|

市場調查報告書

商品編碼

1843273

全球人工智慧編配市場(按產品、部署模式、應用和地區分類)- 預測至 2030 年AI Orchestration Market by Offering, Deployment Model, Application and Region - Global Forecast to 2030 |

||||||

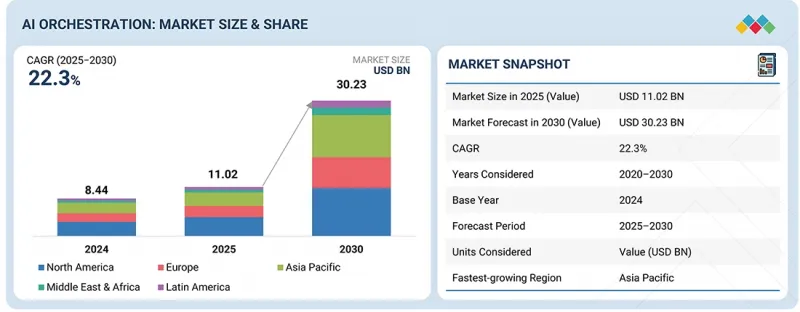

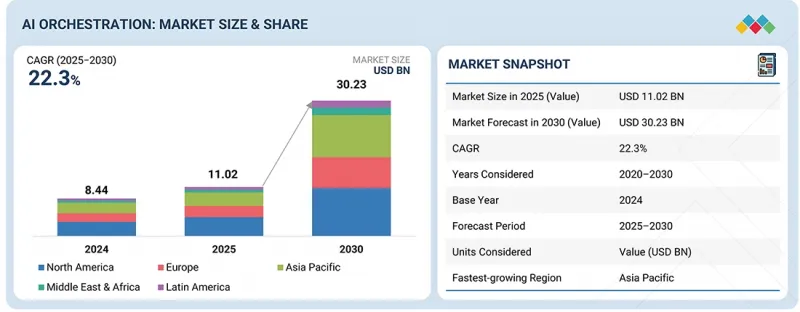

全球人工智慧編配市場預計將從 2025 年的 110.2 億美元成長到 2030 年的 302.3 億美元,複合年成長率為 22.3%。

| 調查範圍 | |

|---|---|

| 調查年份 | 2020-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 美元 |

| 部分 | 產品、編配架構、部署模型、用例、最終用戶、區域 |

| 目標區域 | 北美、歐洲、亞太地區、中東和非洲、拉丁美洲 |

隨著企業需要集中核准、沿襲追蹤和策略執行,並統一應用於IT和業務工作流程,對跨應用程式統一管治層的需求日益成長,這推動了業務成長。監管壓力也不斷加大,銀行、醫療保健和公共部門的合規框架促使買家需要一個審核的編配層,該編排層包含核准、角色感知核准和回滾控制。

這些因素正在推動人工智慧編配成為企業自動化策略的核心層,以透明的控制方式連接助手、工作流程和舊有系統。隨著企業在客戶服務、IT營運、安全、財務和供應鏈等用例中擴展編排操作,能夠將快速實現價值與管治、可攜式策略和可衡量的投資回報率相結合的供應商將引領採用。複雜的定價結構和跨功能的預算分類阻礙了企業級投入。此外,意外沖銷的可能性限制了人工智慧編配工具的自主性,並可能阻礙整體市場的擴張。

隨著公司從協助擴展到確保生產級行動,代理建立工具產品的需求將在預測期內激增。

代理建構工具已成為人工智慧編配領域的重要成長引擎,使團隊能夠在不影響資料管理的情況下快速行動。業務使用者可以使用預先建置的操作設定代理,而平台團隊則設定輸入和輸出、核准和限制,確保所有回寫操作均可追溯且可逆。這種責任分類縮短了建置時間,並確保了客戶服務、IT營運、財務和供應鏈管理等跨學科的一致管治。供應商提供針對常見任務(例如案例更新、授權檢查、資料搜尋和變更請求)的現成操作目錄。他們還提供評估套件,以協助制定部署前的測試計劃和工具選擇。

低程式碼和專業程式碼選項並行運行,使服務所有者組裝流程,並讓工程師無需返工即可添加安全連接器和自訂操作。定價(建構器席位和操作消耗的組合)根據實際使用情況進行調整,使各部門能夠從小規模起步,並充滿信心地進行擴展。隨著組織從試點擴展到基於策略的生產自動化,這些工具將充當新代理商的組裝,將一致的遠端檢測和證據輸入到編排器中。結果:更快的首次價值實現時間、更清晰的審核,以及在多租戶 SaaS、單一租戶 SaaS 或客戶管理的雲端環境中運行的可重複使用代理程式庫的不斷成長。

“規範的工作流程和可衡量的投資回報率促使 BFSI 最終用戶在 2025 年引領 AI編配的採用。”

BFSI 佔據了 AI編配市場中最大的最終用戶細分市場,這反映了其龐大的規模和嚴格的法律規範。金融機構面臨著簡化 KYC 更新、付款調查、貸款核准和索賠處理等流程的壓力,同時確保每一步都是審核的。編配平台提供了必要的治理管治,以確保行動受政策約束、核准基於角色執行,並為監管機構和審核記錄證據。這使銀行和保險公司能夠降低異常處理成本並加快解決時間,而不會影響合規性。 IBM、Palantir 和 UiPath 等供應商已經分享了 BFSI 組織的案例研究,其中精心策劃的工作流程減少了手動接觸點、確保了審核並提高了客戶滿意度。

本報告對全球人工智慧編配市場進行了分析,提供了關鍵促進因素和限制因素、競爭格局和未來趨勢的資訊。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章 主要發現

- AI編配市場為企業帶來誘人機會

- 人工智慧編配市場:三大主要應用

- 北美人工智慧編配市場(按部署模型和軟體)

- 人工智慧編配市場(按地區)

第5章市場概況及產業趨勢

- 介紹

- 市場動態

- 驅動程式

- 抑制因素

- 機會

- 任務

- 人工智慧編配的演變

- 供應鏈分析

- 生態系分析

- 代理編配平台提供商

- Agent Builder 工具提供者

- 工作流程編配供應商

- 模型服務平台提供者

- 資料編配供應商

- 基礎設施編配供應商

- 服務供應商

- 2025年美國關稅的影響 - 人工智慧編配市場

- 介紹

- 主要關稅稅率

- 價格影響分析

- 對國家的影響

- 對終端產業的影響

- 投資金籌措場景

- 案例研究分析

- 技術分析

- 主要技術

- 互補技術

- 鄰近技術

- 監管格局

- 監管機構、政府機構和其他組織

- 規定

- 專利分析

- 調查方法

- 按文獻類型分類的專利申請(2016-2025 年)

- 創新與專利申請

- 定價分析

- 主要企業的平均銷售價格(2025 年)

- 每次使用的平均銷售價格(2025年)

- 大型會議和活動(2025-2026)

- 波特五力分析

- 主要相關利益者和採購標準

- 影響客戶業務的趨勢/中斷

第6章:人工智慧編配市場(按產品)

- 介紹

- 軟體

- AI編配平台

- Agent Builder 工具

- 工作流程編配平台

- 數據編配平台

- 模型服務平台

- 基礎設施編配平台

- 服務

- 專業服務

- 託管服務

第 7 章:依編配架構分類的 AI編配市場

- 介紹

- 集中式編配

- 去中心化編配

- 分散式編配

- 混合編配

第 8 章:按部署模型分類的 AI編配市場

- 介紹

- 單一租戶 SaaS

- 多租戶 SaaS

- 客戶管理雲

- 本地空氣間隙

第 9 章:按應用分類的 AI編配市場

- 介紹

- 客戶服務自動化

- 銷售和收益自動化

- 行銷自動化

- IT服務管理

- 安全服務

- 財務和採購自動化

- 供應鏈自動化

- 人力資源/員工服務台

- 企業知識搜尋

- 軟體工程編碼自動化

- 現場服務和資產管理

- 其他用途

第 10 章:以最終用戶分類的 AI編配市場

- 介紹

- BFSI

- 零售和消費品

- 專業服務提供者

- 醫學與生命科學

- 通訊

- 軟體和技術供應商

- 媒體與娛樂

- 物流與運輸

- 政府/國防

- 車

- 能源與公共產業

- 製造業

- 其他最終用戶

第 11 章:按地區分類的 AI編配市場

- 介紹

- 北美洲

- 北美人工智慧編配市場促進因素

- 北美宏觀經濟展望

- 美國

- 加拿大

- 歐洲

- 歐洲人工智慧編配市場的促進因素

- 歐洲宏觀經濟展望

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 其他歐洲國家

- 亞太地區

- 亞太地區人工智慧編配市場促進因素

- 亞太宏觀經濟展望

- 中國

- 印度

- 日本

- 韓國

- 新加坡

- 澳洲紐西蘭(ANZ)

- 其他亞太地區

- 中東和非洲

- 中東和非洲人工智慧編配市場的促進因素

- 中東和非洲的宏觀經濟展望

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 土耳其

- 卡達

- 其他中東和非洲地區

- 拉丁美洲

- 拉丁美洲人工智慧編配市場促進因素

- 拉丁美洲宏觀經濟展望

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲

第12章 競爭格局

- 概述

- 主要參與企業的策略(2020-2025)

- 收益分析(2020-2024)

- 市佔率分析(2024年)

- 品牌/產品比較

- 代理編配平台產品比較分析

- 產品比較分析:Agent Builder 工具

- 工作流程編配平台產品比較分析

- 主要供應商的公司估值和財務指標

- 企業評估矩陣:主要企業(2024年)

- 公司評估矩陣:Start-Ups/中小企業(2024 年)

- 競爭場景

第13章:公司簡介

- 介紹

- 主要企業

- IBM

- AMAZON WEB SERVICES

- SALESFORCE

- ADOBE

- MICROSOFT

- SAP

- COFORGE

- SERVICENOW

- UIPATH

- NVIDIA

- LIVEPERSON

- GENESYS

- PALANTIR

- KORE.AI

- ALTAIR

- YELLOW.AI

- GLEAN

- DIGITAL.AI

- WORKATO

- APPIAN

- 其他公司

- SOLACE

- JITTERBIT

- SNAPLOGIC

- AISERA

- ONEREACH.AI

- DOMINO DATA LABS

- ANYSCALE

- FORETHOUGHT.AI

- VUE.AI (MAD STREET DEN)

- RAFAY SYSTEMS

- SPACELIFT.IO

- AIRIA

- DAGSTER LABS

- HUMANITEC

- TONKEAN

- AKKA.IO

- SPARKBEYOND

- UNION.AI

- ORKES

- TENEO.AI

- ORBY AI (UNIPHORE)

- MULTIMODAL.DEV

- HOPSWORKS

第14章:相鄰市場與相關市場

- 介紹

- 代理人工智慧市場 - 全球預測(至 2032 年)

- 市場定義

- 市場概況

- 人工智慧平台市場 - 全球預測(至 2030 年)

- 市場定義

- 市場概況

第15章 附錄

The global AI orchestration market size is projected to grow from USD 11.02 billion in 2025 to USD 30.23 billion by 2030, at a CAGR of 22.3%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD (Million) |

| Segments | Offering, Orchestration Architecture, Deployment Model, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

Growth is being driven by the increasing need for a unified governance layer across applications, as organizations seek centralized approvals, lineage tracking, and policy enforcement that apply uniformly across IT and business workflows. Regulatory pressure is also adding momentum, with compliance frameworks in banking, healthcare, and the public sector driving buyers toward audit-ready orchestration layers that incorporate evidence, role-aware approvals, and rollback controls.

These factors are turning AI orchestration into the central layer of enterprise automation strategies, bridging assistants, workflows, and legacy systems with transparent controls. Vendors that can combine fast time-to-value with governance, portable policies, and measurable ROI are expected to lead adoption as enterprises expand orchestrated actions across customer service, IT operations, security, finance, and supply chain use cases. The intricate nature of pricing structures and the division of budgets across functions are impeding enterprise-level commitments. Additionally, the potential for unintentional write-backs is constraining the autonomy of AI orchestration tools, which could hinder overall market expansion.

"Agent builder tools offering to witness breakout demand over the forecast period as enterprises scale from assist to safe, production-grade actions"

Agent builder tools are emerging as a standout growth engine within AI orchestration, enabling teams to move quickly without compromising data control. Business users can compose agents with prebuilt actions, while platform teams set typed inputs and outputs, approvals, and limits, ensuring that every write-back is traceable and reversible. Dividing responsibilities helps reduce build time and ensures consistent governance across various areas, including customer service, IT operations, finance, and supply chain management. Vendors are providing catalogs of ready-to-use actions for common tasks such as case updates, entitlement checks, data lookups, and change requests. Additionally, they offer evaluation kits to assist with testing plans and selecting tools before implementation.

Low-code and pro-code options run side by side, allowing a service owner to assemble a flow and an engineer to add secure connectors or custom actions without requiring rework. Pricing aligns with real usage, featuring a mix of builder seats and action consumption, which enables departments to start small and scale with confidence. As organizations expand from pilots to live, policy-bound automation, these tools act as the assembly line for new agents, feeding orchestrators with consistent telemetry and evidence. The result is a faster time to first value, cleaner audits, and a growing library of reusable agents that run across multi-tenant SaaS, single-tenant SaaS, or customer-managed cloud environments.

"BFSI end user leads AI orchestration adoption in 2025, driven by regulated workflows and measurable ROI"

Banking, financial services, and insurance (BFSI) represent the largest end-user segment in the AI orchestration market, reflecting the scale of operations and the intensity of regulatory oversight. Institutions are under pressure to streamline processes such as KYC updates, payment investigations, loan approvals, and claims handling while keeping every step auditable. Orchestration platforms provide the governance layer necessary to ensure that actions are bound by policy, approvals are enforced based on role, and evidence is logged for regulators and auditors. This helps banks and insurers reduce exception handling costs and expedite resolution times without compromising compliance. Vendors such as IBM, Palantir, and UiPath have already showcased BFSI case studies where orchestrated workflows reduced manual touchpoints, ensured audit readiness, and improved customer satisfaction scores.

Growth is reinforced by the high transaction volume and risk profile of BFSI operations, which makes orchestration's combination of speed and control especially attractive. For example, orchestrated agents can automatically flag anomalies, assemble evidence, and route approvals in payment flows, while ensuring that rollback is always possible. BFSI is expected to contribute the largest revenue share in 2025 and set the pace for adoption in other regulated industries, demonstrating that AI orchestration can deliver both efficiency and compliance at scale.

"North America will have the largest market share in 2025, and Asia Pacific is slated to grow at the fastest rate during the forecast period"

North America is set to capture the largest share of AI orchestration revenue in 2025, anchored by the US with additional momentum from Canada. Enterprises in the region are moving beyond pilots and are standardizing on an orchestration layer that can execute approved actions inside CRM, ERP, ITSM, and data platforms with full evidence. Demand is strongest in banking, healthcare, telecom, software, and public sector programs where audit trails, identity scopes, and clean rollback are non-negotiable. The region benefits from deep hyperscaler footprints and a dense network of global system integrators and boutique specialists that package certified connectors, industry playbooks, and managed services. Buyers also favor deployment choice.

Customer-managed and single-tenant options are commonly used for sensitive workloads, while multi-tenant SaaS supports rapid entry and departmental expansion. Procurement teams request unit economics dashboards, exportable run telemetry, and reference architectures that integrate with existing observability stacks. As organizations expand from assist use cases to governed write-backs and broaden coverage across service, operations, and finance, North America's large installed base and compliance intensity sustain leadership and drive multi-year, portfolio-level rollouts across Fortune 1000 accounts.

Meanwhile, Asia Pacific is expected to record the fastest growth through 2025-2030 as large, distributed enterprises push for efficiency and local regulators clarify rules for responsible AI. Telecom operators, manufacturers, banks, and public agencies in India, China, Japan, and South Korea are scaling programs that connect planning, tool execution, and approvals in one governed run. Growth is facilitated by rising cloud adoption, local data center build-outs, and the need to automate exception-heavy processes across shared-service hubs and field operations. Vendors are tailoring offers to regional needs with localized connectors, language support, and deployment choices that include customer-managed cloud and on-premises runtimes for data residency and key control.

Partners in the region, including global system integrators, local consulting firms, and channel providers, are creating rapid-start kits for various use cases such as customer service automation, IT incident response, and handling non-conformance issues. These kits help organizations achieve quicker returns on investment. As companies assess improvements in cycle time, accuracy, and cost-to-serve, they are likely to shift their budgets from experimentation to expansion. This trend positions the Asia Pacific region as the most dynamic growth driver for AI orchestration in the coming years.

Breakdown of Primaries

In-depth interviews were conducted with chief executive officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the AI orchestration market.

- By Company: Tier I - 33%, Tier II - 44%, and Tier III - 23%

- By Designation: C-Level Executives - 36%, D-Level Executives - 41%, and others - 23%

- By Region: North America - 39%, Europe - 18%, Asia Pacific - 32%, Middle East & Africa - 4%, and Latin America - 7%

The report includes the study and in-depth company profiles of key players offering AI orchestration software and services. The major players in the AI orchestration market include IBM (US), AWS (US), Salesforce (US), Adobe (US), Microsoft (US), SAP (Germany), Google (US), Coforge (India), ServiceNow (US), UiPath (US), NVIDIA (US), LivePerson (US), Genesys (US), Palantir (US), Kore.ai (US), Altair (US), Yellow.ai (US), Glean (US), Digital.ai (US), Workato (US), Appian (US), Solace (Canada), Jitterbit (US), SnapLogic (US), Aisera (US), OneReach.ai (US), Domino Data Labs (US), Anyscale (US), Forethought.ai (US), Vue.ai (US), Rafay Systems (US), Spacelift.io (US), Airia (US), Dagster Labs (US), Humanitec (Germany), Tonkean (US), Akka.io (US), SparkBeyond (US), Union.ai (US), Orkes (US), Teneo.ai (Sweden), Orby AI (US), Multimodal.dev (US), and Hopsworks (Sweden).

Research Coverage

This research report categorizes the AI orchestration market by offering, orchestration architecture, deployment model, application, and end user. The offering segment is split into AI orchestration software and AI orchestration services. The software segment is further split into agent orchestration platforms, agent builder tools, workflow orchestration platforms, data orchestration platforms, model serving platforms, and infrastructure orchestration platforms. The services segment comprises managed services and professional services (training and consulting, system integration and implementation, and support and maintenance). The orchestration architecture segment includes centralized orchestration, decentralized orchestration, distributed orchestration, and hybrid orchestration. The deployment model segment spans single tenant SaaS, multi-tenant SaaS, customer managed cloud, and on premises & air gapped deployment.

Application segment covers customer service automation, sales & revenue automation, marketing automation, IT service management, security operations, finance & procurement automation, supply chain automation, HR & employee service desk, enterprise knowledge search, software engineering & coding automation, field service & asset operations, and other applications (legal operations & contract lifecycle, risk & internal audit, and research & lab workflows). The end user segment is split into BFSI, retail & CPG, professional service providers, healthcare & life sciences, telecommunications, software & technology providers, media & entertainment, logistics & transportation, government & defense, automotive, energy & utilities, manufacturing, and other enterprises (education, travel & hospitality, and construction & real estate). The regional analysis of the AI orchestration market covers North America, Europe, Asia Pacific, the Middle East & Africa (MEA), and Latin America.

The report's scope encompasses detailed information on the major factors, including drivers, restraints, challenges, and opportunities, that influence the growth of the AI orchestration market. A detailed analysis of key industry players has been conducted to provide insights into their business overview, solutions, and services, as well as key strategies, contracts, partnerships, agreements, new product & service launches, mergers and acquisitions, and recent developments associated with the AI orchestration market. This report covers the competitive analysis of upcoming startups in the AI orchestration market ecosystem.

Key Benefits of Buying the Report

The report will provide market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall AI orchestration market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to better position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

Analysis of key drivers (enterprise shift from reactive chat to governed, outcome-linked automation; AI orchestration reducing cost-to-serve and time-to-resolution by executing system actions; need for a common governance layer across apps to centralize approvals, lineage, and policy enforcement; stringent focus on regulatory compliance pushing buyers toward governed AI orchestration), restraints (pricing complexity and cross-function budget splits stalling enterprise-wide commitments; risk of unintended write-backs limiting autonomy and efficiency of AI orchestration tools), opportunities (demand for sovereign and air-gapped AI orchestration in public sector and regulated industries; replacement of overlapping RPA, iPaaS, and workflow stacks with AI orchestration suites; prebuilt template libraries and certified action packs accelerating ROI cycles for mid-market), and challenges (enterprise app sprawl across multi-cloud environments causing vendor lock-in concerns; end-to-end observability across multi-agent orchestration remains complex)

Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and new product & service launches in the AI orchestration market

Market Development: Comprehensive information about lucrative markets - analysis of the AI orchestration market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the AI orchestration market

Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of IBM (US), AWS (US), Salesforce (US), Adobe (US), Microsoft (US), SAP (Germany), Google (US), Coforge (India), ServiceNow (US), UiPath (US), NVIDIA (US), LivePerson (US), Genesys (US), Palantir (US), Kore.ai (US), Altair (US), Yellow.ai (US), Glean (US), Digital.ai (US), Workato (US), Appian (US), Solace (Canada), Jitterbit (US), SnapLogic (US), Aisera (US), OneReach.ai (US), Domino Data Labs (US), Anyscale (US), Forethought.ai (US), Vue.ai (US), Rafay Systems (US), Spacelift.io (US), Airia (US), Dagster Labs (US), Humanitec (Germany), Tonkean (US), Akka.io (US), SparkBeyond (US), Union.ai (US), Orkes (US), Teneo.ai (Sweden), Orby AI (US), Multimodal.dev (US), and Hopsworks (Sweden), among others, in the AI orchestration market. The report also helps stakeholders understand the pulse of the AI orchestration market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- 3.1 RISE OF AI ORCHESTRATION

- 3.2 UNDERSTANDING AI ORCHESTRATION: SCOPE AND BOUNDARIES

- 3.2.1 CONTROL PLANE VS. EXECUTION PLANE VS. DATA PLANE

- 3.2.2 GOVERNANCE, EVALUATION, AND OBSERVABILITY LOOPS

- 3.2.3 BOUNDARIES VS. IPAAS, RPA, AND AI ORCHESTRATION

- 3.3 PACKAGING AND MONETIZATION

- 3.3.1 STANDALONE ORCHESTRATOR SKUS VS. SUITE COMPONENTS

- 3.3.2 PRIMARY PRICING METRICS: USER, TASK, TOKEN, RUNTIME

- 3.3.3 CONNECTOR AND ACTION MONETIZATION

- 3.4 KPIS AND VALUE REALIZATION

- 3.4.1 AUTOMATION RATE, COST PER TASK, AND MTTR

- 3.4.2 ACCURACY, COMPLIANCE, AND AUDIT READINESS

- 3.4.3 ADOPTION, SEAT INTENSITY, AND ROI PROOF POINTS

- 3.5 STRATEGIC IMPERATIVES FOR DECISION-MAKERS

- 3.5.1 CHOOSING ORCHESTRATION TYPE ALIGNED TO WORKLOAD

- 3.5.2 LANDING WITH GOVERNED PILOT AND MEASURABLE KPIS

- 3.5.3 BUILDING OPERATING MODEL: STEWARDSHIP, APPROVALS, RUNBOOKS

- 3.5.4 SCALING THROUGH TEMPLATES, CONNECTOR COVERAGE, AND GUARDRAILS

- 3.6 OUTLOOK AND NEXT HORIZONS

- 3.6.1 STANDARDIZATION OF TOOLS, ACTIONS, AND POLICIES

- 3.6.2 MULTI-AGENT COORDINATION MATURITY

- 3.6.3 AUTONOMOUS OPERATIONS IN REGULATED ENVIRONMENTS

- 3.7 VENDOR LANDSCAPE AND MARKET TRENDS

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AI ORCHESTRATION MARKET

- 4.2 AI ORCHESTRATION MARKET, BY TOP THREE APPLICATIONS

- 4.3 NORTH AMERICA: AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL AND SOFTWARE

- 4.4 AI ORCHESTRATION MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Enterprise shift from reactive chat to governed, outcome-linked automation

- 5.2.1.2 AI orchestration reducing cost-to-serve and time-to-resolution by executing system actions

- 5.2.1.3 Need for common governance layer across apps to centralize approvals, lineage, and policy enforcement

- 5.2.1.4 Stringent focus on regulatory compliance to push buyers toward governed AI orchestration

- 5.2.2 RESTRAINTS

- 5.2.2.1 Pricing complexity and cross-function budget splits stalling enterprise-wide commitments

- 5.2.2.2 Risk of unintended write-backs limiting autonomy and efficiency of AI orchestration tools

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Demand for sovereign and air-gapped AI orchestration in public sector and regulated industries

- 5.2.3.2 Replacement of overlapping RPA, iPaaS, and workflow stacks with AI orchestration suites

- 5.2.3.3 Prebuilt template libraries and certified action packs accelerating ROI cycles for mid-market

- 5.2.4 CHALLENGES

- 5.2.4.1 Enterprise app sprawl across multi-cloud environments to cause vendor lock-in concerns

- 5.2.4.2 End-to-end observability across multi-agent orchestration to build complexity

- 5.2.1 DRIVERS

- 5.3 EVOLUTION OF AI ORCHESTRATION

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 AGENT ORCHESTRATION PLATFORM PROVIDERS

- 5.5.2 AGENT BUILDER TOOL PROVIDERS

- 5.5.3 WORKFLOW ORCHESTRATION PROVIDERS

- 5.5.4 MODEL SERVING PLATFORM PROVIDERS

- 5.5.5 DATA ORCHESTRATION PROVIDERS

- 5.5.6 INFRASTRUCTURE ORCHESTRATION PROVIDERS

- 5.5.7 SERVICE PROVIDERS

- 5.6 IMPACT OF 2025 US TARIFF - AI ORCHESTRATION MARKET

- 5.6.1 INTRODUCTION

- 5.6.1.1 Tariff/Trade policy updates (Aug-Sep 2025)

- 5.6.2 KEY TARIFF RATES

- 5.6.3 PRICE IMPACT ANALYSIS

- 5.6.3.1 Strategic shifts and emerging trends

- 5.6.4 IMPACT ON COUNTRY/REGION

- 5.6.4.1 US

- 5.6.4.2 China

- 5.6.4.3 Europe

- 5.6.4.4 Asia Pacific (excluding China)

- 5.6.5 IMPACT ON END-USE INDUSTRIES

- 5.6.5.1 BFSI

- 5.6.5.2 Telecommunications

- 5.6.5.3 Government & public sector

- 5.6.5.4 Healthcare & life sciences

- 5.6.5.5 Manufacturing

- 5.6.5.6 Retail & e-commerce

- 5.6.5.7 Software & technology providers

- 5.6.1 INTRODUCTION

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 BOOKING.COM SCALES AI TO 14,000 EMPLOYEES WITH GLEAN ASSISTANT

- 5.8.2 ASTRAZENECA ACCELERATES DRUG DISCOVERY WITH AMAZON BEDROCK AGENT ORCHESTRATION

- 5.8.3 TAMPA GENERAL HOSPITAL IMPROVES PATIENT FLOW WITH PALANTIR AIP

- 5.8.4 HOLLAND AMERICA LINE LAUNCHES "ANNA" WITH MICROSOFT COPILOT STUDIO

- 5.8.5 HERITAGE BANK STREAMLINES OPERATIONS WITH UIPATH AI-POWERED ORCHESTRATION

- 5.8.6 FANATICS CONSOLIDATES CX ORCHESTRATION ON GENESYS CLOUD AI

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Language model inference and routing

- 5.9.1.2 Embeddings and vector indexing

- 5.9.1.3 Ontologies and knowledge graphs

- 5.9.1.4 Policy-as-code

- 5.9.1.5 Function invocation semantics

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 On-device/edge compute

- 5.9.2.2 Data quality and lineage

- 5.9.2.3 Chaos/resilience testing

- 5.9.2.4 Caching and optimization

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 iPaaS and BPM engines

- 5.9.3.2 AIOps and observability

- 5.9.3.3 Data warehouse and feature stores

- 5.9.3.4 API management and service networking

- 5.9.1 KEY TECHNOLOGIES

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 REGULATIONS

- 5.10.2.1 North America

- 5.10.2.1.1 Executive Order 14110 on Safe, Secure, and Trustworthy AI (US)

- 5.10.2.1.2 Artificial Intelligence and Data Act-AIDA (Canada)

- 5.10.2.2 Europe

- 5.10.2.2.1 Europe Artificial Intelligence Act (European Union)

- 5.10.2.2.2 General Data Protection Regulation (European Union)

- 5.10.2.2.3 Data Protection Act 2018 (UK)

- 5.10.2.2.4 Federal Data Protection Act (Germany)

- 5.10.2.2.5 French Data Protection Act (France)

- 5.10.2.2.6 Personal Data Protection Code-Legislative Decree 196/2003 (Italy)

- 5.10.2.2.7 Organic Law 3/2018 (Spain)

- 5.10.2.2.8 UAVG and Public-sector Algorithm Transparency (Netherlands)

- 5.10.2.3 Asia Pacific

- 5.10.2.3.1 Interim Measures for the Management of Generative AI Services (China)

- 5.10.2.3.2 Digital Personal Data Protection Act, 2023 (India)

- 5.10.2.3.3 Act on the Protection of Personal Information (Japan)

- 5.10.2.3.4 Basic Act on Artificial Intelligence (South Korea)

- 5.10.2.3.5 Personal Data Protection Act (Singapore)

- 5.10.2.4 Middle East & Africa

- 5.10.2.4.1 Federal Decree-Law No. 45 of 2021 on the Protection of Personal Data (UAE)

- 5.10.2.4.2 Personal Data Protection Law (KSA)

- 5.10.2.4.3 Protection of Personal Information Act (South Africa)

- 5.10.2.4.4 Personal Data Privacy Protection Law (Qatar)

- 5.10.2.4.5 Law on the Protection of Personal Data No. 6698 (Turkey)

- 5.10.2.5 Latin America

- 5.10.2.5.1 General Data Protection Law - LGPD (Brazil)

- 5.10.2.5.2 Federal Law on Protection of Personal Data Held by Private Parties (Mexico)

- 5.10.2.5.3 Personal Data Protection Law No. 25,326 (Argentina)

- 5.10.2.1 North America

- 5.11 PATENT ANALYSIS

- 5.11.1 METHODOLOGY

- 5.11.2 PATENTS FILED, BY DOCUMENT TYPE, 2016-2025

- 5.11.3 INNOVATION AND PATENT APPLICATIONS

- 5.12 PRICING ANALYSIS

- 5.12.1 AVERAGE SELLING PRICE OF OFFERINGS, BY KEY PLAYER, 2025

- 5.12.2 AVERAGE SELLING PRICE OF APPLICATIONS, 2025

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITION RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

6 AI ORCHESTRATION MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 DRIVERS: AI ORCHESTRATION MARKET, BY OFFERING

- 6.2 SOFTWARE

- 6.2.1 AI ORCHESTRATION PLATFORMS

- 6.2.1.1 Enforcing typed tools, approvals, and telemetry to convert pilots into enterprise-scale

- 6.2.2 AGENT BUILDER TOOLS

- 6.2.2.1 Leveraging schema-first catalogs and reusable plans to cut time to value

- 6.2.3 WORKFLOW ORCHESTRATION PLATFORMS

- 6.2.3.1 Expanding automation while preventing shadow processes

- 6.2.4 DATA ORCHESTRATION PLATFORMS

- 6.2.4.1 With lineage and quality gates, keeping agent decisions grounded in trusted, timely data

- 6.2.5 MODEL SERVING PLATFORMS

- 6.2.5.1 Balancing latency, quality, and spend through monitored, cost-aware endpoints

- 6.2.6 INFRASTRUCTURE ORCHESTRATION PLATFORMS

- 6.2.6.1 Rightsizing GPU capacity and delivering reliable hybrid scaling

- 6.2.1 AI ORCHESTRATION PLATFORMS

- 6.3 SERVICES

- 6.3.1 PROFESSIONAL SERVICES

- 6.3.1.1 Training & consulting services

- 6.3.1.1.1 Cross-functional enablement to accelerate adoption of live workflows

- 6.3.1.2 System integration & implementation services

- 6.3.1.2.1 Wiring agents to systems of record with identity, connectors, and rollback paths

- 6.3.1.3 Support & maintenance services

- 6.3.1.3.1 Adding orchestration-aware monitoring to improve orchestration reliability

- 6.3.1.1 Training & consulting services

- 6.3.2 MANAGED SERVICES

- 6.3.2.1 Implementing orchestration with embedded governance, cost control, and SLA-backed uptime

- 6.3.1 PROFESSIONAL SERVICES

7 AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE

- 7.1 INTRODUCTION

- 7.1.1 DRIVERS: AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE

- 7.2 CENTRALIZED ORCHESTRATION

- 7.2.1 CONCENTRATES POLICY AND EVIDENCE TO SCALE CONTROL WITH CLARITY

- 7.3 DECENTRALIZED ORCHESTRATION

- 7.3.1 MULTI-TENANT SAAS DELIVERS QUICKEST PATH FROM PILOT TO MEASURABLE OUTCOMES

- 7.4 DISTRIBUTED ORCHESTRATION

- 7.4.1 OPTIMIZES RESILIENCE AND LOCALITY ACROSS MULTIPLE RUNTIMES

- 7.5 HYBRID ORCHESTRATION

- 7.5.1 ROUTES WORK BY RISK AND PERFORMANCE WHILE PRESERVING CONSISTENT POLICY

8 AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL

- 8.1 INTRODUCTION

- 8.1.1 DRIVERS: AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL

- 8.2 SINGLE TENANT SAAS

- 8.2.1 BALANCING ISOLATION AND AGILITY WITH PROVIDER MANAGED OPERATIONS

- 8.3 MULTI-TENANT SAAS

- 8.3.1 DELIVERING QUICKEST PATH FROM PILOT TO MEASURABLE OUTCOMES

- 8.4 CUSTOMER MANAGED CLOUD

- 8.4.1 MAXIMIZING SOVEREIGNTY AND COST GOVERNANCE WITHIN CUSTOMER SUBSCRIPTIONS

- 8.5 ON-PREMISES & AIR-GAPPED

- 8.5.1 ADDRESSING HIGHEST BARS FOR ISOLATION AND LOCALITY

9 AI ORCHESTRATION MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.1.1 DRIVERS: AI ORCHESTRATION MARKET, BY APPLICATION

- 9.2 CUSTOMER SERVICE AUTOMATION

- 9.2.1 TURNING INTENT INTO FIRST-CONTACT RESOLUTION WITH GOVERNED WRITE-BACKS

- 9.3 SALES & REVENUE AUTOMATION

- 9.3.1 SEQUENCING APPROVALS AND UPDATES FOR PIPELINES TO MOVE WITH FEWER STALLS

- 9.4 MARKETING AUTOMATION

- 9.4.1 ORCHESTRATING COMPLIANT CAMPAIGNS WITH SHARED GUARDRAILS AND REUSABLE PLAYBOOKS

- 9.5 IT SERVICE MANAGEMENT

- 9.5.1 CONVERTING TICKETS INTO GOVERNED ACTIONS WITH REPEATABLE AGENT HANDOFFS

- 9.6 SECURITY OPERATIONS

- 9.6.1 USING POLICY BOUND ORCHESTRATIONS TO REDUCE DWELL TIME AND FALSE POSITIVES

- 9.7 FINANCE & PROCUREMENT AUTOMATION

- 9.7.1 ENFORCING SEPARATION OF DUTIES WHILE ACCELERATING CLOSE AND PAY CYCLES

- 9.8 SUPPLY CHAIN AUTOMATION

- 9.8.1 SYNCHRONIZING PLAN, SOURCE, MAKE, AND DELIVERY WITH GOVERNED CORRECTIVE ACTIONS

- 9.9 HR & EMPLOYEE SERVICE DESK

- 9.9.1 STREAMLINING REQUESTS AND CHANGES WITH ROLE-AWARE APPROVALS

- 9.10 ENTERPRISE KNOWLEDGE SEARCH

- 9.10.1 PAIRING RETRIEVAL WITH ACTION SO ANSWERS BECOME COMPLETED TASKS

- 9.11 SOFTWARE ENGINEERING & CODING AUTOMATION

- 9.11.1 ACCELERATING DELIVERY WHILE SAFEGUARDING CODE AND CHANGE CONTROL

- 9.12 FIELD SERVICE & ASSET OPERATIONS

- 9.12.1 COORDINATING SCHEDULING, PARTS, AND WORK ORDERS UNDER ONE GOVERNED RUN

- 9.13 OTHER APPLICATIONS

10 AI ORCHESTRATION MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.1.1 DRIVERS: AI ORCHESTRATION MARKET, BY END USER

- 10.2 BFSI

- 10.2.1 TARGETING EXCEPTION-HEAVY JOURNEYS WITH ORCHESTRATIONS THAT PROVE CONTROL AND SHORTEN CYCLE TIME

- 10.3 RETAIL & CPG

- 10.3.1 FOCUSING ON FULFILLMENT RELIABILITY, MARGIN DISCIPLINE, AND CUSTOMER MOMENTS THAT CONVERT

- 10.4 PROFESSIONAL SERVICE PROVIDERS

- 10.4.1 PRODUCTIZING DELIVERY WITH REUSABLE PLAYBOOKS AND CLIENT-GRADE EVIDENCE

- 10.5 HEALTHCARE & LIFE SCIENCES

- 10.5.1 SEEKING SAFER THROUGHPUT IN PATIENT AND STUDY WORKFLOWS WITH PRIVACY-FIRST CONTROLS

- 10.6 TELECOMMUNICATIONS

- 10.6.1 PRIORITIZING ASSURANCE AND SERVICE CHANGES WHERE UPTIME AND TENURE ARE AT STAKE

- 10.7 SOFTWARE & TECHNOLOGY PROVIDERS

- 10.7.1 LEVERAGING AI ORCHESTRATION TO SCALE CUSTOMER OPERATIONS WITH EMBEDDED GUARDRAILS

- 10.8 MEDIA & ENTERTAINMENT

- 10.8.1 ORCHESTRATING SUPPLY CHAINS OF CONTENT, RIGHTS, AND PERSONALIZATION AT INDUSTRIAL SCALE

- 10.9 LOGISTICS & TRANSPORTATION

- 10.9.1 COMPRESSING LEAD, MOVE, AND DELIVER CYCLES WITH GOVERNED CORRECTIVE ACTIONS

- 10.10 GOVERNMENT & DEFENSE

- 10.10.1 PRIORITIZING MISSION ASSURANCE WITH AUDITABLE, POLICY-BOUND ORCHESTRATION

- 10.11 AUTOMOTIVE

- 10.11.1 TURNING ENGINEERING AND SERVICE WORKFLOWS INTO CLOSED LOOPS THAT PROTECT SAFETY AND MARGIN

- 10.12 ENERGY & UTILITIES

- 10.12.1 COORDINATING GRID AND ASSET DECISIONS WITH SAFETY, LOCALITY, AND EVIDENCE FRONT AND CENTER

- 10.13 MANUFACTURING

- 10.13.1 SCALING CONTINUOUS IMPROVEMENT BY WIRING DECISIONS TO GOVERNED ACTIONS ON SHOP FLOOR

- 10.14 OTHER END USERS

11 AI ORCHESTRATION MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: AI ORCHESTRATION MARKET DRIVERS

- 11.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.3 US

- 11.2.3.1 Consolidation from scattered copilots to governed control planes delivering closed-loop actions with auditable KPIs

- 11.2.4 CANADA

- 11.2.4.1 Sovereign cloud options and SI-led domain accelerators fast-tracking compliant orchestration in telecom and public sectors

- 11.3 EUROPE

- 11.3.1 EUROPE: AI ORCHESTRATION MARKET DRIVERS

- 11.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.3 UK

- 11.3.3.1 Heavy investment in AI infrastructure and enterprise buyers standardizing action catalogs across finance and public services

- 11.3.4 GERMANY

- 11.3.4.1 IT-OT convergence in manufacturing that requires typed tools, strict approvals, and measurable plant productivity gains

- 11.3.5 FRANCE

- 11.3.5.1 Customer, finance, and network operations pushing for lineage-rich orchestration hosted on compliant European clouds

- 11.3.6 ITALY

- 11.3.6.1 Industrial modernization in automotive and utilities driving shopfloor-to-enterprise runbooks and quality-assured execution

- 11.3.7 SPAIN

- 11.3.7.1 Telco and banking programs scaling closed-loop CX and finance workflows across APIs and legacy interfaces

- 11.3.8 NETHERLANDS

- 11.3.8.1 Banking, logistics, and ports demanding KPI-tied orchestration for fraud, exception handling, and field coordination

- 11.3.9 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: AI ORCHESTRATION MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.3 CHINA

- 11.4.3.1 Sovereign AI programs and domestic cloud ecosystems embedding orchestration into large-scale industrial and public workloads

- 11.4.4 INDIA

- 11.4.4.1 Global SI adoption and exportable blueprints turning orchestration into core layer for managed services and BFSI

- 11.4.5 JAPAN

- 11.4.5.1 Precision manufacturing and regulated finance requiring hybrid orchestration with deep connector quality and auditability

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Telco-centric ecosystems combining AI, 5G, and edge to operationalize multi-agent workflows at scale

- 11.4.7 SINGAPORE

- 11.4.7.1 Regional hub economics with banks, logistics, and e-government utilizing orchestration for fast, measurable outcomes

- 11.4.8 AUSTRALIA & NEW ZEALAND (ANZ)

- 11.4.8.1 Public services, banking, and mining standardizing runbooks on sovereign and hybrid control planes

- 11.4.9 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: AI ORCHESTRATION MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 11.5.3 SAUDI ARABIA

- 11.5.3.1 Vision-scale programs funding multi-domain orchestration with clear KPI ownership across government and energy

- 11.5.4 UAE

- 11.5.4.1 Rapid pilot-to-production cycles in aviation, government, and finance favoring transparent, action-metered platforms

- 11.5.5 SOUTH AFRICA

- 11.5.5.1 Modernization of banking, telco, and mining stacks that need governed handoffs between IT, field, and compliance

- 11.5.6 TURKEY

- 11.5.6.1 Export-oriented manufacturers and banks adopting orchestration to unify ERP, MES, PLM, and customer operations

- 11.5.7 QATAR

- 11.5.7.1 Smart city, energy, and aviation programs institutionalizing approvals, lineage, and closed-loop service delivery

- 11.5.8 REST OF MIDDLE EAST & AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: AI ORCHESTRATION MARKET DRIVERS

- 11.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 11.6.3 BRAZIL

- 11.6.3.1 Large banks, retailers, and telcos demanding auditable execution that reduces backlog and improves resolution time

- 11.6.4 MEXICO

- 11.6.4.1 Nearshoring and cross-border logistics driving governed exception handling across ERP, customs, and warehouse systems

- 11.6.5 ARGENTINA

- 11.6.5.1 Financial services and utilities seeking predictable service quality through standardized approvals and measurable outcomes

- 11.6.6 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES, 2020-2025

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 BRAND/PRODUCT COMPARISON

- 12.5.1 PRODUCT COMPARATIVE ANALYSIS, BY AGENT ORCHESTRATION PLATFORMS

- 12.5.1.1 Palantir (AIP + Foundry)

- 12.5.1.2 Microsoft (Copilot Studio + Azure AI Studio)

- 12.5.1.3 IBM (watsonx Orchestrate + watsonx.ai)

- 12.5.1.4 Google (Vertex AI Agents)

- 12.5.1.5 Glean (Search + Assistant + Agents)

- 12.5.2 PRODUCT COMPARATIVE ANALYSIS, BY AGENT BUILDER TOOLS

- 12.5.2.1 Kore.ai (AI for Work)

- 12.5.2.2 Aisera AI (Copilot Platform)

- 12.5.2.3 Teneo.ai (Teneo Platform)

- 12.5.2.4 Yellow.ai (DAP Platform)

- 12.5.2.5 Genesys (Genesys Cloud CX)

- 12.5.3 PRODUCT COMPARATIVE ANALYSIS, BY WORKFLOW ORCHESTRATION PLATFORMS

- 12.5.3.1 Appian (AI Process Platform)

- 12.5.3.2 UiPath (Business Automation Platform)

- 12.5.3.3 ServiceNow (Now Platform)

- 12.5.3.4 Workato (Automation Platform)

- 12.5.3.5 SnapLogic (Intelligent Integration Platform)

- 12.5.1 PRODUCT COMPARATIVE ANALYSIS, BY AGENT ORCHESTRATION PLATFORMS

- 12.6 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Regional footprint

- 12.7.5.3 Offering footprint

- 12.7.5.4 Deployment model footprint

- 12.7.5.5 Application footprint

- 12.7.5.6 End user footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 IBM

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Product launches and enhancements

- 13.2.1.3.2 Deals

- 13.2.1.4 MnM view

- 13.2.1.4.1 Key strengths

- 13.2.1.4.2 Strategic choices

- 13.2.1.4.3 Weaknesses and competitive threats

- 13.2.2 AMAZON WEB SERVICES

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.3.1 Product launches and enhancements

- 13.2.2.3.2 Deals

- 13.2.2.4 MnM view

- 13.2.2.4.1 Key strengths

- 13.2.2.4.2 Strategic choices

- 13.2.2.4.3 Weaknesses and competitive threats

- 13.2.3 SALESFORCE

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 Recent developments

- 13.2.3.3.1 Product launches and enhancements

- 13.2.3.3.2 Deals

- 13.2.3.4 MnM view

- 13.2.3.4.1 Key strengths

- 13.2.3.4.2 Strategic choices

- 13.2.3.4.3 Weaknesses and competitive threats

- 13.2.4 ADOBE

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 Recent developments

- 13.2.4.3.1 Product launches and enhancements

- 13.2.4.3.2 Deals

- 13.2.4.4 MnM view

- 13.2.4.4.1 Key strengths

- 13.2.4.4.2 Strategic choices

- 13.2.4.4.3 Weaknesses and competitive threats

- 13.2.5 MICROSOFT

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Product launches and enhancements

- 13.2.5.3.2 Deals

- 13.2.5.4 MnM view

- 13.2.5.4.1 Key strengths

- 13.2.5.4.2 Strategic choices

- 13.2.5.4.3 Weaknesses and competitive threats

- 13.2.6 SAP

- 13.2.6.1 Business overview

- 13.2.6.2 Products/Solutions/Services offered

- 13.2.6.3 Recent developments

- 13.2.6.3.1 Product launches and enhancements

- 13.2.6.3.2 Deals

- 13.2.7 GOOGLE

- 13.2.7.1 Business overview

- 13.2.7.2 Products/Solutions/Services offered

- 13.2.7.3 Recent developments

- 13.2.7.3.1 Product launches and enhancements

- 13.2.7.3.2 Deals

- 13.2.8 COFORGE

- 13.2.8.1 Business overview

- 13.2.8.2 Products/Solutions/Services offered

- 13.2.8.3 Recent developments

- 13.2.8.3.1 Product launches and enhancements

- 13.2.8.3.2 Deals

- 13.2.9 SERVICENOW

- 13.2.9.1 Business overview

- 13.2.9.2 Products/Solutions/Services offered

- 13.2.9.3 Recent developments

- 13.2.9.3.1 Product launches and enhancements

- 13.2.9.3.2 Deals

- 13.2.10 UIPATH

- 13.2.10.1 Business overview

- 13.2.10.2 Products/Solutions/Services offered

- 13.2.10.3 Recent developments

- 13.2.10.3.1 Product launches and enhancements

- 13.2.10.3.2 Deals

- 13.2.11 NVIDIA

- 13.2.12 LIVEPERSON

- 13.2.13 GENESYS

- 13.2.14 PALANTIR

- 13.2.15 KORE.AI

- 13.2.16 ALTAIR

- 13.2.17 YELLOW.AI

- 13.2.18 GLEAN

- 13.2.19 DIGITAL.AI

- 13.2.20 WORKATO

- 13.2.21 APPIAN

- 13.2.1 IBM

- 13.3 OTHER PLAYERS

- 13.3.1 SOLACE

- 13.3.2 JITTERBIT

- 13.3.3 SNAPLOGIC

- 13.3.4 AISERA

- 13.3.5 ONEREACH.AI

- 13.3.6 DOMINO DATA LABS

- 13.3.7 ANYSCALE

- 13.3.8 FORETHOUGHT.AI

- 13.3.9 VUE.AI (MAD STREET DEN)

- 13.3.10 RAFAY SYSTEMS

- 13.3.11 SPACELIFT.IO

- 13.3.12 AIRIA

- 13.3.13 DAGSTER LABS

- 13.3.14 HUMANITEC

- 13.3.15 TONKEAN

- 13.3.16 AKKA.IO

- 13.3.17 SPARKBEYOND

- 13.3.18 UNION.AI

- 13.3.19 ORKES

- 13.3.20 TENEO.AI

- 13.3.21 ORBY AI (UNIPHORE)

- 13.3.22 MULTIMODAL.DEV

- 13.3.23 HOPSWORKS

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 AGENTIC AI MARKET - GLOBAL FORECAST TO 2032

- 14.2.1 MARKET DEFINITION

- 14.2.2 MARKET OVERVIEW

- 14.2.2.1 Agentic AI market, by offering

- 14.2.2.2 Agentic AI market, by horizontal use case

- 14.2.2.3 Agentic AI market, by end user

- 14.2.2.4 Agentic AI market, by region

- 14.3 AI PLATFORM MARKET - GLOBAL FORECAST TO 2030

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.3.2.1 AI platform market, by offering

- 14.3.2.2 AI platform market, by functionality

- 14.3.2.3 AI platform market, by user type

- 14.3.2.4 AI platform market, by end user

- 14.3.2.5 AI platform market, by region

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 PRIMARY INTERVIEWS

- TABLE 3 FACTOR ANALYSIS

- TABLE 4 AI ORCHESTRATION MARKET SIZE AND GROWTH RATE, 2020-2024 (USD MILLION, Y-O-Y %)

- TABLE 5 AI ORCHESTRATION MARKET SIZE AND GROWTH RATE, 2025-2030 (USD MILLION, Y-O-Y %)

- TABLE 6 AI ORCHESTRATION MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 7 TARIFF/TRADE POLICY UPDATES (AUG-SEP 2025)

- TABLE 8 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 PATENTS FILED, 2016-2025

- TABLE 15 LIST OF TOP PATENTS IN AI ORCHESTRATION MARKET, 2024-2025

- TABLE 16 AVERAGE SELLING PRICE OF OFFERINGS, BY KEY PLAYER, 2025

- TABLE 17 AVERAGE SELLING PRICE OF APPLICATIONS, 2025

- TABLE 18 AI ORCHESTRATION MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 19 IMPACT OF PORTER'S FIVE FORCES ON AI ORCHESTRATION MARKET

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 21 KEY BUYING CRITERIA FOR TOP THREE ENTERPRISE END USERS

- TABLE 22 AI ORCHESTRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 23 AI ORCHESTRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 24 AI ORCHESTRATION MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 25 AI ORCHESTRATION MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 26 SOFTWARE: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 27 SOFTWARE: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 AI ORCHESTRATION PLATFORMS: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 29 AI ORCHESTRATION PLATFORMS: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 AGENT BUILDER TOOLS: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 31 AGENT BUILDER TOOLS: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 WORKFLOW ORCHESTRATION PLATFORMS: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 33 WORKFLOW ORCHESTRATION PLATFORMS: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 DATA ORCHESTRATION PLATFORMS: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 35 DATA ORCHESTRATION PLATFORMS: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 MODEL SERVING PLATFORMS: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 37 MODEL SERVING PLATFORMS: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 INFRASTRUCTURE ORCHESTRATION PLATFORMS: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 39 INFRASTRUCTURE ORCHESTRATION PLATFORMS: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 AI ORCHESTRATION MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 41 AI ORCHESTRATION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 42 SERVICES: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 43 SERVICES: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 PROFESSIONAL SERVICES: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 45 PROFESSIONAL SERVICES: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 TRAINING & CONSULTING SERVICES: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 47 TRAINING & CONSULTING SERVICES: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 SYSTEM INTEGRATION & IMPLEMENTATION SERVICES: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 49 SYSTEM INTEGRATION & IMPLEMENTATION SERVICES: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 SUPPORT & MAINTENANCE SERVICES: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 51 SUPPORT & MAINTENANCE SERVICES: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 MANAGED SERVICES: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 53 MANAGED SERVICES: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE, 2020-2024 (USD MILLION)

- TABLE 55 AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE, 2025-2030 (USD MILLION)

- TABLE 56 CENTRALIZED ORCHESTRATION: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 57 CENTRALIZED ORCHESTRATION: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 DECENTRALIZED ORCHESTRATION: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 59 DECENTRALIZED ORCHESTRATION: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 DISTRIBUTED ORCHESTRATION: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 61 DISTRIBUTED ORCHESTRATION: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 HYBRID ORCHESTRATION: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 63 HYBRID ORCHESTRATION: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD MILLION)

- TABLE 65 AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD MILLION)

- TABLE 66 SINGLE TENANT SAAS: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 67 SINGLE TENANT SAAS: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 MULTI-TENANT SAAS: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 69 MULTI-TENANT SAAS: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 CUSTOMER MANAGED CLOUD: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 71 CUSTOMER MANAGED CLOUD: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 ON-PREMISES & AIR-GAPPED: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 73 ON-PREMISES & AIR-GAPPED: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 AI ORCHESTRATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 75 AI ORCHESTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 76 CUSTOMER SERVICE AUTOMATION: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 77 CUSTOMER SERVICE AUTOMATION: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 SALES & REVENUE AUTOMATION: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 79 SALES & REVENUE AUTOMATION: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 MARKETING AUTOMATION: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 81 MARKETING AUTOMATION: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 IT SERVICE MANAGEMENT: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 83 IT SERVICE MANAGEMENT: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 SECURITY OPERATIONS: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 85 SECURITY OPERATIONS: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 FINANCE & PROCUREMENT AUTOMATION: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 87 FINANCE & PROCUREMENT AUTOMATION: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 SUPPLY CHAIN AUTOMATION: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 89 SUPPLY CHAIN AUTOMATION: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 90 HR & EMPLOYEE SERVICE DESK: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 91 HR & EMPLOYEE SERVICE DESK: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 92 ENTERPRISE KNOWLEDGE SEARCH: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 93 ENTERPRISE KNOWLEDGE SEARCH: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 94 SOFTWARE ENGINEERING & CODING AUTOMATION: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 95 SOFTWARE ENGINEERING & CODING AUTOMATION: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 96 FIELD SERVICE & ASSET OPERATIONS: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 97 FIELD SERVICE & ASSET OPERATIONS: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 98 OTHER APPLICATIONS: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 99 OTHER APPLICATIONS: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 100 AI ORCHESTRATION MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 101 AI ORCHESTRATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 102 BFSI: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 103 BFSI: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 104 RETAIL & CPG: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 105 RETAIL & CPG: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 106 PROFESSIONAL SERVICE PROVIDERS: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 107 PROFESSIONAL SERVICE PROVIDERS: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 108 HEALTHCARE & LIFE SCIENCES: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 109 HEALTHCARE & LIFE SCIENCES: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 110 TELECOMMUNICATIONS: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 111 TELECOMMUNICATIONS: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 112 SOFTWARE & TECHNOLOGY PROVIDERS: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 113 SOFTWARE & TECHNOLOGY PROVIDERS: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 114 MEDIA & ENTERTAINMENT: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 115 MEDIA & ENTERTAINMENT: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 116 LOGISTICS & TRANSPORTATION: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 117 LOGISTICS & TRANSPORTATION: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 118 GOVERNMENT & DEFENSE: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 119 GOVERNMENT & DEFENSE: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 120 AUTOMOTIVE: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 121 AUTOMOTIVE: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 122 ENERGY & UTILITIES: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 123 ENERGY & UTILITIES: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 124 MANUFACTURING: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 125 MANUFACTURING: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 126 OTHER END USERS: AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 127 OTHER END USERS: AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 128 AI ORCHESTRATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 129 AI ORCHESTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 130 NORTH AMERICA: AI ORCHESTRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 131 NORTH AMERICA: AI ORCHESTRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 132 NORTH AMERICA: AI ORCHESTRATION MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 133 NORTH AMERICA: AI ORCHESTRATION MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 134 NORTH AMERICA: AI ORCHESTRATION MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 135 NORTH AMERICA: AI ORCHESTRATION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 136 NORTH AMERICA: AI ORCHESTRATION MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 137 NORTH AMERICA: AI ORCHESTRATION MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 138 NORTH AMERICA: AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE, 2020-2024 (USD MILLION)

- TABLE 139 NORTH AMERICA: AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE, 2025-2030 (USD MILLION)

- TABLE 140 NORTH AMERICA: AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD MILLION)

- TABLE 141 NORTH AMERICA: AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD MILLION)

- TABLE 142 NORTH AMERICA: AI ORCHESTRATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 143 NORTH AMERICA: AI ORCHESTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 144 NORTH AMERICA: AI ORCHESTRATION MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 145 NORTH AMERICA: AI ORCHESTRATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 146 NORTH AMERICA: AI ORCHESTRATION MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 147 NORTH AMERICA: AI ORCHESTRATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 148 US: AI ORCHESTRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 149 US: AI ORCHESTRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 150 US: AI ORCHESTRATION MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 151 US: AI ORCHESTRATION MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 152 US: AI ORCHESTRATION MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 153 US: AI ORCHESTRATION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 154 US: AI ORCHESTRATION MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 155 US: AI ORCHESTRATION MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 156 US: AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE, 2020-2024 (USD MILLION)

- TABLE 157 US: AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE, 2025-2030 (USD MILLION)

- TABLE 158 US: AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD MILLION)

- TABLE 159 US: AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD MILLION)

- TABLE 160 US: AI ORCHESTRATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 161 US: AI ORCHESTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 162 US: AI ORCHESTRATION MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 163 US: AI ORCHESTRATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 164 CANADA: AI ORCHESTRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 165 CANADA: AI ORCHESTRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 166 CANADA: AI ORCHESTRATION MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 167 CANADA: AI ORCHESTRATION MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 168 CANADA: AI ORCHESTRATION MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 169 CANADA: AI ORCHESTRATION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 170 CANADA: AI ORCHESTRATION MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 171 CANADA: AI ORCHESTRATION MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 172 CANADA: AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE, 2020-2024 (USD MILLION)

- TABLE 173 CANADA: AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE, 2025-2030 (USD MILLION)

- TABLE 174 CANADA: AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD MILLION)

- TABLE 175 CANADA: AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD MILLION)

- TABLE 176 CANADA: AI ORCHESTRATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 177 CANADA: AI ORCHESTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 178 CANADA: AI ORCHESTRATION MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 179 CANADA: AI ORCHESTRATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 180 EUROPE: AI ORCHESTRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 181 EUROPE: AI ORCHESTRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 182 EUROPE: AI ORCHESTRATION MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 183 EUROPE: AI ORCHESTRATION MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 184 EUROPE: AI ORCHESTRATION MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 185 EUROPE: AI ORCHESTRATION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 186 EUROPE: AI ORCHESTRATION MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 187 EUROPE: AI ORCHESTRATION MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 188 EUROPE: AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE, 2020-2024 (USD MILLION)

- TABLE 189 EUROPE: AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE, 2025-2030 (USD MILLION)

- TABLE 190 EUROPE: AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD MILLION)

- TABLE 191 EUROPE: AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD MILLION)

- TABLE 192 EUROPE: AI ORCHESTRATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 193 EUROPE: AI ORCHESTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 194 EUROPE: AI ORCHESTRATION MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 195 EUROPE: AI ORCHESTRATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 196 EUROPE: AI ORCHESTRATION MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 197 EUROPE: AI ORCHESTRATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 198 UK: AI ORCHESTRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 199 UK: AI ORCHESTRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 200 UK: AI ORCHESTRATION MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 201 UK: AI ORCHESTRATION MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 202 UK: AI ORCHESTRATION MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 203 UK: AI ORCHESTRATION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 204 UK: AI ORCHESTRATION MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 205 UK: AI ORCHESTRATION MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 206 UK: AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE, 2020-2024 (USD MILLION)

- TABLE 207 UK: AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE, 2025-2030 (USD MILLION)

- TABLE 208 UK: AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD MILLION)

- TABLE 209 UK: AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD MILLION)

- TABLE 210 UK: AI ORCHESTRATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 211 UK: AI ORCHESTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 212 UK: AI ORCHESTRATION MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 213 UK: AI ORCHESTRATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 214 GERMANY: AI ORCHESTRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 215 GERMANY: AI ORCHESTRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 216 GERMANY: AI ORCHESTRATION MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 217 GERMANY: AI ORCHESTRATION MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 218 GERMANY: AI ORCHESTRATION MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 219 GERMANY: AI ORCHESTRATION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 220 GERMANY: AI ORCHESTRATION MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 221 GERMANY: AI ORCHESTRATION MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 222 GERMANY: AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE, 2020-2024 (USD MILLION)

- TABLE 223 GERMANY: AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE, 2025-2030 (USD MILLION)

- TABLE 224 GERMANY: AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD MILLION)

- TABLE 225 GERMANY: AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD MILLION)

- TABLE 226 GERMANY: AI ORCHESTRATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 227 GERMANY: AI ORCHESTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 228 GERMANY: AI ORCHESTRATION MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 229 GERMANY: AI ORCHESTRATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 230 FRANCE: AI ORCHESTRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 231 FRANCE: AI ORCHESTRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 232 FRANCE: AI ORCHESTRATION MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 233 FRANCE: AI ORCHESTRATION MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 234 FRANCE: AI ORCHESTRATION MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 235 FRANCE: AI ORCHESTRATION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 236 FRANCE: AI ORCHESTRATION MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 237 FRANCE: AI ORCHESTRATION MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 238 FRANCE: AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE, 2020-2024 (USD MILLION)

- TABLE 239 FRANCE: AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE, 2025-2030 (USD MILLION)

- TABLE 240 FRANCE: AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD MILLION)

- TABLE 241 FRANCE: AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD MILLION)

- TABLE 242 FRANCE: AI ORCHESTRATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 243 FRANCE: AI ORCHESTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 244 FRANCE: AI ORCHESTRATION MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 245 FRANCE: AI ORCHESTRATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 246 ITALY: AI ORCHESTRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 247 ITALY: AI ORCHESTRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 248 ITALY: AI ORCHESTRATION MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 249 ITALY: AI ORCHESTRATION MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 250 ITALY: AI ORCHESTRATION MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 251 ITALY: AI ORCHESTRATION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 252 ITALY: AI ORCHESTRATION MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 253 ITALY: AI ORCHESTRATION MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 254 ITALY: AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE, 2020-2024 (USD MILLION)

- TABLE 255 ITALY: AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE, 2025-2030 (USD MILLION)

- TABLE 256 ITALY: AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD MILLION)

- TABLE 257 ITALY: AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD MILLION)

- TABLE 258 ITALY: AI ORCHESTRATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 259 ITALY: AI ORCHESTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 260 ITALY: AI ORCHESTRATION MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 261 ITALY: AI ORCHESTRATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 262 SPAIN: AI ORCHESTRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 263 SPAIN: AI ORCHESTRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 264 SPAIN: AI ORCHESTRATION MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 265 SPAIN: AI ORCHESTRATION MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 266 SPAIN: AI ORCHESTRATION MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 267 SPAIN: AI ORCHESTRATION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 268 SPAIN: AI ORCHESTRATION MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 269 SPAIN: AI ORCHESTRATION MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 270 SPAIN: AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE, 2020-2024 (USD MILLION)

- TABLE 271 SPAIN: AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE, 2025-2030 (USD MILLION)

- TABLE 272 SPAIN: AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD MILLION)

- TABLE 273 SPAIN: AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD MILLION)

- TABLE 274 SPAIN: AI ORCHESTRATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 275 SPAIN: AI ORCHESTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 276 SPAIN: AI ORCHESTRATION MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 277 SPAIN: AI ORCHESTRATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 278 NETHERLANDS: AI ORCHESTRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 279 NETHERLANDS: AI ORCHESTRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 280 NETHERLANDS: AI ORCHESTRATION MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 281 NETHERLANDS: AI ORCHESTRATION MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 282 NETHERLANDS: AI ORCHESTRATION MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 283 NETHERLANDS: AI ORCHESTRATION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 284 NETHERLANDS: AI ORCHESTRATION MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 285 NETHERLANDS: AI ORCHESTRATION MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 286 NETHERLANDS: AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE, 2020-2024 (USD MILLION)

- TABLE 287 NETHERLANDS: AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE, 2025-2030 (USD MILLION)

- TABLE 288 NETHERLANDS: AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD MILLION)

- TABLE 289 NETHERLANDS: AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD MILLION)

- TABLE 290 NETHERLANDS: AI ORCHESTRATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 291 NETHERLANDS: AI ORCHESTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 292 NETHERLANDS: AI ORCHESTRATION MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 293 NETHERLANDS: AI ORCHESTRATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 294 REST OF EUROPE: AI ORCHESTRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 295 REST OF EUROPE: AI ORCHESTRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 296 REST OF EUROPE: AI ORCHESTRATION MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 297 REST OF EUROPE: AI ORCHESTRATION MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 298 REST OF EUROPE: AI ORCHESTRATION MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 299 REST OF EUROPE: AI ORCHESTRATION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 300 REST OF EUROPE: AI ORCHESTRATION MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 301 REST OF EUROPE: AI ORCHESTRATION MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 302 REST OF EUROPE: AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE, 2020-2024 (USD MILLION)

- TABLE 303 REST OF EUROPE: AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE, 2025-2030 (USD MILLION)

- TABLE 304 REST OF EUROPE: AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD MILLION)

- TABLE 305 REST OF EUROPE: AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD MILLION)

- TABLE 306 REST OF EUROPE: AI ORCHESTRATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 307 REST OF EUROPE: AI ORCHESTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 308 REST OF EUROPE: AI ORCHESTRATION MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 309 REST OF EUROPE: AI ORCHESTRATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 310 ASIA PACIFIC: AI ORCHESTRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 311 ASIA PACIFIC: AI ORCHESTRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 312 ASIA PACIFIC: AI ORCHESTRATION MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 313 ASIA PACIFIC: AI ORCHESTRATION MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 314 ASIA PACIFIC: AI ORCHESTRATION MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 315 ASIA PACIFIC: AI ORCHESTRATION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 316 ASIA PACIFIC: AI ORCHESTRATION MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 317 ASIA PACIFIC: AI ORCHESTRATION MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 318 ASIA PACIFIC: AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE, 2020-2024 (USD MILLION)

- TABLE 319 ASIA PACIFIC: AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE, 2025-2030 (USD MILLION)

- TABLE 320 ASIA PACIFIC: AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD MILLION)

- TABLE 321 ASIA PACIFIC: AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD MILLION)

- TABLE 322 ASIA PACIFIC: AI ORCHESTRATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 323 ASIA PACIFIC: AI ORCHESTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 324 ASIA PACIFIC: AI ORCHESTRATION MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 325 ASIA PACIFIC: AI ORCHESTRATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 326 ASIA PACIFIC: AI ORCHESTRATION MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 327 ASIA PACIFIC: AI ORCHESTRATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 328 CHINA: AI ORCHESTRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 329 CHINA: AI ORCHESTRATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 330 CHINA: AI ORCHESTRATION MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 331 CHINA: AI ORCHESTRATION MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 332 CHINA: AI ORCHESTRATION MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 333 CHINA: AI ORCHESTRATION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 334 CHINA: AI ORCHESTRATION MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 335 CHINA: AI ORCHESTRATION MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 336 CHINA: AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE, 2020-2024 (USD MILLION)

- TABLE 337 CHINA: AI ORCHESTRATION MARKET, BY ORCHESTRATION ARCHITECTURE, 2025-2030 (USD MILLION)

- TABLE 338 CHINA: AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD MILLION)

- TABLE 339 CHINA: AI ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD MILLION)

- TABLE 340 CHINA: AI ORCHESTRATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 341 CHINA: AI ORCHESTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 342 CHINA: AI ORCHESTRATION MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 343 CHINA: AI ORCHESTRATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 344 INDIA: AI ORCHESTRATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)