|

市場調查報告書

商品編碼

1812629

全球觸覺技術市場(按回饋類型、組件、產業垂直和地區分類)- 預測至 2030 年Haptic Technology Market by Eccentric Rotating Mass (ERM) & Linear Resonant Actuators (LRAs), Piezo Electric Actuators, Drivers & Microcontrollers, Feedback Type (Tactile, Force), Active Haptic Device, Passive Haptic Device - Global Forecast to 2030 |

||||||

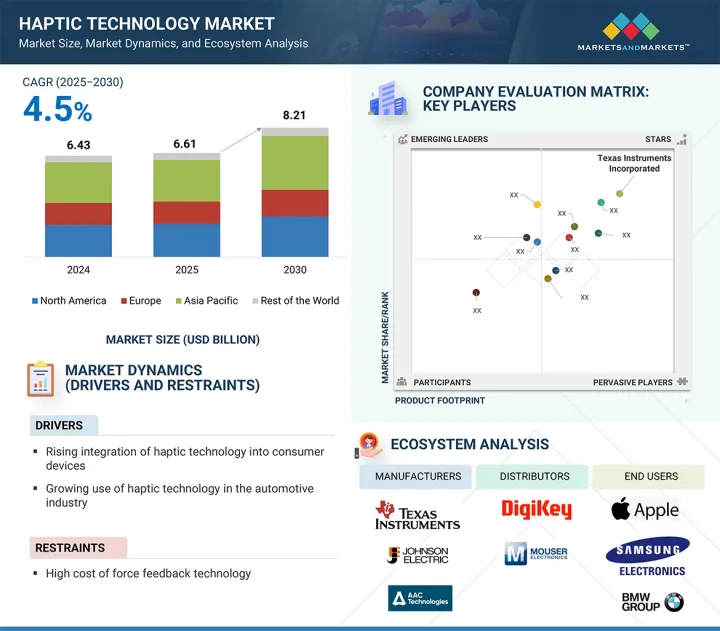

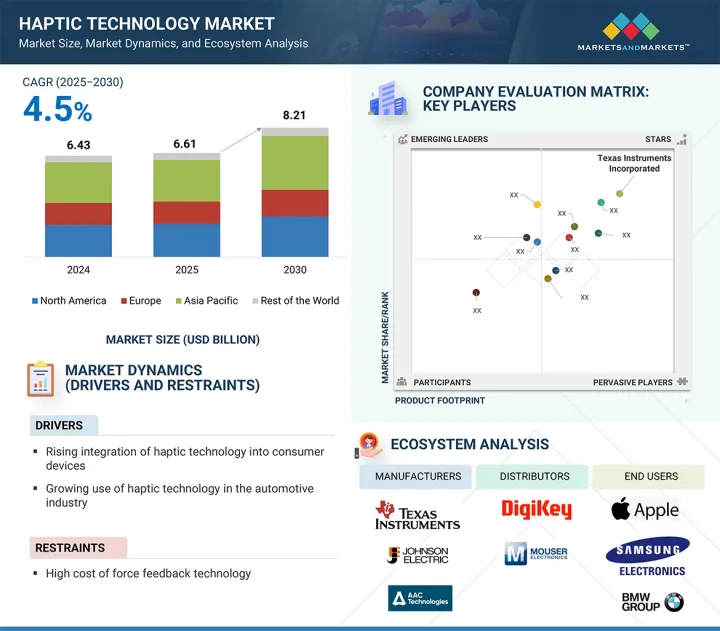

預計 2025 年全球觸覺技術市場價值將達到 66.1 億美元,到 2030 年將達到 82.1 億美元,預測期內複合年成長率為 4.5%。

受智慧型手機、平板電腦、穿戴式裝置、遊戲設備、車載介面和醫療保健應用對改善用戶體驗的需求不斷成長的推動,全部區域的觸覺技術市場正在經歷強勁成長。

| 調查範圍 | |

|---|---|

| 調查年份 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 對價單位 | 金額(十億美元) |

| 按細分市場 | 按回饋類型、組成部分、行業和地區 |

| 目標區域 | 北美、歐洲、亞太地區和其他地區 |

AR、VR 和 XR 平台的廣泛應用,加上高清觸覺和節能致動器等技術創新,進一步加速了這些平台的普及。觸覺解決方案透過提供精準的觸覺回饋回饋、實現直覺的控制並增強沉浸感,在改善使用者互動、可訪問性和安全性方面發揮關鍵作用。觸控螢幕上的觸覺回饋、模擬設備中的力回饋以及先進的觸覺介面等應用正在多個行業中廣泛應用,增強了全球市場前景。

力回饋技術預計將在預測期內佔據第二大市場規模,這得益於其在汽車安全和資訊娛樂系統中的日益普及、在手術模擬器和復健設備中的使用增加以及在遊戲和虛擬訓練環境中的應用不斷擴展。在汽車領域,力回饋技術透過觸覺驅動的轉向系統和控制面板增強駕駛員的感知和控制力,從而提高安全性和使用者體驗。在醫療保健領域,在手術模擬器和復健設備中提供逼真的力感在醫療培訓和復健中起著關鍵作用,可顯著提高精準度、技能發展和患者預後。此外,遊戲和虛擬訓練行業正在加速將力回饋整合到控制器、操縱桿和模擬設備中,以提供逼真的阻力和互動,從而提高沉浸感和參與度。這些多樣化應用的結合將確保對力回饋系統的持續需求,確保其在整個預測期內作為觸覺技術市場中第二大回饋類型的地位。

由於致動器技術的持續進步、對緊湊和節能觸覺組件的需求不斷成長,以及觸覺硬體在消費性電子產品、汽車和醫療保健設備中的整合度不斷提高,預計硬體部分將在預測期內實現最高的複合年成長率。線性諧振致動器(LRA)、偏心旋轉質量 (ERM) 電機和壓電致動器等創新致動器技術的進步,實現了更準確、響應更快、清晰度更高的觸覺回饋,刺激了多個行業的採用。對緊湊和節能組件的不斷成長的需求支持了智慧型手機、穿戴式設備和攜帶式設備的小型化趨勢,使製造商能夠在不影響設備尺寸或電池壽命的情況下提供強大的觸覺性能。此外,觸覺硬體擴大整合到家用電子電器、汽車資訊娛樂系統、AR/VR 控制器、手術模擬器和工業設備中,正在推動市場滲透。這些綜合因素使硬體部分在預測期內成為觸覺技術市場中成長最快的組件類別。

預計在預測期內,北美將在觸覺技術市場中實現第二高的複合年成長率,這得益於對高級遊戲和娛樂體驗的強勁需求、觸覺在醫療培訓和模擬中的應用日益廣泛,以及觸覺反饋在汽車技術中的快速整合。受 VR/AR 設備、遊戲機和身臨其境型配件的高採用率推動,對高級遊戲和娛樂體驗的強勁需求顯著增加了對增強真實感和用戶參與度的觸覺產品的需求。此外,觸覺技術在醫療培訓和模擬中的日益廣泛應用正在推動市場滲透,因為醫院和培訓中心利用觸覺回饋來改善手術模擬、診斷和復原過程,從而獲得更好的結果和技能發展。此外,汽車技術的快速整合也促進了成長,因為汽車製造商將觸覺回饋融入資訊娛樂系統、駕駛輔助功能和安全警報中,以增強用戶互動和道路安全。

本報告研究了全球觸覺技術市場,提供了按回饋類型、組件、行業垂直和地區分類的趨勢見解,以及參與市場的公司概況。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章 市場概況

- 介紹

- 市場動態

- 影響客戶業務的趨勢/中斷

- 定價分析

- 價值鏈分析

- 生態系分析

- 技術分析

- 專利分析

- 貿易分析

- 2025年主要會議和活動

- 案例研究

- 投資金籌措場景

- 關稅和監管狀況

- 波特五力分析

- 主要相關人員和採購標準

- 人工智慧/生成人工智慧對觸覺技術市場的影響

- 2025年美國關稅對觸覺技術市場的影響

第 6 章 主動與被動觸覺設備

- 介紹

- 主動觸覺設備

- 被動觸覺設備

第 7 章 觸覺觸控螢幕類型

- 介紹

- 電容式

- 反抗

- 其他

8. 觸覺技術市場(依回饋類型)

- 介紹

- 觸碰

- 力量

9. 觸覺技術市場(按組件)

- 介紹

- 硬體

- 軟體

第 10 章 觸覺技術市場(依產業垂直分類)

- 介紹

- 家電

- 汽車和運輸

- 教育/研究

- 衛生保健

- 商業的

- 其他

第 11 章 觸覺技術市場(按地區)

- 介紹

- 北美洲

- 北美宏觀經濟展望

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 歐洲宏觀經濟展望

- 英國

- 德國

- 法國

- 義大利

- 其他

- 亞太地區

- 亞太宏觀經濟展望

- 中國

- 日本

- 印度

- 韓國

- 其他

- 其他地區

- 世界其他地區宏觀經濟展望

- 中東

- 南美洲

第12章 競爭格局

- 概述

- 主要參與企業的策略/優勢,2020-2025

- 2024年市佔率分析

- 2020-2024年收益分析

- 估值和財務指標

- 品牌/產品比較

- 公司估值矩陣:2024 年關鍵參與企業

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 競爭場景

第13章:公司簡介

- 介紹

- 主要參與企業

- TEXAS INSTRUMENTS INCORPORATED

- JOHNSON ELECTRIC HOLDINGS LIMITED

- AAC TECHNOLOGIES

- TDK CORPORATION

- MICROCHIP TECHNOLOGY INC.

- IMMERSION

- SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC(ONSEMI)

- PRECISION MICRODRIVES

- SYNAPTICS INCORPORATED

- ULTRALEAP

- 其他公司

- AITO BV

- ALPS ALPINE

- CIRRUS LOGIC INC.

- INFINEON TECHNOLOGIES AG

- VYBRONICS

- RENESAS ELECTRONICS CORPORATION

- HAP2U

- IMAGIS

- NIDEC CORPORATION

- MPLUS

- BOREAS TECHNOLOGIES

- ANALOG DEVICES

- ALLEGRO MICROSYSTEMS

- NOVASENTIS, INC.

- NEED-FOR-POWER MOTOR CO., LTD.

第14章 附錄

The global haptic technology market was valued at USD 6.61 billion in 2025 and is projected to reach USD 8.21 billion by 2030, at a CAGR of 4.5% during the forecast period. The haptic technology market is experiencing strong growth across regions, driven by increasing demand for enhanced user experiences in smartphones, tablets, wearables, gaming devices, automotive interfaces, and healthcare applications.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Feedback Type, Component, Vertical, and Region |

| Regions covered | North America, Europe, APAC, RoW |

The proliferation of AR, VR, and XR platforms, coupled with technological innovations such as high-definition haptics and energy-efficient actuators, is further accelerating adoption. Haptic solutions play a vital role in improving user interaction, accessibility, and safety by delivering precise tactile feedback, enabling intuitive controls, and enhancing immersion. Applications such as tactile feedback in touchscreens, force feedback in simulation devices, and advanced haptic-enabled interfaces are being widely adopted across multiple industries, strengthening the global market outlook.

"Based on feedback type, the force segment will account for the second-largest market size during the forecast period"

Force segment holds the second-largest market size during the forecast period due to its growing adoption in automotive safety and infotainment systems, increasing use in surgical simulators and rehabilitation equipment, and expanding applications in gaming and virtual training environments. In the automotive sector, force feedback technology enhances driver awareness and control through haptic-enabled steering systems and control panels, thereby improving safety and user experience. In the healthcare sector, it plays a crucial role in medical training and rehabilitation by providing realistic force sensations in surgical simulators and rehabilitation devices, which significantly improve precision, skill development, and patient outcomes. Additionally, the gaming and virtual training industries are increasingly integrating force feedback into controllers, joysticks, and simulation equipment to deliver lifelike resistance and interaction, enhancing immersion and engagement. The combination of these diverse applications ensures sustained demand for force feedback systems, securing its position as the second-largest feedback type in the haptic technology market throughout the forecast period.

"Based on component, the hardware segment is projected to register the highest CAGR during the forecast period"

The hardware segment is expected to witness the highest CAGR during the forecast period due to continuous advancements in actuator technologies, rising demand for compact and energy-efficient haptic components, and increasing integration of haptic hardware across consumer electronics, automotive, and healthcare devices. Advancements in actuator technologies, including innovations in Linear Resonant Actuators (LRA), Eccentric Rotating Mass (ERM) motors, and piezo actuators, are enabling more precise, responsive, and high-definition tactile feedback, driving adoption across multiple industries. The rising demand for compact and energy-efficient components supports the growing trend of miniaturization in smartphones, wearables, and portable devices, allowing manufacturers to deliver powerful haptic performance without compromising device size or battery life. Furthermore, the increased integration of haptic hardware in consumer electronics, automotive infotainment systems, AR/VR controllers, surgical simulators, and industrial equipment is expanding market penetration. These combined factors position the hardware segment as the fastest-growing component category in the haptic technology market during the forecast period.

" North America will register the second-highest CAGR during the forecast period"

North America is expected to witness the second-highest CAGR in the haptic technology market during the forecast period due to strong demand for advanced gaming and entertainment experiences, increasing adoption of haptics in medical training and simulation, and rapid integration of haptic feedback in automotive technologies. The strong demand for advanced gaming and entertainment experiences is driven by the high adoption of VR/AR devices, gaming consoles, and immersive accessories, which significantly increases the demand for haptic-enabled products that enhance realism and user engagement. Additionally, the increasing adoption of haptic technology in medical training and simulation is boosting market penetration, as hospitals and training centers leverage haptic feedback to improve surgical simulations, diagnostics, and rehabilitation processes, leading to better outcomes and skill development. Furthermore, rapid integration in automotive technologies is contributing to growth, with automakers incorporating haptic feedback into infotainment systems, driver-assist features, and safety alerts to enhance user interaction and road safety.

Extensive primary interviews were conducted with key industry experts in the haptic technology market to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation - Directors - 50%, Managers - 30%, and Others - 20%

- By Region - North America - 45%, Europe - 30%, Asia Pacific - 20%, and RoW - 5%

The haptic technology market is dominated by a few globally established players, such as Texas Instruments Incorporated (US), Johnson Electric Holdings Limited (China), AAC Technologies (China), TDK Corporation (Japan), Microchip Technology Inc. (US), Immersion (US), Semiconductor Components Industries, LLC (US), Precision Microdrives (UK), Synaptics Incorporated (US), Ultraleap (UK), Aito (Netherlands), ALPS ALPINE CO., LTD. (Japan), Cirrus Logic, Inc. (US), Infineon Technologies AG (Germany), and Vybronics (Vietnam).

The study includes an in-depth competitive analysis of these key players in the haptic technology market, with their company profiles, recent developments, and key market strategies.

Study Coverage:

The report segments the haptic technology market and forecasts its size by feedback type (tactile, force), by component (hardware, software), and vertical (consumer electronics, automotive & transportation, education & research, healthcare, commercial, others). It also discusses the market's drivers, restraints, opportunities, and challenges. It gives a detailed view of the market across four main regions (North America, Europe, Asia Pacific, and RoW). The report includes a value chain analysis of the key players and their competitive analysis in the haptic technology ecosystem.

Key Benefits of Buying the Report:

- Analysis of key drivers (Rising integration of haptic technology into consumer devices, Growing use of haptic technology in automotive industry, Increasing use of haptic technology in healthcare industry, Increasing adoption of haptic technology in industrial applications), restraints (High cost of force feedback technology), opportunities (Rising applications of haptic technology in aerospace & defense industry, Technological advancements in haptic technology), challenges (Technical challenges related to product design, High power consumption in haptic feedback, Leakage issues associated with pneumatic and hydraulic actuators)

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the haptic technology market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the haptic technology market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the haptic technology market

- Competitive Assessment: In-depth assessment of market shares and growth strategies of leading players, such as Texas Instruments Incorporated (US), Johnson Electric Holdings Limited (China), AAC Technologies (China), TDK Corporation (Japan), Microchip Technology Inc. (US), Immersion (US), Semiconductor Components Industries, LLC (US), Precision Microdrives (UK), Synaptics Incorporated (US), Ultraleap (UK), Aito (Netherlands), ALPS ALPINE CO., LTD. (Japan), Cirrus Logic, Inc. (US), Infineon Technologies AG (Germany), and Vybronics (Vietnam)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Breakdown of primary interviews

- 2.1.3.3 Key data from primary sources

- 2.1.3.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 DEMAND-SIDE ANALYSIS

- 2.3.2 SUPPLY-SIDE ANALYSIS

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HAPTIC TECHNOLOGY MARKET

- 4.2 HAPTIC TECHNOLOGY MARKET, BY FEEDBACK TYPE

- 4.3 HAPTIC TECHNOLOGY MARKET, BY COMPONENT

- 4.4 HAPTIC TECHNOLOGY MARKET, BY VERTICAL

- 4.5 HAPTIC TECHNOLOGY MARKET, BY REGION

- 4.6 HAPTIC TECHNOLOGY MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising integration of haptic technology into consumer electronics

- 5.2.1.2 Growing adoption of haptic technology in automotive applications

- 5.2.1.3 Increasing use of haptic technology in healthcare industry

- 5.2.1.4 Surging deployment of haptic technology in industrial applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of force feedback haptic technology

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising applications of haptic technology in aerospace & defense industry

- 5.2.3.2 Emerging applications of haptic technology in education and robotic fields

- 5.2.4 CHALLENGES

- 5.2.4.1 Technical challenges related to product design

- 5.2.4.2 High power consumption of haptic technology-based products

- 5.2.4.3 Leakage issues associated with pneumatic and hydraulic actuators

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE OF ACTUATOR TYPES, BY KEY PLAYER, 2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF ACTUATOR TYPES, BY REGION, 2021-2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Vibrotactile haptic feedback

- 5.7.1.2 Electroactive polymers

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Human-machine interfaces

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Motion tracking systems

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 8501)

- 5.9.2 EXPORT SCENARIO (HS CODE 8501)

- 5.10 KEY CONFERENCES AND EVENTS, 2025

- 5.11 CASE STUDIES

- 5.11.1 INTEGRATION OF HAPTIC TECHNOLOGY INTO MEDICAL SIMULATORS TO SIMULATE ORTHOPEDIC AND LAPAROSCOPIC SURGERIES

- 5.11.2 DEPLOYMENT OF HAPTIC TECHNOLOGY INTO LEGACY CONSUMER ELECTRONIC DEVICES TO ENHANCE USER SATISFACTION

- 5.11.3 USE OF HAPTIC GLOVES IN INDUSTRIAL TRAINING PROGRAMS TO OFFER REALISTIC, TOUCH-SENSITIVE VIRTUAL SIMULATIONS

- 5.11.4 ADOPTION OF HAPTIC TECHNOLOGY BY REHABILITATION CENTERS TO IMPROVE MOTOR SKILLS RECOVERY

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS (HS CODE 8501)

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 KEY REGULATIONS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREATS OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI ON HAPTIC TECHNOLOGY MARKET

- 5.17 IMPACT OF 2025 US TARIFF ON HAPTIC TECHNOLOGY MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON VERTICALS

6 ACTIVE AND PASSIVE HAPTIC DEVICES

- 6.1 INTRODUCTION

- 6.2 ACTIVE HAPTIC DEVICES

- 6.3 PASSIVE HAPTIC DEVICES

7 HAPTIC TOUCH SCREEN TYPES

- 7.1 INTRODUCTION

- 7.2 CAPACITIVE

- 7.3 RESISTIVE

- 7.4 OTHERS

8 HAPTIC TECHNOLOGY MARKET, BY FEEDBACK TYPE

- 8.1 INTRODUCTION

- 8.2 TACTILE

- 8.2.1 WIDE DEPLOYMENT IN SMARTPHONES, WEARABLES, AND GAMING CONTROLLERS TO FACILITATE SEGMENTAL GROWTH

- 8.3 FORCE

- 8.3.1 ROBOTICS, AUTOMOTIVE, AND AEROSPACE APPLICATIONS TO CREATE LUCRATIVE OPPORTUNITIES

9 HAPTIC TECHNOLOGY MARKET, BY COMPONENT

- 9.1 INTRODUCTION

- 9.2 HARDWARE

- 9.2.1 ACTUATORS

- 9.2.1.1 ERM actuators & LRAs

- 9.2.1.1.1 Growing focus on device miniaturization and intuitive interface design to boost segmental growth

- 9.2.1.2 Piezoelectric actuators

- 9.2.1.2.1 Ultra-fast response times, less energy consumption, and low latency features to drive adoption

- 9.2.1.1 ERM actuators & LRAs

- 9.2.2 DRIVERS & MICROCONTROLLERS

- 9.2.2.1 Significant focus of consumer device manufacturers on enhancing user experience to fuel segmental growth

- 9.2.1 ACTUATORS

- 9.3 SOFTWARE

- 9.3.1 NEED FOR REAL-TIME RESPONSIVENESS AND MULTIMODAL SYNCHRONIZATION TO FOSTER SEGMENTAL GROWTH

10 HAPTIC TECHNOLOGY MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- 10.2 CONSUMER ELECTRONICS

- 10.2.1 ESCALATING CONSUMER DEMAND FOR IMMERSIVE EXPERIENCES AND ENHANCED TOUCHSCREEN FUNCTIONALITY TO DRIVE MARKET

- 10.3 AUTOMOTIVE & TRANSPORTATION

- 10.3.1 ELEVATING DEMAND FOR ELECTRIC AND AUTONOMOUS VEHICLES TO CREATE GROWTH OPPORTUNITIES

- 10.4 EDUCATION & RESEARCH

- 10.4.1 SURGING ADOPTION OF E-LEARNING PLATFORMS AND VIRTUAL LABORATORIES TO PROPEL MARKET

- 10.5 HEALTHCARE

- 10.5.1 INCREASING ADOPTION OF SIMULATION-BASED MEDICAL TRAINING MODULES TO FOSTER MARKET GROWTH

- 10.6 COMMERCIAL

- 10.6.1 EMPHASIS ON DELIVERING MULTI-SENSORY EXPERIENCES AS CUSTOMER RETENTION MECHANISM TO DRIVE MARKET

- 10.7 OTHER VERTICALS

11 HAPTIC TECHNOLOGY MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Advancements in XR, AI, and 5G connectivity technologies to augment market growth

- 11.2.3 CANADA

- 11.2.3.1 Government initiatives promoting digital innovation and technology-driven skill development to support market growth

- 11.2.4 MEXICO

- 11.2.4.1 Rising demand for haptic-based surgical simulators and rehabilitation devices to fuel market growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 UK

- 11.3.2.1 Increasing demand for haptic-enabled surgical simulators and rehabilitation devices to create growth opportunities

- 11.3.3 GERMANY

- 11.3.3.1 Rising use of haptic solutions in premium vehicles and industrial automation tools to foster market growth

- 11.3.4 FRANCE

- 11.3.4.1 Elevating demand for haptic-based surgical simulators and telemedicine solutions to foster market growth

- 11.3.5 ITALY

- 11.3.5.1 Growing implementation of Industry 4.0 practices in manufacturing to boost demand

- 11.3.6 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Rising demand for advanced consumer electronics to support market growth

- 11.4.3 JAPAN

- 11.4.3.1 Elevating requirement for immersive consumer electronics and advanced automotive systems to drive market

- 11.4.4 INDIA

- 11.4.4.1 Thriving gaming industry and increasing popularity of VR/AR-based content to fuel market growth

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Significant presence of technology leaders to contribute to market growth

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 ROW

- 11.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 11.5.2 MIDDLE EAST

- 11.5.2.1 GCC

- 11.5.2.1.1 Increasing smartphone penetration and rapid digital adoption to support market expansion

- 11.5.2.2 Africa and Rest of Middle East

- 11.5.2.1 GCC

- 11.5.3 SOUTH AMERICA

- 11.5.3.1 Booming e-commerce industry to create growth opportunities

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.4 REVENUE ANALYSIS, 2020-2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Feedback type footprint

- 12.7.5.4 Vertical footprint

- 12.7.5.5 Component footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES PLAYERS, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of startups/SMEs

- 12.8.5.2 Competitive benchmarking of startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 TEXAS INSTRUMENTS INCORPORATED

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Product launches

- 13.2.1.4 MnM view

- 13.2.1.4.1 Key strengths

- 13.2.1.4.2 Strategic choices

- 13.2.1.4.3 Weaknesses and competitive threats

- 13.2.2 JOHNSON ELECTRIC HOLDINGS LIMITED

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.3.1 Product launches

- 13.2.2.4 MnM view

- 13.2.2.4.1 Key strengths

- 13.2.2.4.2 Strategic choices

- 13.2.2.4.3 Weaknesses and competitive threats

- 13.2.3 AAC TECHNOLOGIES

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 Recent developments

- 13.2.3.3.1 Product launches

- 13.2.3.3.2 Deals

- 13.2.3.4 MnM view

- 13.2.3.4.1 Key strengths

- 13.2.3.4.2 Strategic choices

- 13.2.3.4.3 Weaknesses and competitive threats

- 13.2.4 TDK CORPORATION

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 Recent developments

- 13.2.4.3.1 Product launches

- 13.2.4.3.2 Deals

- 13.2.4.4 MnM view

- 13.2.4.4.1 Key strengths

- 13.2.4.4.2 Strategic choices

- 13.2.4.4.3 Weaknesses and competitive threats

- 13.2.5 MICROCHIP TECHNOLOGY INC.

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Product launches

- 13.2.5.3.2 Deals

- 13.2.5.4 MnM view

- 13.2.5.4.1 Key strengths

- 13.2.5.4.2 Strategic choices

- 13.2.5.4.3 Weaknesses and competitive threats

- 13.2.6 IMMERSION

- 13.2.6.1 Business overview

- 13.2.6.2 Products/Solutions/Services offered

- 13.2.6.3 Recent developments

- 13.2.6.3.1 Deals

- 13.2.7 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC (ONSEMI)

- 13.2.7.1 Business overview

- 13.2.7.2 Products/Solutions/Services offered

- 13.2.8 PRECISION MICRODRIVES

- 13.2.8.1 Business overview

- 13.2.8.2 Products/Solutions/Services offered

- 13.2.9 SYNAPTICS INCORPORATED

- 13.2.9.1 Business overview

- 13.2.9.2 Products/Solutions/Services offered

- 13.2.9.3 Recent developments

- 13.2.9.3.1 Product launches

- 13.2.9.3.2 Deals

- 13.2.10 ULTRALEAP

- 13.2.10.1 Business overview

- 13.2.10.2 Products/Solutions/Services offered

- 13.2.10.3 Recent developments

- 13.2.10.3.1 Product launches

- 13.2.10.3.2 Deals

- 13.2.1 TEXAS INSTRUMENTS INCORPORATED

- 13.3 OTHER PLAYERS

- 13.3.1 AITO BV

- 13.3.2 ALPS ALPINE

- 13.3.3 CIRRUS LOGIC INC.

- 13.3.4 INFINEON TECHNOLOGIES AG

- 13.3.5 VYBRONICS

- 13.3.6 RENESAS ELECTRONICS CORPORATION

- 13.3.7 HAP2U

- 13.3.8 IMAGIS

- 13.3.9 NIDEC CORPORATION

- 13.3.10 MPLUS

- 13.3.11 BOREAS TECHNOLOGIES

- 13.3.12 ANALOG DEVICES

- 13.3.13 ALLEGRO MICROSYSTEMS

- 13.3.14 NOVASENTIS, INC.

- 13.3.15 NEED-FOR-POWER MOTOR CO., LTD.

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS IN MARKET UNDER STUDY

- TABLE 2 CHANGES IMPLEMENTED IN LATEST REPORT VERSION

- TABLE 3 SECONDARY SOURCES CONSIDERED

- TABLE 4 KEY OPINION LEADERS IN DIFFERENT ORGANIZATIONS

- TABLE 5 DATA COMPILED FROM PRIMARY SOURCES

- TABLE 6 HAPTIC TECHNOLOGY MARKET: RISK ASSESSMENT

- TABLE 7 AVERAGE SELLING PRICE OF PIEZOELECTRIC ACTUATORS PROVIDED BY KEY PLAYERS, 2024 (USD)

- TABLE 8 AVERAGE SELLING PRICE OF LINEAR RESONANT ACTUATORS PROVIDED BY KEY PLAYERS, 2024 (USD)

- TABLE 9 AVERAGE SELLING PRICE TREND OF PIEZOELECTRIC ACTUATORS, BY REGION, 2021-2024 (USD)

- TABLE 10 AVERAGE SELLING PRICE TREND OF LINEAR RESONANT ACTUATORS, BY REGION, 2021-2024 (USD)

- TABLE 11 HAPTIC TECHNOLOGY MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 12 LIST OF MAJOR PATENTS, 2021-2024

- TABLE 13 IMPORT DATA FOR HS CODE 8501-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 14 EXPORT DATA FOR HS CODE 8501-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 15 KEY CONFERENCES AND EVENTS, 2025

- TABLE 16 MFN IMPORT TARIFFS FOR HS CODE 8501-COMPLIANT PRODUCTS, BY COUNTRY, 2024

- TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 HAPTIC TECHNOLOGY MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 VERTICALS

- TABLE 23 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

- TABLE 24 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 25 ANTICIPATED CHANGE IN PRICES AND IMPACT OF TARIFF ON VERTICALS

- TABLE 26 HAPTIC TECHNOLOGY MARKET, BY FEEDBACK TYPE, 2021-2024 (USD MILLION)

- TABLE 27 HAPTIC TECHNOLOGY MARKET, BY FEEDBACK TYPE, 2025-2030 (USD MILLION)

- TABLE 28 HAPTIC TECHNOLOGY MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 29 HAPTIC TECHNOLOGY MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 30 HAPTIC TECHNOLOGY MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 31 HAPTIC TECHNOLOGY MARKET, BY HARDWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 32 HARDWARE: HAPTIC TECHNOLOGY MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 33 HARDWARE: HAPTIC TECHNOLOGY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 34 HARDWARE: HAPTIC TECHNOLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 35 HARDWARE: HAPTIC TECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 HAPTIC TECHNOLOGY MARKET, BY ACTUATOR TYPE, 2021-2024 (USD MILLION)

- TABLE 37 HAPTIC TECHNOLOGY MARKET, BY ACTUATOR TYPE, 2025-2030 (USD MILLION)

- TABLE 38 HAPTIC TECHNOLOGY MARKET, BY ACTUATOR TYPE, 2021-2024 (MILLION UNITS)

- TABLE 39 HAPTIC TECHNOLOGY MARKET, BY ACTUATOR TYPE, 2025-2030 (MILLION UNITS)

- TABLE 40 ACTUATORS: HAPTIC TECHNOLOGY MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 41 ACTUATORS: HAPTIC TECHNOLOGY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 42 ACTUATORS: HAPTIC TECHNOLOGY MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 43 ACTUATORS: HAPTIC TECHNOLOGY MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 ACTUATORS: HAPTIC TECHNOLOGY MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 45 ACTUATORS: HAPTIC TECHNOLOGY MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 ACTUATORS: HAPTIC TECHNOLOGY MARKET FOR EDUCATION & RESEARCH, BY REGION, 2021-2024 (USD MILLION)

- TABLE 47 ACTUATORS: HAPTIC TECHNOLOGY MARKET FOR EDUCATION & RESEARCH, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 ACTUATORS: HAPTIC TECHNOLOGY MARKET FOR HEALTHCARE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 49 ACTUATORS: HAPTIC TECHNOLOGY MARKET FOR HEALTHCARE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 ACTUATORS: HAPTIC TECHNOLOGY MARKET FOR COMMERCIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 ACTUATORS: HAPTIC TECHNOLOGY MARKET FOR COMMERCIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 ACTUATORS: HAPTIC TECHNOLOGY MARKET FOR OTHER VERTICALS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 53 ACTUATORS: HAPTIC TECHNOLOGY MARKET FOR OTHER VERTICALS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 ACTUATORS: HAPTIC TECHNOLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 ACTUATORS: HAPTIC TECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 ERM ACTUATORS & LRAS: HAPTIC TECHNOLOGY MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 57 ERM ACTUATORS & LRAS: HAPTIC TECHNOLOGY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 58 ERM ACTUATORS & LRAS: HAPTIC TECHNOLOGY MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 ERM ACTUATORS & LRAS: HAPTIC TECHNOLOGY MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 ERM ACTUATORS & LRAS: HAPTIC TECHNOLOGY MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 61 ERM ACTUATORS & LRAS: HAPTIC TECHNOLOGY MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 ERM ACTUATORS & LRAS: HAPTIC TECHNOLOGY MARKET FOR EDUCATION & RESEARCH, BY REGION, 2021-2024 (USD MILLION)

- TABLE 63 ERM ACTUATORS & LRAS: HAPTIC TECHNOLOGY MARKET FOR EDUCATION & RESEARCH, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 ERM ACTUATORS & LRAS: HAPTIC TECHNOLOGY MARKET FOR HEALTHCARE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 65 ERM ACTUATORS & LRAS: HAPTIC TECHNOLOGY MARKET FOR HEALTHCARE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 ERM ACTUATORS & LRAS: HAPTIC TECHNOLOGY MARKET FOR COMMERCIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 67 ERM ACTUATORS & LRAS: HAPTIC TECHNOLOGY MARKET FOR COMMERCIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 ERM ACTUATORS & LRAS: HAPTIC TECHNOLOGY MARKET FOR OTHER VERTICALS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 ERM ACTUATORS & LRAS: HAPTIC TECHNOLOGY MARKET FOR OTHER VERTICALS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 ERM ACTUATORS & LRAS: HAPTIC TECHNOLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 ERM ACTUATORS & LRAS: HAPTIC TECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 PIEZOELECTRIC ACTUATORS: HAPTIC TECHNOLOGY MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 73 PIEZOELECTRIC ACTUATORS: HAPTIC TECHNOLOGY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 74 PIEZOELECTRIC ACTUATORS: HAPTIC TECHNOLOGY MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 75 PIEZOELECTRIC ACTUATORS: HAPTIC TECHNOLOGY MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 PIEZOELECTRIC ACTUATORS: HAPTIC TECHNOLOGY MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 77 PIEZOELECTRIC ACTUATORS: HAPTIC TECHNOLOGY MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 PIEZOELECTRIC ACTUATORS: HAPTIC TECHNOLOGY MARKET FOR EDUCATION & RESEARCH, BY REGION, 2021-2024 (USD MILLION)

- TABLE 79 PIEZOELECTRIC ACTUATORS: HAPTIC TECHNOLOGY MARKET FOR EDUCATION & RESEARCH, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 PIEZOELECTRIC ACTUATORS: HAPTIC TECHNOLOGY MARKET FOR HEALTHCARE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 81 PIEZOELECTRIC ACTUATORS: HAPTIC TECHNOLOGY MARKET FOR HEALTHCARE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 PIEZOELECTRIC ACTUATORS: HAPTIC TECHNOLOGY MARKET FOR COMMERCIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 83 PIEZOELECTRIC ACTUATORS: HAPTIC TECHNOLOGY MARKET FOR COMMERCIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 PIEZOELECTRIC ACTUATORS: HAPTIC TECHNOLOGY MARKET FOR OTHER VERTICALS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 85 PIEZOELECTRIC ACTUATORS: HAPTIC TECHNOLOGY MARKET FOR OTHER VERTICALS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 PIEZOELECTRIC ACTUATORS: HAPTIC TECHNOLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 87 PIEZOELECTRIC ACTUATORS: HAPTIC TECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 DRIVERS & MICROCONTROLLERS: HAPTIC TECHNOLOGY MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 89 DRIVERS & MICROCONTROLLERS: HAPTIC TECHNOLOGY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 90 DRIVERS & MICROCONTROLLERS: HAPTIC TECHNOLOGY MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 91 DRIVERS & MICROCONTROLLERS: HAPTIC TECHNOLOGY MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 92 DRIVERS & MICROCONTROLLERS: HAPTIC TECHNOLOGY MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 93 DRIVERS & MICROCONTROLLERS: HAPTIC TECHNOLOGY MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 94 DRIVERS & MICROCONTROLLERS: HAPTIC TECHNOLOGY MARKET FOR EDUCATION & RESEARCH, BY REGION, 2021-2024 (USD MILLION)

- TABLE 95 DRIVERS & MICROCONTROLLERS: HAPTIC TECHNOLOGY MARKET FOR EDUCATION & RESEARCH, BY REGION, 2025-2030 (USD MILLION)

- TABLE 96 DRIVERS & MICROCONTROLLERS: HAPTIC TECHNOLOGY MARKET FOR HEALTHCARE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 97 DRIVERS & MICROCONTROLLERS: HAPTIC TECHNOLOGY MARKET FOR HEALTHCARE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 98 DRIVERS & MICROCONTROLLERS: HAPTIC TECHNOLOGY MARKET FOR COMMERCIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 99 DRIVERS & MICROCONTROLLERS: HAPTIC TECHNOLOGY MARKET FOR COMMERCIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 100 DRIVERS & MICROCONTROLLERS: HAPTIC TECHNOLOGY MARKET FOR OTHER VERTICALS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 101 DRIVERS & MICROCONTROLLERS: HAPTIC TECHNOLOGY MARKET FOR OTHER VERTICALS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 102 DRIVERS & MICROCONTROLLERS: HAPTIC TECHNOLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 103 DRIVERS & MICROCONTROLLERS: HAPTIC TECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 104 SOFTWARE: HAPTIC TECHNOLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 105 SOFTWARE: HAPTIC TECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 106 SOFTWARE: HAPTIC TECHNOLOGY MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 107 SOFTWARE: HAPTIC TECHNOLOGY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 108 SOFTWARE: HAPTIC TECHNOLOGY MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 109 SOFTWARE: HAPTIC TECHNOLOGY MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 110 SOFTWARE: HAPTIC TECHNOLOGY MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 111 SOFTWARE: HAPTIC TECHNOLOGY MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 112 SOFTWARE: HAPTIC TECHNOLOGY MARKET FOR EDUCATION & RESEARCH, BY REGION, 2021-2024 (USD MILLION)

- TABLE 113 SOFTWARE: HAPTIC TECHNOLOGY MARKET FOR EDUCATION & RESEARCH, BY REGION, 2025-2030 (USD MILLION)

- TABLE 114 SOFTWARE: HAPTIC TECHNOLOGY MARKET FOR HEALTHCARE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 115 SOFTWARE: HAPTIC TECHNOLOGY MARKET FOR HEALTHCARE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 116 SOFTWARE: HAPTIC TECHNOLOGY MARKET FOR COMMERCIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 117 SOFTWARE: HAPTIC TECHNOLOGY MARKET FOR COMMERCIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 118 SOFTWARE: HAPTIC TECHNOLOGY MARKET FOR OTHER VERTICALS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 119 SOFTWARE: HAPTIC TECHNOLOGY MARKET FOR OTHER VERTICALS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 120 HAPTIC TECHNOLOGY MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 121 HAPTIC TECHNOLOGY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 122 CONSUMER ELECTRONICS: HAPTIC TECHNOLOGY MARKET, BY COMPONENT 2021-2024 (USD MILLION)

- TABLE 123 CONSUMER ELECTRONICS: HAPTIC TECHNOLOGY MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 124 CONSUMER ELECTRONICS: HAPTIC TECHNOLOGY MARKET, BY HARDWARE TYPE 2021-2024 (USD MILLION)

- TABLE 125 CONSUMER ELECTRONICS: HAPTIC TECHNOLOGY MARKET, BY HARDWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 126 CONSUMER ELECTRONICS: HAPTIC TECHNOLOGY MARKET, BY ACTUATOR TYPE 2021-2024 (USD MILLION)

- TABLE 127 CONSUMER ELECTRONICS: HAPTIC TECHNOLOGY MARKET, BY ACTUATOR TYPE, 2025-2030 (USD MILLION)

- TABLE 128 CONSUMER ELECTRONICS: HAPTIC TECHNOLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 129 CONSUMER ELECTRONICS: HAPTIC TECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 130 AUTOMOTIVE & TRANSPORTATION: HAPTIC TECHNOLOGY MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 131 AUTOMOTIVE & TRANSPORTATION: HAPTIC TECHNOLOGY MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 132 AUTOMOTIVE & TRANSPORTATION: HAPTIC TECHNOLOGY MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 133 AUTOMOTIVE & TRANSPORTATION: HAPTIC TECHNOLOGY MARKET, BY HARDWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 134 AUTOMOTIVE & TRANSPORTATION: HAPTIC TECHNOLOGY MARKET, BY ACTUATOR TYPE, 2021-2024 (USD MILLION)

- TABLE 135 AUTOMOTIVE & TRANSPORTATION: HAPTIC TECHNOLOGY MARKET, BY ACTUATOR TYPE, 2025-2030 (USD MILLION)

- TABLE 136 AUTOMOTIVE & TRANSPORTATION: HAPTIC TECHNOLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 137 AUTOMOTIVE & TRANSPORTATION: HAPTIC TECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 138 EDUCATION & RESEARCH: HAPTIC TECHNOLOGY MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 139 EDUCATION & RESEARCH: HAPTIC TECHNOLOGY MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 140 EDUCATION & RESEARCH: HAPTIC TECHNOLOGY MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 141 EDUCATION & RESEARCH: HAPTIC TECHNOLOGY MARKET, BY HARDWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 142 EDUCATION & RESEARCH: HAPTIC TECHNOLOGY MARKET, BY ACTUATOR TYPE, 2021-2024 (USD MILLION)

- TABLE 143 EDUCATION & RESEARCH: HAPTIC TECHNOLOGY MARKET, BY ACTUATOR TYPE, 2025-2030 (USD MILLION)

- TABLE 144 EDUCATION & RESEARCH: HAPTIC TECHNOLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 145 EDUCATION & RESEARCH: HAPTIC TECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 146 HEALTHCARE: HAPTIC TECHNOLOGY MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 147 HEALTHCARE: HAPTIC TECHNOLOGY MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 148 HEALTHCARE: HAPTIC TECHNOLOGY MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 149 HEALTHCARE: HAPTIC TECHNOLOGY MARKET, BY HARDWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 150 HEALTHCARE: HAPTIC TECHNOLOGY MARKET, BY ACTUATOR TYPE, 2021-2024 (USD MILLION)

- TABLE 151 HEALTHCARE: HAPTIC TECHNOLOGY MARKET, BY ACTUATOR TYPE, 2025-2030 (USD MILLION)

- TABLE 152 HEALTHCARE: HAPTIC TECHNOLOGY MARKET, BY REGION 2021-2024 (USD MILLION)

- TABLE 153 HEALTHCARE: HAPTIC TECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 154 COMMERCIAL: HAPTIC TECHNOLOGY MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 155 COMMERCIAL: HAPTIC TECHNOLOGY MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 156 COMMERCIAL: HAPTIC TECHNOLOGY MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 157 COMMERCIAL: HAPTIC TECHNOLOGY MARKET, BY HARDWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 158 COMMERCIAL: HAPTIC TECHNOLOGY MARKET, BY ACTUATOR TYPE, 2021-2024 (USD MILLION)

- TABLE 159 COMMERCIAL: HAPTIC TECHNOLOGY MARKET, BY ACTUATOR TYPE, 2025-2030 (USD MILLION)

- TABLE 160 COMMERCIAL: HAPTIC TECHNOLOGY MARKET, BY REGION 2021-2024 (USD MILLION)

- TABLE 161 COMMERCIAL: HAPTIC TECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 162 OTHER VERTICALS: HAPTIC TECHNOLOGY MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 163 OTHER VERTICALS: HAPTIC TECHNOLOGY MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 164 OTHER VERTICALS: HAPTIC TECHNOLOGY MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 165 OTHER VERTICALS: HAPTIC TECHNOLOGY MARKET, BY HARDWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 166 OTHER VERTICALS: HAPTIC TECHNOLOGY MARKET, BY ACTUATOR TYPE, 2021-2024 (USD MILLION)

- TABLE 167 OTHER VERTICALS: HAPTIC TECHNOLOGY MARKET, BY ACTUATOR TYPE, 2025-2030 (USD MILLION)

- TABLE 168 OTHER VERTICALS: HAPTIC TECHNOLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 169 OTHER VERTICALS: HAPTIC TECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 170 HAPTIC TECHNOLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 171 HAPTIC TECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 172 NORTH AMERICA: HAPTIC TECHNOLOGY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 173 NORTH AMERICA: HAPTIC TECHNOLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 174 NORTH AMERICA: HAPTIC TECHNOLOGY MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 175 NORTH AMERICA: HAPTIC TECHNOLOGY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 176 EUROPE: HAPTIC TECHNOLOGY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 177 EUROPE: HAPTIC TECHNOLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 178 EUROPE: HAPTIC TECHNOLOGY MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 179 EUROPE: HAPTIC TECHNOLOGY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 180 ASIA PACIFIC: HAPTIC TECHNOLOGY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 181 ASIA PACIFIC: HAPTIC TECHNOLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 182 ASIA PACIFIC: HAPTIC TECHNOLOGY MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 183 ASIA PACIFIC: HAPTIC TECHNOLOGY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 184 ROW: HAPTIC TECHNOLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 185 ROW: HAPTIC TECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 186 ROW: HAPTIC TECHNOLOGY MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 187 ROW: HAPTIC TECHNOLOGY MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: HAPTIC TECHNOLOGY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: HAPTIC TECHNOLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 190 HAPTIC TECHNOLOGY MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2025

- TABLE 191 HAPTIC TECHNOLOGY MARKET: MARKET SHARE ANALYSIS OF TOP 5 PLAYERS, 2024

- TABLE 192 HAPTIC TECHNOLOGY MARKET: REGION FOOTPRINT

- TABLE 193 HAPTIC TECHNOLOGY MARKET: FEEDBACK TYPE FOOTPRINT

- TABLE 194 HAPTIC TECHNOLOGY MARKET: VERTICAL FOOTPRINT

- TABLE 195 HAPTIC TECHNOLOGY MARKET: COMPONENT FOOTPRINT

- TABLE 196 HAPTIC TECHNOLOGY MARKET: LIST OF STARTUPS/SMES

- TABLE 197 HAPTIC TECHNOLOGY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 198 HAPTIC TECHNOLOGY MARKET: PRODUCT LAUNCHES, AUGUST 2020-JANUARY 2025

- TABLE 199 HAPTIC TECHNOLOGY MARKET: DEALS, AUGUST 2020-JANUARY 2025

- TABLE 200 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- TABLE 201 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 TEXAS INSTRUMENTS INCORPORATED: PRODUCT LAUNCHES

- TABLE 203 JOHNSON ELECTRIC HOLDINGS LIMITED: COMPANY OVERVIEW

- TABLE 204 JOHNSON ELECTRIC HOLDINGS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 JOHNSON ELECTRIC HOLDINGS LIMITED: PRODUCT LAUNCHES

- TABLE 206 AAC TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 207 AAC TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 AAC TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 209 AAC TECHNOLOGIES: DEALS

- TABLE 210 TDK CORPORATION: COMPANY OVERVIEW

- TABLE 211 TDK CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 TDK CORPORATION: PRODUCT LAUNCHES

- TABLE 213 TDK CORPORATION: DEALS

- TABLE 214 MICROCHIP TECHNOLOGY INC.: COMPANY OVERVIEW

- TABLE 215 MICROCHIP TECHNOLOGY INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 MICROCHIP TECHNOLOGY INC.: PRODUCT LAUNCHES

- TABLE 217 MICROCHIP TECHNOLOGY INC.: DEALS

- TABLE 218 IMMERSION: COMPANY OVERVIEW

- TABLE 219 IMMERSION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 IMMERSION: DEALS

- TABLE 221 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC (ONSEMI): COMPANY OVERVIEW

- TABLE 222 SEMICONDUCTOR COMPONENTS INDUSTRIES LLC (ONSEMI): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 PRECISION MICRODRIVES: COMPANY OVERVIEW

- TABLE 224 PRECISION MICRODRIVES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 SYNAPTICS INCORPORATED: COMPANY OVERVIEW

- TABLE 226 SYNAPTICS INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 SYNAPTICS INCORPORATED: PRODUCT LAUNCHES

- TABLE 228 SYNAPTICS INCORPORATED: DEALS

- TABLE 229 ULTRALEAP: COMPANY OVERVIEW

- TABLE 230 ULTRALEAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 ULTRALEAP: PRODUCT LAUNCHES

- TABLE 232 ULTRALEAP: DEALS

List of Figures

- FIGURE 1 HAPTIC TECHNOLOGY MARKET AND REGIONAL SEGMENTATION

- FIGURE 2 DURATION COVERED

- FIGURE 3 HAPTIC TECHNOLOGY MARKET: RESEARCH DESIGN

- FIGURE 4 PRIMARY AND SECONDARY RESEARCH APPROACH

- FIGURE 5 DATA DERIVED FROM SECONDARY SOURCES

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 HAPTIC TECHNOLOGY MARKET: BOTTOM-UP APPROACH

- FIGURE 8 HAPTIC TECHNOLOGY MARKET: TOP-DOWN APPROACH

- FIGURE 9 HAPTIC TECHNOLOGY MARKET SIZE ESTIMATION METHODOLOGY (DEMAND SIDE)

- FIGURE 10 HAPTIC TECHNOLOGY MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 11 HAPTIC TECHNOLOGY MARKET: DATA TRIANGULATION

- FIGURE 12 HAPTIC TECHNOLOGY MARKET: RESEARCH ASSUMPTIONS

- FIGURE 13 HAPTIC TECHNOLOGY MARKET, 2021-2030

- FIGURE 14 TACTILE SEGMENT TO CAPTURE MAJORITY OF MARKET SHARE IN 2025

- FIGURE 15 HARDWARE COMPONENTS TO LEAD HAPTIC TECHNOLOGY MARKET IN 2025

- FIGURE 16 CONSUMER ELECTRONICS VERTICAL TO DOMINATE HAPTIC TECHNOLOGY MARKET IN 2025

- FIGURE 17 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR HAPTIC TECHNOLOGY DURING FORECAST PERIOD

- FIGURE 18 GROWING DEMAND FOR IMMERSIVE DEVICES TO CREATE GROWTH OPPORTUNITIES

- FIGURE 19 TACTILE SEGMENT TO CAPTURE PROMINENT MARKET SHARE IN 2030

- FIGURE 20 HARDWARE SEGMENT TO COMMAND HAPTIC TECHNOLOGY MARKET IN 2030

- FIGURE 21 CONSUMER ELECTRONICS SEGMENT TO DOMINATE HAPTIC TECHNOLOGY MARKET IN 2030

- FIGURE 22 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 23 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL HAPTIC TECHNOLOGY MARKET DURING FORECAST PERIOD

- FIGURE 24 HAPTIC TECHNOLOGY MARKET DYNAMICS

- FIGURE 25 IMPACT ANALYSIS OF DRIVERS ON HAPTIC TECHNOLOGY MARKET

- FIGURE 26 IMPACT ANALYSIS OF RESTRAINTS ON HAPTIC TECHNOLOGY MARKET

- FIGURE 27 IMPACT ANALYSIS OF OPPORTUNITIES ON HAPTIC TECHNOLOGY MARKET

- FIGURE 28 ENERGY CONSUMED BY DIFFERENT TYPES OF ACTUATORS IN MOBILE DEVICES (%)

- FIGURE 29 IMPACT ANALYSIS OF CHALLENGES ON HAPTIC TECHNOLOGY MARKET

- FIGURE 30 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 31 AVERAGE SELLING PRICE OF PIEZOELECTRIC ACTUATORS OFFERED BY KEY PLAYERS, 2024

- FIGURE 32 AVERAGE SELLING PRICE OF LINEAR RESONANT ACTUATORS OFFERED BY KEY PLAYERS, 2024

- FIGURE 33 AVERAGE SELLING PRICE TREND OF PIEZOELECTRIC ACTUATORS, BY REGION, 2021-2024

- FIGURE 34 AVERAGE SELLING PRICE TREND OF LINEAR RESONANT ACTUATORS, BY REGION, 2021-2024

- FIGURE 35 HAPTIC TECHNOLOGY VALUE CHAIN ANALYSIS

- FIGURE 36 ECOSYSTEM ANALYSIS

- FIGURE 37 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 38 IMPORT SCENARIO FOR HS CODE 8501-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 39 EXPORT SCENARIO FOR HS CODE 8501-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024 (USD MILLION)

- FIGURE 40 INVESTMENT AND FUNDING SCENARIO, 2021-2024

- FIGURE 41 HAPTIC TECHNOLOGY MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 42 IMPACT OF PORTER'S FIVE FORCES

- FIGURE 43 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 VERTICALS

- FIGURE 44 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

- FIGURE 45 IMPACT OF AI/GEN AI ON HAPTIC TECHNOLOGY MARKET

- FIGURE 46 TACTILE SEGMENT TO LEAD HAPTIC TECHNOLOGY MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 47 HARDWARE SEGMENT TO ACCOUNT FOR LARGER SHARE OF HAPTIC TECHNOLOGY MARKET IN 2030

- FIGURE 48 CONSUMER ELECTRONICS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF HAPTIC TECHNOLOGY MARKET IN 2030

- FIGURE 49 ASIA PACIFIC TO LEAD HAPTIC TECHNOLOGY MARKET DURING FORECAST PERIOD

- FIGURE 50 NORTH AMERICA: HAPTIC TECHNOLOGY MARKET SNAPSHOT

- FIGURE 51 EUROPE: HAPTIC TECHNOLOGY MARKET SNAPSHOT

- FIGURE 52 ASIA PACIFIC: HAPTIC TECHNOLOGY MARKET SNAPSHOT

- FIGURE 53 HAPTIC TECHNOLOGY MARKET SHARE ANALYSIS, 2024

- FIGURE 54 HAPTIC TECHNOLOGY MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 55 HAPTIC TECHNOLOGY MARKET: COMPANY VALUATION

- FIGURE 56 HAPTIC TECHNOLOGY MARKET: FINANCIAL METRICS

- FIGURE 57 HAPTIC TECHNOLOGY MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 58 HAPTIC TECHNOLOGY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 59 HAPTIC TECHNOLOGY MARKET: COMPANY FOOTPRINT

- FIGURE 60 HAPTIC TECHNOLOGY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 61 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- FIGURE 62 JOHNSON ELECTRIC HOLDINGS LIMITED: COMPANY SNAPSHOT

- FIGURE 63 AAC TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 64 TDK CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 MICROCHIP TECHNOLOGY INC.: COMPANY SNAPSHOT

- FIGURE 66 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC (ONSEMI): COMPANY SNAPSHOT

- FIGURE 67 SYNAPTICS INCORPORATED: COMPANY SNAPSHOT