part of vehicle design and a major step toward full autonomy.

"The model-in-the-Loop (MiL) segment is projected to lead the ADAS simulation market over the forecast period."

By simulation type, the model-in-the-Loop (MiL) segment is projected to lead the ADAS simulation market over the forecast period, driven by the growing need to evaluate control algorithms early in the development cycle and reduce downstream integration risks. The approach is becoming increasingly valuable as carmakers strive to test control algorithms early, rather than waiting until the hardware is ready. Doing this helps avoid expensive redesigns later in the process. Engineers can test how perception, planning, and control models interact before any physical components are built. Automakers, such as Toyota, Hyundai, BMW, and Ford, are now using MIL setups to adjust sensor fusion and decision-making logic during the first design stages. Running these tests virtually also lets teams see how systems behave in different road, weather, or traffic conditions without needing full prototypes. As cars become software-driven and depend on frequent over-the-air updates, early testing has turned into a must-have step. Simulation firms like Siemens, Ansys, and dSPACE are upgrading their tools with better model libraries and smoother links to SIL and HIL, helping manufacturers validate faster and lower development risk.

"The level 4 & 5 segment is projected to witness the highest growth in the ADAS simulation market over the forecast period."

By level of autonomy, the level 4 & 5 segment is projected to experience the highest growth in the ADAS simulation market over the forecast period. This growth comes due to a highly complex system of fully automated systems that must operate safely without human input. Automakers and tech developers are using advanced simulation to test millions of driving situations that would be impossible or unsafe to recreate on real roads. Companies like Waymo, Cruise, Baidu Apollo, and Hyundai Mobis, along with simulation leaders such as Siemens, Ansys, dSPACE, and AVL, are building large-scale virtual environments to validate sensor fusion, path planning, and AI-based perception systems. This platform helps engineers to study how vehicles respond to extreme weather, sensor faults, or unpredictable traffic in a controlled digital setup. With regulators tightening safety rules and the industry moving toward software-defined mobility, simulation is becoming increasingly essential for verifying the reliability of fully autonomous vehicles and accelerating their deployment in the real world.

"The commercial vehicles segment is projected to achieve higher growth than the passenger cars segment during the forecast period."

By vehicle type, the commercial vehicles segment is projected to register higher growth than the passenger cars segment during the forecast period. The shift is being led by logistics and transport firms that need safer, more efficient fleets. Trucks and buses face longer routes, heavier loads, and more challenging safety targets than cars; thus, simulation has become a practical way to test systems without the cost and risk of real-world trials. Manufacturers such as Volvo Trucks, Daimler, Scania, Tata Motors, and BYD are already utilizing these tools to develop automated driving, collision avoidance, and parking or docking assistance systems. By running virtual tests, engineers can check how vehicles behave in heavy traffic, tight turns, or changing weather before sending them on actual roads. With e-commerce expanding and transport safety rules tightening, many companies are shifting to digital testing platforms. Additionally, simulation leaders like Siemens, Ansys, and dSPACE are updating their systems to handle large vehicles and AI-based driving logic, helping fleets move faster toward automation.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: MNCs - 70 %, Tier-1 Companies- 20%, and Startups - 10%

- By Designation: C-level - 45%, Director-Level - 30%, and Others - 25%

- By Region: Asia Pacific - 35%, North America - 40%, and Europe - 25%

The ADAS simulation market is dominated by major players, including Siemens (Germany), Ansys, Inc. (US), NVIDIA Corporation (US), dSPACE (Germany), AVL (Austria), and more. These companies are expanding their portfolios to strengthen their position in the ADAS Simulation market.

Research Coverage:

The report covers the ADAS simulation market by method (on-premises simulation, cloud-based simulation), simulation type (model-in-the-loop, software-in-the-loop, hardware-in-the-loop, driver-in-the-loop), level of autonomy (level 1, level 2/2+, level 3, level 4 & 5 ), vehicle type (passenger cars, commercial vehicles), offering (software, services), application (autonomous emergency braking, adaptive cruise control, lane departure warning (LDW) & lane keeping assist (LKA), traffic sign recognition (TSR), blind spot detection (BSD), parking assistance, automated parking assist, others), end user (OEMs, tier 1/tier 2 component manufacturers, technology providers/software developers), and region. The report also covers the competitive landscape and company profiles of the significant ADAS simulation market players.

The study includes an in-depth competitive analysis of the key market players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the ADAS Simulation market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- The report will also help stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

- The report will help market leaders/new entrants with information on various trends in the ADAS simulation market based on method, end user, application, simulation type, level of autonomy, vehicle type, offering, and region.

The report provides insight into the following points:

- Analysis of key drivers (Shift from hardware-based validation to virtual development, growing system complexity and calibration, increasing ADAS adoption for higher vehicle automation, rising government safety mandates), restraints (Mismatch between simulation conditions and real-world environments, human behavioral variability, system failure complexity), opportunities (Advancements in autonomous vehicle technology, unlocking strategic control and deep customization through in-house ADAS simulation development, leveraging digital twins to accelerate ADAS validation and reduce cycles), and challenges (Integrating real-world and synthetic data at scale, regulatory & homologation acceptance of simulation)

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product launches in the ADAS simulation market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about products & services, untapped geographies, recent developments, and investments in the ADAS simulation market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and service offerings of leading players like Siemens (Germany), Ansys, Inc. (US), NVIDIA Corporation (US), dSPACE (Germany), AVL (Austria), among others, in the ADAS simulation market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN ADAS SIMULATION MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ADAS SIMULATION MARKET

- 3.2 ADAS SIMULATION MARKET, BY VEHICLE TYPE

- 3.3 ADAS SIMULATION MARKET, BY METHOD

- 3.4 ADAS SIMULATION MARKET, BY OFFERING

- 3.5 ADAS SIMULATION MARKET, BY LEVEL OF AUTONOMY

- 3.6 ADAS SIMULATION MARKET, BY SIMULATION TYPE

- 3.7 ADAS SIMULATION MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Shift from hardware-based validation to virtual development

- 4.2.1.2 Growing system complexity and calibration demands

- 4.2.1.3 Increasing ADAS penetration

- 4.2.1.4 Rising government safety mandates

- 4.2.2 RESTRAINTS

- 4.2.2.1 Gap between simulated scenarios and real-world driving complexity

- 4.2.2.2 Human behavioral variability and system failure complexity

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Advancements in autonomous vehicle technology

- 4.2.3.2 Unlocking strategic control and deep customization through in-house ADAS simulation development

- 4.2.3.3 Integration of digital twin technology

- 4.2.4 CHALLENGES

- 4.2.4.1 Combining real-world and synthetic data at scale

- 4.2.4.2 Regulatory and homologation acceptance of simulation

- 4.2.5 IMPACT ANALYSIS OF MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 MACROECONOMIC INDICATORS

- 5.1.1 INTRODUCTION

- 5.1.2 GDP TRENDS AND FORECAST

- 5.1.3 TRENDS IN GLOBAL ADAS SIMULATION INDUSTRY

- 5.1.4 TRENDS IN GLOBAL AUTOMOTIVE AND TRANSPORTATION INDUSTRY

- 5.2 ECOSYSTEM ANALYSIS

- 5.2.1 ENVIRONMENT AND SCENARIO CONTENT PROVIDERS

- 5.2.2 SIMULATION PLATFORM PROVIDERS

- 5.2.3 SENSOR AND PHYSICS MODEL PROVIDERS

- 5.2.4 HARDWARE-IN-THE-LOOP/SOFTWARE-IN-THE-LOOP/MODEL-IN-THE-LOOP HARDWARE AND INTEGRATION PROVIDERS

- 5.2.5 DATA INFRASTRUCTURE AND HD MAPPING PROVIDERS

- 5.2.6 TIER-1 SYSTEM INTEGRATORS

- 5.2.7 OEMS

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 INVESTMENT AND FUNDING SCENARIO

- 5.6 KEY CONFERENCES AND EVENTS

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 RIDEFLUX ACCELERATES LEVEL 4 AUTONOMY WITH APPLIED INTUITION'S SCALABLE SIMULATION AND DATA MANAGEMENT PLATFORM

- 5.7.2 MERCEDES-BENZ ACCELERATES LEVEL 3 ADAS CERTIFICATION WITH ANSYS OPTISLANG'S ADVANCED RELIABILITY SIMULATION FRAMEWORK

- 5.7.3 TUV SUD VALIDATES ADSCENE'S SCENARIO DATABASE TO STRENGTHEN GLOBAL-STANDARD COMPLIANCE FOR ADAS SAFETY CERTIFICATION

- 5.7.4 TOYOTA ACCELERATES ADAS SAFETY VALIDATION WITH DSPACE'S REAL-TO-VIRTUAL SCENARIO GENERATION AND VEHICLE-IN-THE-LOOP SIMULATION

- 5.7.5 AUTOMATED ADAS/AD VALIDATION ACHIEVED THROUGH INTEGRATED SCENARIO SIMULATION, RADAR EMULATION, AND PROBABILISTIC SAFETY ANALYSIS

- 5.7.6 BOSCH ACCELERATES ADAS DEVELOPMENT WITH UNREAL ENGINE-DRIVEN SOFTWARE-IN-THE-LOOP RADAR AND ACC SIMULATION

- 5.7.7 MOBILEDRIVE ACCELERATES ADAS DEVELOPMENT WITH SIEMENS' MBSE-DRIVEN DIGITAL TWIN AND SIMULATION-BASED VALIDATION FRAMEWORK

- 5.7.8 FORMEL D ENSURES SAFE AND COMPLIANT ADAS/AD DEPLOYMENT THROUGH COMPREHENSIVE SIMULATION AND REAL-WORLD TESTING SERVICES

- 5.8 MAJOR ADAS SIMULATION MARKET CENTERS

- 5.9 ADAS OFFERINGS BY KEY AUTOMAKERS

- 5.9.1 MODEL-WISE ADAS OFFERINGS

- 5.9.1.1 Tesla

- 5.9.1.2 Toyota Motor Corporation

- 5.9.1.2.1 Corolla

- 5.9.1.2.2 Camry

- 5.9.1.2.3 RAV4

- 5.9.1.3 Nissan Motor Co., Ltd.

- 5.9.1.3.1 Versa

- 5.9.1.3.2 Altima

- 5.9.1.3.3 Nissan Leaf

- 5.9.1.3.4 Nissan TITAN

- 5.9.1.4 Mercedes-Benz AG

- 5.9.1.4.1 S-Class Sedan

- 5.9.1.4.2 C-Class Sedan

- 5.9.1.4.3 E-Class Sedan

- 5.9.1.5 Audi

- 5.9.1.5.1 A3 Sedan

- 5.9.1.5.2 A6 Sedan

- 5.9.1.6 Cadillac

- 5.9.1.6.1 Cadillac XT6

- 5.9.1.6.2 Cadillac XT4

- 5.9.1 MODEL-WISE ADAS OFFERINGS

- 5.10 UPCOMING MODELS AND ADAS FEATURES

- 5.11 UPCOMING ADAS SOFTWARE AND SIMULATION DEVELOPMENTS

- 5.11.1 ADVENT OF CLOUD-NATIVE SIMULATION

- 5.11.2 ADOPTION OF VIRTUAL VALIDATION IN REGULATORY FRAMEWORKS

- 5.11.3 ADAS PENETRATION IN MASS-MARKET VEHICLES

- 5.11.4 RISE OF EDGE-BASED ON-VEHICLE SIMULATION

- 5.11.5 EVOLUTION OF HIGH-FIDELITY SENSOR SIMULATION

- 5.11.6 AI-DRIVEN SCENARIO GENERATION

- 5.12 ADAS TESTING FOR SAFE AND SCALABLE AUTOMATION

- 5.13 FUTURE GROWTH BETS

- 5.13.1 EMERGENCE OF ADAS TESTING-AS-A-SERVICE BUSINESS MODELS

- 5.13.2 LEVEL 4/5 TESTING FOR ROBO-TAXIS AND DELIVERY PODS

- 5.13.3 REGIONAL HOTSPOTS FOR ADAS SIMULATION AND TESTING

- 5.13.3.1 China's Smart City Pilots

- 5.13.3.2 US Highway Automation Tests

- 5.13.3.3 EU Safety Mandates

- 5.14 COST EFFICIENCY AND ROI MODELS IN SIMULATION PLATFORMS

- 5.14.1 LIMITATIONS OF TRADITIONAL PHYSICAL (CAPEX-HEAVY) TESTING

- 5.14.2 TRANSITION TOWARD VIRTUAL (OPEX-DRIVEN) TESTING

- 5.14.3 OPERATIONAL AND FINANCIAL BENEFITS OF OPEX MODEL

- 5.14.4 ROI MODELS FOR OEMS AND TIER-1 SUPPLIERS ADOPTING LARGE-SCALE SIMULATION PLATFORMS

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY TECHNOLOGIES

- 6.1.1 AI/ML PERCEPTION TESTING

- 6.1.2 SCENARIO-BASED TESTING

- 6.1.3 SENSOR-BASED TESTING

- 6.1.4 MULTI-SENSOR ENVIRONMENTS

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 EDGE/CLOUD PLATFORMS

- 6.2.2 HIGH-BANDWIDTH DATA LOGGERS

- 6.2.3 HD AND SEMANTIC MAPS

- 6.3 ADJACENT TECHNOLOGIES

- 6.3.1 RADAR EMULATION

- 6.3.2 AD/ADAS TESTING FOR TELEMATICS AND V2X

- 6.3.3 AUTOMATED TESTING FOR SENSOR DATA ACQUISITION

- 6.4 TECHNOLOGY ROADMAP

- 6.4.1 SHORT-TERM (2026-2027)

- 6.4.2 MID-TERM (2028-2030)

- 6.4.3 LONG-TERM (BEYOND 2030)

- 6.5 PATENT ANALYSIS

- 6.6 IMPACT OF AI/GEN AI

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES

- 6.6.3 CASE STUDIES OF AI IMPLEMENTATION

- 6.6.4 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.4.1 Sensor-simulation integration

- 6.6.4.2 Tier-1 and simulation co-development

- 6.6.4.3 OEM-software alliances

- 6.6.4.4 Compute and cloud partnerships

- 6.6.4.5 Mapping and virtual environments

- 6.6.5 CLIENTS' READINESS TO ADOPT AI-INTEGRATED ADAS SIMULATION

7 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 7.1 DECISION-MAKING PROCESS

- 7.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 7.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 7.2.2 BUYING CRITERIA

- 7.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

8 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 8.1 REGIONAL REGULATIONS AND COMPLIANCE

- 8.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.1.2 INDUSTRY STANDARDS

- 8.2 SUSTAINABILITY INITIATIVES

- 8.2.1 CARBON IMPACT AND ECO-APPLICATIONS

- 8.2.2 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 8.2.3 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

9 ADAS SIMULATION MARKET, BY SIMULATION TYPE

- 9.1 INTRODUCTION

- 9.2 MODEL-IN-THE-LOOP

- 9.2.1 HIGH FIDELITY MODEL VALIDATION TO DRIVE MARKET

- 9.3 SOFTWARE-IN-THE-LOOP

- 9.3.1 COMPLIANCE WITH FUNCTIONAL SAFETY EXPECTATIONS UNDER ISO STANDARDS TO DRIVE MARKET

- 9.4 HARDWARE-IN-THE-LOOP

- 9.4.1 ADVANCEMENTS IN MULTI-SENSOR HIL ARCHITECTURES TO DRIVE MARKET

- 9.5 DRIVER-IN-THE-LOOP

- 9.5.1 NEED FOR HUMAN-CENTRIC VALIDATION TO DRIVE MARKET

- 9.6 PRIMARY INSIGHTS

10 ADAS SIMULATION MARKET, BY VEHICLE TYPE

- 10.1 INTRODUCTION

- 10.2 PASSENGER CARS

- 10.2.1 RISE IN SOFTWARE AND SENSOR FUSION COMPLEXITY TO DRIVE MARKET

- 10.3 COMMERCIAL VEHICLES

- 10.3.1 HIGHER OPERATIONAL RISKS TO DRIVE MARKET

- 10.4 PRIMARY INSIGHTS

11 ADAS SIMULATION MARKET, BY OFFERING

- 11.1 INTRODUCTION

- 11.2 SOFTWARE

- 11.2.1 PRESSURE TO SHORTEN DEVELOPMENT CYCLES TO DRIVE MARKET

- 11.2.2 APPLICATION SOFTWARE

- 11.2.3 MIDDLEWARE

- 11.2.4 OPERATING SYSTEMS/PLATFORMS

- 11.3 SERVICES

- 11.3.1 NEED FOR CONSISTENT DATA FLOW AND INTEROPERABILITY TO DRIVE MARKET

- 11.3.2 SIMULATION PLATFORMS

- 11.3.3 VALIDATION SERVICES

- 11.3.4 SUPPORT & MAINTENANCE SERVICES

- 11.4 PRIMARY INSIGHTS

12 ADAS SIMULATION MARKET, BY METHOD

- 12.1 INTRODUCTION

- 12.2 ON-PREMISES

- 12.2.1 NEED FOR DETERMINISTIC HARDWARE VALIDATION AND DATA CONTROL TO DRIVE MARKET

- 12.3 CLOUD-BASED

- 12.3.1 EXTENSIVE USE IN LARGE-SCALE VALIDATION AND REGRESSION TESTING TO DRIVE MARKET

- 12.4 PRIMARY INSIGHTS

13 ADAS SIMULATION MARKET, BY LEVEL OF AUTONOMY

- 13.1 INTRODUCTION

- 13.2 LEVEL 1

- 13.2.1 REGULATORY COMPLIANCE FOR ENTRY-LEVEL SAFETY FEATURES TO DRIVE MARKET

- 13.3 LEVEL 2/2+

- 13.3.1 EXPANDED SAFETY VALIDATION REQUIREMENTS TO DRIVE MARKET

- 13.4 LEVEL 3

- 13.4.1 HIGH VALIDATION COMPLEXITY FOR CONDITIONAL AUTOMATION TO DRIVE MARKET

- 13.5 LEVEL 4/5

- 13.5.1 NEED TO VALIDATE LARGE-SCALE, LONG-TAIL DRIVING SCENARIOS WHILE MINIMIZING ON-ROAD TESTING RISK AND COST TO DRIVE MARKET

- 13.6 PRIMARY INSIGHTS

14 ADAS SIMULATION MARKET, BY APPLICATION

- 14.1 INTRODUCTION

- 14.2 AUTONOMOUS EMERGENCY BRAKING

- 14.3 ADAPTIVE CRUISE CONTROL

- 14.4 LANE DEPARTURE WARNING & LANE KEEPING ASSIST

- 14.5 TRAFFIC SIGN RECOGNITION

- 14.6 BLIND SPOT DETECTION

- 14.7 PARKING ASSISTANCE

- 14.8 AUTOMATED PARKING ASSIST

- 14.9 OTHERS

- 14.10 PRIMARY INSIGHTS

15 ADAS SIMULATION MARKET, BY END USER

- 15.1 INTRODUCTION

- 15.2 OEMS

- 15.3 TIER-1/2 COMPONENT MANUFACTURERS

- 15.4 TECHNOLOGY PROVIDERS/SOFTWARE DEVELOPERS

- 15.5 PRIMARY INSIGHTS

16 ADAS SIMULATION MARKET, BY REGION

- 16.1 INTRODUCTION

- 16.2 ASIA PACIFIC

- 16.2.1 CHINA

- 16.2.2 INDIA

- 16.2.3 JAPAN

- 16.2.4 SOUTH KOREA

- 16.3 EUROPE

- 16.3.1 FRANCE

- 16.3.2 ITALY

- 16.3.3 GERMANY

- 16.3.4 SPAIN

- 16.3.5 UK

- 16.4 NORTH AMERICA

- 16.4.1 US

- 16.4.2 CANADA

17 COMPETITIVE LANDSCAPE

- 17.1 OVERVIEW

- 17.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 17.3 MARKET SHARE ANALYSIS, 2025

- 17.4 REVENUE ANALYSIS, 2020-2024

- 17.5 COMPANY VALUATION AND FINANCIAL METRICS

- 17.6 BRAND/PRODUCT COMPARISON

- 17.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2025

- 17.7.1 STARS

- 17.7.2 EMERGING LEADERS

- 17.7.3 PERVASIVE PLAYERS

- 17.7.4 PARTICIPANTS

- 17.7.5 COMPANY FOOTPRINT

- 17.7.5.1 Company footprint

- 17.7.5.2 Region footprint

- 17.7.5.3 Application footprint

- 17.7.5.4 Vehicle type footprint

- 17.7.5.5 Offering footprint

- 17.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2025

- 17.8.1 PROGRESSIVE COMPANIES

- 17.8.2 RESPONSIVE COMPANIES

- 17.8.3 DYNAMIC COMPANIES

- 17.8.4 STARTING BLOCKS

- 17.8.5 COMPETITIVE BENCHMARKING

- 17.8.5.1 List of start-ups/SMEs

- 17.8.5.2 Competitive benchmarking of start-ups/SMEs

- 17.9 COMPETITIVE SCENARIO

- 17.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 17.9.2 DEALS

- 17.9.3 OTHER DEVELOPMENTS

18 COMPANY PROFILES

- 18.1 KEY PLAYERS

- 18.1.1 SIEMENS

- 18.1.1.1 Business overview

- 18.1.1.2 Products/Solutions offered

- 18.1.1.3 Recent developments

- 18.1.1.3.1 Product launches/developments

- 18.1.1.3.2 Deals

- 18.1.1.3.3 Other developments

- 18.1.1.4 MnM view

- 18.1.1.4.1 Right to win

- 18.1.1.4.2 Strategic choices

- 18.1.1.4.3 Weaknesses and competitive threats

- 18.1.2 ANSYS, INC.

- 18.1.2.1 Business overview

- 18.1.2.2 Products/Solutions offered

- 18.1.2.3 Recent developments

- 18.1.2.3.1 Product launches/developments

- 18.1.2.3.2 Deals

- 18.1.2.3.3 Other developments

- 18.1.2.4 MnM view

- 18.1.2.4.1 Right to win

- 18.1.2.4.2 Strategic choices

- 18.1.2.4.3 Weaknesses and competitive threats

- 18.1.3 NVIDIA CORPORATION

- 18.1.3.1 Business overview

- 18.1.3.2 Products/Solutions offered

- 18.1.3.3 Recent developments

- 18.1.3.3.1 Product launches/developments

- 18.1.3.3.2 Deals

- 18.1.3.3.3 Other developments

- 18.1.3.4 MnM view

- 18.1.3.4.1 Right to win

- 18.1.3.4.2 Strategic choices

- 18.1.3.4.3 Weaknesses and competitive threats

- 18.1.4 DSPACE

- 18.1.4.1 Business overview

- 18.1.4.2 Products/Solutions offered

- 18.1.4.3 Recent developments

- 18.1.4.3.1 Product launches/developments

- 18.1.4.3.2 Deals

- 18.1.4.3.3 Other developments

- 18.1.4.4 MnM view

- 18.1.4.4.1 Right to win

- 18.1.4.4.2 Strategic choices

- 18.1.4.4.3 Weaknesses and competitive threats

- 18.1.5 AVL

- 18.1.5.1 Business overview

- 18.1.5.2 Products/Solutions offered

- 18.1.5.3 Recent developments

- 18.1.5.3.1 Product launches/developments

- 18.1.5.3.2 Deals

- 18.1.5.3.3 Other developments

- 18.1.5.4 MnM view

- 18.1.5.4.1 Right to win

- 18.1.5.4.2 Strategic choices

- 18.1.5.4.3 Weaknesses and competitive threats

- 18.1.6 APPLIED INTUITION, INC.

- 18.1.6.1 Business overview

- 18.1.6.2 Products/Solutions offered

- 18.1.6.3 Recent developments

- 18.1.6.3.1 Product launches/developments

- 18.1.6.3.2 Deals

- 18.1.6.3.3 Other developments

- 18.1.7 IPG AUTOMOTIVE GMBH

- 18.1.7.1 Business overview

- 18.1.7.2 Products/Solutions offered

- 18.1.7.3 Recent developments

- 18.1.7.3.1 Product launches/developments

- 18.1.7.3.2 Deals

- 18.1.7.3.3 Other developments

- 18.1.8 MATHWORKS, INC.

- 18.1.8.1 Business overview

- 18.1.8.2 Products/Solutions offered

- 18.1.8.3 Recent developments

- 18.1.8.3.1 Deals

- 18.1.9 HEXAGON AB

- 18.1.9.1 Business overview

- 18.1.9.2 Products/Solutions offered

- 18.1.9.3 Recent developments

- 18.1.9.3.1 Product launches/developments

- 18.1.9.3.2 Deals

- 18.1.10 VECTOR INFORMATIK GMBH

- 18.1.10.1 Business overview

- 18.1.10.2 Products/Solutions offered

- 18.1.10.3 Recent developments

- 18.1.10.3.1 Product launches/developments

- 18.1.10.3.2 Deals

- 18.1.11 KEYSIGHT TECHNOLOGIES

- 18.1.11.1 Business overview

- 18.1.11.2 Products/Solutions offered

- 18.1.11.3 Recent developments

- 18.1.11.3.1 Product launches/developments

- 18.1.11.3.2 Deals

- 18.1.11.3.3 Other developments

- 18.1.12 DASSAULT SYSTEMES

- 18.1.12.1 Business overview

- 18.1.12.2 Products/Solutions offered

- 18.1.12.3 Recent developments

- 18.1.12.3.1 Deals

- 18.1.13 COGNATA

- 18.1.13.1 Business overview

- 18.1.13.2 Products/Solutions offered

- 18.1.13.3 Recent developments

- 18.1.13.3.1 Product launches/developments

- 18.1.13.3.2 Deals

- 18.1.13.3.3 Other developments

- 18.1.1 SIEMENS

- 18.2 OTHER PLAYERS

- 18.2.1 RFPRO

- 18.2.2 FORETELLIX

- 18.2.3 ELEKTROBIT

- 18.2.4 ETAS

- 18.2.5 VI-GRADE GMBH

- 18.2.6 AVSIMULATION

- 18.2.7 ANTEMOTION

- 18.2.8 PARALLEL DOMAIN

- 18.2.9 REAL-TIME TECHNOLOGIES

- 18.2.10 AIMOTIVE

- 18.2.11 ANYVERSE SL

- 18.2.12 DORLECO

19 RESEARCH METHODOLOGY

- 19.1 RESEARCH DATA

- 19.1.1 SECONDARY DATA

- 19.1.1.1 List of secondary sources

- 19.1.1.2 Key data from secondary sources

- 19.1.2 PRIMARY DATA

- 19.1.2.1 Primary interviews: Demand and supply sides

- 19.1.2.2 Breakdown of primary interviews

- 19.1.2.3 List of primary participants

- 19.1.1 SECONDARY DATA

- 19.2 MARKET SIZE ESTIMATION

- 19.2.1 TOP-DOWN APPROACH

- 19.3 DATA TRIANGULATION

- 19.4 FACTOR ANALYSIS

- 19.5 RESEARCH ASSUMPTIONS

- 19.6 RESEARCH LIMITATIONS

- 19.7 RISK ASSESSMENT

20 APPENDIX

- 20.1 INSIGHTS FROM INDUSTRY EXPERTS

- 20.2 DISCUSSION GUIDE

- 20.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 20.4 CUSTOMIZATION OPTIONS

- 20.4.1 ADAS SIMULATION MARKET, BY LEVEL OF AUTONOMY, AT REGIONAL LEVEL (FOR REGIONS COVERED IN REPORT)

- 20.4.2 COMPANY INFORMATION

- 20.5 RELATED REPORTS

- 20.6 AUTHOR DETAILS

List of Tables

- TABLE 1 MARKET DEFINITION, BY METHOD

- TABLE 2 MARKET DEFINITION, BY SIMULATION TYPE

- TABLE 3 MARKET DEFINITION, BY AUTONOMY

- TABLE 4 MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 5 MARKET DEFINITION, BY OFFERING

- TABLE 6 CURRENCY EXCHANGE RATES, 2019-2024

- TABLE 7 OEM SHIFT FROM LEVEL 0 TO LEVEL 3

- TABLE 8 GLOBAL ADAS SAFETY REGULATIONS

- TABLE 9 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- TABLE 10 GDP PERCENTAGE CHANGE, BY COUNTRY, 2021-2030

- TABLE 11 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 12 FUNDING, BY USE CASE

- TABLE 13 KEY CONFERENCES AND EVENTS, 2026-2027

- TABLE 14 TESLA AUTOPILOT SUBSCRIPTION PRICING

- TABLE 15 NISSAN ALTIMA ADAS PACKAGE

- TABLE 16 NISSAN LEAF ADAS PACKAGE

- TABLE 17 NISSAN TITAN ADAS PACKAGE

- TABLE 18 MERCEDES S-CLASS STANDARD FEATURES

- TABLE 19 MERCEDES C-CLASS ADAS PACKAGE

- TABLE 20 MERCEDES C-CLASS' DISTRONIC ADAPTIVE CRUISE CONTROL

- TABLE 21 MERCEDES E-CLASS ADAS PACKAGE

- TABLE 22 AUDI A3 ADAS PACKAGE

- TABLE 23 AUDI A6 ADAS PACKAGE

- TABLE 24 CADILLAC XT6 ADAS PACKAGE

- TABLE 25 CADILLAC XT4 ADAS PACKAGE

- TABLE 26 UPCOMING MODELS AND ASSOCIATED ADAS FEATURES

- TABLE 27 UPCOMING ADAS SOFTWARE AND SIMULATION DEVELOPMENTS

- TABLE 28 USE CASES OF HIGH-BANDWIDTH DATA LOGGERS IN ADAS DEVELOPMENT

- TABLE 29 PATENT ANALYSIS

- TABLE 30 TOP USE CASES AND MARKET POTENTIAL

- TABLE 31 BEST PRACTICES

- TABLE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY VEHICLE TYPE (%)

- TABLE 33 KEY BUYING CRITERIA, BY LEVEL OF AUTONOMY

- TABLE 34 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 35 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 36 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 37 GLOBAL INDUSTRY STANDARDS

- TABLE 38 ADAS SIMULATION MARKET, BY SIMULATION TYPE, 2021-2024 (USD MILLION)

- TABLE 39 ADAS SIMULATION MARKET, BY SIMULATION TYPE, 2025-2032 (USD MILLION)

- TABLE 40 MODEL-IN-THE-LOOP: ADAS SIMULATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 MODEL-IN-THE-LOOP: ADAS SIMULATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 42 SOFTWARE-IN-THE-LOOP: ADAS SIMULATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 43 SOFTWARE-IN-THE-LOOP: ADAS SIMULATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 44 HARDWARE-IN-THE-LOOP: ADAS SIMULATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 45 HARDWARE-IN-THE-LOOP: ADAS SIMULATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 46 DRIVER-IN-THE-LOOP: ADAS SIMULATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 47 DRIVER-IN-THE-LOOP: ADAS SIMULATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 48 ADAS SIMULATION MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 49 ADAS SIMULATION MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 50 PASSENGER CARS: ADAS SIMULATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 PASSENGER CARS: ADAS SIMULATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 52 COMMERCIAL VEHICLES: ADAS SIMULATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 53 COMMERCIAL VEHICLES: ADAS SIMULATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 54 ADAS SIMULATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 55 ADAS SIMULATION MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 56 SOFTWARE: ADAS SIMULATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 SOFTWARE: ADAS SIMULATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 58 SERVICES: ADAS SIMULATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 SERVICES: ADAS SIMULATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 60 ADAS SIMULATION MARKET, BY METHOD, 2021-2024 (USD MILLION)

- TABLE 61 ADAS SIMULATION MARKET, BY METHOD, 2025-2032 (USD MILLION)

- TABLE 62 ON-PREMISES: ADAS SIMULATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 63 ON-PREMISES: ADAS SIMULATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 64 CLOUD-BASED: ADAS SIMULATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 65 CLOUD-BASED: ADAS SIMULATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 66 ADAS SIMULATION MARKET, BY LEVEL OF AUTONOMY, 2021-2024 (USD MILLION)

- TABLE 67 ADAS SIMULATION MARKET, BY LEVEL OF AUTONOMY, 2025-2032 (USD MILLION)

- TABLE 68 LEVEL 1: ADAS SIMULATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 LEVEL 1: ADAS SIMULATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 70 LEVEL 2/2+: ADAS SIMULATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 LEVEL 2/2+: ADAS SIMULATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 72 LEVEL 3: ADAS SIMULATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 73 LEVEL 3: ADAS SIMULATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 74 LEVEL 4/5: ADAS SIMULATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 75 LEVEL 4/5: ADAS SIMULATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 76 ADAS SIMULATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 77 ADAS SIMULATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 78 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- TABLE 79 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2025

- TABLE 80 REGION FOOTPRINT

- TABLE 81 APPLICATION FOOTPRINT

- TABLE 82 VEHICLE TYPE FOOTPRINT

- TABLE 83 OFFERING FOOTPRINT

- TABLE 84 LIST OF START-UPS/SMES

- TABLE 85 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 86 ADAS SIMULATION MARKET: PRODUCT LAUNCHES, 2022-2025

- TABLE 87 ADAS SIMULATION MARKET: DEALS, 2022- 2025

- TABLE 88 ADAS SIMULATION MARKET: OTHER DEVELOPMENTS, 2022-2025

- TABLE 89 SIEMENS: COMPANY OVERVIEW

- TABLE 90 SIEMENS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 91 SIEMENS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 92 SIEMENS: DEALS

- TABLE 93 SIEMENS: OTHER DEVELOPMENTS

- TABLE 94 ANSYS, INC.: COMPANY OVERVIEW

- TABLE 95 ANSYS, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 96 ANSYS, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 97 ANSYS, INC.: DEALS

- TABLE 98 ANSYS, INC.: OTHER DEVELOPMENTS

- TABLE 99 NVIDIA CORPORATION: COMPANY OVERVIEW

- TABLE 100 NVIDIA CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 101 NVIDIA CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 102 NVIDIA CORPORATION: DEALS

- TABLE 103 NVIDIA CORPORATION: OTHER DEVELOPMENTS

- TABLE 104 DSPACE: COMPANY OVERVIEW

- TABLE 105 DSPACE: PRODUCTS/SOLUTIONS OFFERED

- TABLE 106 DSPACE: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 107 DSPACE: DEALS

- TABLE 108 DSPACE: OTHER DEVELOPMENTS

- TABLE 109 AVL: COMPANY OVERVIEW

- TABLE 110 AVL: PRODUCTS/SOLUTIONS OFFERED

- TABLE 111 AVL: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 112 AVL: DEALS

- TABLE 113 AVL: OTHER DEVELOPMENTS

- TABLE 114 APPLIED INTUITION, INC.: COMPANY OVERVIEW

- TABLE 115 APPLIED INTUITION, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 116 APPLIED INTUITION, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 117 APPLIED INTUITION, INC.: DEALS

- TABLE 118 APPLIED INTUITION, INC.: OTHER DEVELOPMENTS

- TABLE 119 IPG AUTOMOTIVE GMBH: COMPANY OVERVIEW

- TABLE 120 IPG AUTOMOTIVE GMBH: PRODUCTS/SOLUTIONS OFFERED

- TABLE 121 IPG AUTOMOTIVE GMBH: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 122 IPG AUTOMOTIVE GMBH: DEALS

- TABLE 123 IPG AUTOMOTIVE GMBH: OTHER DEVELOPMENTS

- TABLE 124 MATHWORKS, INC.: COMPANY OVERVIEW

- TABLE 125 MATHWORKS, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 126 MATHWORKS, INC.: DEALS

- TABLE 127 HEXAGON AB: COMPANY OVERVIEW

- TABLE 128 HEXAGON AB: PRODUCTS/SOLUTIONS OFFERED

- TABLE 129 HEXAGON AB: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 130 HEXAGON AB: DEALS

- TABLE 131 VECTOR INFORMATIK GMBH: COMPANY OVERVIEW

- TABLE 132 VECTOR INFORMATIK GMBH: PRODUCTS/SOLUTIONS OFFERED

- TABLE 133 VECTOR INFORMATIK GMBH: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 134 VECTOR INFORMATIK GMBH: DEALS

- TABLE 135 KEYSIGHT TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 136 KEYSIGHT TECHNOLOGIES: PRODUCTS/SOLUTIONS OFFERED

- TABLE 137 KEYSIGHT TECHNOLOGIES: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 138 KEYSIGHT TECHNOLOGIES: DEALS

- TABLE 139 KEYSIGHT TECHNOLOGIES: OTHER DEVELOPMENTS

- TABLE 140 DASSAULT SYSTEMES: COMPANY OVERVIEW

- TABLE 141 DASSAULT SYSTEMES: PRODUCTS/SOLUTIONS OFFERED

- TABLE 142 DASSAULT SYSTEMES: DEALS

- TABLE 143 COGNATA: COMPANY OVERVIEW

- TABLE 144 COGNATA: PRODUCTS/SOLUTIONS OFFERED

- TABLE 145 COGNATA: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 146 COGNATA: DEALS

- TABLE 147 COGNATA: OTHER DEVELOPMENTS

- TABLE 148 RFPRO: COMPANY OVERVIEW

- TABLE 149 FORETELLIX: COMPANY OVERVIEW

- TABLE 150 ELEKTROBIT: COMPANY OVERVIEW

- TABLE 151 ETAS: COMPANY OVERVIEW

- TABLE 152 VI-GRADE GMBH: COMPANY OVERVIEW

- TABLE 153 AVSIMULATION: COMPANY OVERVIEW

- TABLE 154 ANTEMOTION: COMPANY OVERVIEW

- TABLE 155 PARALLEL DOMAIN: COMPANY OVERVIEW

- TABLE 156 REAL-TIME TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 157 AIMOTIVE: COMPANY OVERVIEW

- TABLE 158 ANYVERSE SL: COMPANY OVERVIEW

- TABLE 159 DORLECO: COMPANY OVERVIEW

List of Figures

- FIGURE 1 ADAS SIMULATION MARKET SEGMENTATION

- FIGURE 2 MARKET SCENARIO

- FIGURE 3 ADAS SIMULATION MARKET, BY SIMULATION TYPE, 2025-2032

- FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN ADAS SIMULATION MARKET

- FIGURE 5 DISRUPTIONS INFLUENCING GROWTH OF ADAS SIMULATION MARKET

- FIGURE 6 HIGH-GROWTH SEGMENTS IN ADAS SIMULATION MARKET

- FIGURE 7 ASIA PACIFIC TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

- FIGURE 8 EMPHASIS ON VIRTUAL ADAS VALIDATION AND SOFTWARE SAFETY TO DRIVE MARKET

- FIGURE 9 PASSENGER CARS TO BE LARGER THAN COMMERCIAL VEHICLES DURING FORECAST PERIOD

- FIGURE 10 CLOUD-BASED TO RECORD FASTER GROWTH THAN ON-PREMISES DURING FORECAST PERIOD

- FIGURE 11 SOFTWARE TO HOLD HIGHER SHARE THAN SERVICES DURING FORECAST PERIOD

- FIGURE 12 LEVEL 2/2+ SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 13 SOFTWARE-IN-THE-LOOP TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 14 EUROPE TO SURPASS OTHER REGIONAL MARKETS DURING FORECAST PERIOD

- FIGURE 15 ADAS SIMULATION MARKET DYNAMICS

- FIGURE 16 SHIFT FROM TRADITIONAL HARDWARE-BASED VALIDATION TO VIRTUAL VALIDATION

- FIGURE 17 INTEGRATED WORKFLOW OF SCENARIO GENERATION, SIMULATION, AND ADAS CALIBRATION

- FIGURE 18 EVOLUTION OF AUTOMATED SAFETY TECHNOLOGIES

- FIGURE 19 ECOSYSTEM ANALYSIS

- FIGURE 20 SUPPLY CHAIN ANALYSIS

- FIGURE 21 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 22 INVESTMENT AND FUNDING SCENARIO, 2020-2025 (USD MILLION)

- FIGURE 23 REGIONAL DISTRIBUTION OF ADAS SIMULATION PLATFORM AND TECHNOLOGY PROVIDERS

- FIGURE 24 ADAS OFFERINGS BY KEY AUTOMAKERS

- FIGURE 25 TOYOTA SAFETY SENSE 3.0

- FIGURE 26 REGIONAL HOTSPOTS FOR ADAS SIMULATION AND TESTING

- FIGURE 27 FINANCIAL IMPACT OF SHIFTING FROM PHYSICAL TO VIRTUAL TESTING

- FIGURE 28 ROI FOR LARGE-SCALE SIMULATION PLATFORMS

- FIGURE 29 WORKFLOW FOR DEVELOPING AND VALIDATING ML MODELS IN ADAS

- FIGURE 30 AI-ASSISTED SCENARIO GENERATION WORKFLOW FOR ADAS SIMULATION

- FIGURE 31 MULTI-SENSOR PERCEPTION AND MULTI-VEHICLE TESTING ARCHITECTURE FOR ADAS VALIDATION

- FIGURE 32 KEY BENEFITS OF RADAR EMULATION

- FIGURE 33 V2X COMMUNICATION SUPPORTING AD/ADAS TESTING

- FIGURE 34 ADAS SIMULATION TECHNOLOGY ROADMAP

- FIGURE 35 PATENT ANALYSIS

- FIGURE 36 CASE STUDIES OF AI IMPLEMENTATION

- FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY VEHICLE TYPE

- FIGURE 38 KEY BUYING CRITERIA, BY LEVEL OF AUTONOMY

- FIGURE 39 ADAS SIMULATION MARKET, BY SIMULATION TYPE, 2025-2032 (USD MILLION)

- FIGURE 40 ADAS SIMULATION MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- FIGURE 41 ADAS SIMULATION MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- FIGURE 42 ADAS SIMULATION MARKET, BY METHOD, 2025-2032 (USD MILLION)

- FIGURE 43 ADAS SIMULATION MARKET, BY LEVEL OF AUTONOMY, 2025-2032 (USD MILLION)

- FIGURE 44 ADAS SIMULATION MARKET, BY REGION, 2025 VS. 2032 (USD MILLION)

- FIGURE 45 ASIA PACIFIC: ADAS SIMULATION MARKET SNAPSHOT

- FIGURE 46 EUROPE: ADAS SIMULATION MARKET SNAPSHOT

- FIGURE 47 NORTH AMERICA: ADAS SIMULATION MARKET SNAPSHOT

- FIGURE 48 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2025

- FIGURE 49 REVENUE ANALYSIS OF TOP LISTED PLAYERS, 2020-2024

- FIGURE 50 COMPANY VALUATION (USD BILLION)

- FIGURE 51 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 52 BRAND/PRODUCT COMPARISON

- FIGURE 53 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2025

- FIGURE 54 COMPANY FOOTPRINT

- FIGURE 55 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2025

- FIGURE 56 SIEMENS: COMPANY SNAPSHOT

- FIGURE 57 ANSYS, INC.: COMPANY SNAPSHOT

- FIGURE 58 NVIDIA CORPORATION: COMPANY SNAPSHOT

- FIGURE 59 HEXAGON AB: COMPANY SNAPSHOT

- FIGURE 60 KEYSIGHT TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 61 DASSAULT SYSTEMES: COMPANY SNAPSHOT

- FIGURE 62 RESEARCH DESIGN

- FIGURE 63 RESEARCH DESIGN MODEL

- FIGURE 64 KEY INDUSTRY INSIGHTS

- FIGURE 65 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 66 TOP-DOWN APPROACH

- FIGURE 67 DATA TRIANGULATION

- FIGURE 68 MARKET GROWTH PROJECTIONS FROM SUPPLY-SIDE DRIVERS