|

市場調查報告書

商品編碼

1873967

全球軟糖補充劑市場按類型、最終用途、功能、通路和地區分類-預測至2030年Gummy Supplements Market by Type (Vitamin & Minerals, Omega-3 Fatty Acid, Collagen), End-use Demographics (Adults, Children), Functionality Distribution Channel (Hypermarkets & Supermarkets, Pharmacies & Drugstores), and Region - Global Forecast to 2030 |

||||||

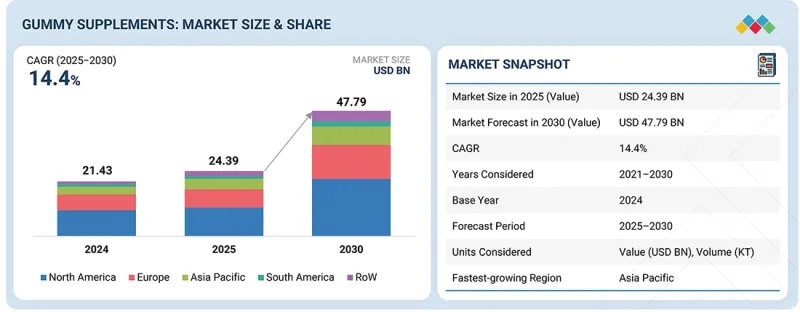

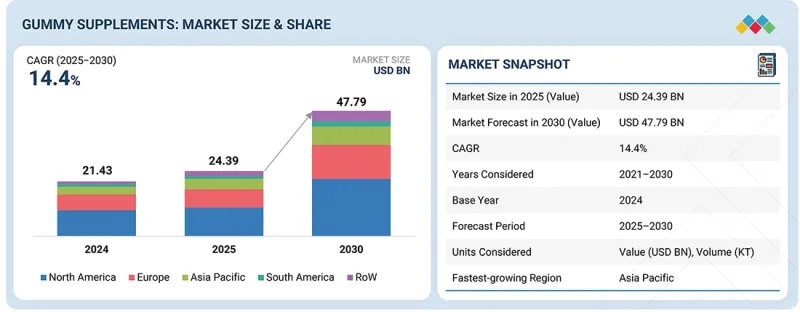

預計到 2025 年,全球軟糖補充劑市場規模將達到 243.9 億美元,到 2030 年將達到約 477.9 億美元,年複合成長率為 14.4%。

| 調查範圍 | |

|---|---|

| 調查期 | 2025-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 美元,1000噸 |

| 部分 | 類型、最終用途、功能、通路、澱粉成分、產地、地區 |

| 目標區域 | 北美、歐洲、亞太地區、南美及其他地區 |

推動這一市場發展的因素是消費者對便捷、美味且有效的營養補充劑的需求不斷變化,以滿足現代人追求健康和養生生活方式的需求。日益增強的健康意識和對預防保健的重視是關鍵促進因素,促使消費者尋求易於服用並融入日常生活的補充劑。產品配方方面的創新,例如無糖、植物來源、純素和潔淨標示成分,正在滿足消費者對天然透明的健康解決方案不斷變化的需求。

此外,老年人口的成長和營養缺乏症的普遍存在進一步推動了市場成長,因為這些群體優先考慮易於獲取且功能性的補充劑。

軟糖類保健品市場受到高昂生產和配方成本的限制,尤其是高級產品和潔淨標示產品。此外,質地、活性成分劣化和溫度敏感性等穩定性及保存期限的挑戰也限制了生產規模的擴大和長期儲存。

“預計在預測期內,CBD軟糖細分市場將佔據最大佔有率。”

CBD軟糖是軟糖補充劑市場中成長最快的細分市場,這主要歸功於消費者對天然、整體健康解決方案日益成長的興趣。 CBD軟糖的快速普及得益於大麻衍生CBD產品的合法化進程不斷推進、人們對CBD在緩解焦慮、疼痛和睡眠障礙方面的療效認知不斷提高,以及其便捷、美味和隱蔽的服用方式。隨著消費者尋求傳統藥丸和酊劑的替代品,CBD軟糖因其劑量精準、效果穩定而越來越受歡迎。

此外,高濃度配方、潔淨標示成分和口味多樣性方面的持續創新,正在增強消費者信任,並擴大其對從千禧世代到老年人等不同人群的吸引力。零售和電商通路的持續擴張,以及與健康領域意見領袖的代言和合作,也正在加速市場滲透。這些因素正推動CBD軟糖的強勁成長,並預計在未來十年內將顯著擴大這一細分市場。

“預計在預測期內,植物來源軟糖將實現最快成長。”

在軟糖補充劑市場中,植物來源軟糖是成長最快的品類,這主要得益於消費者對潔淨標示、天然和純素產品的需求不斷成長。人們對健康、永續性和道德消費的意識不斷提高,推動了果膠和植物萃取物等植物來源成分的普及,取代了傳統的明膠配方。各個年齡層的消費者,尤其是千禧世代和Z世代,都在積極尋找符合自身價值觀的產品,例如環保意識和動物福利,加速了植物性軟糖的市場接受度。

此外,口味、功能和無糖選擇的不斷創新,提升了植物來源軟糖的吸引力。包括電商和健康食品專賣店在內的分銷管道的拓展,以及強調透明度和永續性的行銷力度加大,進一步推動了市場成長。這一趨勢反映了消費者偏好向更健康、更永續的營養解決方案轉變,使植物來源軟糖成為未來市場擴張的關鍵驅動力。

“預計亞太地區在預測期內將實現最高的複合年成長率。”

亞太地區是軟糖保健品市場成長最快的地區,這主要得益於消費者健康意識的提高、可支配收入的增加以及零售和電商通路的拓展。中國、印度和日本憑藉其龐大的人口基數、不斷壯大的中產階級消費群體以及消費者對便捷、功能性保健品日益成長的需求,正在崛起成為重要的成長中心。此外,潔淨標示、植物來源和增強免疫力等產品創新也進一步加速了這些產品的普及。

本報告分析了全球軟糖補充劑市場,並提供了關鍵促進因素和限制因素、競爭格局和未來趨勢的資訊。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章 主要發現

- 軟糖補充劑市場中,企業面臨極具吸引力的成長機會

- 北美軟糖補充劑市場按人口統計和國家分類

- 軟糖補充品市場:區域區隔市場

- 按產品類型和地區分類的軟糖補充劑市場

- 軟糖補充劑市場:按分銷管道和地區分類

- 軟糖補充劑市場:按人口統計和區域分類

第5章 市場概覽

- 介紹

- 宏觀指標

- 中美貿易關稅波動再形成軟糖保健品市場

- 通貨膨脹和原料成本上漲正在影響軟糖補充劑市場。

- 市場動態

- 促進要素

- 抑制因素

- 機會

- 任務

- 生成式人工智慧對軟糖補充劑市場的影響

- 介紹

- 在軟糖補充劑市場中應用生成式人工智慧

- 案例研究分析

- 鄰近的生態系統也正在研究生成式人工智慧

第6章 產業趨勢

- 介紹

- 影響客戶業務的趨勢/顛覆性因素

- 價值鏈分析

- 研究與產品開發

- 原物料採購

- 生產和加工

- 品質與安全經理

- 行銷與分銷

- 最終用戶

- 貿易分析

- 進口分析:維生素原和維生素

- 出口分析:維生素原和維生素

- 生態系/市場地圖分析

- 需求端

- 供應端

- 定價分析

- 軟糖類保健品平均售價(ASP)趨勢

- 2021-2024年各地區軟糖保健品平均售價趨勢

- 主要企業軟糖補充劑的平均售價(2023 年)

- 波特五力分析

- 主要相關利益者和採購標準

- 技術分析

- 主要技術

- 互補分析

- 鄰近技術

- 案例研究

- 專利分析

- 監管環境

- 監管機構、政府機構和其他組織

- 北美洲

- 歐盟

- 亞太地區

- 其他地區

- 重大會議和活動(2025-2026)

- 2025年美國關稅的影響-軟糖補充劑市場

- 介紹

- 主要關稅稅率

- 價格影響分析

- 對國家的影響

- 對終端用戶產業的影響

- 投資和資金籌措方案

7. 依產品類型分類的軟糖補充品市場

- 介紹

- 維生素和礦物質軟糖

- 歐米伽脂肪酸軟糖

- 膠原蛋白軟糖

- CBD軟糖

- 其他產品類型

第8章 按功能分類的軟糖補充品市場

- 介紹

- 免疫

- 整體健康與保健

- 骨骼和關節健康

- 體重管理

- 美容與皮膚健康

- 其他功能

9. 依人口統計資料分類的軟糖補充劑市場

- 介紹

- 孩子

- 成人

第10章 按分銷管道分類的軟糖補充劑市場

- 介紹

- 大賣場和超級市場

- 藥房和藥品商店

- 便利商店

- 線上零售商

- 直銷/多層次傳銷

第11章 依產地分類的軟糖補充品市場

- 介紹

- 動物源性

- 植物來源

第12章 各地區軟糖補充品市場

- 介紹

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 其他地區

- 中東

- 非洲

第13章 競爭格局

- 概述

- 主要參與企業的策略/優勢

- 收入分析(2022-2024)

- 市佔率分析(2024 年)

- 公司估值和財務指標

- 品牌/產品對比

- 企業評估矩陣:主要企業(2024)

- 公司評估矩陣:Start-Ups/中小企業(2024 年)

- 競爭場景

第14章:公司簡介

- 主要企業

- CHURCH & DWIGHT CO., INC.

- H&H GROUP

- AMWAY

- BAYER AG

- HALEON GROUP OF COMPANIES

- NESTLE

- UNILEVER

- OTSUKA HOLDINGS CO., LTD.

- PHARMACARE LABORATORIES AUSTRALIA

- SWANSON

- GLOBAL WIDGET, LLC

- IM HEALTHCARE

- SMP NUTRA

- NATURE'S TRUTH

- HERBALAND NATURALS INC.

- BOSCOGEN, INC.

- ERNEST JACKSON

- NATURE'S WAY BRANDS

- MEDTERRA

- PURE HEMP BOTANICALS

- 其他公司

- HERO NUTRITIONALS

- VITAKEM NUTRACEUTICAL INC.

- THE TROST

- MAKERS NUTRITION, LLC

- CBDISTILLERY

第15章:鄰近及相關市場

- 介紹

- 限制

- 營養補充品成分市場

- 市場定義

- 市場概覽

- 減肥補給品市場

- 市場定義

- 市場概覽

第16章附錄

The gummy supplements market is valued at USD 24.39 billion in 2025 and is projected to reach about USD 47.79 billion by 2030, at a CAGR of 14.4%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD), Volume (KT) |

| Segments | By type, end-use demographics, functionality, distribution channel, starch ingredients, ingredients source, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

The market is driven by an increasing shift in consumer preferences toward convenient, palatable, and effective nutritional options that cater to modern health and wellness lifestyles. Rising health awareness and focus on preventive healthcare are key drivers, encouraging consumers to seek supplements that are easy to consume and integrate into daily routines. Innovations in product formulations, including sugar-free, plant-based, vegan, and clean-label ingredients, are meeting the evolving demands of consumers for natural and transparent wellness solutions.

Additionally, the growing aging population and increased prevalence of nutritional deficiencies further fuel market growth, as these demographics prioritize accessible, functional supplementation.

The gummy supplements market faces restraints due to high production and formulation costs, particularly for premium and clean-label products. Additionally, stability and shelf-life challenges related to texture, active ingredient degradation, and temperature sensitivity limit scalability and long-term storage.

"CBD gummies segment is projected to hold the largest share during the forecast period"

CBD gummies represent the fastest-growing segment by type within the gummy supplement market, driven by increasing consumer interest in natural and holistic wellness solutions. Their rapid adoption is fueled by expanding legalization of hemp-derived CBD products, growing awareness of CBD's therapeutic benefits for anxiety, pain, and sleep disorders, and the appeal of a convenient, tasty, and discreet delivery format. Consumers seek alternatives to traditional pills and tinctures, and CBD gummies offer precise dosing and consistent effects, which further drives their popularity.

Additionally, ongoing innovations in high-potency formulations, clean-label ingredients, and flavor variety enhance consumer trust and broaden the appeal across diverse demographics ranging from millennials to aging populations. The continued expansion of retail and e-commerce channels, along with collaborations and endorsements by wellness influencers, also accelerates market penetration. These factors are expected to foster a strong growth trajectory for CBD gummies, positioning the segment for substantial expansion over the next decade.

"Plant-based gummies are expected to record the fastest growth during the forecast period"

Plant-based gummies are the fastest-growing category within the by source segment in the gummy supplements market, driven by the rising consumer demand for clean-label, natural, and vegan-friendly products. Increasing awareness about health, sustainability, and ethical consumption has driven a shift toward plant-derived ingredients, such as pectin and botanical extracts, which are replacing traditional gelatin-based formulations. Consumers across all age groups, particularly millennials and Gen Z, are actively seeking products that align with their values of environmental consciousness and animal welfare, which has accelerated their adoption.

Furthermore, ongoing innovation in flavor profiles, functional benefits, and sugar-free options enhances the appeal of plant-based gummies. Expanding distribution channels, including e-commerce and specialty health food stores, along with increased marketing efforts around transparency and sustainability, are further accelerating market growth. This trend reflects broader shifts in consumer preferences toward healthier and more sustainable nutrition solutions, positioning plant-based gummies as a key driver of future market expansion.

"Asia Pacific is expected to record the highest CAGR during the forecast period"

The Asia Pacific is the fastest-growing segment in the gummy supplements market, driven by increasing health awareness, rising disposable incomes, and expanding retail and e-commerce distribution channels. China, India, and Japan are emerging as key growth hubs, driven by large populations, a growing middle-class consumer base, and a rising preference for convenient and functional wellness products. Innovation in product offerings, including clean-label, plant-based, and immunity-boosting gummies, further accelerates the adoption of these products.

Additionally, local companies, alongside global brands, are actively marketing tailored gummy supplements to meet the diverse needs of various demographics across the region. The favorable socio-economic factors and evolving consumer preferences are propelling Asia Pacific to become the largest growth engine for the global gummy supplements market in the coming years.

In-depth interviews were conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the gummy supplements market:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: Directors - 20%, Managers - 50%, Executives - 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 20%, South America - 15%, and Rest of the World - 10%

The key players providing gummy supplements services include Church & Dwight Co., Inc. (US), H&H Group (Hongkong), Amway (US), The Clorox Company (US), Bayer AG (Germany), Haleon Group of Companies (UK), Nestle (Switzerland), Unilever (UK), Otsuka Pharmaceutical Co., Ltd. (Japan), PharmaCare Laboratories Australia (Australia), and Swanson (US).

Research Coverage

This research report categorizes the market by type (vitamin & minerals, omega-3 fatty acid, collagen, CBD, and other product types), end-use demographics (adults, children, and elderly), functionality (immunity support, general health & wellness, bone & joint health, beauty & skin health, and others), distribution channel (hypermarkets & supermarkets, pharmacies & drugstores, convenience stores, online retail stores and direct sales & multi-level marketing (MLM)), starch ingredients (with starch and starchless systems), ingredients source (animal-based and plant-based), and region (North America, Europe, Asia Pacific, South America, and RoW). The report's scope encompasses detailed information on drivers, restraints, challenges, and opportunities that influence the growth of the gummy supplements market.

A detailed analysis of key industry players has been conducted to provide insights into their business overview, services, key strategies, including contracts, partnerships, agreements, service launches, and mergers and acquisitions associated with the gummy supplements market. This report provides a competitive analysis of emerging startups in the gummy supplements market ecosystem. Furthermore, the study also covers industry-specific trends, including technology analysis, ecosystem mapping, and market and regulatory landscapes.

Reasons to Buy this Report

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall gummy supplements fungicide and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights into improving their business position, enabling them to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market, providing them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (Growing consumer preference for convenient, tasty, and easy-to-consume dietary supplements), restraints (Higher costs of gummy supplements compared to traditional pills), opportunities (Expanding e-commerce platforms and increasing demand for plant-based and clean-label gummy formulations), and challenges (Regulatory complexities and stringent compliance requirements around ingredient transparency and labeling) influencing the growth of the gummy supplements market

- Service Launch/Innovation: Detailed insights into research & development activities and service launches in the gummy supplements market

- Market Development: Comprehensive information about lucrative markets - analysis of the gummy supplements market across varied regions

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the gummy supplements market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, product/service comparison, and product/service footprints of leading players, including gummy supplements services include include Church & Dwight Co., Inc. (US), H&H Group (Hongkong), Amway (US), The Clorox Company (US), Bayer AG (Germany), Haleon Group of Companies (UK), Nestle (Switzerland), Unilever (UK), Otsuka Pharmaceutical Co., Ltd. (Japan), PharmaCare Laboratories Australia (Australia), and Swanson (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key industry insights

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Primary sources

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 GUMMY SUPPLEMENTS MARKET SIZE ESTIMATION: SUPPLY SIDE

- 2.2.2 GUMMY SUPPLEMENTS MARKET SIZE ESTIMATION: DEMAND SIDE

- 2.2.3 GUMMY SUPPLEMENTS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.4 GUMMY SUPPLEMENTS MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN GUMMY SUPPLEMENTS MARKET

- 4.2 NORTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS AND COUNTRY

- 4.3 GUMMY SUPPLEMENTS MARKET: REGIONAL SUBMARKETS

- 4.4 GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE AND REGION

- 4.5 GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL AND REGION

- 4.6 GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS AND REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACRO INDICATORS

- 5.2.1 US-CHINA TRADE TARIFF FLUCTUATIONS RESHAPE GUMMY SUPPLEMENTS MARKET

- 5.2.2 INFLATION AND RAW MATERIAL COSTS RESHAPE GUMMY SUPPLEMENTS MARKET

- 5.2.2.1 Sweeteners and sugar inputs

- 5.2.2.2 Gelling agents: Gelatin, pectin, and alternatives

- 5.2.2.3 Vitamins, actives, flavors, and specialty additives

- 5.2.2.4 Energy, transportation, and packaging inflation

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Rising rate of vitamin-deficiency diseases and undernutrition

- 5.3.1.2 Soaring burden of metabolic diseases

- 5.3.1.3 Growing focus on preventive health and wellness

- 5.3.1.4 Rising consumer interest in beauty and wellness

- 5.3.1.5 Expanding e-commerce and DTC channels

- 5.3.1.6 Innovation in functional formulations

- 5.3.2 RESTRAINTS

- 5.3.2.1 High production costs and ingredient stability issues

- 5.3.2.2 Regulatory complexities across regions

- 5.3.2.3 Sugar content and health concerns

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Growth of plant-based and sugar-free gummies

- 5.3.3.2 Expansion into personalized and AI-driven nutrition

- 5.3.4 CHALLENGES

- 5.3.4.1 Risks associated with overconsumption

- 5.3.4.2 Limited bioavailability and nutrient degradation

- 5.3.4.3 Intense market competition and brand differentiation

- 5.3.1 DRIVERS

- 5.4 IMPACT OF GENERATIVE AI ON GUMMY SUPPLEMENTS MARKET

- 5.4.1 INTRODUCTION

- 5.4.2 USE OF GENERATIVE AI ON GUMMY SUPPLEMENTS MARKET

- 5.4.3 CASE STUDY ANALYSIS

- 5.4.3.1 Nestle Health Science's robotic technology in gummy production

- 5.4.3.2 Nourished's AI-driven personalized gummy supplements

- 5.4.4 ADJACENT ECOSYSTEM WORKING ON GENERATIVE AI

- 5.4.4.1 Nutraceuticals and dietary supplements

- 5.4.4.2 Functional foods and beverages

- 5.4.4.3 Personalized nutrition and wellness platforms

- 5.4.4.4 Ingredient innovation and supply chain optimization

- 5.4.4.5 Government and regulatory initiatives

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RESEARCH AND PRODUCT DEVELOPMENT

- 6.3.2 RAW MATERIAL SOURCING

- 6.3.3 PRODUCTION AND PROCESSING

- 6.3.4 QUALITY AND SAFETY CONTROLLERS

- 6.3.5 MARKETING AND DISTRIBUTION

- 6.3.6 END USERS

- 6.4 TRADE ANALYSIS

- 6.4.1 IMPORT ANALYSIS: PROVITAMINS AND VITAMINS

- 6.4.2 EXPORT ANALYSIS: PROVITAMINS AND VITAMINS

- 6.5 ECOSYSTEM/MARKET MAP ANALYSES

- 6.5.1 DEMAND SIDE

- 6.5.2 SUPPLY SIDE

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE (ASP) TREND OF GUMMY SUPPLEMENTS, BY TYPE, 2021-2024 (USD/KG)

- 6.6.2 AVERAGE SELLING PRICE (ASP) TREND OF GUMMY SUPPLEMENTS, BY REGION, 2021-2024 (USD/KG)

- 6.6.3 AVERAGE SELLING PRICE (ASP) OF GUMMY SUPPLEMENTS, BY KEY PLAYER, 2023 (USD/UNIT)

- 6.7 PORTER'S FIVE FORCES ANALYSIS

- 6.7.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.7.2 BARGAINING POWER OF SUPPLIERS

- 6.7.3 BARGAINING POWER OF BUYERS

- 6.7.4 THREAT OF SUBSTITUTES

- 6.7.5 THREAT OF NEW ENTRANTS

- 6.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.8.2 BUYING CRITERIA

- 6.9 TECHNOLOGY ANALYSIS

- 6.9.1 KEY TECHNOLOGIES

- 6.9.1.1 Incorporation of heat-sensitive vitamins in gummy supplements

- 6.9.1.2 Taste masking & flavor microencapsulation

- 6.9.2 COMPLEMENTARY ANALYSIS

- 6.9.2.1 Incorporation of heat-sensitive vitamins in gummy supplements

- 6.9.2.2 Pectin gummy supplements

- 6.9.3 ADJACENT TECHNOLOGIES

- 6.9.3.1 3D-printing & personalized dosing platforms

- 6.9.3.2 Plant-based and clean-label ingredient technologies

- 6.9.1 KEY TECHNOLOGIES

- 6.10 CASE STUDY

- 6.11 PATENT ANALYSIS

- 6.12 REGULATORY LANDSCAPE

- 6.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12.2 NORTH AMERICA

- 6.12.2.1 Canada

- 6.12.2.2 US

- 6.12.2.3 Mexico

- 6.12.3 EUROPEAN UNION (EU)

- 6.12.3.1 France

- 6.12.3.2 Spain

- 6.12.4 ASIA PACIFIC

- 6.12.4.1 Japan

- 6.12.4.2 China

- 6.12.4.3 India

- 6.12.4.4 Australia & New Zealand

- 6.12.5 REST OF THE WORLD (ROW)

- 6.12.5.1 Brazil

- 6.12.5.2 Argentina

- 6.12.5.3 Israel

- 6.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.14 IMPACT OF 2025 US TARIFF - GUMMY SUPPLEMENTS MARKET

- 6.14.1 INTRODUCTION

- 6.14.2 KEY TARIFF RATES

- 6.14.3 PRICE IMPACT ANALYSIS

- 6.14.4 IMPACT ON COUNTRIES/REGIONS

- 6.14.4.1 US

- 6.14.4.2 Europe

- 6.14.4.3 Asia Pacific

- 6.14.5 IMPACT ON END-USE INDUSTRIES

- 6.15 INVESTMENT AND FUNDING SCENARIO

7 GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- 7.2 VITAMIN & MINERAL GUMMIES

- 7.2.1 RISING INSTANCES OF VITAMIN DEFICIENCIES TO DRIVE SEGMENT

- 7.3 OMEGA FATTY ACID GUMMIES

- 7.3.1 SOARING CASES OF CVD AND BENEFITS OF OMEGA-3 FATTY ACIDS TO DRIVE SEGMENT

- 7.4 COLLAGEN GUMMIES

- 7.4.1 INCREASED INTEREST IN SKIN CARE AMONG CONSUMERS TO BOOST SEGMENT

- 7.5 CBD GUMMIES

- 7.5.1 RISING CASES OF INSOMNIA COUPLED WITH STRESS AND ANXIETY TO CONTRIBUTE TO SEGMENT GROWTH

- 7.6 OTHER PRODUCT TYPES

8 GUMMY SUPPLEMENTS MARKET, BY FUNCTIONALITY

- 8.1 INTRODUCTION

- 8.2 IMMUNITY

- 8.2.1 INCREASING FOCUS ON IMPROVING IMMUNITY TO DRIVE MARKET

- 8.3 GENERAL HEALTH & WELLNESS [VITAMINS (A, B-COMPLEX, D, E) AND MINERALS (MAGNESIUM, IRON)]

- 8.3.1 GROWING AWARENESS OF ESSENTIAL NUTRIENTS FOR OVERALL WELLNESS AND PREVENTIVE HEALTH TO DRIVE MARKET

- 8.4 BONE & JOINT HEALTH

- 8.4.1 RISING CASES OF OSTEOPOROSIS TO PROPEL MARKET GROWTH

- 8.5 WEIGHT MANAGEMENT

- 8.5.1 CLINICALLY BACKED INGREDIENTS IN GUMMY FORM TO AID WEIGHT MANAGEMENT AND METABOLIC HEALTH

- 8.6 BEAUTY & SKIN HEALTH

- 8.6.1 CLINICALLY SUPPORTED GUMMY SUPPLEMENTS FOR ENHANCED SKIN HEALTH AND RADIANCE.

- 8.7 OTHER FUNCTIONALITIES

9 GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS

- 9.1 INTRODUCTION

- 9.2 CHILDREN

- 9.2.1 INCREASING NEED FOR NUTRIENTS IN CHILDREN TO DRIVE DEMAND FOR GUMMY SUPPLEMENTS

- 9.3 ADULTS

- 9.3.1 RISING RATES OF NUTRIENT DEFICIENCY IN ADULTS TO BOOST CONSUMPTION OF GUMMY SUPPLEMENTS

10 GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL

- 10.1 INTRODUCTION

- 10.2 HYPERMARKETS & SUPERMARKETS

- 10.2.1 PREFERRED PURCHASING DESTINATION AND AVAILABILITY OF VARIANTS TO DRIVE GROWTH

- 10.3 PHARMACIES & DRUGSTORES

- 10.3.1 WIDE PRESENCE AND AROUND-THE-CLOCK SERVICES TO DRIVE GROWTH

- 10.4 CONVENIENCE STORES

- 10.4.1 RISING PREFERENCE FOR SPECIALIZED HEALTHCARE PRODUCTS TO FUEL GROWTH

- 10.5 ONLINE RETAIL STORES

- 10.5.1 INCREASING RELIANCE ON ONLINE STORES FOR BUYING HEALTH-RELATED PRODUCTS TO DRIVE MARKET

- 10.6 DIRECT SALES & MLM

- 10.6.1 EXPANDING REACH THROUGH NETWORKS - DRIVING GROWTH VIA DIRECT ENGAGEMENT AND MULTI-LEVEL MARKETING CHANNELS

11 GUMMY SUPPLEMENTS MARKET, BY INGREDIENT SOURCE

- 11.1 INTRODUCTION

- 11.2 ANIMAL-BASED

- 11.2.1 BLENDING MARINE NUTRITION WITH CLASSIC FORMULATION - DELIVERING OMEGA-3 WELLNESS IN EVERY CHEW

- 11.3 PLANT-BASED

- 11.3.1 NATURALLY DERIVED AND NUTRITIONALLY BALANCED - SHAPING THE FUTURE OF CLEAN NUTRITION

12 GUMMY SUPPLEMENTS MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 US

- 12.2.1.1 Presence of key players and various health trends to boost market

- 12.2.2 CANADA

- 12.2.2.1 Convenience, taste, and health benefits of gummy supplements to drive market

- 12.2.3 MEXICO

- 12.2.3.1 Rising health-conscious and vegan population to drive market

- 12.2.1 US

- 12.3 EUROPE

- 12.3.1 GERMANY

- 12.3.1.1 Growing interest in health & wellness to drive market

- 12.3.2 UK

- 12.3.2.1 Rising prevalence of diseases to drive market

- 12.3.3 FRANCE

- 12.3.3.1 High healthcare costs and increased demand for dietary supplements to drive market

- 12.3.4 SPAIN

- 12.3.4.1 Adoption of healthy lifestyles to drive market

- 12.3.5 ITALY

- 12.3.5.1 Strong e-commerce system and geriatric population to drive market

- 12.3.6 NETHERLANDS

- 12.3.6.1 Rising awareness about health benefits of gummy supplements to drive market

- 12.3.7 REST OF EUROPE

- 12.3.1 GERMANY

- 12.4 ASIA PACIFIC

- 12.4.1 CHINA

- 12.4.1.1 Large population and increasing prevalence of diseases to drive market

- 12.4.2 JAPAN

- 12.4.2.1 Rising awareness and shifting preferences toward dietary supplements to drive market

- 12.4.3 INDIA

- 12.4.3.1 Vitamin deficiency among consumers to drive market

- 12.4.4 SOUTH KOREA

- 12.4.4.1 Increase in health consciousness and attractive marketing campaigns to drive market

- 12.4.5 AUSTRALIA & NEW ZEALAND

- 12.4.5.1 High demand for dietary supplements, particularly in new formats, to drive market

- 12.4.6 REST OF ASIA PACIFIC

- 12.4.1 CHINA

- 12.5 SOUTH AMERICA

- 12.5.1 BRAZIL

- 12.5.1.1 Increasing consumer preference for convenient and palatable formats in nutrient intake to drive market

- 12.5.2 ARGENTINA

- 12.5.2.1 Growing focus on prevention of micronutrient deficiencies and cardiometabolic risks in children and adults to drive market

- 12.5.3 REST OF SOUTH AMERICA

- 12.5.1 BRAZIL

- 12.6 REST OF THE WORLD

- 12.6.1 MIDDLE EAST

- 12.6.1.1 Rising disposable incomes and healthcare costs to drive market

- 12.6.2 AFRICA

- 12.6.2.1 Increase in vitamin deficiency and consumer awareness about health supplements to fuel market

- 12.6.1 MIDDLE EAST

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 REVENUE ANALYSIS, 2022-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Regional footprint

- 13.7.5.3 Product type footprint

- 13.7.5.4 Demographics footprint

- 13.7.5.5 Functionality footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

- 13.9.4 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 CHURCH & DWIGHT CO., INC.

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 H&H GROUP

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.3.2 Expansions

- 14.1.2.3.3 Other developments

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 AMWAY

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Deals

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 BAYER AG

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 HALEON GROUP OF COMPANIES

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Deals

- 14.1.5.3.3 Expansions

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 NESTLE

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Deals

- 14.1.6.3.3 Other developments

- 14.1.6.4 MnM view

- 14.1.6.4.1 Key strengths

- 14.1.6.4.2 Strategic choices

- 14.1.6.4.3 Weaknesses and competitive threats

- 14.1.7 UNILEVER

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches

- 14.1.7.3.2 Deals

- 14.1.7.3.3 Expansions

- 14.1.7.4 MnM view

- 14.1.7.4.1 Key strengths

- 14.1.7.4.2 Strategic choices

- 14.1.7.4.3 Weaknesses and competitive threats

- 14.1.8 OTSUKA HOLDINGS CO., LTD.

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.8.3.2 Expansions

- 14.1.8.4 MnM view

- 14.1.8.4.1 Key strengths

- 14.1.8.4.2 Strategic choices

- 14.1.8.4.3 Weaknesses and competitive threats

- 14.1.9 PHARMACARE LABORATORIES AUSTRALIA

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Expansions

- 14.1.9.4 MnM view

- 14.1.10 SWANSON

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches

- 14.1.10.4 MnM view

- 14.1.11 GLOBAL WIDGET, LLC

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Product launches

- 14.1.11.3.2 Expansions

- 14.1.11.4 MnM view

- 14.1.12 IM HEALTHCARE

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.12.3 Recent developments

- 14.1.12.4 MnM view

- 14.1.13 SMP NUTRA

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.13.3 Recent developments

- 14.1.13.4 MnM view

- 14.1.14 NATURE'S TRUTH

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Solutions/Services offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Other developments

- 14.1.14.4 MnM view

- 14.1.15 HERBALAND NATURALS INC.

- 14.1.15.1 Business overview

- 14.1.15.2 Products/Solutions/Services offered

- 14.1.15.3 Recent developments

- 14.1.15.4 MnM view

- 14.1.16 BOSCOGEN, INC.

- 14.1.16.1 Business overview

- 14.1.16.2 Products/Solutions/Services offered

- 14.1.16.3 Recent developments

- 14.1.16.4 MnM view

- 14.1.17 ERNEST JACKSON

- 14.1.17.1 Business overview

- 14.1.17.2 Products/Solutions/Services offered

- 14.1.17.3 Recent developments

- 14.1.17.4 MnM view

- 14.1.18 NATURE'S WAY BRANDS

- 14.1.18.1 Business overview

- 14.1.18.2 Products/Solutions/Services offered

- 14.1.18.3 Recent developments

- 14.1.18.3.1 Product launches

- 14.1.18.4 MnM view

- 14.1.19 MEDTERRA

- 14.1.19.1 Business overview

- 14.1.19.2 Products/Solutions/Services offered

- 14.1.19.3 Recent developments

- 14.1.19.4 MnM view

- 14.1.20 PURE HEMP BOTANICALS

- 14.1.20.1 Business overview

- 14.1.20.2 Products/Solutions/Services offered

- 14.1.20.3 Recent developments

- 14.1.20.4 MnM view

- 14.1.1 CHURCH & DWIGHT CO., INC.

- 14.2 OTHER PLAYERS

- 14.2.1 HERO NUTRITIONALS

- 14.2.2 VITAKEM NUTRACEUTICAL INC.

- 14.2.3 THE TROST

- 14.2.4 MAKERS NUTRITION, LLC

- 14.2.5 CBDISTILLERY

15 ADJACENT & RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

- 15.3 NUTRACEUTICAL INGREDIENTS MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- 15.4 DIETARY SUPPLEMENTS MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 GUMMY SUPPLEMENTS MARKET SNAPSHOT, 2025 VS. 2030

- TABLE 3 TOP IMPORTERS OF PROVITAMINS AND VITAMINS, 2024

- TABLE 4 TOP EXPORTERS OF PROVITAMINS AND VITAMINS, 2024

- TABLE 5 GUMMY SUPPLEMENTS MARKET: SUPPLY CHAIN (ECOSYSTEM)

- TABLE 6 AVERAGE SELLING PRICE (ASP) TREND OF GUMMY SUPPLEMENTS, BY TYPE, 2021-2024 (USD/KG)

- TABLE 7 AVERAGE SELLING PRICE (ASP) TREND OF GUMMY SUPPLEMENTS, BY REGION, 2021-2024 (USD/KG)

- TABLE 8 AVERAGE SELLING PRICE (ASP) OF GUMMY SUPPLEMENTS, BY KEY PLAYER, 2023 (USD/UNIT)

- TABLE 9 GUMMY SUPPLEMENTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY PRODUCT TYPES

- TABLE 11 KEY BUYING CRITERIA FOR TOP PRODUCT TYPES

- TABLE 12 PECTIN IMPROVED PRODUCTION LINE FOR PLANT-BASED CONSUMER HEALTH PRODUCTS

- TABLE 13 PATENTS PERTAINING TO GUMMY SUPPLEMENTS, 2019-2025

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 DEFINITIONS AND REGULATIONS FOR DIETARY SUPPLEMENTS GLOBALLY

- TABLE 19 GUMMY SUPPLEMENTS MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 20 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 21 GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 22 GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 23 GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2021-2024 (KT)

- TABLE 24 GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025-2030 (KT)

- TABLE 25 VITAMIN & MINERAL GUMMIES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 26 VITAMIN & MINERAL GUMMIES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 OMEGA FATTY ACID GUMMIES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 28 OMEGA FATTY ACID GUMMIES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 COLLAGEN GUMMIES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 30 COLLAGEN GUMMIES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 CBD GUMMIES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 CBD GUMMIES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 OTHER PRODUCT TYPES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 OTHER PRODUCT TYPES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2021-2024 (USD MILLION)

- TABLE 36 GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025-2030 (USD MILLION)

- TABLE 37 CHILDREN: GUMMY SUPPLEMENTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 CHILDREN: GUMMY SUPPLEMENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 ADULTS: GUMMY SUPPLEMENTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 ADULTS: GUMMY SUPPLEMENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2024 (USD MILLION)

- TABLE 42 GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 43 HYPERMARKETS & SUPERMARKETS: GUMMY SUPPLEMENTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 HYPERMARKETS & SUPERMARKETS: GUMMY SUPPLEMENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 PHARMACIES & DRUG STORES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 PHARMACIES & DRUG STORES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 CONVENIENCE STORES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 CONVENIENCE STORES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 ONLINE RETAIL STORES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 ONLINE RETAIL STORES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 DIRECT SALES & MLM: GUMMY SUPPLEMENTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 DIRECT SALES & MLM: GUMMY SUPPLEMENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 GUMMY SUPPLEMENTS MARKET, BY INGREDIENT SOURCE, 2021-2024 (USD MILLION)

- TABLE 54 GUMMY SUPPLEMENTS MARKET, BY INGREDIENT SOURCE, 2025-2030 (USD MILLION)

- TABLE 55 GUMMY SUPPLEMENTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 GUMMY SUPPLEMENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 GUMMY SUPPLEMENTS MARKET, BY REGION, 2021-2024 (KT)

- TABLE 58 GUMMY SUPPLEMENTS MARKET, BY REGION, 2025-2030 (KT)

- TABLE 59 NORTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 60 NORTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 62 NORTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2024 (USD MILLION)

- TABLE 64 NORTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2021-2024 (USD MILLION)

- TABLE 66 NORTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025-2030 (USD MILLION)

- TABLE 67 US: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 68 US: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 69 US: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2021-2024 (USD MILLION)

- TABLE 70 US: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025-2030 (USD MILLION)

- TABLE 71 CANADA: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 72 CANADA: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 73 CANADA: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2021-2024 (USD MILLION)

- TABLE 74 CANADA: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025-2030 (USD MILLION)

- TABLE 75 MEXICO: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 76 MEXICO: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 77 MEXICO: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2021-2024 (USD MILLION)

- TABLE 78 MEXICO: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025-2030 (USD MILLION)

- TABLE 79 EUROPE: GUMMY SUPPLEMENTS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 80 EUROPE: GUMMY SUPPLEMENTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 81 EUROPE: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 82 EUROPE: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 83 EUROPE: GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2024 (USD MILLION)

- TABLE 84 EUROPE: GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 85 EUROPE: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2021-2024 (USD MILLION)

- TABLE 86 EUROPE: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025-2030 (USD MILLION)

- TABLE 87 GERMANY: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 88 GERMANY: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 89 GERMANY: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2021-2024 (USD MILLION)

- TABLE 90 GERMANY: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025-2030 (USD MILLION)

- TABLE 91 UK: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 92 UK: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 93 UK: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2021-2024 (USD MILLION)

- TABLE 94 UK: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025-2030 (USD MILLION)

- TABLE 95 FRANCE: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 96 FRANCE: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 97 FRANCE: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2021-2024 (USD MILLION)

- TABLE 98 FRANCE: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025-2030 (USD MILLION)

- TABLE 99 SPAIN: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 100 SPAIN: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 101 SPAIN: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2021-2024 (USD MILLION)

- TABLE 102 SPAIN: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025-2030 (USD MILLION)

- TABLE 103 ITALY: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 104 ITALY: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 105 ITALY: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2021-2024 (USD MILLION)

- TABLE 106 ITALY: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025-2030 (USD MILLION)

- TABLE 107 NETHERLANDS: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 108 NETHERLANDS: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 109 NETHERLANDS: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2021-2024 (USD MILLION)

- TABLE 110 NETHERLANDS: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025-2030 (USD MILLION)

- TABLE 111 REST OF EUROPE: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 112 REST OF EUROPE: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 113 REST OF EUROPE: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2021-2024 (USD MILLION)

- TABLE 114 REST OF EUROPE: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025-2030 (USD MILLION)

- TABLE 115 ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 116 ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 117 ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 118 ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 119 ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2024 (USD MILLION)

- TABLE 120 ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 121 ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2021-2024 (USD MILLION)

- TABLE 122 ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025-2030 (USD MILLION)

- TABLE 123 CHINA: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 124 CHINA: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 125 CHINA: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2021-2024 (USD MILLION)

- TABLE 126 CHINA: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025-2030 (USD MILLION)

- TABLE 127 JAPAN: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 128 JAPAN: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 129 JAPAN: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2021-2024 (USD MILLION)

- TABLE 130 JAPAN: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025-2030 (USD MILLION)

- TABLE 131 INDIA: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 132 INDIA: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 133 INDIA: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2021-2024 (USD MILLION)

- TABLE 134 INDIA: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025-2030 (USD MILLION)

- TABLE 135 SOUTH KOREA: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 136 SOUTH KOREA: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 137 SOUTH KOREA: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2021-2024 (USD MILLION)

- TABLE 138 SOUTH KOREA: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025-2030 (USD MILLION)

- TABLE 139 AUSTRALIA & NEW ZEALAND: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 140 AUSTRALIA & NEW ZEALAND: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 141 AUSTRALIA & NEW ZEALAND: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2021-2024 (USD MILLION)

- TABLE 142 AUSTRALIA & NEW ZEALAND: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025-2030 (USD MILLION)

- TABLE 143 REST OF ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 144 REST OF ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 145 REST OF ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2021-2024 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025-2030 (USD MILLION)

- TABLE 147 SOUTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 148 SOUTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 149 SOUTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 150 SOUTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 151 SOUTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2024 (USD MILLION)

- TABLE 152 SOUTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 153 SOUTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2021-2024 (USD MILLION)

- TABLE 154 SOUTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025-2030 (USD MILLION)

- TABLE 155 BRAZIL: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 156 BRAZIL: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 157 BRAZIL: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2021-2024 (USD MILLION)

- TABLE 158 BRAZIL: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025-2030 (USD MILLION)

- TABLE 159 ARGENTINA: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 160 ARGENTINA: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 161 ARGENTINA: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2021-2024 (USD MILLION)

- TABLE 162 ARGENTINA: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025-2030 (USD MILLION)

- TABLE 163 REST OF SOUTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 164 REST OF SOUTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 165 REST OF SOUTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2021-2024 (USD MILLION)

- TABLE 166 REST OF SOUTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025-2030 (USD MILLION)

- TABLE 167 REST OF THE WORLD: GUMMY SUPPLEMENTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 168 REST OF THE WORLD: GUMMY SUPPLEMENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 169 REST OF THE WORLD: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 170 REST OF THE WORLD: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 171 REST OF THE WORLD: GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2024 (USD MILLION)

- TABLE 172 REST OF THE WORLD: GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 173 REST OF THE WORLD: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2021-2024 (USD MILLION)

- TABLE 174 REST OF THE WORLD: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025-2030 (USD MILLION)

- TABLE 175 MIDDLE EAST: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 176 MIDDLE EAST: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 177 MIDDLE EAST: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2021-2024 (USD MILLION)

- TABLE 178 MIDDLE EAST: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025-2030 (USD MILLION)

- TABLE 179 AFRICA: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 180 AFRICA: GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 181 AFRICA: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2021-2024 (USD MILLION)

- TABLE 182 AFRICA: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025-2030 (USD MILLION)

- TABLE 183 OVERVIEW OF STRATEGIES ADOPTED BY KEY GUMMY SUPPLEMENTS MARKET PLAYERS, 2020-2025

- TABLE 184 GUMMY SUPPLEMENTS MARKET: MARKET SHARE ANALYSIS, 2024

- TABLE 185 GUMMY SUPPLEMENTS MARKET: REGIONAL FOOTPRINT

- TABLE 186 GUMMY SUPPLEMENTS MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 187 GUMMY SUPPLEMENTS MARKET: DEMOGRAPHICS FOOTPRINT

- TABLE 188 GUMMY SUPPLEMENTS MARKET: FUNCTIONALITY FOOTPRINT

- TABLE 189 GUMMY SUPPLEMENTS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 190 GUMMY SUPPLEMENTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 191 GUMMY SUPPLEMENTS MARKET: PRODUCT LAUNCHES, 2020-OCTOBER 2025

- TABLE 192 GUMMY SUPPLEMENTS MARKET: DEALS, 2020-OCTOBER 2025

- TABLE 193 GUMMY SUPPLEMENTS MARKET: EXPANSIONS, 2020-OCTOBER 2025

- TABLE 194 GUMMY SUPPLEMENTS MARKET: OTHER DEVELOPMENTS, 2020-OCTOBER 2025

- TABLE 195 CHURCH & DWIGHT CO., INC.: COMPANY OVERVIEW

- TABLE 196 CHURCH & DWIGHT CO., INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 CHURCH & DWIGHT CO., INC.: PRODUCT LAUNCHES

- TABLE 198 H&H GROUP: COMPANY OVERVIEW

- TABLE 199 H&H GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 H&H GROUP: DEALS

- TABLE 201 H&H GROUP: EXPANSIONS

- TABLE 202 H&H GROUP: OTHER DEVELOPMENTS

- TABLE 203 AMWAY: COMPANY OVERVIEW

- TABLE 204 AMWAY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 AMWAY: PRODUCT LAUNCHES

- TABLE 206 AMWAY: DEALS

- TABLE 207 BAYER AG: COMPANY OVERVIEW

- TABLE 208 BAYER AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 BAYER AG: PRODUCT LAUNCHES

- TABLE 210 HALEON GROUP OF COMPANIES: COMPANY OVERVIEW

- TABLE 211 HALEON GROUP OF COMPANIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 HALEON GROUP OF COMPANIES: PRODUCT LAUNCHES

- TABLE 213 HALEON GROUP OF COMPANIES: DEALS

- TABLE 214 HALEON GROUP OF COMPANIES: EXPANSIONS

- TABLE 215 NESTLE: COMPANY OVERVIEW

- TABLE 216 NESTLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 NESTLE: PRODUCT LAUNCHES

- TABLE 218 NESTLE: DEALS

- TABLE 219 NESTLE: OTHER DEVELOPMENTS

- TABLE 220 UNILEVER: COMPANY OVERVIEW

- TABLE 221 UNILEVER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 UNILEVER: PRODUCT LAUNCHES

- TABLE 223 UNILEVER PLC: DEALS

- TABLE 224 UNILEVER: EXPANSIONS

- TABLE 225 OTSUKA HOLDINGS CO., LTD.: COMPANY OVERVIEW

- TABLE 226 OTSUKA HOLDINGS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 OTSUKA HOLDINGS CO., LTD.: PRODUCT LAUNCHES

- TABLE 228 OTSUKA HOLDINGS CO., LTD.: EXPANSIONS

- TABLE 229 PHARMACARE LABORATORIES AUSTRALIA: COMPANY OVERVIEW

- TABLE 230 PHARMACARE LABORATORIES AUSTRALIA: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 231 PHARMACARE LABORATORIES AUSTRALIA: EXPANSIONS

- TABLE 232 SWANSON: COMPANY OVERVIEW

- TABLE 233 SWANSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 SWANSON: PRODUCT LAUNCHES

- TABLE 235 GLOBAL WIDGET, LLC: COMPANY OVERVIEW

- TABLE 236 GLOBAL WIDGET, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 GLOBAL WIDGET, LLC: PRODUCT LAUNCHES

- TABLE 238 GLOBAL WIDGET, LLC: EXPANSIONS

- TABLE 239 IM HEALTHCARE: COMPANY OVERVIEW

- TABLE 240 IM HEALTHCARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 SMP NUTRA: COMPANY OVERVIEW

- TABLE 242 SMP NUTRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 NATURE'S TRUTH: COMPANY OVERVIEW

- TABLE 244 NATURE'S TRUTH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 NATURE'S TRUTH: OTHER DEVELOPMENTS

- TABLE 246 HERBALAND NATURALS INC.: COMPANY OVERVIEW

- TABLE 247 HERBALAND NATURALS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 BOSCOGEN, INC.: COMPANY OVERVIEW

- TABLE 249 BOSCOGEN, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 ERNEST JACKSON: COMPANY OVERVIEW

- TABLE 251 ERNEST JACKSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 NATURE'S WAY BRANDS: COMPANY OVERVIEW

- TABLE 253 NATURE'S WAY BRANDS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 NATURE'S WAY BRANDS: PRODUCT LAUNCHES

- TABLE 255 MEDTERRA: COMPANY OVERVIEW

- TABLE 256 MEDTERRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 PURE HEMP BOTANICALS: COMPANY OVERVIEW

- TABLE 258 PURE HEMP BOTANICALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 ADJACENT MARKETS TO GUMMY SUPPLEMENTS MARKET

- TABLE 260 NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 261 NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 262 DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 263 DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

List of Figures

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 YEARS CONSIDERED

- FIGURE 3 GUMMY SUPPLEMENTS MARKET: RESEARCH DESIGN

- FIGURE 4 KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 KEY INDUSTRY INSIGHTS

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: BY VALUE CHAIN, DESIGNATION, AND REGION

- FIGURE 7 PRIMARY SOURCES

- FIGURE 8 SUPPLY-SIDE ANALYSIS

- FIGURE 9 DEMAND-SIDE ANALYSIS

- FIGURE 10 GUMMY SUPPLEMENTS MARKET SHARE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 11 GUMMY SUPPLEMENTS MARKET SHARE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 12 DATA TRIANGULATION METHODOLOGY

- FIGURE 13 ASSUMPTIONS

- FIGURE 14 STUDY LIMITATIONS AND RISK ASSESSMENT

- FIGURE 15 GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025 VS. 2030 (USD MILLION)

- FIGURE 18 GUMMY SUPPLEMENTS MARKET, BY INGREDIENT SOURCE, 2025 VS. 2030 (USD MILLION)

- FIGURE 19 GUMMY SUPPLEMENTS MARKET SHARE AND GROWTH RATE, BY REGION, 2025

- FIGURE 20 GROWING PREFERENCE FOR NATURAL AND ORGANIC INGREDIENTS TO DRIVE MARKET

- FIGURE 21 ADULTS SEGMENT AND US TO ACCOUNT FOR LARGEST MARKET SHARES IN 2025

- FIGURE 22 US TO HOLD LARGEST SHARE IN GUMMY SUPPLEMENTS MARKET IN 2025

- FIGURE 23 NORTH AMERICA TO DOMINATE MARKET ACROSS ALL PRODUCT TYPES, 2025 VS. 2030

- FIGURE 24 ONLINE RETAIL STORES SEGMENT TO LEAD GUMMY SUPPLEMENTS MARKET ACROSS ALL DISTRIBUTION CHANNELS, 2025 VS. 2030

- FIGURE 25 ADULTS SEGMENT TO LEAD GUMMY SUPPLEMENTS MARKET, 2025 VS. 2030

- FIGURE 26 GUMMY SUPPLEMENTS MARKET: DRIVER, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 27 IMPACT OF GENERATIVE AI ON GUMMY SUPPLEMENTS MARKET

- FIGURE 28 REVENUE SHIFT FOR GUMMY SUPPLEMENTS MARKET

- FIGURE 29 GUMMY SUPPLEMENTS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 30 GUMMY SUPPLEMENTS MARKET MAP

- FIGURE 31 GUMMY SUPPLEMENTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY PRODUCT TYPES

- FIGURE 33 KEY BUYING CRITERIA FOR TOP PRODUCT TYPES

- FIGURE 34 NUMBER OF PATENTS GRANTED BETWEEN 2015 AND 2025

- FIGURE 35 INVESTMENT AND FUNDING SCENARIO, 2024 (USD MILLION)

- FIGURE 36 GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 37 GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS, 2025 VS. 2030 (USD MILLION)

- FIGURE 38 GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2025 VS. 2030 (USD MILLION)

- FIGURE 39 GUMMY SUPPLEMENTS MARKET, BY INGREDIENT SOURCE, 2025 VS. 2030 (USD MILLION)

- FIGURE 40 INDIA TO RECORD FASTEST GROWTH DURING FORECAST PERIOD (IN TERMS OF VALUE)

- FIGURE 41 NORTH AMERICA: GUMMY SUPPLEMENTS MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET SNAPSHOT

- FIGURE 43 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2022-2024 (USD MILLION)

- FIGURE 44 MARKET SHARE ANALYSIS, 2024

- FIGURE 45 COMPANY VALUATION FOR MAJOR PLAYERS IN GUMMY SUPPLEMENTS MARKET

- FIGURE 46 EV/EBITDA OF MAJOR PLAYERS

- FIGURE 47 GUMMY SUPPLEMENTS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 48 GUMMY SUPPLEMENTS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 49 GUMMY SUPPLEMENTS MARKET: COMPANY FOOTPRINT

- FIGURE 50 GUMMY SUPPLEMENTS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 51 CHURCH & DWIGHT CO., INC.: COMPANY SNAPSHOT

- FIGURE 52 H&H GROUP: COMPANY SNAPSHOT

- FIGURE 53 AMWAY: COMPANY SNAPSHOT

- FIGURE 54 BAYER AG: COMPANY SNAPSHOT

- FIGURE 55 HALEON GROUP OF COMPANIES: COMPANY SNAPSHOT

- FIGURE 56 NESTLE: COMPANY SNAPSHOT

- FIGURE 57 UNILEVER: COMPANY SNAPSHOT

- FIGURE 58 OTSUKA HOLDINGS CO., LTD.: COMPANY SNAPSHOT