|

市場調查報告書

商品編碼

1913315

乘用車ADAS市場機會、成長要素、產業趨勢分析及2026年至2035年預測Passenger Vehicle ADAS Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

全球乘用車ADAS市場預計2025年將達322億美元,2035年將達1,603億美元,年複合成長率為17.8%。

這一成長主要得益於政府日益嚴格的安全政策和不斷發展的車輛評估標準,這些因素促使汽車製造商整合高級駕駛輔助系統 (ADAS) 以滿足合規要求並增強自身競爭力。消費者越來越重視安全保障、駕駛便利性和減少疲勞駕駛,這推動了智慧輔助技術在乘用車領域的廣泛應用。晶片製造效率的提高、大規模生產以及供應商之間日益激烈的競爭正在降低系統成本,使 ADAS 的應用範圍從高階車型擴展到其他車型,而不會顯著影響車輛價格。汽車製造商正積極利用 ADAS 功能集作為策略工具,以強化品牌形象、支持定價策略並建立長期的客戶忠誠度。消費者對駕駛輔助技術的日益了解進一步增強了市場需求,ADAS 已穩固確立其作為現代乘用車設計核心要素的地位。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 322億美元 |

| 預測金額 | 1603億美元 |

| 複合年成長率 | 17.8% |

預計到2025年,雷達市佔率將達到46%。雷達系統憑藉其穩定的性能和可靠性,被定位為ADAS架構的基礎感測技術;而影像感測器則因其能夠提供支援系統精確判讀的精細視覺輸入而備受重視。感測器解析度和處理能力的提升正在提高系統的整體精度和穩健性,從而強化多感測器整合在下一代ADAS部署中的作用。

車道偏離預警系統預計在2025年佔據17%的市場佔有率,市場規模約為55億美元。此細分市場受益於駕駛輔助解決方案日益成長的需求,這些解決方案有助於減輕駕駛員的疲勞,並提高長途駕駛的舒適度。該系統能夠幫助維持車輛穩定,從而增強使用者的信心和持續的警覺性,這些因素推動了乘用車車主擴大採用此類系統。

預計到2025年,美國乘用車ADAS市場規模將達107億美元。推動ADAS市場普及的因素包括:消費者對高階輔助功能日益成長的興趣、製造商主導的功能差異化以及智慧駕駛功能的日益普及。以軟體為中心的汽車平臺和遠端更新能力正在加速功能增強,並為所有車型類別催生新的收入模式。此外,監管也朝著透過結構化部署框架,在受控條件下逐步支援更高水準的自動化發展。

目錄

第1章調查方法

第2章執行摘要

第3章業界考察

- 生態系分析

- 供應商情況

- 利潤率分析

- 成本結構

- 每個階段的附加價值

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 促進要素

- 監理安全要求

- 消費者偏好安全車輛

- 技術成本降低

- OEM差異化策略

- 電動車的發展

- 產業潛在風險與挑戰

- 高系統整合複雜性

- 高度自動化帶來的監管不確定性

- 市場機遇

- 擴展 2 級以上及 3 級系統

- 感測器融合和人工智慧的進展

- 售後市場和改裝潛力

- 數據貨幣化和軟體服務

- 成長潛力分析

- 監管環境

- 北美洲

- 美國- 聯邦機動車輛安全標準 (FMVSS)

- 加拿大 - 機動車輛安全法規

- 歐洲

- 英國- 道路車輛(構造和使用)條例

- 德國——自動駕駛法

- 法國 - 流動導向法 (LOM)

- 義大利 - 道路交通法規 (Codice della Strada)

- 西班牙 - 一般交通法規

- 亞太地區

- 中國——智慧網聯網汽車法規

- 日本 -道路運輸車輛法

- 印度 - 中央機動車規則

- 拉丁美洲

- 巴西 - 國家交通法規

- 墨西哥 - 墨西哥官方車輛安全標準 (NOM)

- 阿根廷 - 國家交通法

- 中東和非洲

- 阿拉伯聯合大公國 - 聯邦交通法

- 南非 - 國家道路交通法

- 沙烏地阿拉伯 - 交通法規

- 北美洲

- 波特五力分析

- PESTEL 分析

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 生產統計

- 生產基地

- 消費中心

- 出口和進口

- 成本細分分析

- 開發成本結構

- 研發成本分析

- 行銷和銷售成本

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 對ADAS標準、檢驗和安全評估的影響

- Euro NCAP、Global NCAP 和 IIHS 評級如何影響 ADAS 的採用

- 聯合國歐洲經濟委員會法規(R79、R152、R157)及原始設備製造商合規流程

- 按自動化等級分類的認證、檢驗和測試要求

- 安全評級如何影響OEM功能包裝和定價

- ADAS軟體和運算架構概述

- 集中式、領域特定型及區域型ADAS架構

- SoC 與 ECU 的演進(ADAS ECU → 集中式計算)

- 中介軟體、作業系統和即時性約束

- OTA 更新支援狀態及其對軟體生命週期的影響

- ADAS成本及支付意願

- ADAS 資料、網路安全和功能安全(ISO 26262/SOTIF)

- OEM ADAS藍圖與功能遷移分析

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 主要市場公司的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 重大進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 企業擴張計畫和資金籌措

第5章 2022-2035年各系統市場估算與預測

- 主動式車距維持定速系統

- 盲點偵測系統

- 車道偏離預警系統

- 自動緊急煞車(AEB)

- 前方碰撞警報

- 夜視系統

- 駕駛員監控

- 輪胎壓力監測系統

- 抬頭顯示器

- 停車輔助系統

- 其他

第6章 按感測器分類的市場估算與預測,2022-2035年

- 雷達

- 騎士

- 超音波

- 相機

- 其他

第7章 依車輛類型分類的市場估計與預測,2022-2035年

- 轎車

- SUV

- 掀背車

第8章 2022-2035年各層級市場估算與預測

- 一級

- 二級

- 3級

- 4級

- 5級

9. 2022-2035年按推進方式分類的市場估計與預測

- 內燃機(ICE)

- 電動車(EV)

- 電池式電動車(BEV)

- 混合動力電動車(HCEV)

- 燃料電池汽車(FCEV)

- 混合

第10章 按分銷管道分類的市場估算與預測,2022-2035年

- OEM

- 售後市場

第11章 2022-2035年各地區市場估計與預測

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐國家

- 葡萄牙

- 克羅埃西亞

- 比荷盧經濟聯盟

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 新加坡

- 泰國

- 印尼

- 越南

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥倫比亞

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

第12章:公司簡介

- 世界公司

- Aisin

- Aptiv

- Autoliv

- Bosch

- Continental

- Denso

- Harman

- Hella Forvia

- Magna International

- Mobileye

- Renesas Electronics

- Texas Instruments

- Valeo

- ZF Friedrichshafen

- 區域玩家

- Ambarella

- Clarion

- Ficosa

- Gentex

- Siemens

- Emerging/Disruptor Players

- Black Sesame Technologies

- Horizon Robotics

- Innoviz Technologies

- Luminar Technologies

- Mobileye Vision Technologies(China)

- Spark Minda

- Uhnder

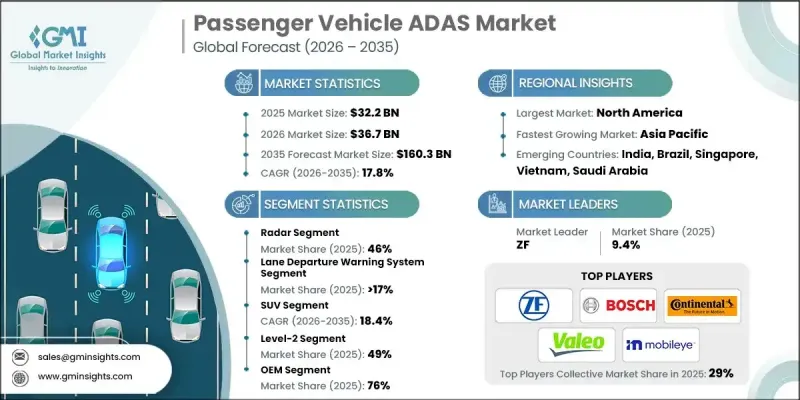

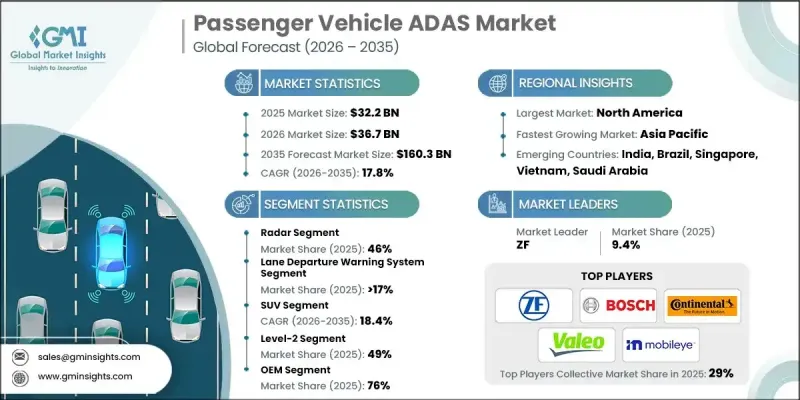

The Global Passenger Vehicle ADAS Market was valued at USD 32.2 billion in 2025 and is estimated to grow at a CAGR of 17.8% to reach USD 160.3 billion by 2035.

Growth is attributed to stricter government safety policies and evolving vehicle assessment standards that encourage automakers to integrate advanced driver assistance capabilities to meet compliance targets and enhance competitiveness. Buyers are increasingly prioritizing protection, driving ease, and reduced fatigue, which is supporting higher adoption of intelligent assistance technologies across passenger vehicles. Improvements in chip manufacturing efficiency, large-scale production, and intensified supplier competition have lowered system costs, allowing ADAS penetration to expand beyond premium models without significantly impacting vehicle pricing. Manufacturers are actively leveraging ADAS feature sets as a strategic tool to strengthen brand perception, support pricing strategies, and build long-term customer loyalty. Increased consumer familiarity with driver assistance technologies continues to reinforce demand, positioning ADAS as a core component of modern passenger vehicle design.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $32.2 Billion |

| Forecast Value | $160.3 Billion |

| CAGR | 17.8% |

The radar segment held 46% share in 2025. Radar systems are positioned as a foundational sensing technology within ADAS architectures due to their consistent performance and reliability. At the same time, image sensors are recognized for delivering detailed visual inputs that support accurate system interpretation. Advancements in sensor resolution and processing capability have improved overall system accuracy and robustness, reinforcing the role of multi-sensor integration in next-generation ADAS deployments.

The lane departure warning system segment held 17% share in 2025, with a valuation of approximately USD 5.5 billion. This segment benefits from the growing demand for driving assistance solutions that help reduce driver workload and improve comfort during extended vehicle operation. The system's ability to support stable vehicle positioning contributes to higher user confidence and sustained attention, factors that are driving its increasing acceptance among passenger vehicle owners.

U.S. Passenger Vehicle ADAS Market was valued at USD 10.7 billion in 2025. Adoption is supported by rising interest in advanced assistance capabilities, manufacturer-led feature differentiation, and broader availability of intelligent driving functions. Software-centric vehicle platforms and remote update capabilities are accelerating feature enhancements and enabling new revenue models across vehicle categories. Regulatory developments are also gradually supporting more advanced automation levels under controlled conditions through structured deployment frameworks.

Key companies active in the Global Passenger Vehicle ADAS Market include Bosch, Mobileye, Continental, Valeo, Aptiv, ZF, Magna International, Denso, Autoliv, Harman, Siemens, and Clarion. Companies operating in the Global Passenger Vehicle ADAS Market are reinforcing their market position through continuous innovation, strategic partnerships, and scalable product development. Leading players are investing heavily in sensor fusion, software intelligence, and system integration to deliver reliable and cost-effective solutions. Collaboration with automakers is helping suppliers align technologies with evolving vehicle platforms and regulatory expectations. Firms are also focusing on modular architectures that allow flexible deployment across different vehicle segments. Expansion of global production capacity and long-term supply agreements are being used to improve cost efficiency and market reach.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 System

- 2.2.3 Sensor

- 2.2.4 Vehicle

- 2.2.5 Level

- 2.2.6 Propulsion

- 2.2.7 Distribution Channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook & strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Regulatory safety mandates

- 3.2.1.3 Consumer preference for safer vehicles

- 3.2.1.4 Technology cost reduction

- 3.2.1.5 OEM differentiation strategies

- 3.2.1.6 Growth of electric vehicles

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High system integration complexity

- 3.2.2.2 Regulatory uncertainty for higher automation

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of Level 2+ and Level 3 systems

- 3.2.3.2 Advancement in sensor fusion and AI

- 3.2.3.3 Aftermarket and retrofit potential

- 3.2.3.4 Data monetization and software services

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S. - Federal Motor Vehicle Safety Standards (FMVSS)

- 3.4.1.2 Canada - Motor Vehicle Safety Regulations

- 3.4.2 Europe

- 3.4.2.1 UK - Road Vehicles (Construction and Use) Regulations

- 3.4.2.2 Germany - Autonomous Driving Act

- 3.4.2.3 France - Mobility Orientation Law (LOM)

- 3.4.2.4 Italy - Highway Code (Codice della Strada)

- 3.4.2.5 Spain - General Traffic Regulation

- 3.4.3 Asia Pacific

- 3.4.3.1 China - Intelligent Connected Vehicle Regulations

- 3.4.3.2 Japan - Road Transport Vehicle Act

- 3.4.3.3 India - Central Motor Vehicle Rules

- 3.4.4 Latin America

- 3.4.4.1 Brazil - National Traffic Code

- 3.4.4.2 Mexico - Official Mexican Vehicle Safety Standards (NOM)

- 3.4.4.3 Argentina - National Traffic Law

- 3.4.5 Middle East & Africa

- 3.4.5.1 UAE - Federal Traffic Law

- 3.4.5.2 South Africa - National Road Traffic Act

- 3.4.5.3 Saudi Arabia - Traffic Law

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Production statistics

- 3.8.1 Production hubs

- 3.8.2 Consumption hubs

- 3.8.3 Export and import

- 3.9 Cost breakdown analysis

- 3.9.1 Development cost structure

- 3.9.2 R&D cost analysis

- 3.9.3 Marketing & sales costs

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.12 ADAS standards, validation & safety ratings impact

- 3.12.1 Euro NCAP, Global NCAP & IIHS rating impact on ADAS adoption

- 3.12.2 UNECE regulations (R79, R152, R157) and OEM compliance pathways

- 3.12.3 Homologation, validation & testing requirements by automation level

- 3.12.4 Impact of safety ratings on OEM feature packaging & pricing

- 3.13 ADAS software & compute architecture landscape

- 3.13.1 Centralized vs domain vs zonal ADAS architectures

- 3.13.2 SoC and ECU evolution (ADAS ECUs → centralized compute)

- 3.13.3 Middleware, operating systems & real-time constraints

- 3.13.4 OTA update readiness & software lifecycle implications

- 3.14 ADAS Cost vs Willingness-to-Pay

- 3.15 ADAS Data, Cybersecurity & Functional Safety (ISO 26262 / SOTIF)

- 3.16 OEM ADAS Roadmap & Feature Migration Analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By System, 2022 - 2035 ($Bn)

- 5.1 Key trends

- 5.2 Adaptive cruise control

- 5.3 Blind spot detection

- 5.4 Lane departure warning system

- 5.5 Automatic emergency braking (AEB)

- 5.6 Forward collision warning

- 5.7 Night vision system

- 5.8 Driver monitoring

- 5.9 Tire pressure monitoring system

- 5.10 Head-up display

- 5.11 Park assist system

- 5.12 Others

Chapter 6 Market Estimates & Forecast, By Sensor, 2022 - 2035 ($Bn, Units)

- 6.1 Key trends

- 6.2 Radar

- 6.3 Lidar

- 6.4 Ultrasonic

- 6.5 Camera

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn, Units)

- 7.1 Key trends

- 7.2 Sedan

- 7.3 SUV

- 7.4 Hatchback

Chapter 8 Market Estimates & Forecast, By Level, 2022-2035 ($Bn, Units)

- 8.1 Key trends

- 8.2 Level-1

- 8.3 Level-2

- 8.4 Level-3

- 8.5 Level-4

- 8.6 Level-5

Chapter 9 Market Estimates & Forecast, By Propulsion, 2022 - 2035 ($Bn, Units)

- 9.1 Key trends

- 9.2 ICE

- 9.3 EV

- 9.3.1 BEV

- 9.3.2 HCEV

- 9.3.3 FCEV

- 9.4 Hybrid

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035 ($Bn, Units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.3.8 Portugal

- 11.3.9 Croatia

- 11.3.10 Benelux

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Singapore

- 11.4.7 Thailand

- 11.4.8 Indonesia

- 11.4.9 Vietnam

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Colombia

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

- 11.6.4 Turkey

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 Aisin

- 12.1.2 Aptiv

- 12.1.3 Autoliv

- 12.1.4 Bosch

- 12.1.5 Continental

- 12.1.6 Denso

- 12.1.7 Harman

- 12.1.8 Hella Forvia

- 12.1.9 Magna International

- 12.1.10 Mobileye

- 12.1.11 Renesas Electronics

- 12.1.12 Texas Instruments

- 12.1.13 Valeo

- 12.1.14 ZF Friedrichshafen

- 12.2 Regional Players

- 12.2.1 Ambarella

- 12.2.2 Clarion

- 12.2.3 Ficosa

- 12.2.4 Gentex

- 12.2.5 Siemens

- 12.3 Emerging / Disruptor Players

- 12.3.1 Black Sesame Technologies

- 12.3.2 Horizon Robotics

- 12.3.3 Innoviz Technologies

- 12.3.4 Luminar Technologies

- 12.3.5 Mobileye Vision Technologies (China)

- 12.3.6 Spark Minda

- 12.3.7 Uhnder