|

市場調查報告書

商品編碼

1829982

全球糖尿病護理設備市場(按產品類型、疾病類型、患者治療設施和地區分類)- 預測至 2030 年Diabetes Care Devices Market by Product Type (Blood Glucose Monitoring (CGM), Insulin Delivery Devices (Insulin Pumps (Tethered), Insulin Pens, Pen Needles), Application) Disease Type (Type 1, Type 2), End User (Homecare/Self) - Global Forecast to 2030 |

||||||

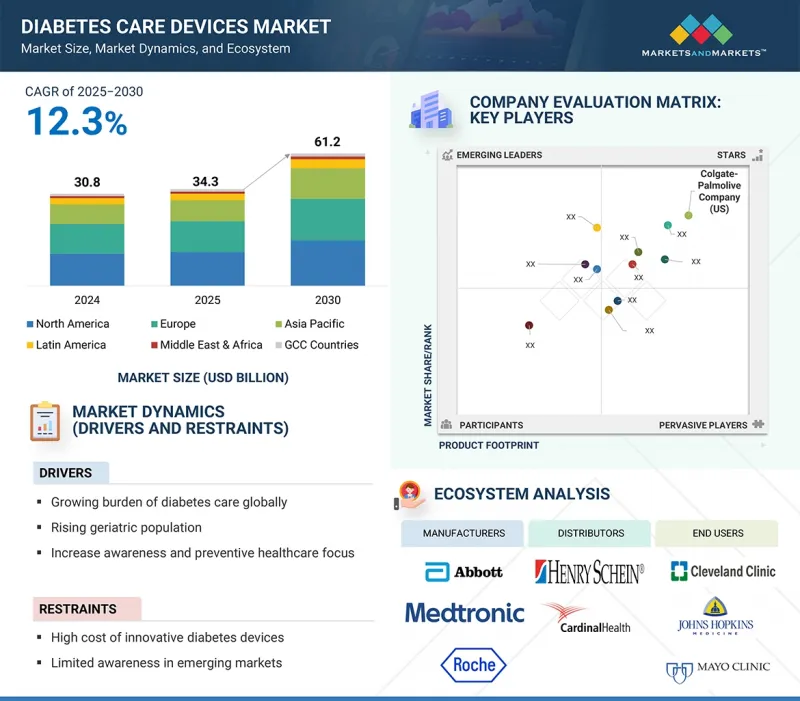

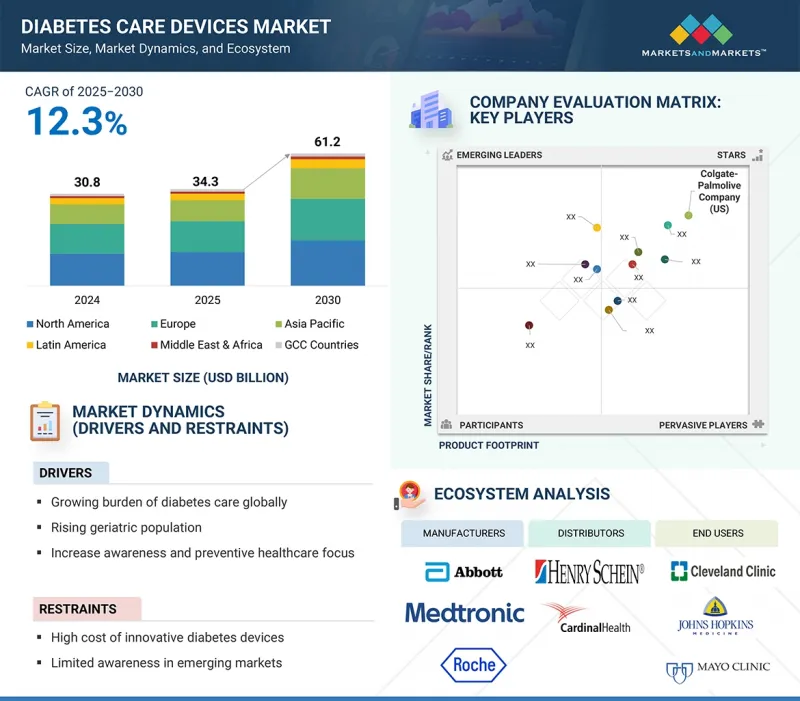

全球糖尿病護理設備市場預計將從 2025 年的 343 億美元成長到 2030 年的 612 億美元,預測期內的複合年成長率為 12.3%。

| 調查範圍 | |

|---|---|

| 調查年份 | 2024-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 對價單位 | 金額(十億美元) |

| 部分 | 按產品類型、疾病類型、患者治療設施和地區 |

| 目標區域 | 北美、亞太、拉丁美洲、中東和非洲 |

由於久坐不動的生活方式、肥胖和飲食習慣改變等因素,糖尿病盛行率不斷上升,顯著增加了對有效的糖尿病監測和管理工具的需求。老年人口的不斷成長,使他們更容易患上第2型糖尿病及其併發症,這進一步推動了對血糖監測設備的需求。此外,人們對預防性醫療保健的認知和重視程度的提高,也促進了早期診斷和自我管理工具的使用,從而擴大了家用設備的使用範圍。技術進步也使這些設備對患者和醫療保健提供者更具吸引力。

更廣泛的市場採用可能會受到設備高成本以及某些市場消費者接受度和依從性低的限制。

全球糖尿病照護設備市場分為三大板塊:血糖值監測系統、胰島素給藥設備和糖尿病管理行動應用。血糖值監測系統憑藉其強大的功能優勢和醫療支持,佔據了最大的市場佔有率。這些設備提供準確的即時追蹤,並有助於預防併發症。糖尿病盛行率的上升、醫生的建議以及智慧型手機整合等技術創新,進一步推動了其在家庭環境中的普及。

全球糖尿病照護設備市場按患者治療機構細分為自助/居家醫療、醫院和專科糖尿病診所。其中,自助/家庭醫療保健預計將佔據最大的市場佔有率。對便利且經濟高效的設備日益成長的需求推動了這一細分市場的成長。許多人依賴連續血糖監測儀等自我檢測設備,這減少了就診需求。預防保健意識的增強、可攜式和連網技術的進步以及易患2型糖尿病的老年人口的不斷成長,都推動了自助/家庭護理設備的需求不斷成長。

這種主導地位主要是由於人群中2型糖尿病的盛行率不斷上升,而這種盛行率的上升是由久坐行為、飲食習慣和肥胖率上升等生活方式相關的風險因素造成的。高熱量飲食、加工食品和缺乏運動導致肥胖率上升,這是造成這種快速成長的主要原因。都市化和現代化進一步減少了日常體力活動,而速食的普及導致已開發國家和開發中國家的肥胖率都在上升。此外,糖尿病是一種與老齡化密切相關的疾病,老年人更容易患上這種疾病。隨著全球人口老化,其盛行率持續上升。

糖尿病患者數量的快速成長以及對先進糖尿病治療的需求不斷成長,推動了亞太地區對糖尿病治療設備的強勁需求。此外,全球領先的糖尿病護理產品公司正在透過推出先進配方和數位整合的糖尿病治療設備來擴大其在亞太地區的業務。

本報告研究了全球糖尿病治療設備市場,提供了按產品類型、疾病類型、患者治療設施和地區分類的趨勢資訊,以及參與市場的公司概況。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章 市場概況

- 介紹

- 市場動態

- 產業趨勢

- 技術分析

- 定價分析

- 生態系分析

- 還款情境分析

- 價值鏈分析

- 波特五力分析

- 主要相關人員和採購標準

- 貿易分析

- 監管分析

- 專利分析

- 2025-2026年主要會議和活動

- 鄰近市場分析

- 影響客戶業務的趨勢/中斷

- 未滿足的需求/最終用戶期望

- 人工智慧/產生人工智慧對糖尿病護理設備市場的影響

- 案例研究分析

- 投資金籌措場景

- 2025年美國關稅對糖尿病照護設備市場的影響

第6章糖尿病護理設備市場(依產品類型)

- 介紹

- 血糖監測系統

- 胰島素輸送裝置

- 糖尿病管理行動應用程式

第7章糖尿病治療設備市場(依疾病類型)

- 介紹

- 1型糖尿病

- 2型糖尿病

第 8 章糖尿病照護設備市場(依病患治療設施)

- 介紹

- 自我/居家醫療

- 醫院和糖尿病診所

第9章糖尿病治療設備市場(按地區)

- 介紹

- 北美洲

- 北美宏觀經濟展望

- 美國

- 加拿大

- 歐洲

- 歐洲宏觀經濟展望

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他

- 亞太地區

- 亞太宏觀經濟展望

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他

- 拉丁美洲

- 拉丁美洲宏觀經濟展望

- 巴西

- 墨西哥

- 其他

- 中東和非洲

- 糖尿病管理中對早期診斷和血糖控制的意識提升將推動市場成長

- 中東和非洲宏觀經濟展望

- 海灣合作理事會國家

- 糖尿病盛行率上升和人均醫療成本上升將推動市場

- 海灣合作理事會國家宏觀經濟展望

第10章 競爭格局

- 介紹

- 主要參與企業的策略/優勢

- 2020-2024年收益分析

- 2024年市佔率分析

- 公司估值矩陣:2024 年關鍵參與企業

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 估值和財務指標

- 品牌/產品比較

- 主要企業研發支出

- 競爭場景

第11章 公司簡介

- 主要參與企業

- F. HOFFMAN-LA ROCHE LTD.

- ABBOTT

- DEXCOM, INC.

- MEDTRONIC

- B. BRAUN SE

- EMBECTA CORP.

- NIPRO

- SENSEONICS

- YPSOMED

- I-SENS, INC.

- TANDEM DIABETES CARE, INC.

- INSULET CORPORATION

- ACON LABORATORIES, INC.

- ARKRAY, INC.

- TERUMO CORPORATION

- 其他公司

- SINOCARE

- AGAMATRIX

- LIFESCAN IP HOLDINGS, LLC

- SD BIOSENSOR, INC.

- DEBIOTECH SA

- SUNGSHIM MEDICAL CO., LTD.

- SOOIL DEVELOPMENTS CO., LTD.

- HINDUSTAN SYRINGES & MEDICAL DEVICES LTD.

- MICROGENE DIAGNOSTIC SYSTEMS(P)LTD.

- ROSSMAX INTERNATIONAL LTD.

第12章 附錄

The global diabetes care devices market is projected to reach 61.2 billion in 2030 from USD 34.3 billion in 2025, at a CAGR of 12.3% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product Type, Disease Type, Patient Care Settings, and Region |

| Regions covered | Europe, North America, Asia Pacific, Latin America, Middle East, and Africa |

The rising prevalence of diabetes, driven by sedentary lifestyles, obesity, and changes in dietary habits, is significantly increasing the demand for effective monitoring and management tools for diabetes care. The growing geriatric population, which is more susceptible to type 2 diabetes and its complications, further boosts the demand for glucose monitoring devices. Additionally, increased awareness and a greater focus on preventive healthcare are encouraging early diagnosis and self-management tools, which are enhancing the use of home-based devices. Technological advancements also make these devices more appealing to both patients and healthcare providers.

Wider market adoption may be limited by the high cost of devices and, in certain markets, low consumer acceptance or adherence.

By product type, the blood glucose monitoring segment is expected to account for the largest share of the global diabetes care devices market.

The global diabetes care devices market is divided into three main segments: blood glucose monitoring systems, insulin delivery devices, and diabetes management mobile applications. The blood glucose monitoring system segment holds the largest market share due to its strong functional advantages and medical support. These devices provide accurate real-time tracking, which helps prevent complications. Rising diabetes prevalence, physician recommendations, and innovations like smartphone integration further increase home adoption settings.

By patient care settings, the self/home healthcare segment is expected to account for the largest share of the global diabetes care devices market.

The global diabetes care devices market is segmented by patient care settings into the following categories: self/home healthcare and hospitals & diabetes specialty clinics. Among these, the self/home healthcare segment is expected to hold the largest market share. The increasing demand for convenient, cost-effective devices is driving growth in this area. Many people rely on self-testing devices, such as continuous blood glucose monitors, which reduce the need for clinical visits. Rising awareness of preventive care, advancements in both portable and connected technologies, and an increasing geriatric population, which is more susceptible to type 2 diabetes, are fueling the growth in demand for self/homecare devices.

By disease type, the type 2 diabetes segment is expected to account for the largest share of the global diabetes care devices market.

This dominance is mainly driven by lifestyle-related risk factors such as sedentary behavior, dietary habits, and increasing obesity, which make type 2 diabetes more prevalent in the population. The rise in obesity, fueled by high-calorie diets, processed foods, and physical inactivity, is the primary contributor to its rapid growth. Urbanization and modernization have further reduced daily physical activity while increasing access to fast food, leading to rising rates across both developed and developing countries. The disease is also strongly age-related, with older adults being more susceptible, and as global populations age, the prevalence naturally continues to rise.

The diabetes care devices market in the Asia Pacific is expected to grow at the highest CAGR during the forecast period.

The rapid rise in diabetes cases and the increasing demand for advanced diabetes care are driving a strong need for diabetes care devices in the Asia Pacific region. Additionally, global leaders in diabetes care products are expanding their footprint in the Asia Pacific by launching advanced formulations and digitally integrated diabetes care devices.

A breakdown of the primary participants (supply side) for the diabetes care devices market referred to in this report is provided below:

- By Company Type: Tier 1 (30%), Tier 2 (35%), and Tier 3 (35%)

- By Designation: C-level Executives (20%), Directors (35%), and Others (45%)

- By Region: North America (30%), Europe (25%), Asia Pacific (20%), Latin America (20%), Middle East & Africa (2%), GCC Countries (3%)

Prominent players in the diabetes care devices market include F. Hoffmann Roche Ltd (Switzerland), Abbott Laboratories (US), Medtronic (Ireland), Dexcom (US), Insulet Corporation (US), B Braun Se (Germany), Embecta Corp (US), Nipro (Japan), Senseonics (US), Ypsomed (Switzerland), i-Sens, Inc (South Korea), Tandem Diabetes Care, Inc (US), ACON LABORATORIES, INC (US), ARKRAY, INC(Japan), Terumo Corporation (Japan), Sinocare Inc (Japan), Waveform Diabetes (AgaMatrix) (US), Lifescan IP Holdings (US), SD Biosensor, Inc (South Korea), DeBiotech SA. (Switzerland), Sungshim Medical Co, Ltd (South Korea), Sooil Developments Co., Ltd (South Korea), Hindustan syringes and medical devices (India), Microgene Diagnostic Systems Pvt Ltd (India), Rossmax International Ltd (Taiwan)

Research Coverage

The report provides an analysis of the diabetes care devices market, focusing on estimating the market size and potential for future growth across various segments, including distribution channels, regions, indications, and product types. Additionally, the report features a competitive analysis of the key players in the market, detailing their company profiles, product and service offerings, recent developments, and key market insights strategies.

Reasons to Buy the Report

The report offers valuable insights for both market leaders and new entrants in the diabetes care devices industry, providing estimated revenue figures for the entire market and its subsegments. It helps stakeholders understand the competitive landscape, allowing them to better position their businesses and develop effective go-to-market strategies. Additionally, the report emphasizes key market drivers, restraints, challenges, and opportunities, assisting stakeholders in assessing the current state of the market.

This report provides insights into the following pointers:

- Analysis of key drivers (growing burden of diabetes care globally, rising geriatric population, increasing awareness and preventive healthcare focus, technological advancements), restraints (high cost of innovative diabetes devices, limited awareness in emerging markets), opportunities (enhanced diabetes management with advanced patient-implantable CGM devices) and challenges (limited sensor durability leading to repeated and costly replacements, high cost and socio-economic disparities in access to devices).

- Market Penetration: This report provides detailed information on the product portfolios offered by major players in the global diabetes care devices market. It covers various segments, including product types, patient care settings, and regions.

- Product Enhancement/Innovation: Comprehensive details about new product launches and anticipated trends in the global diabetes care devices market.

- Market Development: Thorough knowledge and analysis of the profitable rising markets by product types, patient care settings, disease type, and regions.

- Market Diversification: Comprehensive information about newly launched products and services, expanding markets, current advancements, and investments in the global diabetes care devices market.

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings of products and services, and capacities of the major competitors in the global diabetes care devices market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

- 1.5.1 REFINEMENTS IN SCOPE

- 1.5.2 COVERAGE OF NEW PLAYERS

- 1.5.3 ADDITION OF SEGMENTS

- 1.5.4 UPDATED MARKET DEVELOPMENTS OF PROFILED PLAYERS

- 1.5.5 UPDATED FINANCIAL INFORMATION/PRODUCT PORTFOLIOS OF PLAYERS

- 1.5.6 UPDATED GEOGRAPHIC ANALYSIS

- 1.5.7 IMPACT OF AI

- 1.5.8 IMPACT OF US TARIFF

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key sources of secondary data

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key objectives of primary research

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 REVENUE SHARE ANALYSIS

- 2.2.2 BOTTOM-UP APPROACH (SUPPLY-SIDE ANALYSIS)

- 2.2.3 COMPANY PRESENTATIONS & PRIMARY INTERVIEWS

- 2.2.4 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 SCOPE-RELATED LIMITATIONS

- 2.6.2 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 DIABETES CARE DEVICES MARKET OVERVIEW

- 4.2 ASIA PACIFIC: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE AND COUNTRY (2024)

- 4.3 DIABETES CARE DEVICES MARKET: GEOGRAPHICAL MIX

- 4.4 DIABETES CARE DEVICES MARKET: REGIONAL MIX

- 4.5 DIABETES CARE DEVICES MARKET: DEVELOPED VS. EMERGING MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surging global diabetes patient population requiring continuous care

- 5.2.1.2 Rapidly growing geriatric population

- 5.2.1.3 Increasing efforts toward public awareness and preventive healthcare

- 5.2.1.4 Rapid technological advancements in diabetes care

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of advanced diabetes care devices

- 5.2.2.2 Limited awareness in emerging healthcare markets

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Enhanced diabetes management with advanced patient-implantable continuous glucose monitoring devices

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited sensor durability with repeated and costly replacements

- 5.2.4.2 High cost and socio-economic disparities in access to diabetes care devices

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 RISING ADOPTION OF DIGITAL HEALTH SOLUTIONS AND TELEMEDICINE INTEGRATION IN DIABETES CARE

- 5.3.2 ACCELERATING SHIFT TOWARD HOME-BASED, PATIENT-CENTRIC, AND SELF-MANAGED DIABETES CARE

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 KEY TECHNOLOGIES

- 5.4.1.1 Implantable sensors

- 5.4.1.2 Smart automated insulin pumps

- 5.4.2 COMPLEMENTARY TECHNOLOGIES

- 5.4.2.1 Telehealth services

- 5.4.3 ADJACENT TECHNOLOGIES

- 5.4.3.1 Cutting-edge and smartphone-enabled diabetes self-management technologies

- 5.4.1 KEY TECHNOLOGIES

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF DIABETES CARE DEVICES, BY KEY PLAYER, 2022-2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF DIABETES CARE DEVICES, BY REGION, 2022-2024

- 5.6 ECOSYSTEM ANALYSIS

- 5.6.1 ROLE IN ECOSYSTEM

- 5.7 REIMBURSEMENT SCENARIO ANALYSIS

- 5.8 VALUE CHAIN ANALYSIS

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.9.2 BARGAINING POWER OF SUPPLIERS

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 THREAT OF SUBSTITUTES

- 5.9.5 THREAT OF NEW ENTRANTS

- 5.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 KEY BUYING CRITERIA

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA FOR HS CODE 9027, 2020-2024

- 5.11.2 EXPORT DATA FOR HS CODE 9027, 2020-2024

- 5.12 REGULATORY ANALYSIS

- 5.12.1 REGULATORY FRAMEWORK

- 5.12.1.1 North America

- 5.12.1.1.1 US

- 5.12.1.1.2 Canada

- 5.12.1.2 Europe

- 5.12.1.3 Asia Pacific

- 5.12.1.3.1 China

- 5.12.1.3.2 Japan

- 5.12.1.3.3 India

- 5.12.1.4 Latin America

- 5.12.1.4.1 Brazil

- 5.12.1.4.2 Mexico

- 5.12.1.5 Middle East

- 5.12.1.6 Africa

- 5.12.1.1 North America

- 5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

- 5.12.1 REGULATORY FRAMEWORK

- 5.13 PATENT ANALYSIS

- 5.13.1 PATENT PUBLICATION TRENDS FOR DIABETES CARE DEVICES MARKET

- 5.13.2 JURISDICTION ANALYSIS: TOP APPLICANTS FOR PATENTS IN DIABETES CARE DEVICES

- 5.13.3 LIST OF MAJOR PATENTS

- 5.14 KEY CONFERENCES & EVENTS, 2025-2026

- 5.15 ADJACENT MARKET ANALYSIS

- 5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.17 UNMET NEEDS/END-USER EXPECTATIONS

- 5.17.1 UNMET NEEDS

- 5.17.2 END-USER EXPECTATIONS

- 5.18 IMPACT OF AI/GEN AI IN DIABETES CARE DEVICES MARKET

- 5.19 CASE STUDY ANALYSIS

- 5.19.1 LONG-TERM GLUCOSE MONITORING FOR SENSITIVE SKIN PATIENTS USING SENSEONICS' EVERSENSE E3 IMPLANTABLE SENSORS

- 5.19.2 ENHANCING PATIENT ADHERENCE AND GLYCEMIC CONTROL USING ABBOTT'S FREESTYLE LIBRE 2 CGM

- 5.19.3 MEDTRONIC MINIMED INSULIN PUMP TO ENHANCE GLUCOSE CONTROL AND IMPROVE DAILY MANAGEMENT FOR PEOPLE WITH DIABETES

- 5.20 INVESTMENT & FUNDING SCENARIO

- 5.21 IMPACT OF 2025 US TARIFF ON DIABETES CARE DEVICES MARKET

- 5.21.1 INTRODUCTION

- 5.21.2 KEY TARIFF RATES

- 5.21.3 PRICE IMPACT ANALYSIS

- 5.21.4 IMPACT ON END-USE INDUSTRIES

6 DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE

- 6.1 INTRODUCTION

- 6.2 BLOOD GLUCOSE MONITORING SYSTEMS

- 6.2.1 SELF-MONITORING BLOOD GLUCOSE SYSTEMS

- 6.2.1.1 Need for self-monitoring in type 1 and type 2 diabetes management to propel market growth

- 6.2.2 CONTINUOUS GLUCOSE MONITORING SYSTEMS

- 6.2.2.1 Technological advancements in continuous glucose monitoring systems to track trends and enhance diabetes management

- 6.2.3 TEST STRIPS/TEST PAPERS

- 6.2.3.1 Shift toward non-invasive methods for blood glucose monitoring to restrain market growth

- 6.2.4 LANCETS/LANCING DEVICES

- 6.2.4.1 Need for infection and accidental pricking to increase popularity of safety lancets/lancing devices

- 6.2.1 SELF-MONITORING BLOOD GLUCOSE SYSTEMS

- 6.3 INSULIN DELIVERY DEVICES

- 6.3.1 INSULIN PUMPS & ACCESSORIES

- 6.3.1.1 Tethered pumps

- 6.3.1.1.1 Increase in collaborations and partnerships among companies to develop integrated insulin systems

- 6.3.1.2 Tubeless insulin pumps

- 6.3.1.2.1 Use of artificial intelligence to replace traditional vial-syringe combinations with tubeless pumps

- 6.3.1.1 Tethered pumps

- 6.3.2 INSULIN PENS

- 6.3.2.1 Reusable insulin pens

- 6.3.2.1.1 Technology innovations and cost-effectiveness to boost market growth

- 6.3.2.2 Disposable insulin pens

- 6.3.2.2.1 Ease of use, accurate dose measurement, and built-in cartridges to propel segment growth

- 6.3.2.1 Reusable insulin pens

- 6.3.3 PEN NEEDLES

- 6.3.3.1 Reduced chances of infection and accidental pricking to augment market growth

- 6.3.4 INSULIN SYRINGES & NEEDLES

- 6.3.4.1 Safety concerns and need for affordable alternatives to limit market growth

- 6.3.5 OTHER INSULIN DELIVERY DEVICES

- 6.3.1 INSULIN PUMPS & ACCESSORIES

- 6.4 DIABETES MANAGEMENT MOBILE APPLICATIONS

- 6.4.1 INCREASING PREVALENCE OF DIABETES AND RISING ADOPTION OF BLOOD GLUCOSE TRACKING APPLICATIONS TO DRIVE MARKET

7 DIABETES CARE DEVICES MARKET, BY DISEASE TYPE

- 7.1 INTRODUCTION

- 7.2 TYPE 1 DIABETES

- 7.2.1 CHRONIC NATURE OF TYPE 1 DIABETES AND NEED FOR IMPROVED DIAGNOSIS TO AID MARKET GROWTH

- 7.3 TYPE 2 DIABETES

- 7.3.1 RISING BURDEN OF TYPE 2 DIABETES TO INCREASE NEED FOR SCALABLE CARE DEVICE SOLUTIONS

8 DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS

- 8.1 INTRODUCTION

- 8.2 SELF/HOME HEALTHCARE

- 8.2.1 INCREASING AFFORDABILITY OF SELF-MONITORING SYSTEMS AND INSULIN DELIVERY DEVICES TO FUEL PREFERENCE

- 8.3 HOSPITALS & DIABETES SPECIALTY CLINICS

- 8.3.1 RISING DEMAND FOR POINT-OF-CARE TESTING IN HOSPITALS TO BOOST MARKET GROWTH

9 DIABETES CARE DEVICES MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 US to dominate North American diabetes care devices market during forecast period

- 9.2.3 CANADA

- 9.2.3.1 High prevalence of diabetes and supportive government disease management initiatives to spur market growth

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Advanced healthcare infrastructure to drive adoption of innovative diabetes care devices

- 9.3.3 UK

- 9.3.3.1 Increased government support and improved research funding to propel market growth

- 9.3.4 FRANCE

- 9.3.4.1 Substantial national spending on diabetes management and robust healthcare infrastructure to aid market growth

- 9.3.5 ITALY

- 9.3.5.1 High diabetes-related mortality and increased public investment to augment market growth

- 9.3.6 SPAIN

- 9.3.6.1 Minimal co-payments and full reimbursement to drive market

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Huge diabetic population and high government healthcare spending to spur market growth

- 9.4.3 JAPAN

- 9.4.3.1 Increased geriatric population and supportive healthcare policies to support market growth

- 9.4.4 INDIA

- 9.4.4.1 Rise in diabetes cases and affordable local manufacturing to fuel diabetes care devices demand

- 9.4.5 AUSTRALIA

- 9.4.5.1 Comprehensive government-backed initiatives and subsidies to support market growth

- 9.4.6 SOUTH KOREA

- 9.4.6.1 Rise in diabetes cases and strong government healthcare support to boost market growth

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Increasing adoption of advanced diabetes monitoring and management solutions to aid market growth

- 9.5.3 MEXICO

- 9.5.3.1 Supportive regulatory frameworks and high burden of diabetes to propel market growth

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 INCREASING AWARENESS OF EARLY DIAGNOSIS AND GLYCEMIC CONTROL FOR DIABETES MANAGEMENT TO FAVOR MARKET GROWTH

- 9.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.7 GCC COUNTRIES

- 9.7.1 RISE IN DIABETES PREVALENCE AND HIGH PER CAPITA HEALTHCARE EXPENDITURE TO DRIVE MARKET

- 9.7.2 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN DIABETES CARE DEVICES MARKET

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Product type footprint

- 10.5.5.4 Patient care settings footprint

- 10.5.5.5 Disease type footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 COMPANY VALUATION & FINANCIAL METRICS

- 10.7.1 FINANCIAL METRICS

- 10.7.2 COMPANY VALUATION

- 10.8 BRAND/PRODUCT COMPARISON

- 10.9 R&D EXPENDITURE OF KEY PLAYERS

- 10.10 COMPETITIVE SCENARIO

- 10.10.1 PRODUCT LAUNCHES AND APPROVALS

- 10.10.2 DEALS

- 10.10.3 EXPANSIONS

- 10.10.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 F. HOFFMAN-LA ROCHE LTD.

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches & approvals

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 ABBOTT

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches & approvals

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Expansions

- 11.1.2.3.4 Other developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 DEXCOM, INC.

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches & approvals

- 11.1.3.3.2 Deals

- 11.1.3.3.3 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses & competitive threats

- 11.1.4 MEDTRONIC

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches & approvals

- 11.1.4.3.2 Deals

- 11.1.4.3.3 Expansions

- 11.1.4.3.4 Other developments

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 B. BRAUN SE

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Right to win

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses & competitive threats

- 11.1.6 EMBECTA CORP.

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product approvals

- 11.1.6.3.2 Deals

- 11.1.6.3.3 Expansions

- 11.1.6.3.4 Other developments

- 11.1.7 NIPRO

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Expansions

- 11.1.8 SENSEONICS

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches & approvals

- 11.1.8.3.2 Deals

- 11.1.8.3.3 Other developments

- 11.1.9 YPSOMED

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches & approvals

- 11.1.9.3.2 Deals

- 11.1.9.3.3 Expansions

- 11.1.9.3.4 Other developments

- 11.1.10 I-SENS, INC.

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product approvals

- 11.1.10.3.2 Deals

- 11.1.11 TANDEM DIABETES CARE, INC.

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Product launches & approvals

- 11.1.11.3.2 Deals

- 11.1.12 INSULET CORPORATION

- 11.1.12.1 Business overview

- 11.1.12.2 Products/Solutions offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Product launches & approvals

- 11.1.12.3.2 Deals

- 11.1.12.3.3 Expansions

- 11.1.12.3.4 Other developments

- 11.1.13 ACON LABORATORIES, INC.

- 11.1.13.1 Business overview

- 11.1.13.2 Products/Solutions offered

- 11.1.14 ARKRAY, INC.

- 11.1.14.1 Business overview

- 11.1.14.2 Products/Solutions offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Product launches

- 11.1.15 TERUMO CORPORATION

- 11.1.15.1 Business overview

- 11.1.15.2 Products/Solutions offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Product launches

- 11.1.15.3.2 Deals

- 11.1.15.3.3 Expansions

- 11.1.15.3.4 Other developments

- 11.1.1 F. HOFFMAN-LA ROCHE LTD.

- 11.2 OTHER PLAYERS

- 11.2.1 SINOCARE

- 11.2.2 AGAMATRIX

- 11.2.3 LIFESCAN IP HOLDINGS, LLC

- 11.2.4 SD BIOSENSOR, INC.

- 11.2.5 DEBIOTECH S.A.

- 11.2.6 SUNGSHIM MEDICAL CO., LTD.

- 11.2.7 SOOIL DEVELOPMENTS CO., LTD.

- 11.2.8 HINDUSTAN SYRINGES & MEDICAL DEVICES LTD.

- 11.2.9 MICROGENE DIAGNOSTIC SYSTEMS (P) LTD.

- 11.2.10 ROSSMAX INTERNATIONAL LTD.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 DIABETES CARE DEVICES MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 STANDARD CURRENCY CONVERSION RATES

- TABLE 3 STUDY ASSUMPTIONS IN DIABETES CARE DEVICES MARKET

- TABLE 4 RISK ANALYSIS IN DIABETES CARE DEVICES MARKET

- TABLE 5 AVERAGE SELLING PRICE TREND OF DIABETES CARE DEVICES, BY KEY PLAYER, 2022-2024 (USD)

- TABLE 6 AVERAGE SELLING PRICE TREND OF DIABETES CARE, BY REGION, 2022-2024 (USD)

- TABLE 7 DIABETES CARE DEVICES MARKET: ROLE IN ECOSYSTEM

- TABLE 8 DIABETES CARE DEVICES MARKET: PORTER'S FIVE FORCES

- TABLE 9 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY END USER

- TABLE 10 KEY BUYING CRITERIA FOR MAJOR END USERS

- TABLE 11 IMPORT DATA FOR HS CODE 9027, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 12 EXPORT DATA FOR HS CODE 9027, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 LIST OF MAJOR PATENTS IN DIABETES CARE DEVICES MARKET, 2022-2024

- TABLE 19 DIABETES CARE DEVICES MARKET: LIST OF KEY CONFERENCES & EVENTS, JANUARY 2025-DECEMBER 2026

- TABLE 20 UNMET NEEDS IN DIABETES CARE DEVICES MARKET

- TABLE 21 END-USER EXPECTATIONS IN DIABETES CARE DEVICES MARKET

- TABLE 22 IMPACT OF AI/GEN AI IN DIABETES CARE DEVICES MARKET

- TABLE 23 CASE STUDY 1: LONG-TERM GLUCOSE MONITORING FOR SENSITIVE SKIN PATIENTS USING SENSEONICS' EVERSENSE E3 IMPLANTABLE SENSORS

- TABLE 24 CASE STUDY 2: ENHANCING PATIENT ADHERENCE AND GLYCEMIC CONTROL USING ABBOTT'S FREESTYLE LIBRE 2 CGM

- TABLE 25 CASE STUDY 3: MEDTRONIC MINIMED INSULIN PUMP TO ENHANCE GLUCOSE CONTROL AND IMPROVE DAILY MANAGEMENT FOR PEOPLE WITH DIABETES

- TABLE 26 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 27 DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 28 DIABETES CARE DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 29 DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 30 DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 31 SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 TEST STRIPS/TEST PAPERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 34 LANCETS/LANCING DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 35 DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 36 DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 38 INSULIN PUMPS & ACCESSORIES MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 39 INSULIN PUMPS & ACCESSORIES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 40 TETHERED INSULIN PUMPS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 TUBELESS INSULIN PUMPS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 43 INSULIN PENS MARKET, COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 REUSABLE INSULIN PENS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 DISPOSABLE INSULIN PENS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 PEN NEEDLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 INSULIN SYRINGES & NEEDLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 48 OTHER INSULIN DELIVERY DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 DIABETES CARE DEVICES MARKET FOR DIABETES MANAGEMENT MOBILE APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 50 DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 51 TYPE 1 DIABETES CARE DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 TYPE 2 DIABETES CARE DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 54 DIABETES CARE DEVICES MARKET FOR SELF/HOME HEALTHCARE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 55 DIABETES CARE DEVICES MARKET FOR HOSPITAL & DIABETES SPECIALTY CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 56 DIABETES CARE DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 57 NORTH AMERICA: DIABETES CARE DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 NORTH AMERICA: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 59 NORTH AMERICA: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 60 NORTH AMERICA: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 62 NORTH AMERICA: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 65 US: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 66 US: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 67 US: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 68 US: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 69 US: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 70 US: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 71 US: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 72 CANADA: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 73 CANADA: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 74 CANADA: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 75 CANADA: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 76 CANADA: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 77 CANADA: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 78 CANADA: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 79 EUROPE: DIABETES CARE DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 80 EUROPE: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 81 EUROPE: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 82 EUROPE: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 83 EUROPE: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 84 EUROPE: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 85 EUROPE: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 86 EUROPE: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 87 GERMANY: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 88 GERMANY: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 89 GERMANY: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 90 GERMANY: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 91 GERMANY: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 92 GERMANY: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 93 GERMANY: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 94 UK: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 95 UK: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 96 UK: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 97 UK: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 98 UK: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 99 UK: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 100 UK: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 101 FRANCE: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 102 FRANCE: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 103 FRANCE: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 104 FRANCE: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 105 FRANCE: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 106 FRANCE: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 107 FRANCE: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 108 ITALY: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 109 ITALY: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 110 ITALY: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 111 ITALY: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 112 ITALY: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 113 ITALY: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 114 ITALY: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 115 SPAIN: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 116 SPAIN: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 117 SPAIN: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 118 SPAIN: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 119 SPAIN: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 120 SPAIN: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 121 SPAIN: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 122 REST OF EUROPE: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 123 REST OF EUROPE: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 124 REST OF EUROPE: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 125 REST OF EUROPE: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 126 REST OF EUROPE: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 127 REST OF EUROPE: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 128 REST OF EUROPE: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 129 ASIA PACIFIC: DIABETES CARE DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 130 ASIA PACIFIC: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 ASIA PACIFIC: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 134 ASIA PACIFIC: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 135 ASIA PACIFIC: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 136 ASIA PACIFIC: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 137 CHINA: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 138 CHINA: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 139 CHINA: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 140 CHINA: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 141 CHINA: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 142 CHINA: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 143 CHINA: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 144 JAPAN: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 145 JAPAN: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 146 JAPAN: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 147 JAPAN: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 148 JAPAN: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 149 JAPAN: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 150 JAPAN: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 151 INDIA: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 152 INDIA: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 153 INDIA: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 154 INDIA: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 155 INDIA: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 156 INDIA: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 157 INDIA: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 158 AUSTRALIA: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 159 AUSTRALIA: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 160 AUSTRALIA: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 161 AUSTRALIA: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 162 AUSTRALIA: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 163 AUSTRALIA: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 164 AUSTRALIA: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 165 SOUTH KOREA: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 166 SOUTH KOREA: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 167 SOUTH KOREA: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 168 SOUTH KOREA: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 169 SOUTH KOREA: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 170 SOUTH KOREA: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 171 SOUTH KOREA: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 173 REST OF ASIA PACIFIC: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 174 REST OF ASIA PACIFIC: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 175 REST OF ASIA PACIFIC: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 176 REST OF ASIA PACIFIC: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 177 REST OF ASIA PACIFIC: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 178 REST OF ASIA PACIFIC: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 179 LATIN AMERICA: DIABETES CARE DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 180 LATIN AMERICA: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 181 LATIN AMERICA: DIABETES CARE DEVICES MARTKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 182 LATIN AMERICA: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 183 LATIN AMERICA: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 184 LATIN AMERICA: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 185 LATIN AMERICA: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 186 LATIN AMERICA: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 187 BRAZIL: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 188 BRAZIL: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 189 BRAZIL: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 190 BRAZIL: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 191 BRAZIL: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 192 BRAZIL: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 193 BRAZIL: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 194 MEXICO: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 195 MEXICO: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 196 MEXICO: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 197 MEXICO: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 198 MEXICO: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 199 MEXICO: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 200 MEXICO: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 201 REST OF LATIN AMERICA: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 202 REST OF LATIN AMERICA: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 203 REST OF LATIN AMERICA: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 204 REST OF LATIN AMERICA: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 205 REST OF LATIN AMERICA: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 206 REST OF LATIN AMERICA: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 207 REST OF LATIN AMERICA: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 215 GCC COUNTRIES: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 216 GCC COUNTRIES: DIABETES CARE DEVICES MARKET FOR BLOOD GLUCOSE MONITORING SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 217 GCC COUNTRIES: DIABETES CARE DEVICES MARKET FOR INSULIN DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 218 GCC COUNTRIES: INSULIN PUMPS & ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 219 GCC COUNTRIES: INSULIN PENS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 220 GCC COUNTRIES: DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2023-2030 (USD MILLION)

- TABLE 221 GCC COUNTRIES: DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 222 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN DIABETES CARE DEVICES MARKET, JANUARY 2022-AUGUST 2025

- TABLE 223 DIABETES CARE DEVICES MARKET: DEGREE OF COMPETITION

- TABLE 224 DIABETES CARE DEVICES MARKET: REGION FOOTPRINT

- TABLE 225 DIABETES CARE DEVICES MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 226 DIABETES CARE DEVICES MARKET: PATIENT CARE SETTINGS FOOTPRINT

- TABLE 227 DIABETES CARE DEVICES MARKET: DISEASE TYPE FOOTPRINT

- TABLE 228 DIABETES CARE DEVICES MARKET: DETAILED LIST OF KEY STARTUPS/SME PLAYERS

- TABLE 229 DIABETES CARE DEVICES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SME PLAYERS, BY PRODUCT TYPE AND REGION

- TABLE 230 DIABETES CARE DEVICES MARKET: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022- JUNE 2025

- TABLE 231 DIABETES CARE DEVICES MARKET: DEALS, JANUARY 2022- JUNE 2025

- TABLE 232 DIABETES CARE DEVICES MARKET: EXPANSIONS, JANUARY 2022- JUNE 2025

- TABLE 233 DIABETES CARE DEVICES MARKET: OTHER DEVELOPMENTS, JANUARY 2022- JUNE 2025

- TABLE 234 F. HOFFMAN-LA ROCHE LTD.: COMPANY OVERVIEW

- TABLE 235 F. HOFFMAN-LA ROCHE LTD.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 236 F. HOFFMANN-LA ROCHE LTD.: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 237 F. HOFFMANN-LA ROCHE LTD.: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 238 F. HOFFMANN-LA ROCHE LTD.: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 239 ABBOTT: COMPANY OVERVIEW

- TABLE 240 ABBOTT: PRODUCTS/SOLUTIONS OFFERED

- TABLE 241 ABBOTT: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 242 ABBOTT: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 243 ABBOTT: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 244 ABBOTT: OTHER DEVELOPMENTS, JANUARY 2022-AUGUST 2025

- TABLE 245 DEXCOM, INC.: COMPANY OVERVIEW

- TABLE 246 DEXCOM, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 247 DEXCOM, INC.: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 248 DEXCOM, INC.: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 249 DEXCOM, INC.: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 250 MEDTRONIC: COMPANY OVERVIEW

- TABLE 251 MEDTRONIC: PRODUCTS/SOLUTIONS OFFERED

- TABLE 252 MEDTRONIC: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 253 MEDTRONIC: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 254 MEDTRONIC: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 255 MEDTRONIC: OTHER DEVELOPMENTS, JANUARY 2022-AUGUST 2025

- TABLE 256 B. BRAUN SE: COMPANY OVERVIEW

- TABLE 257 B. BRAUN SE: PRODUCTS/SOLUTIONS OFFERED

- TABLE 258 EMBECTA CORP.: COMPANY OVERVIEW

- TABLE 259 EMBECTA CORP.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 260 EMBECTA CORP.: PRODUCTS APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 261 EMBECTA CORP.: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 262 EMBECTA CORP.: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 263 EMBECTA CORP.: OTHER DEVELOPMENTS, JANUARY 2022-AUGUST 2025

- TABLE 264 NIPRO: COMPANY OVERVIEW

- TABLE 265 NIPRO: PRODUCTS/SOLUTIONS OFFERED

- TABLE 266 NIPRO: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 267 SENSEONICS: COMPANY OVERVIEW

- TABLE 268 SENSEONICS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 269 SENSEONICS: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 270 SENSEONICS: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 271 SENSEONICS: OTHER DEVELOPMENTS, JANUARY 2022-AUGUST 2025

- TABLE 272 YPSOMED: COMPANY OVERVIEW

- TABLE 273 YPSOMED: PRODUCTS/SOLUTIONS OFFERED

- TABLE 274 YPSOMED: PRODUCTS LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 275 YPSOMED: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 276 YPSOMED: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 277 YPSOMED: OTHER DEVELOPMENTS, JANUARY 2022-AUGUST 2025

- TABLE 278 I-SENS, INC.: COMPANY OVERVIEW

- TABLE 279 I-SENS, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 280 I-SENS, INC.: PRODUCTS APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 281 I-SENS, INC.: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 282 TANDEM DIABETES CARE, INC.: COMPANY OVERVIEW

- TABLE 283 TANDEM DIABETES CARE, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 284 TANDEM DIABETES CARE, INC.: PRODUCTS LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 285 TANDEM DIABETES CARE, INC.: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 286 INSULET CORPORATION: COMPANY OVERVIEW

- TABLE 287 INSULET CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 288 INSULET CORPORATION: PRODUCTS LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 289 INSULET CORPORATION: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 290 INSULET CORPORATION: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 291 INSULET CORPORATION: OTHER DEVELOPMENTS, JANUARY 2022-AUGUST 2025

- TABLE 292 ACON LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 293 ACON LABORATORIES, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 294 ARKRAY, INC.: COMPANY OVERVIEW

- TABLE 295 ARKRAY, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 296 ARKRAY, INC.: PRODUCTS LAUNCHES, JANUARY 2022-AUGUST 2025

- TABLE 297 TERUMO CORPORATION: COMPANY OVERVIEW

- TABLE 298 TERUMO CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 299 TERUMO CORPORATION: PRODUCTS LAUNCHES, JANUARY 2022-AUGUST 2025

- TABLE 300 TERUMO CORPORATION: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 301 TERUMO CORPORATION: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 302 TERUMO CORPORATION: OTHER DEVELOPMENTS, JANUARY 2022-AUGUST 2025

- TABLE 303 SINOCARE: COMPANY OVERVIEW

- TABLE 304 AGAMATRIX: COMPANY OVERVIEW

- TABLE 305 LIFESCAN IP HOLDINGS, LLC: COMPANY OVERVIEW

- TABLE 306 SD BIOSENSOR, INC.: COMPANY OVERVIEW

- TABLE 307 DEBIOTECH S.A.: COMPANY OVERVIEW

- TABLE 308 SUNGSHIM MEDICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 309 SOOIL DEVELOPMENTS CO., LTD.: COMPANY OVERVIEW

- TABLE 310 HINDUSTAN SYRINGES & MEDICAL DEVICES LTD.: COMPANY OVERVIEW

- TABLE 311 MICROGENE DIAGNOSTIC SYSTEMS (P) LTD.: COMPANY OVERVIEW

- TABLE 312 ROSSMAX INTERNATIONAL LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 DIABETES CARE DEVICES MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 DIABETES CARE DEVICES MARKET: YEARS CONSIDERED

- FIGURE 3 DIABETES CARE DEVICES MARKET: RESEARCH DESIGN

- FIGURE 4 DIABETES CARE DEVICES MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 DIABETES CARE DEVICES MARKET: KEY PRIMARY SOURCES (SUPPLY AND DEMAND SIDES)

- FIGURE 6 DIABETES CARE DEVICES MARKET: KEY DATA FROM PRIMARY SOURCES

- FIGURE 7 DIABETES CARE DEVICES MARKET: KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 8 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY- AND DEMAND-SIDE PARTICIPANTS

- FIGURE 9 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 10 DIABETES CARE DEVICES MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS (2024)

- FIGURE 11 DIABETES CARE DEVICES MARKET: REVENUE SHARE ANALYSIS FOR ABBOTT (US) (2024)

- FIGURE 12 SUPPLY-SIDE ANALYSIS OF DIABETES CARE DEVICES MARKET (2024)

- FIGURE 13 DIABETES CARE DEVICES MARKET: CAGR PROJECTIONS (SUPPLY-SIDE ANALYSIS)

- FIGURE 14 DIABETES CARE DEVICES MARKET: BOTTOM-UP APPROACH

- FIGURE 15 CAGR PROJECTIONS FROM DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES ANALYSIS IN DIABETES CARE DEVICES MARKET (2025-2030)

- FIGURE 16 DIABETES CARE DEVICES MARKET: TOP-DOWN APPROACH

- FIGURE 17 DIABETES CARE DEVICES MARKET: DATA TRIANGULATION

- FIGURE 18 DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 19 DIABETES CARE DEVICES MARKET, BY DISEASE TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 20 DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS, 2025 VS. 2030 (USD MILLION)

- FIGURE 21 REGIONAL SNAPSHOT OF DIABETES CARE DEVICES MARKET

- FIGURE 22 TECHNOLOGICAL ADVANCEMENTS IN DIABETES CARE DEVICES TO DRIVE MARKET

- FIGURE 23 CHINA AND BLOOD GLUCOSE MONITORING SYSTEMS COMMNADED LARGEST ASIA PACIFIC MARKET SHARE IN 2024

- FIGURE 24 JAPAN TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 25 ASIA PACIFIC TO REGISTER HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 26 EMERGING MARKETS TO ACCOUNT FOR HIGHER GROWTH RATES DURING STUDY PERIOD

- FIGURE 27 DIABETES CARE DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 28 DIABETES CARE DEVICES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 29 DIABETES CARE DEVICES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 30 DIABETES CARE DEVICES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 31 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY END USER

- FIGURE 32 KEY BUYING CRITERIA FOR MAJOR END USERS

- FIGURE 33 TOP PATENT APPLICANTS/OWNERS (COMPANIES/INSTITUTES) FOR DIABETES CARE DEVICES MARKET (JANUARY 2014-DECEMBER 2024)

- FIGURE 34 TOP PATENT APPLICANT COUNTRIES FOR PATENTS ON DIABETES CARE DEVICES (JANUARY 2014-DECEMBER 2024)

- FIGURE 35 ADJACENT MARKETS TO DIABETES CARE DEVICES MARKET

- FIGURE 36 DIABETES CARE DEVICES MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 37 IMPACT OF AI/GEN AI ON DIABETES CARE DEVICES MARKET

- FIGURE 38 FUNDING AND NUMBER OF DEALS IN DIABETES CARE DEVICES MARKET, 2019-2023 (USD MILLION)

- FIGURE 39 GEOGRAPHIC SNAPSHOT OF DIABETES CARE DEVICES MARKET

- FIGURE 40 NORTH AMERICA: DIABETES CARE DEVICES MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: DIABETES CARE DEVICES MARKET SNAPSHOT

- FIGURE 42 REVENUE SHARE ANALYSIS OF KEY PLAYERS IN DIABETES CARE DEVICES MARKET (2020-2024)

- FIGURE 43 MARKET SHARE ANALYSIS OF KEY PLAYERS IN DIABETES CARE DEVICES MARKET (2024)

- FIGURE 44 DIABETES CARE DEVICES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 45 DIABETES CARE DEVICES MARKET: COMPANY FOOTPRINT

- FIGURE 46 DIABETES CARE DEVICES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 47 EV/EBITDA OF KEY VENDORS

- FIGURE 48 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 49 DIABETES CARE DEVICES MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 50 R&D EXPENDITURE OF KEY PLAYERS IN DIABETES CARE DEVICES MARKET (2022-2024)

- FIGURE 51 F. HOFFMAN-LA ROCHE LTD.: COMPANY SNAPSHOT

- FIGURE 52 ABBOTT: COMPANY SNAPSHOT

- FIGURE 53 DEXCOM, INC.: COMPANY SNAPSHOT

- FIGURE 54 MEDTRONIC: COMPANY SNAPSHOT

- FIGURE 55 B. BRAUN SE: COMPANY SNAPSHOT

- FIGURE 56 EMBECTA CORP.: COMPANY SNAPSHOT

- FIGURE 57 NIPRO: COMPANY SNAPSHOT

- FIGURE 58 SENSEONICS: COMPANY SNAPSHOT

- FIGURE 59 YPSOMED: COMPANY SNAPSHOT

- FIGURE 60 I-SENS, INC.: COMPANY SNAPSHOT

- FIGURE 61 TANDEM DIABETES CARE, INC.: COMPANY SNAPSHOT

- FIGURE 62 INSULET CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 TERUMO CORPORATION: COMPANY SNAPSHOT