|

市場調查報告書

商品編碼

1883936

鋼絲繩市場按捻方式、直徑、塗層類型、應用、材質和地區分類-預測至2030年Steel Wire Rope Market by Lay Type, Material Type, Coating, Diameter, Application, and Region - Global Forecast to 2030 |

||||||

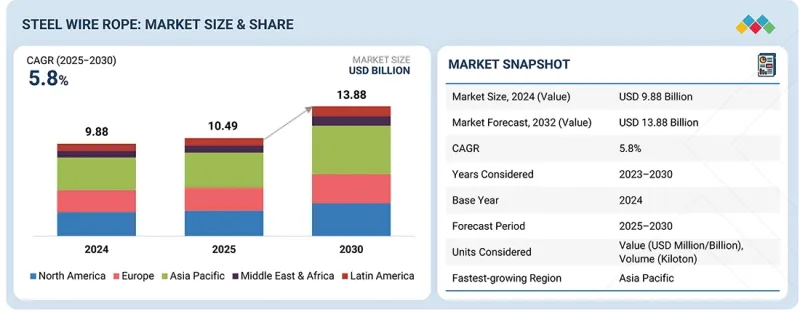

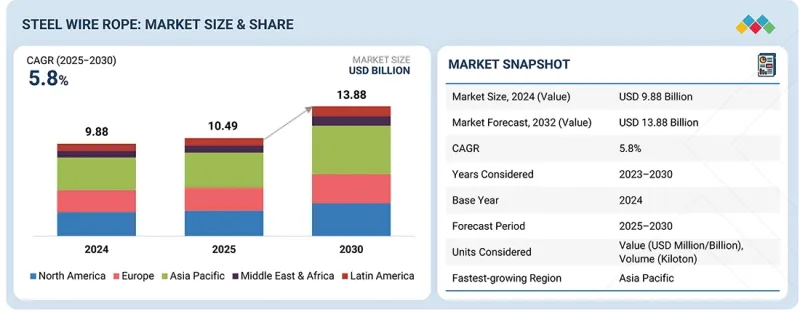

2025年鋼絲繩市場規模預估為104.9億美元,預估至2030年將達138.8億美元,複合年成長率為5.8%。

普通絞合鋼索具有優異的橫向穩定性和抗旋轉性能,是起重機、起吊裝置和土木基礎設施計劃的理想選擇,並佔據了整個鋼索市場最大的佔有率。其易於連接、檢查和維護,滿足全球主要建築和工業應用領域的安全和監管要求。

| 調查範圍 | |

|---|---|

| 調查期 | 2023-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 目標單元 | 金額(百萬美元)和數量(千噸) |

| 部分 | 依扭曲類型、直徑、塗層類型、應用、材質、區域 |

| 目標區域 | 歐洲、北美、亞太地區、中東和非洲以及拉丁美洲 |

與特殊類型的鋼絲繩相比,普通捻向鋼絲繩更耐壓、變形和意外旋轉,也更容易捲繞到捲筒上。憑藉其運作可靠性、符合法規要求和廣泛的適用性,普通捻向鋼絲繩已穩固確立了其在市場上的首選地位。

由於其成本效益高、機械強度優異且供應充足,鍍鋅鋼絲繩在工業和商業應用中廣受歡迎,預計其在鋼絲繩市場的複合年成長率將位居第二。鍍鋅製程是將鋅塗覆在鋼絲上,從而提高其耐腐蝕性並延長使用壽命,尤其是在半腐蝕性和戶外環境中。鍍鋅鋼絲繩因其耐用性、低維護成本和耐惡劣環境等優點,廣泛應用於建築、船舶、交通運輸、農業和採礦等高要求產業。與不銹鋼繩相比,鍍鋅鋼絲繩價格更實惠。它可以批量生產,以滿足對成本敏感的需求,尤其適用於需要高抗張強度和耐環境磨損(包括磨損、潮濕、紫外線和化學品腐蝕)的大型建設計劃。

按塗層類型分類,塑膠塗層鋼絲繩佔據了鋼絲繩市場第二大佔有率,這主要歸功於其優異的耐腐蝕性、耐久性和成本效益,尤其是在戶外和惡劣環境下的應用。鋼絲上的鍍鋅層提供犧牲陽極防腐蝕保護,而PVC、PE和尼龍等塑膠塗層則提供額外的耐磨、防潮、抗紫外線和化學劣化保護。這些特性使得塑膠塗層鍍鋅鋼絲繩非常適合建築、海事、採礦、交通運輸和農業等對使用壽命長、維護成本低的產業應用。

預計在預測期內,工業和起重機領域的鋼絲繩市場將實現第二高的複合年成長率。全球基礎設施建設、建設活動的增加以及製造業的擴張正在推動工業和起重機應用領域對鋼絲繩的需求。由於其強度高、耐久性強、耐磨性和抗疲勞性,鋼絲繩對於重型起重、物料搬運和重型作業至關重要。採礦、石油天然氣、港口和物流等行業的成長也促進了起重機和起重設備的使用,進一步推動了需求。此外,鋼絲繩設計技術的進步,例如塗層改進和抗張強度提高,正在提升其可靠性和耐久性,從而推動工業領域對鋼絲繩的安全性和作業效率的提升。

由於工業化進程加快和基礎設施建設蓬勃發展,包括建築、交通和能源計劃的擴張,中東和非洲地區預計將成為鋼絲繩市場複合年成長率第二高的地區。原油探勘和生產活動的顯著成長以及採礦業的蓬勃發展,推動了對耐用、高性能鋼絲繩的需求,這些鋼絲繩對於重型起重和物料搬運至關重要。可再生能源計劃投資的增加、海上活動的活性化以及港口建設的推進,也進一步促進了市場擴張。政府旨在實現經濟多元化、改善交通網路和增強本地製造業能力的舉措,也在市場成長中發揮關鍵作用。

本報告分析了全球鋼絲繩市場,並提供了按股數、直徑、塗層類型、應用、材質和地區分類的趨勢資訊,以及參與該市場的公司的概況。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章 市場概覽

- 介紹

- 市場動態

- 波特五力分析

- 主要相關人員和採購標準

- 定價分析

- 宏觀經濟展望

- 供應鏈分析

- 生態系分析

- 貿易分析

- 技術分析

- 專利分析

- 監管狀態

- 大型會議和活動

- 案例研究分析

- 影響客戶業務的趨勢與干擾因素

- 人工智慧/生成式人工智慧的影響

- 投資和資金籌措方案

- 2025年美國關稅對鋼絲繩市場的影響

6. 鋼絲繩市場(依絞合類型分類)

- 介紹

- 常規扭轉

- 朗特

7. 鋼絲繩市場(依直徑分類)

- 介紹

- 1/4英吋或更小

- 超過 1/4 英寸

8. 鋼絲繩市場(依塗層類型分類)

- 介紹

- 塑膠塗層

- 非塑膠塗層

第9章 鋼絲繩市場(依應用領域分類)

- 介紹

- 建造

- 礦業

- 海洋/漁業

- 工業和起重機

- 石油和天然氣

- 其他

第10章 鋼絲繩市場(依材質分類)

- 介紹

- 碳鋼

- 鍍鋅鋼

- 不銹鋼

- 其他

第11章 鋼絲繩市場(按地區分類)

- 介紹

- 北美洲

- 亞太地區

- 歐洲

- 拉丁美洲

- 中東和非洲

第12章 競爭格局

- 介紹

- 主要參與企業的策略/優勢,2020-2025 年

- 2020-2024年收入分析

- 2024年市佔率分析

- 品牌/產品對比

- 公司估值矩陣:主要參與企業,2024 年

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 估值和財務指標

- 競爭場景

第13章:公司簡介

- 主要參與企業

- BEKAERT

- WIRECO

- KISWIRE LTD.

- USHA MARTIN LIMITED

- TEUFELBERGER

- LOOS & CO. INC.

- PFEIFER GROUP

- TOKYO ROPE MFG. CO., LTD.

- JIANGSU LANGSHAN WIRE ROPE CO., LTD.

- BILCO GROUP

- SWR LTD.

- LEXCO CABLE

- JIANGYIN JIAHUA ROPES CO., LTD.

- NANTONG SHENWEI STEEL WIRE ROPE CO., LTD.

- BHARAT WIRE ROPES LTD.

- 其他公司

- HANGZHOU ZHEZHONG CHAIN CO., LTD.

- TYLER MADISON, INC.

- ORION ROPES PRIVATE LIMITED

- ASAHI ROPES

- DAVANGERE WIRE ROPE INDUSTRY PVT. LTD

- SHREE STEEL WIRE ROPES LTD.

- JD WIRE ROPES

- SURASHA WIREROPES

- JIANGYIN TUOXIN STEEL ROPE CO., LTD.

- SHREE VARDHAMAN WIRE ROPES

第14章附錄

The steel wire rope market is estimated to be USD 10.49 billion in 2025 and is projected to reach USD 13.88 billion by 2030, at a CAGR of 5.8%. Regular lay type accounted for the largest share of the overall steel wire rope market because it provides superior lateral stability and resistance to rotation, making it ideal for use in cranes, hoists, and civil infrastructure projects. Their ease of splicing, inspection, and maintenance aligns with safety and regulatory requirements in major construction and industrial applications globally.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | Lay Type, Material Type, Coating, Diameter, Application, and Region |

| Regions covered | Europe, North America, Asia Pacific, the Middle East & Africa, and Latin America |

Regular-lay ropes are more resistant to crushing, deformation, and unwanted rotation and spool more easily onto drums than more specialized types. This combination of operational reliability, regulatory compliance, and broad applicability secures regular lay ropes as the preferred choice in the market.

"The galvanized steel material type is projected to be the second-fastest-growing segment during the forecast period."

The galvanized steel segment of the steel wire rope market is projected to witness the second-highest CAGR due to its cost-effectiveness, good mechanical strength, and widespread availability, making it highly favored in industrial and commercial applications. The galvanization process coats the steel wire with zinc, providing corrosion resistance and extending the rope's lifespan, especially in semi-corrosive or outdoor environments. Galvanized wire ropes are widely used in demanding sectors such as construction, marine, transport, agriculture, and mining because of their durability, low maintenance costs, and ability to withstand harsh conditions. Unlike stainless steel ropes, galvanized wires offer a more affordable solution. They can be produced in larger volumes to meet cost-sensitive demands, particularly for large-scale construction projects that require high tensile strength and resistance to environmental wear, including abrasion, moisture, UV rays, and chemical exposure.

"Plastic-coated segment accounted for the second-largest share of the steel wire rope market."

Based on coating, the plastic-coated segment accounted for the second-largest share of the overall steel wire rope market due to its superior corrosion resistance, durability, and cost-effectiveness, especially in outdoor and harsh environment applications. The zinc galvanization process applied to steel wires offers sacrificial corrosion protection, which, when combined with plastic coatings like PVC, PE, or nylon, provides enhanced protection against abrasion, moisture, UV rays, and chemical degradation. These characteristics make plastic-coated galvanized steel ropes highly suitable for demanding applications in construction, maritime, mining, transportation, and agriculture, where longevity and low maintenance are critical.

"The industrial & crane segment is projected to register the second-highest growth rate during the forecast period."

The steel wire rope market in the industrial & crane segment is projected to register the second-highest CAGR during the forecast period. Demand for steel wire ropes in industrial and crane applications is rising due to increasing infrastructure development, construction activities, and expanding manufacturing industries worldwide. These ropes are essential for heavy lifting, material handling, and high-load operations because of their strength, durability, and resistance to abrasion and fatigue. Growth in sectors like mining, oil and gas, ports, and logistics also contributes to higher usage of cranes and hoisting equipment, further boosting demand. Furthermore, technological advancements in wire rope design, such as improved coatings and higher tensile strength, make them more reliable and longer lasting, encouraging industries to adopt them for safety and operational efficiency.

"Middle East & Africa is projected to register the second-highest CAGR in the steel wire rope market during the forecast period."

The Middle East & Africa is projected to register the second-highest CAGR in the steel wire rope market due to rapid industrialization and infrastructure development, including expanding construction, transportation, and energy projects. Significant growth in crude oil exploration and production activities, along with booming mining operations, drives demand for durable, high-performance steel wire ropes essential for heavy lifting and material handling. Increasing investments in renewable energy projects, flourishing maritime activities, and port developments further bolster market expansion. Government initiatives aimed at economic diversification, improving transportation networks, and boosting local manufacturing capabilities also play a crucial role in the market growth.

This study has been validated through primary interviews with industry experts globally. The primary sources have been divided into the following three categories:

- By Company Type: Tier 1 - 40%, Tier 2 - 33%, and Tier 3 - 27%

- By Designation: C-level - 50%, Director-level - 30%, and Managers - 20%

- By Region: North America - 20%, Europe - 15%, Asia Pacific - 50%, the Middle East & Africa - 10%, and Latin America - 5%

The report provides a comprehensive analysis of the following companies:

Prominent companies in this market include Bekaert (Belgium), WireCo (US), Kiswire Ltd. (South Korea), Usha Martin Limited (India), TEUFELBERGER (Austria), Loos & Co., Inc. (US), Pfeifer Group (Germany), Tokyo Rope Mfg. Co., Ltd. (Japan), Jiangsu Langshan Wire Rope Co., Ltd. (China), Bilco Group (US), SWR Ltd. (UK), Lexco Cable (US), Jiangyin Jiahua Ropes Co., Ltd. (China), Nantong Shenwei Steel Wire Rope Co., Ltd. (China), and Bharat Wire Ropes Ltd. (India).

Research Coverage

This research report categorizes the steel wire rope market by lay type (regular lay, lang lay), material type (carbon steel, galvanized steel, stainless steel, other material types), coating (non-plastic coated, plastic coated), diameter (<=1/4 Inch, >1/4 inch), application (construction, mining, marine & fishing, industrial & crane, oil & gas, other applications), and region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The scope of the report includes detailed information about the major factors influencing the growth of the steel wire rope market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted to provide insights into their business overview, solutions and services, key strategies, and recent developments in the steel wire rope market. This report includes a competitive analysis of upcoming startups in the steel wire rope market ecosystem.

Reasons to Buy This Report

The report will help market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall steel wire rope market and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (rising demand from construction and infrastructure development), restraints (fluctuating raw material prices), opportunities (growing expansion in renewable energy & marine applications), and challenges (intense market competition) influencing the growth of the steel wire rope market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product launches in the steel wire rope market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the steel wire rope market across varied regions

- Market Diversification: Exhaustive information about services, untapped geographies, recent developments, and investments in the steel wire rope market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Bekaert (Belgium), WireCo (US), Kiswire Ltd. (South Korea), Usha Martin Limited (India), TEUFELBERGER (Austria), Loos & Co., Inc. (US), Pfeifer Group (Germany), Tokyo Rope Mfg. Co., Ltd. (Japan), Jiangsu Langshan Wire Rope Co., Ltd. (China), Bilco Group (US), SWR Ltd. (UK), Lexco Cable (US), Jiangyin Jiahua Ropes Co., Ltd. (China), Nantong Shenwei Steel Wire Rope Co., Ltd. (China), and Bharat Wire Ropes Ltd. (India)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary participants

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.3.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN STEEL WIRE ROPE MARKET

- 4.2 STEEL WIRE ROPE MARKET, BY APPLICATION AND REGION

- 4.3 STEEL WIRE ROPE MARKET, BY LAY TYPE

- 4.4 STEEL WIRE ROPE MARKET, BY MATERIAL TYPE

- 4.5 STEEL WIRE ROPE MARKET, BY COATING

- 4.6 STEEL WIRE ROPE MARKET, BY DIAMETER

- 4.7 STEEL WIRE ROPE MARKET, BY APPLICATION

- 4.8 STEEL WIRE ROPE MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand from construction and infrastructure development

- 5.2.1.2 Expansion of mining operations and industrial activities

- 5.2.2 RESTRAINTS

- 5.2.2.1 Fluctuating raw material prices

- 5.2.2.2 High competition from synthetic ropes

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing expansion in renewable energy & marine applications

- 5.2.3.2 Integrating automation with smart rope technologies

- 5.2.4 CHALLENGES

- 5.2.4.1 Intense market competition

- 5.2.4.2 Fatigue & breakage risk

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND AMONG KEY PLAYERS, BY APPLICATION

- 5.5.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.6 MACROECONOMIC OUTLOOK

- 5.6.1 INTRODUCTION

- 5.6.2 GDP TRENDS AND FORECAST

- 5.6.3 TRENDS IN GLOBAL STEEL WIRE ROPE INDUSTRY

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.8 ECOSYSTEM ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 EXPORT SCENARIO (HS CODE 731210)

- 5.9.2 IMPORT SCENARIO (HS CODE 731210)

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Wire drawing and stranding

- 5.10.1.2 Specialized coating and surface treatments

- 5.10.1.3 Rope closing

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 X-ray and ultrasonic non-destructive testing

- 5.10.1 KEY TECHNOLOGIES

- 5.11 PATENT ANALYSIS

- 5.11.1 INTRODUCTION

- 5.11.2 METHODOLOGY

- 5.11.3 DOCUMENT TYPES

- 5.11.4 INSIGHTS

- 5.11.5 LEGAL STATUS

- 5.11.6 JURISDICTION ANALYSIS

- 5.11.7 TOP APPLICANT ANALYSIS

- 5.11.8 TOP US PATENT OWNERS, 2015-2024

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 KEY CONFERENCES AND EVENTS

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 INNOVATIVE STEEL WIRE ROPE SOLUTION FOR GALWAY'S PEDESTRIAN AND CYCLE SAFETY

- 5.14.2 SHADEMAKERS' PARTNERSHIP WITH SWR DELIVERS PREMIUM STEEL WIRE ROPE FOR YACHTS

- 5.14.3 STREAMLINING WAKEBOARD LIFT OPERATIONS WITH HIGH-PERFORMANCE STEEL WIRE ROPES

- 5.15 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.16 IMPACT OF AI/GEN AI

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 IMPACT OF 2025 US TARIFF ON STEEL WIRE ROPE MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 KEY IMPACT ON MAJOR COUNTRIES/REGIONS

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END USERS

6 STEEL WIRE ROPE MARKET, BY LAY TYPE

- 6.1 INTRODUCTION

- 6.2 REGULAR LAY

- 6.2.1 GROWING USE IN CONSTRUCTION, HOISTING, AND GENERAL LIFTING APPLICATIONS

- 6.3 LANG LAY

- 6.3.1 RISING ADOPTION IN DYNAMIC AND HEAVY-DUTY INDUSTRIAL APPLICATIONS

7 STEEL WIRE ROPE MARKET, BY DIAMETER

- 7.1 INTRODUCTION

- 7.2 <=1/4 INCH

- 7.2.1 RISING DEMAND FOR FLEXIBLE AND LIGHTWEIGHT ROPES

- 7.3 >1/4 INCH

- 7.3.1 EXPANDING HEAVY-DUTY APPLICATIONS ACROSS CORE INDUSTRIES

8 STEEL WIRE ROPE MARKET, BY COATING TYPE

- 8.1 INTRODUCTION

- 8.2 PLASTIC-COATED

- 8.2.1 RISING DEMAND FOR ENHANCED DURABILITY AND CORROSION RESISTANCE

- 8.3 NON-PLASTIC COATED

- 8.3.1 EXPANDING USE IN HEAVY-DUTY INDUSTRIAL AND CONSTRUCTION APPLICATIONS

9 STEEL WIRE ROPE MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 CONSTRUCTION

- 9.2.1 RISING ADOPTION OF ADVANCED CONSTRUCTION EQUIPMENT AND SAFETY STANDARDS

- 9.3 MINING

- 9.3.1 INCREASING DEPTH AND SCALE OF MINING OPERATIONS

- 9.4 MARINE & FISHING

- 9.4.1 GROWING MODERNIZATION OF PORT INFRASTRUCTURE AND FISHING FLEETS

- 9.5 INDUSTRIAL & CRANE

- 9.5.1 RISING INDUSTRIAL AUTOMATION AND MATERIAL HANDLING DEMAND

- 9.6 OIL & GAS

- 9.6.1 INCREASING GLOBAL ENERGY DEMAND AND OFFSHORE PRODUCTION EXPANSION

- 9.7 OTHER APPLICATIONS

10 STEEL WIRE ROPE MARKET, BY MATERIAL TYPE

- 10.1 INTRODUCTION

- 10.2 CARBON STEEL

- 10.2.1 HIGH STRENGTH AND COST-EFFECTIVENESS FOR HEAVY-DUTY APPLICATIONS

- 10.3 GALVANIZED STEEL

- 10.3.1 GROWING DEMAND FOR CORROSION-RESISTANT SOLUTIONS IN OUTDOOR APPLICATIONS

- 10.4 STAINLESS STEEL

- 10.4.1 EXPANDING USE IN HEAVY-DUTY INDUSTRIAL AND CONSTRUCTION APPLICATIONS

- 10.5 OTHER MATERIAL TYPES

11 STEEL WIRE ROPE MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: STEEL WIRE ROPE MARKET, BY COATING TYPE

- 11.2.2 NORTH AMERICA: STEEL WIRE ROPE MARKET, BY LAY TYPE

- 11.2.3 NORTH AMERICA: STEEL WIRE ROPE MARKET, BY DIAMETER

- 11.2.4 NORTH AMERICA: STEEL WIRE ROPE MARKET, BY MATERIAL TYPE

- 11.2.5 NORTH AMERICA: STEEL WIRE ROPE MARKET, BY APPLICATION

- 11.2.6 NORTH AMERICA: STEEL WIRE ROPE MARKET, BY COUNTRY

- 11.2.6.1 US

- 11.2.6.1.1 Rising construction and energy projects fueling market expansion

- 11.2.6.2 Canada

- 11.2.6.2.1 Expansion of mining and energy activities driving market growth

- 11.2.6.1 US

- 11.3 ASIA PACIFIC

- 11.3.1 ASIA PACIFIC: STEEL WIRE ROPE MARKET, BY COATING TYPE

- 11.3.2 ASIA PACIFIC: STEEL WIRE ROPE MARKET, BY LAY TYPE

- 11.3.3 ASIA PACIFIC: STEEL WIRE ROPE MARKET, BY DIAMETER

- 11.3.4 ASIA PACIFIC: STEEL WIRE ROPE MARKET, BY MATERIAL TYPE

- 11.3.5 ASIA PACIFIC: STEEL WIRE ROPE MARKET, BY APPLICATION

- 11.3.6 ASIA PACIFIC: STEEL WIRE ROPE MARKET, BY COUNTRY

- 11.3.6.1 China

- 11.3.6.1.1 Large-scale infrastructure and industrial expansion fueling demand

- 11.3.6.2 South Korea

- 11.3.6.2.1 Expanding shipbuilding and offshore industries driving market growth

- 11.3.6.3 India

- 11.3.6.3.1 Rapid infrastructure development and industrial expansion fueling demand

- 11.3.6.4 Japan

- 11.3.6.4.1 Technological advancements and strong industrial base boosting demand

- 11.3.6.5 Rest of Asia Pacific

- 11.3.6.1 China

- 11.4 EUROPE

- 11.4.1 EUROPE: STEEL WIRE ROPE MARKET, BY COATING TYPE

- 11.4.2 EUROPE: STEEL WIRE ROPE MARKET, BY LAY TYPE

- 11.4.3 EUROPE: STEEL WIRE ROPE MARKET, BY DIAMETER

- 11.4.4 EUROPE: STEEL WIRE ROPE MARKET, BY MATERIAL TYPE

- 11.4.5 EUROPE: STEEL WIRE ROPE MARKET, BY APPLICATION

- 11.4.6 EUROPE: STEEL WIRE ROPE MARKET, BY COUNTRY

- 11.4.6.1 Germany

- 11.4.6.1.1 Expanding industrial and manufacturing base fueling demand

- 11.4.6.2 France

- 11.4.6.2.1 Rising infrastructure and offshore wind development boosting demand

- 11.4.6.3 UK

- 11.4.6.3.1 Revival of offshore oil & gas and marine activities stimulating demand

- 11.4.6.4 Italy

- 11.4.6.4.1 Expanding construction and infrastructure projects boosting demand

- 11.4.6.5 Spain

- 11.4.6.5.1 Rising renewable energy and infrastructure development driving demand

- 11.4.6.6 Rest of Europe

- 11.4.6.1 Germany

- 11.5 LATIN AMERICA

- 11.5.1 LATIN AMERICA: STEEL WIRE ROPE MARKET, BY COATING TYPE

- 11.5.2 LATIN AMERICA: STEEL WIRE ROPE MARKET, BY LAY TYPE

- 11.5.3 LATIN AMERICA: STEEL WIRE ROPE MARKET, BY DIAMETER

- 11.5.4 LATIN AMERICA: STEEL WIRE ROPE MARKET, BY MATERIAL TYPE

- 11.5.5 LATIN AMERICA: STEEL WIRE ROPE MARKET, BY APPLICATION

- 11.5.6 LATIN AMERICA: STEEL WIRE ROPE MARKET, BY COUNTRY

- 11.5.6.1 Mexico

- 11.5.6.1.1 Infrastructure expansion and industrial growth accelerating market demand

- 11.5.6.2 Brazil

- 11.5.6.2.1 Expansion of mining and energy activities driving market growth

- 11.5.6.3 Rest of Latin America

- 11.5.6.1 Mexico

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 MIDDLE EAST & AFRICA: STEEL WIRE ROPE MARKET, BY COATING TYPE

- 11.6.2 MIDDLE EAST & AFRICA: STEEL WIRE ROPE MARKET, BY LAY TYPE

- 11.6.3 MIDDLE EAST & AFRICA: STEEL WIRE ROPE MARKET, BY DIAMETER

- 11.6.4 MIDDLE EAST & AFRICA: STEEL WIRE ROPE MARKET, BY MATERIAL TYPE

- 11.6.5 MIDDLE EAST & AFRICA: STEEL WIRE ROPE MARKET, BY APPLICATION

- 11.6.6 MIDDLE EAST & AFRICA: STEEL WIRE ROPE MARKET, BY COUNTRY

- 11.6.6.1 GCC countries

- 11.6.6.1.1 UAE

- 11.6.6.1.1.1 Infrastructure modernization and mega projects fueling demand

- 11.6.6.1.2 Saudi Arabia

- 11.6.6.1.2.1 Mega infrastructure and industrial projects accelerating market growth

- 11.6.6.1.3 Rest of GCC countries

- 11.6.6.1.1 UAE

- 11.6.6.2 South Africa

- 11.6.6.2.1 Expanding mining operations driving market growth

- 11.6.6.3 Rest of Middle East & Africa

- 11.6.6.1 GCC countries

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN, 2020-2025

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 BRAND/PRODUCT COMPARISON

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT

- 12.6.5.1 Company footprint

- 12.6.5.2 Region footprint

- 12.6.5.3 Lay type footprint

- 12.6.5.4 Material type footprint

- 12.6.5.5 Coating type footprint

- 12.6.5.6 Diameter footprint

- 12.6.5.7 Application footprint

- 12.7 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING

- 12.7.5.1 Detailed list of key start-ups/SMEs

- 12.7.5.2 Competitive benchmarking of key start-ups/SMEs

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 DEALS

- 12.9.2 PRODUCT LAUNCHES

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 BEKAERT

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 WIRECO

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 KISWIRE LTD.

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 MnM view

- 13.1.3.3.1 Key strengths

- 13.1.3.3.2 Strategic choices

- 13.1.3.3.3 Weaknesses and competitive threats

- 13.1.4 USHA MARTIN LIMITED

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 TEUFELBERGER

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Key strengths

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses and competitive threats

- 13.1.6 LOOS & CO. INC.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 MnM view

- 13.1.6.3.1 Key strengths

- 13.1.6.3.2 Strategic choices

- 13.1.6.3.3 Weaknesses and competitive threats

- 13.1.7 PFEIFER GROUP

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.7.4 MnM view

- 13.1.7.4.1 Key strengths

- 13.1.7.4.2 Strategic choices

- 13.1.7.4.3 Weaknesses and competitive threats

- 13.1.8 TOKYO ROPE MFG. CO., LTD.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 MnM view

- 13.1.8.3.1 Key strengths

- 13.1.8.3.2 Strategic choices

- 13.1.8.3.3 Weaknesses and competitive threats

- 13.1.9 JIANGSU LANGSHAN WIRE ROPE CO., LTD.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 MnM view

- 13.1.9.3.1 Key strengths

- 13.1.9.3.2 Strategic choices

- 13.1.9.3.3 Weaknesses and competitive threats

- 13.1.10 BILCO GROUP

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 MnM view

- 13.1.10.3.1 Key strengths

- 13.1.10.3.2 Strategic choices

- 13.1.10.3.3 Weaknesses and competitive threats

- 13.1.11 SWR LTD.

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 MnM view

- 13.1.11.3.1 Key strengths

- 13.1.11.3.2 Strategic choices

- 13.1.11.3.3 Weaknesses and competitive threats

- 13.1.12 LEXCO CABLE

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 MnM view

- 13.1.12.3.1 Key strengths

- 13.1.12.3.2 Strategic choices

- 13.1.12.3.3 Weaknesses and competitive threats

- 13.1.13 JIANGYIN JIAHUA ROPES CO., LTD.

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.13.3 MnM view

- 13.1.13.3.1 Key strengths

- 13.1.13.3.2 Strategic choices

- 13.1.13.3.3 Weaknesses and competitive threats

- 13.1.14 NANTONG SHENWEI STEEL WIRE ROPE CO., LTD.

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 MnM view

- 13.1.14.3.1 Key strengths

- 13.1.14.3.2 Strategic choices

- 13.1.14.3.3 Weaknesses and competitive threats

- 13.1.15 BHARAT WIRE ROPES LTD.

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.15.3 MnM view

- 13.1.15.3.1 Key strengths

- 13.1.15.3.2 Strategic choices

- 13.1.15.3.3 Weaknesses and competitive threats

- 13.1.1 BEKAERT

- 13.2 OTHER PLAYERS

- 13.2.1 HANGZHOU ZHEZHONG CHAIN CO., LTD.

- 13.2.2 TYLER MADISON, INC.

- 13.2.3 ORION ROPES PRIVATE LIMITED

- 13.2.4 ASAHI ROPES

- 13.2.5 DAVANGERE WIRE ROPE INDUSTRY PVT. LTD

- 13.2.6 SHREE STEEL WIRE ROPES LTD.

- 13.2.7 J D WIRE ROPES

- 13.2.8 SURASHA WIREROPES

- 13.2.9 JIANGYIN TUOXIN STEEL ROPE CO., LTD.

- 13.2.10 SHREE VARDHAMAN WIRE ROPES

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 STEEL WIRE ROPE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 3 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 4 AVERAGE SELLING PRICE TREND OF KEY PLAYERS IN STEEL WIRE ROPE MARKET, BY APPLICATION, 2024 (USD/KG)

- TABLE 5 AVERAGE SELLING PRICE TREND OF STEEL WIRE ROPE, BY REGION, 2023-2024 (USD/KG)

- TABLE 6 GDP PERCENTAGE CHANGE, BY COUNTRY, 2021-2029 (%)

- TABLE 7 ROLE OF COMPANIES IN STEEL WIRE ROPE ECOSYSTEM

- TABLE 8 TOP 10 EXPORTING COUNTRIES OF STEEL WIRE ROPES, 2020-2024 (USD THOUSAND)

- TABLE 9 TOP 10 IMPORTING COUNTRIES OF STEEL WIRE ROPES, 2020-2024 (USD THOUSAND)

- TABLE 10 TOTAL NUMBER OF PATENTS, 2015-2024

- TABLE 11 PATENTS BY UNIV CHINA MINING, 2021-2024

- TABLE 12 PATENTS BY JIANGSU SAFETY STEEL WIRE ROPE, 2023

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 18 TOP USE CASES AND MARKET POTENTIAL

- TABLE 19 AI IMPLEMENTATION IN STEEL WIRE ROPE MARKET

- TABLE 20 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 21 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR STEEL WIRE ROPE, 2024 VS. 2025

- TABLE 22 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKETS DUE TO TARIFF IMPACT

- TABLE 23 STEEL WIRE ROPE MARKET, BY LAY TYPE, 2023-2030 (USD MILLION)

- TABLE 24 STEEL WIRE ROPE MARKET, BY LAY TYPE, 2023-2030 (KILOTON)

- TABLE 25 REGULAR LAY: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 26 REGULAR LAY: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 27 LANG LAY: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 28 LANG LAY: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 29 STEEL WIRE ROPE MARKET, BY DIAMETER, 2023-2030 (USD MILLION)

- TABLE 30 STEEL WIRE ROPE MARKET, BY DIAMETER, 2023-2030 (KILOTON)

- TABLE 31 <=1/4 INCH: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 32 <=1/4 INCH: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 33 >1/4 INCH: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 34 >1/4 INCH: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 35 STEEL WIRE ROPE MARKET, BY COATING TYPE, 2023-2030 (USD MILLION)

- TABLE 36 STEEL WIRE ROPE MARKET, BY COATING TYPE, 2023-2030 (KILOTON)

- TABLE 37 PLASTIC-COATED: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 38 PLASTIC-COATED: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 39 NON-PLASTIC COATED: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 40 NON-PLASTIC COATED: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 41 STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 42 STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 43 CONSTRUCTION: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 CONSTRUCTION: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 45 MINING: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 46 MINING: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 47 MARINE & FISHING: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 48 MARINE & FISHING: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 49 INDUSTRIAL & CRANE: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 50 INDUSTRIAL & CRANE: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 51 OIL & GAS: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 52 OIL & GAS: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 53 OTHER APPLICATIONS: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 54 OTHER APPLICATIONS: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 55 STEEL WIRE ROPE MARKET, BY MATERIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 56 STEEL WIRE ROPE MARKET, BY MATERIAL TYPE, 2023-2030 (KILOTON)

- TABLE 57 CARBON STEEL: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 58 CARBON STEEL: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 59 GALVANIZED STEEL: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 60 GALVANIZED STEEL: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 61 STAINLESS STEEL: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 62 STAINLESS STEEL: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 63 OTHER MATERIAL TYPES: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 64 OTHER MATERIAL TYPES: STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 65 STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 66 STEEL WIRE ROPE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 67 NORTH AMERICA: STEEL WIRE ROPE MARKET, BY COATING TYPE, 2023-2030 (USD MILLION)

- TABLE 68 NORTH AMERICA: STEEL WIRE ROPE MARKET, BY COATING TYPE, 2023-2030 (KILOTON)

- TABLE 69 NORTH AMERICA: STEEL WIRE ROPE MARKET, BY LAY TYPE, 2023-2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: STEEL WIRE ROPE MARKET, BY LAY TYPE, 2023-2030 (KILOTON)

- TABLE 71 NORTH AMERICA: STEEL WIRE ROPE MARKET, BY DIAMETER, 2023-2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: STEEL WIRE ROPE MARKET, BY DIAMETER, 2023-2030 (KILOTON)

- TABLE 73 NORTH AMERICA: STEEL WIRE ROPE MARKET, BY MATERIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 74 NORTH AMERICA: STEEL WIRE ROPE MARKET, BY MATERIAL TYPE, 2023-2030 (KILOTON)

- TABLE 75 NORTH AMERICA: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 77 NORTH AMERICA: STEEL WIRE ROPE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: STEEL WIRE ROPE MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 79 US: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 80 US: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 81 CANADA: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 82 CANADA: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 83 ASIA PACIFIC: STEEL WIRE ROPE MARKET, BY COATING TYPE, 2023-2030 (USD MILLION)

- TABLE 84 ASIA PACIFIC: STEEL WIRE ROPE MARKET, BY COATING TYPE, 2023-2030 (KILOTON)

- TABLE 85 ASIA PACIFIC: STEEL WIRE ROPE MARKET, BY LAY TYPE, 2023-2030 (USD MILLION)

- TABLE 86 ASIA PACIFIC: STEEL WIRE ROPE MARKET, BY LAY TYPE, 2023-2030 (KILOTON)

- TABLE 87 ASIA PACIFIC: STEEL WIRE ROPE MARKET, BY DIAMETER, 2023-2030 (USD MILLION)

- TABLE 88 ASIA PACIFIC: STEEL WIRE ROPE MARKET, BY DIAMETER, 2023-2030 (KILOTON)

- TABLE 89 ASIA PACIFIC: STEEL WIRE ROPE MARKET, BY MATERIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 90 ASIA PACIFIC: STEEL WIRE ROPE MARKET, BY MATERIAL TYPE, 2023-2030 (KILOTON)

- TABLE 91 ASIA PACIFIC: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 92 ASIA PACIFIC: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 93 ASIA PACIFIC: STEEL WIRE ROPE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 94 ASIA PACIFIC: STEEL WIRE ROPE MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 95 CHINA: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 96 CHINA: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 97 SOUTH KOREA: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 98 SOUTH KOREA: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 99 INDIA: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 100 INDIA: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 101 JAPAN: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 102 JAPAN: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 103 REST OF ASIA PACIFIC: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 104 REST OF ASIA PACIFIC: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 105 EUROPE: STEEL WIRE ROPE MARKET, BY COATING TYPE, 2023-2030 (USD MILLION)

- TABLE 106 EUROPE: STEEL WIRE ROPE MARKET, BY COATING TYPE, 2023-2030 (KILOTON)

- TABLE 107 EUROPE: STEEL WIRE ROPE MARKET, BY LAY TYPE, 2023-2030 (USD MILLION)

- TABLE 108 EUROPE: STEEL WIRE ROPE MARKET, BY LAY TYPE, 2023-2030 (KILOTON)

- TABLE 109 EUROPE: STEEL WIRE ROPE MARKET, BY DIAMETER, 2023-2030 (USD MILLION)

- TABLE 110 EUROPE: STEEL WIRE ROPE MARKET, BY DIAMETER, 2023-2030 (KILOTON)

- TABLE 111 EUROPE: STEEL WIRE ROPE MARKET, BY MATERIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 112 EUROPE: STEEL WIRE ROPE MARKET, BY MATERIAL TYPE, 2023-2030 (KILOTON)

- TABLE 113 EUROPE: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 114 EUROPE: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 115 EUROPE: STEEL WIRE ROPE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 116 EUROPE: STEEL WIRE ROPE MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 117 GERMANY: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 118 GERMANY: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 119 FRANCE: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 120 FRANCE: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 121 UK: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 122 UK: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 123 ITALY: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 124 ITALY: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 125 SPAIN: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 126 SPAIN: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 127 REST OF EUROPE: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 128 REST OF EUROPE: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 129 LATIN AMERICA: STEEL WIRE ROPE MARKET, BY COATING TYPE, 2023-2030 (USD MILLION)

- TABLE 130 LATIN AMERICA: STEEL WIRE ROPE MARKET, BY COATING TYPE, 2023-2030 (KILOTON)

- TABLE 131 LATIN AMERICA: STEEL WIRE ROPE MARKET, BY LAY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 LATIN AMERICA: STEEL WIRE ROPE MARKET, BY LAY TYPE, 2023-2030 (KILOTON)

- TABLE 133 LATIN AMERICA: STEEL WIRE ROPE MARKET, BY DIAMETER, 2023-2030 (USD MILLION)

- TABLE 134 LATIN AMERICA: STEEL WIRE ROPE MARKET, BY DIAMETER, 2023-2030 (KILOTON)

- TABLE 135 LATIN AMERICA: STEEL WIRE ROPE MARKET, BY MATERIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 136 LATIN AMERICA: STEEL WIRE ROPE MARKET, BY MATERIAL TYPE, 2023-2030 (KILOTON)

- TABLE 137 LATIN AMERICA: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 138 LATIN AMERICA: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 139 LATIN AMERICA: STEEL WIRE ROPE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 140 LATIN AMERICA: STEEL WIRE ROPE MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 141 MEXICO: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 142 MEXICO: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 143 BRAZIL: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 144 BRAZIL: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 145 REST OF LATIN AMERICA: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 146 REST OF LATIN AMERICA: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 147 MIDDLE EAST & AFRICA: STEEL WIRE ROPE MARKET, BY COATING TYPE, 2023-2030 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: STEEL WIRE ROPE MARKET, BY COATING TYPE, 2023-2030 (KILOTON)

- TABLE 149 MIDDLE EAST & AFRICA: STEEL WIRE ROPE MARKET, BY LAY TYPE, 2023-2030 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: STEEL WIRE ROPE MARKET, BY LAY TYPE, 2023-2030 (KILOTON)

- TABLE 151 MIDDLE EAST & AFRICA: STEEL WIRE ROPE MARKET, BY DIAMETER, 2023-2030 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: STEEL WIRE ROPE MARKET, BY DIAMETER, 2023-2030 (KILOTON)

- TABLE 153 MIDDLE EAST & AFRICA: STEEL WIRE ROPE MARKET, BY MATERIAL TYPE, 2023-2030 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: STEEL WIRE ROPE MARKET, BY MATERIAL TYPE, 2023-2030 (KILOTON)

- TABLE 155 MIDDLE EAST & AFRICA: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 157 MIDDLE EAST & AFRICA: STEEL WIRE ROPE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: STEEL WIRE ROPE MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 159 UAE: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 160 UAE: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 161 SAUDI ARABIA: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 162 SAUDI ARABIA: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 163 REST OF GCC COUNTRIES: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 164 REST OF GCC COUNTRIES: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 165 SOUTH AFRICA: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 166 SOUTH AFRICA: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 167 REST OF MIDDLE EAST & AFRICA: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 168 REST OF MIDDLE EAST & AFRICA: STEEL WIRE ROPE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 169 KEY PLAYERS' STRATEGIES/RIGHT TO WIN, 2020-2025

- TABLE 170 STEEL WIRE ROPE MARKET: DEGREE OF COMPETITION, 2024

- TABLE 171 STEEL WIRE ROPE MARKET: REGION FOOTPRINT

- TABLE 172 STEEL WIRE ROPE MARKET: LAY TYPE FOOTPRINT

- TABLE 173 STEEL WIRE ROPE MARKET: MATERIAL TYPE FOOTPRINT

- TABLE 174 STEEL WIRE ROPE MARKET: COATING TYPE FOOTPRINT

- TABLE 175 STEEL WIRE ROPE MARKET: DIAMETER FOOTPRINT

- TABLE 176 STEEL WIRE ROPE MARKET: APPLICATION FOOTPRINT

- TABLE 177 STEEL WIRE ROPE MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 178 STEEL WIRE ROPE MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES (1/2)

- TABLE 179 STEEL WIRE ROPE MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES (2/2)

- TABLE 180 STEEL WIRE ROPE MARKET: DEALS, JANUARY 2020-OCTOBER 2025

- TABLE 181 STEEL WIRE ROPE MARKET: PRODUCT LAUNCHES, JANUARY 2020-OCTOBER 2025

- TABLE 182 STEEL WIRE ROPE MARKET: EXPANSIONS, JANUARY 2020-OCTOBER 2025

- TABLE 183 BEKAERT: COMPANY OVERVIEW

- TABLE 184 BEKAERT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 BEKAERT: DEALS

- TABLE 186 WIRECO: COMPANY OVERVIEW

- TABLE 187 WIRECO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 WIRECO: PRODUCT LAUNCHES

- TABLE 189 WIRECO: EXPANSIONS

- TABLE 190 KISWIRE LTD.: COMPANY OVERVIEW

- TABLE 191 KISWIRE LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 USHA MARTIN LIMITED: COMPANY OVERVIEW

- TABLE 193 USHA MARTIN LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 USHA MARTIN LIMITED: PRODUCT LAUNCHES

- TABLE 195 TEUFELBERGER: COMPANY OVERVIEW

- TABLE 196 TEUFELBERGER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 LOOS & CO.INC.: COMPANY OVERVIEW

- TABLE 198 LOOS & CO. INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 PFEIFER GROUP: COMPANY OVERVIEW

- TABLE 200 PFEIFER GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 PFEIFER GROUP: DEALS

- TABLE 202 TOKYO ROPE MFG. CO., LTD.: COMPANY OVERVIEW

- TABLE 203 TOKYO ROPE MFG. CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 JIANGSU LANGSHAN WIRE ROPE CO., LTD.: COMPANY OVERVIEW

- TABLE 205 JIANGSU LANGSHAN WIRE ROPE CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 206 BILCO GROUP: COMPANY OVERVIEW

- TABLE 207 BILCO GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 SWR LTD.: COMPANY OVERVIEW

- TABLE 209 SWR LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 LEXCO CABLE: COMPANY OVERVIEW

- TABLE 211 LEXCO CABLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 JIANGYIN JIAHUA ROPES CO., LTD.: COMPANY OVERVIEW

- TABLE 213 JIANGYIN JIAHUA ROPES CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 NANTONG SHENWEI STEEL WIRE ROPE CO., LTD.: COMPANY OVERVIEW

- TABLE 215 NANTONG SHENWEI STEEL WIRE ROPE CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 BHARAT WIRE ROPES LTD.: COMPANY OVERVIEW

- TABLE 217 BHARAT WIRE ROPES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 HANGZHOU ZHEZHONG CHAIN CO., LTD.: COMPANY OVERVIEW

- TABLE 219 TYLER MADISON, INC.: COMPANY OVERVIEW

- TABLE 220 ORION ROPES PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 221 ASAHI ROPES: COMPANY OVERVIEW

- TABLE 222 DAVANGERE WIRE ROPE INDUSTRY PVT. LTD: COMPANY OVERVIEW

- TABLE 223 SHREE STEEL WIRE ROPES LTD.: COMPANY OVERVIEW

- TABLE 224 J D WIRE ROPES: COMPANY OVERVIEW

- TABLE 225 SURASHA WIREROPES: COMPANY OVERVIEW

- TABLE 226 JIANGYIN TUOXIN STEEL ROPE CO., LTD.: COMPANY OVERVIEW

- TABLE 227 SHREE VARDHAMAN WIRE ROPES: COMPANY OVERVIEW

List of Figures

- FIGURE 1 STEEL WIRE ROPE MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 STEEL WIRE ROPE MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 STEEL WIRE ROPE MARKET: DATA TRIANGULATION

- FIGURE 6 REGULAR LAY TYPE TO ACCOUNT FOR LARGER MARKET SHARE IN 2030

- FIGURE 7 STAINLESS STEEL SEGMENT TO LEAD MARKET IN 2030

- FIGURE 8 NON-PLASTIC COATED SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 9 >1/4 INCH SEGMENT TO ACCOUNT FOR LARGER SHARE IN 2030

- FIGURE 10 CONSTRUCTION APPLICATION TO LEAD MARKET IN 2030

- FIGURE 11 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 12 INCREASING DEMAND FROM CONSTRUCTION APPLICATION TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 13 CONSTRUCTION SEGMENT AND ASIA PACIFIC LED STEEL WIRE ROPE MARKET IN 2024

- FIGURE 14 LANG LAY TYPE TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 15 STAINLESS STEEL TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 PLASTIC COATED SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 17 <=1/4 INCH SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 18 CONSTRUCTION APPLICATION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 CHINA TO REGISTER HIGHEST CAGR IN STEEL WIRE ROPE MARKET DURING FORECAST PERIOD

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN STEEL WIRE ROPE MARKET

- FIGURE 21 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 23 BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 24 STEEL WIRE ROPE MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 25 STEEL WIRE ROPE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 EXPORT DATA FOR HS CODE 731210-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 27 IMPORT DATA FOR HS CODE 731210-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 28 PATENT ANALYSIS, BY DOCUMENT TYPE, 2015-2024

- FIGURE 29 PATENT PUBLICATION TRENDS, 2015-2024

- FIGURE 30 LEGAL STATUS OF PATENTS, 2015-2024

- FIGURE 31 CHINA REGISTERED HIGHEST PERCENTAGE OF PATENTS BETWEEN 2015 AND 2024

- FIGURE 32 TOP 10 PATENT APPLICANTS, 2015-2024

- FIGURE 33 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 34 INVESTMENT AND FUNDING SCENARIO, 2021-2024 (USD MILLION)

- FIGURE 35 LANG LAY SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 36 <=1/4 INCH DIAMETER SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 37 PLASTIC-COATED SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 CONSTRUCTION SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 STAINLESS STEEL SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 CHINA TO REGISTER HIGHEST GROWTH IN STEEL WIRE ROPE MARKET DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA: STEEL WIRE ROPE MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: STEEL WIRE ROPE MARKET SNAPSHOT

- FIGURE 43 EUROPE: STEEL WIRE ROPE MARKET SNAPSHOT

- FIGURE 44 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD MILLION)

- FIGURE 45 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 46 TOP TRENDING BRANDS/PRODUCTS

- FIGURE 47 BRAND/PRODUCT COMPARISON

- FIGURE 48 STEEL WIRE ROPE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 49 STEEL WIRE ROPE MARKET: COMPANY FOOTPRINT

- FIGURE 50 STEEL WIRE ROPE MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 51 STEEL WIRE ROPE MARKET: COMPANY VALUATION

- FIGURE 52 STEEL WIRE ROPE MARKET: FINANCIAL METRICS (EV/EBITDA)

- FIGURE 53 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA

- FIGURE 54 BEKAERT: COMPANY SNAPSHOT

- FIGURE 55 KISWIRE LTD.: COMPANY SNAPSHOT

- FIGURE 56 USHA MARTIN LIMITED: COMPANY SNAPSHOT

- FIGURE 57 TOKYO ROPE MFG. CO., LTD.: COMPANY SNAPSHOT

- FIGURE 58 BHARAT WIRE ROPES LTD.: COMPANY SNAPSHOT