|

市場調查報告書

商品編碼

1906300

全球橡膠加工油市場(至2030年):按類型(環烷油、石蠟油、TDAE、DAE、MES、RAE、TRAE)、應用(輪胎、工業橡膠製品、油基聚合物、熱可塑性橡膠)、黏度和地區分類Rubber Process Oil Market by Type (Naphthenic, Paraffinic, TDAE, DAE, MES, RAE, and TRAE), Application (Tires, Industrial Rubber Products, Oil-extended Polymers, and Thermoplastic Elastomers), Viscosity, and Region - Global Forecast to 2030 |

||||||

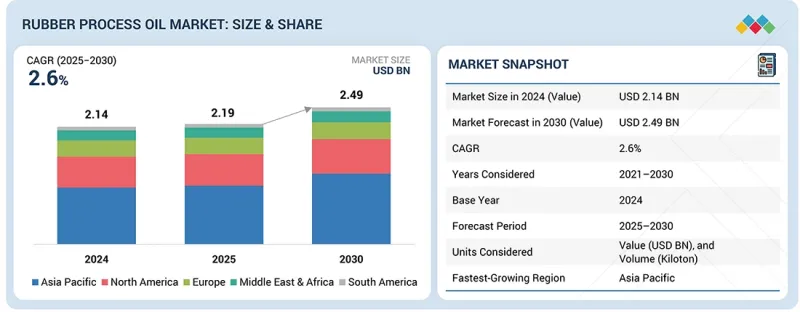

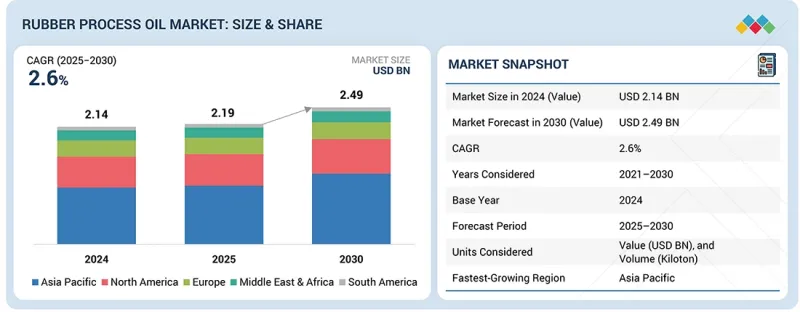

全球橡膠加工油市場預計將從 2025 年的 21.9 億美元成長到 2030 年的 24.9 億美元,預測期內複合年成長率為 2.6%。

橡膠加工油在改善天然橡膠和合成橡膠化合物的加工性能方面發揮著至關重要的作用。

| 調查範圍 | |

|---|---|

| 調查期 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 金額(美元),數量(千噸) |

| 部分 | 類型、黏度和應用 |

| 目標區域 | 北美洲、亞太地區、歐洲、中東和非洲、南美洲 |

這些油品透過改善填料分散性、降低黏度並實現更順暢的混煉操作,從而支持輪胎、工業橡膠製品、熱可塑性橡膠和油基聚合物的穩定生產。市場正日益受到不斷變化的混煉要求的影響,製造商正專注於更清潔、低多環芳烴 (PAH) 含量以及針對特定應用的油品,以滿足不斷變化的監管標準和性能預期。隨著橡膠混煉製程日益專業化以及生產線效率要求的提高,不同黏度範圍和萃取類型的客製化橡膠顆粒油 (RPO) 的重要性也在穩步成長。

「按類型分類,預計在預測期內,經處理的蒸餾芳香提取物 (TDAE) 細分市場將佔據第二大佔有率(以金額為準)。”

TDAE在性能、安全性和成本方面實現了卓越的平衡,使其成為眾多橡膠應用領域的首選。隨著監管標準逐步淘汰高多環芳烴(PAH)含量的芳香油,許多輪胎和工業橡膠製造商正轉向TDAE,將其作為更安全、更合規的替代方案,同時保持傳統配方所需的易加工性、優異的回彈性和相容性。 TDAE能夠保持膠料的柔軟性,改善分散性,並提供出色的滾動阻力和耐熱性能,使其成為標準輪胎和中高性能輪胎的可靠之選。此外,其易得性和經濟性也使其能夠被大批量生產商所接受。 TDAE兼具合規性、可靠的性能和成本效益,使其成為RPO市場第二大細分市場,並保持對輪胎和非輪胎橡膠產品的穩定需求。

按應用領域分類,預計工業橡膠領域在預測期內將佔據第二大市場佔有率。

由於工業橡膠廣泛應用於皮帶、軟管、墊圈、密封件和模製件等眾多產品,預計在預測期內,工業橡膠領域將成為第二大應用領域。橡膠加工油在工業橡膠製造中至關重要,因為它們可以提高柔軟性、改善填料分散性並確保穩定的加工性能。受工業化、基礎設施建設以及各行業對耐用、高性能橡膠部件的需求推動,預計該領域的需求將保持穩定。此外,製造商擴大採用高品質、低多環芳烴(PAH)含量的加工油,以在滿足環境和監管標準的同時保持產品性能。雖然輪胎製造仍然是按總量計算的最大應用領域,但由於工業橡膠的持續使用、廣泛的適用性以及對性能最佳化、符合監管要求的加工油日益成長的需求,該領域仍保持著強勁的地位。

預計在預測期內,北美將佔據第二大市場佔有率。

北美預計將繼續保持其在橡膠加工油市場的第二大地位,這主要得益於其在汽車製造業的強大實力、大規模的替換輪胎市場以及成熟的工業橡膠產業。該地區擁有成熟的生產能力,能夠生產大量對橡膠加工油品質要求極高的產品,例如輪胎、皮帶、軟管、墊圈和模壓橡膠零件。高性能和特殊橡膠材料的先進產品研發也推動了對更清潔、更精煉的RPO(例如TDAE和低PAH配方)的穩定需求。此外,該地區嚴格的法規環境也促進了更安全、更環保的油品的使用,並支持向更高價值的RPO類型轉型。憑藉穩定的煉油基礎、客戶對高品質材料的強烈偏好以及橡膠加工技術的不斷進步,北美在市場規模方面穩居第二,這得益於其持續的工業活動和強大的汽車產業生態系統。

本報告調查了全球橡膠加工油市場,並提供了市場概況、影響市場成長的各種因素分析、技術和專利趨勢、法律制度、案例研究、市場規模趨勢和預測、按各個細分市場、地區/主要國家進行的詳細分析、競爭格局以及主要企業的概況。

目錄

第1章 引言

第2章執行摘要

第3章重要考察

第4章 市場概覽

- 市場動態

- 促進要素

- 抑制因素

- 機會

- 任務

- 未滿足的需求和閒置頻段

- 與相關市場和不同產業相關的跨領域機遇

- 一級/二級/三級公司的策略性舉措

第5章 產業趨勢

- 波特五力分析

- 全球宏觀經濟展望

- 供應鏈分析

- 生態系分析

- 定價分析

- 貿易分析

- 2025-2026 年重要會議與活動

- 影響您業務的趨勢/顛覆性因素

- 投資和資金籌措方案

- 案例研究分析

- 川普關稅對橡膠加工油市場的影響

第6章:技術進步、人工智慧影響、專利、創新與未來應用

- 關鍵新興技術

- 生物基橡膠加工油

- 互補技術

- 用於提高橡膠加工油性能的先進添加劑

- 技術/產品藍圖

- 專利分析

- 未來應用

- 生成式人工智慧對橡膠加工油市場的影響

第7章永續性和監管環境

- 地方法規和合規性

- 對永續性的承諾

- 永續性影響和監管政策舉措

- 認證、標籤和環境標準

第8章:顧客狀況與購買行為

- 決策流程

- 主要相關利益者和採購標準

- 採用障礙和內部挑戰

- 各種應用中尚未滿足的需求

- 市場盈利

第9章 橡膠加工油市場(依黏度分類)

- 低黏度

- 中等黏度

- 高黏度

第10章 橡膠加工油市場依應用領域分類

- 胎

- 油基聚合物

- 工業橡膠製品

- 熱可塑性橡膠(TPE)

- 其他

第11章 橡膠加工油市場(按類型分類)

- 經處理的蒸餾芳香萃取物 (TDAE)

- 蒸餾香精(DAE)

- 溫和萃取溶劑 (MES)

- 殘留芳香萃取物 (RAE) 和處理後的殘留芳香萃取物 (TRAE)

- 石蠟

- 環烷烴

第12章 各地區橡膠加工油市場

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 印尼

- 泰國

- 其他

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 俄羅斯

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 其他

- 中東和非洲

- 海灣合作理事會國家

- 伊朗

- 其他

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他

第13章 競爭格局

- 主要參與企業的策略/優勢

- 收入分析

- 市佔率分析

- 品牌/產品對比

- 公司評估矩陣:主要企業

- 公司估值矩陣:Start-Ups/中小企業

- 競爭場景

- 估值和財務指標

第14章:公司簡介

- 主要企業

- SINOPEC

- PETROCHINA COMPANY LIMITED

- CHEVRON CORPORATION

- EXXON MOBIL CORPORATION

- SHELL PLC

- APAR INDUSTRIES LTD.

- PANAMA PETROCHEM LTD.

- BEHRAN OIL CO.

- ENILIVE SPA

- GANDHAR OIL REFINERY (INDIA) LIMITED

- HINDUSTAN PETROLEUM CORPORATION LIMITED

- INDIAN OIL CORPORATION LTD

- ORLEN UNIPETROL GROUP

- IDEMITSU KOSAN CO., LTD.

- REPSOL

- ORGKHIM BIOCHEMICAL HOLDING

- GPPL

- IRANOL (LLP)

- PETRO GULF INTERNATIONAL FZE

- CALUMET, INC.

- H&R GROUP

- NYNAS AB

- IRPC PUBLIC COMPANY LIMITED

- PT. ENERCO RPO INTERNASIONAL

- WITMANS INDUSTRIES PVT. LTD.

- THAIOIL GROUP

- SHANGDONG TIANYUAN CHEMICAL CO., LTD

- PSP SPECIALTIES PUBLIC COMPANY LIMITED

- 其他公司

- PETRO NAFT

- PANOL INDUSTRIES RMC FZE

- EAGLE PETROCHEM

- LODHA PETRO

- RLS PETROCHEM LUBRICANTS LLC

- GAZPROMNEFT-LUBRICANTS LTD.

第15章調查方法

第16章附錄

The global rubber process oil market is projected to grow from USD 2.19 billion in 2025 to USD 2.49 billion by 2030, at a CAGR of 2.6% during the forecast period. Rubber process oils play a critical role in improving the processing behavior and performance characteristics of both natural and synthetic rubber compounds.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), and Volume (Kiloton) |

| Segments | Type, Viscosity, and Application |

| Regions covered | North America, Asia Pacific, Europe, Middle East & Africa, and South America |

By enhancing filler dispersion, reducing viscosity, and enabling smoother mixing operations, these oils support consistent production of tires, industrial rubber goods, thermoplastic elastomers, and oil-extended polymers. The market is increasingly shaped by shifting formulation requirements, where manufacturers are focusing on cleaner, low-PAH, and more application-specific oils to meet evolving regulatory norms and performance expectations. As rubber formulations become more specialized and production lines demand higher efficiency, the relevance of tailored RPO grades-across viscosity ranges and extract types-continues to grow steadily.

"By type, treated distillate aromatic extract (TDAE) segment to account for second-largest share during forecast period in terms of value"

The treated distillate aromatic extract (TDAE) segment is estimated to account for the second-largest share of the rubber process oil market. TDAE strikes a strong balance between performance, safety, and cost, making it a preferred choice for a wide range of rubber applications. As regulatory norms continue to phase down high-PAH aromatic oils, many tire and industrial rubber manufacturers are adopting TDAE as a safer and more compliant alternative, yet one that still offers the processing ease, elasticity improvement, and compatibility required in traditional formulations. Its ability to maintain compound softness, enhance dispersion, and support better rolling and heat-resistance characteristics has made it a dependable option for both standard and mid-performance tire categories. At the same time, its availability and affordability keep it accessible for large-volume producers. This combination of regulatory alignment, performance reliability, and cost suitability has positioned TDAE as the second-largest segment in the RPO market, with steady demand across both tire and non-tire rubber products.

"By application, industrial rubber segment to account for second-largest market share during forecast period"

The industrial rubber segment is projected to be the second-largest application of rubber process oil during the forecast period due to its wide use in products such as belts, hoses, gaskets, seals, and molded components. Rubber process oils enhance flexibility, improve filler dispersion, and ensure consistent processing performance, making them essential for industrial rubber manufacturing. The segment benefits from steady demand driven by industrialization, infrastructure development, and the need for durable and high-performance rubber components across multiple sectors. Additionally, manufacturers increasingly adopt high-quality and low-PAH oils to comply with environmental and regulatory standards while maintaining product performance. Although tire manufacturing remains the largest application segment due to higher overall volume, industrial rubber maintains a strong position because of recurring usage, broad applicability, and rising demand for performance-optimized, regulation-compliant oils.

"North America to account for second-largest market share during forecast period"

North America is projected to be the second-largest market for rubber process oil due to its strong presence in automotive manufacturing, a large replacement tire market, and a well-established industrial rubber sector. The region benefits from mature production capabilities for tires, belts, hoses, gaskets, and molded rubber components, all of which rely heavily on consistent and high-quality rubber process oils. Advanced product development in high-performance and specialty rubber materials also drives steady demand for cleaner and more refined RPO grades, including TDAE and low-PAH formulations. In addition, the region's robust regulatory environment encourages the use of safer, environmentally aligned oils, reinforcing the shift toward higher-value RPO types. A stable refining base, strong customer preference for premium-quality materials, and continuous upgrades in rubber processing technologies collectively position North America as the second-largest regional market, supported by sustained industrial activity and a strong automotive ecosystem.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 65%, Tier 2 - 20%, and Tier 3 - 15%

- By Designation: Directors - 25%, Managers - 30%, and Others - 45%

- By Region: North America - 30%, Asia Pacific - 40%, Europe - 20%, Middle East & Africa - 7%, and South America - 3%

Sinopec (China), Exxon Mobil Corporation (US), PetroChina Company Limited (China), Chevron Corporation (US), and Shell plc (UK) are some of the major players operating in the rubber process oil market.

Research Coverage:

The report segments the rubber process oil market based on type, viscosity, application, and region. It provides detailed information regarding the major factors influencing the market's growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles rubber process oil manufacturers, comprehensively analyzing their market shares and core competencies.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants by providing them with the closest approximations of revenue numbers of the rubber process oil market and its segments. This report is also expected to help stakeholders obtain an improved understanding of the market's competitive landscape, gain insights to improve the position of their businesses, and make suitable go-to-market strategies. It also enables stakeholders to understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of critical Drivers (Rising global vehicle production-including passenger cars, MHCVs, and off-highway vehicles-along with increasing aftermarket tire replacements, is boosting tire output and driving demand for rubber process oils; Growth in synthetic rubber production; Rising demand for low-PAH, low-viscosity, and specialty oils), Restraints (Stringent global regulations on aromatic RPO (EU, US, China), Substitution by bio-based/sustainable plasticizers, Declining availability of suitable Group I/II base oils), Opportunities (Rising demand for green/biodegradable rubber oils; New tire plant investments across Asia, MEA, and Eastern Europe; Rising demand for luxury vehicles and electric cars boosting need for high-performance tires), and Challenges (Fluctuating prices of key RPO feedstocks such as crude-derived distillates and aromatic extracts)

- Product Development/Innovation: Detailed insights on upcoming technologies and research & development activities in the rubber process oil market

- Market Development: Comprehensive information about lucrative markets - the report analyses the rubber process oil market across varied regions.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as Sinopec (China), Exxon Mobil Corporation (US), PetroChina Company Limited (China), Chevron Corporation (US), and Shell plc (UK) in the rubber process oil market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN RUBBER PROCESS OIL MARKET

- 2.4 HIGH GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RUBBER PROCESS OIL MARKET

- 3.2 RUBBER PROCESS OIL MARKET, BY REGION

- 3.3 RUBBER PROCESS OIL MARKET, BY TYPE

- 3.4 RUBBER PROCESS OIL MARKET, BY KEY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rising global vehicle production, along with increasing aftermarket tire replacements, boosting tire output

- 4.2.1.2 Growth in synthetic rubber production

- 4.2.1.3 Rising demand for low-PAH, low-viscosity, and specialty oils

- 4.2.2 RESTRAINTS

- 4.2.2.1 Stringent global regulations on aromatic RPO (EU, US, China)

- 4.2.2.2 Substitution by bio-based/sustainable plasticizers

- 4.2.2.3 Declining availability of suitable Group I/II base oils

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Rising demand for green/biodegradable rubber oils

- 4.2.3.2 New tire plant investments across Asia, MEA, and Eastern Europe

- 4.2.3.3 Rising demand for luxury vehicles and electric cars boosting need for high-performance tires

- 4.2.4 CHALLENGES

- 4.2.4.1 Fluctuating prices of key RPO feedstocks, such as crude-derived distillates and aromatic extracts, create cost pressures

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN RUBBER PROCESS OIL MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.5.1 KEY MOVES AND STRATEGIC FOCUS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 BARGAINING POWER OF SUPPLIERS

- 5.1.2 BARGAINING POWER OF BUYERS

- 5.1.3 THREAT OF NEW ENTRANTS

- 5.1.4 THREAT OF SUBSTITUTES

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 GLOBAL MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL RUBBER PROCESS OIL INDUSTRY

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.3.1 RAW MATERIAL SUPPLY

- 5.3.2 RUBBER PROCESS OIL PRODUCTION

- 5.3.3 RUBBER PROCESS OIL TYPES

- 5.3.4 DISTRIBUTORS

- 5.3.5 END-USE INDUSTRIES

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF RUBBER PROCESS OIL, BY REGION, 2022-2025

- 5.5.2 AVERAGE SELLING PRICE OF RUBBER PROCESS OIL TYPE, BY KEY PLAYER, 2025

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT SCENARIO (HS CODE 2709)

- 5.6.2 EXPORT SCENARIO (HS CODE 2709)

- 5.7 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 RRII (RUBBER RESEARCH INSTITUTE) - INDIAN OIL COLLABORATION ON ADVANCED RUBBER PROCESS OIL APPLICATIONS

- 5.10.2 REPSOL'S BIOEXTENSOIL - A CIRCULAR AND HIGH-PERFORMANCE ALTERNATIVE TO MINERAL RUBBER PROCESS OILS

- 5.10.3 SHELL FLAVEX 595 - ENABLING COMPLIANCE AND HIGH-PERFORMANCE TIRE MANUFACTURING

- 5.11 TRUMP TARIFF IMPACT ON RUBBER PROCESS OIL MARKET

- 5.11.1 KEY TARIFF RATES IMPACTING MARKET

- 5.11.2 PRICE IMPACT ANALYSIS

- 5.11.3 KEY IMPACT ON VARIOUS REGIONS

- 5.11.3.1 US

- 5.11.3.2 Europe

- 5.11.3.3 Asia Pacific

- 5.11.4 IMPACT ON END-USE INDUSTRIES OF RUBBER PROCESS OIL MARKET

- 5.11.4.1 Tires

- 5.11.4.2 Oil-extended polymers

- 5.11.4.3 Industrial rubber products

- 5.11.4.4 Thermoplastic elastomers (TPEs)

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 BIO-BASED RUBBER PROCESS OILS

- 6.1.1.1 Introduction: A shift toward sustainable processing oils

- 6.1.1.2 Renewable feedstocks driving material transformation

- 6.1.1.3 Regulatory alignment and industry-wide adoption momentum

- 6.1.1.4 Market impact and long-term strategic relevance

- 6.1.1 BIO-BASED RUBBER PROCESS OILS

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 ADVANCED ADDITIVES FOR ENHANCED PERFORMANCE IN RUBBER PROCESS OILS

- 6.2.2 TECHNOLOGY/PRODUCT ROADMAP

- 6.2.2.1 Short-term (2025-2027) | process efficiency & low-PCA compliance

- 6.2.2.2 Mid-term (2027-2030) | sustainability transition & value-added formulations

- 6.2.2.3 Long-term (2030-2035+) | circularity, high-performance synthesis & next-gen RPO

- 6.3 PATENT ANALYSIS

- 6.3.1 METHODOLOGY

- 6.4 FUTURE APPLICATIONS

- 6.4.1 TIRES: ENHANCED FLEXIBILITY AND PROCESSING EFFICIENCY

- 6.4.2 OIL-EXTENDED POLYMERS: IMPROVED POLYMER FLOW AND REDUCED VISCOSITY

- 6.4.3 INDUSTRIAL RUBBER PRODUCTS: SUPPORTED ELASTICITY AND UNIFORM COMPOUNDING

- 6.4.4 THERMOPLASTIC ELASTOMERS (TPE): FACILITATED SOFTENING AND MELT-FLOW BEHAVIOR

- 6.5 IMPACT OF GENERATIVE AI ON RUBBER PROCESS OIL MARKET

- 6.5.1 INTRODUCTION

- 6.5.2 AI-DRIVEN FORMULATION INNOVATION

- 6.5.3 SMART MANUFACTURING AND PROCESS OPTIMIZATION

- 6.5.4 MARKET INSIGHT AND PRODUCT POSITIONING

- 6.5.5 CUSTOMER COLLABORATION AND VALUE-ADDED SERVICES

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF RUBBER PROCESS OIL

- 7.2.1.1 Carbon Impact Reduction

- 7.2.1.2 Eco-applications

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF RUBBER PROCESS OIL

- 7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 7.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS IN VARIOUS APPLICATIONS

- 8.5 MARKET PROFITABILITY

- 8.5.1 REVENUE POTENTIAL

- 8.5.2 COST DYNAMICS

- 8.5.3 MARGIN OPPORTUNITIES IN KEY APPLICATIONS

9 RUBBER PROCESS OIL MARKET, BY VISCOSITY

- 9.1 INTRODUCTION

- 9.2 LOW VISCOSITY

- 9.2.1 GROWING FOCUS ON EFFICIENT, EASY-PROCESSING RUBBER FORMULATIONS

- 9.3 MEDIUM VISCOSITY

- 9.3.1 BROAD ADAPTABILITY AND CONSISTENT PERFORMANCE

- 9.4 HIGH VISCOSITY

- 9.4.1 RISE IN DEMAND FOR DURABLE, HIGH-PERFORMANCE RUBBER PRODUCTS

10 RUBBER PROCESS OIL MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 TIRES

- 10.2.1 RISING DEMAND FOR HIGH-PERFORMANCE, DURABLE, AND ENVIRONMENTALLY COMPLIANT TIRES

- 10.3 OIL-EXTENDED POLYMERS

- 10.3.1 GROWING USE OF OIL-EXTENDED POLYMERS IN HIGH-PERFORMANCE RUBBER PRODUCTS

- 10.4 INDUSTRIAL RUBBER PRODUCTS

- 10.4.1 INCREASING NEED FOR DURABLE, HIGH-PERFORMANCE, AND COMPLIANT INDUSTRIAL RUBBER PRODUCTS

- 10.5 THERMOPLASTIC ELASTOMERS (TPE)

- 10.5.1 RISING ADOPTION OF THERMOPLASTIC ELASTOMERS IN VERSATILE AND HIGH-PERFORMANCE APPLICATIONS

- 10.6 OTHER APPLICATIONS

11 RUBBER PROCESS OIL MARKET, BY TYPE

- 11.1 INTRODUCTION

- 11.2 TREATED DISTILLATE AROMATIC EXTRACT (TDAE)

- 11.2.1 RISING PREFERENCE FOR CLEANER, REGULATION-COMPLIANT, AND HIGH-PERFORMANCE RUBBER PROCESS OILS

- 11.3 DISTILLATE AROMATIC EXTRACT (DAE)

- 11.3.1 CONTINUED USE OF COST-EFFECTIVE, HIGH-SOLVENCY AROMATIC OILS LIKE DAE IN KEY RUBBER PROCESSING APPLICATIONS

- 11.4 MILD EXTRACTED SOLVATE (MES)

- 11.4.1 INCREASING INDUSTRY SHIFT TOWARD LOW-PAH, ENVIRONMENTALLY COMPLIANT, AND PERFORMANCE-STABLE RUBBER PROCESS OILS

- 11.5 RESIDUAL AROMATIC EXTRACT (RAE) AND TREATED RESIDUAL AROMATIC EXTRACT (TRAE)

- 11.5.1 STEADY USE OF RAE AND GROWING ADOPTION OF CLEANER TRAE GRADES

- 11.6 PARAFFINIC

- 11.6.1 RISING NEED FOR CLEAN, THERMALLY STABLE, AND HIGH-PERFORMANCE RUBBER FORMULATIONS

- 11.7 NAPHTHENIC

- 11.7.1 NEED FOR EFFICIENT, FLEXIBLE, AND WIDE-COMPATIBILITY PROCESSING OILS

12 RUBBER PROCESS OIL MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 CHINA

- 12.2.1.1 Increasing vehicle and tire production in China boosting rubber compounding activity

- 12.2.2 JAPAN

- 12.2.2.1 Advanced tire manufacturing and precision-focused industrial rubber production

- 12.2.3 INDIA

- 12.2.3.1 Strong replacement-driven tire growth and expanding industrial rubber production

- 12.2.4 SOUTH KOREA

- 12.2.4.1 Growing vehicle production and strong industrial rubber manufacturing base

- 12.2.5 INDONESIA

- 12.2.5.1 Expansion of industrial rubber manufacturing base and rise in domestic tire demand

- 12.2.6 THAILAND

- 12.2.6.1 Abundant natural rubber resources and growing domestic tire and industrial rubber production

- 12.2.7 REST OF ASIA PACIFIC

- 12.2.1 CHINA

- 12.3 NORTH AMERICA

- 12.3.1 US

- 12.3.1.1 Shift toward electric mobility strengthening demand dynamics for rubber process oils

- 12.3.2 CANADA

- 12.3.2.1 Growth in industrial production base and increasing need for durable, climate-resilient rubber components

- 12.3.3 MEXICO

- 12.3.3.1 Expansion of automotive manufacturing base and rising demand for cost-efficient, high-performance rubber goods

- 12.3.1 US

- 12.4 EUROPE

- 12.4.1 RUSSIA

- 12.4.1.1 Growing tire replacement needs and expanding industrial rubber production

- 12.4.2 GERMANY

- 12.4.2.1 Shift toward electric mobility and strong manufacturing demand for rubber-intensive components

- 12.4.3 UK

- 12.4.3.1 Expanding demand for high-quality rubber components and growing EV-related material production

- 12.4.4 FRANCE

- 12.4.4.1 Rising vehicle registrations and strong demand for tire and industrial rubber components

- 12.4.5 SPAIN

- 12.4.5.1 Rising tire demand and expanding industrial rubber manufacturing

- 12.4.6 ITALY

- 12.4.6.1 Strong tire manufacturing activity and rising demand for industrial rubber components

- 12.4.7 REST OF EUROPE

- 12.4.1 RUSSIA

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 GCC COUNTRIES

- 12.5.1.1 Saudi Arabia

- 12.5.1.1.1 Rising vehicle registrations and industrial expansion under Vision 2030

- 12.5.1.2 UAE

- 12.5.1.2.1 Growing vehicle usage, strong replacement demand, and rising industrial rubber consumption

- 12.5.1.3 Rest of GCC Countries

- 12.5.1.1 Saudi Arabia

- 12.5.2 IRAN

- 12.5.2.1 Expanding domestic tire production, increasing self-sufficiency, and rising output across multiple vehicle segments

- 12.5.3 REST OF MIDDLE EAST & AFRICA

- 12.5.1 GCC COUNTRIES

- 12.6 SOUTH AMERICA

- 12.6.1 BRAZIL

- 12.6.1.1 Expanding automotive activity, strong tire demand, and broad-based industrial rubber production

- 12.6.2 ARGENTINA

- 12.6.2.1 Sustained tire demand and expanding use of industrial rubber products

- 12.6.3 COLOMBIA

- 12.6.3.1 High demand for tires, mining-related rubber goods, and general industrial rubber components

- 12.6.4 REST OF SOUTH AMERICA

- 12.6.1 BRAZIL

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 REVENUE ANALYSIS

- 13.3.1 TOP 5 PLAYERS' REVENUE ANALYSIS

- 13.4 MARKET SHARE ANALYSIS

- 13.4.1 MARKET SHARE OF KEY PLAYERS

- 13.4.1.1 Sinopec (China)

- 13.4.1.2 PetroChina Company Limited (China)

- 13.4.1.3 Chevron Corporation (US)

- 13.4.1.4 Exxon Mobil Corporation (US)

- 13.4.1.5 Shell plc (UK)

- 13.4.1 MARKET SHARE OF KEY PLAYERS

- 13.5 BRAND/PRODUCT COMPARISON

- 13.5.1 POWEROIL FLEXOIL N

- 13.5.2 PANOL C 160-P

- 13.5.3 ENI CELTIS

- 13.5.4 DIVYOL PARAFFINIC OIL

- 13.5.5 CALSOL

- 13.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- 13.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.6.5.1 Company footprint

- 13.6.5.2 Region footprint

- 13.6.5.3 Viscosity footprint

- 13.6.5.4 Type footprint

- 13.6.5.5 Application footprint

- 13.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- 13.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.7.5.1 Detailed list of key startups/SMEs

- 13.7.5.2 Competitive benchmarking of key startups/SMEs

- 13.8 COMPETITIVE SCENARIO

- 13.8.1 PRODUCT LAUNCHES

- 13.8.2 DEALS

- 13.9 COMPANY VALUATION AND FINANCIAL METRICS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 SINOPEC

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 MnM view

- 14.1.1.3.1 Right to win

- 14.1.1.3.2 Strategic choices

- 14.1.1.3.3 Weaknesses and competitive threats

- 14.1.2 PETROCHINA COMPANY LIMITED

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 MnM view

- 14.1.2.3.1 Right to win

- 14.1.2.3.2 Strategic choices

- 14.1.2.3.3 Weaknesses and competitive threats

- 14.1.3 CHEVRON CORPORATION

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 MnM view

- 14.1.3.3.1 Right to win

- 14.1.3.3.2 Strategic choices

- 14.1.3.3.3 Weaknesses and competitive threats

- 14.1.4 EXXON MOBIL CORPORATION

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 MnM view

- 14.1.4.3.1 Right to win

- 14.1.4.3.2 Strategic choices

- 14.1.4.3.3 Weaknesses and competitive threats

- 14.1.5 SHELL PLC

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 MnM view

- 14.1.5.3.1 Right to win

- 14.1.5.3.2 Strategic choices

- 14.1.5.3.3 Weaknesses and competitive threats

- 14.1.6 APAR INDUSTRIES LTD.

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.7 PANAMA PETROCHEM LTD.

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.8 BEHRAN OIL CO.

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.9 ENILIVE S.P.A.

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.10 GANDHAR OIL REFINERY (INDIA) LIMITED

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.11 HINDUSTAN PETROLEUM CORPORATION LIMITED

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.12 INDIAN OIL CORPORATION LTD

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.13 ORLEN UNIPETROL GROUP

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.14 IDEMITSU KOSAN CO., LTD.

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Solutions/Services offered

- 14.1.15 REPSOL

- 14.1.15.1 Business overview

- 14.1.15.2 Products/Solutions/Services offered

- 14.1.16 ORGKHIM BIOCHEMICAL HOLDING

- 14.1.16.1 Business overview

- 14.1.16.2 Products/Solutions/Services offered

- 14.1.17 GPPL

- 14.1.17.1 Business overview

- 14.1.17.2 Products/Solutions/Services offered

- 14.1.18 IRANOL (LLP)

- 14.1.18.1 Business overview

- 14.1.18.2 Products/Solutions/Services offered

- 14.1.19 PETRO GULF INTERNATIONAL FZE

- 14.1.19.1 Business overview

- 14.1.19.2 Products/Solutions/Services offered

- 14.1.20 CALUMET, INC.

- 14.1.20.1 Business overview

- 14.1.20.2 Products/Solutions/Services offered

- 14.1.21 H&R GROUP

- 14.1.21.1 Business overview

- 14.1.21.2 Products/Solutions/Services offered

- 14.1.22 NYNAS AB

- 14.1.22.1 Business overview

- 14.1.22.2 Products/Solutions/Services offered

- 14.1.22.3 Recent developments

- 14.1.22.3.1 Product launches

- 14.1.23 IRPC PUBLIC COMPANY LIMITED

- 14.1.23.1 Business overview

- 14.1.23.2 Products/Solutions/Services offered

- 14.1.24 PT. ENERCO RPO INTERNASIONAL

- 14.1.24.1 Business overview

- 14.1.24.2 Products/Solutions/Services offered

- 14.1.24.3 Recent developments

- 14.1.24.3.1 Deals

- 14.1.25 WITMANS INDUSTRIES PVT. LTD.

- 14.1.25.1 Business overview

- 14.1.25.2 Products/Solutions/Services offered

- 14.1.26 THAIOIL GROUP

- 14.1.26.1 Business overview

- 14.1.26.2 Products/Solutions/Services offered

- 14.1.27 SHANGDONG TIANYUAN CHEMICAL CO., LTD

- 14.1.27.1 Business overview

- 14.1.27.2 Products/Solutions/Services offered

- 14.1.28 P.S.P. SPECIALTIES PUBLIC COMPANY LIMITED

- 14.1.28.1 Business overview

- 14.1.28.2 Products/Solutions/Services offered

- 14.1.1 SINOPEC

- 14.2 OTHER PLAYERS

- 14.2.1 PETRO NAFT

- 14.2.2 PANOL INDUSTRIES RMC FZE

- 14.2.3 EAGLE PETROCHEM

- 14.2.4 LODHA PETRO

- 14.2.5 RLS PETROCHEM LUBRICANTS LLC

- 14.2.6 GAZPROMNEFT - LUBRICANTS LTD.

15 RESEARCH METHODOLOGY

- 15.1 RESEARCH DATA

- 15.1.1 SECONDARY DATA

- 15.1.1.1 Key data from secondary sources

- 15.1.2 PRIMARY DATA

- 15.1.2.1 Key data from primary sources

- 15.1.2.2 List of primary interview participants (demand and supply sides)

- 15.1.2.3 Key industry insights

- 15.1.2.4 Breakdown of interviews with experts

- 15.1.1 SECONDARY DATA

- 15.2 MATRIX CONSIDERED FOR DEMAND-SIDE ANALYSIS

- 15.3 MARKET SIZE ESTIMATION

- 15.3.1 BOTTOM-UP APPROACH

- 15.3.2 TOP-DOWN APPROACH

- 15.3.2.1 Calculations for supply-side analysis

- 15.4 GROWTH FORECAST

- 15.5 DATA TRIANGULATION

- 15.6 RESEARCH ASSUMPTIONS

- 15.7 RESEARCH LIMITATIONS

- 15.8 RISK ASSESSMENT

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

List of Tables

- TABLE 1 GLOBAL TIRE MANUFACTURING CAPACITY EXPANSIONS

- TABLE 2 RUBBER PROCESS OIL MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE), BY KEY COUNTRY, 2022-2024 (%)

- TABLE 4 UNEMPLOYMENT RATE, BY KEY COUNTRY, 2022-2024 (%)

- TABLE 5 INFLATION RATE AVERAGE CONSUMER PRICES, BY KEY COUNTRY, 2022-2024 (%)

- TABLE 6 FOREIGN DIRECT INVESTMENT, BY REGION, 2022 & 2023 (USD BILLION)

- TABLE 7 ROLES OF COMPANIES IN RUBBER PROCESS OIL ECOSYSTEM

- TABLE 8 AVERAGE SELLING PRICE TREND OF LITHIUM-ION RUBBER PROCESS OIL, BY REGION, 2022-2025 (USD/TON)

- TABLE 9 AVERAGE SELLING PRICE TREND OF LITHIUM-ION RUBBER PROCESS OIL, BY KEY PLAYER, 2025 (USD/TON)

- TABLE 10 IMPORT DATA FOR HS CODE 2709, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 11 EXPORT DATA FOR HS CODE 2709, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 12 RUBBER PROCESS OIL MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 13 RUBBER PROCESS OIL MARKET: LIST OF MAJOR PATENTS, 2014-2024

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 GLOBAL STANDARDS IN RUBBER PROCESS OIL MARKET

- TABLE 18 CERTIFICATIONS, LABELING, AND ECO-STANDARDS IN RUBBER PROCESS OIL MARKET

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 20 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 21 RUBBER PROCESS OIL MARKET: UNMET NEEDS IN KEY APPLICATIONS

- TABLE 22 RUBBER PROCESS OIL MARKET, BY VISCOSITY, 2021-2024 (USD MILLION)

- TABLE 23 RUBBER PROCESS OIL MARKET, BY VISCOSITY, 2025-2030 (USD MILLION)

- TABLE 24 RUBBER PROCESS OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 25 RUBBER PROCESS OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 26 RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 27 RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 28 RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 29 RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 30 RUBBER PROCESS OIL MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 31 RUBBER PROCESS OIL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 RUBBER PROCESS OIL MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 33 RUBBER PROCESS OIL MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 34 ASIA PACIFIC: RUBBER PROCESS OIL MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 35 ASIA PACIFIC: RUBBER PROCESS OIL MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 36 ASIA PACIFIC: RUBBER PROCESS OIL MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 37 ASIA PACIFIC: RUBBER PROCESS OIL MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 38 ASIA PACIFIC: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 39 ASIA PACIFIC: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 40 ASIA PACIFIC: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 41 ASIA PACIFIC: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 42 CHINA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 43 CHINA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 44 CHINA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 45 CHINA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 46 JAPAN: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 47 JAPAN: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 48 JAPAN: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 49 JAPAN: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 50 INDIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 51 INDIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 52 INDIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 53 INDIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 54 SOUTH KOREA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 55 SOUTH KOREA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 56 SOUTH KOREA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 57 SOUTH KOREA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 58 INDONESIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 59 INDONESIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 60 INDONESIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 61 INDONESIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 62 THAILAND: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 63 THAILAND: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 64 THAILAND: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 65 THAILAND: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 66 REST OF ASIA PACIFIC: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 67 REST OF ASIA PACIFIC: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 68 REST OF ASIA PACIFIC: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 69 REST OF ASIA PACIFIC: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 70 NORTH AMERICA: RUBBER PROCESS OIL MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 71 NORTH AMERICA: RUBBER PROCESS OIL MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: RUBBER PROCESS OIL MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 73 NORTH AMERICA: RUBBER PROCESS OIL MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 74 NORTH AMERICA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 75 NORTH AMERICA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 77 NORTH AMERICA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 78 US: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 79 US: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 80 US: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 81 US: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 82 CANADA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 83 CANADA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 84 CANADA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 85 CANADA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 86 MEXICO: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 87 MEXICO: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 88 MEXICO: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 89 MEXICO: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 90 EUROPE: RUBBER PROCESS OIL MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 91 EUROPE: RUBBER PROCESS OIL MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 92 EUROPE: RUBBER PROCESS OIL MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 93 EUROPE: RUBBER PROCESS OIL MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 94 EUROPE: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 95 EUROPE: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 96 EUROPE: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 97 EUROPE: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 98 RUSSIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 99 RUSSIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 100 RUSSIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 101 RUSSIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 102 GERMANY: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 103 GERMANY: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 104 GERMANY: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 105 GERMANY: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 106 UK: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 107 UK: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 108 UK: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 109 UK: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 110 FRANCE: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 111 FRANCE: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 112 FRANCE: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 113 FRANCE: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 114 SPAIN: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 115 SPAIN: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 116 SPAIN: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 117 SPAIN: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 118 ITALY: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 119 ITALY: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 120 ITALY: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 121 ITALY: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 122 REST OF EUROPE: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 123 REST OF EUROPE: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 124 REST OF EUROPE: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 125 REST OF EUROPE: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 126 MIDDLE EAST & AFRICA: RUBBER PROCESS OIL MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: RUBBER PROCESS OIL MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: RUBBER PROCESS OIL MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 129 MIDDLE EAST & AFRICA: RUBBER PROCESS OIL MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 130 MIDDLE EAST & AFRICA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 133 MIDDLE EAST & AFRICA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 134 SAUDI ARABIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 135 SAUDI ARABIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 136 SAUDI ARABIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 137 SAUDI ARABIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 138 UAE: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 139 UAE: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 140 UAE: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 141 UAE: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 142 REST OF GCC COUNTRIES: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 143 REST OF GCC COUNTRIES: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 144 REST OF GCC COUNTRIES: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 145 REST OF GCC COUNTRIES: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 146 IRAN: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 147 IRAN: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 148 IRAN: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 149 IRAN: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 150 REST OF MIDDLE EAST & AFRICA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 151 REST OF MIDDLE EAST & AFRICA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 152 REST OF MIDDLE EAST & AFRICA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 153 REST OF MIDDLE EAST & AFRICA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 154 SOUTH AMERICA: RUBBER PROCESS OIL MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 155 SOUTH AMERICA: RUBBER PROCESS OIL MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 156 SOUTH AMERICA: RUBBER PROCESS OIL MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 157 SOUTH AMERICA: RUBBER PROCESS OIL MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 158 SOUTH AMERICA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 159 SOUTH AMERICA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 160 SOUTH AMERICA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 161 SOUTH AMERICA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 162 BRAZIL: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 163 BRAZIL: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 164 BRAZIL: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 165 BRAZIL: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 166 ARGENTINA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 167 ARGENTINA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 168 ARGENTINA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 169 ARGENTINA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 170 COLOMBIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 171 COLOMBIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 172 COLOMBIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 173 COLOMBIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 174 REST OF SOUTH AMERICA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 175 REST OF SOUTH AMERICA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 176 REST OF SOUTH AMERICA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 177 REST OF SOUTH AMERICA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 178 RUBBER PROCESS OIL MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, (2020-2025)

- TABLE 179 RUBBER PROCESS OIL MARKET: DEGREE OF COMPETITION, 2024

- TABLE 180 RUBBER PROCESS OIL MARKET: REGION FOOTPRINT

- TABLE 181 RUBBER PROCESS OIL MARKET: VISCOSITY FOOTPRINT

- TABLE 182 RUBBER PROCESS OIL MARKET: TYPE FOOTPRINT

- TABLE 183 RUBBER PROCESS OIL MARKET: APPLICATION FOOTPRINT

- TABLE 184 RUBBER PROCESS OIL MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 185 RUBBER PROCESS OIL MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 186 RUBBER PROCESS OIL MARKET: PRODUCT LAUNCHES, JANUARY 2020- NOVEMBER 2025

- TABLE 187 RUBBER PROCESS OIL MARKET: DEALS, JANUARY 2020-NOVEMBER 2025

- TABLE 188 SINOPEC: COMPANY OVERVIEW

- TABLE 189 SINOPEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 PETROCHINA COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 191 PETROCHINA COMPANY LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 CHEVRON CORPORATION: COMPANY OVERVIEW

- TABLE 193 CHEVRON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 EXXON MOBIL CORPORATION: COMPANY OVERVIEW

- TABLE 195 EXXON MOBIL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 SHELL PLC: COMPANY OVERVIEW

- TABLE 197 SHELL PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 APAR INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 199 APAR INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 PANAMA PETROCHEM LTD.: COMPANY OVERVIEW

- TABLE 201 PANAMA PETROCHEM LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 BEHRAN OIL CO.: COMPANY OVERVIEW

- TABLE 203 BEHRAN OIL CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 ENILIVE S.P.A.: COMPANY OVERVIEW

- TABLE 205 ENILIVE S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 GANDHAR OIL REFINERY (INDIA) LIMITED: COMPANY OVERVIEW

- TABLE 207 GANDHAR OIL REFINERY (INDIA) LIMITED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 208 HINDUSTAN PETROLEUM CORPORATION LIMITED: COMPANY OVERVIEW

- TABLE 209 HINDUSTAN PETROLEUM CORPORATION LIMITED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 210 INDIAN OIL CORPORATION LTD: COMPANY OVERVIEW

- TABLE 211 INDIAN OIL CORPORATION LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 ORLEN UNIPETROL GROUP: COMPANY OVERVIEW

- TABLE 213 ORLEN UNIPETROL GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 IDEMITSU KOSAN CO., LTD.: COMPANY OVERVIEW

- TABLE 215 IDEMITSU KOSAN CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 REPSOL: COMPANY OVERVIEW

- TABLE 217 REPSOL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 ORGKHIM BIOCHEMICAL HOLDING: COMPANY OVERVIEW

- TABLE 219 ORGKHIM BIOCHEMICAL HOLDING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 GPPL: COMPANY OVERVIEW

- TABLE 221 GPPL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 IRANOL (LLP): COMPANY OVERVIEW

- TABLE 223 IRANOL (LLP): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 PETRO GULF INTERNATIONAL FZE: COMPANY OVERVIEW

- TABLE 225 PETRO GULF INTERNATIONAL FZE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 CALUMET, INC.: COMPANY OVERVIEW

- TABLE 227 CALUMET, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 H&R GROUP: COMPANY OVERVIEW

- TABLE 229 H&R GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 NYNAS AB: COMPANY OVERVIEW

- TABLE 231 NYNAS AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 NYNAS AB: PRODUCT LAUNCHES (JANUARY 2020- NOVEMBER 2025)

- TABLE 233 IRPC PUBLIC COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 234 IRPC PUBLIC COMPANY LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 PT. ENERCO RPO INTERNASIONAL: COMPANY OVERVIEW

- TABLE 236 PT. ENERCO RPO INTERNASIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 PT. ENERCO RPO INTERNASIONAL: DEALS (JANUARY 2020- NOVEMBER 2025)

- TABLE 238 WITMANS INDUSTRIES PVT. LTD.: COMPANY OVERVIEW

- TABLE 239 WITMANS INDUSTRIES PVT. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 THAIOIL GROUP: COMPANY OVERVIEW

- TABLE 241 THAIOIL GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 SHANGDONG TIANYUAN CHEMICAL CO., LTD: COMPANY OVERVIEW

- TABLE 243 SHANGDONG TIANYUAN CHEMICAL CO., LTD: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 244 P.S.P. SPECIALTIES PUBLIC COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 245 P.S.P. SPECIALTIES PUBLIC COMPANY LIMITED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 246 PETRO NAFT: COMPANY OVERVIEW

- TABLE 247 PANOL INDUSTRIES RMC FZE: COMPANY OVERVIEW

- TABLE 248 EAGLE PETROCHEM: COMPANY OVERVIEW

- TABLE 249 LODHA PETRO: COMPANY OVERVIEW

- TABLE 250 RLS PETROCHEM LUBRICANTS LLC: COMPANY OVERVIEW

- TABLE 251 GAZPROMNEFT - LUBRICANTS LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 RUBBER PROCESS OIL MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 MARKET SCENARIO

- FIGURE 3 GLOBAL RUBBER PROCESS OIL MARKET, 2021-2030

- FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN RUBBER PROCESS OIL MARKET, 2020-2025

- FIGURE 5 DISRUPTIONS INFLUENCING GROWTH OF RUBBER PROCESS OIL MARKET

- FIGURE 6 HIGH-GROWTH SEGMENTS IN RUBBER PROCESS OIL MARKET 2025-2030

- FIGURE 7 RUBBER PROCESS OIL IN ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 8 RISING DEMAND FOR GREEN/BIODEGRADABLE RUBBER OILS TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 9 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 10 NAPHTHENIC SEGMENT TO DOMINATE MARKET FROM 2025 TO 2030

- FIGURE 11 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN RUBBER PROCESS OIL MARKET

- FIGURE 13 LIGHT VEHICLE PROPULSION TYPE SALES AND SHARE, BY KEY COUNTRY, 2024 VS. 2030 (PERCENTAGE & MILLION UNITS)

- FIGURE 14 MOTOR VEHICLES (CARS AND COMMERCIAL VEHICLES) PRODUCTION, 2021-2024, (MILLION UNITS)

- FIGURE 15 GLOBAL AUTOMOTIVE TIRE MARKET, 2022 TO 2033 (MILLION UNITS)

- FIGURE 16 NEW CAR REGISTRATIONS, 2023-2024, (MILLION UNITS)

- FIGURE 17 AUTOMOTIVE GREEN TIRE PRODUCTION, 2023-2025 (MILLION UNITS)

- FIGURE 18 GLOBAL PARAFFINIC BASE STOCK DEMAND, 2015-2030, (THOUSAND BARRELS PER DAY)

- FIGURE 19 GLOBAL LUXURY CAR SALES, BY REGION/COUNTRY, 2021-2033 (THOUSAND UNITS)

- FIGURE 20 CRUDE OIL FIRST PURCHASE PRICES, 2011 TO 2024

- FIGURE 21 RUBBER PROCESS OIL MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 RUBBER PROCESS OIL MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 RUBBER PROCESS OIL MARKET: ECOSYSTEM MAPPING

- FIGURE 24 AVERAGE SELLING PRICE TREND OF RUBBER PROCESS OIL, BY REGION, 2022-2025 (USD/TON)

- FIGURE 25 AVERAGE SELLING PRICE TREND OF RUBBER PROCESS OIL TYPE, BY KEY PLAYER, 2025 (USD/TON)

- FIGURE 26 IMPORT DATA RELATED TO HS CODE 2709, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 27 EXPORT DATA RELATED TO HS CODE 2709, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 28 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 29 RUBBER PROCESS OIL MARKET: INVESTMENT AND FUNDING SCENARIO, 2019-2025

- FIGURE 30 LIST OF MAJOR PATENTS RELATED TO RUBBER PROCESS OIL, 2014-2024

- FIGURE 31 FUTURE APPLICATIONS OF RUBBER PROCESS OIL

- FIGURE 32 RUBBER PROCESS OIL MARKET: DECISION-MAKING FACTORS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 34 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 35 ADOPTION BARRIERS & INTERNAL CHALLENGES

- FIGURE 36 MEDIUM VISCOSITY SEGMENT ACCOUNTS FOR LARGEST SHARE OF RUBBER PROCESS OIL MARKET

- FIGURE 37 TIRES SEGMENT ACCOUNTS FOR LARGEST SHARE OF RUBBER PROCESS OIL MARKET

- FIGURE 38 NAPHTHENIC SEGMENT ACCOUNTS FOR LARGEST SHARE OF RUBBER PROCESS OIL MARKET

- FIGURE 39 ASIA PACIFIC TO LEAD RUBBER PROCESS OIL MARKET DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC: RUBBER PROCESS OIL MARKET SNAPSHOT

- FIGURE 41 NORTH AMERICA: RUBBER PROCESS OIL MARKET SNAPSHOT

- FIGURE 42 EUROPE: RUBBER PROCESS OIL MARKET SNAPSHOT

- FIGURE 43 RUBBER PROCESS OIL MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2020-2024 (USD BILLION)

- FIGURE 44 RUBBER PROCESS OIL MARKET SHARE ANALYSIS, 2024

- FIGURE 45 BRAND/PRODUCT COMPARISON

- FIGURE 46 RUBBER PROCESS OIL MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 47 RUBBER PROCESS OIL MARKET: COMPANY FOOTPRINT

- FIGURE 48 RUBBER PROCESS OIL MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 49 EV/EBITDA

- FIGURE 50 ENTERPRISE VALUE

- FIGURE 51 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS

- FIGURE 52 SINOPEC: COMPANY SNAPSHOT

- FIGURE 53 PETROCHINA COMPANY LIMITED: COMPANY SNAPSHOT

- FIGURE 54 CHEVRON CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 EXXON MOBIL CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 SHELL PLC: COMPANY SNAPSHOT

- FIGURE 57 APAR INDUSTRIES LTD.: COMPANY SNAPSHOT

- FIGURE 58 PANAMA PETROCHEM LTD.: COMPANY SNAPSHOT

- FIGURE 59 GANDHAR OIL REFINERY (INDIA) LIMITED: COMPANY SNAPSHOT

- FIGURE 60 HINDUSTAN PETROLEUM CORPORATION LIMITED: COMPANY SNAPSHOT

- FIGURE 61 INDIAN OIL CORPORATION LTD: COMPANY SNAPSHOT

- FIGURE 62 ORLEN UNIPETROL GROUP: COMPANY SNAPSHOT

- FIGURE 63 IDEMITSU KOSAN CO., LTD.: COMPANY SNAPSHOT

- FIGURE 64 REPSOL: COMPANY SNAPSHOT

- FIGURE 65 GPPL: COMPANY SNAPSHOT

- FIGURE 66 CALUMET, INC.: COMPANY SNAPSHOT

- FIGURE 67 H&R GROUP: COMPANY SNAPSHOT

- FIGURE 68 NYNAS AB: COMPANY SNAPSHOT

- FIGURE 69 IRPC PUBLIC COMPANY LIMITED: COMPANY SNAPSHOT

- FIGURE 70 THAIOIL GROUP: COMPANY SNAPSHOT

- FIGURE 71 P.S.P. SPECIALTIES PUBLIC COMPANY LIMITED: COMPANY SNAPSHOT

- FIGURE 72 RESEARCH DESIGN

- FIGURE 73 BOTTOM-UP APPROACH

- FIGURE 74 TOP-DOWN APPROACH

- FIGURE 75 METHODOLOGY FOR SUPPLY-SIDE SIZING OF RUBBER PROCESS OIL MARKET (1/2)

- FIGURE 76 METHODOLOGY FOR SUPPLY-SIDE SIZING OF RUBBER PROCESS OIL MARKET (2/2)

- FIGURE 77 DATA TRIANGULATION