|

市場調查報告書

商品編碼

1854898

全球助聽器市場按產品、聽力損失類型、患者類型、技術、通路和地區分類-預測至2030年Hearing Aids Market by Product (Devices(RITE, BTE, Canal, ITE), Implants (Cochlear, Bone-anchored)), Type of Hearing Loss (Sensorineural, Conductive), Patient (Adults, Pediatrics), Technology (Digital, Analog), Channel & Region - Global Forecast to 2030 |

||||||

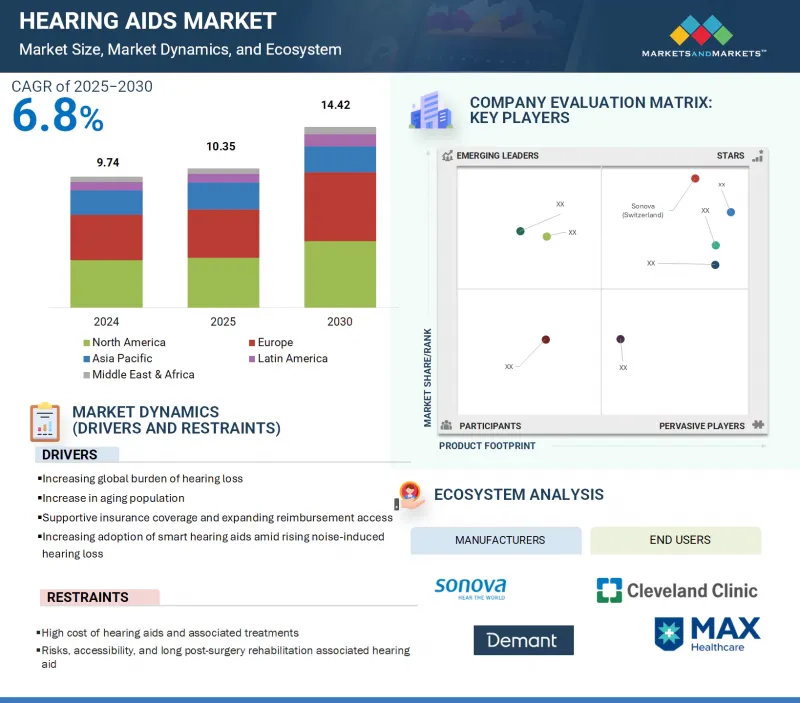

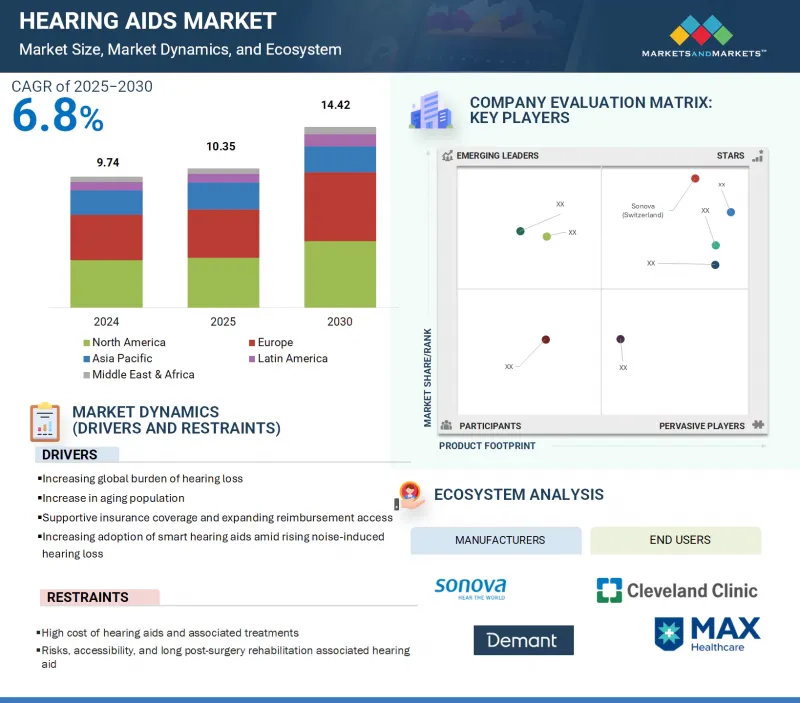

全球助聽器市場預計將從 2025 年的 103.5 億美元成長到 2030 年的 144.2 億美元,預測期內複合年成長率為 6.8%。

| 調查範圍 | |

|---|---|

| 調查年度 | 2024-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 考慮單位 | 金額(十億美元) |

| 部分 | 按產品、聽力損失類型、患者類型、技術、分銷管道和地區分類 |

| 目標區域 | 北美、歐洲、亞太地區、拉丁美洲、中東和非洲 |

助聽器市場的顯著成長是由聽力損失的日益普遍、人口老化以及人們對聽力相關疾病的認知不斷提高所推動的。

此外,智慧型易用型數位助聽器的日益普及預計將進一步推動市場成長。

助聽器市場按分銷管道細分,具體包括聽力及耳鼻喉科醫院和診所、零售及藥局以及線上平台。預計到2024年,醫院和診所將佔據最大的市場佔有率。這些機構提供全面的聽力保健服務,包括診斷、設備驗配和植入後管理,這對進行性或複雜性聽力損失患者尤其重要。患者對這些機構建立的信任顯著提高了助聽器的普及率。耳鼻喉科醫院和診所通常配備合格的專家、隔音測試環境、診斷設備和手術設施。這些機構透過在同一地點提供非手術解決方案和植入式助聽器,簡化了患者的就醫體驗。研究表明,最佳化的臨床框架,例如非捆綁式定價模式,將進一步促進助聽器的普及。這些醫療機構憑藉其提供精準診斷、專家諮詢和全面的助聽器及植入式設備服務的能力,在市場上持續脫穎而出。

全球助聽器市場分為數位助聽器和類比助聽器。截至2024年,數位助聽器憑藉其卓越的功能(包括更高的言語清晰度和自適應聲音處理能力)佔據了最大的市場佔有率。這些助聽器將環境噪音轉換為數位訊號,並利用先進的演算法進行處理,從而最佳化聽力、抑制不必要的背景噪音並減少聲音回饋,而這些功能是傳統類比助聽器所不具備的。數位助聽器主要由聽力學家在醫院和專業聽力中心等臨床機構進行驗配。許多最新的助聽器都具備無線連接功能,支援遠端調節和自動適應各種聲學環境,從而提升了使用者的便利性和整體體驗。同時,模擬助聽器的市佔率正在逐漸下降。類比助聽器主要用於低成本地區,尤其是在中低收入國家的農村和基礎設施薄弱地區,這些地區獲取數位技術和驗配服務的機會有限。

全球助聽器市場分為五個區域:北美、歐洲、亞太、拉丁美洲以及中東和非洲。亞太地區正快速擴張,這主要得益於老年人口的顯著成長、耳鼻喉科服務需求的上升以及醫療基礎設施的大量投資。該地區為行業相關人員提供了巨大的成長潛力,預計在預測期內將實現最高的複合年成長率。人口老化導致韓國、台灣和新加坡等國家聽力損失盛行率上升,對聽力保健的需求也隨之增加。政府旨在提高醫療保健服務可近性並擴大醫院和診所網路的舉措,使助聽器更容易獲得。此外,該地區蓬勃發展的醫療旅遊業,尤其是在泰國和馬來西亞,也推動了聽力保健解決方案的普及和應用。預計這些趨勢將使全部區域市場保持強勁成長。

本報告對全球助聽器市場進行了分析,並按產品、聽力損失類型、患者類型、技術、分銷管道和地理趨勢進行了分析,同時還提供了參與該市場的公司的概況。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章 市場概覽

- 介紹

- 市場動態

- 定價分析

- 價值鏈分析

- 供應鏈分析

- 生態系分析

- 波特五力分析

- 主要相關人員和採購標準

- 監管分析

- 貿易分析

- 專利分析

- 大型會議和活動

- 影響客戶業務的趨勢/顛覆性因素

- 技術分析

- 投資和資金籌措方案

- 人工智慧/生成式人工智慧將如何影響助聽器市場

- 案例研究分析

- 人工智慧對助聽器市場的影響

- 美國關稅法規對助聽器市場的影響

第6章 助聽器市場(依產品分類)

- 介紹

- 助聽器

- RITE型

- BTE型

- 運河類型

- ITC 類型

- 其他

- 助聽器植入

- 人工電子耳

- 骨固定系統

第7章 助聽器市場(依聽力損失類型分類)

- 介紹

- 感音性聽障

- 傳導性聽力損失

第8章 助聽器市場(依病患類型分類)

- 介紹

- 成人

- 孩子們

第9章 助聽器市場(依技術分類)

- 介紹

- 數位的

- 模擬

第10章 助聽器市場(依通路分類)

- 介紹

- 聽力學及耳鼻喉科醫院及診所

- 零售商店和藥局

- 線上銷售

第11章:各地區助聽器市場

- 介紹

- 北美洲

- 北美宏觀經濟展望

- 美國

- 加拿大

- 歐洲

- 歐洲宏觀經濟展望

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 其他

- 亞太地區

- 亞太宏觀經濟展望

- 中國

- 印度

- 日本

- 澳洲

- 其他

- 拉丁美洲

- 拉丁美洲宏觀經濟展望

- 巴西

- 墨西哥

- 其他

- 中東和非洲

- 中東和非洲宏觀經濟展望

第12章 競爭格局

- 概述

- 主要參與企業的策略/優勢,2024 年

- 2022-2024年收益分析

- 2024年市佔率分析

- 公司估值矩陣:主要參與企業,2024 年

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 估值和財務指標

- 品牌/產品對比

- 競爭場景

第13章:公司簡介

- 主要參與企業

- SONOVA

- WSAUDIOLOGY

- DEMANT A/S

- COCHLEAR LTD.

- GN STORE NORD A/S

- STARKEY LABORATORIES, INC.

- MED-EL MEDICAL ELECTRONICS

- EARGO INC.

- RION CO., LTD.

- ZHEJIANG NUROTRON BIOTECHNOLOGY CO., LTD.

- 其他公司

- AUDINA HEARING INSTRUMENTS, INC.

- NEUBIO AG

- HORENTEK HEARING DIAGNOSTICS

- SEBOTEK HEARING SYSTEMS, LLC

- ARPHI ELECTRONICS PRIVATE LIMITED

- IN4 TECHNOLOGY CORPORATION

- AUDICUS

- NANO HEARING AIDS

- LORECA HEARING AID

- EARLENS CORP.

- AUSTAR HEARING SCIENCE AND TECHNOLOGY(XIAMEN)CO., LTD.

- SHANGHAI LISTENT MEDICAL TECH CO., LTD.

- AUDIFON GMBH & CO. KG

- FOSHAN VOHOM TECHNOLOGY CO., LTD.

- TODOC CO., LTD.

第14章附錄

The global hearing aids market is projected to reach USD 14.42 billion by 2030 from USD 10.35 billion in 2025, at a CAGR of 6.8% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Type of Hearing Loss, Patient Type, Technology, Distribution Channel, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

The large growth in the hearing aids market is due to the increasing prevalence of hearing loss, the rising aging population, and growing awareness of hearing-related disorders, which drive market growth. Additionally, the increasing adoption of smart and user-friendly digital hearing aids is expected to further support market expansion.

"Audiology and ENT hospitals & clinics are the leading distribution channel in the hearing aids market."

The hearing aids market is delineated by distribution channels, specifically categorized into audiology and ENT hospitals and clinics, retail and pharmacy outlets, and online platforms. In 2024, hospitals and clinics commanded the largest market share. These institutions provide a comprehensive continuum of hearing healthcare, encompassing diagnosis, device fitting, and post-fitting management, which is particularly critical for individuals with progressive or complex hearing impairments. The established trust in these facilities significantly enhances adoption rates. Audiology and ENT hospitals & clinics are typically staffed with qualified specialists and are equipped with soundproof testing environments, diagnostic apparatus, and surgical capabilities. They deliver non-surgical solutions and implantable hearing devices within a single location, streamlining the patient's experience. Research indicates that optimized clinical frameworks-such as unbundled pricing models-further facilitate increased uptake of hearing aids. These healthcare settings remain preeminent in the market due to their ability to provide precise diagnostics, professional counsel, and integrated services for hearing aids and implantable devices.

"Digital hearing commanded the largest share in the hearing aids technology market in 2024."

The global hearing aids market categorizes devices into digital and analog hearing aids. As of 2024, digital hearing aids accounted for the largest market share owing to their superior functionalities, including enhanced speech intelligibility and adaptive sound processing capabilities. These devices convert ambient noise into digital signals, which are then processed using sophisticated algorithms to optimize auditory perception, suppress unwanted background noise, and reduce acoustic feedback-features that are notably absent in traditional analog hearing aids. Digital hearing aids are predominantly prescribed by audiologists in clinical settings such as hospitals and specialized hearing care facilities. A significant number of contemporary models are equipped with wireless connectivity, allowing for remote adjustment and automatic adaptation to varying acoustic environments, thereby improving user convenience and overall experience. Meanwhile, analog hearing aids are experiencing a gradual decline in market presence; they remain primarily in use in low-cost settings, particularly in rural or infrastructure-limited regions of low- and middle-income countries, where access to digital technology and fitting services is restricted.

"Asia Pacific is expected to be the fastest-growing region of the hearing aids regional market during the study period."

The global hearing aids market is categorized into five primary regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific region is witnessing rapid expansion, driven by a significant increase in the elderly demographic, heightened demand for otolaryngological services, and substantial investments in healthcare infrastructure. This region presents considerable growth potential for industry stakeholders and is anticipated to achieve the highest compound annual growth rate (CAGR) during the forecast period. As demographic aging progresses, nations such as South Korea, Taiwan, and Singapore observe a rising prevalence of hearing loss, escalating the demand for audiological care. Government initiatives aimed at enhancing healthcare access and expanding hospital and clinic networks have made hearing aids more accessible to the population. Furthermore, the region's burgeoning medical tourism sector, particularly in Thailand and Malaysia, is facilitating an increase in the availability and adoption of hearing care solutions. These trends are expected to sustain robust market growth across the Asia Pacific region.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1: 38%, Tier 2: 29%, and Tier 3: 33%

- By Designation: C Level: 27%, Director Level: 18%, and Others: 55%

- By Region: North America: 50%, Europe: 20%, Asia Pacific: 20%, Latin America: 7%, and Middle East & Africa: 3%

Note 1: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = <USD 1.00 billion.

Note 2: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 3: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The major players operating in the hearing aids market are Sonova (Switzerland), Demant A/S(Denmark), GN Store Nord A/S (Denmark), Cochlear Ltd. (Australia), Rion Co., Ltd. (Japan), Eargo Inc. (US), Starkey Laboratories, Inc. (US), WSAudiology (Denmark), Zhejiang Nurotron Biotechnology Co., Ltd. (China), and MED-EL Medical Electronics (Austria), among others.

Research Coverage

This report examines the hearing aids market based on product type, type of hearing loss, patient type, technology, distribution channel, and region. It also explores factors such as drivers, restraints, opportunities, and challenges that influence market growth, and provides details on the competitive landscape for market leaders. Additionally, the report analyzes micro markets concerning their growth trends. It forecasts the revenue of market segments across five major regions and their respective countries.

Reasons to Buy the Report

The report will enable established firms as well as entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them to garner a larger market share. Firms purchasing the report could use one or a combination of the strategies mentioned below to strengthen their market presence.

This report provides insights on the following pointers:

- Analysis of key drivers (increasing global burden of hearing loss, increase in aging population, supportive insurance coverage and expanding reimbursement access, increasing adoption of smart hearing aids amid rising noise-induced hearing loss), restraints (high cost of hearing aids and associated treatments, risks, accessibility, and long post-surgery rehabilitation associated with hearing aid), opportunities (high-growth potential for hearing technologies in emerging economies, integration with digital health platforms enhances hearing device care), and challenges (shortage of skilled professionals performing ENT Procedures).

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the hearing aids market

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the hearing aids market

- Market Development: Comprehensive information on lucrative emerging regions

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the hearing aids market

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach 1: Company revenue estimation approach

- 2.2.1.2 Approach 2: Presentations of companies and primary interviews

- 2.2.1.3 Approach 3: Primary interviews

- 2.2.1.4 Growth forecast

- 2.2.1.5 CAGR projections

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.4.1 STUDY-RELATED ASSUMPTIONS

- 2.4.2 PARAMETRIC ASSUMPTIONS

- 2.4.3 GROWTH RATE ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 HEARING AIDS MARKET OVERVIEW

- 4.2 ASIA PACIFIC: HEARING AIDS CARE MARKET SHARE, BY DISTRIBUTION CHANNEL AND COUNTRY

- 4.3 HEARING AIDS MARKET, BY KEY COUNTRY

- 4.4 HEARING AIDS MARKET, REGIONAL MIX

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increase in global burden of hearing loss

- 5.2.1.2 Increase in aging population

- 5.2.1.3 Supportive insurance coverage and expanding reimbursement access

- 5.2.1.4 Increase in adoption of smart hearing aids amid rising noise-induced hearing loss

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of hearing aids and associated treatments

- 5.2.2.2 Risks, accessibility, and long post-surgery rehabilitation associated with hearing aids

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High-growth potential for hearing technologies in emerging economies

- 5.2.3.2 Integration with digital health platforms to enhance hearing device care

- 5.2.4 CHALLENGES

- 5.2.4.1 Shortage of skilled professionals performing ENT procedures

- 5.2.1 DRIVERS

- 5.3 PRICING ANALYSIS

- 5.3.1 AVERAGE SELLING PRICE TREND OF HEARING AID PRODUCTS, BY REGION

- 5.3.2 AVERAGE SELLING PRICE TREND OF HEARING AID PRODUCTS, BY KEY PLAYER

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF BUYERS

- 5.7.4 BARGAINING POWER OF SUPPLIERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.8.2 KEY BUYING CRITERIA

- 5.9 REGULATORY ANALYSIS

- 5.9.1 REGULATORY FRAMEWORK

- 5.9.1.1 North America

- 5.9.1.1.1 US

- 5.9.1.1.2 Canada

- 5.9.1.2 Europe

- 5.9.1.3 Asia Pacific

- 5.9.1.3.1 Japan

- 5.9.1.3.2 China

- 5.9.1.3.3 India

- 5.9.1.4 Latin America

- 5.9.1.4.1 Brazil

- 5.9.1.4.2 Mexico

- 5.9.1.5 Middle East

- 5.9.1.6 Africa

- 5.9.1.1 North America

- 5.9.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.1 REGULATORY FRAMEWORK

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT DATA (HS CODE 902140)

- 5.10.2 EXPORT DATA (HS CODE 902140)

- 5.11 PATENT ANALYSIS

- 5.11.1 LIST OF MAJOR PATENTS

- 5.12 KEY CONFERENCES & EVENTS

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.14 TECHNOLOGY ANALYSIS

- 5.14.1 KEY TECHNOLOGIES

- 5.14.1.1 Digital signal processing (DSP)

- 5.14.2 COMPLEMENTARY TECHNOLOGIES

- 5.14.2.1 Bimodal hearing solutions

- 5.14.3 ADJACENT TECHNOLOGIES

- 5.14.3.1 Cochlear implants & bone-anchored hearing systems

- 5.14.1 KEY TECHNOLOGIES

- 5.15 INVESTMENT & FUNDING SCENARIO

- 5.16 IMPACT OF AI/GEN AI ON COCHLEAR IMPLANTS MARKET

- 5.17 CASE STUDY ANALYSIS

- 5.17.1 ADVANCING HEARING CAPABILITY WITH INTEGRATED COCHLEAR IMPLANT AND HEARING AID TECHNOLOGY

- 5.17.2 WIDEX MOMENT EXPERIENCE: RESTORING SOUND PRECISION THROUGH ADVANCED HEARING TECHNOLOGY

- 5.17.3 NANCY E. AND BAHA SYSTEM: REDISCOVERING SOUND AFTER FIVE DECADES

- 5.18 IMPACT OF AI ON HEARING AIDS MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 MARKET POTENTIAL OF AI IN HEARING AIDS MARKET

- 5.18.3 AI USE CASES

- 5.18.4 KEY COMPANIES IMPLEMENTING AI

- 5.18.5 FUTURE OF AI IN HEARING AIDS MARKET

- 5.19 IMPACT OF US TARIFF REGULATION ON HEARING AIDS MARKET

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.4 KEY IMPACTS ON COUNTRY/REGION

- 5.19.4.1 North America

- 5.19.4.2 Europe

- 5.19.4.3 Asia Pacific

- 5.19.5 IMPACT ON END-USE INDUSTRIES

- 5.19.5.1 Audiology and ENT hospitals & clinics

6 HEARING AIDS MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 HEARING AID DEVICES

- 6.2.1 RECEIVER-IN-THE-EAR HEARING AIDS

- 6.2.1.1 Designed to manage mild to severe hearing loss

- 6.2.2 BEHIND-THE-EAR HEARING AIDS

- 6.2.2.1 Affordability and advancements in BTE hearing aids to drive growth

- 6.2.3 CANAL HEARING AIDS

- 6.2.3.1 Technological innovations and low visibility to drive demand for canal aids

- 6.2.4 IN-THE-EAR HEARING AIDS

- 6.2.4.1 Custom fit and advanced functionality of ITE hearing aids to drive market expansion

- 6.2.5 OTHER HEARING AID DEVICES

- 6.2.1 RECEIVER-IN-THE-EAR HEARING AIDS

- 6.3 HEARING IMPLANTS

- 6.3.1 COCHLEAR IMPLANTS

- 6.3.1.1 Cochlear implants to lead hearing implants market

- 6.3.2 BONE-ANCHORED SYSTEMS

- 6.3.2.1 Rise in adoption of bone-anchored hearing systems in single-sided deafness and conductive hearing loss

- 6.3.1 COCHLEAR IMPLANTS

7 HEARING AIDS MARKET, BY TYPE OF HEARING LOSS

- 7.1 INTRODUCTION

- 7.2 SENSORINEURAL HEARING LOSS

- 7.2.1 GROWTH OF ELDERLY POPULATION TO DRIVE SENSORINEURAL HEARING LOSS SEGMENT

- 7.3 CONDUCTIVE HEARING LOSS

- 7.3.1 TECHNOLOGICAL INNOVATIONS AND REGULATORY APPROVALS TO FUEL GROWTH OF CONDUCTIVE HEARING LOSS SEGMENT

8 HEARING AIDS MARKET, BY PATIENT TYPE

- 8.1 INTRODUCTION

- 8.2 ADULTS

- 8.2.1 HIGHER SUSCEPTIBILITY TO HEARING LOSS MAKES ADULTS KEY SEGMENT OF OVERALL PATIENT POOL

- 8.3 PEDIATRICS

- 8.3.1 TECHNOLOGICAL ADVANCEMENTS TO FUEL GROWTH OF PEDIATRIC HEARING AIDS

9 HEARING AIDS MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 DIGITAL

- 9.2.1 PRECISION SOUND TAILORED THROUGH DIGITAL PROCESSING TO PROPEL MARKET

- 9.3 ANALOG

- 9.3.1 ANALOG: AFFORDABLE SOLUTIONS FOR BASIC HEARING NEEDS

10 HEARING AIDS MARKET, BY DISTRIBUTION CHANNEL

- 10.1 INTRODUCTION

- 10.2 AUDIOLOGY AND ENT HOSPITALS & CLINICS

- 10.2.1 EXPERT-LED CARE IN CLINICAL SETTINGS TO DRIVE HIGHER ADOPTION AND SATISFACTION

- 10.3 RETAIL & PHARMACY STORES

- 10.3.1 EXPANDING ACCESS TO HEARING CARE THROUGH CONVENIENT AND AFFORDABLE IN-STORE OPTIONS

- 10.4 ONLINE SALES

- 10.4.1 EMERGING CHANNEL OFFERING REMOTE ACCESS TO HEARING AIDS

11 HEARING AIDS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 US to lead North America's hearing aids market through 2030

- 11.2.3 CANADA

- 11.2.3.1 Targeted awareness-raising and aging trends to drive steady growth in Canada's hearing aids market

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Growth in healthcare expenditure in Germany to drive demand for advanced hearing aids

- 11.3.3 UK

- 11.3.3.1 Rise in burden of hearing loss continues to fuel market expansion in UK

- 11.3.4 FRANCE

- 11.3.4.1 Investment in R&D and technological innovation to drive market expansion in France

- 11.3.5 SPAIN

- 11.3.5.1 Rise in life expectancy and aging population to boost market growth

- 11.3.6 ITALY

- 11.3.6.1 Rise in Italy's elderly population to create further potential demand for hearing aids

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 China to continue dominating Asia Pacific hearing aids market

- 11.4.3 INDIA

- 11.4.3.1 Healthcare infrastructure improvements to drive hearing aids market growth

- 11.4.4 JAPAN

- 11.4.4.1 Aging population and favorable insurance policies to support adoption in Japan

- 11.4.5 AUSTRALIA

- 11.4.5.1 Rise in geriatric population and government programs to accelerate market growth

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Largest healthcare sector in region and government initiatives to drive market

- 11.5.3 MEXICO

- 11.5.3.1 Expanding hospital infrastructure to support hearing healthcare growth

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2024

- 12.3 REVENUE ANALYSIS, 2022-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Regional footprint

- 12.5.5.3 Product footprint

- 12.5.5.4 Type of hearing loss footprint

- 12.5.5.5 Patient type footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of key startups/SMEs

- 12.7 COMPANY VALUATION AND FINANCIAL METRICS

- 12.7.1 COMPANY VALUATION

- 12.7.2 FINANCIAL METRICS

- 12.8 BRAND/PRODUCT COMPARISON

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES & APPROVALS

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 SONOVA

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches & approvals

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 WSAUDIOLOGY

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches & approvals

- 13.1.2.3.2 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 DEMANT A/S

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches & approvals

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Expansions

- 13.1.3.3.4 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 COCHLEAR LTD.

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches & approvals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses & competitive threats

- 13.1.5 GN STORE NORD A/S

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches & approvals

- 13.1.5.3.2 Deals

- 13.1.5.3.3 Other developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses & competitive threats

- 13.1.6 STARKEY LABORATORIES, INC.

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches & approvals

- 13.1.6.3.2 Deals

- 13.1.7 MED-EL MEDICAL ELECTRONICS

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.8 EARGO INC.

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.9 RION CO., LTD.

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.10 ZHEJIANG NUROTRON BIOTECHNOLOGY CO., LTD.

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.1 SONOVA

- 13.2 OTHER PLAYERS

- 13.2.1 AUDINA HEARING INSTRUMENTS, INC.

- 13.2.2 NEUBIO AG

- 13.2.3 HORENTEK HEARING DIAGNOSTICS

- 13.2.4 SEBOTEK HEARING SYSTEMS, LLC

- 13.2.5 ARPHI ELECTRONICS PRIVATE LIMITED

- 13.2.6 IN4 TECHNOLOGY CORPORATION

- 13.2.7 AUDICUS

- 13.2.8 NANO HEARING AIDS

- 13.2.9 LORECA HEARING AID

- 13.2.10 EARLENS CORP.

- 13.2.11 AUSTAR HEARING SCIENCE AND TECHNOLOGY (XIAMEN) CO., LTD.

- 13.2.12 SHANGHAI LISTENT MEDICAL TECH CO., LTD.

- 13.2.13 AUDIFON GMBH & CO. KG

- 13.2.14 FOSHAN VOHOM TECHNOLOGY CO., LTD.

- 13.2.15 TODOC CO., LTD.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 HEARING AIDS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 KEY DATA FROM PRIMARY SOURCES

- TABLE 3 HEARING AIDS MARKET: RISK ASSESSMENT

- TABLE 4 ESTIMATED INCREASE IN GERIATRIC POPULATION, BY REGION, 2023 VS. 2030 VS. 2050

- TABLE 5 AVERAGE SELLING PRICE TREND OF HEARING AID PRODUCTS, BY REGION, 2023-2025 (USD)

- TABLE 6 AVERAGE SELLING PRICE TREND OF HEARING AID PRODUCTS, BY KEY PLAYER, 2023-2025 (USD)

- TABLE 7 HEARING AIDS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 8 HEARING AIDS MARKET: PORTER'S FIVE FORCES

- TABLE 9 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS

- TABLE 10 KEY BUYING CRITERIA FOR MAJOR DISTRIBUTION CHANNEL

- TABLE 11 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 12 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 13 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 14 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

- TABLE 15 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 IMPORT DATA (HS CODE 902140), BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 22 EXPORT DATA (HS CODE 902140), BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 23 HEARING AIDS MARKET: LIST OF MAJOR PATENTS

- TABLE 24 HEARING AIDS MARKET: LIST OF KEY CONFERENCES & EVENTS, JANUARY 2025-DECEMBER 2026

- TABLE 25 US ADJUSTED RECIPROCAL TARIFF RATES, 2024

- TABLE 26 HEARING AIDS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 27 KEY PRODUCTS IN HEARING AID DEVICES MARKET

- TABLE 28 HEARING AID DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 29 HEARING AID DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 30 NORTH AMERICA: HEARING AID DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 31 EUROPE: HEARING AID DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 ASIA PACIFIC: HEARING AID DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 LATIN AMERICA: HEARING AID DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 34 RECEIVER-IN-THE-EAR HEARING AIDS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 35 NORTH AMERICA: RECEIVER-IN-THE-EAR HEARING AIDS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 36 EUROPE: RECEIVER-IN-THE-EAR HEARING AIDS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 ASIA PACIFIC: RECEIVER-IN-THE-EAR HEARING AIDS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 LATIN AMERICA: RECEIVER-IN-THE-EAR HEARING AIDS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 39 BEHIND-THE-EAR HEARING AIDS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 40 NORTH AMERICA: BEHIND-THE-EAR HEARING AIDS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 EUROPE: BEHIND-THE-EAR HEARING AIDS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 ASIA PACIFIC: BEHIND-THE-EAR HEARING AIDS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 LATIN AMERICA: BEHIND-THE-EAR HEARING AIDS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 CANAL HEARING AIDS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 45 NORTH AMERICA: CANAL HEARING AIDS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 EUROPE: CANAL HEARING AIDS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 ASIA PACIFIC: CANAL HEARING AIDS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 48 LATIN AMERICA: CANAL HEARING AIDS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 IN-THE-EAR HEARING AIDS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: IN-THE-EAR HEARING AIDS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 EUROPE: IN-THE-EAR HEARING AIDS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 ASIA PACIFIC: IN-THE-EAR HEARING AIDS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 LATIN AMERICA: IN-THE-EAR HEARING AIDS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 OTHER HEARING AID DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 55 NORTH AMERICA: OTHER HEARING AID DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 56 EUROPE: OTHER HEARING AID DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 57 ASIA PACIFIC: OTHER HEARING AID DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 LATIN AMERICA: OTHER HEARING AID DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 59 KEY PRODUCTS IN HEARING AID DEVICES MARKET

- TABLE 60 HEARING IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 61 HEARING IMPLANTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 62 NORTH AMERICA: HEARING IMPLANTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 63 EUROPE: HEARING IMPLANTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 64 ASIA PACIFIC: HEARING IMPLANTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 65 LATIN AMERICA: HEARING IMPLANTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 66 COCHLEAR IMPLANTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: COCHLEAR IMPLANTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 68 EUROPE: COCHLEAR IMPLANTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 69 ASIA PACIFIC: COCHLEAR IMPLANTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 70 LATIN AMERICA: COCHLEAR IMPLANTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 71 BONE-ANCHORED SYSTEMS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: BONE-ANCHORED SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 73 EUROPE: BONE-ANCHORED SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 74 ASIA PACIFIC: BONE-ANCHORED SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 75 LATIN AMERICA: BONE-ANCHORED SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 76 HEARING AIDS MARKET, BY TYPE OF HEARING LOSS, 2023-2030 (USD MILLION)

- TABLE 77 HEARING AIDS MARKET FOR SENSORINEURAL HEARING LOSS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: HEARING AIDS MARKET FOR SENSORINEURAL HEARING LOSS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 79 EUROPE: HEARING AIDS MARKET FOR SENSORINEURAL HEARING LOSS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 80 ASIA PACIFIC: HEARING AIDS MARKET FOR SENSORINEURAL HEARING LOSS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 81 LATIN AMERICA: HEARING AIDS MARKET FOR SENSORINEURAL HEARING LOSS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 82 HEARING AIDS MARKET FOR CONDUCTIVE HEARING LOSS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 83 NORTH AMERICA: HEARING AIDS MARKET FOR CONDUCTIVE HEARING LOSS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 84 EUROPE: HEARING AIDS MARKET FOR CONDUCTIVE HEARING LOSS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 85 ASIA PACIFIC: HEARING AIDS MARKET FOR CONDUCTIVE HEARING LOSS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 86 LATIN AMERICA: HEARING AIDS MARKET FOR CONDUCTIVE HEARING LOSS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 87 HEARING AIDS MARKET, BY PATIENT TYPE, 2023-2030 (USD MILLION)

- TABLE 88 HEARING AIDS MARKET FOR ADULT PATIENTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 89 NORTH AMERICA: HEARING AIDS MARKET FOR ADULT PATIENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 90 EUROPE: HEARING AIDS MARKET FOR ADULT PATIENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 91 ASIA PACIFIC: HEARING AIDS MARKET FOR ADULT PATIENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 92 LATIN AMERICA: HEARING AIDS MARKET FOR ADULT PATIENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 93 HEARING AIDS MARKET FOR PEDIATRIC PATIENTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: HEARING AIDS MARKET FOR PEDIATRIC PATIENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 95 EUROPE: HEARING AIDS MARKET FOR PEDIATRIC PATIENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 96 ASIA PACIFIC: HEARING AIDS MARKET FOR PEDIATRIC PATIENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 97 LATIN AMERICA: HEARING AIDS MARKET FOR PEDIATRIC PATIENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 98 HEARING AIDS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 99 DIGITAL HEARING AIDS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: DIGITAL HEARING AIDS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 101 EUROPE: DIGITAL HEARING AIDS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 102 ASIA PACIFIC: DIGITAL HEARING AIDS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 103 LATIN AMERICA: DIGITAL HEARING AIDS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 104 ANALOG HEARING AIDS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: ANALOG HEARING AIDS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 106 EUROPE: ANALOG HEARING AIDS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 107 ASIA PACIFIC: ANALOG HEARING AIDS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 108 LATIN AMERICA: ANALOG HEARING AIDS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 109 HEARING AIDS MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 110 HEARING AIDS MARKET THROUGH AUDIOLOGY AND ENT HOSPITALS & CLINICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 111 NORTH AMERICA: HEARING AIDS MARKET THROUGH AUDIOLOGY AND ENT HOSPITALS & CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 112 EUROPE: HEARING AIDS MARKET THROUGH AUDIOLOGY AND ENT HOSPITALS & CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 113 ASIA PACIFIC: HEARING AIDS MARKET THROUGH AUDIOLOGY AND ENT HOSPITALS & CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 114 LATIN AMERICA: HEARING AIDS MARKET THROUGH AUDIOLOGY AND ENT HOSPITALS & CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 115 HEARING AIDS MARKET THROUGH RETAIL & PHARMACY STORES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 116 NORTH AMERICA: HEARING AIDS MARKET THROUGH RETAIL & PHARMACY STORES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 117 EUROPE: HEARING AIDS MARKET THROUGH RETAIL & PHARMACY STORES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 118 ASIA PACIFIC: HEARING AIDS MARKET THROUGH RETAIL & PHARMACY STORES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 119 LATIN AMERICA: HEARING AIDS MARKET THROUGH RETAIL & PHARMACY STORES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 120 HEARING AIDS MARKET THROUGH ONLINE SALES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 121 NORTH AMERICA: HEARING AIDS MARKET THROUGH ONLINE SALES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 122 EUROPE: HEARING AIDS MARKET THROUGH ONLINE SALES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 123 ASIA PACIFIC: HEARING AIDS MARKET THROUGH ONLINE SALES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 124 LATIN AMERICA: HEARING AIDS MARKET THROUGH ONLINE SALES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 125 HEARING AIDS SOLD GLOBALLY, 2023-2030 (MILLION UNITS)

- TABLE 126 HEARING AIDS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 127 NORTH AMERICA: MACROECONOMIC INDICATORS

- TABLE 128 NORTH AMERICA: HEARING AIDS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 129 NORTH AMERICA: HEARING AIDS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 130 NORTH AMERICA: HEARING AID DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 131 NORTH AMERICA: HEARING IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 NORTH AMERICA: HEARING AIDS MARKET, BY TYPE OF HEARING LOSS, 2023-2030 (USD MILLION)

- TABLE 133 NORTH AMERICA: HEARING AIDS MARKET, BY PATIENT TYPE, 2023-2030 (USD MILLION)

- TABLE 134 NORTH AMERICA: HEARING AIDS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 135 NORTH AMERICA: HEARING AIDS MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 136 US: HEARING AIDS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 137 US: HEARING AID DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 138 US: HEARING IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 139 US: HEARING AIDS MARKET, BY TYPE OF HEARING LOSS, 2023-2030 (USD MILLION)

- TABLE 140 US: HEARING AIDS MARKET, BY PATIENT TYPE, 2023-2030 (USD MILLION)

- TABLE 141 US: HEARING AIDS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 142 US: HEARING AIDS MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 143 CANADA: HEARING AIDS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 144 CANADA: HEARING AID DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 145 CANADA: HEARING IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 146 CANADA: HEARING AIDS MARKET, BY TYPE OF HEARING LOSS, 2023-2030 (USD MILLION)

- TABLE 147 CANADA: HEARING AIDS MARKET, BY PATIENT TYPE, 2023-2030 (USD MILLION)

- TABLE 148 CANADA: HEARING AIDS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 149 CANADA: HEARING AIDS MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 150 EUROPE: MACROECONOMIC INDICATORS

- TABLE 151 EUROPE: HEARING AIDS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 152 EUROPE: HEARING AIDS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 153 EUROPE: HEARING AID DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 154 EUROPE: HEARING IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 155 EUROPE: HEARING AIDS MARKET, BY TYPE OF HEARING LOSS, 2023-2030 (USD MILLION)

- TABLE 156 EUROPE: HEARING AIDS MARKET, BY PATIENT TYPE, 2023-2030 (USD MILLION)

- TABLE 157 EUROPE: HEARING AIDS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 158 EUROPE: HEARING AIDS MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 159 GERMANY: HEARING AIDS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 160 GERMANY: HEARING AID DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 161 GERMANY: HEARING IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 162 GERMANY: HEARING AIDS MARKET, BY TYPE OF HEARING LOSS, 2023-2030 (USD MILLION)

- TABLE 163 GERMANY: HEARING AIDS MARKET, BY PATIENT TYPE, 2023-2030 (USD MILLION)

- TABLE 164 GERMANY: HEARING AIDS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 165 GERMANY: HEARING AIDS MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 166 UK: HEARING AIDS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 167 UK: HEARING AID DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 168 UK: HEARING IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 169 UK: HEARING AIDS MARKET, BY TYPE OF HEARING LOSS, 2023-2030 (USD MILLION)

- TABLE 170 UK: HEARING AIDS MARKET, BY PATIENT TYPE, 2023-2030 (USD MILLION)

- TABLE 171 UK: HEARING AIDS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 172 UK: HEARING AIDS MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 173 FRANCE: HEARING AIDS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 174 FRANCE: HEARING AID DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 175 FRANCE: HEARING IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 176 FRANCE: HEARING AIDS MARKET, BY TYPE OF HEARING LOSS, 2023-2030 (USD MILLION)

- TABLE 177 FRANCE: HEARING AIDS MARKET, BY PATIENT TYPE, 2023-2030 (USD MILLION)

- TABLE 178 FRANCE: HEARING AIDS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 179 FRANCE: HEARING AIDS MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 180 SPAIN: HEARING AIDS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 181 SPAIN: HEARING AID DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 182 SPAIN: HEARING IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 183 SPAIN: HEARING AIDS MARKET, BY TYPE OF HEARING LOSS, 2023-2030 (USD MILLION)

- TABLE 184 SPAIN: HEARING AIDS MARKET, BY PATIENT TYPE, 2023-2030 (USD MILLION)

- TABLE 185 SPAIN: HEARING AIDS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 186 SPAIN: HEARING AIDS MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 187 ITALY: HEARING AIDS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 188 ITALY: HEARING AID DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 189 ITALY: HEARING IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 190 ITALY: HEARING AIDS MARKET, BY TYPE OF HEARING LOSS, 2023-2030 (USD MILLION)

- TABLE 191 ITALY: HEARING AIDS MARKET, BY PATIENT TYPE, 2023-2030 (USD MILLION)

- TABLE 192 ITALY: HEARING AIDS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 193 ITALY: HEARING AIDS MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 194 REST OF EUROPE: HEARING AIDS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 195 REST OF EUROPE: HEARING AID DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 196 REST OF EUROPE: HEARING IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 197 REST OF EUROPE: HEARING AIDS MARKET, BY TYPE OF HEARING LOSS, 2023-2030 (USD MILLION)

- TABLE 198 REST OF EUROPE: HEARING AIDS MARKET, BY PATIENT TYPE, 2023-2030 (USD MILLION)

- TABLE 199 REST OF EUROPE: HEARING AIDS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 200 REST OF EUROPE: HEARING AIDS MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 201 ASIA PACIFIC: KEY MACROECONOMIC INDICATORS

- TABLE 202 ASIA PACIFIC: HEARING AIDS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 203 ASIA PACIFIC: HEARING AIDS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 204 ASIA PACIFIC: HEARING AID DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 205 ASIA PACIFIC: HEARING IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 206 ASIA PACIFIC: HEARING AIDS MARKET, BY TYPE OF HEARING LOSS, 2023-2030 (USD MILLION)

- TABLE 207 ASIA PACIFIC: HEARING AIDS MARKET, BY PATIENT TYPE, 2023-2030 (USD MILLION)

- TABLE 208 ASIA PACIFIC: HEARING AIDS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 209 ASIA PACIFIC: HEARING AIDS MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 210 CHINA: HEARING AIDS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 211 CHINA: HEARING AID DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 212 CHINA: HEARING IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 213 CHINA: HEARING AIDS MARKET, BY TYPE OF HEARING LOSS, 2023-2030 (USD MILLION)

- TABLE 214 CHINA: HEARING AIDS MARKET, BY PATIENT TYPE, 2023-2030 (USD MILLION)

- TABLE 215 CHINA: HEARING AIDS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 216 CHINA: HEARING AIDS MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 217 INDIA: HEARING AIDS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 218 INDIA: HEARING AID DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 219 INDIA: HEARING IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 220 INDIA: HEARING AIDS MARKET, BY TYPE OF HEARING LOSS, 2023-2030 (USD MILLION)

- TABLE 221 INDIA: HEARING AIDS MARKET, BY PATIENT TYPE, 2023-2030 (USD MILLION)

- TABLE 222 INDIA: HEARING AIDS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 223 INDIA: HEARING AIDS MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 224 JAPAN: HEARING AIDS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 225 JAPAN: HEARING AID DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 226 JAPAN: HEARING IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 227 JAPAN: HEARING AIDS MARKET, BY TYPE OF HEARING LOSS, 2023-2030 (USD MILLION)

- TABLE 228 JAPAN: HEARING AIDS MARKET, BY PATIENT TYPE, 2023-2030 (USD MILLION)

- TABLE 229 JAPAN: HEARING AIDS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 230 JAPAN: HEARING AIDS MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 231 AUSTRALIA: HEARING AIDS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 232 AUSTRALIA: HEARING AID DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 233 AUSTRALIA: HEARING IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 234 AUSTRALIA: HEARING AIDS MARKET, BY TYPE OF HEARING LOSS, 2023-2030 (USD MILLION)

- TABLE 235 AUSTRALIA: HEARING AIDS MARKET, BY PATIENT TYPE, 2023-2030 (USD MILLION)

- TABLE 236 AUSTRALIA: HEARING AIDS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 237 AUSTRALIA: HEARING AIDS MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 238 REST OF ASIA PACIFIC: HEARING AIDS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 239 REST OF ASIA PACIFIC: HEARING AID DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 240 REST OF ASIA PACIFIC: HEARING IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 241 REST OF ASIA PACIFIC: HEARING AIDS MARKET, BY TYPE OF HEARING LOSS, 2023-2030 (USD MILLION)

- TABLE 242 REST OF ASIA PACIFIC: HEARING AIDS MARKET, BY PATIENT TYPE, 2023-2030 (USD MILLION)

- TABLE 243 REST OF ASIA PACIFIC: HEARING AIDS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 244 REST OF ASIA PACIFIC: HEARING AIDS MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 245 LATIN AMERICA: KEY MACROECONOMIC INDICATORS

- TABLE 246 LATIN AMERICA: HEARING AIDS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 247 LATIN AMERICA: HEARING AIDS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 248 LATIN AMERICA: HEARING AID DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 249 LATIN AMERICA: HEARING IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 250 LATIN AMERICA: HEARING AIDS MARKET, BY TYPE OF HEARING LOSS, 2023-2030 (USD MILLION)

- TABLE 251 LATIN AMERICA: HEARING AIDS MARKET, BY PATIENT TYPE, 2023-2030 (USD MILLION)

- TABLE 252 LATIN AMERICA: HEARING AIDS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 253 LATIN AMERICA: HEARING AIDS MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 254 BRAZIL: HEARING AIDS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 255 BRAZIL: HEARING AID DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 256 BRAZIL: HEARING IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 257 BRAZIL: HEARING AIDS MARKET, BY TYPE OF HEARING LOSS, 2023-2030 (USD MILLION)

- TABLE 258 BRAZIL: HEARING AIDS MARKET, BY PATIENT TYPE, 2023-2030 (USD MILLION)

- TABLE 259 BRAZIL: HEARING AIDS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 260 BRAZIL: HEARING AIDS MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 261 MEXICO: HEARING AIDS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 262 MEXICO: HEARING AID DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 263 MEXICO: HEARING IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 264 MEXICO: HEARING AIDS MARKET, BY TYPE OF HEARING LOSS, 2023-2030 (USD MILLION)

- TABLE 265 MEXICO: HEARING AIDS MARKET, BY PATIENT TYPE, 2023-2030 (USD MILLION)

- TABLE 266 MEXICO: HEARING AIDS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 267 MEXICO: HEARING AIDS MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 268 REST OF LATIN AMERICA: HEARING AIDS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 269 REST OF LATIN AMERICA: HEARING AID DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 270 REST OF LATIN AMERICA: HEARING IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 271 REST OF LATIN AMERICA: HEARING AIDS MARKET, BY TYPE OF HEARING LOSS, 2023-2030 (USD MILLION)

- TABLE 272 REST OF LATIN AMERICA: HEARING AIDS MARKET, BY PATIENT TYPE, 2023-2030 (USD MILLION)

- TABLE 273 REST OF LATIN AMERICA: HEARING AIDS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 274 REST OF LATIN AMERICA: HEARING AIDS MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 275 MIDDLE EAST & AFRICA: KEY MACROECONOMIC INDICATORS

- TABLE 276 MIDDLE EAST & AFRICA: HEARING AIDS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 277 MIDDLE EAST & AFRICA: HEARING AID DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 278 MIDDLE EAST & AFRICA: HEARING IMPLANTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 279 MIDDLE EAST & AFRICA: HEARING AIDS MARKET, BY TYPE OF HEARING LOSS, 2023-2030 (USD MILLION)

- TABLE 280 MIDDLE EAST & AFRICA: HEARING AIDS MARKET, BY PATIENT TYPE, 2023-2030 (USD MILLION)

- TABLE 281 MIDDLE EAST & AFRICA: HEARING AIDS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 282 MIDDLE EAST & AFRICA: HEARING AIDS MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

- TABLE 283 HEARING AIDS MARKET: OVERVIEW OF STRATEGIES DEPLOYED BY KEY MANUFACTURING COMPANIES, JANUARY 2022-MAY 2025

- TABLE 284 HEARING AIDS MARKET: DEGREE OF COMPETITION

- TABLE 285 HEARING AIDS MARKET: REGIONAL FOOTPRINT, 2024

- TABLE 286 HEARING AIDS MARKET: PRODUCT FOOTPRINT, 2024

- TABLE 287 HEARING AIDS MARKET: TYPE OF HEARING LOSS FOOTPRINT, 2024

- TABLE 288 HEARING AIDS MARKET: PATIENT TYPE FOOTPRINT, 2024

- TABLE 289 HEARING AIDS MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2024

- TABLE 290 HEARING AIDS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 291 HEARING AIDS MARKET: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-MAY 2025

- TABLE 292 HEARING AIDS MARKET: DEALS, JANUARY 2022-MAY 2025

- TABLE 293 HEARING AIDS MARKET: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 294 HEARING AIDS MARKET: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 295 SONOVA: COMPANY OVERVIEW

- TABLE 296 SONOVA: PRODUCTS OFFERED

- TABLE 297 SONOVA: PRODUCT LAUNCHES & APPROVALS

- TABLE 298 SONOVA: DEALS

- TABLE 299 SONOVA: EXPANSIONS

- TABLE 300 WSAUDIOLOGY: COMPANY OVERVIEW

- TABLE 301 WSAUDIOLOGY: PRODUCTS OFFERED

- TABLE 302 WSAUDIOLOGY: PRODUCT LAUNCHES & APPROVALS

- TABLE 303 WSAUDIOLOGY: DEALS

- TABLE 304 DEMANT A/S: COMPANY OVERVIEW

- TABLE 305 DEMANT A/S: PRODUCTS OFFERED

- TABLE 306 DEMANT A/S: PRODUCT LAUNCHES & APPROVALS

- TABLE 307 DEMANT A/S: DEALS

- TABLE 308 DEMANT A/S: EXPANSIONS

- TABLE 309 DEMANT A/S: OTHER DEVELOPMENTS

- TABLE 310 COCHLEAR LTD.: COMPANY OVERVIEW

- TABLE 311 COCHLEAR LTD.: PRODUCTS OFFERED

- TABLE 312 COCHLEAR LTD.: PRODUCT LAUNCHES & APPROVALS

- TABLE 313 GN STORE NORD A/S: COMPANY OVERVIEW

- TABLE 314 GN STORE NORD A/S: PRODUCTS OFFERED

- TABLE 315 GN STORE NORD A/S: PRODUCT LAUNCHES & APPROVALS

- TABLE 316 GN STORE NORD A/S: DEALS, JANUARY 2022-MAY 2025

- TABLE 317 GN STORE NORD A/S: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 318 STARKEY LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 319 STARKEY LABORATORIES, INC.: PRODUCTS OFFERED

- TABLE 320 STARKEY LABORATORIES, INC.: PRODUCT LAUNCHES & APPROVALS

- TABLE 321 STARKEY LABORATORIES, INC.: DEALS

- TABLE 322 MED-EL MEDICAL ELECTRONICS: COMPANY OVERVIEW

- TABLE 323 MED-EL MEDICAL ELECTRONICS: PRODUCTS OFFERED

- TABLE 324 MED-EL MEDICAL ELECTRONICS: DEALS

- TABLE 325 EARGO INC.: COMPANY OVERVIEW

- TABLE 326 EARGO INC.: PRODUCTS OFFERED

- TABLE 327 RION CO., LTD.: COMPANY OVERVIEW

- TABLE 328 RION CO., LTD.: PRODUCTS OFFERED

- TABLE 329 RION CO., LTD.: DEALS

- TABLE 330 ZHEJIANG NUROTRON BIOTECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 331 ZHEJIANG NUROTRON BIOTECHNOLOGY CO., LTD.: PRODUCTS OFFERED

List of Figures

- FIGURE 1 HEARING AIDS MARKET SEGMENTATION

- FIGURE 2 STUDY YEARS CONSIDERED

- FIGURE 3 HEARING AIDS MARKET: RESEARCH DESIGN

- FIGURE 4 KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 PRIMARY SOURCES

- FIGURE 6 KEY INDUSTRY INSIGHTS

- FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 8 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

- FIGURE 9 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 10 HEARING AIDS MARKET: TOP-DOWN APPROACH

- FIGURE 11 DATA TRIANGULATION METHODOLOGY

- FIGURE 12 HEARING AIDS MARKET, BY PRODUCT, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 HEARING AIDS MARKET, BY TYPE OF HEARING LOSS, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 HEARING AIDS MARKET, BY PATIENT TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 HEARING AIDS MARKET, BY TECHNOLOGY, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 HEARING AIDS MARKET, BY DISTRIBUTION CHANNEL, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 GEOGRAPHICAL SNAPSHOT OF HEARING AIDS MARKET

- FIGURE 18 INCREASING PREVALENCE OF HEARING LOSS AND GROWING GERIATRIC POPULATION TO DRIVE MARKET

- FIGURE 19 AUDIOLOGY AND ENT HOSPITALS & CLINICS ACCOUNTED FOR LARGEST SHARE IN ASIA PACIFIC IN 2024

- FIGURE 20 INDIA TO RECORD HIGHEST GROWTH RATE FROM 2025 TO 2030

- FIGURE 21 ASIA PACIFIC TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 22 HEARING AIDS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 HEARING AIDS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 COCHLEAR IMPLANTS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 25 HEARING AIDS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 HEARING AIDS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS

- FIGURE 28 KEY BUYING CRITERIA FOR MAJOR DISTRIBUTION CHANNEL

- FIGURE 29 PATENT ANALYSIS FOR HEARING AIDS, JANUARY 2015-DECEMBER 2024

- FIGURE 30 HEARING AIDS MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 31 HEARING AIDS MARKET: FUNDING AND NUMBER OF DEALS, 2020-2025

- FIGURE 32 AI USE CASES

- FIGURE 33 NORTH AMERICA: HEARING AIDS MARKET SNAPSHOT

- FIGURE 34 ASIA PACIFIC: HEARING DEVICES MARKET SNAPSHOT

- FIGURE 35 HEARING AIDS MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2022-2024 (USD MILLION)

- FIGURE 36 HEARING AIDS MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 37 RANKING OF KEY PLAYERS IN HEARING AIDS MARKET, 2024

- FIGURE 38 HEARING AIDS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 39 HEARING AIDS MARKET: COMPANY FOOTPRINT (KEY PLAYERS), 2024

- FIGURE 40 HEARING AIDS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 41 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS, 2025

- FIGURE 42 EV/EBITDA OF KEY VENDORS, 2025

- FIGURE 43 HEARING AIDS MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 44 SONOVA: COMPANY SNAPSHOT, 2024

- FIGURE 45 WSAUDIOLOGY: COMPANY SNAPSHOT, 2024

- FIGURE 46 DEMANT A/S: COMPANY SNAPSHOT, 2024

- FIGURE 47 COCHLEAR LTD.: COMPANY SNAPSHOT, 2024

- FIGURE 48 GN STORE NORD A/S: COMPANY SNAPSHOT, 2024

- FIGURE 49 RION CO., LTD.: COMPANY SNAPSHOT, 2024