|

市場調查報告書

商品編碼

1869556

全球互動資訊亭市場按類型、功能、位置、顯示面板尺寸、安裝方式、垂直方向和地區分類-預測至2030年Interactive Kiosk Market By Type, Vertical, Mounting Type, Offering and Region - Global Forecast to 2030 |

||||||

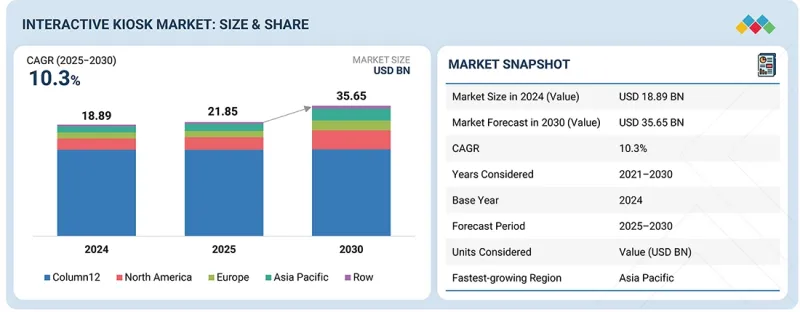

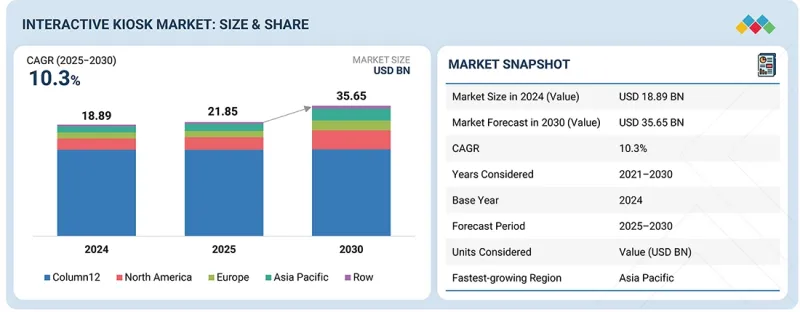

全球互動式資訊亭市場預計將從 2025 年的 218.5 億美元成長到 2030 年的 356.5 億美元,預測期內複合年成長率將達到 10.3%。

市場成長的驅動力來自零售、銀行、交通運輸和醫療保健等行業對提升客戶參與、營運效率和自助服務自動化的日益成長的需求。尤其值得一提的是,人們對安全、衛生和非接觸式互動的日益關注,以及全球數位化和智慧城市計畫的推進,正在推動自助服務終端在全球的普及。

| 調查範圍 | |

|---|---|

| 調查期 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 目標單元 | 金額(十億美元) |

| 部分 | 按類型、按產品、按位置、按顯示面板尺寸、按安裝方式、按行業、按地區 |

| 目標區域 | 北美、歐洲、亞太地區及其他地區 |

此外,人工智慧、物聯網連接和數據分析技術的進步,使得智慧自助服務終端能夠提供個人化服務、即時監控,並與企業系統無縫整合。加之模組化硬體和雲端基礎軟體平台的價格日益優惠,互動式自助服務終端正變得越來越易於擴充性,並能更好地應用於工業和消費領域。

按類型分類,醫療服務自助終端細分市場預計將在預測期內實現最高的複合年成長率。這一成長主要得益於醫院、診所和藥房擴大採用自助終端進行患者登記、排隊管理、預約安排和遠距醫療服務。此外,數位醫療基礎設施和自助服務技術的日益普及推動了自助終端與電子健康記錄(EMR) 系統和遠端醫療平台的整合,從而提高了營運效率和病患體驗。在醫療保健領域,互動式自助終端被用於接待、計費和資訊提供,從而減輕了行政負擔並提高了服務可近性。此外,政府為促進醫療服務數位化而持續推進的各項舉措,以及人工智慧驅動的分析和非接觸式技術的進步,預計將使醫療自助終端在預測期內成為關鍵成長領域。

預計點餐和零售自助終端市場將迎來快速發展。該領域的成長主要歸功於快餐店、超級市場和零售店對自助點餐、非接觸式支付和個人化購物體驗日益成長的需求。這些自助終端能夠加快服務速度、縮短等待時間並提高訂單準確率,進而提升顧客滿意度。整合即時菜單更新、動態定價和追加提升銷售功能的先進軟體進一步推動了其在大型零售連鎖店中的應用。此外,人工智慧和物聯網賦能的自助終端在數據分析、客戶參與和庫存管理方面的應用日益廣泛,也為市場的持續成長提供了支撐。隨著企業日益關注自動化和效率提升,點餐和零售自助終端將繼續成為全球互動自助終端市場的關鍵驅動力。

亞太地區互動自助服務終端市場的發展主要得益於快速的數位轉型、零售基礎設施的擴張以及智慧城市和交通計劃投資的不斷成長。中國、日本、韓國和印度等國家在銀行、零售、醫療保健和公共服務等各領域主導互動自助服務終端的應用。自動化、自助服務和非接觸式技術的整合正在加速其在機場、地鐵站和商業場所的普及。此外,人工智慧分析、雲端基礎管理平台和多語言介面的日益普及,也提升了自助服務終端的效能和易用性,使其能夠更好地服務不同用戶群。政府支持數位包容的各項舉措,以及成本效益高的製造能力,進一步鞏固了亞太地區在預測期內互動自助服務終端市場成長最快的地位。

本報告分析了全球互動資訊亭市場,並按類型、產品、位置、顯示面板尺寸、安裝類型、垂直行業、區域趨勢和公司概況對市場進行了細分。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章 市場概覽

- 介紹

- 市場動態

- 影響客戶業務的趨勢/干擾因素

- 定價分析

- 2025-2026 年主要會議和活動

- 價值鏈分析

- 生態系分析

- 技術分析

- 專利分析

- 案例研究分析

- 貿易分析

- 關稅和監管狀況

- 波特五力分析

- 主要相關人員和採購標準

- 2021-2024年投資與資金籌措情景

- 人工智慧/生成式人工智慧對互動式自助服務終端市場的影響

- 2025年美國關稅對互動資訊亭市場的影響

第6章 互動資訊亭市場(依類型分類)

- 介紹

- 資訊和目錄自助服務終端

- 售票和預訂自助服務亭

- 訂購及零售自助終端

- 支付和金融服務自助服務終端

- 比特幣自助服務終端

- 醫療保健服務亭

- 飯店旅遊資訊亭

- 政府和公共服務亭

- 其他

7. 互動資訊亭市場(依產品/服務分類)

- 介紹

- 硬體

- 軟體

- 服務

第8章 互動資訊亭市場(依地點分類)

- 介紹

- 室內的

- 戶外

第9章 互動資訊亭市場(依顯示面板尺寸分類)

- 介紹

- 小的

- 中等的

- 大的

第10章 互動資訊亭市場(依安裝類型分類)

- 介紹

- 落地架式

- 壁掛式

- 其他

第11章 互動資訊亭市場(依產業垂直領域分類)

- 介紹

- 零售

- 餐廳和快餐服務

- 運輸

- 衛生保健

- 公共部門

- 金融服務

- 飯店業

- 娛樂休閒

- 其他

第12章 各地區的互動資訊亭市場

- 介紹

- 北美洲

- 北美宏觀經濟展望

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 歐洲宏觀經濟展望

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 波蘭

- 北歐的

- 其他

- 亞太地區

- 亞太宏觀經濟展望

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 其他

- 其他地區

- 世界其他地區宏觀經濟展望

- 南美洲

- 中東

- 非洲

第13章 競爭格局

- 概述

- 主要參與企業的策略/優勢,2021-2025年

- 2024年市佔率分析

- 2021-2024年收入分析

- 估值和財務指標

- 品牌/產品對比

- 公司估值矩陣:主要參與企業,2024 年

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 競爭場景

第14章:公司簡介

- 主要參與企業

- NCR VOYIX CORPORATION

- DIEBOLD NIXDORF, INCORPORATED

- ZEBRA TECHNOLOGIES CORP.

- ADVANTECH CO., LTD.

- GLORY LTD.

- KIOSK INFORMATION SYSTEMS

- PYRAMID COMPUTER GMBH

- OLEA KIOSKS INC.

- NCR ATLEOS

- MERIDIAN KIOSKS

- 其他公司

- PEERLESS-AV

- SLABB KIOSKS

- SITA

- SOURCE TECHNOLOGIES

- VERIFONE, INC.

- LAMASATECH LTD

- BITACCESS

- GENERAL BYTES

- SHENZHEN LEAN KIOSK SYSTEMS CO., LTD.

- OLICOM INTERNATIONAL SRL

- REDYREF

- GRGBANKING

- EVOKE CREATIVE LIMITED

- PARTTEAM & OEMKIOSKS

- EMBROSS

第15章附錄

The global interactive kiosk market is projected to reach USD 35.65 billion by 2030 from USD 21.85 billion in 2025, registering a CAGR of 10.3% during the forecast period. The rising demand for enhanced customer engagement, operational efficiency, and self-service automation across industries such as retail, banking, transportation, and healthcare fuels the market growth. The increasing focus on safety, hygiene, and contactless interactions, particularly following global digitalization and smart city initiatives, boosts kiosk adoption worldwide.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Vertical, Mounting Type, Offering and Region |

| Regions covered | North America, Europe, APAC, RoW |

Additionally, advancements in AI, IoT connectivity, and data analytics enable intelligent kiosks capable of personalized services, real-time monitoring, and seamless integration with enterprise systems. The growing affordability of modular hardware and cloud-based software platforms further makes interactive kiosks scalable and accessible across both industrial and consumer-facing applications.

"Healthcare service kiosks segment is projected to record the highest CAGR during the forecast period."

By type, the healthcare service kiosks segment is projected to exhibit the highest CAGR during the forecast period. This growth is supported by the increasing deployment of kiosks in hospitals, clinics, and pharmacies for patient registration, queue management, appointment scheduling, and teleconsultation services. Additionally, the growing adoption of digital health infrastructure and self-service technologies augments the integration of kiosks with electronic medical records (EMR) systems and telehealth platforms to enhance operational efficiency and patient experience. In the healthcare sector, interactive kiosks are used for check-ins, billing, and information dissemination, helping reduce administrative burden and improve service accessibility. Furthermore, ongoing government initiatives to digitize healthcare services and advancements in AI-driven analytics and touchless technology are expected to position healthcare kiosks as a key growth segment during the forecast period.

"Ordering & retail kiosks segment is projected to account for a significant market share in 2025."

The ordering & retail kiosks segment is expected to witness rapid adoption. The segmental growth is attributed to the increasing demand for self-ordering, contactless payment, and personalized shopping experiences across quick-service restaurants (QSRs), supermarkets, and retail outlets. These kiosks enable faster service, reduce queue times, and improve order accuracy, resulting in enhanced customer satisfaction. The integration of advanced software for real-time menu updates, dynamic pricing, and upselling features is further boosting deployment across major retail chains. Additionally, the growing adoption of AI- and IoT-enabled kiosks for data analytics, customer engagement, and inventory management supports sustained market growth. As businesses increasingly focus on automation and efficiency, ordering and retail kiosks continue to emerge as a key driver for the interactive kiosk market worldwide.

"Asia Pacific is projected to register the highest CAGR in the interactive kiosk market between 2025 and 2030."

The Asia Pacific interactive kiosk market is driven by rapid digital transformation, expanding retail infrastructure, and increasing investments in smart city and transportation projects. Countries such as China, Japan, South Korea, and India are leading the adoption of interactive kiosks across sectors, including banking, retail, healthcare, and public services. The focus on automation, self-service, and contactless technology integration accelerates deployments in airports, metro stations, and commercial complexes. Additionally, the growing penetration of AI-powered analytics, cloud-based management platforms, and multilingual interfaces enhances kiosk performance and accessibility for diverse user bases. Supportive government programs promoting digital inclusion and cost-effective manufacturing capabilities further position the region as the fastest-growing market for interactive kiosks during the forecast period.

Extensive primary interviews were conducted with key industry experts in the interactive kiosk market space to determine and verify the market size for various segments and subsegments gathered through secondary research.

The breakdown of primary participants for the report is shown below.

- By Company Type: Tier 1 - 20%, Tier 2 - 45%, Tier 3 - 35%

- By Designation: C-level Executives - 35%, Directors - 25%, Others - 40%

- By Region: North America - 45%, Europe - 25%, Asia Pacific - 20%, RoW - 10%

The interactive kiosk market is dominated by a few globally established players, such as NCR Voyix Corporation (US), Diebold Nixdorf, Incorporated (US), Zebra Technologies Corp. (US), Advantech Co., Ltd. (Taiwan), and Glory Ltd. (Japan). The study includes an in-depth competitive analysis of these key players in the interactive kiosk market, with their company profiles, recent developments, and key market strategies.

Study Coverage:

The report segments the interactive kiosk market and forecasts its size by type (information & directory kiosks, ticketing & reservation kiosks, ordering & retail kiosks, payment & financial service kiosks, bitcoin kiosks, healthcare service kiosks, hospitality & travel kiosks, government & public service kiosks, and other kiosk types), vertical (retail, restaurant & QSR, transportation, healthcare, public sector, financial services, hospitality, entertainment & leisure, and other verticals), mounting type (floor-standing kiosks, wall-mounted kiosks, and other mounting types), display panel size (small, medium, and large), location (indoor and outdoor), and offering (hardware, software, and services).

The report discusses the market's drivers, restraints, opportunities, and challenges, and provides a detailed view across North America, Europe, Asia Pacific, and RoW. It includes a supply chain analysis of the key players and their competitive analysis in the interactive kiosk ecosystem.

Key Benefits of Buying the Report:

- Analysis of key drivers (Growing preference for contactless and secure payment technologies, Mounting demand for self-service kiosks across industries), restraints (High initial setup and maintenance costs, Cybersecurity and data privacy concerns), opportunities (High emphasis on streamlining operations in healthcare and government sectors, Growing popularity of QSRs and convenience retail), challenges (Requirement for continuous software and hardware lifecycle management, Environmental and vandalism concerns in outdoor installations)

- Product development/innovation: Detailed insights into upcoming technologies, research and development activities, and product launches in the interactive kiosk market

- Market development: Comprehensive information about lucrative markets across varied regions

- Market diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the interactive kiosk market

- Competitive assessment: In-depth assessment of market share, growth strategies, and service offerings of leading players, such as NCR Voyix Corporation (US), Diebold Nixdorf, Incorporated (US), Zebra Technologies Corp. (US), Advantech Co., Ltd. (Taiwan), and Glory Ltd. (Japan), in the interactive kiosk market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 INTRODUCTION

- 2.2 RESEARCH DATA

- 2.2.1 SECONDARY AND PRIMARY RESEARCH

- 2.2.2 SECONDARY DATA

- 2.2.2.1 List of key secondary sources

- 2.2.2.2 Key data from secondary sources

- 2.2.3 PRIMARY DATA

- 2.2.3.1 List of primary interview participants

- 2.2.3.2 Breakdown of primaries

- 2.2.3.3 Key data from primary sources

- 2.2.3.4 Key industry insights

- 2.3 FACTOR ANALYSIS

- 2.3.1 SUPPLY-SIDE ANALYSIS

- 2.3.2 DEMAND-SIDE ANALYSIS

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.4.2 TOP-DOWN APPROACH

- 2.4.2.1 Approach to arrive at market size using the top-down analysis (supply side)

- 2.4.1 BOTTOM-UP APPROACH

- 2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN INTERACTIVE KIOSK MARKET

- 4.2 INTERACTIVE KIOSK MARKET, BY OFFERING

- 4.3 INTERACTIVE KIOSK MARKET, BY TYPE

- 4.4 INTERACTIVE KIOSK MARKET, BY VERTICAL

- 4.5 INTERACTIVE KIOSK MARKET, BY REGION

- 4.6 INTERACTIVE KIOSK MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing preference for contactless and secure payment technologies

- 5.2.1.2 Mounting demand for self-service kiosks across industries

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial setup and maintenance costs

- 5.2.2.2 Cybersecurity and data privacy concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High emphasis on streamlining operations in healthcare and government sectors

- 5.2.3.2 Growing popularity of QSRs and convenience retail

- 5.2.3.3 Rise of device-as-a-service (DaaS) models

- 5.2.4 CHALLENGES

- 5.2.4.1 Requirement for continuous software and hardware lifecycle management

- 5.2.4.2 Environmental and vandalism concerns in outdoor installations

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE OF SELF-SERVICE INTERACTIVE KIOSKS, BY KEY PLAYER, 2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF SELF-SERVICE INTERACTIVE KIOSKS, 2021-2024

- 5.4.3 PRICING RANGE OF INFORMATION & DIRECTORY KIOSKS, BY REGION, 2024

- 5.5 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Haptic feedback systems

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Cloud-native CMS & SaaS platforms

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Cryptocurrency acceptance modules

- 5.8.3.2 Robotics

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 DIEBOLD NIXDORF AND DAVE & BUSTER'S PARTNER TO ELEVATE GUEST EXPERIENCES USING INTERACTIVE KIOSKS

- 5.10.2 PYRAMID COMPUTER ENABLES DIGITAL SELF-SERVICE TRANSFORMATION FOR DE DIGITALE RETAIL STORES

- 5.10.3 ADVANTECH-AURES DELIVERS SELF-SERVICE KIOSKS FOR HOSHO BUDGET-ACCOMMODATION CONCEPT

- 5.10.4 PYRAMID COMPUTER AIDS SIEMENS HIMED IN DIGITIZING PATIENT SERVICES THROUGH POLYTOUCH SELF-SERVICE KIOSKS

- 5.10.5 LAMASATECH ENABLES HAMPSHIRE COUNTY COUNCIL TO GATHER REAL-TIME VISITOR FEEDBACK WITH SELF-SERVICE KIOSKS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO (HS CODE 847690)

- 5.11.2 EXPORT SCENARIO (HS CODE 847690)

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 TARIFF ANALYSIS

- 5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.3 STANDARDS

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 THREAT OF SUBSTITUTES

- 5.13.3 BARGAINING POWER OF SUPPLIERS

- 5.13.4 BARGAINING POWER OF BUYERS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 INVESTMENT AND FUNDING SCENARIO, 2021-2024

- 5.16 IMPACT OF AI/GENERATIVE AI ON INTERACTIVE KIOSK MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 USE CASES OF AI/GEN AI IN INTERACTIVE KIOSK MARKET

- 5.17 IMPACT OF 2025 US TARIFF ON INTERACTIVE KIOSK MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON VERTICALS

6 INTERACTIVE KIOSK MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 INFORMATION & DIRECTORY KIOSKS

- 6.2.1 ABILITY TO ENHANCE USER EXPERIENCE AND REDUCE WORKLOAD OF STAFF MANAGING INQUIRIES TO FUEL SEGMENTAL GROWTH

- 6.3 TICKETING & RESERVATION KIOSKS

- 6.3.1 EMPHASIS ON AUTOMATION TO REDUCE QUEUE TIMES AND ENHANCE SERVICE SPEED TO AUGMENT SEGMENTAL GROWTH

- 6.4 ORDERING & RETAIL KIOSKS

- 6.4.1 DEMAND FOR CONTACTLESS ORDERING AND DIGITAL ENGAGEMENT TO CONTRIBUTE TO SEGMENTAL GROWTH

- 6.5 PAYMENT & FINANCIAL SERVICE KIOSKS

- 6.5.1 FOCUS ON REDUCING TRAFFIC IN BANKS AND FINANCIAL INSTITUTES TO BOLSTER SEGMENTAL GROWTH

- 6.6 BITCOIN KIOSKS

- 6.6.1 ABILITY TO BRIDGE GAP BETWEEN DIGITAL ASSETS AND TRADITIONAL CURRENCY NETWORKS TO DRIVE MARKET

- 6.7 HEALTHCARE SERVICE KIOSKS

- 6.7.1 CONCERN ABOUT REDUCING OPERATIONAL COSTS AND IMPROVING PATIENT THROUGHPUT TO FUEL SEGMENTAL GROWTH

- 6.8 HOSPITALITY & TRAVEL KIOSKS

- 6.8.1 HIGH DEMAND FOR CONTACTLESS SERVICES TO ACCELERATE SEGMENTAL GROWTH

- 6.9 GOVERNMENT & PUBLIC SERVICE KIOSKS

- 6.9.1 EMPHASIS ON INCREASING TRANSPARENCY AND REDUCING ADMINISTRATIVE DELAYS TO FOSTER SEGMENTAL GROWTH

- 6.10 OTHER KIOSK TYPES

7 INTERACTIVE KIOSK MARKET, BY OFFERING

- 7.1 INTRODUCTION

- 7.2 HARDWARE

- 7.2.1 DISPLAYS

- 7.2.1.1 LCDs

- 7.2.1.1.1 Enhanced visual performance and energy-efficiency features to foster segmental growth

- 7.2.1.2 LEDs

- 7.2.1.2.1 Superior brightness, contrast, and lifespan to boost segmental growth

- 7.2.1.3 LEDs

- 7.2.1.3.1 High adoption in luxury retail, automotive showrooms, and premium hospitality venues to fuel segmental growth

- 7.2.1.1 LCDs

- 7.2.2 INPUT DEVICES

- 7.2.2.1.1 Anti-glare coatings and scratch-resistant, anti-microbial surfaces to expedite segmental growth

- 7.2.2.2 Keyboards

- 7.2.2.2.1 Use for data entry, login authentication, and complex form completion to facilitate segmental growth

- 7.2.3 PROCESSING UNITS

- 7.2.3.1 Industrial PCs

- 7.2.3.1.1 Integration of high-performance computing platforms for real-time kiosk processing to drive market

- 7.2.3.2 Embedded systems

- 7.2.3.2.1 Ability to support cost-efficient and energy-optimized kiosk operations to bolster segmental growth

- 7.2.3.1 Industrial PCs

- 7.2.4 PERIPHERAL COMPONENTS

- 7.2.4.1 Printers

- 7.2.4.1.1 Low maintenance requirements due to technological advancements to boost adoption

- 7.2.4.2 Scanners

- 7.2.4.2.1 Rapid transition toward contactless operations to contribute to segmental growth

- 7.2.4.3 Payment modules

- 7.2.4.3.1 Need for secure and seamless digital transactions to expedite segmental growth

- 7.2.4.1 Printers

- 7.2.5 OTHER HARDWARE TYPES

- 7.2.1 DISPLAYS

- 7.3 SOFTWARE

- 7.3.1 KIOSK MANAGEMENT SOFTWARE

- 7.3.1.1 Rising adoption of cloud-based management platforms to improve remote operations and uptime to drive market

- 7.3.2 CONTENT MANAGEMENT SYSTEMS (CMS)

- 7.3.2.1 Ability to deliver multimedia, transactional, and promotional information to augment segmental growth

- 7.3.3 OTHER SOFTWARE TYPES

- 7.3.1 KIOSK MANAGEMENT SOFTWARE

- 7.4 SERVICES

- 7.4.1 INSTALLATION & INTEGRATION

- 7.4.1.1 Rising preference for turnkey deployment and seamless system integration to fuel segmental growth

- 7.4.2 MAINTENANCE & SUPPORT

- 7.4.2.1 Increasing adoption of predictive maintenance and IoT-enabled support to boost segmental growth

- 7.4.3 OTHER SERVICES

- 7.4.1 INSTALLATION & INTEGRATION

8 INTERACTIVE KIOSK MARKET, BY LOCATION

- 8.1 INTRODUCTION

- 8.2 INDOOR

- 8.2.1 LONG HARDWARE LIFESPAN, LOW MAINTENANCE COSTS, AND ENHANCED DISPLAY PERFORMANCE TO BOOST SEGMENTAL GROWTH

- 8.3 OUTDOOR

- 8.3.1 GROWING FOCUS ON PUBLIC CONVENIENCE AND DIGITAL ENGAGEMENT TO FOSTER SEGMENTAL GROWTH

9 INTERACTIVE KIOSK MARKET, BY DISPLAY PANEL SIZE

- 9.1 INTRODUCTION

- 9.2 SMALL

- 9.2.1 COST EFFICIENCY, LOW POWER CONSUMPTION, AND COMPATIBILITY WITH WALL-MOUNTED INSTALLATIONS AND CONFINED SPACES TO DRIVE MARKET

- 9.3 MEDIUM

- 9.3.1 RISING DEPLOYMENT OF KIOSKS IN RETAIL, HOSPITALITY, AND TRANSPORTATION SECTORS TO AUGMENT SEGMENTAL GROWTH

- 9.4 LARGE

- 9.4.1 INCREASING USE IN APPLICATIONS WHERE HIGH VISIBILITY AND CONTENT-RICH INTERFACES ARE ESSENTIAL TO FUEL SEGMENTAL GROWTH

10 INTERACTIVE KIOSK MARKET, BY MOUNTING TYPE

- 10.1 INTRODUCTION

- 10.2 FLOOR-STANDING

- 10.2.1 FLEXIBILITY, VISIBILITY, AND ACCESSIBILITY FEATURES TO SUPPORT MARKET GROWTH

- 10.3 WALL-MOUNTED

- 10.3.1 COMPACT DESIGN AND EASE OF INSTALLATION TO BOOST ADOPTION

- 10.4 OTHER MOUNTING TYPES

11 INTERACTIVE KIOSK MARKET, BY VERTICAL

- 11.1 INTRODUCTION

- 11.2 RETAIL

- 11.2.1 INCREASING ADOPTION OF OMNICHANNEL ENGAGEMENT STRATEGIES TO ACCELERATE SEGMENTAL GROWTH

- 11.3 RESTAURANT & QSR

- 11.3.1 RISING IMPLEMENTATION OF SELF-ORDERING AND PAYMENT SYSTEMS TO OPTIMIZE OPERATIONS TO FUEL SEGMENTAL GROWTH

- 11.4 TRANSPORTATION

- 11.4.1 GROWING EMPHASIS ON IMPROVING CHECK-IN, TICKETING, AND PASSENGER ASSISTANCE TO BOOST SEGMENTAL GROWTH

- 11.5 HEALTHCARE

- 11.5.1 INCREASING NEED TO STREAMLINE PATIENT ADMINISTRATION, REDUCE CLERICAL ERRORS, AND IMPROVE PATIENT EXPERIENCE TO DRIVE MARKET

- 11.6 PUBLIC SECTOR

- 11.6.1 RISING ADOPTION OF SELF-SERVICE KIOSKS SUPPORTING GOVERNANCE INITIATIVES TO CONTRIBUTE TO SEGMENTAL GROWTH

- 11.7 FINANCIAL SERVICES

- 11.7.1 RAPID SHIFT TOWARD DIGITAL ASSETS TO ACCELERATE SEGMENTAL GROWTH

- 11.8 HOSPITALITY

- 11.8.1 INCREASING AUTOMATION OF CHECK-IN/CHECK-OUT PROCESSES TO EXPEDITE SEGMENTAL GROWTH

- 11.9 ENTERTAINMENT & LEISURE

- 11.9.1 STRONG FOCUS ON IMPROVING SESSION SECURITY AND CUSTOMER THROUGHPUT TO BOLSTER SEGMENTAL GROWTH

- 11.10 OTHER VERTICALS

12 INTERACTIVE KIOSK MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 12.2.2 US

- 12.2.2.1 Rising adoption of self-service technologies across public and commercial sectors to drive market

- 12.2.3 CANADA

- 12.2.3.1 Increasing deployment of touchless and AI-enabled interactive systems to augment market growth

- 12.2.4 MEXICO

- 12.2.4.1 Growing internet penetration and expansion of self-service kiosks across retail, banking, and transportation sectors to fuel market growth

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 12.3.2 GERMANY

- 12.3.2.1 Rising deployment of advanced kiosks in airports, banking, hospitality, and QSR sectors to drive market

- 12.3.3 UK

- 12.3.3.1 Government initiatives supporting digital transformation to contribute to market growth

- 12.3.4 FRANCE

- 12.3.4.1 Heightened demand for self-service solutions at banking facilities to accelerate market growth

- 12.3.5 ITALY

- 12.3.5.1 Rising deployment of digital and multilingual self-service kiosks to fuel market growth

- 12.3.6 SPAIN

- 12.3.6.1 Rising adoption of self-service technologies to enhance digital transformation across retail and banking sectors to drive market

- 12.3.7 POLAND

- 12.3.7.1 Rapid expansion of digital infrastructure and tourism growth to bolster market growth

- 12.3.8 NORDICS

- 12.3.8.1 Strong digital ecosystem and high consumer awareness to support market growth

- 12.3.9 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 12.4.2 CHINA

- 12.4.2.1 Growing awareness about low energy consumption and operational costs of kiosks to drive market

- 12.4.3 JAPAN

- 12.4.3.1 Rising per-capita income and evolving lifestyles to accelerate market growth

- 12.4.4 SOUTH KOREA

- 12.4.4.1 Increasing educational programs on digital devices to contribute to market growth

- 12.4.5 INDIA

- 12.4.5.1 Rising focus on enhancing customer experience to expedite market growth

- 12.4.6 AUSTRALIA

- 12.4.6.1 Government initiatives and retail digitization to boost kiosk adoption

- 12.4.7 REST OF ASIA PACIFIC

- 12.5 ROW

- 12.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 12.5.2 SOUTH AMERICA

- 12.5.2.1 Growing emphasis on retail and service automation to boost market growth

- 12.5.3 MIDDLE EAST

- 12.5.3.1 Rising government initiatives on smart city development to augment market growth

- 12.5.3.2 GCC countries

- 12.5.3.3 Rest of Middle East

- 12.5.4 AFRICA

- 12.5.4.1 High emphasis on financial inclusion and public service modernization to drive market

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.4 REVENUE ANALYSIS, 2021-2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Offering footprint

- 13.7.5.4 Type footprint

- 13.7.5.5 Vertical footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 NCR VOYIX CORPORATION

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.3.3 Other developments

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths/Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses/Competitive threats

- 14.1.2 DIEBOLD NIXDORF, INCORPORATED

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.3.2 Expansions

- 14.1.2.3.3 Other developments

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths/Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses/Competitive threats

- 14.1.3 ZEBRA TECHNOLOGIES CORP.

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Deals

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths/Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses/Competitive threats

- 14.1.4 ADVANTECH CO., LTD.

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths/Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses/Competitive threats

- 14.1.5 GLORY LTD.

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Deals

- 14.1.5.3.2 Expansions

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths/Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses/Competitive threats

- 14.1.6 KIOSK INFORMATION SYSTEMS

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Deals

- 14.1.7 PYRAMID COMPUTER GMBH

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.8 OLEA KIOSKS INC.

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.8.3.2 Deals

- 14.1.9 NCR ATLEOS

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Services/Solutions offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Deals

- 14.1.10 MERIDIAN KIOSKS

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Deals

- 14.1.1 NCR VOYIX CORPORATION

- 14.2 OTHER PLAYERS

- 14.2.1 PEERLESS-AV

- 14.2.2 SLABB KIOSKS

- 14.2.3 SITA

- 14.2.4 SOURCE TECHNOLOGIES

- 14.2.5 VERIFONE, INC.

- 14.2.6 LAMASATECH LTD

- 14.2.7 BITACCESS

- 14.2.8 GENERAL BYTES

- 14.2.9 SHENZHEN LEAN KIOSK SYSTEMS CO., LTD.

- 14.2.10 OLICOM INTERNATIONAL S.R.L.

- 14.2.11 REDYREF

- 14.2.12 GRGBANKING

- 14.2.13 EVOKE CREATIVE LIMITED

- 14.2.14 PARTTEAM & OEMKIOSKS

- 14.2.15 EMBROSS

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS

List of Tables

- TABLE 1 INTERACTIVE KIOSK MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 MAJOR SECONDARY SOURCES

- TABLE 3 PRIMARY INTERVIEW PARTICIPANTS

- TABLE 4 INTERACTIVE KIOSK MARKET: RESEARCH ASSUMPTIONS

- TABLE 5 INTERACTIVE KIOSK MARKET: RISK ANALYSIS

- TABLE 6 PRICING RANGE OF SELF-SERVICE INTERACTIVE KIOSKS OFFERED BY KEY PLAYERS, 2024 (USD)

- TABLE 7 AVERAGE SELLING PRICE TREND OF SELF-SERVICE INTERACTIVE KIOSKS, 2021-2024 (USD)

- TABLE 8 PRICING RANGE OF INFORMATION & DIRECTORY KIOSKS, BY REGION, 2024 (USD)

- TABLE 9 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 10 ROLES OF COMPANIES IN INTERACTIVE KIOSK ECOSYSTEM

- TABLE 11 LIST OF MAJOR PATENTS, 2021-2024

- TABLE 12 IMPORT DATA FOR HS CODE 847690-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 13 EXPORT DATA FOR HS CODE 847690-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 14 MFN TARIFF FOR HS CODE 847690-COMPLIANT PRODUCTS, BY COUNTRY, 2024

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 IMPACT OF PORTER'S FIVE FORCES, 2024

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

- TABLE 21 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 22 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 23 INTERACTIVE KIOSK MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 24 INTERACTIVE KIOSK MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 25 INFORMATION & DIRECTORY KIOSKS: INTERACTIVE KIOSK MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 26 INFORMATION & DIRECTORY KIOSKS: INTERACTIVE KIOSK MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 27 INFORMATION & DIRECTORY KIOSKS: INTERACTIVE KIOSK MARKET, BY LOCATION, 2021-2024 (USD MILLION)

- TABLE 28 INFORMATION & DIRECTORY KIOSKS: INTERACTIVE KIOSK MARKET, BY LOCATION, 2025-2030 (USD MILLION)

- TABLE 29 INFORMATION & DIRECTORY KIOSKS: INTERACTIVE KIOSK MARKET, BY MOUNTING TYPE, 2021-2024 (USD MILLION)

- TABLE 30 INFORMATION & DIRECTORY KIOSKS: INTERACTIVE KIOSK MARKET, BY MOUNTING TYPE, 2025-2030 (USD MILLION)

- TABLE 31 INFORMATION & DIRECTORY KIOSKS: INTERACTIVE KIOSK MARKET, BY DISPLAY PANEL SIZE, 2021-2024 (USD MILLION)

- TABLE 32 INFORMATION & DIRECTORY KIOSKS: INTERACTIVE KIOSK MARKET, BY DISPLAY PANEL SIZE, 2025-2030 (USD MILLION)

- TABLE 33 INFORMATION & DIRECTORY KIOSKS: INTERACTIVE KIOSK MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 INFORMATION & DIRECTORY KIOSKS: INTERACTIVE KIOSK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 TICKETING & RESERVATION KIOSKS: INTERACTIVE KIOSK MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 36 TICKETING & RESERVATION KIOSKS: INTERACTIVE KIOSK MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 37 TICKETING & RESERVATION KIOSKS: INTERACTIVE KIOSK MARKET, BY LOCATION, 2021-2024 (USD MILLION)

- TABLE 38 TICKETING & RESERVATION KIOSKS: INTERACTIVE KIOSK MARKET, BY LOCATION, 2025-2030 (USD MILLION)

- TABLE 39 TICKETING & RESERVATION KIOSKS: INTERACTIVE KIOSK MARKET, BY MOUNTING TYPE, 2021-2024 (USD MILLION)

- TABLE 40 TICKETING & RESERVATION KIOSKS: INTERACTIVE KIOSK MARKET, BY MOUNTING TYPE, 2025-2030 (USD MILLION)

- TABLE 41 TICKETING & RESERVATION KIOSKS: INTERACTIVE KIOSK MARKET, BY DISPLAY PANEL SIZE, 2021-2024 (USD MILLION)

- TABLE 42 TICKETING & RESERVATION KIOSKS: INTERACTIVE KIOSK MARKET, BY DISPLAY PANEL SIZE, 2025-2030 (USD MILLION)

- TABLE 43 TICKETING & RESERVATION KIOSKS: INTERACTIVE KIOSK MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 TICKETING & RESERVATION KIOSKS: INTERACTIVE KIOSK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 ORDERING & RETAIL KIOSKS: INTERACTIVE KIOSK MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 46 ORDERING & RETAIL KIOSKS: INTERACTIVE KIOSK MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 47 ORDERING & RETAIL KIOSKS: INTERACTIVE KIOSK MARKET, BY LOCATION, 2021-2024 (USD MILLION)

- TABLE 48 ORDERING & RETAIL KIOSKS: INTERACTIVE KIOSK MARKET, BY LOCATION, 2025-2030 (USD MILLION)

- TABLE 49 ORDERING & RETAIL KIOSKS: INTERACTIVE KIOSK MARKET, BY MOUNTING TYPE, 2021-2024 (USD MILLION)

- TABLE 50 ORDERING & RETAIL KIOSKS: INTERACTIVE KIOSK MARKET, BY MOUNTING TYPE, 2025-2030 (USD MILLION)

- TABLE 51 ORDERING & RETAIL KIOSKS: INTERACTIVE KIOSK MARKET, BY DISPLAY PANEL SIZE, 2021-2024 (USD MILLION)

- TABLE 52 ORDERING & RETAIL KIOSKS: INTERACTIVE KIOSK MARKET, BY DISPLAY PANEL SIZE, 2025-2030 (USD MILLION)

- TABLE 53 ORDERING & RETAIL KIOSKS: INTERACTIVE KIOSK MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 ORDERING & RETAIL KIOSKS: INTERACTIVE KIOSK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 PAYMENT & FINANCIAL SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 56 PAYMENT & FINANCIAL SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 57 PAYMENT & FINANCIAL SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY LOCATION, 2021-2024 (USD MILLION)

- TABLE 58 PAYMENT & FINANCIAL SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY LOCATION, 2025-2030 (USD MILLION)

- TABLE 59 PAYMENT & FINANCIAL SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY MOUNTING TYPE, 2021-2024 (USD MILLION)

- TABLE 60 PAYMENT & FINANCIAL SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY MOUNTING TYPE, 2025-2030 (USD MILLION)

- TABLE 61 PAYMENT & FINANCIAL SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY DISPLAY PANEL SIZE, 2021-2024 (USD MILLION)

- TABLE 62 PAYMENT & FINANCIAL SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY DISPLAY PANEL SIZE, 2025-2030 (USD MILLION)

- TABLE 63 PAYMENT & FINANCIAL SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 PAYMENT & FINANCIAL SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 BITCOIN KIOSKS: INTERACTIVE KIOSK MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 66 BITCOIN KIOSKS: INTERACTIVE KIOSK MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 67 BITCOIN KIOSKS: INTERACTIVE KIOSK MARKET, BY LOCATION, 2021-2024 (USD MILLION)

- TABLE 68 BITCOIN KIOSKS: INTERACTIVE KIOSK MARKET, BY LOCATION, 2025-2030 (USD MILLION)

- TABLE 69 BITCOIN KIOSKS: INTERACTIVE KIOSK MARKET, BY MOUNTING TYPE, 2021-2024 (USD MILLION)

- TABLE 70 BITCOIN KIOSKS: INTERACTIVE KIOSK MARKET, BY MOUNTING TYPE, 2025-2030 (USD MILLION)

- TABLE 71 BITCOIN KIOSKS: INTERACTIVE KIOSK MARKET, BY DISPLAY PANEL SIZE, 2021-2024 (USD MILLION)

- TABLE 72 BITCOIN KIOSKS: INTERACTIVE KIOSK MARKET, BY DISPLAY PANEL SIZE, 2025-2030 (USD MILLION)

- TABLE 73 BITCOIN KIOSKS: INTERACTIVE KIOSK MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 BITCOIN KIOSKS: INTERACTIVE KIOSK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 HEALTHCARE SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 76 HEALTHCARE SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 77 HEALTHCARE SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY LOCATION, 2021-2024 (USD MILLION)

- TABLE 78 HEALTHCARE SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY LOCATION, 2025-2030 (USD MILLION)

- TABLE 79 HEALTHCARE SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY MOUNTING TYPE, 2021-2024 (USD MILLION)

- TABLE 80 HEALTHCARE SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY MOUNTING TYPE, 2025-2030 (USD MILLION)

- TABLE 81 HEALTHCARE SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY DISPLAY PANEL SIZE, 2021-2024 (USD MILLION)

- TABLE 82 HEALTHCARE SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY DISPLAY PANEL SIZE, 2025-2030 (USD MILLION)

- TABLE 83 HEALTHCARE SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 HEALTHCARE SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 HOSPITALITY & TRAVEL KIOSKS: INTERACTIVE KIOSK MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 86 HOSPITALITY & TRAVEL KIOSKS: INTERACTIVE KIOSK MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 87 HOSPITALITY & TRAVEL KIOSKS: INTERACTIVE KIOSK MARKET, BY LOCATION, 2021-2024 (USD MILLION)

- TABLE 88 HOSPITALITY & TRAVEL KIOSKS: INTERACTIVE KIOSK MARKET, BY LOCATION, 2025-2030 (USD MILLION)

- TABLE 89 HOSPITALITY & TRAVEL KIOSKS: INTERACTIVE KIOSK MARKET, BY MOUNTING TYPE, 2021-2024 (USD MILLION)

- TABLE 90 HOSPITALITY & TRAVEL KIOSKS: INTERACTIVE KIOSK MARKET, BY MOUNTING TYPE, 2025-2030 (USD MILLION)

- TABLE 91 HOSPITALITY & TRAVEL KIOSKS: INTERACTIVE KIOSK MARKET, BY DISPLAY PANEL SIZE, 2021-2024 (USD MILLION)

- TABLE 92 HOSPITALITY & TRAVEL KIOSKS: INTERACTIVE KIOSK MARKET, BY DISPLAY PANEL SIZE, 2025-2030 (USD MILLION)

- TABLE 93 HOSPITALITY & TRAVEL KIOSKS: INTERACTIVE KIOSK MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 HOSPITALITY & TRAVEL KIOSKS: INTERACTIVE KIOSK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 GOVERNMENT & PUBLIC SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 96 GOVERNMENT & PUBLIC SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 97 GOVERNMENT & PUBLIC SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY LOCATION, 2021-2024 (USD MILLION)

- TABLE 98 GOVERNMENT & PUBLIC SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY LOCATION, 2025-2030 (USD MILLION)

- TABLE 99 GOVERNMENT & PUBLIC SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY MOUNTING TYPE, 2021-2024 (USD MILLION)

- TABLE 100 GOVERNMENT & PUBLIC SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY MOUNTING TYPE, 2025-2030 (USD MILLION)

- TABLE 101 GOVERNMENT & PUBLIC SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY DISPLAY PANEL SIZE, 2021-2024 (USD MILLION)

- TABLE 102 GOVERNMENT & PUBLIC SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY DISPLAY PANEL SIZE, 2025-2030 (USD MILLION)

- TABLE 103 GOVERNMENT & PUBLIC SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 104 GOVERNMENT & PUBLIC SERVICE KIOSKS: INTERACTIVE KIOSK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 105 OTHER KIOSK TYPES: INTERACTIVE KIOSK MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 106 OTHER KIOSK TYPES: INTERACTIVE KIOSK MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 107 OTHER KIOSK TYPES: INTERACTIVE KIOSK MARKET, BY LOCATION, 2021-2024 (USD MILLION)

- TABLE 108 OTHER KIOSK TYPES: INTERACTIVE KIOSK MARKET, BY LOCATION, 2025-2030 (USD MILLION)

- TABLE 109 OTHER KIOSK TYPES: INTERACTIVE KIOSK MARKET, BY MOUNTING TYPE, 2021-2024 (USD MILLION)

- TABLE 110 OTHER KIOSK TYPES: INTERACTIVE KIOSK MARKET, BY MOUNTING TYPE, 2025-2030 (USD MILLION)

- TABLE 111 OTHER KIOSK TYPES: INTERACTIVE KIOSK MARKET, BY DISPLAY PANEL SIZE, 2021-2024 (USD MILLION)

- TABLE 112 OTHER KIOSK TYPES: INTERACTIVE KIOSK MARKET, BY DISPLAY PANEL SIZE, 2025-2030 (USD MILLION)

- TABLE 113 OTHER KIOSK TYPES: INTERACTIVE KIOSK MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 114 OTHER KIOSK TYPES: INTERACTIVE KIOSK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 115 INTERACTIVE KIOSK MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 116 INTERACTIVE KIOSK MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 117 INTERACTIVE KIOSK MARKET, 2021-2024 (THOUSAND UNITS)

- TABLE 118 INTERACTIVE KIOSK MARKET, 2025-2030 (THOUSAND UNITS)

- TABLE 119 HARDWARE: INTERACTIVE KIOSK MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 120 HARDWARE: INTERACTIVE KIOSK MARKET, BY HARDWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 121 DISPLAYS: INTERACTIVE KIOSK MARKET, BY DISPLAY TYPE, 2021-2024 (USD MILLION)

- TABLE 122 DISPLAYS: INTERACTIVE KIOSK MARKET, BY DISPLAY TYPE, 2025-2030 (USD MILLION)

- TABLE 123 INPUT DEVICES: INTERACTIVE KIOSK MARKET, BY INPUT DEVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 124 INPUT DEVICES: INTERACTIVE KIOSK MARKET, BY INPUT DEVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 125 PROCESSING UNITS: INTERACTIVE KIOSK MARKET, BY PROCESSING UNIT TYPE, 2021-2024 (USD MILLION)

- TABLE 126 PROCESSING UNITS: INTERACTIVE KIOSK MARKET, BY PROCESSING UNIT TYPE, 2025-2030 (USD MILLION)

- TABLE 127 PERIPHERAL COMPONENTS: INTERACTIVE KIOSK MARKET, BY PERIPHERAL COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 128 PERIPHERAL COMPONENTS: INTERACTIVE KIOSK MARKET, BY PERIPHERAL COMPONENT TYPE, 2025-2030 (USD MILLION)

- TABLE 129 SOFTWARE: INTERACTIVE KIOSK MARKET, BY SOFTWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 130 SOFTWARE: INTERACTIVE KIOSK MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 131 SERVICES: INTERACTIVE KIOSK MARKET, BY SERVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 132 SERVICES: INTERACTIVE KIOSK MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 133 INTERACTIVE KIOSK MARKET, BY LOCATION, 2021-2024 (USD MILLION)

- TABLE 134 INTERACTIVE KIOSK MARKET, BY LOCATION, 2025-2030 (USD MILLION)

- TABLE 135 INDOOR: INTERACTIVE KIOSK MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 136 INDOOR: INTERACTIVE KIOSK MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 137 OUTDOOR: INTERACTIVE KIOSK MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 138 OUTDOOR: INTERACTIVE KIOSK MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 139 INTERACTIVE KIOSK MARKET, BY DISPLAY PANEL SIZE, 2021-2024 (USD MILLION)

- TABLE 140 INTERACTIVE KIOSK MARKET, BY DISPLAY PANEL SIZE, 2025-2030 (USD MILLION)

- TABLE 141 SMALL: INTERACTIVE KIOSK MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 142 SMALL: INTERACTIVE KIOSK MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 143 MEDIUM: INTERACTIVE KIOSK MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 144 MEDIUM: INTERACTIVE KIOSK MARKET, BY TYPE, 2025-2030(USD MILLION)

- TABLE 145 LARGE: INTERACTIVE KIOSK MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 146 LARGE: INTERACTIVE KIOSK MARKET, BY TYPE, 2025-2030(USD MILLION)

- TABLE 147 INTERACTIVE KIOSK MARKET, BY MOUNTING TYPE, 2021-2024 (USD MILLION)

- TABLE 148 INTERACTIVE KIOSK MARKET, BY MOUNTING TYPE, 2025-2030 (USD MILLION)

- TABLE 149 FLOOR-STANDING: INTERACTIVE KIOSK MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 150 FLOOR-STANDING: INTERACTIVE KIOSK MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 151 WALL-MOUNTED: INTERACTIVE KIOSK MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 152 WALL-MOUNTED: INTERACTIVE KIOSK MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 153 OTHER MOUNTING TYPES: INTERACTIVE KIOSK MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 154 OTHER MOUNTING TYPES: INTERACTIVE KIOSK MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 155 INTERACTIVE KIOSK MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 156 INTERACTIVE KIOSK MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 157 INTERACTIVE KIOSK MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 158 INTERACTIVE KIOSK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 159 NORTH AMERICA: INTERACTIVE KIOSK MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 160 NORTH AMERICA: INTERACTIVE KIOSK MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 161 NORTH AMERICA: INTERACTIVE KIOSK MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 162 NORTH AMERICA: INTERACTIVE KIOSK MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 163 EUROPE: INTERACTIVE KIOSK MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 164 EUROPE: INTERACTIVE KIOSK MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 165 EUROPE: INTERACTIVE KIOSK MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 166 EUROPE: INTERACTIVE KIOSK MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 167 ASIA PACIFIC: INTERACTIVE KIOSK MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 168 ASIA PACIFIC: INTERACTIVE KIOSK MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 169 ASIA PACIFIC: INTERACTIVE KIOSK MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 170 ASIA PACIFIC: INTERACTIVE KIOSK MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 171 ROW: INTERACTIVE KIOSK MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 172 ROW: INTERACTIVE KIOSK MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 173 ROW: INTERACTIVE KIOSK MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 174 ROW: INTERACTIVE KIOSK MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 175 MIDDLE EAST: INTERACTIVE KIOSK MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 176 MIDDLE EAST: INTERACTIVE KIOSK MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 177 INTERACTIVE KIOSK MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-OCTOBER 2025

- TABLE 178 INTERACTIVE KIOSK MARKET: DEGREE OF COMPETITION, 2024

- TABLE 179 INTERACTIVE KIOSK MARKET: REGION FOOTPRINT

- TABLE 180 INTERACTIVE KIOSK MARKET: OFFERING FOOTPRINT

- TABLE 181 INTERACTIVE KIOSK MARKET: TYPE FOOTPRINT

- TABLE 182 INTERACTIVE KIOSK MARKET: VERTICAL FOOTPRINT

- TABLE 183 INTERACTIVE KIOSK MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 184 INTERACTIVE KIOSK MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 185 INTERACTIVE KIOSK MARKET: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2025

- TABLE 186 INTERACTIVE KIOSK MARKET: DEALS, JANUARY 2021-OCTOBER 2025

- TABLE 187 NCR VOYIX CORPORATION: COMPANY OVERVIEW

- TABLE 188 NCR VOYIX CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 NCR VOYIX CORPORATION: PRODUCT LAUNCHES

- TABLE 190 NCR VOYIX CORPORATION: DEALS

- TABLE 191 NCR VOYIX CORPORATION: OTHER DEVELOPMENTS

- TABLE 192 DIEBOLD NIXDORF, INCORPORATED: COMPANY OVERVIEW

- TABLE 193 DIEBOLD NIXDORF, INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 DIEBOLD NIXDORF, INCORPORATED: DEALS

- TABLE 195 DIEBOLD NIXDORF, INCORPORATED: EXPANSIONS

- TABLE 196 DIEBOLD NIXDORF, INCORPORATED: OTHER DEVELOPMENTS

- TABLE 197 ZEBRA TECHNOLOGIES CORP.: COMPANY OVERVIEW

- TABLE 198 ZEBRA TECHNOLOGIES CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 ZEBRA TECHNOLOGIES CORP.: PRODUCT LAUNCHES

- TABLE 200 ZEBRA TECHNOLOGIES CORP.: DEALS

- TABLE 201 ADVANTECH CO., LTD.: COMPANY OVERVIEW

- TABLE 202 ADVANTECH CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 ADVANTECH CO., LTD.: PRODUCT LAUNCHES

- TABLE 204 ADVANTECH CO., LTD.: DEALS

- TABLE 205 GLORY LTD.: COMPANY OVERVIEW

- TABLE 206 GLORY LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 GLORY LTD.: DEALS

- TABLE 208 GLORY LTD.: EXPANSIONS

- TABLE 209 KIOSK INFORMATION SYSTEMS: COMPANY OVERVIEW

- TABLE 210 KIOSK INFORMATION SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 KIOSK INFORMATION SYSTEMS: PRODUCT LAUNCHES

- TABLE 212 KIOSK INFORMATION SYSTEMS: DEALS

- TABLE 213 PYRAMID COMPUTER GMBH: COMPANY OVERVIEW

- TABLE 214 PYRAMID COMPUTER GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 OLEA KIOSKS INC.: COMPANY OVERVIEW

- TABLE 216 OLEA KIOSKS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 OLEA KIOSKS INC.: PRODUCT LAUNCHES

- TABLE 218 OLEA KIOSKS INC.: DEALS

- TABLE 219 NCR ATLEOS: COMPANY OVERVIEW

- TABLE 220 NCR ATLEOS: PRODUCT/SERVICE/SOLUTION OFFERED

- TABLE 221 NCR ATLEOS: DEALS

- TABLE 222 MERIDIAN KIOSKS: COMPANY OVERVIEW

- TABLE 223 MERIDIAN KIOSKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 MERIDIAN KIOSKS: DEALS

- TABLE 225 PEERLESS-AV: COMPANY OVERVIEW

- TABLE 226 SLABB KIOSKS: COMPANY OVERVIEW

- TABLE 227 SITA: COMPANY OVERVIEW

- TABLE 228 SOURCE TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 229 VERIFONE, INC.: COMPANY OVERVIEW

- TABLE 230 LAMASATECH LTD: COMPANY OVERVIEW

- TABLE 231 BITACCESS: COMPANY OVERVIEW

- TABLE 232 GENERAL BYTES: COMPANY OVERVIEW

- TABLE 233 SHENZHEN LEAN KIOSK SYSTEMS CO., LTD.: COMPANY OVERVIEW

- TABLE 234 OLICOM INTERNATIONAL S.R.L.: COMPANY OVERVIEW

- TABLE 235 REDYREF: COMPANY OVERVIEW

- TABLE 236 GRGBANKING: COMPANY OVERVIEW

- TABLE 237 EVOKE CREATIVE LIMITED: COMPANY OVERVIEW

- TABLE 238 PARTTEAM & OEMKIOSKS: COMPANY OVERVIEW

- TABLE 239 EMBROSS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 INTERACTIVE KIOSK MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 INTERACTIVE KIOSK MARKET: DURATION COVERED

- FIGURE 3 INTERACTIVE KIOSK MARKET: RESEARCH DESIGN

- FIGURE 4 INTERACTIVE KIOSK MARKET: RESEARCH APPROACH

- FIGURE 5 DATA CAPTURED FROM SECONDARY SOURCES

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 DATA CAPTURED FROM PRIMARY SOURCES

- FIGURE 8 CORE FINDINGS FROM INDUSTRY EXPERTS

- FIGURE 9 INTERACTIVE KIOSK MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 10 INTERACTIVE KIOSK MARKET: DEMAND-SIDE ANALYSIS

- FIGURE 11 REVENUE GENERATED FROM SALES OF INTERACTIVE KIOSKS

- FIGURE 12 INTERACTIVE KIOSK MARKET: BOTTOM-UP APPROACH

- FIGURE 13 INTERACTIVE KIOSK MARKET: TOP-DOWN APPROACH

- FIGURE 14 INTERACTIVE KIOSK MARKET: DATA TRIANGULATION

- FIGURE 15 INTERACTIVE KIOSK MARKET SIZE, 2021-2030

- FIGURE 16 ORDERING & RETAIL KIOSKS SEGMENT TO DOMINATE MARKET BETWEEN 2025 AND 2030

- FIGURE 17 OUTDOOR SEGMENT TO REGISTER HIGHER CAGR IN INTERACTIVE KIOSK MARKET FROM 2025 TO 2030

- FIGURE 18 FLOOR-STANDING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 19 MEDIUM SEGMENT TO ACCOUNT FOR LARGEST SHARE OF INTERACTIVE KIOSK MARKET IN 2025

- FIGURE 20 NORTH AMERICA TO HOLD LARGEST SHARE OF INTERACTIVE KIOSK MARKET IN 2025

- FIGURE 21 RAPID TECHNOLOGICAL ADVANCEMENTS TO CREATE LUCRATIVE OPPORTUNITIES FOR PLAYERS IN INTERACTIVE KIOSK MARKET

- FIGURE 22 HARDWARE SEGMENT TO DOMINATE INTERACTIVE KIOSK MARKET BETWEEN 2025 AND 2030

- FIGURE 23 PAYMENT & FINANCIAL SERVICE KIOSKS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 24 RETAIL SEGMENT TO HOLD LARGEST SHARE OF INTERACTIVE KIOSK MARKET IN 2025

- FIGURE 25 NORTH AMERICA TO HOLD LARGEST SHARE OF INTERACTIVE KIOSK MARKET IN 2030

- FIGURE 26 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL INTERACTIVE KIOSK MARKET DURING FORECAST PERIOD

- FIGURE 27 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 28 DRIVERS: IMPACT ANALYSIS

- FIGURE 29 RESTRAINTS: IMPACT ANALYSIS

- FIGURE 30 OPPORTUNITIES: IMPACT ANALYSIS

- FIGURE 31 CHALLENGES: IMPACT ANALYSIS

- FIGURE 32 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 33 AVERAGE SELLING PRICE OF SELF-SERVICE INTERACTIVE KIOSKS OFFERED BY KEY PLAYERS, 2024

- FIGURE 34 AVERAGE SELLING PRICE TREND OF SELF-SERVICE INTERACTIVE KIOSKS DURING 2021-2024

- FIGURE 35 INTERACTIVE KIOSK VALUE CHAIN ANALYSIS

- FIGURE 36 INTERACTIVE KIOSK ECOSYSTEM

- FIGURE 37 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 38 IMPORT DATA FOR HS CODE 847690-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2021-2024

- FIGURE 39 EXPORT DATA FOR HS CODE 847690-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2021-2024

- FIGURE 40 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 41 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 42 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 43 USE CASES AND IMPACT OF AI/GEN AI ON INTERACTIVE KIOSK MARKET

- FIGURE 44 ORDERING & RETAIL KIOSKS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 45 HARDWARE OFFERING TO CAPTURE LARGEST MARKET SHARE IN 2030

- FIGURE 46 INDOOR SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2025 AND 2030

- FIGURE 47 MEDIUM SEGMENT TO DOMINATE INTERACTIVE KIOSK MARKET DURING FORECAST PERIOD

- FIGURE 48 FLOOR-STANDING SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2030

- FIGURE 49 RETAIL SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2025 AND 2030

- FIGURE 50 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN INTERACTIVE KIOSK MARKET BETWEEN 2025 AND 2030

- FIGURE 51 NORTH AMERICA: INTERACTIVE KIOSK MARKET SNAPSHOT

- FIGURE 52 EUROPE: INTERACTIVE KIOSK MARKET SNAPSHOT

- FIGURE 53 ASIA PACIFIC: INTERACTIVE KIOSK MARKET SNAPSHOT

- FIGURE 54 ROW: INTERACTIVE KIOSK MARKET SNAPSHOT

- FIGURE 55 MARKET SHARE ANALYSIS OF COMPANIES OFFERING INTERACTIVE KIOSKS, 2024

- FIGURE 56 INTERACTIVE KIOSK MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2021-2024

- FIGURE 57 COMPANY VALUATION

- FIGURE 58 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 59 BRAND/PRODUCT COMPARISON

- FIGURE 60 INTERACTIVE KIOSK MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 61 INTERACTIVE KIOSK MARKET: COMPANY FOOTPRINT

- FIGURE 62 INTERACTIVE KIOSK MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 63 NCR VOYIX CORPORATION: COMPANY SNAPSHOT

- FIGURE 64 DIEBOLD NIXDORF, INCORPORATED: COMPANY SNAPSHOT

- FIGURE 65 ZEBRA TECHNOLOGIES CORP.: COMPANY SNAPSHOT

- FIGURE 66 ADVANTECH CO., LTD.: COMPANY SNAPSHOT

- FIGURE 67 GLORY LTD.: COMPANY SNAPSHOT

- FIGURE 68 PYRAMID COMPUTER GMBH: COMPANY SNAPSHOT

- FIGURE 69 NCR ATLEOS: COMPANY SNAPSHOT