|

市場調查報告書

商品編碼

1844718

有機酸:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Organic Acids - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

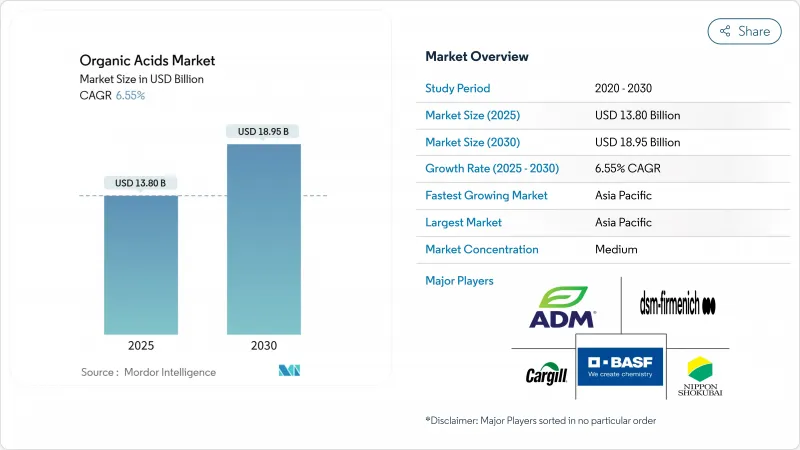

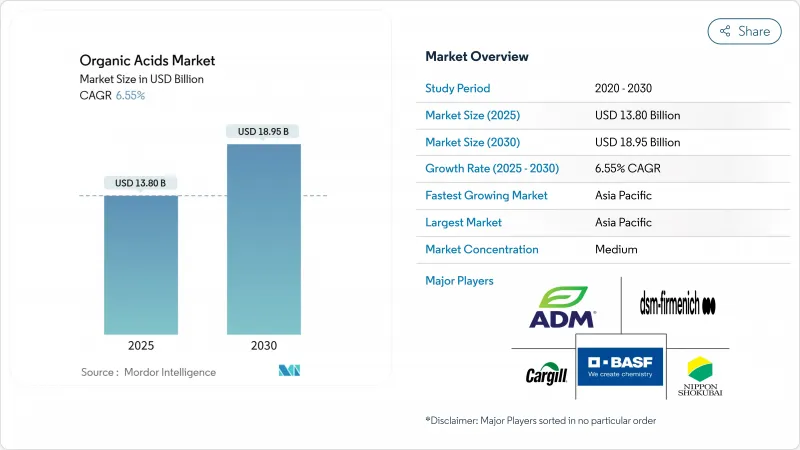

預計有機酸市場規模到 2025 年將達到 138 億美元,到 2030 年將擴大到 189.5 億美元,複合年成長率為 6.55%。

這種成長主要得益於從石化方法到生物發酵製程的重大轉變,以及食品、聚合物和製藥業對潔淨標示產品的需求不斷增加。

有機酸,包括乙酸、檸檬酸和乳酸,在食品保鮮、增味和pH值調節等各種應用中發揮至關重要的作用。環境問題和對永續替代品的需求正在推動向生物基生產方式的轉變。此外,消費者對天然和清潔標籤產品的偏好日益成長,促使製造商在食品和飲料配方中加入有機酸。在聚合物和製藥行業,有機酸因其功能特性而日益應用,例如用作化學合成的中間體並提升產品性能。預計有機酸在各個價值鏈中的應用將支持市場在預測期內的強勁成長。

全球有機酸市場趨勢與洞察

乙酸作為太陽能 EVA 薄膜的醋酸乙烯單體的快速應用

太陽能光伏 (PV) 產業的快速發展顯著增加了醋酸乙烯單體(VAM) 生產中對醋酸的需求。這項需求主要源自於 EVA封裝膜,它對於提高太陽能板的耐用性和效率至關重要。如今,生產商可以利用大豆油的非催化分解,以可再生原料生產商業級 VAM。這種創新製程生產的醋酸是一種高價值產品,能夠滿足太陽能光電產業嚴格的品質要求。透過採用這種生物基生產路線,製造商可以履行永續性義務,同時實現供應鏈多元化,並減少對石化衍生 VAM 的依賴。此外,將生物基醋酸與可再生乙醇衍生乙烯結合,可以建立一條完全永續的VAM 生產路線。這項進步使有機酸製造商能夠在快速擴張的太陽能市場中抓住溢價機會。

注射劑型對藥用級乳酸的需求

藥用級乳酸的需求是有機酸市場的主要驅動力,尤其是由於其在注射劑中的應用日益廣泛。乳酸以其良好的生物相容性和生物分解性而聞名,在製藥行業中被廣泛用於增強藥物傳輸系統。根據美國食品藥物管理局(FDA) 的數據,在藥物製劑中使用乳酸符合嚴格的安全性和有效性標準,使其成為注射劑的首選。此外,世界衛生組織 (WHO) 強調了此類生物相容性化合物在改善患者預後方面的重要性,尤其是在重症監護藥物方面。此外,糖尿病和心血管疾病等慢性疾病的日益普及導致注射劑需求激增,進一步推動了對藥用級乳酸的需求。根據美國疾病管制與預防中心 (CDC) 的數據,到 2023 年,美國成年人糖尿病的盛行率將達到 15.8%,這凸顯了對有效藥物輸送系統日益成長的需求。預計這種成長將直接影響製藥應用對乳酸的需求。

嚴格的VOC指令限制石油基丙烯酸和己二酸

針對石油基丙烯酸和己二酸的嚴格揮發性有機化合物 (VOC) 指令嚴重阻礙了有機酸市場的發展。這些指令旨在透過限制使用會導致 VOC排放的石化衍生物來減少環境污染並促進永續性。眾所周知,VOC 對人類健康和環境都有不利影響,包括導致地面臭氧層的形成和空氣品質惡化。因此,包括北美、歐洲和亞太地區在內的各個地區的監管機構正在實施嚴格的 VOC排放控制指南,這直接影響了石油基丙烯酸和己二酸的生產和使用。有機酸市場的製造商在遵守這些法規方面面臨挑戰,這可能導致生產成本增加,因為需要先進的技術和流程來滿足合規標準。此外,這些法規鼓勵業界探索和採用替代原料,例如生物基原料,這些原料更環保,但通常成本更高且擴充性較差。

細分分析

2024 年,乙酸在有機酸市場保持主導地位,佔據 34.16% 的主導市場。這種主導地位歸因於其在紡織、食品飲料和製藥等各行業的廣泛應用。乙酸在醋酸乙烯單體(VAM) 的生產中起著關鍵作用,而 VAM 是製造黏合劑、油漆和被覆劑的關鍵前驅物。乙酸也用於製造乙酸酐、對苯二甲酸和乙酸酯,進一步推動了需求。該化合物的多功能性和在終端用戶行業的廣泛需求繼續推動其成長並鞏固其作為市場領導的地位。預計新興國家對工業應用的日益關注和對 VAM 需求的不斷成長將在未來幾年進一步推動乙酸的成長。

同時,琥珀酸已成為有機酸市場中成長最快的細分市場。預計在2025-2030年的預測期內,琥珀酸的複合年成長率將達到9.67%。這一成長主要源於其作為可生物分解聚合物基本成分的日益普及,這得益於日益成長的環保意識以及對永續材料的監管支持。琥珀酸也用於製造樹脂、被覆劑和個人保健產品,進一步提升了其市場佔有率。此外,生物基生產技術的進步使琥珀酸成為一種經濟高效、可再生的石油基化學品替代品。

石化原料將主導有機酸市場,到2024年將佔61.52%的顯著佔有率。這些來源將繼續在滿足食品飲料、製藥和化學品等各行各業對有機酸的高需求方面發揮關鍵作用。完善的石化生產基礎設施和相對較低的生產成本使其佔據了強大的市場地位。然而,對環境永續性的擔憂和原油價格的波動可能會在未來幾年對石化基有機酸的成長構成挑戰。

同時,生物基有機酸預計在預測期內將以驚人的11.07%的複合年成長率成長。這一成長的驅動力在於消費者對永續環保產品的日益成長的偏好,以及鼓勵使用可再生資源的嚴格環境法規。生物基有機酸源自玉米、甘蔗和其他生質能等可再生原料,使其成為石化原料的永續替代品。生物技術和發酵過程的進步進一步提高了生物基有機酸生產的效率和擴充性,使其成為市場的關鍵成長動力。

區域分析

2024 年,亞太地區將在全球有機酸市場中佔據主導地位,佔據最大的區域市場佔有率 30.42%,並以預計 9.41% 的複合年成長率成為成長最快的地區,到 2030 年。這種雙重領導地位歸功於該地區強大的製造業生態系統和不斷壯大的中產階級人口不斷轉變的消費模式。受都市化進程加速和消費者偏好變化的推動,食品、製藥和工業應用對有機酸的需求尤其強勁。中國是該地區最大的有機酸生產國,但面臨產能過剩和持續的貿易爭端等挑戰,這些挑戰可能會影響市場動態。然而,在快速的經濟發展、有利的政府政策和與全球永續性標準的接軌的支持下,印度和東南亞國家正在成為重要的成長貢獻者。

由於生物基生產技術的進步以及優先考慮永續性和高品質標準的監管框架,北美在有機酸市場繼續保持穩固地位。該地區正在大力投資發酵產能,以彌補現有的基礎設施缺口並實現更有效率的生產流程。食品飲料、製藥和農業等各行各業對生物基替代品的日益普及,進一步提振了北美對有機酸的需求。該地區對創新和永續性的關注,使其成為開發先進有機酸解決方案的領導者,服務於國內和國際市場。這些因素使北美在全球市場繼續佔據關鍵地位。

歐洲有機酸市場成熟,注重高階應用和嚴格的合規性。隨著各行各業日益轉向永續和環保的解決方案,該地區嚴格的環境標準為生物基製造商創造了機會。歐洲對有機酸的需求主要來自食品保鮮、製藥和工業流程等領域的應用,這些領域對品質和永續性至關重要。同時,南美、中東和非洲代表著全球有機酸市場的新興機會。這些地區經濟發展迅速,農業資源豐富,為有機酸的生產和消費提供了堅實的基礎。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 醋酸醋酸乙烯單體中醋酸的快速採用,用於太陽能EVA薄膜

- 注射藥用乳酸的需求

- 檸檬酸類天然防腐劑在潔淨標示飲品的興起

- 琥珀酸作為 BioPBS 和 BioBDO 的基石的開發

- 飼料級甲酸和丙酸在無非洲豬瘟豬飼料中的應用

- 在飼料中用作抗生素的替代品

- 市場限制

- 嚴格的VOC指令限制石油基丙烯酸和己二酸

- 中國低純度檸檬酸產能過剩及價格壓縮

- 合成酸的環境問題阻礙了市場成長

- 阻礙市場成長的技術和基礎設施障礙

- 供應鏈分析

- 監理展望

- 五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場規模和成長預測(數量和金額)

- 按類型

- 醋酸

- 檸檬酸

- 乳酸

- 琥珀酸

- 蘋果酸

- 丙酸

- 甲酸

- 富馬酸和馬來酸

- 其他(苯甲酸、葡萄糖酸、己二酸等)

- 按原料

- 生物基

- 石化

- 混合/副產品

- 按用途

- 飲食

- 動物飼料和營養

- 製藥和醫療保健

- 個人護理和化妝品

- 工業化學品和中間體(VAM、PTA、丙烯酸酯等)

- 聚合物和生質塑膠(PLA、PBS、PHA)

- 其他(紡織品、潤滑劑、電子產品)

- 按形式

- 液體

- 乾/晶體/粉末

- 區域分析

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 其他北美地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲國家

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 其他亞太地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市場排名分析

- 公司簡介

- BASF SE

- Cargill, Incorporated

- Archer Daniels Midland Company

- Royal DSM(Reverdia)

- Nippon Shokubai Co., Ltd.

- DSM-Firmenich AG

- Roquette Freres

- Celanese Corporation

- Corbion NV

- Thermo Fisher Scientific

- Bartek Ingredients Inc.

- Fuso Chemical Co., Ltd.

- Inner Mongolia

- Mitsubishi Chemical Group

- Fengchen Group Co.,Ltd

- RZBC GROUP CO., LTD

- TINNAKORN CHEMICAL & SUPPLY

- Shandong Feiyang Chemical

- Jinan Finer Chemical Co., Ltd

- Anhui BBCA Biochemical

第7章 市場機會與未來展望

The organic acids market size reached USD 13.80 billion in 2025 and is forecast to advance to USD 18.95 billion by 2030 at a 6.55% CAGR.This growth is largely driven by a notable transition from petrochemical methods to bio-based fermentation processes, alongside an increasing demand for clean-label products across food, polymer, and pharmaceutical sectors.

Organic acids, which include acetic acid, citric acid, lactic acid, and others, play a crucial role in various applications such as food preservation, flavor enhancement, and pH regulation. The shift toward bio-based production methods is gaining traction due to environmental concerns and the need for sustainable alternatives. Additionally, the rising consumer preference for natural and clean-label products is pushing manufacturers to adopt organic acids in food and beverage formulations. In the polymer and pharmaceutical industries, organic acids are increasingly used for their functional properties, such as acting as intermediates in chemical synthesis and enhancing product performance. This growing adoption across diverse value chains underscores the market's robust expansion during the forecast period.

Global Organic Acids Market Trends and Insights

Rapid Uptake of Acetic Acid in Vinyl-Acetate-Monomer for Solar-EVA Films

The rapid growth of the photovoltaic industry has significantly increased the demand for acetic acid in the production of vinyl acetate monomers (VAM). EVA encapsulant films, which are essential for improving the durability and efficiency of solar panels, drive this demand. Producers can now manufacture commercial-grade VAM from renewable feedstocks by utilizing the non-catalytic cracking of soybean oil. This innovative process generates acetic acid as a valuable co-product that complies with the stringent quality requirements of the solar industry. By adopting this bio-based production pathway, manufacturers address sustainability mandates while diversifying supply chains to reduce reliance on petrochemical-derived VAM. Additionally, integrating ethylene derived from renewable ethanol with bio-based acetic acid establishes a fully sustainable VAM production route. This advancement enables organic acid producers to capitalize on premium pricing opportunities in the rapidly expanding solar market.

Pharmaceutical-grade Lactic Acid Demand for Injectable Drug Formulations

The demand for pharmaceutical-grade lactic acid is a significant driver in the organic acids market, particularly due to its increasing application in injectable drug formulations. Lactic acid, known for its biocompatibility and biodegradability, is widely used in the pharmaceutical industry to enhance drug delivery systems. According to the U.S. Food and Drug Administration (FDA), the adoption of lactic acid in drug formulations aligns with stringent safety and efficacy standards, making it a preferred choice for injectable drugs . Additionally, the World Health Organization emphasizes the importance of such biocompatible compounds in improving patient outcomes, especially in critical care medications. Moreover, the increasing prevalence of chronic diseases such as diabetes and cardiovascular disorders has led to a surge in demand for injectable drugs, further driving the need for pharmaceutical-grade lactic acid. According to the Centers for Disease Control and Prevention (CDC), the prevalence of total diabetes was 15.8% in all adults in the United States in 2023, highlighting the growing need for effective drug delivery systems. This growth is expected to directly impact the demand for lactic acid in pharmaceutical applications.

Stringent VOC Directives Limiting Petro-based Acrylic and Adipic Acids

The organic acid market is experiencing significant restraint due to stringent Volatile Organic Compound (VOC) directives imposed on petro-based acrylic and adipic acids. These directives aim to reduce environmental pollution and promote sustainability by limiting the use of petrochemical derivatives that contribute to VOC emissions. VOCs are known to have adverse effects on both human health and the environment, including contributing to ground-level ozone formation and air quality degradation. As a result, regulatory bodies across various regions, including North America, Europe, and Asia-Pacific, have implemented strict guidelines to curb VOC emissions, directly impacting the production and usage of petro-based acrylic and adipic acids. Manufacturers in the organic acid market are facing challenges in complying with these regulations, which may lead to increased production costs due to the need for advanced technologies and processes to meet compliance standards. Additionally, the restrictions are driving the industry to explore and adopt alternative raw materials, such as bio-based feedstocks, which are more environmentally friendly but often come with higher costs and scalability issues.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Citric-acid-based Natural Preservatives in Clean-Label Beverages

- Growth of Succinic Acid as a Building Block for Bio-PBS and Bio-BDO

- Environmental Concerns with Synthetic Acids Hindering the Market Growth

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, acetic acid holds a dominant 34.16% market share in the organic acids market, maintaining its leadership position. This dominance is attributed to its extensive applications across various industries, including textiles, food and beverages, and pharmaceuticals. Acetic acid plays a critical role in the production of vinyl acetate monomer (VAM), which is a key precursor for manufacturing adhesives, paints, and coatings. Additionally, its use in the production of acetic anhydride, terephthalic acid, and acetate esters further enhances its demand. The compound's versatility and widespread demand across end-user industries continue to drive its growth and solidify its position as a market leader. The increasing focus on industrial applications and the rising demand for VAM in emerging economies are expected to further bolster the growth of acetic acid in the coming years.

Succinic acid, on the other hand, is emerging as the fastest-growing segment in the organic acids market. It is projected to register a robust CAGR of 9.67% during the forecast period of 2025 to 2030. This growth is primarily fueled by its increasing adoption as a building block for biodegradable polymers, which are gaining traction due to rising environmental concerns and regulatory support for sustainable materials. Succinic acid is also used in the production of resins, coatings, and personal care products, further contributing to its expanding market presence. Moreover, advancements in bio-based production technologies have made succinic acid a cost-effective and renewable alternative to petroleum-based chemicals.

In 2024, petrochemical sources dominated the organic acids market, holding a significant 61.52% share. These sources continue to play a crucial role in meeting the high demand for organic acids across various industries, including food and beverages, pharmaceuticals, and chemicals. The established infrastructure for petrochemical production and the relatively lower production costs contribute to their strong market position. However, concerns regarding environmental sustainability and fluctuating crude oil prices may pose challenges to the growth of petrochemical-based organic acids in the coming years.

On the other hand, bio-based sources of organic acids are expected to grow at an impressive CAGR of 11.07% during the forecast period. This growth is driven by increasing consumer preference for sustainable and eco-friendly products, along with stringent environmental regulations encouraging the adoption of renewable resources. Bio-based organic acids are derived from renewable feedstocks such as corn, sugarcane, and other biomass, making them a more sustainable alternative to petrochemical sources. Advancements in biotechnology and fermentation processes are further enhancing the efficiency and scalability of bio-based organic acid production, positioning this segment as a key growth driver in the market.

The Organic Acids Market Report is Segmented by Type (Acetic Acid, Citric Acid, and More), Source (Bio-Based, Petro-Chemical, Hybrid/Co-product Streams), Application (Food and Beverages, Animal Feed and Nutrition, and More ), Form (Liquid, Dry/Crystal/Powder), and Geography (North America, South America, Europe, Middle East and Africa, Asia-Pacific). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

In 2024, Asia-Pacific dominated the global organic acids market, holding the largest regional market share of 30.42% and registering the fastest growth with a projected CAGR of 9.41% through 2030. This dual leadership stems from the region's robust manufacturing ecosystem and the rising consumption patterns of its expanding middle-class population. The demand for organic acids is particularly strong in food, pharmaceutical, and industrial applications, driven by increasing urbanization and changing consumer preferences. China, as a key producer in the region, faces challenges such as overcapacity and ongoing trade disputes, which could impact its market dynamics. However, India and Southeast Asian countries are emerging as significant growth contributors, supported by rapid economic development, favorable government policies, and alignment with global sustainability standards.

North America continues to maintain a strong foothold in the organic acids market, underpinned by its technological advancements in bio-based production and a regulatory framework that prioritizes sustainability and high-quality standards. The region has witnessed substantial investments in fermentation capacity, addressing previous infrastructure gaps and enabling more efficient production processes. The demand for organic acids in North America is further bolstered by the growing adoption of bio-based alternatives across various industries, including food and beverages, pharmaceuticals, and agriculture. The region's focus on innovation and sustainability has positioned it as a leader in the development of advanced organic acid solutions, catering to both domestic and international markets. These factors ensure North America's continued prominence in the global market landscape.

Europe, with its mature organic acids market, emphasizes premium applications and strict regulatory compliance. The region's stringent environmental standards create opportunities for bio-based producers, as industries increasingly shift towards sustainable and eco-friendly solutions.The demand for organic acids in Europe is driven by their applications in food preservation, pharmaceuticals, and industrial processes, where quality and sustainability are paramount. Meanwhile, South America and the Middle East & Africa represent emerging opportunities in the global organic acids market. These regions benefit from economic development and abundant agricultural resources, which provide a strong foundation for organic acid production and consumption.

- BASF SE

- Cargill, Incorporated

- Archer Daniels Midland Company

- Royal DSM (Reverdia)

- Nippon Shokubai Co., Ltd.

- DSM-Firmenich AG

- Roquette Freres

- Celanese Corporation

- Corbion N.V.

- Thermo Fisher Scientific

- Bartek Ingredients Inc.

- Fuso Chemical Co., Ltd.

- Inner Mongolia

- Mitsubishi Chemical Group

- Fengchen Group Co.,Ltd

- RZBC GROUP CO., LTD

- TINNAKORN CHEMICAL & SUPPLY

- Shandong Feiyang Chemical

- Jinan Finer Chemical Co., Ltd

- Anhui BBCA Biochemical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Uptake of Acetic Acid in Vinyl-Acetate-Monomer for Solar-EVA Films

- 4.2.2 Pharmaceutical-grade Lactic Acid Demand for Injectable Drug Formulations

- 4.2.3 Expansion of Citric-acid-based Natural Preservatives in Clean-Label Beverages

- 4.2.4 Growth of Succinic Acid as a Building Block for Bio-PBS and Bio-BDO

- 4.2.5 Feed-grade Formic & Propionic Acids Adoption for ASF-Free Swine Diets

- 4.2.6 Use in Animal Feed as Antibiotic Alternatives

- 4.3 Market Restraints

- 4.3.1 Stringent VOC Directives Limiting Petro-based Acrylic and Adipic Acids

- 4.3.2 Over-capacity and Price Compression in Chinese Low-purity Citric Acid

- 4.3.3 Environmental Concerns with Synthetic Acids Hindering the Market Growth

- 4.3.4 Technological and Infrastructural Barriers Hampering the Market Growth

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Type

- 5.1.1 Acetic Acid

- 5.1.2 Citric Acid

- 5.1.3 Lactic Acid

- 5.1.4 Succinic Acid

- 5.1.5 Malic Acid

- 5.1.6 Propionic Acid

- 5.1.7 Formic Acid

- 5.1.8 Fumaric and Maleic Acids

- 5.1.9 Others (Benzoic, Gluconic, Adipic, etc.)

- 5.2 By Source

- 5.2.1 Bio-based

- 5.2.2 Petro-chemical

- 5.2.3 Hybrid/Co-product Streams

- 5.3 By Application

- 5.3.1 Food and Beverages

- 5.3.2 Animal Feed and Nutrition

- 5.3.3 Pharmaceuticals and Healthcare

- 5.3.4 Personal Care and Cosmetics

- 5.3.5 Industrial Chemicals and Intermediates (VAM, PTA, Acrylates, etc.)

- 5.3.6 Polymers and Bioplastics (PLA, PBS, PHA)

- 5.3.7 Others (Textiles, Lubricants, Electronics)

- 5.4 By Form

- 5.4.1 Liquid

- 5.4.2 Dry/Crystal/Powder

- 5.5 Geographic Analysis

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Middle East and Africa

- 5.5.4.1 Saudi Arabia

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 Asia-Pacific

- 5.5.5.1 China

- 5.5.5.2 India

- 5.5.5.3 Japan

- 5.5.5.4 Australia

- 5.5.5.5 Rest of Asia-Pacific

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, and Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 Cargill, Incorporated

- 6.4.3 Archer Daniels Midland Company

- 6.4.4 Royal DSM (Reverdia)

- 6.4.5 Nippon Shokubai Co., Ltd.

- 6.4.6 DSM-Firmenich AG

- 6.4.7 Roquette Freres

- 6.4.8 Celanese Corporation

- 6.4.9 Corbion N.V.

- 6.4.10 Thermo Fisher Scientific

- 6.4.11 Bartek Ingredients Inc.

- 6.4.12 Fuso Chemical Co., Ltd.

- 6.4.13 Inner Mongolia

- 6.4.14 Mitsubishi Chemical Group

- 6.4.15 Fengchen Group Co.,Ltd

- 6.4.16 RZBC GROUP CO., LTD

- 6.4.17 TINNAKORN CHEMICAL & SUPPLY

- 6.4.18 Shandong Feiyang Chemical

- 6.4.19 Jinan Finer Chemical Co., Ltd

- 6.4.20 Anhui BBCA Biochemical