|

市場調查報告書

商品編碼

1873972

全球人工智慧(AI)機器人市場:按組件、技術、機器人類型、應用和地區分類-預測至2030年Artificial Intelligence (AI) Robots Market by Component (Hardware, Software), Technology (Machine learning, Computer Vision, Context Awareness, NLP, Localization & Mapping/SLAM, Motion Planning & Control) and Robot Type - Global Forecast to 2030 |

||||||

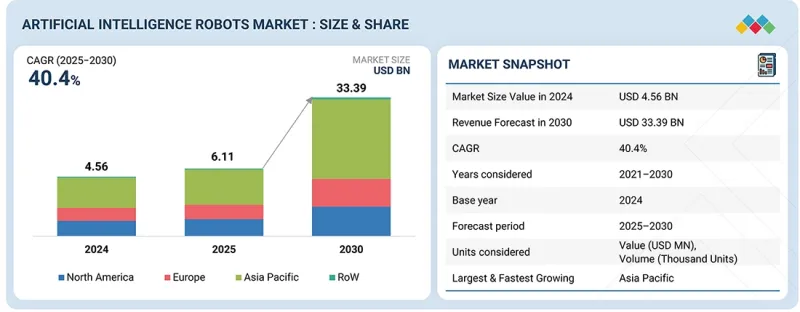

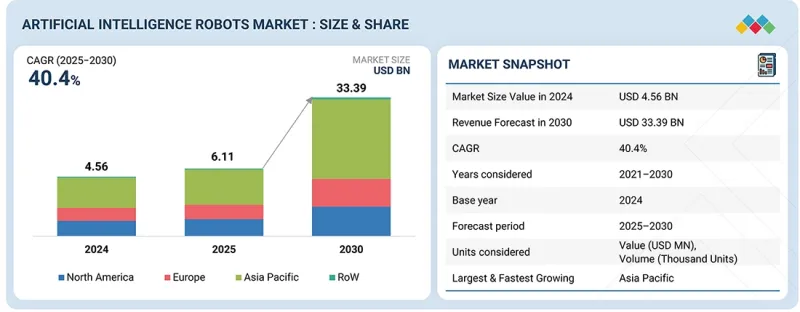

全球人工智慧機器人市場預計將從 2025 年的 61.1 億美元成長到 2030 年的 333.9 億美元,複合年成長率為 40.4%。

| 調查範圍 | |

|---|---|

| 調查期 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 目標單元 | 金額(十億美元) |

| 部分 | 按組件、技術、機器人類型、應用、區域 |

| 目標區域 | 北美、歐洲、亞太地區及其他地區 |

推動人工智慧機器人市場發展的關鍵因素是智慧機器人在工業自動化領域的加速應用。隨著工廠和物流中心致力於提高生產力和效率,人工智慧機器人正被部署到組裝、偵測、包裝和物料搬運等任務中。這些機器人利用機器學習進行自適應決策,從而能夠無縫整合到現代智慧工廠中。製造業中心日益嚴重的勞動力短缺和不斷上漲的工資成本,推動了對能夠降低營運成本和提高品質的自動化解決方案的需求。感測器技術和電腦視覺的快速發展,使機器人能夠在複雜的環境中導航並執行精確的任務,這使其成為具有競爭力和可擴展性的製造業不可或缺的一部分。

由於機器學習技術能夠使機器人從數據中學習並隨著時間的推移不斷提升效能,因此預計將在人工智慧機器人市場佔據重要佔有率。這項技術使機器人能夠適應複雜多變的環境,從而提高其自主性、準確性和決策能力。機器學習支援物體識別、預測性維護和即時調整等高級功能,這些功能對於製造業、醫療保健、物流和服務業的應用至關重要。隨著人工智慧機器人變得越來越聰明和多功能,對機器學習驅動型解決方案的需求預計將快速成長,並將成為推動市場擴張的關鍵技術領域。

硬體組件在實現機器人功能方面發揮著至關重要的作用。感測器、致動器、處理器和機械框架等關鍵硬體元件構成了機器人系統的核心,確保了機器人的精確操作、移動性和環境感知能力。工業自動化、醫療應用和自動駕駛汽車等領域對先進感測器和高性能處理器的需求日益成長,這些應用需要即時數據處理和運行穩定性。

預計到2030年,中國將佔據亞太地區人工智慧機器人市場最大的佔有率,這主要得益於快速的工業化進程和對自動化技術的巨額投資。中國強大的製造業基礎,以及政府主導的「中國製造2025」等舉措,正推動著人工智慧機器人在汽車、電子、物流等各個領域的廣泛應用。中國在機器人創新領域的領先地位、龐大的國內市場以及垂直整合的供應鏈進一步鞏固了其優勢。眾多大型機器人企業的存在以及充足的研發資金,將使中國在預測期內保持競爭優勢並鞏固其市場領導地位。

本報告研究了全球人工智慧(AI)機器人市場,按組件、技術、機器人類型、應用和地區對市場進行了深入分析,並提供了參與該市場的公司的概況。

目錄

第1章 引言

第2章執行摘要

第3章重要考察

第4章 市場概覽

- 介紹

- 市場動態

- 相互關聯的市場與跨產業機遇

- 一級/二級/三級公司的策略性舉措

第5章 產業趨勢

- 波特五力分析

- 宏觀經濟展望

- 供應鏈分析

- 生態系分析

- 定價分析

- 貿易分析

- 2026年重大會議和活動

- 影響客戶業務的趨勢/干擾因素

- 投資和資金籌措方案

- 案例研究分析

- 2025年美國關稅將如何影響人工智慧機器人市場

第6章:技術進步、人工智慧的影響、專利、創新與未來應用

- 主要技術

- 互補技術

- 技術/產品藍圖

- 專利分析

- 未來應用

第7章 監理環境

- 地方法規和合規性

- 監管機構、政府機構和其他組織

- 業界標準

第8章:顧客狀況與購買行為

- 決策流程

- 主要相關人員和採購標準

- 招募障礙和內部挑戰

- 各種應用中尚未滿足的需求

第9章 人工智慧機器人市場(按組件分類)

- 介紹

- 硬體

- 軟體

第10章 人工智慧機器人市場(依技術分類)

- 介紹

- 機器學習

- 電腦視覺

- 情境感知

- 自然語言處理

- 定位與地圖建構/SLAM

- 運動規劃與控制

第11章 人工智慧機器人市場(以機器人類型分類)

- 介紹

- 工業機器人

- 服務機器人

第12章 人工智慧機器人市場(按應用領域分類)

- 介紹

- 軍事/國防

- 個人援助和護理

- 安全與監控

- 公共基礎設施

- 教育與娛樂

- 勘測與太空探勘

- 工業

- 農業

- 醫療保健援助

- 倉儲/物流

- 零售

- 其他

第13章 人工智慧機器人市場(按地區分類)

- 介紹

- 北美洲

- 北美宏觀經濟展望

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 歐洲宏觀經濟展望

- 英國

- 德國

- 義大利

- 法國

- 西班牙

- 其他

- 亞太地區

- 亞太宏觀經濟展望

- 中國

- 澳洲

- 日本

- 韓國

- 印度

- 其他

- 其他地區

- 世界其他地區宏觀經濟展望

- 中東和非洲

- 南美洲

第14章 競爭格局

- 概述

- 主要參與企業的策略/優勢,2022-2025年

- 2020-2024年收入分析

- 2024年市佔率分析

- 估值和財務指標

- 品牌/產品對比

- 公司估值矩陣:主要參與企業,2024 年

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 競爭場景

第15章 公司簡介

- 主要參與企業

- NABTESCO CORPORATION

- NIDEC CORPORATION

- PANASONIC CORPORATION

- YASKAWA ELECTRIC CORPORATION

- ABB

- NVIDIA CORPORATION

- INTEL CORPORATION

- ADVANCED MICRO DEVICES, INC.

- TEXAS INSTRUMENTS INCORPORATED

- INFINEON TECHNOLOGIES AG

- IBM

- QUALCOMM TECHNOLOGIES, INC.

- SONY GROUP CORPORATION

- BOSCH SENSORTEC GMBH

- STMICROELECTRONICS

- NXP SEMICONDUCTORS

- 其他公司

- NEURALA, INC.

- STAUBLI INTERNATIONAL AG

- BRAIN CORPORATION

- WIBOTIC

- ELMO MOTION CONTROL LTD.

- ADVANCED MOTION CONTROLS

- ODRIVE

- INTERMODALICS

- ROBOTEQ

- ENERGY ROBOTICS

- SEA MACHINES ROBOTICS, INC.

- PILZ GMBH & CO. KG

- MOTION INDUSTRIES, INC.

- MAXON

- FAULHABER

- LUXONIS

- XELA ROBOTICS

- BENEWAKE(BEIJING)CO., LTD.

第16章調查方法

第17章附錄

The global AI robots market is projected to grow from USD 6.11 billion in 2025 to USD 33.39 billion by 2030, at a CAGR of 40.4%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Component, Technology, Robot Type and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Adoption of AI Robots for Industrial Automation to Drive Market"

A primary factor propelling the AI robots market is the accelerated adoption of intelligent robots in industrial automation. As factories and logistics hubs strive for higher productivity and efficiency, AI-powered robots are deployed for tasks such as assembly, inspection, packaging, and material handling. These robots leverage machine learning for adaptive decision-making, allowing seamless integration into modern smart factories. Growing labor shortages and rising wage costs in manufacturing hubs are driving demand for automated solutions that reduce operational expenses and enhance quality. Rapid advancements in sensors and computer vision further enable robots to navigate complex environments and execute precise operations, making them indispensable for competitive and scalable manufacturing.

"Machine Learning Technology to Hold Majority of Market Share in 2030."

Machine learning technology is expected to hold a significant share of the AI robot market due to its ability to enable robots to learn from data and improve their performance over time. This technology allows robots to adapt to complex and dynamic environments, enhancing their autonomy, precision, and decision-making capabilities. Machine learning facilitates advanced functions such as object recognition, predictive maintenance, and real-time adjustments, which are crucial for applications in manufacturing, healthcare, logistics, and service industries. As AI robots become more intelligent and versatile, the demand for machine learning-driven solutions is projected to grow rapidly, making it a key technology segment driving market expansion.

"Hardware Segment to Account for Largest Market Share Throughout Forecast Period"

Hardware components play a fundamental role in enabling robotic functions. Essential hardware elements such as sensors, actuators, processors, and mechanical frameworks form the core of robot systems, ensuring precise operation, mobility, and environmental perception. The demand for advanced sensors and high-performance processors is driven by industrial automation, healthcare applications, and autonomous vehicles, which require reliable hardware for real-time data processing and operational stability.

"China to Account for Prominent Share of Asia Pacific Market for AI Robots in 2030."

China is expected to account for the largest share of the Asia Pacific AI robots market by 2030, driven by rapid industrialization and substantial investments in automation technologies. The country's strong manufacturing base, along with government initiatives such as the "Made in China 2025" plan, supports the widespread adoption of AI-powered robots across various sectors, including automotive, electronics, and logistics. China's leadership in robotics innovation, a vast domestic market, and vertically integrated supply chains further reinforce its dominant position. The presence of major robotics companies and extensive R&D funding enables China to sustain its competitive edge and maintain market leadership throughout the forecast period.

Extensive primary interviews were conducted with key industry experts in the AI robots market to determine and verify the market size for various segments and subsegments, which were gathered through secondary research. The breakup of primary participants for the report is shown below:

The study draws insights from a range of industry experts, including component suppliers, Tier 1 companies, and OEMs. The breakup of the primaries is as follows:

- By Company Type: Tier 1 - 30%, Tier 2 - 50%, and Tier 3 - 20%

- By Designation: C-level Executives - 25%, Directors - 20%, and Others - 55%

- By Region: North America - 40%, Europe - 20%, Asia Pacific - 30%, and RoW - 10%

Notes: The three tiers of companies are based on their total revenue as of 2024: Tier 1, equal to or greater than USD 1,000 million; Tier 2, between USD 500 million and USD 1,000 million; and Tier 3, less than or equal to USD 500 million. Other designations include managers and academicians.

Nabtesco Corporation (Japan), NIDEC CORPORATION (Japan), Panasonic Corporation (Japan), YASKAWA ELECTRIC CORPORATION (Japan), ABB (Switzerland), Texas Instruments Incorporated (US), Infineon Technologies AG (Germany), IBM (US), Qualcomm Technologies, Inc. (US), Sony Corporation (Japan), Bosch Sensortec GmbH (Germany), STMicroelectronics (Switzerland) are some key players in the AI robots market.

The study includes an in-depth competitive analysis of these key players in the AI robots market, with their company profiles, recent developments, and key market strategies.

Study Coverage:

This research report categorizes the AI robots market based on component: hardware & software, by robot type: industrial & service, by technology: machine learning, computer vision, context awareness, natural language, localization & mapping/slam processing, motion planning & control, by application: military & defence, personal assistance and care giving, security and surveillance, public infrastructure, education and entertainment, research and space exploration, industrial, agriculture, healthcare assistance, warehouse & logistics, retail, others and region (North America, Europe, Asia Pacific and Row). The report outlines the key drivers, restraints, challenges, and opportunities influencing the AI robot market and provides forecasts through 2030. The report also includes leadership mapping and analysis of all companies in the AI robot ecosystem.

Key Benefits of Buying the Report

The report will assist market leaders/new entrants in this market by providing information on the closest approximations of the revenue numbers for the overall AI robots market and its subsegments. This report will help stakeholders understand the competitive landscape and gain valuable insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of Key Drivers (High adoption of robots for personal use, Support from governments worldwide to develop modern technologies, Rise in demand for industrial robots ) Restraints (Reluctance to adopt new technologies), Opportunities (Increasing aging population worldwide boosting the demand for AI-based robots for elderly assistance, Increasing investments in AI robotics), and Challenges (Long time to commercialize robots and high maintenance costs), influencing the growth of the AI robots market

- Product Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and the latest product and service launches in the AI robot market

- Market Development: Comprehensive information about lucrative markets by analyzing the AI robots market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the AI robots market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Nabtesco Corporation (Japan), NIDEC CORPORATION (Japan), Panasonic Corporation (Japan), YASKAWA ELECTRIC CORPORATION (Japan), ABB (Switzerland), and Texas Instruments Incorporated (US) in the AI robots market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEAR CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIONS SHAPING AI ROBOTS MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AI ROBOTS MARKET

- 3.2 AI ROBOTS MARKET, BY ROBOT TYPE

- 3.3 AI ROBOTS MARKET, BY APPLICATION

- 3.4 AI ROBOTS MARKET, BY COMPONENT

- 3.5 AI ROBOTS MARKET IN ASIA PACIFIC, BY APPLICATION AND COUNTRY

- 3.6 AI ROBOTS MARKET, BY GEOGRAPHY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 High adoption of robots for personal use

- 4.2.1.2 Rising government support for robotics and industrial-AI projects

- 4.2.1.3 Growing emphasis on industrial automation

- 4.2.2 RESTRAINTS

- 4.2.2.1 High capital investment and shortage of technical expertise

- 4.2.2.2 Lack of standardized regulations to prevent risks associated with networked and autonomous robots

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Mounting demand for AI-based robots for elderly assistance

- 4.2.3.2 Increasing investment in AI robotics

- 4.2.4 CHALLENGES

- 4.2.4.1 Long period of AI robot commercialization

- 4.2.4.2 Complexities associated with integrating AI robots into workflows

- 4.2.1 DRIVERS

- 4.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF BUYERS

- 5.1.4 BARGAINING POWER OF SUPPLIERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL CONSUMER ROBOTS INDUSTRY

- 5.2.4 TRENDS IN GLOBAL HEALTHCARE INDUSTRY

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 PRICING RANGE AI ROBOT SENSORS OFFERED BY KEY PLAYERS, BY TYPE, 2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF AI ROBOT SENSORS, BY REGION, 2021-2024

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT SCENARIO (HS CODE 847950)

- 5.6.2 EXPORT SCENARIO (HS CODE 847950)

- 5.7 KEY CONFERENCES AND EVENTS, 2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 PHILIPS ADOPTS SOFTBANK'S AI ROBOT TO TRANSFORM INNOVATION LAB

- 5.10.2 UNIVERSITY OF PISA INSTALLS HANSON ROBOTS TO SUPPORT THERAPY AND RESEARCH FOR AUTISM SPECTRUM DISORDER

- 5.10.3 MOBILE ROBOTS HELP IMPROVE PRODUCTIVITY AND EFFICIENCY OF AUDI ASSEMBLY LINE

- 5.10.4 NEXCOM USES INTEL'S ROBOTICS TO OPTIMIZE MANUFACTURING OPERATIONS

- 5.11 IMPACT OF 2025 US TARIFF ON AI ROBOTS MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON APPLICATIONS

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACTS, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY TECHNOLOGIES

- 6.1.1 MACHINE LEARNING AND COMPUTER VISION

- 6.1.2 NATURAL LANGUAGE PROCESSING AND HUMAN-ROBOT INTERACTION

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 INTERNET OF THINGS (IOT) AND EDGE COMPUTING

- 6.2.2 CLOUD COMPUTING AND DIGITAL TWINS

- 6.3 TECHNOLOGY/PRODUCT ROADMAP

- 6.4 PATENT ANALYSIS

- 6.5 FUTURE APPLICATIONS

7 REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FOR VARIOUS APPLICATIONS

9 AI ROBOT MARKET, BY COMPONENT

- 9.1 INTRODUCTION

- 9.2 HARDWARE

- 9.2.1 DRIVE SYSTEMS

- 9.2.1.1 Gearboxes

- 9.2.1.1.1 Ability to handle variable payloads to contribute to segmental growth

- 9.2.1.2 Motors

- 9.2.1.2.1 Adoption of AI-driven predictive control to fuel segmental growth

- 9.2.1.3 Motor controllers

- 9.2.1.3.1 Trend toward AI-enabled control systems to accelerate segmental growth

- 9.2.1.1 Gearboxes

- 9.2.2 SENSORS

- 9.2.2.1 Image sensors

- 9.2.2.1.1 High dynamic range and depth sensing features to boost segmental growth

- 9.2.2.2 LiDAR sensors

- 9.2.2.2.1 Demand for autonomous navigation to accelerate segmental growth

- 9.2.2.3 Temperature sensors

- 9.2.2.3.1 Ability to protect sensitive electronic components from overheating and ensure system reliability to drive market

- 9.2.2.4 Tactile sensors

- 9.2.2.4.1 Focus on enabling touch and force detection in robotics to fuel segmental growth

- 9.2.2.5 Pressure sensors

- 9.2.2.5.1 Use for tactile perception and internal state monitoring to expedite segmental growth

- 9.2.2.6 Encoders

- 9.2.2.6.1 Requirement for precision motion control in advanced robotic applications to augment segmental growth

- 9.2.2.7 IMUs

- 9.2.2.7.1 Increasing application in autonomous vehicles, aerial drones, and humanoid robots to bolster segmental growth

- 9.2.2.8 Ultrasonic sensors

- 9.2.2.8.1 Need for spatial awareness and safe maneuverability in robots to provide market growth opportunities

- 9.2.2.9 Other sensors

- 9.2.2.1 Image sensors

- 9.2.3 CONTROL SYSTEMS

- 9.2.3.1 CPU

- 9.2.3.1.1 Need for high-performance, low-latency processing in AI-driven robotic systems to accelerate segmental growth

- 9.2.3.2 GPU

- 9.2.3.2.1 Growing need for parallel computing and real-time AI processing to foster segmental growth

- 9.2.3.3 ASIC

- 9.2.3.3.1 High demand for miniaturization, low-latency processing, and energy-efficient designs to boost segmental growth

- 9.2.3.4 FPGA

- 9.2.3.4.1 Requirement for low-latency, high-throughput processing in real-time environments to accelerate segmental growth

- 9.2.3.5 DSP

- 9.2.3.5.1 Mounting adoption of intelligent edge devices, AMRs, and cobots to expedite market growth

- 9.2.3.6 Other control systems

- 9.2.3.1 CPU

- 9.2.4 ENERGY SUPPLY SYSTEMS

- 9.2.4.1 Power supply units

- 9.2.4.1.1 Emphasis on reliable and intelligent power management systems to accelerate segmental growth

- 9.2.4.2 Batteries

- 9.2.4.2.1 High demand for high-density, safe, and efficient battery systems to drive market

- 9.2.4.1 Power supply units

- 9.2.1 DRIVE SYSTEMS

- 9.3 SOFTWARE

- 9.3.1 ROBOTIC OS/ROS

- 9.3.1.1 Use to facilitate modularity, scalability, and interoperability to boost segmental growth

- 9.3.2 APPLICATION SOFTWARE

- 9.3.2.1 Ability to support human-robot collaboration to contribute to segmental growth

- 9.3.1 ROBOTIC OS/ROS

10 AI ROBOTS MARKET, BY TECHNOLOGY

- 10.1 INTRODUCTION

- 10.2 MACHINE LEARNING

- 10.2.1 DEPLOYMENT BY RESEARCHERS TO TEACH HUMANOID ROBOTS TO FUEL SEGMENTAL GROWTH

- 10.3 COMPUTER VISION

- 10.3.1 FOCUS ON HELPING ROBOTS PRECISELY LOCATE AND IDENTIFY IMAGES TO AUGMENT SEGMENTAL GROWTH

- 10.4 CONTEXT AWARENESS

- 10.4.1 DEVELOPMENT OF SOPHISTICATED HARD AND SOFT SENSORS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 10.5 NATURAL LANGUAGE PROCESSING

- 10.5.1 USE TO UNDERSTAND HUMAN SPEECH APPLICATIONS IN ROBOTS FOR ELDERLY ASSISTANCE TO EXPEDITE SEGMENTAL GROWTH

- 10.6 LOCALIZATION & MAPPING/SLAM

- 10.6.1 ABILITY TO HELP ROBOTS CREATE ACCURATE MAPS OF SURROUNDINGS TO FUEL SEGMENTAL GROWTH

- 10.7 MOTION PLANNING & CONTROL

- 10.7.1 EMPHASIS ON PRECISION, SAFETY, AND REAL-TIME AUTONOMOUS OPERATION IN ROBOTICS TO FACILITATE SEGMENTAL GROWTH

11 AI ROBOTS MARKET, BY ROBOT TYPE

- 11.1 INTRODUCTION

- 11.2 INDUSTRIAL ROBOTS

- 11.2.1 TRADITIONAL ROBOTS

- 11.2.1.1 Greater adaptability, predictive maintenance, and intelligent decision-making to foster segmental growth

- 11.2.2 COLLABORATIVE ROBOTS

- 11.2.2.1 Use to enable flexible, low-barrier automation in mixed human-robot workcells to augment segmental growth

- 11.2.1 TRADITIONAL ROBOTS

- 11.3 SERVICE ROBOTS

- 11.3.1 HUMAN-ASSIST ROBOTS

- 11.3.1.1 Growing aging population and shortage of healthcare workers to contribute to segmental growth

- 11.3.2 MOBILE ROBOTS

- 11.3.2.1 High emphasis on automation of transportation and repetitive workflows to boost segmental growth

- 11.3.3 SOCIAL ROBOTS

- 11.3.3.1 Rising need for personalized education tools and focus on automation to expedite segmental growth

- 11.3.1 HUMAN-ASSIST ROBOTS

12 AI ROBOTS MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 MILITARY & DEFENSE

- 12.2.1 INCREASING NEED FOR REAL-TIME DATA COLLECTION AND THREAT DETECTION TO ACCELERATE SEGMENTAL GROWTH

- 12.2.2 SPYING

- 12.2.3 SEARCH & RESCUE OPERATIONS

- 12.2.4 BORDER SECURITY

- 12.2.5 COMBAT OPERATIONS

- 12.3 PERSONAL ASSISTANCE & CAREGIVING

- 12.3.1 GROWING PREFERENCE FOR INDEPENDENT LIVING TO ACCELERATE SEGMENTAL GROWTH

- 12.3.2 ELDERLY ASSISTANCE

- 12.3.3 COMPANIONSHIP

- 12.4 SECURITY & SURVEILLANCE

- 12.4.1 MOUNTING DEMAND FOR REAL-TIME MONITORING AND AUTOMATED SAFETY MANAGEMENT SYSTEMS TO FUEL SEGMENTAL GROWTH

- 12.5 PUBLIC INFRASTRUCTURE

- 12.5.1 INCREASING RELIANCE ON ROBOTS FOR CONSTRUCTION, INSPECTION, AND MONITORING APPLICATIONS TO DRIVE MARKET

- 12.6 EDUCATION & ENTERTAINMENT

- 12.6.1 WIDESPREAD ADOPTION OF DIGITAL TECHNOLOGY TO AUGMENT SEGMENTAL GROWTH

- 12.7 RESEARCH & SPACE EXPLORATION

- 12.7.1 RISING DEPLOYMENT OF ROBOTS FOR COMPUTATIONAL NEUROSCIENCE AND EDUCATIONAL PURPOSES TO SUPPORT MARKET GROWTH

- 12.8 INDUSTRIAL

- 12.8.1 RISE OF SMART FACTORIES AND INDUSTRY 4.0 INITIATIVES TO FACILITATE SEGMENTAL GROWTH

- 12.9 AGRICULTURE

- 12.9.1 GROWING FOCUS ON ANALYZING REAL-TIME DATA OF WEATHER CONDITIONS AND CROP PRICES TO FOSTER SEGMENTAL GROWTH

- 12.10 HEALTHCARE ASSISTANCE

- 12.10.1 ABILITY OF ROBOTS TO HELP PREDICT HIGH-RISK CONDITIONS OF PATIENTS TO ACCELERATE SEGMENTAL GROWTH

- 12.11 WAREHOUSE & LOGISTICS

- 12.11.1 RISING NEED TO OPTIMIZE SUPPLY CHAIN MANAGEMENT TO CONTRIBUTE TO SEGMENTAL GROWTH

- 12.12 RETAIL

- 12.12.1 GROWING EMPHASIS ON OPTIMIZING STORE OPERATIONS AND ENHANCING CUSTOMER EXPERIENCE TO BOOST SEGMENTAL GROWTH

- 12.13 OTHER APPLICATIONS

13 AI ROBOTS MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 13.2.2 US

- 13.2.2.1 Increasing investment in advanced technologies by government and private institutions drive market

- 13.2.3 CANADA

- 13.2.3.1 Rising deployment of AI across diverse industries to augment market growth

- 13.2.4 MEXICO

- 13.2.4.1 Emergence as major industrial hub to contribute to market growth

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 13.3.2 UK

- 13.3.2.1 Rapid advances in AI and collaborative robotics to accelerate market growth

- 13.3.3 GERMANY

- 13.3.3.1 Strong industrial base and focus on automation to boost market growth

- 13.3.4 ITALY

- 13.3.4.1 Growing emphasis on improving efficiency and productivity across industries to augment market growth

- 13.3.5 FRANCE

- 13.3.5.1 Mounting adoption of robots to enhance productivity, reduce operational costs, and address labor shortages to drive market

- 13.3.6 SPAIN

- 13.3.6.1 Increasing demand for automation solutions to accelerate market growth

- 13.3.7 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 13.4.2 CHINA

- 13.4.2.1 Escalating adoption of automation solutions in labor-intensive industries to contribute to market growth

- 13.4.3 AUSTRALIA

- 13.4.3.1 Rapid advances in automation solutions for industrial applications to bolster market growth

- 13.4.4 JAPAN

- 13.4.4.1 Strong government support for robots and technological innovation to fuel market growth

- 13.4.5 SOUTH KOREA

- 13.4.5.1 Rapid advances in sensor technologies to accelerate market growth

- 13.4.6 INDIA

- 13.4.6.1 Rapid digital transformation and robust IT infrastructure to boost market growth

- 13.4.7 REST OF ASIA PACIFIC

- 13.5 ROW

- 13.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 13.5.2 MIDDLE EAST & AFRICA

- 13.5.2.1 Increasing government support for automation and manufacturing expansion to foster market growth

- 13.5.3 SOUTH AMERICA

- 13.5.3.1 Escalating adoption of autonomous mobile robots to contribute to market growth

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 14.3 REVENUE ANALYSIS, 2020-2024

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.6 BRAND/PRODUCT COMPARISON

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.7.5.1 Company footprint

- 14.7.5.2 Region footprint

- 14.7.5.3 Component footprint

- 14.7.5.4 Robot type footprint

- 14.7.5.5 Technology footprint

- 14.7.5.6 Application footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.8.5.1 Detailed list of key startups/SMEs

- 14.8.5.2 Competitive benchmarking of key startups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 NABTESCO CORPORATION

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Deals

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths/Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses/Competitive threats

- 15.1.2 NIDEC CORPORATION

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Deals

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths/Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses/Competitive threats

- 15.1.3 PANASONIC CORPORATION

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Deals

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths/Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses/Competitive threats

- 15.1.4 YASKAWA ELECTRIC CORPORATION

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product launches

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths/Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses/Competitive threats

- 15.1.5 ABB

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product launches

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths/Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses/Competitive threats

- 15.1.6 NVIDIA CORPORATION

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Product launches

- 15.1.7 INTEL CORPORATION

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product launches

- 15.1.7.3.2 Deals

- 15.1.8 ADVANCED MICRO DEVICES, INC.

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Product launches

- 15.1.8.3.2 Deals

- 15.1.8.3.3 Other developments

- 15.1.9 TEXAS INSTRUMENTS INCORPORATED

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Product launches

- 15.1.9.3.2 Deals

- 15.1.10 INFINEON TECHNOLOGIES AG

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Product launches

- 15.1.11 IBM

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Deals

- 15.1.12 QUALCOMM TECHNOLOGIES, INC.

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Solutions/Services offered

- 15.1.13 SONY GROUP CORPORATION

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Solutions/Services offered

- 15.1.13.3 Recent developments

- 15.1.13.3.1 Product launches

- 15.1.13.3.2 Deals

- 15.1.14 BOSCH SENSORTEC GMBH

- 15.1.14.1 Business overview

- 15.1.14.2 Products/Solutions/Services offered

- 15.1.14.3 Recent developments

- 15.1.14.3.1 Deals

- 15.1.15 STMICROELECTRONICS

- 15.1.15.1 Business overview

- 15.1.15.2 Products/Solutions/Services offered

- 15.1.15.3 Recent developments

- 15.1.15.3.1 Product launches

- 15.1.16 NXP SEMICONDUCTORS

- 15.1.16.1 Business overview

- 15.1.16.2 Products/Solutions/Services offered

- 15.1.16.3 Recent developments

- 15.1.16.3.1 Deals

- 15.1.1 NABTESCO CORPORATION

- 15.2 OTHER PLAYERS

- 15.2.1 NEURALA, INC.

- 15.2.2 STAUBLI INTERNATIONAL AG

- 15.2.3 BRAIN CORPORATION

- 15.2.4 WIBOTIC

- 15.2.5 ELMO MOTION CONTROL LTD.

- 15.2.6 ADVANCED MOTION CONTROLS

- 15.2.7 ODRIVE

- 15.2.8 INTERMODALICS

- 15.2.9 ROBOTEQ

- 15.2.10 ENERGY ROBOTICS

- 15.2.11 SEA MACHINES ROBOTICS, INC.

- 15.2.12 PILZ GMBH & CO. KG

- 15.2.13 MOTION INDUSTRIES, INC.

- 15.2.14 MAXON

- 15.2.15 FAULHABER

- 15.2.16 LUXONIS

- 15.2.17 XELA ROBOTICS

- 15.2.18 BENEWAKE (BEIJING) CO., LTD.

16 RESEARCH METHODOLOGY

- 16.1 RESEARCH DATA

- 16.1.1 SECONDARY AND PRIMARY RESEARCH

- 16.1.2 SECONDARY DATA

- 16.1.2.1 Key data from secondary sources

- 16.1.2.2 List of key secondary sources

- 16.1.3 PRIMARY DATA

- 16.1.3.1 Key data from primary sources

- 16.1.3.2 Key industry insights

- 16.1.3.3 List of primary interview participants

- 16.1.3.4 Breakdown of primaries

- 16.2 MARKET SIZE ESTIMATION

- 16.2.1 BOTTOM-UP APPROACH

- 16.2.1.1 Approach to arrive at market size using bottom-up analysis (supply side)

- 16.2.2 TOP-DOWN APPROACH

- 16.2.2.1 Approach to arrive at market size using top-down analysis (demand side)

- 16.2.1 BOTTOM-UP APPROACH

- 16.3 MARKET FORECAST APPROACH

- 16.3.1 SUPPLY SIDE

- 16.3.2 DEMAND SIDE

- 16.4 DATA TRIANGULATION

- 16.5 RESEARCH ASSUMPTIONS

- 16.6 RESEARCH LIMITATIONS

- 16.7 RISK ANALYSIS

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS

List of Tables

- TABLE 1 AI ROBOTS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 AI ROBOTS MARKET: SUMMARY OF CHANGES

- TABLE 3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- TABLE 4 STRATEGIC FOCUS OF TIER 1/2/3 PLAYERS

- TABLE 5 IMPACT OF PORTER'S FIVE FORCES ANALYSIS, 2024

- TABLE 6 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021-2030

- TABLE 7 ROLE OF COMPANIES IN AI ROBOTS ECOSYSTEM

- TABLE 8 PRICING RANGE OF AI ROBOT SENSORS OFFERED BY KEY PLAYERS, BY TYPE, 2024 (USD)

- TABLE 9 AVERAGE SELLING PRICE TREND OF AI ROBOT SENSORS, BY REGION, 2021-2024 (USD)

- TABLE 10 IMPORT DATA FOR HS CODE 847950-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 11 EXPORT DATA FOR HS CODE 847950-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 12 LIST OF KEY CONFERENCES AND EVENTS, 2026

- TABLE 13 PHILIPS ADOPTS SOFTBANK'S AI ROBOT TO TRANSFORM INNOVATION LAB

- TABLE 14 UNIVERSITY OF PISA INSTALLS HANSON ROBOTS TO SUPPORT THERAPY AND RESEARCH FOR AUTISM SPECTRUM DISORDER

- TABLE 15 MOBILE ROBOTS HELP IMPROVE PRODUCTIVITY AND EFFICIENCY OF AUDI ASSEMBLY LINE

- TABLE 16 NEXCOM USES INTEL'S ROBOTICS TO OPTIMIZE MANUFACTURING OPERATIONS

- TABLE 17 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 18 AI ROBOTS MARKET: KEY REGULATIONS

- TABLE 19 PATENTS APPLIED AND GRANTED, 2024-2025

- TABLE 20 FUTURE APPLICATIONS

- TABLE 21 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 KEY REGULATIONS

- TABLE 26 REGULATORY STANDARDS

- TABLE 27 IMPACT OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 28 BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 29 UNMET NEEDS IN AI ROBOTS MARKET, BY APPLICATION

- TABLE 30 AI ROBOTS MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 31 AI ROBOTS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 32 HARDWARE: AI ROBOTS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 33 HARDWARE: AI ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 34 HARDWARE: AI ROBOTS MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 35 HARDWARE: AI ROBOTS MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 36 DRIVE SYSTEMS: AI ROBOTS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 37 DRIVE SYSTEMS: AI ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 38 DRIVE SYSTEMS: AI ROBOTS MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 39 DRIVE SYSTEMS: AI ROBOTS MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 40 SENSORS: AI ROBOTS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 41 SENSORS: AI ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 42 SENSORS: AI ROBOTS MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 43 SENSORS: AI ROBOTS MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 44 CONTROL SYSTEMS: AI ROBOTS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 45 CONTROL SYSTEMS: AI ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 46 CONTROL SYSTEMS: AI ROBOTS MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 47 CONTROL SYSTEMS: AI ROBOTS MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 48 ENERGY SUPPLY SYSTEMS: AI ROBOTS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 49 ENERGY SUPPLY SYSTEMS: AI ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 50 ENERGY SUPPLY SYSTEMS: AI ROBOTS MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS/VOLTS)

- TABLE 51 ENERGY SUPPLY SYSTEMS: AI ROBOTS MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS/VOLTS)

- TABLE 52 SOFTWARE: AI ROBOTS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 53 SOFTWARE: AI ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 54 AI ROBOTS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 55 AI ROBOTS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 56 AI ROBOTS MARKET, BY ROBOT TYPE, 2021-2024 (USD MILLION)

- TABLE 57 AI ROBOTS MARKET, BY ROBOT TYPE, 2025-2030 (USD MILLION)

- TABLE 58 INDUSTRIAL ROBOTS: AI ROBOTS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 59 INDUSTRIAL ROBOTS: AI ROBOTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 60 INDUSTRIAL ROBOTS: AI ROBOTS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 61 INDUSTRIAL ROBOTS: AI ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 62 INDUSTRIAL ROBOTS: AI ROBOTS MARKET FOR HARDWARE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 63 INDUSTRIAL ROBOTS: AI ROBOTS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 64 INDUSTRIAL ROBOTS: AI ROBOTS MARKET FOR HARDWARE, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 65 INDUSTRIAL ROBOTS: AI ROBOTS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 66 INDUSTRIAL ROBOTS: AI ROBOTS MARKET FOR DRIVE SYSTEMS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 67 INDUSTRIAL ROBOTS: AI ROBOTS MARKET FOR DRIVE SYSTEMS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 68 INDUSTRIAL ROBOTS: AI ROBOTS MARKET FOR DRIVE SYSTEMS, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 69 INDUSTRIAL ROBOTS: AI ROBOTS MARKET FOR DRIVE SYSTEMS, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 70 INDUSTRIAL ROBOTS: AI ROBOTS MARKET FOR SENSORS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 71 INDUSTRIAL ROBOTS: AI ROBOTS MARKET FOR SENSORS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 72 INDUSTRIAL ROBOTS: AI ROBOTS MARKET FOR SENSORS, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 73 INDUSTRIAL ROBOTS: AI ROBOTS MARKET FOR SENSORS, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 74 INDUSTRIAL ROBOTS: AI ROBOTS MARKET FOR CONTROL SYSTEMS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 75 INDUSTRIAL ROBOTS: AI ROBOTS MARKET FOR CONTROL SYSTEMS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 76 INDUSTRIAL ROBOTS: AI ROBOTS MARKET FOR CONTROL SYSTEMS, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 77 INDUSTRIAL ROBOTS: AI ROBOTS MARKET FOR CONTROL SYSTEMS, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 78 INDUSTRIAL ROBOTS: AI ROBOTS MARKET FOR ENERGY SUPPLY SYSTEMS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 79 INDUSTRIAL ROBOTS: AI ROBOTS MARKET FOR ENERGY SUPPLY SYSTEMS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 80 INDUSTRIAL ROBOTS: AI ROBOTS MARKET FOR CONTROL SYSTEMS, BY TYPE, 2021-2024 (THOUSAND UNITS/VOLTS)

- TABLE 81 INDUSTRIAL ROBOTS: AI ROBOTS MARKET FOR CONTROL SYSTEMS, BY TYPE, 2025-2030 (THOUSAND UNITS/VOLTS)

- TABLE 82 TRADITIONAL ROBOTS: AI ROBOTS MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 83 TRADITIONAL ROBOTS: AI ROBOTS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 84 TRADITIONAL ROBOTS: AI ROBOTS MARKET FOR HARDWARE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 85 TRADITIONAL ROBOTS: AI ROBOTS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 86 COLLABORATIVE ROBOTS: AI ROBOTS MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 87 COLLABORATIVE ROBOTS: AI ROBOTS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 88 COLLABORATIVE ROBOTS: AI ROBOTS MARKET FOR HARDWARE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 89 COLLABORATIVE ROBOTS: AI ROBOTS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 90 SERVICE ROBOTS: AI ROBOTS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 91 SERVICE ROBOTS: AI ROBOTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 92 SERVICE ROBOTS: AI ROBOTS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 93 SERVICE ROBOTS: AI ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 94 SERVICE ROBOTS: AI ROBOTS MARKET FOR HARDWARE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 95 SERVICE ROBOTS: AI ROBOTS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 96 SERVICE ROBOTS: AI ROBOTS MARKET FOR HARDWARE, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 97 SERVICE ROBOTS: AI ROBOTS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 98 SERVICE ROBOTS: AI ROBOTS MARKET FOR DRIVE SYSTEMS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 99 SERVICE ROBOTS: AI ROBOTS MARKET FOR DRIVE SYSTEMS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 100 SERVICE ROBOTS: AI ROBOTS MARKET FOR DRIVE SYSTEMS, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 101 SERVICE ROBOTS: AI ROBOTS MARKET FOR DRIVE SYSTEMS, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 102 SERVICE ROBOTS: AI ROBOTS MARKET FOR SENSORS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 103 SERVICE ROBOTS: AI ROBOTS MARKET FOR SENSORS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 104 SERVICE ROBOTS: AI ROBOTS MARKET FOR SENSORS, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 105 SERVICE ROBOTS: AI ROBOTS MARKET FOR SENSORS, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 106 SERVICE ROBOTS: AI ROBOTS MARKET FOR CONTROL SYSTEMS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 107 SERVICE ROBOTS: AI ROBOTS MARKET FOR CONTROL SYSTEMS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 108 SERVICE ROBOTS: AI ROBOTS MARKET FOR CONTROL SYSTEMS, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 109 SERVICE ROBOTS: AI ROBOTS MARKET FOR CONTROL SYSTEMS, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 110 SERVICE ROBOTS: AI ROBOTS MARKET FOR ENERGY SUPPLY SYSTEMS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 111 SERVICE ROBOTS: AI ROBOTS MARKET FOR ENERGY SUPPLY SYSTEMS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 112 SERVICE ROBOTS: AI ROBOTS MARKET FOR CONTROL SYSTEMS, BY TYPE, 2021-2024 (THOUSAND UNITS/VOLTS)

- TABLE 113 SERVICE ROBOTS: AI ROBOTS MARKET FOR CONTROL SYSTEMS, BY TYPE, 2025-2030 (THOUSAND UNITS/VOLTS)

- TABLE 114 HUMAN-ASSIST ROBOTS: AI ROBOTS MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 115 HUMAN-ASSIST ROBOTS: AI ROBOTS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 116 HUMAN-ASSIST ROBOTS: AI ROBOTS MARKET FOR HARDWARE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 117 HUMAN-ASSIST ROBOTS: AI ROBOTS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 118 MOBILE ROBOTS: AI ROBOTS MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 119 MOBILE ROBOTS: AI ROBOTS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 120 MOBILE ROBOTS: AI ROBOTS MARKET FOR HARDWARE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 121 MOBILE ROBOTS: AI ROBOTS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 122 SOCIAL ROBOTS: AI ROBOTS MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 123 SOCAL ROBOTS: AI ROBOTS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 124 SOCIAL ROBOTS: AI ROBOTS MARKET FOR HARDWARE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 125 SOCIAL ROBOTS: AI ROBOTS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 126 AI ROBOTS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 127 AI ROBOTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 128 MILITARY & DEFENSE: AI ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 129 MILITARY & DEFENSE: AI ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 130 MILITARY & DEFENSE: AI ROBOTS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 131 MILITARY & DEFENSE: AI ROBOTS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 132 PERSONAL ASSISTANCE & CAREGIVING: AI ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 133 PERSONAL ASSISTANCE & CAREGIVING: AI ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 134 PERSONAL ASSISTANCE & CAREGIVING: AI ROBOTS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 135 PERSONAL ASSISTANCE & CAREGIVING: AI ROBOTS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 136 SECURITY & SURVEILLANCE: AI ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 137 SECURITY & SURVEILLANCE: AI ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 138 SECURITY & SURVEILLANCE: AI ROBOTS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 139 SECURITY & SURVEILLANCE: AI ROBOTS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 140 PUBLIC INFRASTRUCTURE: AI ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 141 PUBLIC INFRASTRUCTURE: AI ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 142 PUBLIC INFRASTRUCTURE: AI ROBOTS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 143 PUBLIC INFRASTRUCTURE: AI ROBOTS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 144 EDUCATION & ENTERTAINMENT: AI ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 145 EDUCATION & ENTERTAINMENT: AI ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 146 EDUCATION & ENTERTAINMENT: AI ROBOTS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 147 EDUCATION & ENTERTAINMENT: AI ROBOTS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 148 RESEARCH & SPACE EXPLORATION: AI ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 149 RESEARCH & SPACE EXPLORATION: AI ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 150 RESEARCH & SPACE EXPLORATION: AI ROBOTS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 151 RESEARCH & SPACE EXPLORATION: AI ROBOTS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 152 INDUSTRIAL: AI ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 153 INDUSTRIAL: AI ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 154 INDUSTRIAL: AI ROBOTS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 155 INDUSTRIAL: AI ROBOTS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 156 AGRICULTURE: AI ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 157 AGRICULTURE: AI ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 158 AGRICULTURE: AI ROBOTS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 159 AGRICULTURE: AI ROBOTS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 160 HEALTHCARE ASSISTANCE: AI ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 161 HEALTHCARE ASSISTANCE: AI ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 162 HEALTHCARE ASSISTANCE: AI ROBOTS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 163 HEALTHCARE ASSISTANCE: AI ROBOTS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 164 WAREHOUSE & LOGISTICS: AI ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 165 WAREHOUSE & LOGISTICS: AI ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 166 WAREHOUSE & LOGISTICS: AI ROBOTS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 167 WAREHOUSE & LOGISTICS: AI ROBOTS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 168 RETAIL: AI ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 169 RETAIL: AI ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 170 RETAIL: AI ROBOTS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 171 RETAIL: AI ROBOTS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 172 OTHER APPLICATIONS: AI ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 173 OTHER APPLICATIONS: AI ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 174 OTHER APPLICATIONS: AI ROBOTS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 175 OTHER APPLICATIONS: AI ROBOTS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 176 AI ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 177 AI ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 178 NORTH AMERICA: AI ROBOTS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 179 NORTH AMERICA: AI ROBOTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 180 NORTH AMERICA: AI ROBOTS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 181 NORTH AMERICA: AI ROBOTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 182 EUROPE: AI ROBOTS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 183 EUROPE: AI ROBOTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 184 EUROPE: AI ROBOTS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 185 EUROPE: AI ROBOTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 186 ASIA PACIFIC: AI ROBOTS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 187 ASIA PACIFIC: AI ROBOTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 188 ASIA PACIFIC: AI ROBOTS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 189 ASIA PACIFIC: AI ROBOTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 190 ROW: AI ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 191 ROW: AI ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 192 ROW: AI ROBOTS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 193 ROW: AI ROBOTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 194 AI ROBOTS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2022-OCTOBER 2025

- TABLE 195 AI ROBOTS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 196 AI ROBOTS MARKET: REGION FOOTPRINT

- TABLE 197 AI ROBOTS MARKET: COMPONENT FOOTPRINT

- TABLE 198 AI ROBOTS MARKET: ROBOT TYPE FOOTPRINT

- TABLE 199 AI ROBOTS MARKET: TECHNOLOGY FOOTPRINT

- TABLE 200 AI ROBOTS MARKET: APPLICATION FOOTPRINT

- TABLE 201 AI ROBOTS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 202 AI ROBOTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 203 AI ROBOTS MARKET: PRODUCT LAUNCHES, JANUARY 2022-OCTOBER 2025

- TABLE 204 AI ROBOT MARKET: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 205 NABTESCO CORPORATION: COMPANY OVERVIEW

- TABLE 206 NABTESCO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 NABTESCO CORPORATION: DEALS

- TABLE 208 NIDEC CORPORATION: COMPANY OVERVIEW

- TABLE 209 NIDEC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 NIDEC CORPORATION: DEALS

- TABLE 211 PANASONIC HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 212 PANASONIC HOLDINGS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 PANASONIC HOLDINGS CORPORATION: DEALS

- TABLE 214 YASKAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 215 YASKAWA ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 YASKAWA ELECTRIC CORPORATION: PRODUCT LAUNCHES

- TABLE 217 ABB: COMPANY OVERVIEW

- TABLE 218 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 ABB: PRODUCT LAUNCHES

- TABLE 220 NVIDIA CORPORATION: COMPANY OVERVIEW

- TABLE 221 NVIDIA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 NVIDIA CORPORATION: PRODUCT LAUNCHES

- TABLE 223 INTEL CORPORATION: COMPANY OVERVIEW

- TABLE 224 INTEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 INTEL CORPORATION: PRODUCT LAUNCHES

- TABLE 226 INTEL CORPORATION: DEALS

- TABLE 227 ADVANCED MICRO DEVICES, INC.: COMPANY OVERVIEW

- TABLE 228 ADVANCED MICRO DEVICES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 ADVANCED MICRO DEVICES, INC.: PRODUCT LAUNCHES

- TABLE 230 ADVANCED MICRO DEVICES, INC.: DEALS

- TABLE 231 ADVANCED MICRO DEVICES, INC.: OTHER DEVELOPMENTS

- TABLE 232 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- TABLE 233 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 TEXAS INSTRUMENTS INCORPORATED: PRODUCT LAUNCHES

- TABLE 235 TEXAS INSTRUMENTS INCORPORATED: DEALS

- TABLE 236 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 237 INFINEON TECHNOLOGIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES

- TABLE 239 IBM: COMPANY OVERVIEW

- TABLE 240 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 IBM: DEALS

- TABLE 242 QUALCOMM TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 243 QUALCOMM TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 SONY GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 245 SONY GROUP CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERINGS

- TABLE 246 SONY GROUP CORPORATION: PRODUCT LAUNCHES

- TABLE 247 SONY GROUP CORPORATION: DEALS

- TABLE 248 BOSCH SENSORTEC GMBH: COMPANY OVERVIEW

- TABLE 249 BOSCH SENSORTEC GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERING

- TABLE 250 BOSCH SENSORTEC GMBH: DEALS

- TABLE 251 STMICROELECTRONICS: COMPANY OVERVIEW

- TABLE 252 STMICROELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 STMICROELECTRONICS: PRODUCT LAUNCHES

- TABLE 254 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- TABLE 255 NXP SEMICONDUCTORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 NXP SEMICONDUCTORS: DEALS

- TABLE 257 NEURALA, INC.: COMPANY OVERVIEW

- TABLE 258 STAUBLI INTERNATIONAL AG: COMPANY OVERVIEW

- TABLE 259 BRAIN CORPORATION: COMPANY OVERVIEW

- TABLE 260 WIBOTIC: COMPANY OVERVIEW

- TABLE 261 ELMO MOTION CONTROL LTD.: COMPANY OVERVIEW

- TABLE 262 ADVANCED MOTION CONTROLS: COMPANY OVERVIEW

- TABLE 263 ODRIVE: COMPANY OVERVIEW

- TABLE 264 INTERMODALICS: COMPANY OVERVIEW

- TABLE 265 ROBOTEQ: COMPANY OVERVIEW

- TABLE 266 ENERGY ROBOTICS: COMPANY OVERVIEW

- TABLE 267 SEA MACHINES ROBOTICS, INC.: COMPANY OVERVIEW

- TABLE 268 PILZ GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 269 MOTION INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 270 MAXON: COMPANY OVERVIEW

- TABLE 271 FAULHABER: COMPANY OVERVIEW

- TABLE 272 LUXONIS: COMPANY OVERVIEW

- TABLE 273 XELA ROBOTICS: COMPANY OVERVIEW

- TABLE 274 BENEWAKE (BEIJING) CO., LTD.: COMPANY OVERVIEW

- TABLE 275 MAJOR SECONDARY SOURCES

- TABLE 276 PRIMARY INTERVIEW PARTICIPANTS

- TABLE 277 AI ROBOTS MARKET: RESEARCH ASSUMPTIONS

- TABLE 278 AI ROBOTS MARKET: RISK ANALYSIS

List of Figures

- FIGURE 1 AI ROBOTS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 AI ROBOTS MARKET: DURATION CONSIDERED

- FIGURE 3 GLOBAL AI ROBOTS MARKET SIZE, 2021-2030

- FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN AI ROBOTS MARKET, 2021-2025

- FIGURE 5 DISRUPTIONS INFLUENCING AI ROBOTS MARKET GROWTH

- FIGURE 6 HIGH-GROWTH SEGMENTS IN AI ROBOTS MARKET, 2025-2030

- FIGURE 7 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN GLOBAL AI ROBOTS MARKET DURING FORECAST PERIOD

- FIGURE 8 INCREASING DEVELOPMENT OF INFORMATION TECHNOLOGY ECOSYSTEM TO DRIVE AI ROBOTS MARKET

- FIGURE 9 SERVICE ROBOTS SEGMENT TO DOMINATE MARKET FROM 2025 TO 2030

- FIGURE 10 PERSONAL ASSISTANCE & CAREGIVING SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 11 HARDWARE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2030

- FIGURE 12 PERSONAL ASSISTANCE & CAREGIVING SEGMENT AND CHINA TO HOLD LARGEST SHARES OF ASIA PACIFIC AI ROBOTS MARKET IN 2030

- FIGURE 13 INDIA TO RECORD HIGHEST CAGR IN GLOBAL AI ROBOTS MARKET BETWEEN 2025 AND 2030

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 15 IMPACT ANALYSIS: DRIVERS

- FIGURE 16 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 17 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 18 IMPACT ANALYSIS: CHALLENGES

- FIGURE 19 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 20 AI ROBOTS SUPPLY CHAIN

- FIGURE 21 AI ROBOTS ECOSYSTEM

- FIGURE 22 AVERAGE SELLING PRICE TREND OF AI ROBOT SENSORS IN REGIONS, 2021-2024

- FIGURE 23 IMPORT DATA FOR HS CODE 847950-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 24 EXPORT DATA FOR HS CODE 847950-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 25 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 26 INVESTMENT AND FUNDING SCENARIO, 2022-2024

- FIGURE 27 PATENT ANALYSIS, 2015-2024

- FIGURE 28 DECISION-MAKING FACTORS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 31 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- FIGURE 32 SOFTWARE SEGMENT TO RECORD HIGHER CAGR IN AI ROBOTS MARKET DURING FORECAST PERIOD

- FIGURE 33 MACHINE LEARNING SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025 AND 2030

- FIGURE 34 SERVICE ROBOTS SEGMENT TO EXHIBIT HIGHER CAGR FROM 2025 TO 2030

- FIGURE 35 PERSONAL ASSISTANCE & CAREGIVING SEGMENT TO DOMINATE AI ROBOTS MARKET FROM 2025 TO 2030

- FIGURE 36 ASIA PACIFIC TO RECORD HIGHEST CAGR IN AI ROBOTS MARKET BETWEEN 2025 AND 2030

- FIGURE 37 NORTH AMERICA: AI ROBOTS MARKET SNAPSHOT

- FIGURE 38 EUROPE: AI ROBOTS MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: AI ROBOTS MARKET SNAPSHOT

- FIGURE 40 AI ROBOTS MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- FIGURE 41 MARKET SHARE ANALYSIS OF COMPANIES OFFERING AI ROBOTS, 2024

- FIGURE 42 COMPANY VALUATION

- FIGURE 43 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 44 BRAND/PRODUCT COMPARISON

- FIGURE 45 AI ROBOTS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 46 AI ROBOTS MARKET: COMPANY FOOTPRINT

- FIGURE 47 AI ROBOTS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 48 NABTESCO CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 NIDEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 51 YASKAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 ABB: COMPANY SNAPSHOT

- FIGURE 53 NVIDIA CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 INTEL CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 ADVANCED MICRO DEVICES, INC.: COMPANY SNAPSHOT

- FIGURE 56 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- FIGURE 57 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- FIGURE 58 IBM: COMPANY SNAPSHOT

- FIGURE 59 QUALCOMM TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 60 SONY GROUP CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 BOSCH SENSORTEC GMBH: COMPANY SNAPSHOT

- FIGURE 62 STMICROELECTRONICS: COMPANY SNAPSHOT

- FIGURE 63 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- FIGURE 64 AI ROBOTS MARKET: RESEARCH DESIGN

- FIGURE 65 AI ROBOTS MARKET: RESEARCH APPROACH

- FIGURE 66 DATA CAPTURED FROM SECONDARY SOURCES

- FIGURE 67 DATA CAPTURED FROM PRIMARY SOURCES

- FIGURE 68 CORE FINDINGS FROM INDUSTRY EXPERTS

- FIGURE 69 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 70 AI ROBOTS MARKET: BOTTOM-UP APPROACH

- FIGURE 71 AI ROBOTS MARKET: TOP-DOWN APPROACH

- FIGURE 72 AI ROBOTS MARKET SIZE ESTIMATION (SUPPLY SIDE)

- FIGURE 73 AI ROBOTS MARKET: DATA TRIANGULATION