|

市場調查報告書

商品編碼

1901406

全球有機酸市場按來源、類型、形態、應用、功能和地區分類-預測至2030年Organic Acids Market by Type (Acetic Acid, Citric Acid, Formic Acid, Lactic Acid, Propionic Acid), Application (Food & Beverages, Feed, Industrial, Pharmaceutical, Agriculture), Source, Form, Function, and Region - Global Forecast to 2030 |

||||||

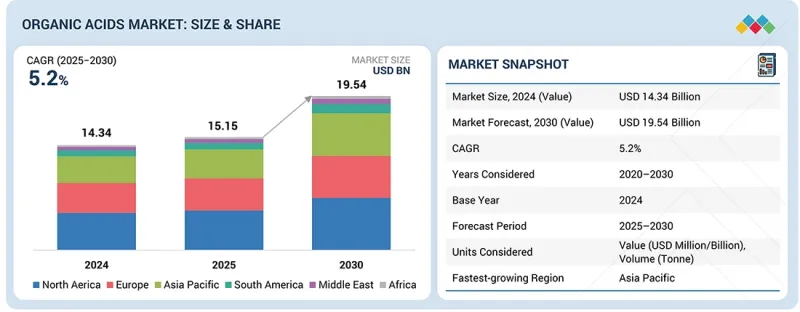

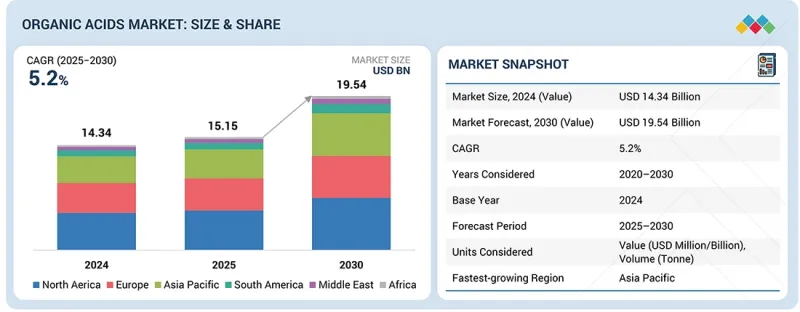

預計到 2025 年,有機酸市場價值將達到 151.5 億美元,到 2030 年將達到 195.4 億美元,預測期內複合年成長率為 5.2%。

市場擴張的驅動力是消費者對天然、生物基和潔淨標示成分的需求不斷成長,尤其是在食品、飲料和動物營養領域。

| 調查範圍 | |

|---|---|

| 調查期 | 2025-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 目標單元 | 金額(美元)和數量(千噸) |

| 部分 | 按產地、類型、形式、用途、功能、區域 |

| 目標區域 | 北美、歐洲、亞太地區、南美及其他地區 |

消費者對健康和永續性意識的不斷提高,以及向環保生產流程的轉變,正在推動全球有機酸的普及。此外,生物發酵和循環生產模式等技術創新,以及歐洲和北美等地區完善的法規結構,也促進了市場成長。隨著企業加大對低碳和可再生生產方式的投資,有機酸產業已成為更廣泛的生物基化學品領域永續成長和創新的關鍵促進者。

預計畜牧業將在全球有機酸市場中佔據重要佔有率,這主要得益於有機酸在動物營養中作為飼料酸化劑、防腐劑和性能增強劑的廣泛應用。甲酸、乳酸、檸檬酸和丙酸等有機酸在維持最佳腸道環境、提高營養吸收和防止飼料微生物污染方面發揮關鍵作用。該市場正經歷策略性發展和產品創新,旨在支持無抗生素和永續的畜牧生產。 2025年1月,嘉吉公司在亞太地區推出了一種新型有機酸飼料添加劑,旨在改善家禽腸道健康和飼料轉換率。同樣,2024年6月,凱敏工業公司推出了Formyl™,這是一種結合了包埋甲酸鈣和檸檬酸的先進酸化劑,旨在降低豬的病原體負荷。這些進展凸顯了有機酸在提高動物生產力、飼料品質和整體畜牧生產力方面的重要作用。

由於其保存期限長、易於操作且與自動化生產和輸送系統具有良好的兼容性,乾燥有機酸在食品、飼料和農業應用領域日益普及。其固體穩定性最大限度地降低了污染風險,使其成為智慧閉合迴路生產環境的理想選擇。烘焙、糖果和加工食品產業對乾燥有機酸的需求特別強勁,因為乾燥有機酸有助於保持產品新鮮度、增強風味並確保微生物穩定性,而無需使用合成防腐劑。此外,乾燥形式便於經濟高效的儲存和運輸,無需專門的低溫運輸,從而提高了物流效率。隨著全球對天然、潔淨標示和永續成分的需求加速成長,乾燥有機酸市場預計將保持穩定成長。包封技術和緩釋性的進步進一步提升了其功效,推動了各行業對高效、穩定且環保的食品保鮮和飼料強化解決方案的應用。

預計在預測期內,歐洲在全球有機酸市場中將以第二高的複合年成長率成長。這主要得益於工業應用的不斷拓展、對永續性的高度重視以及對生物基化學品生產投資的持續成長。BASF SE)和科比昂(Corbion NV)等主要企業正透過低碳和循環製造領域的創新主導這項轉型。BASF於2022年9月發布的「零碳足跡」(ZeroPCF)丙酸,實現了從原料採購到生產的零碳足跡,充分體現了歐洲對可再生原料和能源的重視。同樣,總部位於荷蘭的科比昂在泰國宣佈建造的循環乳酸工廠也反映了歐洲在開發低排放生產模式方面的技術領先地位。食品、飼料和製藥業對有機酸日益成長的需求,以及歐洲綠色交易的支持性政策,正在推動該地區向永續生產轉型。此外,從石油化工到發酵製程的轉變,使歐洲成為生態高效有機酸生產的中心,鞏固了其作為全球市場擴張主要貢獻者的地位。

市場上的主要企業包括BASF股份公司(德國)、嘉吉公司(美國)、阿徹丹尼爾斯米德蘭公司(美國)、塞拉尼斯公司(美國)、伊士曼化學公司(美國)、科比昂公司(荷蘭)、泰萊公司(英國)、帝斯曼公司(荷蘭)、河南金丹乳酸科技有限公司(美國)、麥克瑞安公司(

調查範圍

本報告按類型(乙酸、檸檬酸、甲酸、乳酸、丙酸、抗壞血酸、葡萄糖酸、富馬酸、蘋果酸等)、應用領域(食品飲料、飼料、醫藥、工業和農業)、原料來源(生物基和合成)、形態(乾粉和液體)、功能(酸味劑、防腐劑、增味劑、抗氧化劑、pH調節劑市場分析。本報告涵蓋影響有機酸市場成長的關鍵因素的詳細資訊,包括市場促進因素、限制因素、挑戰和成長機會。該報告還對主要行業參與者進行了詳細分析,深入探討了他們的業務概況、解決方案和服務、關鍵策略以及合約、合作關係和協議。此外,本報告還涵蓋了新產品和服務的發布、併購以及與有機酸市場相關的最新發展動態。報告中還對有機酸市場生態系統中新興的Start-Ups進行了競爭分析。

購買本報告的好處

本報告為市場領導和新參與企業提供有機酸市場及其細分市場整體收入規模的最準確估計值。它還有助於相關人員了解競爭格局,並提供有助於他們最佳化業務定位和製定合適的打入市場策略的洞察。此外,本報告還深入分析市場趨勢,並提供關鍵市場促進因素、限制、挑戰和機會的資訊。

本報告深入分析了以下內容:

1. 按類型、來源和應用進行詳細細分 - 本報告按類型(乙酸、檸檬酸、甲酸、乳酸、丙酸、抗壞血酸、葡萄糖酸、富馬酸、酸味劑酸及其他)、應用(食品飲料、飼料、醫藥、工業和農業)、來源(生物基和合成)、形態(乾粉和液體)以及功能(酸化劑、防腐劑、酸化劑)對市場進行分析劑。這種詳細的細分有助於相關人員識別高成長領域、最佳化產品開發,並在供應鏈中對產品進行策略性定位。

2. 聚焦新興市場的區域洞察-本報告提供詳盡的區域和國別分析,重點在於亞太和南美等快速成長市場的成長機會。報告檢驗了影響各行業有機酸應用的區域政策、法規結構和需求趨勢。此外,報告還概述了促進生物基化學品生產的投資趨勢和政府舉措,為希望在這些高成長地區拓展業務、實現在地化生產或增強市場影響的公司提供寶貴的見解。

3. 競爭情報與創新趨勢-報告全面介紹了BASF SE)、科比恩公司 (Corbion NV)、嘉吉公司 (Cargill Incorporated)和相關利益者 Industries) 等主要企業的概況,並深入分析了它們的戰略舉措和技術創新。報告追蹤了新產品發布、產能擴張、併購舉措等關鍵趨勢,使利害關係人能夠對標市場表現,並識別影響有機酸市場的新興創新趨勢。

4. 基於數據驅動方法的需求預測-市場規模估計值和2030年成長預測採用穩健的自上而下和自下而上的分析方法,並經專家諮詢和官方貿易數據檢驗。這些預測為全球有機酸產業的策略投資規劃、生產擴張和長期機會評估提供了可靠的參考。

目錄

第1章 引言

第2章執行摘要

第3章重要考察

第4章 市場概覽

- 市場動態

- 未滿足的需求和差距

- 相互關聯的市場與跨產業機遇

- 1/2/3級玩家的策略舉措

第5章 產業趨勢

- 波特五力分析

- 總體經濟指標

- 供應鏈分析

- 價值鏈分析

- 生態系分析

- 定價分析

- 貿易分析

- 2026年重大會議和活動

- 影響客戶業務的趨勢/干擾因素

- 投資和資金籌措方案

- 案例研究分析

- 2025年美國關稅對有機酸市場的影響

第6章:技術進步、人工智慧影響、專利、創新與未來應用

- 關鍵新興技術

- 互補技術

- 技術/產品藍圖

- 專利分析

- 未來應用

- 人工智慧/生成式人工智慧對有機酸市場的影響

- 成功案例和實際應用

第7章永續性和監管環境

- 地方法規和合規性

- 對永續性的承諾

- 監理政策如何影響永續性舉措

- 認證、標籤和環境標準

第8章:顧客狀況與購買行為

- 決策流程

- 採購過程中的關鍵相關人員及其評估標準

- 招募障礙和內部挑戰

- 來自各個終端使用者產業的未滿足需求

- 市場盈利

第9章 有機酸市場(依來源)

- 生物基

- 合成

第10章 有機酸市場(按類型分類)

- 醋酸

- 檸檬酸

- 甲酸

- 乳酸

- 丙酸

- 抗壞血酸

- 葡萄糖酸

- 富馬酸

- 蘋果酸

- 其他

第11章 有機酸市場(依形式)

- 乾燥

- 液體

第12章 有機酸市場(依應用領域分類)

- 食品/飲料

- 製藥

- 工業的

- 其他

第13章 有機酸市場(依功能分類)

- 酸味劑

- 防腐劑

- 增味劑

- 抗氧化劑

- pH調節劑

第14章 有機酸市場(依地區分類)

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 義大利

- 法國

- 西班牙

- 英國

- 其他

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲和紐西蘭

- 其他

- 南美洲

- 巴西

- 阿根廷

- 其他

- 其他地區

- 中東

- 非洲

第15章 競爭格局

- 概述

- 主要參與企業的策略/優勢,2021-2024年

- 2022-2024年收入分析

- 2024年市佔率分析

- 品牌/產品對比

- 公司估值矩陣:主要參與企業,2024 年

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 競爭場景

第16章:公司簡介

- 主要參與企業

- BASF SE

- ADM

- CARGILL, INCORPORATED

- CORBION

- JUNGBUNZLAUER SUISSE AG

- THE DOW CHEMICAL COMPANY

- EASTMAN CHEMICAL COMPANY

- DSM-FIRMENICH

- POLYNT SPA

- CELANESE CORPORATION

- TATE & LYLE

- HENAN JINDAN LACTIC ACID TECHNOLOGY CO., LTD.

- SHANDONG ENSIGN INDUSTRY CO., LTD.

- FOODCHEM INTERNATIONAL CORPORATION

- AFYREN

- GALACTIC

- 其他公司

- HAWKINS

- BBCA BIOCHEMICAL

- RZBC GROUP CO., LTD.

- BARTEK INGREDIENTS INC.

- FUSO CHEMICAL CO., LTD.

- VINIPUL CHEMICALS PRIVATE LIMITED

- GEOCON PRODUCTS

- LOBA CHEMIE PVT. LTD.

- CITNVBEL NV

- PEER CHEMICAL INDUSTRIES

- SHANDONG ACID TECHNOLOGY CO., LTD.

第17章調查方法

第18章:鄰近及相關市場

第19章附錄

The organic acids market is estimated to be valued at USD 15.15 billion in 2025 and is projected to reach USD 19.54 billion by 2030, growing at a CAGR of 5.2% during the forecast period. The market's expansion is driven by rising demand for natural, bio-based, and clean-label ingredients, particularly in the food, beverage, and animal nutrition sectors.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) and Volume (KT) |

| Segments | Type, Source, Application, Form, Function, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, RoW |

Growing consumer awareness of health and sustainability, coupled with the shift toward eco-friendly manufacturing processes, is propelling adoption globally. Moreover, technological innovations, such as bio-fermentation and circular production models, along with supportive regulatory frameworks in regions like Europe and North America, are enhancing market growth. As companies increasingly invest in low-carbon and renewable production methods, the organic acids industry is emerging as a key enabler of sustainable growth and innovation within the broader bio-based chemicals landscape.

"The livestock application segment is estimated to witness a significant share during the forecast period."

The livestock segment is projected to have a significant share in the global organic acids market, driven by their extensive use as feed acidifiers, preservatives, and performance enhancers in animal nutrition. Organic acids such as formic, lactic, citric, and propionic acids play a crucial role in maintaining optimal gut health, improving nutrient absorption, and preventing microbial contamination in feed. The market is witnessing strategic advancements and product innovations aimed at supporting antibiotic-free and sustainable animal production. In January 2025, Cargill Incorporated launched a new organic-acid-based feed additive in the Asia Pacific region to enhance poultry gut health and feed efficiency. Similarly, in June 2024, Kemin Industries introduced FORMYL(TM), an advanced acidifier combining encapsulated calcium formate and citric acid to reduce pathogen load in swine. These developments highlight the pivotal role of organic acids in promoting animal performance, feed quality, and overall livestock productivity.

"The dry formulation segment is estimated to maintain robust growth."

Dry forms of organic acids are gaining strong preference across food, feed, and agriculture applications due to their extended shelf life, ease of handling, and excellent compatibility with automated manufacturing and feeding systems. Their solid-state stability minimizes contamination risks, making them well-suited for integration into smart and closed-loop production environments. This demand is particularly high in the bakery, confectionery, and processed food industries, where dry organic acids help maintain product freshness, enhance flavor, and ensure microbial stability without the need for synthetic preservatives. Additionally, the dry form supports cost-effective storage and transportation, eliminating the need for specialized cold chains and improving logistical efficiency. As the global shift toward natural, clean-label, and sustainable ingredients accelerates, the dry organic acids segment is poised for steady growth. Technological advancements in encapsulation and controlled-release formulations are further enhancing their effectiveness, driving adoption across diverse sectors seeking efficient, stable, and eco-friendly solutions for food preservation and feed enhancement.

"Europe is estimated to grow at the second-highest CAGR in the organic acids market."

Europe is estimated to grow at the second-highest CAGR in the global organic acids market during the forecast period, driven by expanding industrial applications, a strong focus on sustainability, and increased investments in bio-based chemical production. Major European players, such as BASF SE and Corbion N.V., are leading this transformation through innovations in low-carbon and circular manufacturing. BASF's launch of Propionic Acid ZeroPCF in September 2022, featuring a cradle-to-gate carbon footprint of zero, underscores the region's commitment to renewable raw materials and energy. Similarly, Corbion's circular lactic acid plant in Thailand, announced by its Netherlands-based parent company, reflects Europe's technological leadership in developing low-emission production models. The growing demand for organic acids in food, feed, and pharmaceutical industries, coupled with supportive policies under the European Green Deal, is propelling the region's transition toward sustainable production. Additionally, the shift from petrochemical to fermentation-based processes positions Europe as a hub for eco-efficient organic acid manufacturing, solidifying its role as a key contributor to the market's global expansion.

In-depth interviews were conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the organic acids market:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: Directors - 20%, Managers - 50%, Executives - 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 20%, South America - 15%, and Rest of the World (Middle East and Africa) - 10%

Prominent companies in the market include BASF SE (Germany), Cargill, Incorporated (US), Archer Daniels Midland Company (US), Celanese Corporation (US), Eastman Chemical Company (US), Corbion (Netherlands), Tate & Lyle PLC (UK), Koninklijke DSM N.V. (Netherlands), Henan Jindan Lactic Acid Technology Co., Ltd. (China), Myriant Corporation (US), Jungbunzlauer Suisse AG (Switzerland), and The Dow Chemical Company (US).

Research Coverage

This research report categorizes the organic acids market by type (acetic acid, citric acid, formic acid, lactic acid, propionic acid, ascorbic acid, gluconic acid, fumaric acid, malic acid, and others), application (food & beverages, feed, pharmaceutical, industrial, and agriculture), source (bio-based and synthetic), form (dry and liquid), function (acidulant, preservative, flavor enhancer, antioxidants, and pH control agents), and region. The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the organic acids market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, and agreements. The study includes new product & service launches, mergers & acquisitions, and recent developments associated with the organic acids market. This report also includes a competitive analysis of emerging startups in the organic acids market ecosystem.

Reasons to buy this report

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall organic acids and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

1. In-depth Segmentation across Type, Source, and Application: This report offers an in-depth analysis of the organic acids market, categorizing it by type (acetic acid, citric acid, formic acid, lactic acid, propionic acid, ascorbic acid, gluconic acid, fumaric acid, malic acid, and others), application (food & beverages, feed, pharmaceutical, industrial, agriculture), source (bio-based and synthetic), form (dry and liquid), function (acidulant, preservative, flavor enhancer, antioxidants, and pH control agents). Such detailed segmentation enables stakeholders to pinpoint high-growth areas, optimize product development, and strategically position offerings along the supply chain.

2. Region-specific Insights with Focus on Emerging Markets: The report delivers in-depth regional and country-level analysis, highlighting growth opportunities in fast-expanding markets such as the Asia Pacific and South America. It examines regional policies, regulatory frameworks, and demand dynamics influencing the adoption of organic acids across various industries. Additionally, the study outlines investment trends and government initiatives promoting bio-based chemical production, offering valuable insights for companies aiming to expand, localize manufacturing, or strengthen their market presence in these high-potential regions.

3. Competitive Intelligence and Innovation Landscape: Comprehensive profiles of key players such as BASF SE, Corbion N.V., Cargill Incorporated, and Kemin Industries are included, detailing their strategic moves and technological innovations. The report tracks major developments, including new product launches, capacity expansions, mergers & acquisitions, and R&D initiatives, enabling stakeholders to benchmark performance and identify emerging innovation trends shaping the organic acids market.

4. Demand Forecasts Backed by Data-driven Methodologies: Market size estimations and growth projections up to 2030 are derived using robust top-down and bottom-up analytical approaches, validated through expert consultations and official trade data. These forecasts offer reliable insights for strategic investment planning, production expansion, and long-term opportunity assessment within the global organic acids industry.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 UNITS CONSIDERED

- 1.4.1 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ORGANIC ACIDS MARKET

- 3.2 ORGANIC ACIDS MARKET: SHARE OF MAJOR REGIONAL SUBMARKETS

- 3.3 ASIA PACIFIC: ORGANIC ACIDS MARKET, BY APPLICATION AND COUNTRY

- 3.4 ORGANIC ACIDS MARKET, BY APPLICATION AND REGION

- 3.5 ORGANIC ACIDS MARKET, BY FORM

- 3.6 ORGANIC ACIDS MARKET, BY SOURCE

- 3.7 ORGANIC ACIDS MARKET, BY TYPE

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Multifunctional roles and applications of organic acids in food safety and quality

- 4.2.1.2 Rising health consciousness

- 4.2.1.3 Growing use of sustainable formic acid in animal feed preservation

- 4.2.2 RESTRAINTS

- 4.2.2.1 Regulatory compliance and labeling requirements

- 4.2.2.2 Increased transportation and logistics expenses

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Emergence of organic acids in personal care and cosmetic formulations

- 4.2.3.2 Innovations in technologies and wide industry scope

- 4.2.4 CHALLENGES

- 4.2.4.1 Maintaining consistent product quality due to fermentation variability

- 4.2.4.2 Intense competition from large-scale chemical manufacturers offering low-cost synthetic acids

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 INTRODUCTION

- 4.3.2 EMERGING GAPS AND INNOVATION WHITE SPACES

- 4.3.2.1 Inconsistent fermentation performance at commercial scale

- 4.3.2.2 Overdependence on food-grade feedstocks and limited alternative inputs

- 4.3.2.3 High cost and energy intensity of downstream purification

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 AGRICULTURE AND FOOD PROCESSING

- 4.4.2 PHARMACEUTICALS AND HEALTHCARE

- 4.4.3 INDUSTRIAL CHEMICALS AND MATERIALS

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.5.1 STRATEGIC MOVES BY KEY PLAYERS

5 INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 PORTER'S FIVE FORCES ANALYSIS

- 5.2.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.2.2 BARGAINING POWER OF SUPPLIERS

- 5.2.3 BARGAINING POWER OF BUYERS

- 5.2.4 THREAT OF SUBSTITUTES

- 5.2.5 THREAT OF NEW ENTRANTS

- 5.3 MACROECONOMIC INDICATORS

- 5.3.1 GROWTH IN GLOBAL POPULATION AND FOOD DEMAND

- 5.3.2 STABLE GLOBAL GDP GROWTH AND MACRO PROJECTIONS

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.6.1 DEMAND SIDE

- 5.6.2 SUPPLY SIDE

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND OF ORGANIC ACIDS, BY TYPE

- 5.7.2 AVERAGE SELLING PRICE TREND OF ORGANIC ACIDS, BY REGION

- 5.8 TRADE ANALYSIS

- 5.8.1 TRADE ANALYSIS OF ORGANIC ACIDS

- 5.8.1.1 Export trends of acetic acids under HS code 291521 (2020-2024)

- 5.8.1.2 Import trends of acetic acids under HS code 291521 (2020-2024)

- 5.8.1.3 Export trends of formic acids under HS code 291511 (2020-2024)

- 5.8.1.4 Import trends of formic acids under HS code 291511 (2020-2024)

- 5.8.1 TRADE ANALYSIS OF ORGANIC ACIDS

- 5.9 KEY CONFERENCES AND EVENTS, 2026

- 5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.11 INVESTMENT AND FUNDING SCENARIO

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 JUNGBUNZLAUER INSTALLED LARGE-SCALE INDUSTRIAL HEAT PUMPS THAT CAPTURE EXCESS HEAT FROM FERMENTATION

- 5.12.2 DOW PARTNERED WITH KEMIN INDUSTRIES AND ADESCO NUTRICINES TO CONDUCT GATE-TO-GATE LIFE CYCLE ASSESSMENT

- 5.13 IMPACT OF 2025 US TARIFF - ORGANIC ACIDS MARKET

- 5.13.1 INTRODUCTION

- 5.13.2 KEY TARIFF RATES

- 5.13.3 PRICE IMPACT ANALYSIS

- 5.13.4 IMPACT ON COUNTRY/REGION

- 5.13.4.1 US

- 5.13.4.2 European Union

- 5.13.4.3 China

- 5.13.5 IMPACT ON END-USE INDUSTRIES

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 INTRODUCTION

- 6.2 KEY EMERGING TECHNOLOGIES

- 6.3 COMPLEMENTARY TECHNOLOGIES

- 6.4 TECHNOLOGY/PRODUCT ROADMAP

- 6.5 PATENT ANALYSIS

- 6.5.1 LIST OF MAJOR PATENTS

- 6.6 FUTURE APPLICATIONS

- 6.7 IMPACT OF AI/GEN AI ON ORGANIC ACIDS MARKET

- 6.7.1 TOP USE CASES AND MARKET POTENTIAL

- 6.7.2 CASE STUDIES ON AI IMPLEMENTATION IN ORGANIC ACIDS MARKET

- 6.7.2.1 Using Gen AI to enable proper extraction conditions

- 6.7.2.2 AI transforms bioreactor sensor data into dynamic videos showing microbial growth

- 6.7.3 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.7.4 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN ORGANIC ACIDS MARKET

- 6.8 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 INTRODUCTION

- 7.2 REGIONAL REGULATIONS AND COMPLIANCE

- 7.2.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.2.2 INDUSTRY STANDARDS

- 7.3 SUSTAINABILITY INITIATIVES

- 7.3.1 CORBION'S BIO-BASED LACTIC ACID & CIRCULAR FERMENTATION MODEL

- 7.4 IMPACT OF REGULATORY POLICIES ON SUSTAINABILITY INITIATIVES

- 7.5 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 INTRODUCTION

- 8.2 DECISION-MAKING PROCESS

- 8.3 KEY STAKEHOLDERS INVOLVED IN BUYING PROCESS AND THEIR EVALUATION CRITERIA

- 8.3.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.3.2 BUYING CRITERIA

- 8.4 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.5 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 8.6 MARKET PROFITABILITY

9 ORGANIC ACIDS MARKET, BY SOURCE

- 9.1 INTRODUCTION

- 9.2 BIO-BASED

- 9.2.1 COST-EFFECTIVENESS AND HIGH STABILITY PROPERTIES TO PROPEL DEMAND

- 9.3 SYNTHETIC

- 9.3.1 EASY AVAILABILITY AND CONSISTENT QUALITY TO DRIVE MARKET

10 ORGANIC ACIDS MARKET, BY TYPE

- 10.1 INTRODUCTION

- 10.2 ACETIC ACID

- 10.2.1 EXTENSIVE APPLICATIONS IN VARIOUS INDUSTRIES TO BOOST MARKET

- 10.3 CITRIC ACID

- 10.3.1 INCREASING ROLE IN FEED FORMULATIONS AND FEED PRESERVATION TO DRIVE MARKET

- 10.4 FORMIC ACID

- 10.4.1 INNOVATIONS BY MARKET PLAYERS TO DRIVE DEMAND

- 10.5 LACTIC ACID

- 10.5.1 BIODEGRADABILITY AND VERSATILITY TO DRIVE DEMAND

- 10.6 PROPIONIC ACID

- 10.6.1 GROWING USE IN VARIOUS INDUSTRIES TO DRIVE DEMAND

- 10.7 ASCORBIC ACID

- 10.7.1 RISING AWARENESS ABOUT NUTRITIONAL VALUE AND IMMUNE-BOOSTING PROPERTIES TO DRIVE MARKET

- 10.8 GLUCONIC ACID

- 10.8.1 GROWING RELEVANCE IN PROMOTING ENVIRONMENTAL SUSTAINABILITY AND PRODUCT INNOVATION TO DRIVE DEMAND

- 10.9 FUMARIC ACID

- 10.9.1 RISING DEMAND FOR PROCESSED FOOD AND FUNCTIONAL INGREDIENTS TO FUEL MARKET

- 10.10 MALIC ACID

- 10.10.1 MULTIFUNCTIONAL PROPERTIES TO DRIVE DEMAND

- 10.11 OTHER TYPES

11 ORGANIC ACIDS MARKET, BY FORM

- 11.1 INTRODUCTION

- 11.2 DRY

- 11.2.1 CONVENIENCE IN STORAGE, HANDLING, AND TRANSPORTATION TO DRIVE DEMAND

- 11.3 LIQUID

- 11.3.1 UNIFORM MIXING AND PRECISE DOSING OF LIQUID ORGANIC ACIDS TO PROPEL DEMAND

12 ORGANIC ACIDS MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 FOOD & BEVERAGES

- 12.2.1 DEMAND FOR CLEAN-LABEL AND NATURAL INGREDIENTS TO DRIVE MARKET

- 12.2.1.1 Beverages

- 12.2.1.2 Dairy products

- 12.2.1.3 Bakery and confectionery

- 12.2.1.4 Meat and processed meat

- 12.2.1.5 Canned and processed foods

- 12.2.1.6 Nutritional and dietary supplements

- 12.2.1.7 Others

- 12.2.1 DEMAND FOR CLEAN-LABEL AND NATURAL INGREDIENTS TO DRIVE MARKET

- 12.3 PHARMACEUTICALS

- 12.3.1 GROWING NEED FOR FORMULATION STABILITY AND FUNCTIONAL EXCIPIENTS TO DRIVE MARKET

- 12.4 INDUSTRIAL

- 12.4.1 INCREASING USE OF BIO-BASED INTERMEDIATES AND PROCESS CHEMICALS TO DRIVE MARKET

- 12.5 OTHERS

13 ORGANIC ACIDS MARKET, BY FUNCTION

- 13.1 INTRODUCTION

- 13.2 ACIDULANTS

- 13.2.1 IMPROVING FLAVOR PROFILE OF BEVERAGES, CONFECTIONERY, AND BAKERY PRODUCTS

- 13.3 PRESERVATIVES

- 13.3.1 PREVENTING SPOILAGE AND EXTENDING SHELF LIFE IN BAKERY ITEMS, BEVERAGES, AND DAIRY PRODUCTS

- 13.4 FLAVOR ENHANCERS

- 13.4.1 ENHANCING TASTE, STABILITY, AND CONSUMER APPEAL IN NATURAL AND PROCESSED FOODS

- 13.5 ANTIOXIDANTS

- 13.5.1 EFFECTIVE ROLE IN SUPPORTING BETTER FOOD PRODUCTIVITY

- 13.6 PH CONTROL AGENTS

- 13.6.1 REGULATING ACIDITY, STABILIZING FORMULATIONS, AND MAINTAINING PRODUCT QUALITY

14 ORGANIC ACIDS MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 US

- 14.2.1.1 Increasing demand for organic acid products to boost market

- 14.2.2 CANADA

- 14.2.2.1 Increased production of poultry products to boost market

- 14.2.3 MEXICO

- 14.2.3.1 Expanding food processing industry to drive market

- 14.2.1 US

- 14.3 EUROPE

- 14.3.1 GERMANY

- 14.3.1.1 Growing use in biodegradable materials, preservatives, and specialty chemicals to drive demand for organic acids

- 14.3.2 ITALY

- 14.3.2.1 Growing industry demand for renewable organic acid solutions with high purity and lower environmental impact to drive market

- 14.3.3 FRANCE

- 14.3.3.1 Partnerships among key players and increasing focus on sustainability to drive market

- 14.3.4 SPAIN

- 14.3.4.1 Expanding application areas to drive market

- 14.3.5 UK

- 14.3.5.1 Rising demand for high-performance acids to drive market

- 14.3.6 REST OF EUROPE

- 14.3.1 GERMANY

- 14.4 ASIA PACIFIC

- 14.4.1 CHINA

- 14.4.1.1 Robust food, beverage, and biotechnology sectors to drive demand for organic acids

- 14.4.2 INDIA

- 14.4.2.1 Increasing industrial demand and government initiatives to strengthen domestic production to drive market

- 14.4.3 JAPAN

- 14.4.3.1 Increasing industrial demand and advancements in bio-based production technologies to drive market

- 14.4.4 AUSTRALIA & NEW ZEALAND

- 14.4.4.1 Increasing demand for sustainable chemicals to drive market

- 14.4.5 REST OF ASIA PACIFIC

- 14.4.1 CHINA

- 14.5 SOUTH AMERICA

- 14.5.1 BRAZIL

- 14.5.1.1 Growing import of organic acids to create opportunities for domestic producers and international manufacturers

- 14.5.2 ARGENTINA

- 14.5.2.1 Rising agricultural and industrial needs to drive market

- 14.5.3 REST OF SOUTH AMERICA

- 14.5.1 BRAZIL

- 14.6 REST OF THE WORLD

- 14.6.1 MIDDLE EAST

- 14.6.1.1 Increasing demand for bio-based acids to fuel market

- 14.6.2 AFRICA

- 14.6.2.1 Growing use of organic acids in food applications to propel market

- 14.6.1 MIDDLE EAST

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 15.3 REVENUE ANALYSIS, 2022-2024

- 15.4 MARKET SHARE ANALYSIS, 2024

- 15.5 BRAND/PRODUCT COMPARISON

- 15.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.6.1 STARS

- 15.6.2 EMERGING LEADERS

- 15.6.3 PERVASIVE PLAYERS

- 15.6.4 PARTICIPANTS

- 15.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.6.5.1 Company footprint

- 15.6.5.2 Regional footprint

- 15.6.5.3 Type footprint

- 15.6.5.4 Application footprint

- 15.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.7.1 PROGRESSIVE COMPANIES

- 15.7.2 RESPONSIVE COMPANIES

- 15.7.3 DYNAMIC COMPANIES

- 15.7.4 STARTING BLOCKS

- 15.7.5 COMPETITIVE BENCHMARKING, STARTUPS/SMES, 2024

- 15.7.5.1 Detailed list of key startups/SMEs

- 15.7.5.2 Competitive benchmarking of key startups/SMEs

- 15.8 COMPETITIVE SCENARIO

- 15.8.1 PRODUCT LAUNCHES

- 15.8.2 DEALS

- 15.8.3 EXPANSIONS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 BASF SE

- 16.1.1.1 Business overview

- 16.1.1.2 Products/Solutions/Services offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Product launches

- 16.1.1.4 MnM view

- 16.1.1.4.1 Key strengths

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses and competitive threats

- 16.1.2 ADM

- 16.1.2.1 Business overview

- 16.1.2.2 Products/Solutions/Services offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Deals

- 16.1.2.4 MnM view

- 16.1.2.4.1 Key strengths

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses and competitive threats

- 16.1.3 CARGILL, INCORPORATED

- 16.1.3.1 Business overview

- 16.1.3.2 Products/Solutions/Services offered

- 16.1.3.3 MnM view

- 16.1.3.3.1 Key strengths

- 16.1.3.3.2 Strategic choices

- 16.1.3.3.3 Weaknesses and competitive threats

- 16.1.4 CORBION

- 16.1.4.1 Business overview

- 16.1.4.2 Products/Solutions/Services offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Expansions

- 16.1.4.4 MnM view

- 16.1.4.4.1 Key strengths

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses and competitive threats

- 16.1.5 JUNGBUNZLAUER SUISSE AG

- 16.1.5.1 Business overview

- 16.1.5.2 Products/Solutions/Services offered

- 16.1.5.3 MnM view

- 16.1.5.3.1 Key strengths

- 16.1.5.3.2 Strategic choices

- 16.1.5.3.3 Weaknesses and competitive threats

- 16.1.6 THE DOW CHEMICAL COMPANY

- 16.1.6.1 Business overview

- 16.1.6.2 Products/Solutions/Services offered

- 16.1.6.3 MnM view

- 16.1.6.3.1 Key strengths

- 16.1.6.3.2 Strategic choices

- 16.1.6.3.3 Weaknesses and competitive threats

- 16.1.7 EASTMAN CHEMICAL COMPANY

- 16.1.7.1 Business overview

- 16.1.7.2 Products/Solutions/Services offered

- 16.1.7.3 MnM view

- 16.1.7.3.1 Key strengths

- 16.1.7.3.2 Strategic choices

- 16.1.7.3.3 Weaknesses and competitive threats

- 16.1.8 DSM-FIRMENICH

- 16.1.8.1 Business overview

- 16.1.8.2 Products/Solutions/Services offered

- 16.1.8.3 MnM view

- 16.1.8.3.1 Key strengths

- 16.1.8.3.2 Strategic choices

- 16.1.8.3.3 Weaknesses and competitive threats

- 16.1.9 POLYNT S.P.A.

- 16.1.9.1 Business overview

- 16.1.9.2 Products/Solutions/Services offered

- 16.1.9.3 MnM view

- 16.1.9.3.1 Key strengths

- 16.1.9.3.2 Strategic choices

- 16.1.9.3.3 Weaknesses and competitive threats

- 16.1.10 CELANESE CORPORATION

- 16.1.10.1 Business overview

- 16.1.10.2 Products/Solutions/Services offered

- 16.1.10.3 MnM view

- 16.1.10.3.1 Key strengths

- 16.1.10.3.2 Strategic choices

- 16.1.10.3.3 Weaknesses and competitive threats

- 16.1.11 TATE & LYLE

- 16.1.11.1 Business overview

- 16.1.11.2 Products/Solutions/Services offered

- 16.1.11.3 MnM view

- 16.1.11.3.1 Key strengths

- 16.1.11.3.2 Strategic choices

- 16.1.11.3.3 Weaknesses and competitive threats

- 16.1.12 HENAN JINDAN LACTIC ACID TECHNOLOGY CO., LTD.

- 16.1.12.1 Business overview

- 16.1.12.2 Products/Solutions/Services offered

- 16.1.12.3 MnM view

- 16.1.12.3.1 Key strengths

- 16.1.12.3.2 Strategic choices

- 16.1.12.3.3 Weaknesses and competitive threats

- 16.1.13 SHANDONG ENSIGN INDUSTRY CO., LTD.

- 16.1.13.1 Business overview

- 16.1.13.2 Products/Solutions/Services offered

- 16.1.13.3 MnM view

- 16.1.13.3.1 Key strengths

- 16.1.13.3.2 Strategic choices

- 16.1.13.3.3 Weaknesses and competitive threats

- 16.1.14 FOODCHEM INTERNATIONAL CORPORATION

- 16.1.14.1 Business overview

- 16.1.14.2 Products/Solutions/Services offered

- 16.1.14.3 MnM view

- 16.1.14.3.1 Key strengths

- 16.1.14.3.2 Strategic choices

- 16.1.14.3.3 Weaknesses and competitive threats

- 16.1.15 AFYREN

- 16.1.15.1 Business overview

- 16.1.15.2 Products/Solutions/Services offered

- 16.1.15.3 MnM view

- 16.1.15.3.1 Key strengths

- 16.1.15.3.2 Strategic choices

- 16.1.15.3.3 Weaknesses and competitive threats

- 16.1.16 GALACTIC

- 16.1.16.1 Business overview

- 16.1.16.2 Products/Solutions/Services offered

- 16.1.16.3 MnM view

- 16.1.16.3.1 Key strengths

- 16.1.16.3.2 Strategic choices

- 16.1.16.3.3 Weaknesses and competitive threats

- 16.1.1 BASF SE

- 16.2 OTHER PLAYERS

- 16.2.1 HAWKINS

- 16.2.1.1 Business overview

- 16.2.1.2 Products/Solutions/Services offered

- 16.2.1.3 MnM view

- 16.2.1.3.1 Key strengths

- 16.2.1.3.2 Strategic choices

- 16.2.1.3.3 Weaknesses and competitive threats

- 16.2.2 BBCA BIOCHEMICAL

- 16.2.2.1 Business overview

- 16.2.2.2 Products/Solutions/Services offered

- 16.2.2.3 MnM view

- 16.2.2.3.1 Key strengths

- 16.2.2.3.2 Strategic choices

- 16.2.2.3.3 Weaknesses and competitive threats

- 16.2.3 RZBC GROUP CO., LTD.

- 16.2.3.1 Business overview

- 16.2.3.2 Products/Solutions/Services offered

- 16.2.3.3 MnM view

- 16.2.3.3.1 Key strengths

- 16.2.3.3.2 Strategic choices

- 16.2.3.3.3 Weaknesses and competitive threats

- 16.2.4 BARTEK INGREDIENTS INC.

- 16.2.4.1 Business overview

- 16.2.4.2 Products/Solutions/Services offered

- 16.2.4.3 MnM view

- 16.2.4.3.1 Key strengths

- 16.2.4.3.2 Strategic choices

- 16.2.4.3.3 Weaknesses and competitive threats

- 16.2.5 FUSO CHEMICAL CO., LTD.

- 16.2.5.1 Business overview

- 16.2.5.2 Products/Solutions/Services offered

- 16.2.5.3 MnM view

- 16.2.5.3.1 Key strengths

- 16.2.5.3.2 Strategic choices

- 16.2.5.3.3 Weaknesses and competitive threats

- 16.2.6 VINIPUL CHEMICALS PRIVATE LIMITED

- 16.2.6.1 Business overview

- 16.2.6.2 Products/Solutions/Services offered

- 16.2.6.3 MnM view

- 16.2.6.3.1 Key strengths

- 16.2.6.3.2 Strategic choices

- 16.2.6.3.3 Weaknesses and competitive threats

- 16.2.7 GEOCON PRODUCTS

- 16.2.8 LOBA CHEMIE PVT. LTD.

- 16.2.9 CITNVBEL NV

- 16.2.10 PEER CHEMICAL INDUSTRIES

- 16.2.11 SHANDONG ACID TECHNOLOGY CO., LTD.

- 16.2.1 HAWKINS

17 RESEARCH METHODOLOGY

- 17.1 RESEARCH DATA

- 17.1.1 SECONDARY DATA

- 17.1.1.1 Key data from secondary sources

- 17.1.2 PRIMARY DATA

- 17.1.2.1 Key data from primary sources

- 17.1.2.2 Key primary participants

- 17.1.2.3 Breakdown of primary interviews

- 17.1.2.4 Key industry insights

- 17.1.1 SECONDARY DATA

- 17.2 MARKET SIZE ESTIMATION

- 17.2.1 BOTTOM-UP APPROACH

- 17.2.2 TOP-DOWN APPROACH

- 17.2.3 BASE NUMBER CALCULATION

- 17.3 MARKET SIZE ESTIMATION

- 17.3.1 BOTTOM-UP APPROACH

- 17.3.2 APPROACH TWO (TOP-DOWN APPROACH)

- 17.4 MARKET FORECAST APPROACH

- 17.4.1 SUPPLY SIDE

- 17.4.2 DEMAND SIDE

- 17.5 DATA TRIANGULATION

- 17.6 FACTOR ANALYSIS

- 17.7 RESEARCH ASSUMPTIONS

- 17.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

18 ADJACENT AND RELATED MARKETS

- 18.1 INTRODUCTION

- 18.2 LIMITATIONS

- 18.3 LACTIC ACID AND POLYLACTIC ACID MARKET

- 18.3.1 MARKET DEFINITION

- 18.3.2 MARKET OVERVIEW

19 APPENDIX

- 19.1 DISCUSSION GUIDE

- 19.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.3 CUSTOMIZATION OPTIONS

- 19.4 RELATED REPORTS

- 19.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 ORGANIC ACIDS MARKET SNAPSHOT, 2025 VS. 2030

- TABLE 3 IMPACT OF PORTER'S FIVE FORCES ON ORGANIC ACIDS MARKET

- TABLE 4 AVERAGE SELLING PRICE OF CITRIC ACID, BY KEY PLAYER, 2025 (USD/KG)

- TABLE 5 AVERAGE SELLING PRICE OF LACTIC ACID, BY KEY PLAYER, 2025 (USD/KG)

- TABLE 6 AVERAGE SELLING PRICE OF ACETIC ACID, BY KEY PLAYER, 2025 (USD/KG)

- TABLE 7 AVERAGE SELLING PRICE OF FORMIC ACID, BY KEY PLATER, 2025 (USD/KG)

- TABLE 8 AVERAGE SELLING PRICE OF PROPIONIC ACID, BY KEY PLAYER, 2025 (USD/KG)

- TABLE 9 AVERAGE SELLING PRICE TREND OF ORGANIC ACIDS, BY TYPE, 2020-2024 (USD/KG)

- TABLE 10 AVERAGE SELLING PRICE OF ORGANIC ACIDS, BY REGION, 2020-2024 (USD/KG)

- TABLE 11 TOP 10 EXPORTERS OF HS CODE 291521, 2020-2024 (USD THOUSAND)

- TABLE 12 TOP 10 IMPORTERS OF HS CODE 291521, 2020-2024 (USD THOUSAND)

- TABLE 13 TOP 10 EXPORTERS OF HS CODE 291511, 2020-2024 (USD THOUSAND)

- TABLE 14 TOP 10 IMPORTERS OF HS CODE 291511, 2020-2024 (USD THOUSAND)

- TABLE 15 ORGANIC ACIDS MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2026

- TABLE 16 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 17 EXPECTED IMPACT LEVEL ON TARGET PRODUCTS WITH RELEVANT HS CODES DUE TO US TARIFF IMPACT

- TABLE 18 ORGANIC ACIDS MARKET: EXPECTED TARIFF IMPACT ON END-USE INDUSTRIES

- TABLE 19 LIST OF MAJOR PATENTS, 2015-2025

- TABLE 20 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS

- TABLE 26 KEY BUYING CRITERIA FOR TOP APPLICATIONS

- TABLE 27 ORGANIC ACIDS MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 28 ORGANIC ACIDS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 29 BIO-BASED: ORGANIC ACIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 30 BIO-BASED: ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 SYNTHETIC: ORGANIC ACIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 32 SYNTHETIC: ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 34 ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 35 ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (KILO TONS)

- TABLE 36 ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (KILO TONS)

- TABLE 37 ACETIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 38 ACETIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 ACETIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2020-2024 (KILO TONS)

- TABLE 40 ACETIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (KILO TONS)

- TABLE 41 CITRIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 42 CITRIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 CITRIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2020-2024 (KILO TONS)

- TABLE 44 CITRIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (KILO TONS)

- TABLE 45 FORMIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 46 FORMIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 FORMIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2020-2024 (KILO TONS)

- TABLE 48 FORMIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (KILO TONS)

- TABLE 49 LACTIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 50 LACTIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 LACTIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2020-2024 (KILO TONS)

- TABLE 52 LACTIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (KILO TONS)

- TABLE 53 PROPIONIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 54 PROPIONIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 PROPIONIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2020-2024 (KILO TONS)

- TABLE 56 PROPIONIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (KILO TONS)

- TABLE 57 ASCORBIC ACID ORGANIC ACIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 58 ASCORBIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 ASCORBIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2020-2024 (KILO TONS)

- TABLE 60 ASCORBIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (KILO TONS)

- TABLE 61 GLUCONIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 62 GLUCONIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 GLUCONIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2020-2024 (KILO TONS)

- TABLE 64 GLUCONIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (KILO TONS)

- TABLE 65 FUMARIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 66 FUMARIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 FUMARIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2020-2024 (KILO TONS)

- TABLE 68 FUMARIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (KILO TONS)

- TABLE 69 MALIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 70 MALIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 MALIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2020-2024 (KILO TONS)

- TABLE 72 MALIC ACID: ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (KILO TONS)

- TABLE 73 OTHER TYPES: ORGANIC ACIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 74 OTHER TYPES: ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 OTHER TYPES: ORGANIC ACIDS MARKET, BY REGION, 2020-2024 (KILO TONS)

- TABLE 76 OTHER TYPES: ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (KILO TONS)

- TABLE 77 ORGANIC ACIDS MARKET, BY FORM, 2020-2024 (USD MILLION)

- TABLE 78 ORGANIC ACIDS MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 79 ORGANIC ACIDS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 80 ORGANIC ACIDS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 81 FOOD & BEVERAGES: ORGANIC ACIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 82 FOOD & BEVERAGES: ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 FOOD & BEVERAGES: ORGANIC ACIDS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 84 FOOD & BEVERAGES: ORGANIC ACIDS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 85 PHARMACEUTICALS: ORGANIC ACIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 86 PHARMACEUTICALS: ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 INDUSTRIAL: ORGANIC ACIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 88 INDUSTRIAL: ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 OTHERS: ORGANIC ACIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 90 OTHERS: ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 ORGANIC ACIDS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 92 ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 ORGANIC ACIDS MARKET, BY REGION, 2020-2024 (KILO TONS)

- TABLE 94 ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (KILO TONS)

- TABLE 95 NORTH AMERICA: ORGANIC ACIDS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 96 NORTH AMERICA: ORGANIC ACIDS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 97 NORTH AMERICA: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 98 NORTH AMERICA: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (KILO TONS)

- TABLE 100 NORTH AMERICA: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (KILO TONS)

- TABLE 101 NORTH AMERICA: ORGANIC ACIDS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 102 NORTH AMERICA: ORGANIC ACIDS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 103 NORTH AMERICA: ORGANIC ACIDS MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 104 NORTH AMERICA: ORGANIC ACIDS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 105 US: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 106 US: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 107 US: ORGANIC ACIDS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 108 US: ORGANIC ACIDS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 109 CANADA: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 110 CANADA: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 111 CANADA: ORGANIC ACIDS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 112 CANADA: ORGANIC ACIDS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 113 MEXICO: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 114 MEXICO: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 115 MEXICO: ORGANIC ACIDS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 116 MEXICO: ORGANIC ACIDS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 117 EUROPE: ORGANIC ACIDS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 118 EUROPE: ORGANIC ACIDS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 119 EUROPE: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 120 EUROPE: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 121 EUROPE: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (KILO TONS)

- TABLE 122 EUROPE: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (KILO TONS)

- TABLE 123 EUROPE: ORGANIC ACIDS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 124 EUROPE: ORGANIC ACIDS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 125 EUROPE: ORGANIC ACIDS MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 126 EUROPE: ORGANIC ACIDS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 127 GERMANY: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 128 GERMANY: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 129 GERMANY: ORGANIC ACIDS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 130 GERMANY: ORGANIC ACIDS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 131 ITALY: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 132 ITALY: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 133 ITALY: ORGANIC ACIDS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 134 ITALY: ORGANIC ACIDS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 135 FRANCE: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 136 FRANCE: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 137 FRANCE: ORGANIC ACIDS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 138 FRANCE: ORGANIC ACIDS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 139 SPAIN: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 140 SPAIN: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 141 SPAIN: ORGANIC ACIDS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 142 SPAIN: ORGANIC ACIDS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 143 UK: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 144 UK: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 145 UK: ORGANIC ACIDS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 146 UK: ORGANIC ACIDS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 147 REST OF EUROPE: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 148 REST OF EUROPE: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 149 REST OF EUROPE: ORGANIC ACIDS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 150 REST OF EUROPE: ORGANIC ACIDS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 151 ASIA PACIFIC: ORGANIC ACIDS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 152 ASIA PACIFIC: ORGANIC ACIDS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 153 ASIA PACIFIC: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 154 ASIA PACIFIC: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 155 ASIA PACIFIC: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (KILO TONS)

- TABLE 156 ASIA PACIFIC: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (KILO TONS)

- TABLE 157 ASIA PACIFIC: ORGANIC ACIDS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 158 ASIA PACIFIC: ORGANIC ACIDS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 159 ASIA PACIFIC: ORGANIC ACIDS MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 160 ASIA PACIFIC: ORGANIC ACIDS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 161 CHINA: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 162 CHINA: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 163 CHINA: ORGANIC ACIDS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 164 CHINA: ORGANIC ACIDS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 165 INDIA: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 166 INDIA: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 167 INDIA: ORGANIC ACIDS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 168 INDIA: ORGANIC ACIDS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 169 JAPAN: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 170 JAPAN: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 171 JAPAN: ORGANIC ACIDS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 172 JAPAN: ORGANIC ACIDS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 173 AUSTRALIA & NEW ZEALAND: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 174 AUSTRALIA & NEW ZEALAND: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 175 AUSTRALIA & NEW ZEALAND: ORGANIC ACIDS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 176 AUSTRALIA & NEW ZEALAND: ORGANIC ACIDS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 177 REST OF ASIA PACIFIC: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 178 REST OF ASIA PACIFIC: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 179 REST OF ASIA PACIFIC: ORGANIC ACIDS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 180 REST OF ASIA PACIFIC: ORGANIC ACIDS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 181 SOUTH AMERICA: ORGANIC ACIDS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 182 SOUTH AMERICA: ORGANIC ACIDS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 183 SOUTH AMERICA: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 184 SOUTH AMERICA: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 185 SOUTH AMERICA: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (KILO TONS)

- TABLE 186 SOUTH AMERICA: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (KILO TONS)

- TABLE 187 SOUTH AMERICA: ORGANIC ACIDS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 188 SOUTH AMERICA: ORGANIC ACIDS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 189 SOUTH AMERICA: ORGANIC ACIDS MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 190 SOUTH AMERICA: ORGANIC ACIDS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 191 BRAZIL: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 192 BRAZIL: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 193 BRAZIL: ORGANIC ACIDS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 194 BRAZIL: ORGANIC ACIDS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 195 ARGENTINA: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 196 ARGENTINA: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 197 ARGENTINA: ORGANIC ACIDS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 198 ARGENTINA: ORGANIC ACIDS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 199 REST OF SOUTH AMERICA: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 200 REST OF SOUTH AMERICA: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 201 REST OF SOUTH AMERICA: ORGANIC ACIDS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 202 REST OF SOUTH AMERICA: ORGANIC ACIDS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 203 REST OF THE WORLD: ORGANIC ACIDS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 204 REST OF THE WORLD: ORGANIC ACIDS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 205 REST OF THE WORLD: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 206 REST OF THE WORLD: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 207 REST OF THE WORLD: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (KILO TONS)

- TABLE 208 REST OF THE WORLD: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (KILO TONS)

- TABLE 209 REST OF THE WORLD: ORGANIC ACIDS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 210 REST OF THE WORLD: ORGANIC ACIDS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 211 REST OF THE WORLD: ORGANIC ACIDS MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 212 REST OF THE WORLD: ORGANIC ACIDS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 213 MIDDLE EAST: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 214 MIDDLE EAST: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 215 MIDDLE EAST: ORGANIC ACIDS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 216 MIDDLE EAST: ORGANIC ACIDS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 217 AFRICA: ORGANIC ACIDS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 218 AFRICA: ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 219 AFRICA: ORGANIC ACIDS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 220 AFRICA: ORGANIC ACIDS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 221 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MARKET PLAYERS, 2021-2024

- TABLE 222 ORGANIC ACIDS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 223 ORGANIC ACIDS MARKET: REGIONAL FOOTPRINT

- TABLE 224 ORGANIC ACIDS MARKET: TYPE FOOTPRINT

- TABLE 225 ORGANIC ACIDS MARKET: APPLICATION FOOTPRINT

- TABLE 226 ORGANIC ACIDS MARKET: KEY STARTUPS/SMES

- TABLE 227 ORGANIC ACIDS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 228 ORGANIC ACIDS MARKET: PRODUCT LAUNCHES, 2020-NOVEMBER 2025

- TABLE 229 ORGANIC ACIDS MARKET: DEALS, 2020-NOVEMBER 2025

- TABLE 230 ORGANIC ACIDS MARKET: EXPANSIONS, 2020-NOVEMBER 2025

- TABLE 231 BASF SE: COMPANY OVERVIEW

- TABLE 232 BASF SE: PRODUCTS OFFERED

- TABLE 233 BASF SE: PRODUCT LAUNCHES

- TABLE 234 ADM: COMPANY OVERVIEW

- TABLE 235 ADM: PRODUCTS OFFERED

- TABLE 236 ADM: DEALS

- TABLE 237 CARGILL, INCORPORATED: COMPANY OVERVIEW

- TABLE 238 CARGILL, INCORPORATED: PRODUCTS OFFERED

- TABLE 239 CORBION: COMPANY OVERVIEW

- TABLE 240 CORBION: PRODUCTS OFFERED

- TABLE 241 CORBION: EXPANSIONS

- TABLE 242 JUNGBUNZLAUER SUISSE AG: COMPANY OVERVIEW

- TABLE 243 JUNGBUNZLAUER SUISSE AG: PRODUCTS OFFERED

- TABLE 244 THE DOW CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 245 THE DOW CHEMICAL COMPANY: PRODUCTS OFFERED

- TABLE 246 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 247 EASTMAN CHEMICAL COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 DSM-FIRMENICH: COMPANY OVERVIEW

- TABLE 249 DSM-FIRMENICH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 POLYNT S.P.A.: COMPANY OVERVIEW

- TABLE 251 POLYNT S.P.A.: PRODUCTS OFFERED

- TABLE 252 CELANESE CORPORATION: COMPANY OVERVIEW

- TABLE 253 CELANESE CORPORATION: PRODUCTS OFFERED

- TABLE 254 TATE & LYLE: COMPANY OVERVIEW

- TABLE 255 TATE & LYLE: PRODUCTS OFFERED

- TABLE 256 HENAN JINDAN LACTIC ACID TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 257 HENAN JINDAN LACTIC ACID TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 258 SHANDONG ENSIGN INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 259 SHANDONG ENSIGN INDUSTRY CO., LTD.: PRODUCTS OFFERED

- TABLE 260 FOODCHEM INTERNATIONAL CORPORATION: COMPANY OVERVIEW

- TABLE 261 FOODCHEM INTERNATIONAL CORPORATION: PRODUCTS OFFERED

- TABLE 262 AFYREN: COMPANY OVERVIEW

- TABLE 263 AFYREN: PRODUCTS OFFERED

- TABLE 264 GALACTIC: COMPANY OVERVIEW

- TABLE 265 GALACTIC: PRODUCTS OFFERED

- TABLE 266 HAWKINS: COMPANY OVERVIEW

- TABLE 267 HAWKINS: PRODUCTS OFFERED

- TABLE 268 BBCA BIOCHEMICAL: COMPANY OVERVIEW

- TABLE 269 BBCA BIOCHEMICAL: PRODUCTS OFFERED

- TABLE 270 RZBC GROUP: COMPANY OVERVIEW

- TABLE 271 RZBC GROUP: PRODUCTS OFFERED

- TABLE 272 BARTEK INGREDIENTS INC.: COMPANY OVERVIEW

- TABLE 273 BARTEK INGREDIENTS INC.: PRODUCTS OFFERED

- TABLE 274 FUSO CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 275 FUSO CHEMICAL CO., LTD.: PRODUCTS OFFERED

- TABLE 276 VINIPUL CHEMICALS PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 277 VINIPUL CHEMICALS PRIVATE LIMITED: PRODUCTS OFFERED

- TABLE 278 GEOCON PRODUCTS: COMPANY OVERVIEW

- TABLE 279 LOBA CHEMIE PVT. LTD.: COMPANY OVERVIEW

- TABLE 280 CITRIBEL NV: COMPANY OVERVIEW

- TABLE 281 PEER CHEMICAL INDUSTRIES: COMPANY OVERVIEW

- TABLE 282 SHANDONG ACID TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 283 ADJACENT MARKETS TO ORGANIC ACIDS MARKET

- TABLE 284 LACTIC ACID AND POLYLACTIC ACID MARKET, BY FORM, 2018-2022 (USD MILLION)

- TABLE 285 LACTIC ACID AND POLYLACTIC ACID MARKET, BY FORM, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 ORGANIC ACIDS MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 2 ORGANIC ACIDS MARKET, BY FORM, 2025 VS. 2030 (USD MILLION)

- FIGURE 3 ORGANIC ACIDS MARKET, BY SOURCE, 2025 VS. 2030 (USD MILLION)

- FIGURE 4 ORGANIC ACIDS MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 5 ORGANIC ACIDS MARKET, BY REGION

- FIGURE 6 RISING HEALTH AWARENESS AND GOVERNMENT SUPPORT FOR ORGANIC ACIDS ADOPTION TO DRIVE MARKET

- FIGURE 7 CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 8 INDUSTRIAL SEGMENT AND CHINA TO ACCOUNT FOR LARGEST MARKET SHARES IN ASIA PACIFIC IN 2025

- FIGURE 9 INDUSTRIAL SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 10 LIQUID SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 SYNTHETIC SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 ACETIC ACID SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 ORGANIC ACIDS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 14 ORGANIC ACIDS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 15 GLOBAL POPULATION GROWTH, 1950-2050 (BILLION)

- FIGURE 16 GDP GROWTH, 2016-2024 (TRILLION)

- FIGURE 17 ORGANIC ACIDS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 18 ORGANIC ACIDS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 19 ORGANIC ACIDS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 20 AVERAGE SELLING PRICE TREND OF ORGANIC ACIDS, BY TYPE, 2020-2024 (USD/KG)

- FIGURE 21 AVERAGE SELLING PRICE TREND OF ORGANIC ACIDS, BY REGION, 2020-2024 (USD/KG)

- FIGURE 22 EXPORT VALUE OF ACETIC ACIDS UNDER HS CODE 291521 FOR KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 23 IMPORT VALUE OF ACETIC ACIDS UNDER HS CODE 291521 FOR KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 24 EXPORT VALUE OF FORMIC UNDER HS CODE 291511 FOR KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 25 IMPORT VALUE OF FORMIC ACIDS UNDER HS CODE 291511 FOR KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- FIGURE 27 INVESTMENT AND FUNDING SCENARIO, 2020-2025 (USD MILLION)

- FIGURE 28 NUMBER OF PATENTS APPLIED AND GRANTED FOR ORGANIC ACIDS MARKET, 2015-2025

- FIGURE 29 REGIONAL ANALYSIS OF PATENTS GRANTED FOR ORGANIC ACIDS MARKET, 2015-2025

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS

- FIGURE 31 KEY BUYING CRITERIA FOR TOP APPLICATIONS

- FIGURE 32 ORGANIC ACIDS MARKET, BY SOURCE, 2025 VS. 2030 (USD MILLION)

- FIGURE 33 ORGANIC ACIDS MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 34 ORGANIC ACIDS MARKET, BY FORM, 2025 VS. 2030 (USD MILLION)

- FIGURE 35 ORGANIC ACIDS MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 36 ORGANIC ACIDS MARKET, BY KEY COUNTRY, 2025-2030 (CAGR)

- FIGURE 37 NORTH AMERICA: ORGANIC ACIDS MARKET SNAPSHOT

- FIGURE 38 ASIA PACIFIC: ORGANIC ACIDS MARKET SNAPSHOT

- FIGURE 39 REVENUE ANALYSIS FOR KEY COMPANIES, 2022-2024 (USD BILLION)

- FIGURE 40 SHARE ANALYSIS OF LEADING PLAYERS IN ORGANIC ACIDS MARKET, 2024

- FIGURE 41 ORGANIC ACIDS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 42 ORGANIC ACIDS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 43 ORGANIC ACIDS MARKET: COMPANY FOOTPRINT

- FIGURE 44 ORGANIC ACIDS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 45 BASF SE: COMPANY SNAPSHOT

- FIGURE 46 ADM: COMPANY SNAPSHOT

- FIGURE 47 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- FIGURE 48 CORBION: COMPANY SNAPSHOT

- FIGURE 49 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

- FIGURE 50 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

- FIGURE 51 DSM-FIRMENICH: COMPANY SNAPSHOT

- FIGURE 52 POLYNT S.P.A.: COMPANY SNAPSHOT

- FIGURE 53 CELANESE CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 TATE & LYLE: COMPANY SNAPSHOT

- FIGURE 55 HENAN JINDAN LACTIC ACID TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 56 AFYREN: COMPANY SNAPSHOT

- FIGURE 57 HAWKINS: COMPANY SNAPSHOT

- FIGURE 58 ORGANIC ACIDS MARKET: RESEARCH DESIGN

- FIGURE 59 ORGANIC ACIDS MARKET: BOTTOM-UP APPROACH

- FIGURE 60 ORGANIC ACIDS MARKET: TOP-DOWN APPROACH

- FIGURE 61 APPROACH 1: SUPPLY-SIDE ANALYSIS

- FIGURE 62 APPROACH 2: DEMAND-SIDE ANALYSIS

- FIGURE 63 ORGANIC ACIDS MARKET SIZE ESTIMATION - BOTTOM-UP APPROACH

- FIGURE 64 ORGANIC ACIDS MARKET SIZE ESTIMATION - TOP-DOWN APPROACH

- FIGURE 65 ORGANIC ACIDS MARKET: DATA TRIANGULATION