|

市場調查報告書

商品編碼

1881290

全球自主水下航行器市場按類型、形狀、推進方式、系統、速度、成本、應用和地區分類-預測至2030年Autonomous Underwater Vehicle Market by Shape (Torpedo, Laminar Flow Body, Streamlined Rectangular Style, Multi-Hull Vehicle), Type (Shallow, Medium, Large), System, Speed, Propulsion, Application, Cost and Region - Global Forecast to 2030 |

||||||

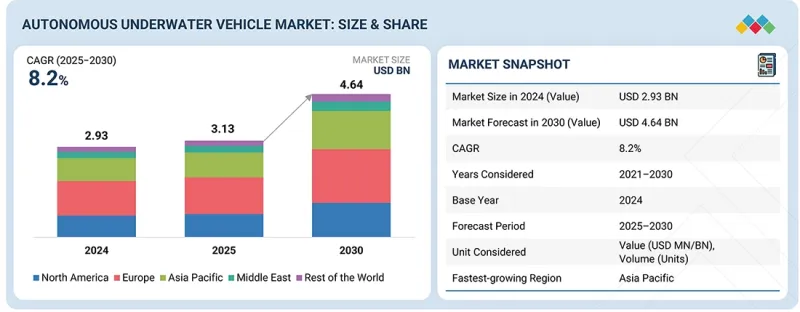

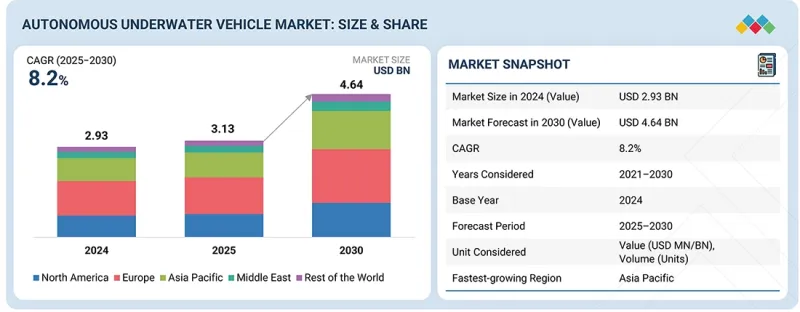

預計自主水下航行器 (AUV) 市場將從 2025 年的 31.3 億美元成長到 2030 年的 46.4 億美元,複合年成長率為 8.2%。

從銷售來看,AUV市場預計將從2025年的997台成長到2030年的1,424台。隨著全球國防組織、海上能源營運商和海洋研究機構加快採用自主系統執行深海任務、長期監視和海底資產檢查,AUV市場正在穩步擴張。

| 調查範圍 | |

|---|---|

| 調查期 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 目標單元 | 金額(十億美元) |

| 部分 | 按類型、形狀、推進方式、系統、速度、成本、應用和區域分類 |

| 目標區域 | 北美、歐洲、亞太地區及其他地區 |

需求的主要促進因素是:對無人海上能力的投資增加、海上探勘和維護活動的擴大,以及不斷減少人類在危險水下環境中所面臨的風險。

低成本自主水下航行器(AUV)正迅速普及,其應用領域不斷擴展,尤其是在海岸監視、環境數據採集、港口安保和淺水勘測等對頻繁部署和成本效益要求較高的領域。價格適中的感測器、緊湊型推進系統和模組化設計的普及,使得使用者無需大量資本投入即可擴展作業規模,這在學術界、商業界和政府調查計畫中尤其重要。

軍事和國防優勢的提升得益於自主掃雷計畫、反潛作戰舉措、港口保護需求以及快速擴展的深海監視任務。國防機構正在增加對長航時自主水下航行器(AUV)的投資,以提高情境察覺、降低海軍人員風險並支援多域海上作戰。美國、歐洲和亞洲的現代化進程正進一步加速軍用級AUV平台的採購。

北美自主水下航行器市場的主要驅動力來自美國的大量資金投入、不斷擴大的海洋能源探勘以及聯邦研究機構積極參與深海科學和環境監測。該地區成熟的工業基礎,加上主要自主水下航行器製造商和國防承包商的存在,使得下一代系統的快速部署成為可能。對北極監視、海底基礎設施檢查和無人海上作業日益成長的關注,進一步鞏固了北美的市場地位。

本報告分析了全球自主水下航行器市場,涵蓋了按類型、形狀、推進方式、系統、速度、成本、應用和地區分類的趨勢,以及參與該市場的公司的概況。

目錄

第1章 引言

第2章執行摘要

第3章重要考察

第4章 市場概覽

- 介紹

- 市場動態

- 未滿足的需求和差距

- 相互關聯的市場與跨產業機遇

- 一級/二級/三級公司的策略性舉措

第5章 產業趨勢

- 生態系分析

- 價值鏈分析

- 2025年美國關稅

- 貿易分析

- 案例研究分析

- 重大會議和活動

- 總擁有成本

- 投資和資金籌措方案

- 定價分析

- 容量數據

- 營運數據

- 材料清單

- 宏觀經濟展望

- 經營模式

第6章:技術進步、人工智慧影響、專利、創新與未來應用

- 主要技術

- 互補技術

- 技術藍圖

- 專利分析

- 未來應用

- 人工智慧/生成式人工智慧的影響

- 大趨勢的影響

第7章永續性和監管環境

- 地方法規和合規性

- 對永續性的承諾

- 認證、標籤和環境標準

第8章:顧客狀況與購買行為

- 決策流程

- 買方相關人員和採購評估標準

- 招募障礙和內部挑戰

- 各個終端用戶產業尚未滿足的需求

第9章 自主水下航行器市場,按類型分類(市場規模及至2030年的預測 - 價值,百萬美元;銷量,單位)

- 介紹

- 小型(小於100公尺)

- 中等尺寸(100-1000公尺)

- 大型(超過1000公尺)

第10章 自主水下航行器市場,按類型分類(市場規模及至2030年的預測 - 價值,百萬美元;銷量,單位)

- 介紹

- 魚雷

- 層流

- 流線型矩形風格

- 多體船

11. 按推進類型分類的自主水下航行器市場(市場規模及至 2030 年的預測 - 價值,百萬美元)

- 介紹

- 電

- 機器

- 混合

12. 自主水下航行器市場,按系統分類(市場規模及至 2030 年的預測 - 價值,百萬美元)

- 介紹

- 避免碰撞

- 溝通與網路

- 導航與導引

- 推進與移動

- 有效載荷和感測器

- 底盤

- 電力和能源

- 其他

13. 自主水下航行器市場(按速度分類)(市場規模及至 2030 年的預測 - 價值,百萬美元)

- 介紹

- 低於5節

- 5節或以上

14. 自主水下航行器市場,按成本分類(市場規模及至 2030 年的預測 - 價值,百萬美元)

- 介紹

- 低成本

- 標準

- 高階

15. 自主水下航行器市場,按應用領域分類(市場規模及至 2030 年的預測 - 價值,百萬美元)

- 介紹

- 軍事/國防

- 石油和天然氣

- 環境保護與監測

- 海洋學

- 考古與探勘

- 搜救行動

16. 自主水下航行器市場(按地區分類)

- 介紹

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 挪威

- 其他

- 亞太地區

- 中國

- 日本

- 澳洲

- 韓國

- 印度

- 其他

- 中東

- GCC

- 以色列

- 土耳其

- 其他

- 其他地區

- 非洲

- 拉丁美洲

第17章 競爭格局

- 介紹

- 主要參與企業的策略/優勢,2021-2024年

- 2021-2024年收入分析

- 2024年市佔率分析

- 品牌/產品對比

- 估值和財務指標

- 公司估值矩陣:主要參與企業,2024 年

- 公司估值矩陣:新興企業/中小企業,2024 年

- 競爭場景

第18章:公司簡介

- 主要參與企業

- KONGSBERG

- SAIPEM SPA

- EXAIL TECHNOLOGIES

- BAE SYSTEMS

- SAAB AB

- TELEDYNE TECHNOLOGIES INCORPORATED

- HII

- GENERAL DYNAMICS CORPORATION

- KAWASAKI HEAVY INDUSTRIES, LTD

- LOCKHEED MARTIN CORPORATION

- TKMS

- L3HARRIS TECHNOLOGIES, INC.

- BOSTON ENGINEERING

- BOEING

- XYLEM INC

- INTERNATIONAL SUBMARINE ENGINEERING LIMITED

- NORTHROP GRUMMAN

- 其他公司

- MSUBS

- FALMOUTH SCIENTIFIC, INC

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- ECOSUB ROBOTICS

- EELUME AS

- HYDROMEA

- GRAAL TECH SRL

- BALTROBOTICS

- OCEANSCAN-MARINE SYSTEMS & TECHNOLOGY

- RTSYS

第19章調查方法

第20章附錄

The autonomous underwater vehicle market is expected to reach USD 4.64 billion by 2030, from USD 3.13 billion in 2025, with a CAGR of 8.2%. In terms of volume, it is likely to grow from 997 units in 2025 to 1,424 units by 2030. The market for AUVs is expanding steadily, as global defense agencies, offshore energy operators, and ocean research institutions accelerate the adoption of autonomous systems for deep-water missions, long-endurance surveillance, and subsea asset inspection.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Propulsion, System, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

Demand is primarily supported by rising investments in unmanned maritime capabilities, increasing offshore exploration and maintenance activities, and the ongoing shift toward reducing human exposure in hazardous underwater environments.

"The low cost segment is expected to exhibit the fastest growth during the forecast period."

Low-cost AUVs are experiencing rapid adoption due to their increasing use in coastal monitoring, environmental data collection, port security, and shallow-water survey missions, where frequent deployment and cost efficiency are crucial. The availability of affordable sensors, compact propulsion systems, and modular designs enables users to scale operations without incurring high capital expenditures, particularly in academic, commercial, and government research programs.

"The military & defense segment is expected to surpass other applications during the forecast period."

The prevalence of the military & defense segment is driven by rapid growth in autonomous mine countermeasure programs, anti-submarine warfare initiatives, harbor protection requirements, and classified deep-sea surveillance missions. Defense agencies are investing heavily in long-endurance AUVs that enhance situational awareness, reduce risks to naval crews, and support multi-domain maritime operations. Modernization efforts in the US, Europe, and Asia are further accelerating procurement of military-grade AUV platforms.

"North America is expected to rank second in the autonomous underwater vehicle market during the forecast period."

North America's autonomous underwater vehicle market is primarily driven by substantial funding from the US Navy, expanding offshore energy exploration, and the strong involvement of federal research institutions in deep-ocean science and environmental monitoring. The region's mature industrial base, combined with the presence of leading AUV manufacturers and defense contractors, enables the rapid deployment of next-generation systems. Growing emphasis on Arctic surveillance, subsea infrastructure inspection, and unmanned maritime operations further strengthens North America's position in the market.

The breakdown of profiles for primary participants in the autonomous underwater vehicle market is provided below:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: Directors - 20%, Managers - 10%, and Others - 70%

- By Region: North America - 40%, Europe - 20%, Asia Pacific - 20%, Middle East - 10% Rest of the World - 10%

Research Coverage:

This market study covers the autonomous underwater vehicle market across various segments and subsegments. It aims to estimate the size and growth potential of this market across different parts and regions. This study also includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to their products and business offerings, recent developments, and key market strategies they adopted.

Reasons to buy this report:

This report is designed to assist both established market leaders and new entrants by providing accurate revenue estimates for the autonomous underwater vehicle market. It will also help stakeholders grasp the competitive landscape and offer valuable insights for positioning their businesses and developing effective go-to-market strategies. Additionally, the report will highlight key market trends, including essential drivers, constraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Indepth Analysis of Drivers (Rising offshore oil and gas investments, increasing use of AUVs for border and maritime security, growing shift toward renewable energy operations, advancements in AUV autonomy and sensors), Restraints (High development and operational costs, limitations in endurance and mission range), Opportunities (Integration of next-generation batteries, wider use of AUVs for cable protection and seabed monitoring, expansion of offshore energy exploration), and Challenges (Slow underwater communication speeds and signal issues, data-loss risks due to harsh marine conditions, legal and ethical concerns in autonomous underwater operations)

- Market Penetration: Comprehensive information on AUVs offered by the top market players

- Product Development/Innovation: Detailed insights on upcoming technologies, R&D activities, and product launches in the autonomous underwater vehicle market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the autonomous underwater vehicle market

- Competitive Assessment: In-depth assessment of market share, growth strategies, products, and manufacturing capabilities of leading players in the autonomous underwater vehicle market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENT AND EMERGING FRONTIERS

- 2.5 GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTONOMOUS UNDERWATER VEHICLE MARKET

- 3.2 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION

- 3.3 SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE

- 3.4 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM

- 3.5 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY COMMUNICATION & NETWORKING SYSTEM

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rise of offshore oil and gas exploration

- 4.2.1.2 Emphasis on maritime security

- 4.2.1.3 Shift toward renewable energy sources

- 4.2.1.4 Technological innovations in AUVs

- 4.2.2 RESTRAINTS

- 4.2.2.1 High development, operational, and maintenance costs

- 4.2.2.2 Limited endurance and range

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Integration of NiMH batteries into medium- and high-speed AUVs

- 4.2.3.2 Focus on protecting subsea cables and energy pipelines

- 4.2.3.3 Push for energy diversification

- 4.2.4 CHALLENGES

- 4.2.4.1 Harsh underwater conditions

- 4.2.4.2 Risk of data loss and prolonged research timelines

- 4.2.4.3 Legal and ethical concerns

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 REAL-TIME UNDERWATER COMMUNICATION AND DATA TRANSMISSION

- 4.3.2 LACK OF STANDARDIZATION AND INTEROPERABILITY FRAMEWORKS

- 4.3.3 ENERGY LIMITATIONS AND ENDURANCE CONSTRAINTS

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 OFFSHORE RENEWABLE ENERGY

- 4.4.2 MARITIME SECURITY AND BORDER SURVEILLANCE

- 4.4.3 OCEAN DATA AND CLIMATE RESEARCH

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 ECOSYSTEM ANALYSIS

- 5.1.1 PROMINENT COMPANIES

- 5.1.2 PRIVATE AND SMALL ENTERPRISES

- 5.1.3 END USERS

- 5.2 VALUE CHAIN ANALYSIS

- 5.2.1 CONCEPT AND RESEARCH

- 5.2.2 COMPONENT AND MATERIAL DEVELOPMENT

- 5.2.3 AUV MANUFACTURING

- 5.2.4 SYSTEM INTEGRATION AND VALIDATION

- 5.2.5 POST-DEPLOYMENT SERVICE

- 5.3 2025 US TARIFF

- 5.3.1 INTRODUCTION

- 5.3.2 KEY TARIFF RATES

- 5.3.3 PRICE IMPACT ANALYSIS

- 5.3.4 IMPACT ON COUNTRY/REGION

- 5.3.4.1 US

- 5.3.4.2 Europe

- 5.3.4.3 Asia Pacific

- 5.3.5 IMPACT ON END-USE INDUSTRIES

- 5.3.5.1 Military & defense

- 5.3.5.2 Oil & gas

- 5.3.5.3 Environment protection & monitoring

- 5.3.5.4 Oceanography

- 5.3.5.5 Archaeology & exploration

- 5.3.5.6 Search & salvage operation

- 5.4 TRADE ANALYSIS

- 5.4.1 IMPORT SCENARIO (HS CODE 900630)

- 5.4.2 EXPORT SCENARIO (HS CODE 900630)

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 CELLULA ROBOTICS: GUARDIAN AUV FOR DEFENSE MISSIONS

- 5.5.2 FUJITSU AND NATIONAL MARITIME RESEARCH INSTITUTE: DIGITAL TWIN UNDERWATER MONITORING

- 5.5.3 AUSTRALIAN ECONOMIC ACCELERATOR AND UNIVERSITY OF SYDNEY: SOVEREIGN AUV FOR OFFSHORE INFRASTRUCTURE ASSESSMENT

- 5.6 KEY CONFERENCES AND EVENTS

- 5.7 TOTAL COST OF OWNERSHIP

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 PRICING ANALYSIS

- 5.9.1 AVERAGE SELLING PRICE TREND, BY TYPE

- 5.9.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.10 VOLUME DATA

- 5.11 OPERATIONAL DATA

- 5.12 BILL OF MATERIALS

- 5.13 MACROECONOMIC OUTLOOK

- 5.13.1 INTRODUCTION

- 5.13.2 GDP TRENDS AND FORECAST

- 5.13.3 TRENDS IN GLOBAL UNDERWATER VEHICLE INDUSTRY

- 5.13.4 TRENDS IN GLOBAL MARINE INDUSTRY

- 5.14 BUSINESS MODELS

- 5.14.1 DIRECT SALES MODEL

- 5.14.2 LEASING/AUV-AS-A-SERVICE MODEL

- 5.14.3 DATA-AS-A-SERVICE (DAAS) MODEL

- 5.14.4 BUILD-OPERATE-TRANSFER (BOT) MODEL

- 5.14.5 COLLABORATIVE R&D/CO-DEVELOPMENT MODEL

- 5.14.6 SUBSCRIPTION/SOFTWARE LICENSING MODEL

- 5.14.7 TURNKEY INTEGRATED SOLUTION MODEL

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY TECHNOLOGIES

- 6.1.1 DOPPLER VELOCITY LOG

- 6.1.2 FIBER-OPTIC GYROSCOPE-BASED INERTIAL NAVIGATION SYSTEM

- 6.1.3 ULTRA-SHORT BASELINE ACOUSTIC POSITIONING

- 6.1.4 LONG-BASELINE ACOUSTIC POSITIONING

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 UNDERWATER ACOUSTIC BEACON NETWORK

- 6.2.2 FIBER-OPTIC DATA LINKS FOR SURFACE-TO-SHORE TRANSFER

- 6.2.3 HIGH-CAPACITY DATA STORAGE MODULE

- 6.3 TECHNOLOGY ROADMAP

- 6.4 PATENT ANALYSIS

- 6.5 FUTURE APPLICATIONS

- 6.6 IMPACT OF AI/GEN AI

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES

- 6.6.3 CASE STUDIES OF AI IMPLEMENTATION

- 6.6.4 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.5 CLIENTS' READINESS TO ADOPT AI/GEN AI

- 6.7 IMPACT OF MEGATRENDS

- 6.7.1 BIG DATA AND OCEAN INTELLIGENCE PLATFORMS

- 6.7.2 CLOUD AND EDGE COMPUTING INTEGRATION

- 6.7.3 GEN AI AND DIGITAL TWIN ECOSYSTEMS

- 6.7.4 IOT-ENABLED MARITIME CONNECTIVITY

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 CARBON IMPACT REDUCTION

- 7.2.2 ECO-APPLICATIONS

- 7.3 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS OF VARIOUS END-USE INDUSTRIES

9 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE (MARKET SIZE & FORECAST TO 2030 - IN VALUE, USD MILLION & VOLUME, UNITS)

- 9.1 INTRODUCTION

- 9.2 SHALLOW (<100 M)

- 9.2.1 SUPPORTING COASTAL SURVEILLANCE AND MINE COUNTERMEASURE MISSIONS IN CONFINED WATERS

- 9.2.2 USE CASE: KONGSBERG'S REMUS-100 FOR VERY SHALLOW WATER MINE COUNTERMEASURE MISSIONS

- 9.2.3 MICRO/SMALL

- 9.2.4 MINI

- 9.3 MEDIUM (100-1,000 M)

- 9.3.1 BRIDGING ENDURANCE AND PAYLOAD FOR SCIENTIFIC AND INDUSTRIAL SEAFLOOR MISSIONS

- 9.3.2 USE CASE: MBARI'S SEAFLOOR MAPPING DEEP-RATED SURVEY VEHICLE FOR FULLY AUTONOMOUS MISSIONS

- 9.4 LARGE (>1,000 M)

- 9.4.1 ENABLING LONG-RANGE AND MODULAR MISSIONS WITH HEAVY-PAYLOAD CAPACITY

- 9.4.2 USE CASE: BOEING'S ORCA FOR MODULAR MISSION PACKAGES

- 9.4.3 DEEP WATER

- 9.4.4 LARGE DISPLACEMENT

- 9.4.5 EXTRA LARGE

10 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE (MARKET SIZE & FORECAST TO 2030 - IN VALUE, USD MILLION & VOLUME, UNITS)

- 10.1 INTRODUCTION

- 10.2 TORPEDO

- 10.2.1 OPTIMIZING DEEP-SEA ENDURANCE THROUGH HYDRODYNAMIC STABILITY

- 10.3 LAMINAR FLOW BODY

- 10.3.1 IMPROVING ENERGY EFFICIENCY THROUGH FLOW-OPTIMIZED HULL DESIGNS

- 10.4 STREAMLINED RECTANGULAR STYLE

- 10.4.1 BALANCING PAYLOAD MODULARITY WITH OPERATIONAL STABILITY FOR INDUSTRIAL TASKS

- 10.5 MULTI-HULL

- 10.5.1 EXPANDING PAYLOAD FLEXIBILITY AND REDUNDANCY FOR MULTI-SENSOR UNDERWATER MISSIONS

11 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION (MARKET SIZE & FORECAST TO 2030 - IN VALUE, USD MILLION)

- 11.1 INTRODUCTION

- 11.2 ELECTRIC

- 11.2.1 FUELING TRANSITION TO ENERGY-DENSE, LOW-MAINTENANCE AUV OPERATIONS

- 11.2.2 USE CASE: REMUS SERIES LI-ION BATTERY SYSTEMS DEVELOPED BY SAFT/MATHEWS FOR PROLONGED MISSIONS

- 11.3 MECHANICAL

- 11.3.1 ENABLING PERSISTENT OCEAN OBSERVATION THROUGH ENERGY-NEUTRAL PROPULSION

- 11.3.2 USE CASE: TELEDYNE'S SLOCUM G3 GLIDER FOR LONG ENDURANCE WITH BUOYANCY ENGINE AND WINGS FOR COASTAL PROGRAMS

- 11.4 HYBRID

- 11.4.1 EXPANDING DEEP-SEA MISSION ENDURANCE THROUGH HYDROGEN AND FUEL-CELL INTEGRATION

- 11.4.2 USE CASE: EARLY PEM FUEL-CELL AUV PROTOTYPES DELIVER ~4 KW FOR PROPULSION WITH HYDROGEN STORED IN METAL HYDRIDE TANKS

12 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM (MARKET SIZE & FORECAST TO 2030 - IN VALUE, USD MILLION)

- 12.1 INTRODUCTION

- 12.2 COLLISION AVOIDANCE

- 12.2.1 INTEGRATION OF ADVANCED SONAR AND BUOYANCY SYSTEMS ENHANCES AUV AUTONOMY AND MISSION SAFETY

- 12.2.2 FORWARD-LOOKING SONAR

- 12.2.3 OTHERS

- 12.3 COMMUNICATION & NETWORKING

- 12.3.1 SHIFT TOWARD HYBRID ACOUSTIC-OPTICAL LINKS STRENGTHENS REAL-TIME UNDERWATER CONNECTIVITY

- 12.3.2 UNDERWATER ACOUSTIC COMMUNICATION

- 12.3.3 SUBSEA WIRELESS OPTICAL COMMUNICATION

- 12.3.4 SURFACE RF & WI-FI COMMUNICATION

- 12.3.5 SATELLITE COMMUNICATION

- 12.3.6 OTHERS

- 12.4 NAVIGATION & GUIDANCE

- 12.4.1 PRECISION NAVIGATION TECHNOLOGIES DRIVE ACCURACY AND AUTONOMY IN DEEP-SEA AUV MISSIONS

- 12.4.2 INERTIAL & DEAD-RECKONING

- 12.4.2.1 Inertial navigation

- 12.4.2.2 Compass-based navigation

- 12.4.2.3 Others

- 12.4.3 ACOUSTIC NAVIGATION

- 12.4.4 OTHERS

- 12.5 PROPULSION & MOBILITY

- 12.5.1 SHIFT TOWARD ELECTRICALLY DRIVEN MODULAR PROPULSION SYSTEMS ENHANCES AUV ENDURANCE AND EFFICIENCY

- 12.5.2 THRUST GENERATION

- 12.5.2.1 Propulsion motor

- 12.5.2.2 Thruster

- 12.5.2.3 Others

- 12.5.3 MOTION & CONTROL ACTUATION

- 12.5.3.1 Fin control actuator

- 12.5.3.2 Servo/Linear electromechanical actuator

- 12.5.4 BUOYANCY & VERTICAL MOTION

- 12.5.4.1 Pump motor

- 12.5.4.2 Variable buoyancy system

- 12.5.4.3 Others

- 12.5.5 OTHERS

- 12.6 PAYLOAD & SENSOR

- 12.6.1 EXPANDING AUV CAPABILITIES FROM DEEP-SEA MAPPING TO CLIMATE MONITORING

- 12.6.2 ACOUSTIC IMAGING & MAPPING PAYLOAD

- 12.6.2.1 Side-scan sonar imager

- 12.6.2.2 Multibeam echo sounder

- 12.6.2.3 Synthetic aperture sonar

- 12.6.2.4 Sub-bottom profiler

- 12.6.2.5 Others

- 12.6.3 OPTICAL IMAGING PAYLOAD

- 12.6.3.1 High-resolution digital still camera

- 12.6.3.2 Dual-eye camera

- 12.6.3.3 Others

- 12.6.4 ENVIRONMENTAL & OCEANOGRAPHIC SENSOR PAYLOAD

- 12.6.4.1 CTD sensor

- 12.6.4.2 Biogeochemical sensor

- 12.6.4.3 Acoustic Doppler Current Profiler

- 12.6.5 OTHERS

- 12.7 CHASSIS

- 12.7.1 INNOVATIONS IN LIGHTWEIGHT AND PRESSURE-RESISTANT CHASSIS MATERIALS ENHANCE STRUCTURAL EFFICIENCY

- 12.7.2 METAL ALLOY HULL

- 12.7.3 FIBER-REINFORCED COMPOSITE

- 12.7.4 OTHERS

- 12.8 POWER & ENERGY

- 12.8.1 ADVANCES IN HIGH-DENSITY ENERGY STORAGE AND EFFICIENT POWER CONVERSION EXTEND AUV MISSION ENDURANCE

- 12.8.2 ENERGY STORAGE

- 12.8.2.1 Battery module

- 12.8.2.2 Pressure-tolerant subsea battery system

- 12.8.2.3 Supercapacitor

- 12.8.3 POWER MANAGEMENT & DISTRIBUTION

- 12.8.3.1 BMS

- 12.8.3.2 DC/DC converter

- 12.8.3.3 Busbar

- 12.8.3.4 Others

- 12.8.4 OTHERS

- 12.9 OTHER SYSTEMS

13 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SPEED (MARKET SIZE & FORECAST TO 2030 - IN VALUE, USD MILLION)

- 13.1 INTRODUCTION

- 13.2 <5 KNOTS

- 13.2.1 ENHANCING MISSION DURATION AND DATA STABILITY

- 13.3 >5 KNOTS

- 13.3.1 IMPROVING OPERATIONAL EFFICIENCY AND RAPID UNDERWATER RESPONSE

14 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY COST (MARKET SIZE & FORECAST TO 2030 - IN VALUE, USD MILLION)

- 14.1 INTRODUCTION

- 14.2 LOW-COST

- 14.2.1 ENABLING ACCESSIBLE SURVEY OPERATIONS AND WIDENING UNDERWATER PARTICIPATION

- 14.3 STANDARD

- 14.3.1 BALANCING PERFORMANCE AND COST FOR RELIABLE SUBSEA MISSIONS

- 14.4 HIGH-END

- 14.4.1 ADVANCING DEEP-SEA CAPABILITIES AND SUPPORT COMPLEX UNDERWATER OPERATIONS

15 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION (MARKET SIZE & FORECAST TO 2030 - IN VALUE, USD MILLION)

- 15.1 INTRODUCTION

- 15.2 MILITARY & DEFENSE

- 15.2.1 STRENGTHENING MARITIME SURVEILLANCE AND THREAT DETECTION

- 15.2.2 BORDER SECURITY & SURVEILLANCE

- 15.2.3 ANTISUBMARINE WARFARE

- 15.2.4 ANTI-TRAFFICKING & CONTRABAND MONITORING

- 15.2.5 ENVIRONMENTAL ASSESSMENT

- 15.2.6 MINE COUNTERMEASURE IDENTIFICATION

- 15.3 OIL & GAS

- 15.3.1 IMPROVING SUBSEA ASSET INTEGRITY AND INSPECTION EFFICIENCY

- 15.3.2 PIPELINE SURVEY

- 15.3.3 GEOPHYSICAL SURVEY

- 15.3.4 DEBRIS/CLEARANCE SURVEY

- 15.3.5 BASELINE ENVIRONMENTAL ASSESSMENT SURVEY

- 15.4 ENVIRONMENTAL PROTECTION & MONITORING

- 15.4.1 SUPPORTING MARINE RESOURCE MANAGEMENT AND POLLUTION CONTROL

- 15.4.2 HABITAT RESEARCH

- 15.4.3 WATER SAMPLING

- 15.4.4 FISHERY STUDY

- 15.4.5 EMERGENCY RESPONSE

- 15.5 OCEANOGRAPHY

- 15.5.1 ADVANCING OCEAN DATA COLLECTION AND CLIMATE OBSERVATION

- 15.6 ARCHAEOLOGY & EXPLORATION

- 15.6.1 ENABLING SUBMERGED SITE IDENTIFICATION AND DOCUMENTATION

- 15.7 SEARCH & SALVAGE OPERATION

- 15.7.1 ENHANCING UNDERWATER OBJECT DETECTION AND RECOVERY PLANNING

16 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY REGION

- 16.1 INTRODUCTION

- 16.2 NORTH AMERICA

- 16.2.1 US

- 16.2.1.1 Sustained defense programs and expansion of offshore industries to drive market

- 16.2.2 CANADA

- 16.2.2.1 Arctic operations and cross-agency initiatives to drive market

- 16.2.1 US

- 16.3 EUROPE

- 16.3.1 UK

- 16.3.1.1 Increased adoption of unmanned maritime systems to drive market

- 16.3.2 GERMANY

- 16.3.2.1 Baltic security requirements to drive market

- 16.3.3 FRANCE

- 16.3.3.1 Seabed protection efforts to drive market

- 16.3.4 ITALY

- 16.3.4.1 Mediterranean surveillance programs to drive market

- 16.3.5 SPAIN

- 16.3.5.1 National research and coastal monitoring to drive market

- 16.3.6 NORWAY

- 16.3.6.1 Cold-water operations to drive market

- 16.3.7 REST OF EUROPE

- 16.3.1 UK

- 16.4 ASIA PACIFIC

- 16.4.1 CHINA

- 16.4.1.1 National R&D programs to drive market

- 16.4.2 JAPAN

- 16.4.2.1 Government research initiatives to drive market

- 16.4.3 AUSTRALIA

- 16.4.3.1 Defense procurement and domestic capability growth to drive market

- 16.4.4 SOUTH KOREA

- 16.4.4.1 Deep-sea engineering and industrial specialization to drive market

- 16.4.5 INDIA

- 16.4.5.1 Indigenous development and expanding subsea requirements to drive market

- 16.4.6 REST OF ASIA PACIFIC

- 16.4.1 CHINA

- 16.5 MIDDLE EAST

- 16.5.1 GCC

- 16.5.1.1 Saudi Arabia

- 16.5.1.1.1 Environmental research and heritage exploration to drive market

- 16.5.1.2 UAE

- 16.5.1.2.1 Security programs and local technology development to drive market

- 16.5.1.1 Saudi Arabia

- 16.5.2 ISRAEL

- 16.5.2.1 Advanced defense platforms and sensor innovation to drive market

- 16.5.3 TURKEY

- 16.5.3.1 Multi-role underwater missions to drive market

- 16.5.4 REST OF MIDDLE EAST

- 16.5.1 GCC

- 16.6 REST OF THE WORLD

- 16.6.1 AFRICA

- 16.6.1.1 Maritime enforcement pressures and offshore inspection needs to drive market

- 16.6.2 LATIN AMERICA

- 16.6.2.1 Defense modernization and deepwater survey requirements to drive market

- 16.6.1 AFRICA

17 COMPETITIVE LANDSCAPE

- 17.1 INTRODUCTION

- 17.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 17.3 REVENUE ANALYSIS, 2021-2024

- 17.4 MARKET SHARE ANALYSIS, 2024

- 17.5 BRAND/PRODUCT COMPARISON

- 17.6 COMPANY VALUATION AND FINANCIAL METRICS

- 17.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 17.7.1 STARS

- 17.7.2 EMERGING LEADERS

- 17.7.3 PERVASIVE PLAYERS

- 17.7.4 PARTICIPANTS

- 17.7.5 COMPANY FOOTPRINT

- 17.7.5.1 Company footprint

- 17.7.5.2 Region footprint

- 17.7.5.3 Application footprint

- 17.7.5.4 Type footprint

- 17.7.5.5 Speed footprint

- 17.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 17.8.1 PROGRESSIVE COMPANIES

- 17.8.2 RESPONSIVE COMPANIES

- 17.8.3 DYNAMIC COMPANIES

- 17.8.4 STARTING BLOCKS

- 17.8.5 COMPETITIVE BENCHMARKING

- 17.8.5.1 List of start-ups/SMEs

- 17.8.5.2 Competitive benchmarking of start-ups/SMEs

- 17.9 COMPETITIVE SCENARIO

- 17.9.1 PRODUCT LAUNCHES

- 17.9.2 DEALS

- 17.9.3 OTHER DEVELOPMENTS

18 COMPANY PROFILES

- 18.1 KEY PLAYERS

- 18.1.1 KONGSBERG

- 18.1.1.1 Business overview

- 18.1.1.2 Products offered

- 18.1.1.3 Recent developments

- 18.1.1.3.1 Deals

- 18.1.1.3.2 Other developments

- 18.1.1.4 MnM view

- 18.1.1.4.1 Right to win

- 18.1.1.4.2 Strategic choices

- 18.1.1.4.3 Weaknesses and competitive threats

- 18.1.2 SAIPEM S.P.A.

- 18.1.2.1 Business overview

- 18.1.2.2 Products offered

- 18.1.2.3 Recent developments

- 18.1.2.3.1 Other developments

- 18.1.2.4 MnM view

- 18.1.2.4.1 Right to win

- 18.1.2.4.2 Strategic choices

- 18.1.2.4.3 Weaknesses and competitive threats

- 18.1.3 EXAIL TECHNOLOGIES

- 18.1.3.1 Business overview

- 18.1.3.2 Products offered

- 18.1.3.3 Recent developments

- 18.1.3.3.1 Product launches

- 18.1.3.3.2 Deals

- 18.1.3.3.3 Other developments

- 18.1.3.4 MnM view

- 18.1.3.4.1 Right to win

- 18.1.3.4.2 Strategic choices

- 18.1.3.4.3 Weaknesses and competitive threats

- 18.1.4 BAE SYSTEMS

- 18.1.4.1 Business overview

- 18.1.4.2 Products offered

- 18.1.4.3 Recent developments

- 18.1.4.3.1 Product launches

- 18.1.4.3.2 Deals

- 18.1.4.3.3 Other developments

- 18.1.4.4 MnM view

- 18.1.4.4.1 Right to win

- 18.1.4.4.2 Strategic choices

- 18.1.4.4.3 Weaknesses and competitive threats

- 18.1.5 SAAB AB

- 18.1.5.1 Business overview

- 18.1.5.2 Products offered

- 18.1.5.3 Recent developments

- 18.1.5.3.1 Deals

- 18.1.5.3.2 Other developments

- 18.1.5.4 MnM view

- 18.1.5.4.1 Right to win

- 18.1.5.4.2 Strategic choices

- 18.1.5.4.3 Weaknesses and competitive threats

- 18.1.6 TELEDYNE TECHNOLOGIES INCORPORATED

- 18.1.6.1 Business overview

- 18.1.6.2 Products offered

- 18.1.6.3 Recent developments

- 18.1.6.3.1 Product launches

- 18.1.6.3.2 Deals

- 18.1.6.3.3 Other developments

- 18.1.7 HII

- 18.1.7.1 Business overview

- 18.1.7.2 Products offered

- 18.1.7.3 Recent developments

- 18.1.7.3.1 Deals

- 18.1.7.3.2 Other developments

- 18.1.8 GENERAL DYNAMICS CORPORATION

- 18.1.8.1 Business overview

- 18.1.8.2 Products offered

- 18.1.8.3 Recent developments

- 18.1.8.3.1 Other developments

- 18.1.9 KAWASAKI HEAVY INDUSTRIES, LTD

- 18.1.9.1 Business overview

- 18.1.9.2 Products offered

- 18.1.9.3 Recent developments

- 18.1.9.3.1 Deals

- 18.1.9.3.2 Other developments

- 18.1.10 LOCKHEED MARTIN CORPORATION

- 18.1.10.1 Business overview

- 18.1.10.2 Products offered

- 18.1.11 TKMS

- 18.1.11.1 Business overview

- 18.1.11.2 Products offered

- 18.1.11.3 Recent developments

- 18.1.11.3.1 Other developments

- 18.1.12 L3HARRIS TECHNOLOGIES, INC.

- 18.1.12.1 Business overview

- 18.1.12.2 Products offered

- 18.1.12.3 Recent developments

- 18.1.12.3.1 Deals

- 18.1.12.3.2 Other developments

- 18.1.13 BOSTON ENGINEERING

- 18.1.13.1 Business overview

- 18.1.13.2 Products offered

- 18.1.13.3 Recent developments

- 18.1.13.3.1 Other developments

- 18.1.14 BOEING

- 18.1.14.1 Business overview

- 18.1.14.2 Products offered

- 18.1.14.3 Recent developments

- 18.1.14.3.1 Other developments

- 18.1.15 XYLEM INC

- 18.1.15.1 Business overview

- 18.1.15.2 Products offered

- 18.1.15.3 Recent developments

- 18.1.15.3.1 Deals

- 18.1.15.4 Other developments

- 18.1.16 INTERNATIONAL SUBMARINE ENGINEERING LIMITED

- 18.1.16.1 Business overview

- 18.1.16.2 Products offered

- 18.1.16.3 Recent developments

- 18.1.16.3.1 Product launches

- 18.1.16.4 Other developments

- 18.1.17 NORTHROP GRUMMAN

- 18.1.17.1 Business overview

- 18.1.17.2 Products offered

- 18.1.17.3 Recent developments

- 18.1.17.3.1 Other developments

- 18.1.1 KONGSBERG

- 18.2 OTHER PLAYERS

- 18.2.1 MSUBS

- 18.2.2 FALMOUTH SCIENTIFIC, INC

- 18.2.3 MITSUBISHI HEAVY INDUSTRIES, LTD.

- 18.2.4 ECOSUB ROBOTICS

- 18.2.5 EELUME AS

- 18.2.6 HYDROMEA

- 18.2.7 GRAAL TECH SRL

- 18.2.8 BALTROBOTICS

- 18.2.9 OCEANSCAN - MARINE SYSTEMS & TECHNOLOGY

- 18.2.10 RTSYS

19 RESEARCH METHODOLOGY

- 19.1 RESEARCH DATA

- 19.1.1 SECONDARY DATA

- 19.1.1.1 Key data from secondary sources

- 19.1.2 PRIMARY DATA

- 19.1.2.1 Primary interview participants

- 19.1.2.2 Key data from primary sources

- 19.1.2.3 Breakdown of primary interviews

- 19.1.1 SECONDARY DATA

- 19.2 MARKET SIZE ESTIMATION

- 19.2.1 BOTTOM-UP APPROACH

- 19.2.2 TOP-DOWN APPROACH

- 19.2.3 BASE NUMBER CALCULATION

- 19.3 DATA TRIANGULATION

- 19.4 FACTOR ANALYSIS

- 19.4.1 SUPPLY-SIDE INDICATORS

- 19.4.2 DEMAND-SIDE INDICATORS

- 19.5 RESEARCH ASSUMPTIONS

- 19.6 RESEARCH LIMITATIONS

- 19.7 RISK ASSESSMENT

20 APPENDIX

- 20.1 DISCUSSION GUIDE

- 20.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 20.3 CUSTOMIZATION OPTIONS

- 20.4 RELATED REPORTS

- 20.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES

- TABLE 2 UNMET NEEDS AND WHITE SPACES

- TABLE 3 CROSS-SECTOR OPPORTUNITIES

- TABLE 4 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- TABLE 5 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 6 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 7 COMPONENT-LEVEL PRICE IMPACT ANALYSIS

- TABLE 8 IMPORT DATA FOR HS CODE 900630-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 9 EXPORT DATA FOR HS CODE 900630-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 10 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 11 TOTAL COST OF OWNERSHIP OF AUTONOMOUS UNDERWATER VEHICLES

- TABLE 12 AVERAGE SELLING PRICE TREND OF AUTONOMOUS UNDERWATER VEHICLES, BY TYPE, 2019-2024 (USD/UNIT)

- TABLE 13 AVERAGE SELLING PRICE TREND OF SHALLOW AUTONOMOUS UNDERWATER VEHICLES, 2019-2024 (USD/UNIT)

- TABLE 14 AVERAGE SELLING PRICE TREND OF LARGE AUTONOMOUS UNDERWATER VEHICLES, 2019-2024 (USD/UNIT)

- TABLE 15 AVERAGE SELLING PRICE TREND OF AUTONOMOUS UNDERWATER VEHICLES, BY REGION, 2019-2024 (USD MILLION)

- TABLE 16 NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE VOLUME, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 17 NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE VOLUME, BY COUNTRY, 2025-2030 (UNITS)

- TABLE 18 EUROPE: AUTONOMOUS UNDERWATER VEHICLE VOLUME, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 19 EUROPE: AUTONOMOUS UNDERWATER VEHICLE VOLUME, BY COUNTRY, 2025-2030 (UNITS)

- TABLE 20 ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE VOLUME, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 21 ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE VOLUME, BY COUNTRY, 2025-2030 (UNITS)

- TABLE 22 MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE VOLUME, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 23 MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE VOLUME, BY COUNTRY, 2025-2030 (UNITS)

- TABLE 24 REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE VOLUME, BY REGION, 2021-2024 (UNITS)

- TABLE 25 REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE VOLUME, BY REGION, 2025-2030 (UNITS)

- TABLE 26 NORTH AMERICAN AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2021-2024 (UNITS)

- TABLE 27 NORTH AMERICAN AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2025-2030 (UNITS)

- TABLE 28 EUROPEAN AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2021-2024 (UNITS)

- TABLE 29 EUROPEAN AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2025-2030 (UNITS)

- TABLE 30 ASIA PACIFIC AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2021-2024 (UNITS)

- TABLE 31 ASIA PACIFIC AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2025-2030 (UNITS)

- TABLE 32 MIDDLE EASTERN AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2021-2024 (UNITS)

- TABLE 33 MIDDLE EASTERN AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2025-2030 (UNITS)

- TABLE 34 REST OF THE WORLD AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2021-2024 (UNITS)

- TABLE 35 REST OF THE WORLD AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2025-2030 (UNITS)

- TABLE 36 BILL OF MATERIALS FOR AUTONOMOUS UNDERWATER VEHICLES, 2024

- TABLE 37 GDP PERCENTAGE CHANGE, BY COUNTRY, 2021-2029

- TABLE 38 EVOLUTION OF AUTONOMOUS UNDERWATER VEHICLES

- TABLE 39 PATENT ANALYSIS

- TABLE 40 DEEP-SEA MINERAL EXPLORATION NETWORKS: FUTURE OF AUTONOMOUS SEABED RESOURCE MAPPING

- TABLE 41 AUTONOMOUS MCM AUV SYSTEMS: FUTURE OF INTELLIGENT UNDERSEA DEFENSE OPERATIONS

- TABLE 42 TOP USE CASES AND MARKET POTENTIAL

- TABLE 43 BEST PRACTICES

- TABLE 44 CASE STUDIES OF AI IMPLEMENTATION

- TABLE 45 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 46 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 47 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 48 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 49 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 50 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 51 GLOBAL DESIGN, STRUCTURAL, AND OPERATIONAL STANDARDS

- TABLE 52 GLOBAL ELECTRICAL, COMMUNICATION, AND CYBERSECURITY STANDARDS

- TABLE 53 GLOBAL QUALITY, ENVIRONMENTAL, AND COMPLIANCE STANDARDS

- TABLE 54 CARBON IMPACT REDUCTION

- TABLE 55 ECO-APPLICATIONS

- TABLE 56 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

- TABLE 57 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY SPEED (%)

- TABLE 58 KEY BUYING CRITERIA, BY SPEED

- TABLE 59 UNMET NEEDS IN AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION

- TABLE 60 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 61 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 62 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 63 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (UNITS)

- TABLE 64 SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 65 SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 66 SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 67 SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (UNITS)

- TABLE 68 LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 69 LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 70 LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 71 LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (UNITS)

- TABLE 72 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 73 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 74 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2021-2024 (UNITS)

- TABLE 75 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2025-2030 (UNITS)

- TABLE 76 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 77 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 78 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 79 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 80 COLLISION AVOIDANCE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 81 COLLISION AVOIDANCE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 82 COMMUNICATION & NETWORKING: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 83 COMMUNICATION & NETWORKING: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 84 NAVIGATION & GUIDANCE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 85 NAVIGATION & GUIDANCE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 86 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY INERTIAL & DEAD-RECKONING SYSTEM, 2021-2024 (USD MILLION)

- TABLE 87 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY INERTIAL & DEAD-RECKONING SYSTEM, 2025-2030 (USD MILLION)

- TABLE 88 PROPULSION & MOBILITY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 89 PROPULSION & MOBILITY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 90 CHASSIS: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 91 CHASSIS: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 92 POWER & ENERGY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 93 POWER & ENERGY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 94 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY ENERGY STORAGE SYSTEM, 2021-2024 (USD MILLION)

- TABLE 95 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY ENERGY STORAGE SYSTEM, 2025-2030 (USD MILLION)

- TABLE 96 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY POWER MANAGEMENT & DISTRIBUTION SYSTEM, 2021-2024 (USD MILLION)

- TABLE 97 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY POWER MANAGEMENT & DISTRIBUTION SYSTEM, 2025-2030 (USD MILLION)

- TABLE 98 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 99 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 100 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 101 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 102 MILITARY & DEFENSE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 103 MILITARY & DEFENSE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 104 OIL & GAS: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 105 OIL & GAS: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 106 ENVIRONMENTAL PROTECTION & MONITORING: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 107 ENVIRONMENTAL PROTECTION & MONITORING: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 108 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 109 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 110 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 111 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY REGION, 2025-2030 (UNITS)

- TABLE 112 NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 113 NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 114 NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 115 NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 116 NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 117 NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 118 NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 119 NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 120 NORTH AMERICA: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 121 NORTH AMERICA: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 122 NORTH AMERICA: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 123 NORTH AMERICA: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 124 NORTH AMERICA: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 125 NORTH AMERICA: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 126 NORTH AMERICA: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 127 NORTH AMERICA: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (UNITS)

- TABLE 128 NORTH AMERICA: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 129 NORTH AMERICA: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 130 NORTH AMERICA: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 131 NORTH AMERICA: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (UNITS)

- TABLE 132 NORTH AMERICA: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 133 NORTH AMERICA: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 134 NORTH AMERICA: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 135 NORTH AMERICA: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (UNITS)

- TABLE 136 NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 137 NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 138 NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 139 NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 140 US: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 141 US: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 142 US: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 143 US: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 144 US: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 145 US: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 146 US: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 147 US: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (UNITS)

- TABLE 148 CANADA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 149 CANADA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 150 CANADA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 151 CANADA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 152 CANADA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 153 CANADA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 154 CANADA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 155 CANADA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (UNITS)

- TABLE 156 EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 157 EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 158 EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 159 EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 160 EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 161 EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 162 EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 163 EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 164 EUROPE: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 165 EUROPE: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 166 EUROPE: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 167 EUROPE: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 168 EUROPE: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 169 EUROPE: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 170 EUROPE: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 171 EUROPE: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (UNITS)

- TABLE 172 EUROPE: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 173 EUROPE: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 174 EUROPE: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 175 EUROPE: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (UNITS)

- TABLE 176 EUROPE: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 177 EUROPE: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 178 EUROPE: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 179 EUROPE: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (UNITS)

- TABLE 180 EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 181 EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 182 EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 183 EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 184 UK: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 185 UK: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 186 UK: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 187 UK: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 188 UK: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 189 UK: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 190 UK: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 191 UK: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (UNITS)

- TABLE 192 GERMANY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 193 GERMANY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 194 GERMANY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 195 GERMANY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 196 GERMANY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 197 GERMANY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 198 GERMANY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 199 GERMANY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (UNITS)

- TABLE 200 FRANCE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 201 FRANCE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 202 FRANCE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 203 FRANCE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 204 FRANCE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 205 FRANCE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 206 FRANCE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 207 FRANCE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (UNITS)

- TABLE 208 ITALY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 209 ITALY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 210 ITALY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 211 ITALY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 212 ITALY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 213 ITALY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 214 ITALY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 215 ITALY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (UNITS)

- TABLE 216 SPAIN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 217 SPAIN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 218 SPAIN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 219 SPAIN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 220 SPAIN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 221 SPAIN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 222 SPAIN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 223 SPAIN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (UNITS)

- TABLE 224 NORWAY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 225 NORWAY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 226 NORWAY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 227 NORWAY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 228 NORWAY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 229 NORWAY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 230 NORWAY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 231 NORWAY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (UNITS)

- TABLE 232 REST OF EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 233 REST OF EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 234 REST OF EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 235 REST OF EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 236 REST OF EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 237 REST OF EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 238 REST OF EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 239 REST OF EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (UNITS)

- TABLE 240 ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 241 ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 242 ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 243 ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 244 ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 245 ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 246 ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 247 ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 248 ASIA PACIFIC: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 249 ASIA PACIFIC: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 250 ASIA PACIFIC: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 251 ASIA PACIFIC: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 252 ASIA PACIFIC: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 253 ASIA PACIFIC: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 254 ASIA PACIFIC: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 255 ASIA PACIFIC: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (UNITS)

- TABLE 256 ASIA PACIFIC: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 257 ASIA PACIFIC: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 258 ASIA PACIFIC: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 259 ASIA PACIFIC: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (UNITS)

- TABLE 260 ASIA PACIFIC: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 261 ASIA PACIFIC: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 262 ASIA PACIFIC: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 263 ASIA PACIFIC: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (UNITS)

- TABLE 264 ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 265 ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 266 ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 267 ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 268 CHINA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 269 CHINA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 270 CHINA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 271 CHINA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 272 CHINA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 273 CHINA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 274 CHINA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (UUNITS)

- TABLE 275 CHINA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (UNITS)

- TABLE 276 JAPAN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 277 JAPAN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 278 JAPAN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 279 JAPAN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 280 JAPAN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 281 JAPAN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 282 JAPAN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 283 JAPAN: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (UNITS)

- TABLE 284 AUSTRALIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 285 AUSTRALIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 286 AUSTRALIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 287 AUSTRALIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 288 AUSTRALIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 289 AUSTRALIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 290 AUSTRALIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 291 AUSTRALIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (UNITS)

- TABLE 292 SOUTH KOREA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 293 SOUTH KOREA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 294 SOUTH KOREA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 295 SOUTH KOREA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 296 SOUTH KOREA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 297 SOUTH KOREA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 298 SOUTH KOREA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 299 SOUTH KOREA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (UNITS)

- TABLE 300 INDIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 301 INDIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 302 INDIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 303 INDIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 304 INDIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 305 INDIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 306 INDIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 307 INDIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (UNITS)

- TABLE 308 REST OF ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 309 REST OF ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 310 REST OF ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 311 REST OF ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 312 REST OF ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 313 REST OF ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 314 REST OF ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 315 REST OF ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (UNITS)

- TABLE 316 MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 317 MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 318 MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 319 MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 320 MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 321 MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 322 MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 323 MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 324 MIDDLE EAST: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 325 MIDDLE EAST: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 326 MIDDLE EAST: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 327 MIDDLE EAST: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 328 MIDDLE EAST: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 329 MIDDLE EAST: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 330 MIDDLE EAST: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 331 MIDDLE EAST: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (UNITS)

- TABLE 332 MIDDLE EAST: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 333 MIDDLE EAST: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 334 MIDDLE EAST: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 335 MIDDLE EAST: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (UNITS)

- TABLE 336 MIDDLE EAST: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 337 MIDDLE EAST: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 338 MIDDLE EAST: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 339 MIDDLE EAST: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (UNITS)

- TABLE 340 MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 341 MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 342 MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 343 MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 344 SAUDI ARABIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 345 SAUDI ARABIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 346 SAUDI ARABIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 347 SAUDI ARABIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 348 SAUDI ARABIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 349 SAUDI ARABIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 350 SAUDI ARABIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 351 SAUDI ARABIA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (UNITS)

- TABLE 352 UAE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 353 UAE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 354 UAE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 355 UAE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 356 UAE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 357 UAE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 358 UAE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 359 UAE: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (UNITS)

- TABLE 360 ISRAEL: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 361 ISRAEL: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 362 ISRAEL: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 363 ISRAEL: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 364 ISRAEL: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 365 ISRAEL: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 366 ISRAEL: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 367 ISRAEL: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (UNITS)

- TABLE 368 TURKEY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 369 TURKEY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 370 TURKEY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 371 TURKEY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 372 TURKEY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 373 TURKEY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 374 TURKEY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 375 TURKEY: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (UNITS)

- TABLE 376 REST OF MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 377 REST OF MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 378 REST OF MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 379 REST OF MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 380 REST OF MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 381 REST OF MIDDLE EAST: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 382 REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 383 REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 384 REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 385 REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 386 REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 387 REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 388 REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 389 REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 390 REST OF THE WORLD: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 391 REST OF THE WORLD: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 392 REST OF THE WORLD: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 393 REST OF THE WORLD: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 394 REST OF THE WORLD: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 395 REST OF THE WORLD: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 396 REST OF THE WORLD: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 397 REST OF THE WORLD: SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (UNITS)

- TABLE 398 REST OF THE WORLD: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 399 REST OF THE WORLD: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 400 REST OF THE WORLD: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 401 REST OF THE WORLD: MEDIUM AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (UNITS)

- TABLE 402 REST OF THE WORLD: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 403 REST OF THE WORLD: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 404 REST OF THE WORLD: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 405 REST OF THE WORLD: LARGE AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (UNITS)

- TABLE 406 REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 407 REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE, 2025-2030 (USD MILLION)

- TABLE 408 REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 409 REST OF THE WORLD: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 410 AFRICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 411 AFRICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 412 AFRICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 413 AFRICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 414 AFRICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 415 AFRICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 416 AFRICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 417 AFRICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (UNITS)

- TABLE 418 LATIN AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 419 LATIN AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 420 LATIN AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 421 LATIN AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 422 LATIN AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 423 LATIN AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 424 LATIN AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 425 LATIN AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE, 2025-2030 (UNITS)

- TABLE 426 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- TABLE 427 AUTONOMOUS UNDERWATER VEHICLE MARKET: DEGREE OF COMPETITION

- TABLE 428 REGION FOOTPRINT

- TABLE 429 APPLICATION FOOTPRINT

- TABLE 430 TYPE FOOTPRINT

- TABLE 431 SPEED FOOTPRINT

- TABLE 432 LIST OF START-UPS/SMES

- TABLE 433 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 434 AUTONOMOUS UNDERWATER VEHICLE MARKET: PRODUCT LAUNCHES, 2021-2025

- TABLE 435 AUTONOMOUS UNDERWATER VEHICLE MARKET: DEALS, 2021-2025

- TABLE 436 AUTONOMOUS UNDERWATER VEHICLE MARKET: OTHER DEVELOPMENTS, 2021-2025

- TABLE 437 KONGSBERG: COMPANY OVERVIEW

- TABLE 438 KONGSBERG: PRODUCTS OFFERED

- TABLE 439 KONGSBERG: DEALS

- TABLE 440 KONGSBERG: OTHER DEVELOPMENTS

- TABLE 441 SAIPEM S.P.A.: COMPANY OVERVIEW

- TABLE 442 SAIPEM S.P.A.: PRODUCTS OFFERED

- TABLE 443 SAIPEM S.P.A.: OTHER DEVELOPMENTS

- TABLE 444 EXAIL TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 445 EXAIL TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 446 EXAIL TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 447 EXAIL TECHNOLOGIES: DEALS

- TABLE 448 EXAIL TECHNOLOGIES: OTHER DEVELOPMENTS

- TABLE 449 BAE SYSTEMS: COMPANY OVERVIEW

- TABLE 450 BAE SYSTEMS: PRODUCTS OFFERED

- TABLE 451 BAE SYSTEMS: PRODUCT LAUNCHES

- TABLE 452 BAE SYSTEMS: DEALS

- TABLE 453 BAE SYSTEMS: OTHER DEVELOPMENTS

- TABLE 454 SAAB AB: COMPANY OVERVIEW

- TABLE 455 SAAB AB: PRODUCTS OFFERED

- TABLE 456 SAAB AB: DEALS

- TABLE 457 SAAB AB: OTHER DEVELOPMENTS

- TABLE 458 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

- TABLE 459 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCTS OFFERED

- TABLE 460 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCT LAUNCHES

- TABLE 461 TELEDYNE TECHNOLOGIES INCORPORATED: DEALS

- TABLE 462 TELEDYNE TECHNOLOGIES INCORPORATED: OTHER DEVELOPMENTS

- TABLE 463 HII: COMPANY OVERVIEW

- TABLE 464 HII: PRODUCTS OFFERED

- TABLE 465 HII: DEALS

- TABLE 466 HII: OTHER DEVELOPMENTS

- TABLE 467 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

- TABLE 468 GENERAL DYNAMICS CORPORATION: PRODUCTS OFFERED

- TABLE 469 GENERAL DYNAMICS CORPORATION: OTHER DEVELOPMENTS

- TABLE 470 KAWASAKI HEAVY INDUSTRIES, LTD: COMPANY OVERVIEW

- TABLE 471 KAWASAKI HEAVY INDUSTRIES, LTD: PRODUCTS OFFERED

- TABLE 472 KAWASAKI HEAVY INDUSTRIES, LTD: DEALS

- TABLE 473 KAWASAKI HEAVY INDUSTRIES, LTD: OTHER DEVELOPMENTS

- TABLE 474 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 475 LOCKHEED MARTIN CORPORATION: PRODUCTS OFFERED

- TABLE 476 TKMS: COMPANY OVERVIEW

- TABLE 477 TKMS: PRODUCTS OFFERED

- TABLE 478 TKMS: OTHER DEVELOPMENTS

- TABLE 479 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 480 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS OFFERED

- TABLE 481 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 482 L3HARRIS TECHNOLOGIES, INC.: OTHER DEVELOPMENTS

- TABLE 483 BOSTON ENGINEERING: COMPANY OVERVIEW

- TABLE 484 BOSTON ENGINEERING: PRODUCTS OFFERED

- TABLE 485 BOSTON ENGINEERING: OTHER DEVELOPMENTS

- TABLE 486 BOEING: COMPANY OVERVIEW

- TABLE 487 BOEING: PRODUCTS OFFERED

- TABLE 488 BOEING: OTHER DEVELOPMENTS

- TABLE 489 XYLEM INC: COMPANY OVERVIEW

- TABLE 490 XYLEM INC: PRODUCTS OFFERED

- TABLE 491 XYLEM INC: DEALS

- TABLE 492 XYLEM INC: OTHER DEVELOPMENTS

- TABLE 493 INTERNATIONAL SUBMARINE ENGINEERING LIMITED: COMPANY OVERVIEW

- TABLE 494 INTERNATIONAL SUBMARINE ENGINEERING LIMITED: PRODUCTS OFFERED

- TABLE 495 INTERNATIONAL SUBMARINE ENGINEERING LIMITED: PRODUCT LAUNCHES

- TABLE 496 INTERNATIONAL SUBMARINE ENGINEERING LIMITED: OTHER DEVELOPMENTS

- TABLE 497 NORTHROP GRUMMAN: COMPANY OVERVIEW