|

市場調查報告書

商品編碼

1833647

助聽器市場機會、成長動力、產業趨勢分析及2025-2034年預測Hearing Aids Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

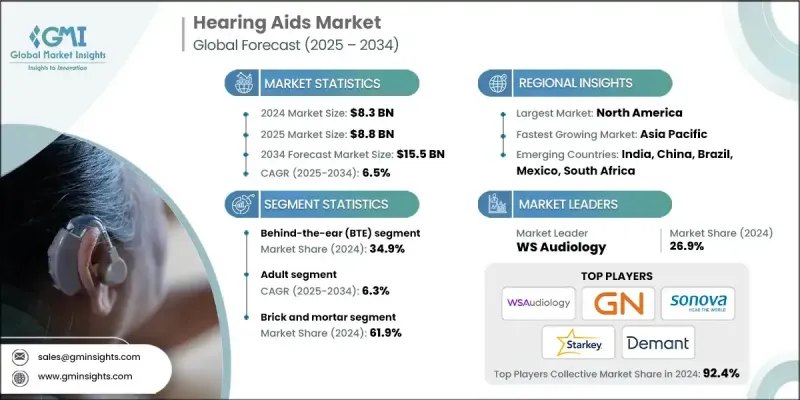

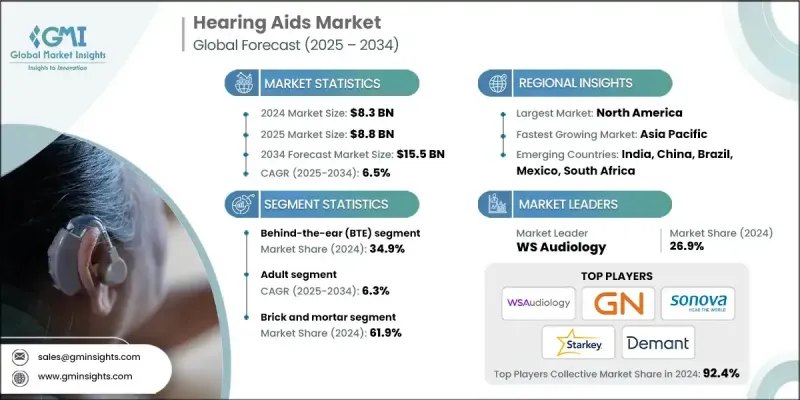

2024 年全球助聽器市場價值為 83 億美元,預計到 2034 年將以 6.5% 的複合年成長率成長至 155 億美元。

人口老化是助聽器市場最具影響力的促進因素之一,尤其是在北美、歐洲和亞洲部分地區等已開發地區。隨著預期壽命的延長,65歲以上族群的比例也不斷上升,而這個年齡層的人最容易罹患老年性耳聾,也就是與年齡相關的聽力損失。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 83億美元 |

| 預測值 | 155億美元 |

| 複合年成長率 | 6.5% |

耳背式(BTE)設備需求不斷成長

耳背式助聽器 (BTE) 憑藉其多功能性、耐用性以及適應各種聽力損失程度的能力,在 2024 年創造了可觀的收入。耳背式助聽器因其易於使用、電池續航時間更長以及能夠與輔助聽力技術整合而尤其受到老年人和兒童的青睞。人們日益青睞兼顧性能與舒適度的多功能助聽器,這有助於耳背式助聽器保持其競爭優勢。

成年人採用率不斷提高

2024年,成人市場佔據了相當大的佔有率,這得益於與年齡相關的聽力損失盛行率的上升。隨著數百萬成年人步入老年,聽力障礙變得越來越普遍,這刺激了對處方和非處方解決方案的需求。各大公司正在調整行銷策略,以吸引那些精通科技、注重可充電電池、智慧型手機整合和低調美觀等功能的老年消費者。

實體店面獲得發展

由於產品的臨床特性,實體店將在2025年至2034年期間達到可觀的複合年成長率。面對面的聽力評估、專業的驗配和售後支持,使得實體診所和聽力中心繼續成為首選的銷售管道,尤其對於首次使用者而言。個人化護理和現場測試產品的能力仍然是保持該管道相關性和韌性的關鍵優勢。

北美將成為利潤豐厚的地區

2024年,北美助聽器市場估值顯著提升,這得益於其人口老化、強大的醫療基礎設施以及廣泛的認知度。美國引領了高階助聽器和非處方助聽器的普及。監管支持,例如美國食品藥物管理局(FDA)對非處方設備的批准,正在推動助聽器的普及,並擴大消費者的選擇範圍。

助聽器市場的主要參與者有 Clariti Hearing、SOUNDWAVE HEARING、GN Store Nord、EARGO、Sonova、RION、Starkey、Audio Service、SeboTek Hearing Systems、Demant、Zounds Hearing、Ear Technology、WS Audiology、Audina Hearing Instruments 和 Nano Hearing Audiology

為了鞏固品牌地位並贏得市場佔有率,助聽器製造商正在整合產品創新、多通路分銷和直接面對消費者的推廣策略。許多製造商正在投資人工智慧聲音處理、基於應用程式的控制和可充電技術,以滿足現代用戶的期望。與零售藥局、眼鏡連鎖店和消費性電子產品商店建立策略合作夥伴關係,正在幫助品牌將業務範圍拓展到傳統聽力診所之外。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 聽力損失盛行率上升

- 老年人口不斷增加

- 對治療方案的認知不斷提高

- 政府的便利性舉措

- 產業陷阱與挑戰

- 助聽器價格高昂且缺乏報銷

- 發展中地區缺乏聽力損失和助聽器的知識

- 市場機會

- 助聽器與智慧型手機和穿戴式科技的整合

- 電子商務和遠距聽力學服務的興起

- 成長動力

- 成長潛力分析

- 報銷場景

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 技術格局

- 當前的技術趨勢

- 新興技術

- 非處方助聽器立法

- 需要非處方助聽器

- 立法和變化

- 影響評估

- 消費者途徑

- 傳統途徑

- 需要新的途徑

- 混合途徑

- 消費者洞察

- 政策格局

- 美國預防治療工作小組(USPSTF)

- 醫療保險聽力學家獲取和服務法案(MAASA)

- 投資者概覽

- 風險管理分析

- 研究與開發

- 營運

- 行銷和銷售

- 品質

- 智慧財產

- 監管

- 資訊科技

- 氣候

- 金融的

- 定價分析

- 差距分析

- 波特的分析

- PESTEL分析

- 未來市場趨勢

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲和中東地區

- 競爭定位矩陣

- 主要市場參與者的競爭分析

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 耳背式(BTE)

- 耳內接收器/耳道接收器(RITE/RIC)

- 完全耳道式/隱形耳道式(CIC/IIC)

- 耳內式 (ITE)

- 耳道內(ITC)

第6章:市場估計與預測:按患者,2021 - 2034 年

- 主要趨勢

- 成人

- 兒科

第7章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 實體店面

- 電子商務

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Audina Hearing Instruments

- Audio Service

- Clariti Hearing

- Demant

- Ear Technology

- EARGO

- GN Store Nord

- Nano Hearing Aids

- RION

- SeboTek Hearing Systems

- Sonova

- SOUNDWAVE HEARING

- Starkey

- WS Audiology

- Zounds Hearing

The Global Hearing Aids Market was valued at USD 8.3 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 15.5 billion by 2034.

The aging population is one of the most influential drivers of the hearing aids market, particularly in developed regions such as North America, Europe, and parts of Asia. As life expectancy continues to rise, so does the proportion of individuals aged 65 and older, an age group that is most susceptible to presbycusis, or age-related hearing loss.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.3 Billion |

| Forecast Value | $15.5 Billion |

| CAGR | 6.5% |

Rising Demand for Behind-the-Ear (BTE) Devices

The Behind-the-Ear (BTE) segment generated notable revenues in 2024 owing to its versatility, durability, and ability to accommodate a wide range of hearing loss levels. BTE devices are especially preferred for older adults and children because of their ease of use, longer battery life, and ability to integrate with assistive listening technologies. The growing preference for multifunctional devices that balance performance with comfort is helping BTE models maintain their competitive edge.

Increasing Adoption Among Adults

The adult segment held a sizeable share in 2024, driven by the rising prevalence of age-related hearing loss. As millions of adults enter their senior years, hearing impairment is becoming increasingly common, fueling demand for both prescription and over-the-counter solutions. Companies are tailoring their marketing strategies to appeal to tech-savvy older consumers who value features like rechargeable batteries, smartphone integration, and discreet aesthetics.

Brick-and-Mortar to Gain Traction

The brick-and-mortar will grow at a decent CAGR during 2025-2034, backed by the clinical nature of the product. In-person hearing assessments, professional fittings, and post-purchase support continue to make physical clinics and audiology centers the preferred point of sale, especially for first-time users. Personalized care and the ability to test products on-site remain key advantages that keep this channel relevant and resilient.

North America to Emerge as a Lucrative Region

North America hearing aids market garnered significant valuation in 2024, bolstered by its aging population, strong healthcare infrastructure, and widespread awareness. United States leads to the adoption of premium and over-the-counter hearing aids. Regulatory support, such as the FDA's approval of OTC devices, is driving accessibility and expanding consumer choice.

Major players in the hearing aids market are Clariti Hearing, SOUNDWAVE HEARING, GN Store Nord, EARGO, Sonova, RION, Starkey, Audio Service, SeboTek Hearing Systems, Demant, Zounds Hearing, Ear Technology, WS Audiology, Audina Hearing Instruments, and Nano Hearing Aids

To strengthen their presence and gain share, hearing aid manufacturers are deploying a combination of product innovation, multi-channel distribution, and direct-to-consumer outreach. Many are investing in AI-powered sound processing, app-based controls, and rechargeable technology to meet the expectations of modern users. Strategic partnerships with retail pharmacies, optical chains, and consumer electronics outlets are helping brands expand their reach beyond traditional audiology clinics.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Patient trends

- 2.2.4 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increase in prevalence of hearing loss

- 3.2.1.2 Rising geriatric population

- 3.2.1.3 Growing awareness regarding treatment options

- 3.2.1.4 Facilitative government initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of hearing aids and lack of reimbursement

- 3.2.2.2 Lack of knowledge regarding hearing loss and hearing aids in developing regions

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of hearing aids with smartphones and wearable tech

- 3.2.3.2 Rising e-commerce and tele-audiology services

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Reimbursement scenario

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 OTC hearing aids legislation

- 3.7.1 Need for OTC hearing aids

- 3.7.2 Legislation and changes

- 3.7.3 Impact assessment

- 3.8 Consumer pathway

- 3.8.1 Conventional pathway

- 3.8.2 Need for new pathway

- 3.8.3 Hybrid pathway

- 3.9 Consumer insights

- 3.10 Policy landscape

- 3.10.1 U.S. preventive treatments task force (USPSTF)

- 3.10.2 Medicare audiologist access and services act (MAASA)

- 3.11 Investor overview

- 3.12 Risk management analysis

- 3.12.1 Research and development

- 3.12.2 Operations

- 3.12.3 Marketing and sales

- 3.12.4 Quality

- 3.12.5 Intellectual property rights

- 3.12.6 Regulatory

- 3.12.7 Information technology

- 3.12.8 Climate

- 3.12.9 Financial

- 3.13 Pricing analysis

- 3.14 Gap analysis

- 3.15 Porter's analysis

- 3.16 PESTEL analysis

- 3.17 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Behind-the-ear (BTE)

- 5.3 Receiver in the ear/receiver in canal (RITE/RIC)

- 5.4 Completely-in-the-canal/invisible-in-canal (CIC/IIC)

- 5.5 In-the-ear (ITE)

- 5.6 In-the-canal (ITC)

Chapter 6 Market Estimates and Forecast, By Patient, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Adult

- 6.3 Pediatric

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Brick and mortar

- 7.3 E-commerce

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Audina Hearing Instruments

- 9.2 Audio Service

- 9.3 Clariti Hearing

- 9.4 Demant

- 9.5 Ear Technology

- 9.6 EARGO

- 9.7 GN Store Nord

- 9.8 Nano Hearing Aids

- 9.9 RION

- 9.10 SeboTek Hearing Systems

- 9.11 Sonova

- 9.12 SOUNDWAVE HEARING

- 9.13 Starkey

- 9.14 WS Audiology

- 9.15 Zounds Hearing